Xanthan Gum Market by Application (Food & Beverages, Oil & Gas, Pharmaceuticals), Function (Thickeners, Stabilizers, Gelling Agents, Fat Replacers, Coating Materials), Form (Dry, Liquid), and Region - Global Forecast to 2022

[137 pages report] The xanthan gum market is estimated at USD 373.6 million in 2016; it is projected to reach USD 452.8 million by 2022, at a CAGR of 3.25% during the forecast period. Owing to its multi-functionality xanthan gum has wide applications and an increase in consumption of convenience foods are the factor driving the xanthan gum market.

The periodization considered for the study is as follows:

|

Report Metrics |

Details |

|

Base year |

2016 |

|

Forecast Period |

2014 to 2022 |

The objectives of the report

- To define, segment, and project the global market size for xanthan gum on the basis of application, form, function, and region

- To project the size of the market and its submarkets, in terms of value and volume, with respect to four regions (along with their respective key countries): North America, Europe, Asia-Pacific, and Rest of the World (RoW)

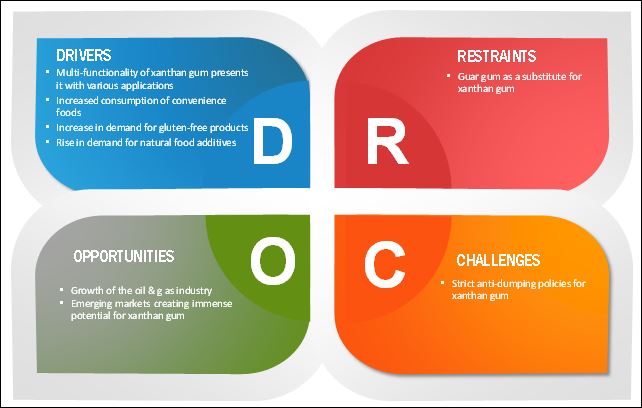

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of key market players

- To profile key players and comprehensively analyze their core competencies

- To analyze competitive developments such as expansions, investments, and agreements in the xanthan gum market

- To provide a detailed competitive landscape of this market, along with an analysis of the business and corporate strategies adopted by key players

Research Methodology:

- The key regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to find the value of the xanthan gum for regions such as North America, Europe, Asia-Pacific, and RoW

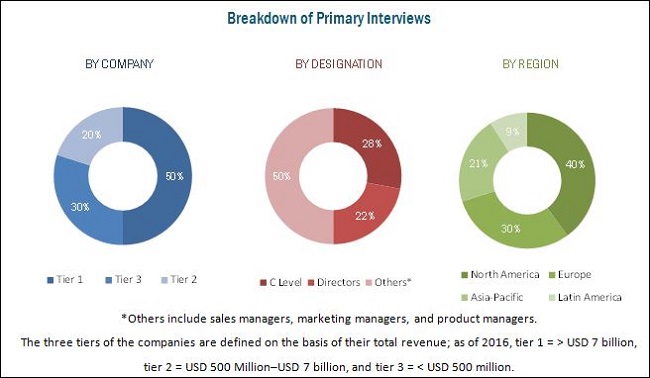

The key players were identified through secondary sources such as the US Department of Agriculture (USDA), the United States Environmental Protection Agency (USEPA), FAOSTAT, Center for Disease Control and Prevention (CDC), World Health Organization (WHO), EUROPA, and FSSAI while their market share in respective regions was determined through both, primary and secondary research processes. The research methodology included the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for the key insights (both quantitative and qualitative) for the xanthan gum market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the xanthan gum market include government organizations, R&D institutes, xanthan gum manufacturing companies, [such as Cargill (U.S.), Archer Daniels Midland Company (U.S.), Ingredion Incorporated (U.S.), E. I. du Pont de Nemours and Company (U.S.), and Jungbunzlauer Suisse AG (Switzerland)], & National Agricultural Research Organization, The Agricultural Research Organization, and Australian Institute of Agricultural Science and Technology.

Xanthan Gum Market Target Audience

The stakeholders for the report are as follows:

- Manufacturers/Suppliers

- Food & beverage manufacturers & processors

- Pharmaceutical manufacturers & processors

- Feed manufacturers

- Chemical industries

- Research & development laboratories

- Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, Codex Alimetarius, and Food Safety Australia and New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers

- End users

- Food & beverage manufacturers/suppliers

- Pharmaceutical manufacturers

- Pet food manufacturers

Scope of the Xanthan Gum Market Report:

This research report categorizes the market based on application, function, form, and region.

