Vertical Farming Market by Growth Mechanism (Hydroponics, Aeroponics, Aquaponics), Structure (Building-based and Shipping container-based), Crop Type, Offering (Hardware, Software, Services) & Region - Global Forecast to 2029

Updated on : August 28, 2025

Vertical Farming Market Summary

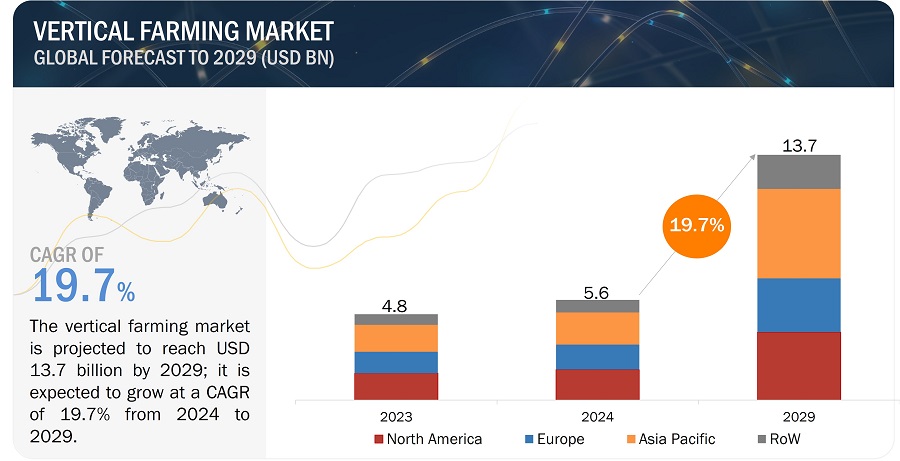

The global Vertical Farming Market was valued at USD 5.6 billion in 2024 and is projected to grow from USD 6.2 billion in 2025 to USD 13.7 billion by 2029, at a CAGR of 19.7% during the forecast period. This growth is driven primarily by the need for sustainable agricultural practices in urban areas, coupled with significant advancements in technologies such as IoT, AI, and hydroponics. Key factors such as declining arable land, climate change, and rising urban population density further accentuate the demand for vertical farming as a viable solution for food security and resource efficiency.

Key Takeaways:

• The global Vertical Farming Market was valued at USD 5.6 billion in 2024 and is projected to grow from USD 6.2 billion in 2025 to USD 13.7 billion by 2029, at a CAGR of 19.7% during the forecast period.

• By Product: Innovations in hydroponic and aeroponic systems are enhancing yield and operational efficiency, making these methods increasingly popular among growers.

• By Technology: The integration of LED grow lights and smart lighting systems is pivotal in optimizing energy use and crop growth cycles, offering significant advantages over traditional farming methods.

• By Application: Vertical farming is gaining traction in cannabis cultivation, which is driving vertical farming market expansion due to high demand and favorable regulatory changes.

• By End User: Increasing adoption by urban agriculture initiatives and commercial growers who are leveraging AI and IoT for precision farming and resource management.

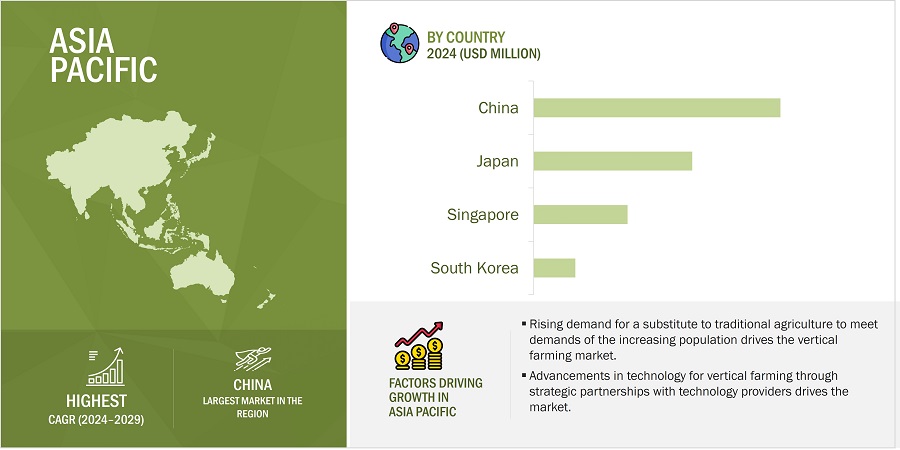

• By Region: Asia Pacific is expected to grow fastest at a 28.0% CAGR, with substantial investments and government initiatives supporting sustainable agriculture in densely populated areas.

• Ecosystem Dynamics: The competitive landscape is characterized by collaborations and partnerships, with key players focusing on developing advanced climate control systems and data-driven farm management solutions.

The vertical farming market is poised for robust growth, propelled by technological innovations and the urgent need for sustainable food production systems. Long-term projections indicate that advancements in AI and Gen AI will play a crucial role in optimizing crop yields and reducing resource usage. As urbanization continues to rise, vertical farming presents an attractive opportunity for cities aiming for food sovereignty and environmental stewardship. The market is set to benefit from increasing investments and evolving regulations that support resilient agricultural practices..

