Virology Specimen Collection Market by Product (Viral Transport Media, Swabs, Blood Collection Kits, Specimen Collection Tubes), Sample Type (Blood, Cervical, Nasal, Nasopharyngeal, Throat, Oral), Region - Global Forecast to 2026

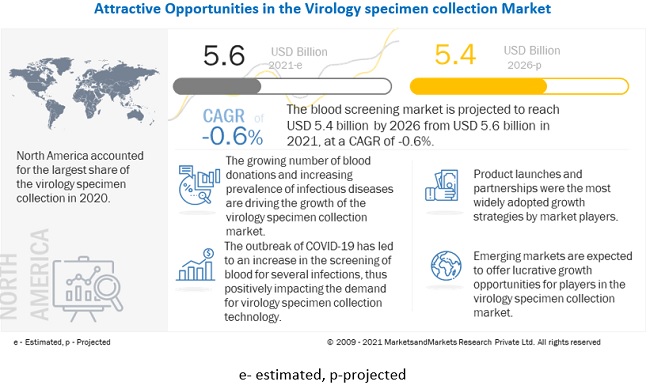

The global Virology Specimen Collection Market boasts a total value of $5.6 billion in 2021 and is projected to register a growth rate of -0.6% to reach a value of $5.4 billion by 2026. Growth in this market is mainly driven by the rising prevalence of viral diseases, the increasing prevalence of human papillomavirus (HPV) and cervical cancer, and the growing number of blood donations.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising prevalence of viral diseases and emergence of newer pathogens

The Zika virus and Babesia outbreaks, alongside announcements for their inclusion in virology specimen collection tests, indicate the need for innovation in virology specimen collection technologies, consumables, and instruments. Other countries have also undertaken initiatives to check for new and emerging diseases. For example, the prevalence of malaria in African regions and the possibility of mosquito-borne transfer of Zika has resulted in mandates for Zika virus screening in the region.

Opportunity: Emerging economics

Emerging markets such as India, the Middle East, and Africa offer promising opportunities for players in the virology specimen collection industry due to their increasing disposable incomes and improving healthcare infrastructure. For instance, according to Statista (August 2021), India’s healthcare sector was worth about USD 160 billion in 2017. It was estimated to reach USD 372 billion by 2022 due to growing income levels, greater health awareness, and the rising incidence of lifestyle diseases. Currently, ELISA is widely used in India, with NAT registering relatively low penetration. NAT is still not mandatory in India, unlike the US, Canada, most of Europe, Japan, Korea, Singapore, Sri Lanka, UAE, South Africa, Thailand, and China. Almost 100 blood banks, including AIIMS, PGI Chandigarh, CMC Vellore, Medanta-The Medicity, and Narayana Hrudayalaya, are using NAT in ID-NAT format, and 40 blood banks are using the pooling technique. Similarly, the Indian government is taking initiatives to train doctors, hospitals, and blood banks to use NAT.

Restraint: Alternative technologies

Various medium solutions have been recommended to stabilize specimens to detect bacteria and viruses, particularly during diagnostic investigations. The future of public health is likely to become increasingly digital, and there is a need for the alignment of international strategies for the regulation, evaluation, and use of digital technologies such as digital epidemiological surveillance, rapid case identification, interruption of community transmission, to strengthen pandemic management, and future preparedness for COVID-19 and other infectious diseases. These are usually based on balanced salt or saline solutions with a buffering capacity to maintain a near-neutral ph. To enhance the stability of viruses, a spectrum of protein supplements has and continues to be recommended. While some laboratories have prepared viral transport medium (VTM) in-house, commercial preparations are used extensively and are often supplied as part of a sample collection kit with sterile swabs.

Challenge: High cost of virology specimen collection technologies

Given the rise in blood donations, blood safety awareness, and healthcare expenditure across the globe, newer technologies are extensively used in high-income countries and will be adopted successfully in middle and lower-income countries in the next decade. However, many developing countries, such as India and China, currently rely on ELISA. This is a major inhibitor for the growth of the virology specimen collection market for NAT in the current timeframe. The high cost of advanced tests has driven the greater use of older, less efficient tests such as first-generation ELISA. Despite its limitations, this test is used in many parts of the world. For instance, the HIV-1 assays from Cepheid and Abbott are estimated to cost USD 17.95 and USD 25.00, respectively. By contrast, a consensus meeting of TB experts suggested that the cost for a replacement test for sputum smear microscopy should be in the range of USD 4–6. Therefore, while it is exciting that new diagnostic tools are becoming available to improve clinical care in austere environments, the cost per test is a key barrier to uptake and sustained use. This presents a need for reducing the prices of virology specimen collection products. Until this challenge is met and overcome, it will continue to hinder the growth of the market.