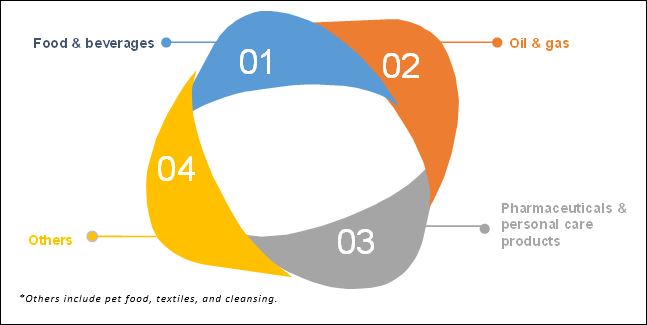

Based on the application, the market has been segmented as follows:

- Food & beverages

- Oil & gas

- Pharmaceuticals & personal care

- Others

Based on the function, the market has been segmented as follows:

- Thickeners

- Stabilizers

- Gelling agents

- Fat replacers

- Coating materials

- Others

Based on the form, the market has been segmented as follows:

- Dry

- Liquid

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customization

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs. The following customization options are available for the report:

Product analysis

- ‘Product Matrix’ gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Emerging Application Analysis

- Regional and country-level market information for application and function segments

Multifunctionality of xanthan gum and its wide applications in confectionery products to stimulate its demand to cross the mark of USD 452.8 million by 2022

Xanthan gum is a polysaccharide produced by bacterial fermentation using nutrient sources. It is a natural hydrocolloid that can be used as a stabilizer, thickening agent, or fat replacer in a wide variety of food & beverages. It also helps to reduce water mobility and provides enhanced stability against salt, temperature, and shear industrial-based products such as oil & gas, horizontal drilling fluids, and under reaming. Moreover, it is also used in various chemical applications such as adhesives, oil & gas, lubricants, pharmaceuticals, personal care products, textiles, and ceramic glazes.

The global xanthan gum market size is projected to reach USD 452.8 million by 2022. Globally, the multifunctionality of xanthan gum has led to the large-scale adoption of xanthan gum in numerous applications. Changing lifestyles, rise in the consumption of convenience food, increased preference of natural food additives, and an increasing number of oil & gas drilling activities are some of the factors driving the growth of the market.

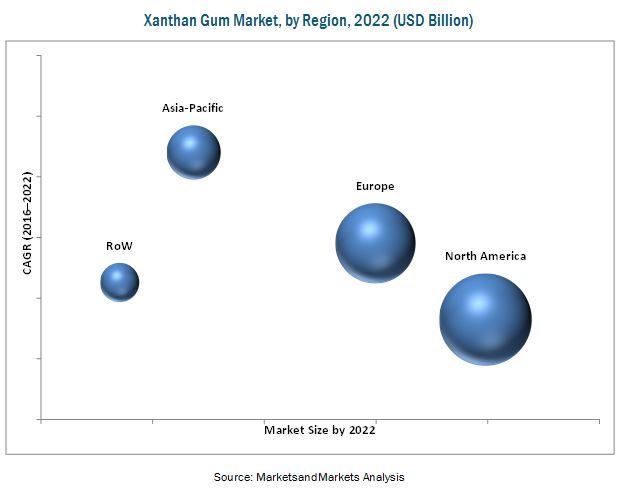

North America is the largest market for xanthan gum due to the growing demand from the food & beverage and oil & gas industries. The Asia Pacific region is the fastest-growing market for xanthan gum due to the rising consumption of natural and processed food & beverage products and growing health consciousness among consumers.

Guar gum usage as a substitute for xanthan gum acts as the major restraining factor for the market

Guar gum is a natural gum derived from guar seed. It is a high-molecular-weight polysaccharide consisting of mannose and galactose units and can hydrate in cold water to form highly viscous solutions. Guar gum is widely used in oil & gas well drilling, food & beverage, pharmaceutical, textile, and pet food industries due to its basic functions as a thickener, stabilizer, gelling agent, and emulsifier.

As its characteristics are similar to those of xanthan gum, guar gum is used as a substitute. The major difference in both ingredients is the variation in quantities for different food products. Xanthan gum can be used in low quantities as compared with xanthan gum. Apart from the variation in quantity, both ingredients perform the same function and are used in the same applications. Also, xanthan gum is generally more expensive in comparison to guar gum. Thus, it creates a potential threat to the xanthan gum market.

The growing domestic market for food & beverage food products in the emerging markets of Brazil, Russia, China, and India is expected to create a positive impact on the global food & beverage industry, which will fuel the demand of xanthan gum during the forecast period. Furthermore, the growing oil & gas fracking industry in the Middle Eastern countries, Brazil, and Argentina are projected to lead to moderate growth in the xanthan gum market.

The leading market players are also expanding their facilities in China, considering the potential demand in the market. The emerging markets for xanthan gum are growing, creating the immense potential for the processed food industry due to the changing lifestyles and increasing working population. Economic surges in India and China have led to the growth of the urban population with increased disposable incomes, creating a larger market for convenience and ready-to-eat food products. This is projected to lead to the growth of the market.