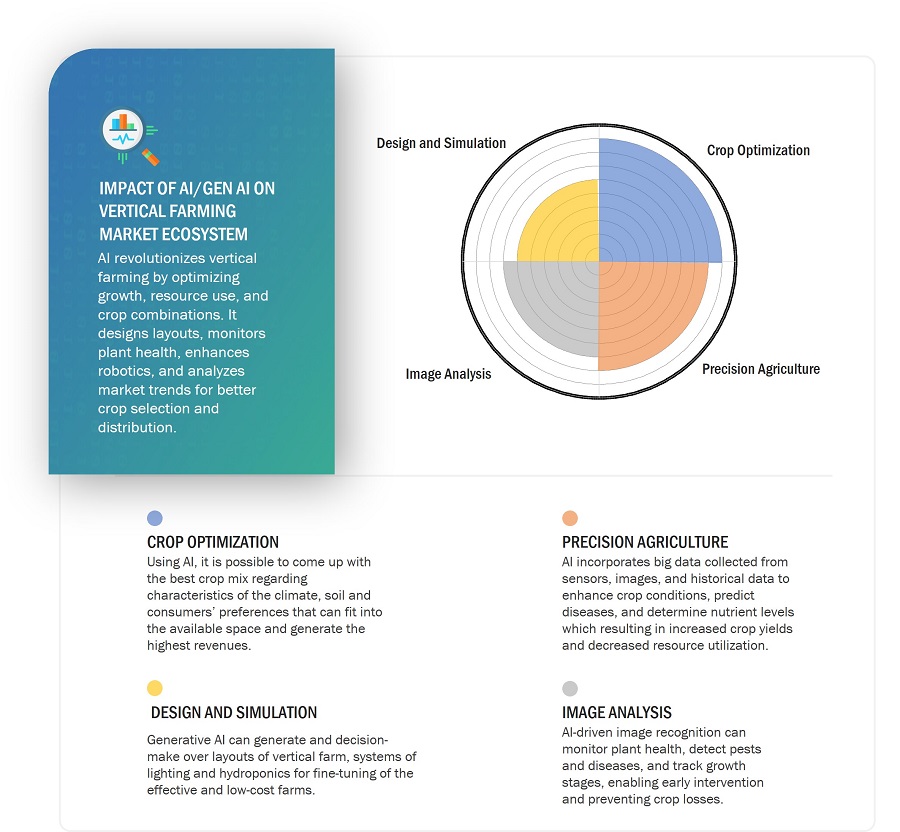

Impact of AI/Gen AI on vertical farming market

The major use cases of AI/Gen AI in the vertical farming market share includes precision agriculture, crop optimization, robotics and automation, and image analysis. Precision agriculture incorporates AI for data interpretation for the purpose of maximizing crop production and minimizing the consumption of resources. Crop optimizers provide the optimal crop layouts for certain conditions to make the best use of space and make more money. It also plans and proves farm layouts and systems for optimization. Image analysis is used to keep track of the plant’s health, pest invasions, and growth on the plants, and this can be detected early. AI improves the functions of robots and increases their performance and work rate and increases revenues. Third, AI helps in the determination of the nature and type of crops to be grown, the right prices to charge for these crops, and to decide where exactly to transport the crops. AI and Generative AI are also largely improving and revolutionizing the vertical farming market in terms of its efficiency, sustainability, and productivity with its integration. It plays another critical role in vertical farms; AI controls light, temperature and humidity of the crops on a real time hence efficiency levels are high while wastes are low. Sustainable crop developments are even enhanced by generative AI, as it matters to farmers how, when, and to what extent their crops will grow, develop diseases, and require resources. Hence it enables practices such as precision agriculture that imply the efficient use of water and chemicals hence making it environmentally efficient. Whilst cities aim towards food autarchy, AI-driven vertical farming is a strategic course to the food problems; therefore, AI farming becomes an indispensable component for the future of food production.

Attractive opportunities in the vertical farming market size

Vertical Farming Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Vertical Farming Market Trends and Dynamics

Driver: Year-round crop production irrespective of weather conditions

The advantage of vertical farming is that it is least affected by weather; actually, it could produce crops all through the year without having to bother over the effects of unfavorable weather on the type and appearance of the produce. Farming under secure environment rear high-quality produce and the production procedure is also predictable and programmable for the growers. Also, vertical farming properly achieves the reduction of the times of harvests and enhancement of the volume without affecting the quality or flavor of the produce, which remain fully intact. This assists the growers to have a prepared investment in the upcoming delivery timetables and offtake arrangements that are required by their customers. Besides, shifts of rainfall patterns and temperatures could reduce the farming efficiency in some countries around the world. As the climate becomes more volatile internationally and global warming being a problem all over the world, vertical farm is likely to become the ideal one. Thus, the loss due to disasters was 4 percent of the potentially produced crops and livestock globally. This relatively constitutes a significant percentage that can cause significantly interruption of production with cumulative effects on the global markets and food security. Further, vertical farming can be useful for cities or for countries for that entirely rely on imported different type of green vegetables. What is more the vertical farms do not succumb to diseases such as hurricanes, hail, drought, and snap freeze. These factors expected should increase the application of vertical farming on various levels globally.

Restraint: Limited crop variety

Vertical farming has some critical challenges when it comes to crop selection, and although it is good at growing spinach and basil, it hardly can grow crops that require some form of pollination or crops that develop remarkable root structures. Some crops like tomatoes and peppers are self-pollinated by natural insects which are difficult to mimic in a greenhouse hence requiring manual or mechanical pollination. Also, there are some types of plants that are unsuitable for growing in a hydroponic or aeroponic system because their root systems have very significant depth to penetrate hence may not be able to achieve maximum growth and production in these systems. Additionally, lights and climate differentials that various crops necessary in the production can increase energy costs as a producer tries to control the conditions. To address these issues, further studies are underway on the selection of proper cultivars for vertical farming and better ways of pollination that are critical to the diversification of crops that can be produced under those low-space and innovative farming practices.