The market is highly consolidated. The top players— Becton, Dickinson and Company (US), Quidel Corporation (US), Thermo Fisher Scientific Inc. (US), Trinity Biotech (Ireland), Titan Biotech Ltd. (India)-in the market accounted for a combined majority market share in 2020. There is a high degree of competition among the market players. Only major companies can afford high-capital investments as well as the high cost of R&D and manufacturing. This will prevent new entrants from entering this market.

In 2020, virology transport media segment accounted for the largest share of the virology specimen collection market, by product type

The market is segmented into viral transport media, swabs, blood collection kits, and specimen collection tubes. The viral transport media accounted for the largest share of the market in 2020, mainly due to the rising number of blood donations, and the emergence of new pathogens.

In 2020, nasopharyngeal sample segment accounted for the largest share in the market, by technology

The virology specimen collection market is segmented blood, cervical, nasal, nasopharyngeal, throat, oral, and other (conjunctiva, feces, nasopharyngeal aspirate or wash, urethral, urine samples, semen, sputum, and cerebrospinal fluid) samples. In 2020, nasopharyngeal samples accounted for the largest share of the market. The large share of this segment can be attributed primarily due to the fast detection of transfusion transmissible infection (TTIs), and the increasing prevalence of HPV-related cancers (all cervical cancers) & human papillomavirus (HPV).

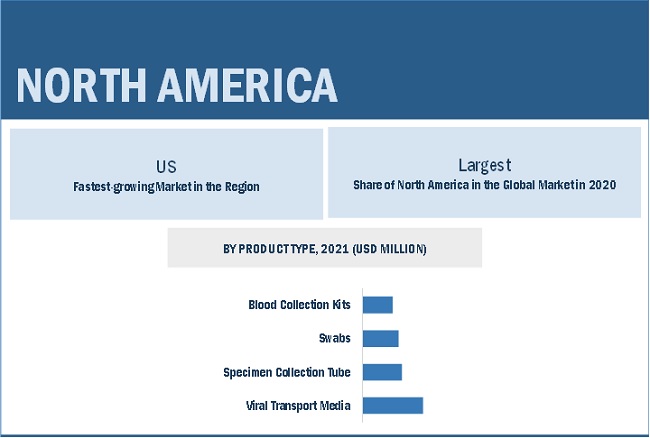

North America is the largest regional market for virology specimen collection

The global virology specimen collection market has been segmented into five major regions—North America, Europe, the Asia Pacific, and the Rest of the World. North America accounted for the largest regional market for virology specimen collection. The large share of North America in this market can be attributed to the increasing adoption of NAT (due to the high prevalence of TTIs), and the technological developments including portable diagnostics.

To know about the assumptions considered for the study, download the pdf brochure

Some key players in the virology specimen collection market (2021- 2026)

- Becton, Dickson and Company (US)

- Quidel Corporation (US)

- Thermo Fisher Scientific Inc. (US)

- Trinity Biotech (Ireland)

- Titan Biotech Ltd. (India)

Virology Specimen Collection Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$5.6 billion |

|

Estimated Value by 2026 |

$5.4 billion |

|

Growth Rate |

poised to grow at a CAGR of -0.6% |

|

Largest Share Segments |

Virology Transport Media & Nasopharyngeal Sample |

|

Market Report Segmentation |

Product Type, Sample, End User & Region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This report categorizes the virology specimen collection market into the following segments and subsegments:

By Product Type

- Blood Collection Kits

- Specimen Collection Tubes

- Viral Transport Media

- Swabs

By Sample

- Blood Samples

- Nasopharyngeal Samples

- Throat Samples

- Nasal Sampls

- Cervical Samples

- Oral Samples

- Other Samples

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In June 2020, BD announced the CE Mark and market launch of the BD Vacutainer UltraTouch Blood collection set.

- In September 2020, the company launched the Thermo Scientific SpeciMAX Stabilized Saliva Collection Kit.

- In February 2020, BD announced a partnership with Babson Diagnostic to enable small-volume blood collection for diagnostic testing.

Frequently Asked Questions (FAQ):

What are the recent trends affecting the virology specimen collection market?