Market Dynamics

Leading xanthan gum manufacturers are investing in R&D and expanding their global presence to increase their market share.

Food & Beverages.

Xanthan gum is extensively used in bakery products, confectionery products, sauces & dressings, meat & poultry, dairy products, and many other food applications. The Xanthomonas campestris strain that is used to yield xanthan gum is non-pathogenic and non-toxic to animals and humans. Therefore, it has become the most preferred food ingredient compared to other substitutes.

Xanthan gum offers several advantages such as enhancing the texture of bakery products, stability, extending shelf life, and water retention, owing to which it is used by bakery and confectionery manufacturers for various food applications such as fruit cakes and ice creams.

Oil & Gas

Xanthan gum is widely used in oil recovery and oil drilling applications to serve multiple purposes such as the reduction in water mobility and providing enhanced stability against salt, temperature, and shear. The rising oil & gas drilling activities in the US, Argentina, Brazil, and the Middle Eastern countries are projected to drive the demand for xanthan gum in the next few years. Companies that are engaged in offering xanthan gum for oil & gas drilling applications, such as CP Kelco (US) under the brand names XANVIS, KELZAN, and Jungbunzlauer provide xanthan gum for oil drilling and ore mining and refining.

Pharmaceuticals & Personal Care Products

Xanthan gum is toxicologically safe and is frequently used in various pharmaceutical and personal care applications such as creams, bath products, makeup, skin & hair care, and oral care products. It acts as a binder, emulsion stabilizer, emulsifying surfactant, skin-conditioning agent, and viscosity-increasing agent in these products. It is characterized by the unique rheological properties and can be used as a suspending agent, an emulsion and foam stabilizer, a foam enhancer, and as a thickener in several personal care applications such as shampoos, liquid soaps, color cosmetics, creams & lotions, and toothpaste.

Others

Other applications of xanthan gum include pet food, cleansers, and textile printing. Its characteristics such as improved rheology of liquid formulations and stabilizing emulsions are driving the demand for xanthan gum in pet food, textile, and cleanser industries. A steady increase in demand for xanthan gum by cleanser applications was witnessed over the last few years owing to the compatibility of xanthan gum with acids and salts.

Key Questions

- What are the upcoming technologies, substitutes, and trends that will have a significant impact on the market in the future?

- Xanthan gum is getting traction in the market; how will this impact the food industry in the next five years?

- What will be the prominent revenue-generating pockets for the market in the next five years?

- Most suppliers have opted for expansions & acquisitions as the key strategies as seen from the recent developments. Where will it take the industry in the mid to long term?

The xanthan gum market is driven due to the multi-functionality of xanthan gum resulting in many application areas, increased consumption of convenience foods, and increased demand for gluten-free food products.

The market for xanthan gum, based on application, has been segmented into food & beverage, oil & gas, pharmaceuticals & personal care, others (pet food, cleansing, and textile). The market for food & beverage is projected to grow at the highest CAGR between 2016 and 2022. The market for food & beverage is driven due to the pseudoplastic and mouthfeel effects produced by xanthan gum. Moreover, increased demand for gluten-free products all over the world is fuelling the demand for xanthan gum as a replacement for gluten. It is widely used as an additive in gluten-free products owing to its better binding characteristics in comparison to other food additives such as guar gum and locust bean gum.

The xanthan gum market, based on function, has been segmented into thickeners, gelling agents, stabilizers, coating materials, fat replacers, and others (emulsifiers and foaming agents.). The market for fat replacers is projected to grow at the highest CAGR between 2016 and 2022. Xanthan gum is widely demanded in the aforementioned applications, and its demand as a gelling agent will continue to grow in the coming years owing to the various advantages offered by this product. For instance, xanthan gum prevents weeping in gels, forms a gel when combined with locust bean gel, and can form a mucus paste that resembles a gel.

The market for xanthan gum, based on form, has been segmented into dry and liquid. The market for dry is projected to grow at the highest CAGR between 2016 and 2022. Dry xanthan gum is used in food applications such as salad dressings, bakery products, and frozen food over the last few years. This increase in demand can be attributed to its major functions such as emulsion stabilizing, viscosity control, and thaw stability. Xanthan gum in its dry form is widely used by pharmaceutical and personal care companies for the manufacturing of products such as tablets and toothpaste, respectively.

The North American region is projected to be the largest market for xanthan gum, the U.S. being the fastest-growing market in the region, from 2016 to 2022. Asia-Pacific is also projected to be the fastest-growing market during the forecast period, due to the high population in this region consuming products that contain xanthan gum as their constituent. An increase in domestic demand for food & beverages, especially convenience foods and emerging countries such as India and China, owing to the growth in urbanization, rapid economic development, and change in lifestyles in these countries are the factors that will drive the demand for xanthan gum during the forecast period.