Opportunity: Reduced environmental impact from agriculture by the adoption of vertical farming

Vertical farming is significant in decreasing the repercussions of the ecological consequences of agriculture. It means that one is able to cultivate the same or more crops using a lesser proportion of water as compared to using more water and producing the same yield. It also eliminates chemical, and pesticides employed to cultivate crops and reduces the transportation cost. In vertical farming everything is done naturally, that is, it is an overall organic process. It drastically reduces the use of chemicals and promotes the application of natural products in this growth mechanism of vertical farming like using fish to produce nutrient solutions for plant in the form of waste in an aquaponics system. Additionally, since vertical farming is done in a controlled environment, they are protected from all sorts of hazardous insects, thus no use of pesticide. Without having to implement methods that in the process exclude burning of field, grass or any kind of waste, it assures production of healthy and quality production to its consumers. In this regard, it is anticipated to open a new window of opportunities for the players in the vertical farming industry. Irrigation is the largest user of fresh water and this ranges between 70-80% of freshwater usage on the global stage. Also, over 2 billion individuals are worldwide affected by water scarcity. Thus, vertical farming has, in essence, been able to cut water usage by 95% and sometimes by 99%. For instance, the water usage for growing one kilogram of tomatoes in the field ranges from 60 to 200 liters. On the other hand in vertical farms, to yield the same amount of tomatoes, 2 to 4 liters of water suffices only.

Challenge: High start-up costs

The first issue that is encountered in vertical farming is the high capital costs that any farmer or company that wants to venture in indoor vertical farming faces. It needs a large amount of capital to build vertical farms and the costs of operating vertical farms are high. Consequently, they established that vertical farming was costly than the conventional farming methods. Management of the environment within the buildings like light, climate, pollination and the placement of the plants are important ideal for a vertical farm. . The farmers are subjected to high levels of initial costs as far as the devices and equipment for vertical farming is concerned. The equipment, sensors and lighting systems are costly and have to be purchased apart along with the farming equipment. When establishing all the systems of vertical farm, the management devices, the farm monitoring and sensing devices, as well as the total system interface, are also installed. Moreover, if such systems and components were brought from other countries, the escalation of the setup cost would be even worse. This is one the major factors restraining the growth of the vertical farming market This has been prompted by some of the following reasons.

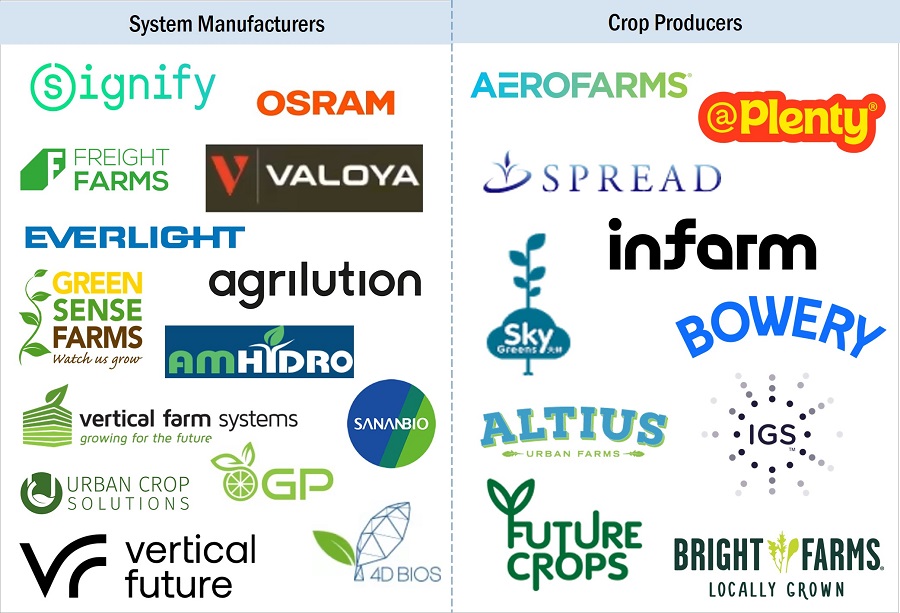

Vertical Farming Market Ecosystem

Key companies in the vertical farming market include well-established, financially stable system manufacturers and crop producers. Prominent companies in this market include Signify (Netherlands), Freight Farms (US), AeroFarms (US), Sky Greens (Singapore), Spread (Japan), Plenty (US), Valoya (Finland), Osram (Germany), Everlight Electronics (Taiwan), and Heliospectra AB (Sweden), among others.

Vertical Farming Market Segmentation

By Offering, service segment likely to exhibit the highest CAGR during the forecast period

The need to automate processes and employ different technologies that enable the efficiency of organizations’ activities is the foremost reason behind the service offering. This means that, while, as the sophisticated systems of a vertical farm include AI monitoring, robotic harvesting, and Automated climate control services, the need to get both managed services and system Integration is inevitable. Most of these services assist in the running of the farm and contribute to, or act as substitutes to labor, while at the same time increasing on agricultural productivity. Also, the modern trend of sustainable agriculture and concerns of resource consumption push vertical farms to develop complex and effective service solutions for resource consumption. This is boosted by the increasing urbanization and the push for localized food production, which makes the service segments as a critical element in advancing of vertical farming.

By mechanism, hydroponics is expected to account for largest share between 2024 and 2029.

Hydroponics is a methodology of raising plants without soil, using only water and nutrients and, hence, providing food production principles that are very efficient. It is less input intensive especially space and water as compared to conventional farming hence it is a good option. Besides, by means of hydroponics it is possible to produce food throughout the year without reference to the climate changes. Hydroponics is preferred by commercial growers mostly because it has several advantages that are propitious to vertical farming. First of all, it makes the process effective by minimizing water consumption and the occupied area. Secondly, it provides growers with more substantial discretion concerning the environmental conditions of the hydroponic system at the growers’ sites. Third, hydroponics produce very quality crops that are suitable for the vertical farming market as emphasizing the following benefits. Finally, it leads to sustainability of the natural recourses since organic farming offers a more natural way of growing food crops than the conventional methods. Such benefits have rendered hydroponics as the most suitable form of farming among commercial growers with the aspects of vertical production.