Recent trends affecting the virology specimen collection market are the COVID-19 outbreak, growing blood donations, and growing adoption of NAT technology.

What are the major types of virology specimen collection used?

The virology specimen collection market is segmented into viral transport media, swabs, blood collection kits, and specimen collection tubes. The viral transport media accounted for the largest share of the virology specimen collection market in 2020, mainly due to the rising number of blood donations, and the emergence of new pathogens.

Who are the key players in the virology specimen collection market?

The key players in this market are Becton, Dickinson and Company (US), Quidel Corporation (US), Thermo Fisher Scientific Inc. (US), Trinity Biotech (Ireland), Titan Biotech Ltd. (India), Diasorin SA (Italy), Vircell S.L. (Spain), Copan Italia S.P.A (Italy), Puritan Medical Products Co. (UK), Hardy Diagnostics (US).

Which region is lucrative for the virology specimen collection market?

Like China, Japan, and India, the emerging economies in the Asia Pacific region will be the lucrative markets for virology specimen collection. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 13)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

FIGURE 1 VIROLOGY SPECIMEN COLLECTION MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 VIROLOGY SPECIMEN COLLECTION MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

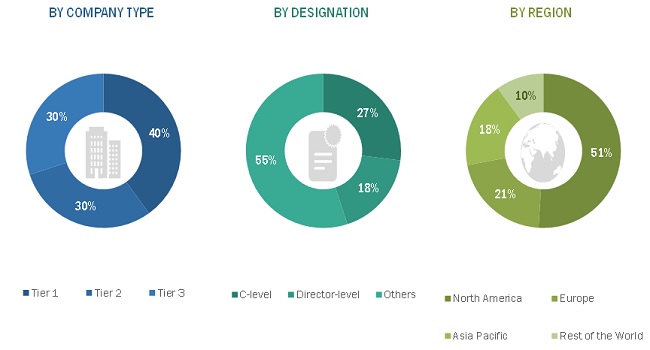

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 5 VIROLOGY SPECIMEN COLLECTION MARKET: TOP-DOWN APPROACH

2.4 ASSUMPTIONS FOR THE STUDY

2.5 GROWTH RATE ASSUMPTIONS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

2.8 COVID-19 HEALTH ASSESSMENT

2.9 COVID-19 ECONOMIC ASSESSMENT

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 6 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 7 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.11 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE MARKET

3 MARKET OVERVIEW (Page No. - 26)

3.1 INTRODUCTION

3.2 MARKET DYNAMICS

FIGURE 8 VIROLOGY SPECIMEN COLLECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

3.2.1 DRIVERS

3.2.1.1 Rising prevalence of viral diseases and emergence of newer pathogens

3.2.1.2 Rising number of blood donations

3.2.2 RESTRAINTS

3.2.2.1 Need for alternative technologies

3.2.3 OPPORTUNITIES

3.2.3.1 Technological advancements

3.2.3.2 Lucrative opportunities in emerging economies

3.2.4 CHALLENGES

3.2.4.1 High cost of technologies and collection kits

3.2.4.2 Usage of low-sensitivity screening

3.3 IMPACT OF COVID-19 ON THE MARKET

3.4 PESSIMISTIC, OPTIMISTIC, AND REALISTIC SCENARIOS

3.4.1 VIROLOGY SPECIMEN COLLECTION MARKET

FIGURE 9 PESSIMISTIC SCENARIO

FIGURE 10 OPTIMISTIC SCENARIO

FIGURE 11 REALISTIC SCENARIO

3.5 PRICING ANALYSIS

TABLE 1 PRICE OF VIROLOGY SPECIMEN COLLECTION PRODUCTS (2021)

3.6 PATENT ANALYSIS

3.6.1 PATENT ANALYSIS OF VIRAL TRANSPORT MEDIA

3.6.2 PATENT ANALYSIS OF BLOOD COLLECTION KITS

3.7 TRADE ANALYSIS

3.7.1 TRADE ANALYSIS FOR DIAGNOSTIC REAGENTS

TABLE 2 IMPORT DATA FOR PREPARED CULTURE MEDIA FOR THE DEVELOPMENT OR MAINTENANCE OF MICRO-ORGANISMS INCL. VIRUSES AND THE LIKE OR OF PLANT, HUMAN OR ANIMAL CELLS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 3 EXPORT DATA FOR PREPARED CULTURE MEDIA FOR THE DEVELOPMENT OR MAINTENANCE OF MICRO-ORGANISMS INCL. VIRUSES AND THE LIKE OR OF PLANT, HUMAN OR ANIMAL CELLS, BY COUNTRY, 2016–2020 (USD MILLION)