Vertical Farming Industry Regional Analysis

Asia Pacific is estimated to have largest market share in the global vertical farming market in 2023

It is estimated that the Asia Pacific region will have the highest growth rate in the vertical farming considering the fact that the growth rate in this region is expected to rise at a faster pace as compared to other regions in the globe. Some of these are born from factors such as high population density in the urban areas, degradation of arable land due to the environment, and the current trends in Healthy Eating, Natural and Organic Foods that notably apply minimal pesticide use. Present day countries such as China, Japan and India among others have shifted focus to such innovative technologies on agriculture, farming techniques such as hydroponics and aeroponics because of their high yields in the context of population density. Besides, automation and IoT also have crucial participation in how the agriculture practice is implemented and improved organizational effectiveness causing it to be an efficient model of vertical farming to meet the population’s increasing food needs without being detrimental to the environment. Considering the fact that the process of sustainable farming is in practice, Asia-Pacific region is expected to share the expertise and examples of vertical farming along with innovations that are expected to shape the vertical farming industry.

Vertical Farming Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Vertical Farming Companies - Key Market Players

- Signify (Netherlands),

- Freight Farms (US),

- AeroFarms (US),

- Sky Greens (Singapore),

- Osram (Germany),

- Spread (Japan),

- Plenty (US),

- Valoya (Finland),

- Everlight Electronics (Taiwan),

- Heliospectra AB (Sweden) are some of the key players in the vertical farming companies.

Vertical Farming Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 5.6 billion in 2024 |

|

Expected Market Size |

USD 13.7 billion by 2029 |

|

Growth Rate |

CAGR of 19.7% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By offering, growth mechanism, structure, crop type, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Signify (Netherlands), Freight Farms (US), AeroFarms (US), Sky Greens (Singapore), Spread (Japan), Plenty (US), Valoya (Finland), Osram (Germany), Everlight Electronics (Taiwan), and Heliospectra AB (Sweden) are some of the key players in the vertical farming market. |

Vertical Farming Market Highlights

This research report categorizes the vertical farming market share based on offering, technology, vertical, implementation, application, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Growth Mechanism |

|

|

By Structure |

|

|

By Crop Type |

|

|

By Region |

|

Recent Developments in Vertical Farming Industry

- In June 2023, Signify has teamed up with Siemens, a technology firm, for the provision of IT services in vertical farming. It says the idea is to see how technology can be used to control and manage processes including climate, lighting, planting, and watering for 80 Acres Farm, an Ohio based chain that grows crops indoors and supplies local supermarkets and retailers.

- In May 2023, Amazon Fresh expanded its agreement with AeroFarms, where AeroFarms is set to become a major provider of hydroponic greens to Amazon Fresh.

- In February 2023, ams OSRAM signed a deal with Revolution Microelectronics, a designer of the controlled agriculture environment based in the United States of America.

- In February 2023, Realty Income Corp entered a deal with Plenty Unlimited Inc plan involved the construction of farming space that will be leased fully to Plenty Unlimited for up to an investment of one billion US dollars.

- In May 2022, ams OSRAM launched the OSLON Optimal series of LEDs that consists of the latest 1mm2 chip ideal for horticulture lighting.

- In August 2021. The deal for this partnership was signed between AeroFarms and Nokia Bell Labs in order to fuse both companies’ experience and enrich their capacities in networking, as well as in autonomous a system, integrated machine vision and machine learning technologies to examine plant interactions on the most fundamental levels.

- In August 2021. AeroFarms declared that operated in the Middle West region through a project with WWF and STLCEA to present the best practices to reduce the environmental impacts of vertical farming indoors.

Frequently Asked Questions:

What is the current size of the global vertical farming market?

The vertical farming market is projected to reach USD 13.7 billion by 2029 from USD 5.6 billion in 2024, at a CAGR of 19.7% during forecast period.

Who are the winners in the global vertical farming market share?

Companies such as Signify (Netherlands), Freight Farms (US), AeroFarms (US), Sky Greens (Singapore), Spread (Japan), Plenty (US), Valoya (Finland), Osram (Germany), Everlight Electronics (Taiwan), and Heliospectra AB (Sweden), fall under the winner’s category.

Which region is expected to hold the highest vertical farming market share?

In recent years the Asia-Pacific region has been recognized as the fast-growing vertical farming market stimulated by the increasing rate of urbanization, reduction of the arable land, and growing consumers’ need for fresh and certified organic food. China, Japan and India among others have aimed at venturing into hydroponics and aeroponics systems. Through automation and incorporation of IoT, demands for food production are met and so is the use of vertical farming. As the populace becomes informed of sustainable farming practices, the region is expected to be ahead in the specifics of vertical farming.

What are the major drivers and opportunities related to vertical farming market share?

Some of the significant factors that lead to the development of vertical farming include; urbanization, shortage of viable land, climatic change, and consumers’ concern with organic food production. Potential benefits include IoT and AI, optimization of productivity, and the subject geo-urban environments’ ability to cultivate produce locally to cut down on the transportation and pollution of foods.

What are the major restraints and challenges associated with the market?

Some of the significant limitations and impediments in vertical farming consist of a high cost of installation and implementation, elevated energy usage, restricted adaptable types of crop, and technicality as well as professional labor necessity. Also, competition from the markets for the crop and local practices of farming challenges the adoption of the new practice.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 MARKET DYNAMICSDRIVERS- High yield associated with vertical farming over conventional farming- Advancements in light-emitting diode (LED) technology- Year-round crop production irrespective of weather conditions- Decrease in arable land and water scarcity amid growing urban populationRESTRAINTS- Lack of technically skilled workforce and limited crop types- High startup costsOPPORTUNITIES- Reduced environmental impact from vertical agriculture- Potential market opportunities in Asia Pacific and Middle East- Growth of cannabis cultivation through vertical farmingCHALLENGES- Maintenance of temperature, humidity, and air circulation in vertical farm- Higher energy consumption leading to high operational costs- Large-scale cost-intensiveness

-

5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY LIGHTING COMPONENTSAVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY KEY PLAYERAVERAGE SELLING PRICE TREND OF LIGHTING COMPONENTS, BY REGION

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Climate control systems- Hydroponic and aeroponic systems- UV and far-red light integrationCOMPLEMENTARY TECHNOLOGIES- Smart lighting- LED grow lightsADJACENT TECHNOLOGIES- Spectrum control technology

-

5.8 PATENT ANALYSIS

-

5.9 TRADE ANALYSISHS CODE 8539 - LIGHTING PRODUCTS- Export data- Import dataHS CODE 8436 - AGRICULTURAL EQUIPMENT- Export data- Import dataHS CODE 8415 - HVAC CONTROL SYSTEM- Export data- Import data

- 5.10 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.11 CASE STUDY ANALYSISLJUSGÅRDA: SCALING UP INDOOR GROWTH WITH HELIOSPECTRAHORTIPOLARIS: PERENNIAL SUPPORT FOR LED LIGHTING IN CULTIVATION AND RESEARCH FACILITIES BY FLUENCE BY OSRAMAEROFARMS: IMPROVING AEROPONIC PRECISION FARMING USING AIAEROFARMS: IOT DEPLOYMENT FOR DATA-DRIVEN INSIGHTS IN COLLABORATION WITH DELL EMCRIAT: SIGNIFY’S LED LIGHTING SOLUTION USED FOR VERTICAL FARMING TOMATOES AND CUCUMBERSKARMA FARM: FREIGHT FARMS ADDED HYDROPONIC SOLUTIONS TO ACHIEVE SUSTAINABILITY

-

5.12 TARIFF AND REGULATORY FRAMEWORKTARIFFS ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONSSTANDARDS

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.15 IMPACT OF AI/GEN AI ON VERTICAL FARMING MARKETINTRODUCTIONUSE OF GEN AI IN VERTICAL FARMINGCASE STUDY ANALYSIS- John Deere: Modernizing agriculture through AI and automation- CropIn: Leveraging AI and data analytics to provide farmers with real-time insights- California’s Central Valley: AI-controlled Irrigation to be game changer for water management in agriculture- CropIn and AWS: Collaborating to tackle global hunger with AIIMPACT ON MARKETADJACENT ECOSYSTEM WORKING ON GEN AI

- 6.1 INTRODUCTION

-

6.2 HARDWARELIGHTING- Lighting fixtures- Lighting controlHYDROPONIC COMPONENTS- Appropriate utilization of nutrient-laden water to ensure high crop growthCLIMATE CONTROL- Effective HVAC systems critical to ensure high productivity through precise temperature controlSENSORS- Sensors to provide necessary data points for accurate monitoring to ensure high productivity and farm efficiency

-

6.3 SOFTWAREFARM MANAGEMENT SOFTWARE- Real-time monitoring and analytics help optimize crop growth and respond quickly to any issues

-

6.4 SERVICESMANAGED & PROFESSIONAL SERVICES- Consulting services offer customized strategies for vertical farms, addressing specific challenges and goalsMAINTENANCE & SUPPORT SERVICES- Regular maintenance required by advanced technology in vertical farming to ensure optimal performance and prevent costly breakdowns

- 7.1 INTRODUCTION

-

7.2 HYDROPONICSSIMPLE AND COST-EFFECTIVE INSTALLATION AND EFFICIENT GROWTH OPTION FOR CULTIVATION WITH LIMITED ARABLE LAND

-

7.3 AEROPONICSHIGH PRODUCTIVITY AND LOW TIMEFRAME ACHIEVED USING IMPROVED MINIMAL LAND AND WATER RESOURCES

-

7.4 AQUAPONICSMINIMAL WATER AND PESTICIDE USAGE

- 8.1 INTRODUCTION

-

8.2 BUILDING-BASED VERTICAL FARMSCOUNTRIES WITH UNSUPPORTED CROP ENVIRONMENTS TO BE EARLY ADOPTERS OF BUILDING-BASED VERTICAL FARMS

-

8.3 SHIPPING CONTAINER-BASED VERTICAL FARMSEMERGING VERTICAL FARMING SOLUTIONS FOR SMALL FARMERS

- 9.1 INTRODUCTION

-

9.2 VEGETABLESLETTUCE MAINLY CULTIVATED IN CONTROLLED ENVIRONMENTS IN VERTICAL FARMS

-

9.3 FRUITSINCREASE IN DEMAND FOR ORGANIC FRUITS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MACROECONOMIC OUTLOOKUS- Increase in number of vertical farms and partnerships among companies in USCANADA- Presence of technologically advanced vertical farming companies in CanadaMEXICO- Increase in population, deteriorating cultivation zones, and scarcity of water drive adoption of vertical farming in Mexico

-

10.3 EUROPEEUROPE: MACROECONOMIC OUTLOOKEU4- Focus on advanced technologies helps create high growth opportunities for vertical farming market in EU4UK- Introduction of robotic arms for automating several vertical farming processes, such as harvesting, to reduce labor costsSCANDINAVIA- Deployment of vertical farms in restaurants, retail, and grocery stores eliminates food wastage during transportation in ScandinaviaNETHERLANDS- Partnerships and collaborations between leading vertical farming companies are driving market’s growth in NetherlandsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MACROECONOMIC OUTLOOKCHINA- Increase in investment in vertical farming due to growth in urban population and declining agricultural land in ChinaJAPAN- High involvement in R&D for vertical farming producing growth opportunities in JapanSINGAPORE- Government support and achieving food security help Singapore become global leader in vertical farmingSOUTH KOREA- Unavailability of land for traditional farming due to high population densityREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: MACROECONOMIC OUTLOOKSOUTH AMERICA- Emergence of startups involved in vertical farmingMIDDLE EAST & AFRICA- GCC- Rest of the Middle East & Africa

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- 11.3 REVENUE ANALYSIS, 2019–2023

- 11.4 MARKET SHARE ANALYSIS, 2023

-

11.5 COMPANY VALUATION AND FINANCIAL METRICSCOMPANY VALUATIONEV/EBIDTA

- 11.6 BRAND/PRODUCT COMPARISON

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Offering footprint- Growth mechanism footprint- Structure footprint- Crop type footprint- Regional footprint