3.8 VALUE CHAIN ANALYSIS

FIGURE 12 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASE

3.9 SUPPLY CHAIN ANALYSIS

FIGURE 13 MARKET: SUPPLY CHAIN ANALYSIS

3.10 ECOSYSTEM ANALYSIS OF THE MARKET

FIGURE 14 MARKET: ECOSYSTEM ANALYSIS

3.10.1 ROLE IN ECOSYSTEM

3.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

3.11.1 THREAT OF NEW ENTRANTS

3.11.2 THREAT OF SUBSTITUTES

3.11.3 BARGAINING POWER OF BUYERS

3.11.4 BARGAINING POWER OF SUPPLIERS

3.11.5 DEGREE OF COMPETITION

3.12 REGULATORY LANDSCAPE

3.12.1 NORTH AMERICA

3.12.1.1 US

3.12.1.2 Canada

3.12.2 EUROPE

3.12.3 ASIA PACIFIC

3.12.3.1 Japan

3.12.3.2 India

3.12.4 LATIN AMERICA

3.12.4.1 Brazil

3.12.4.2 Mexico

3.12.5 MIDDLE EAST

3.13 CASE STUDY ANALYSIS

3.13.1 CASE STUDY 1

3.14 TECHNOLOGY ANALYSIS

3.15 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

3.15.1 REVENUE SOURCES ARE SHIFTING TOWARD MORE TECHNOLOGY-BASED SOLUTIONS DUE TO THE COVID-19 PANDEMIC

3.15.2 REVENUE SHIFT FOR THE MARKET

4 VIROLOGY SPECIMEN COLLECTION MARKET, BY PRODUCT TYPE (Page No. - 44)

4.1 INTRODUCTION

TABLE 5 MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

4.2 VIRAL TRANSPORT MEDIA

4.2.1 REPEAT PURCHASE OF VIRAL TRANSPORT MEDIA TO DRIVE MARKET GROWTH IN THE COMING YEARS

TABLE 6 MARKET FOR VIRAL TRANSPORT MEDIA, BY REGION, 2019–2026 (USD MILLION)

4.3 SPECIMEN COLLECTION TUBES

4.3.1 SURGE IN PATIENT POPULATION TO DRIVE SEGMENT GROWTH

TABLE 7 MARKET FOR SPECIMEN COLLECTION TUBES, BY REGION, 2019–2026 (USD MILLION)

4.4 SWABS

4.4.1 INCREASING INCIDENCE OF VIRAL DISEASES TO PROPEL MARKET GROWTH

TABLE 8 MARKET FOR SWABS, BY REGION, 2019–2026 (USD MILLION)

4.5 BLOOD COLLECTION KITS

4.5.1 GROWING PRESSURE ON CLINICAL LABORATORIES TO DRIVE THE MARKET GROWTH

TABLE 9 MARKET FOR BLOOD COLLECTION KITS, BY REGION, 2019–2026 (USD MILLION)

5 VIROLOGY SPECIMEN COLLECTION MARKET, BY SAMPLE (Page No. - 49)

5.1 INTRODUCTION

TABLE 10 MARKET, BY SAMPLE, 2019–2026 (USD MILLION)

5.2 BLOOD SAMPLES

5.2.1 RISING NUMBER OF LEUKEMIA AND LYMPHOMA CASES WILL SUPPORT THE MARKET GROWTH

TABLE 11 MARKET FOR BLOOD SAMPLES, BY REGION, 2019–2026 (USD MILLION)

5.3 CERVICAL SAMPLES

5.3.1 INCREASING INCIDENCE OF HPV WILL DRIVE THE GROWTH OF THIS SEGMENT

TABLE 12 MARKET FOR CERVICAL SAMPLES, BY REGION, 2019–2026 (USD MILLION)

5.4 NASAL SAMPLES

5.4.1 RISING PREVALENCE OF RESPIRATORY DISORDERS TO SUPPORT THE MARKET GROWTH

TABLE 13 MARKET FOR NASAL SAMPLES, BY REGION, 2019–2026 (USD MILLION)