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSSIGNIFY HOLDING- Business overview- Products/Solutions/Services offered- Recent Developments- MnM viewAMS-OSRAM AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFREIGHT FARMS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewsAEROFARMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELIOSPECTRA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPLENTY UNLIMITED INC.- Business overview- Products/Solutions/Services offered- Recent developmentsVALOYA- Business overview- Products/Solutions/Services offered- Recent developmentsEVERLIGHT ELECTRONICS CO., LTD- Business overview- Products/Solutions/Services offeredSPREAD CO., LTD.- Business overview- Products/Solutions/Services offered- Recent DevelopmentsSKY GREENS- Business overview- Products/solutions/services offered

-

12.2 OTHER KEY PLAYERSAMHYDROURBAN CROP SOLUTIONSVERTICAL FARM SYSTEMSBOWERY FARMING INC.AGRICOOLSANANBIOINFARMINTELLIGENT GROWTH SOLUTIONS LIMITED4D BIOS INCBRIGHTFARMSVERTICAL FUTURECUBICFARM SYSTEMS CORP.VERTICAL HARVESTHYDROFARMGENERAL HYDROPONICS

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 PRIMARY PARTICIPANTS CROSS VALUE CHAIN

- TABLE 4 RISK FACTOR ANALYSIS

- TABLE 5 BENEFITS OF VERTICAL FARMS VERSUS OTHER METHODS

- TABLE 6 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY KEY PLAYER, 2019–2023 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY REGION, 2019–2023 (USD)

- TABLE 8 VERTICAL FARMING MARKET: ECOSYSTEM

- TABLE 9 LIST OF GRANTED PATENTS RELATED TO MARKET, 2021–2023

- TABLE 10 EXPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 11 IMPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 13 IMPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 16 MARKET: DETAILED LIST OF RELATED CONFERENCES AND EVENTS, 2024–2025

- TABLE 17 NETHERLANDS: MFN TARIFF FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT EXPORTED, 2023

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 VERTICAL FARMING MARKET: REGULATIONS

- TABLE 23 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 24 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY OFFERING

- TABLE 25 KEY BUYING CRITERIA FOR TOP THREE OFFERINGS

- TABLE 26 MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 27 MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 28 VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020–2023 (USD MILLION)

- TABLE 29 VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2024–2029 (USD MILLION)

- TABLE 30 VERTICAL FARMING HARDWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 31 VERTICAL FARMING HARDWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 32 VERTICAL FARMING LIGHTING HARDWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 33 VERTICAL FARMING LIGHTING HARDWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 34 VERTICAL FARMING HYDROPONIC COMPONENTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 35 VERTICAL FARMING HYDROPONIC COMPONENTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 36 VERTICAL FARMING CLIMATE CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 37 VERTICAL FARMING CLIMATE CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 38 VERTICAL FARMING SENSORS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 39 VERTICAL FARMING SENSORS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 40 VERTICAL FARMING SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 41 VERTICAL FARMING SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 42 VERTICAL FARMING SERVICES MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 43 VERTICAL FARMING SERVICES MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 44 VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 45 MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 46 HYDROPONIC MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 47 HYDROPONIC MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 48 AEROPONIC MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 49 AEROPONIC MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 50 AQUAPONIC MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 51 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 52 MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 53 MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 54 BUILDING-BASED VERTICAL FARMING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 SHIPPING CONTAINER-BASED MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 57 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 58 MARKET, BY CROP TYPE, 2020–2023 (THOUSAND TONS)

- TABLE 59 MARKET, BY CROP TYPE, 2024–2029 (THOUSAND TONS)

- TABLE 60 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 61 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020–2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2024–2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 72 US: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 73 US: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 74 US: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 75 US: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 76 CANADA: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY COUNTRY/REGION, 2020–2023 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY/REGION, 2024–2029 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 84 EUROPE: MARKET FOR HARDWARE, BY HARDWARE TYPE, 2020–2023 (USD MILLION)

- TABLE 85 EUROPE: MARKET FOR HARDWARE, BY HARDWARE TYPE, 2024–2029 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 90 EU4: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 91 EU4: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 92 EU4: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 93 EU4: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 94 UK: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 95 UK: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 96 UK: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 97 UK: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 102 ASIA PACIFIC: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020–2023 (USD MILLION)

- TABLE 103 ASIA PACIFIC: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2024–2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 108 CHINA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 109 CHINA: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 110 CHINA: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 111 CHINA: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 112 JAPAN: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 113 JAPAN: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 114 JAPAN: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 115 JAPAN: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 116 ROW: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 117 ROW: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 118 ROW: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 119 ROW: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 120 ROW: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020–2023 (USD MILLION)

- TABLE 121 ROW: MARKET HARDWARE, BY HARDWARE TYPE, 2024–2029 (USD MILLION)

- TABLE 122 ROW: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 123 ROW: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 124 ROW: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 125 ROW: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 126 SOUTH AMERICA: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 127 SOUTH AMERICA: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 128 SOUTH AMERICA: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 129 SOUTH AMERICA: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY GROWTH MECHANISM, 2020–2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY GROWTH MECHANISM, 2024–2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY STRUCTURE, 2020–2023 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY STRUCTURE, 2024–2029 (USD MILLION)

- TABLE 136 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 137 VERTICAL FARMING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 138 MARKET: OFFERING FOOTPRINT, 2023

- TABLE 139 MARKET: GROWTH MECHANISM FOOTPRINT, 2023

- TABLE 140 MARKET: STRUCTURE FOOTPRINT, 2023

- TABLE 141 MARKET: CROP TYPE FOOTPRINT, 2023

- TABLE 142 MARKET: REGIONAL FOOTPRINT, 2023

- TABLE 143 MARKET: LIST OF KEY STARTUPS/SMES, 2023

- TABLE 144 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES, 2023

- TABLE 145 MARKET: PRODUCT LAUNCHES, JANUARY 2020–APRIL 2024

- TABLE 146 MARKET: DEALS, JANUARY 2020–APRIL 2024

- TABLE 147 MARKET: EXPANSIONS, JANUARY 2020–APRIL 2024

- TABLE 148 MARKET: OTHER DEVELOPMENTS, JANUARY 2020–APRIL 2024

- TABLE 149 SIGNIFY HOLDING: BUSINESS OVERVIEW

- TABLE 150 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 SIGNIFY HOLDING: DEALS

- TABLE 152 AMS-OSRAM AG: BUSINESS OVERVIEW

- TABLE 153 AMS-OSRAM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 AMS-OSRAM AG: PRODUCT LAUNCHES

- TABLE 155 AMS-OSRAM AG: DEALS

- TABLE 156 FREIGHT FARMS, INC. BUSINESS OVERVIEW

- TABLE 157 FREIGHT FARMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 FREIGHT FARMS, INC: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 159 FREIGHT FARMS, INC: DEALS

- TABLE 160 AEROFARMS: BUSINESS OVERVIEW

- TABLE 161 AEROFARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 AEROFARMS: DEALS

- TABLE 163 HELIOSPECTRA: BUSINESS OVERVIEW

- TABLE 164 HELIOSPECTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 HELIOSPECTRA: PRODUCT LAUNCHES

- TABLE 166 HELIOSPECTRA: DEALS

- TABLE 167 HELIOSPECTRA: OTHER DEVELOPMENTS

- TABLE 168 PLENTY UNLIMITED INC.: BUSINESS OVERVIEW

- TABLE 169 PLENTY UNLIMITED INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 PLENTY UNLIMITED INC.: DEALS

- TABLE 171 PLENTY UNLIMITED INC.: EXPANSIONS

- TABLE 172 VALOYA: BUSINESS OVERVIEW

- TABLE 173 VALOYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 VALOYA: DEALS

- TABLE 175 EVERLIGHT ELECTRONICS CO., LTD: BUSINESS OVERVIEW

- TABLE 176 EVERLIGHT ELECTRONICS CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 SPREAD CO., LTD.: BUSINESS OVERVIEW

- TABLE 178 SPREAD CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SPREAD CO., LTD.: DEALS

- TABLE 180 SKY GREENS: BUSINESS OVERVIEW

- TABLE 181 SKY GREENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 VERTICAL FARMING MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

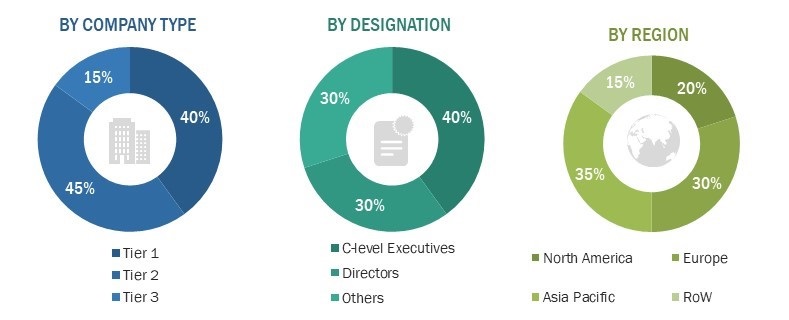

- FIGURE 7 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 SECONDARY AND PRIMARY RESEARCH APPROACHES

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) – REVENUE GENERATED BY KEY PLAYERS

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE) - BOTTOM-UP ESTIMATION BASED ON REGION

- FIGURE 11 VERTICAL FARMING MARKET: BOTTOM-UP APPROACH

- FIGURE 12 MARKET: TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION

- FIGURE 14 RESEARCH ASSUMPTIONS

- FIGURE 15 MARKET GROWTH TREND, 2020–2029 (USD MILLION)

- FIGURE 16 HYDROPONICS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 SHIPPING-BASED VERTICAL FARMS TO EXHIBIT HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 18 LETTUCE LIKELY TO BE MOST COMMONLY GROWN CROP ACROSS DIFFERENT VERTICAL FARMS

- FIGURE 19 SERVICES TO BE FASTEST-GROWING SEGMENT IN MARKET DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2024 TO 2029

- FIGURE 21 INCREASE IN INVESTMENTS AND PARTNERSHIPS BETWEEN FARMS AND TECHNOLOGY PROVIDERS TO BOOST MARKET GROWTH

- FIGURE 22 HARDWARE TO BE MOST ADOPTED AMONG VERTICAL FARMING OFFERINGS IN 2024 AND 2029

- FIGURE 23 LIGHTING SEGMENT TO GAIN MORE MARKET SHARE BETWEEN 2024 AND 2029

- FIGURE 24 HYDROPONIC GROWTH MECHANISM TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 25 BUILDING-BASED VERTICAL FARMS TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 26 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 27 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 GLOBAL POPULATION, 2015–2050 (BILLION)

- FIGURE 29 MARKET DRIVERS AND THEIR IMPACT

- FIGURE 30 MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 31 MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 32 MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 33 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE OF LIGHTING COMPONENT OFFERED BY KEY PLAYERS, 2023 (USD)

- FIGURE 35 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY KEY PLAYER, 2019–2023 (USD)

- FIGURE 36 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY REGION, 2019–2023 (USD)

- FIGURE 37 SUPPLY CHAIN ANALYSIS: VERTICAL FARMING MARKET

- FIGURE 38 MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO

- FIGURE 40 NUMBER OF PATENTS GRANTED WORLDWIDE FROM 2014 TO 2023

- FIGURE 41 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MARKET, 2014–2023

- FIGURE 42 EXPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY COUNTRY, 2020–2023 (USD THOUSAND)

- FIGURE 43 IMPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY REGION, 2020–2022 (USD THOUSAND)