5.5 NASOPHARYNGEAL SAMPLES

5.5.1 INCREASE IN NUMBER OF RT-PCR TESTS WILL DRIVE THE GROWTH OF THIS SEGMENT

TABLE 14 MARKET FOR NASOPHARYNGEAL SAMPLES, BY REGION, 2019–2026 (USD MILLION)

5.6 THROAT SAMPLES

5.6.1 INCREASING PREVALENCE OF VIRAL DISEASES TO DRIVE THE SEGMENT GROWTH

TABLE 15 MARKET FOR THROAT SAMPLES, BY REGION, 2019–2026 (USD MILLION)

5.7 ORAL SAMPLES

5.7.1 QUICK DIAGNOSTIC RESULTS THROUGH ORAL SWABS TO DRIVE THE GROWTH OF THIS MARKET

TABLE 16 MARKET FOR ORAL SAMPLES, BY REGION, 2019–2026 (USD MILLION)

5.8 OTHER SAMPLES

TABLE 17 MARKET FOR OTHER SAMPLES, BY REGION, 2019–2026 (USD MILLION)

6 VIROLOGY SPECIMEN COLLECTION MARKET, BY REGION (Page No. - 56)

6.1 INTRODUCTION

TABLE 18 MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2 NORTH AMERICA

6.2.1 RISING PREVALENCE OF HIV IN THE REGION WILL SUPPORT THE MARKET GROWTH

FIGURE 15 NORTH AMERICA: VIROLOGY SPECIMEN COLLECTION MARKET SNAPSHOT

TABLE 19 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 20 NORTH AMERICA: MARKET, BY SAMPLE, 2019–2026 (USD MILLION)

6.3 EUROPE

6.3.1 RISING INCIDENCE OF HUMAN PAPILLOMAVIRUS TO SUPPORT GROWTH

TABLE 21 EUROPE: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 22 EUROPE: MARKET, BY SAMPLE, 2019–2026 (USD MILLION)

6.4 ASIA PACIFIC

6.4.1 APAC MARKET IS MAINLY DRIVEN BY LARGE-SCALE COVID TESTING ACTIVITY

FIGURE 16 ASIA PACIFIC: VIROLOGY SPECIMEN COLLECTION MARKET SNAPSHOT

TABLE 23 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 24 ASIA PACIFIC: MARKET, BY SAMPLE, 2019–2026 (USD MILLION)

6.5 REST OF THE WORLD

TABLE 25 REST OF THE WORLD: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 26 REST OF THE WORLD: MARKET, BY SAMPLE, 2019–2026 (USD MILLION)

7 COMPANY PROFILES (Page No. - 65)

7.1 KEY PLAYERS

7.1.1 BECTON, DICKINSON AND COMPANY

7.1.2 QUIDEL CORPORATION

7.1.3 THERMO FISHER SCIENTIFIC, INC.

7.1.4 TRINITY BIOTECH

7.1.5 TITAN BIOTECH LTD.

7.1.6 DIASORIN SA

7.1.7 VIRCELL S.L.

7.1.8 COPAN ITALIA S.P.A

7.1.9 PURITAN MEDICAL PRODUCTS CO.

7.1.10 HARDY DIAGNOSTICS

8 APPENDIX (Page No. - 73)

8.1 INSIGHTS FROM INDUSTRY EXPERTS

8.2 DISCUSSION GUIDE

8.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

8.4 AVAILABLE CUSTOMIZATIONS

8.5 AUTHOR DETAILS

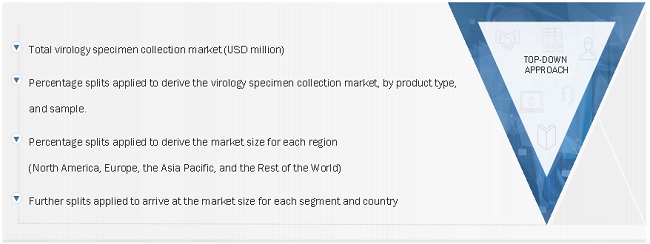

This study involved four major activities in estimating the current size of the virology specimen collection market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the virology specimen collection market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Virology specimen collection Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global virology specimen collection market by product type, sample, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall virology specimen collection market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the virology specimen collection market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Virology specimen collection market size and growth rate estimates for countries in the Rest of the North America, Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the virology specimen collection market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Virology Specimen Collection Market

What are the business expansion opportunities in Virology Specimen Collection Market?

How the emerging trends are influencing the global growth for Virology Specimen Collection Market?

Can you share more detailed information on the segment wise market size for the Virology Specimen Collection Market?