- FIGURE 44 EXPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY COUNTRY, 2020–2023 (USD THOUSAND)

- FIGURE 45 IMPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY REGION, 2020–2022 (USD THOUSAND)

- FIGURE 46 EXPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY COUNTRY, 2020–2023 (USD THOUSAND)

- FIGURE 47 IMPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY REGION, 2020–2022 (USD THOUSAND)

- FIGURE 48 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 49 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY OFFERING

- FIGURE 50 KEY BUYING CRITERIA FOR TOP THREE OFFERINGS

- FIGURE 51 ADOPTION OF GEN AI IN VERTICAL FARMING

- FIGURE 52 MARKET, BY OFFERING

- FIGURE 53 MARKET BY HARDWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 54 LIGHTING HARDWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 55 MARKET, BY GROWTH MECHANISM

- FIGURE 56 HYDROPONICS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024 AND 2029

- FIGURE 57 MARKET, BY STRUCTURE

- FIGURE 58 BUILDING-BASED VERTICAL FARMS TO HOLD LARGEST MARKET SHARE IN 2024 AND 2029

- FIGURE 59 LETTUCE CROP TYPE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 60 MARKET, BY REGION

- FIGURE 61 SINGAPORE TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 62 ASIA PACIFIC TO RECORD HIGHEST GROWTH RATE IN MARKET DURING FORECAST PERIOD

- FIGURE 63 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 64 EUROPE: MARKET SNAPSHOT

- FIGURE 65 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 66 ROW: MARKET SNAPSHOT

- FIGURE 67 VERTICAL FARMING MARKET: REVENUE ANALYSIS OF THREE KEY PLAYERS, 2019–2023

- FIGURE 68 MARKET SHARE ANALYSIS, 2023

- FIGURE 69 COMPANY VALUATION OF KEY MARKET VENDORS, 2023 (USD BILLION)

- FIGURE 70 FINANCIAL METRICS (EV/EBITDA) OF KEY MARKET VENDORS, 2023

- FIGURE 71 BRAND/PRODUCT COMPARISON

- FIGURE 72 MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 73 MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 74 MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 75 SIGNIFY HOLDING: COMPANY SNAPSHOT

- FIGURE 76 AMS-OSRAM AG: COMPANY SNAPSHOT

- FIGURE 77 HELIOSPECTRA: COMPANY SNAPSHOT

- FIGURE 78 EVERLIGHT ELECTRONICS CO., LTD: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the vertical farming market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering vertical farming systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the vertical farming market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of Vertical farming systems to identify key players based on their products and prevailing industry trends in the Vertical farming market by offering, type, panel size, location, vertical, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the Vertical farming market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the vertical farming market.

- Company-wise revenues generated through the sale of lighting, hydroponic components, climate control, sensors, software, and services have been estimated.

- Break down of the sales data of key companies offering products for vertical farming has been estimated, and percentage splits have been derived.

- The market size of each offering segment i.e. hardware, software, and services have been estimated.

- The global vertical farming market size has been arrived after adding market estimates from hardware, software, and services segment .

The top-down approach has been used to estimate and validate the total size of the Vertical farming market.

- MarketsandMarkets has considered top-line investments and R&D expenditure in the vertical farming ecosystem.

- Information related to the revenue generated in the vertical farming market through different segments—growth mechanisms, structures, and geography—has been collected.

- Multiple on-field discussions with key opinion leaders have been carried out across major companies involved in the vertical farming market to validate their market position.

- Geographic splits have been estimated using secondary sources based on numerous factors, such as the number of players in a specific country and region and the range of offerings each company serves.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the vertical farming market.

Market Definition

Vertical farming is a method of cultivating crops on a vertical stack in an urban setup. In vertical farming, an artificial environment is created inside a facility, using technology, which helps plants grow with high nutritious content in a short period compared with traditional farming. Growth, productivity, and quality of plants depend on technologies, such as climate control, air purification, lighting, and pump and irrigation systems. Vertical farming can be done using three different growth mechanisms: hydroponics, aeroponics, and aquaponics. The vertical farms can be of different types, such as building-based, shipping container-based, and deep farms. The output of the vertical farms is multifold compared with conventional farming in the same area of a farm, as crops are grown using vertical stacks in vertical farms in a controlled environment agriculture technology, increasing the quantity of produce, while in conventional farming, crops are planted at a single level, making vertical farming an efficient farming technique.

Key Stakeholders

- Raw material vendors

- Original technology designers and suppliers

- Raw material and component suppliers

- Vertical farming system manufacturers

- Assembly manufacturers

- System integrators

- Assembly and packaging vendors

- Technical universities

- Research institutes and organizations

- Market research and consulting firms

- Original equipment manufacturers (OEMs)

Report Objectives

- To define, describe, and forecast the vertical farming market by growth mechanism, structure, and offering, in terms of value

- To define, describe, and forecast the market by crop type in terms of volume

- To describe and forecast the market for various segments, with respect to four main regions, namely, the North America, Europe, Asia Pacific, and the RoW(South America, and MEA), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the market’s growth

- To analyze the impact of generative artificial intelligence (Gen AI) on the vertical farming market.

- To provide a detailed overview of the vertical farming market’s value chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis for the market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to the vertical farming systems

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments such as product launches/developments, contracts, collaborations, partnerships, agreements, acquisitions, expansions, and research and development (R&D) activities carried out by players in the vertical farming market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vertical Farming Market

We want to establish a pilot project for vertical farming in Germany

I want to know the breakdown of the categories of the vertical farming market. So for instance, container farms, vertical greenhouses, instrument suppliers etc...

I am doing a report on vertical farming and believe this PDF would be a great asset in finding useful information.

UK protected edibles conventional producer, looking to enter VF as a primary producer. I am also applying for a Nuffield Scholarship to study VF in more detail so your report would be very useful. Thanks.