Guar gum used as a substitute for xanthan gum is one of the restraints for the market.

Cargill (U.S.) is one of the key players in the xanthan gum market and focuses on strengthening its product portfolio by continuously expanding its production capacity of xanthan gum. The company’s core competencies are expansion in potential markets, the strong product portfolio for xanthan gum, and global footprint for functional food products. Recently, the company set up a new R&D center in China, to produce new and innovative food products in new flavors for the consumers in China.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Macroeconmic Indicators

2.2.1 Growth of Purchasing Power of Middle-Income Population in Emerging Economies

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Market Opportunities for Xanthan Gum Manufacturers

4.2 Xanthan Gum Market Size, By Region

4.3 Asia-Pacific Xanthan Gum Market, By Country and Application

4.4 North America: Xanthan Gum Market, By Function, 2016 vs 2022

4.5 Market, By Application

4.6 Market Attractiveness

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Application

5.2.2 Function

5.2.3 Form

5.2.4 Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Multi-Functionality of Xanthan Gum, Resulting in Many Application Areas

5.3.1.2 Increase in Consumption of Convenience Foods

5.3.1.3 Increase in Demand for Gluten-Free Food Products

5.3.1.4 Rise in Demand for Natural Food Additives

5.3.2 Restraints

5.3.2.1 Guar Gum as A Substitute for Xanthan Gum

5.3.3 Opportunities

5.3.3.1 Growth of the Oil & Gas Industry

5.3.3.2 Emerging Markets: Immense Potential for the Market

5.3.4 Challenges

5.3.4.1 Strict Anti-Dumping Policies for Xanthan Gum

6 Industry Trends (Page No. - 45)

6.1 Regulations Governing the Xanthan Gum Market

6.1.1 Regulatory Status Determined By the Eu

6.1.2 U.S. Food and Drug Administration Regulations

6.1.2.1 Code of Regulation (21 CFR 172.695)

6.1.2.2 Code of Federal Regulations (21 CFR 573.1010)

6.2 Supply Chain

6.3 Recent Trends

6.4 Price Analysis

7 Market for Xanthan Gum, By Application (Page No. - 48)

7.1 Introduction

7.2 Food & Beverages

7.2.1 Bakery Products

7.2.2 Confectionery Products

7.2.3 Sauces & Dressings

7.2.4 Meat & Poultry Products

7.2.5 Beverages

7.2.6 Dairy Products

7.2.7 Others

7.3 Oil & Gas

7.4 Pharmaceutical & Personal Care

7.5 Other Applications

8 Xanthan Gum Market, By Function (Page No. - 57)

8.1 Introduction

8.2 Thickeners

8.3 Stabilizers

8.4 Gelling Agents

8.5 Fat Replacers

8.6 Coating Materials

8.7 Other Functions

9 Market for Xanthan Gum , By Form (Page No. - 65)

9.1 Introduction

9.2 Dry Form

9.3 Liquid Form

10 Brand Overview (Page No. - 69)

11 Xanthan Gum Market, By Region (Page No. - 71)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 France

11.3.2 U.K.

11.3.3 Germany

11.3.4 Spain

11.3.5 Italy

11.3.6 Denmark

11.3.7 Russia

11.3.8 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 South Africa

11.5.4 Others in RoW

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 Expansions & Investments

12.3.2 Mergers & Acquisitions

12.3.3 Joint Ventures, Agreements, and Partnerships

12.3.4 New Products Launches

13 Company Profiles (Page No. - 106)

13.1 Cargill

13.2 E. I. Du Pont De Nemours and Company

13.3 Archer Daniels Midland Company

13.4 Solvay

13.5 Fufeng Group Company Ltd.

13.6 Ingredion Incorporated

13.7 Cp Kelco

13.8 Jungbunzlauer Suisse AG

13.9 Deosen Biochemical Ltd.

13.10 Fuerst Day Lawson

14 Appendix (Page No. - 129)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (66 Tables)

Table 1 Investments With A View to Expand Production Capabilities is The Most Prevailing Strategic Trend in The Xanthan Gum Industry

Table 2 Global Xanthan Gum Price, By Region (USD/Kg)

Table 3 Xanthan Gum Market Size, By Application, 2014–2022 (USD Million)

Table 4 Xanthan Gum: Food & Beverage Market Size, By Region, 2014–2022 (USD Million)

Table 5 Xanthan Gum: Food & Beverages Market Size, By Sub-Application, 2014–2022 (USD Million)

Table 6 Xanthan Gum: Oil& Gas Market Size, By Region, 2014–2022 (USD Million)

Table 7 Xanthan Gum: Pharmaceutical & Personal Care Market Size, By Region, 2014–2022 (USD Million)

Table 8 Xanthan Gum: Other Applications Market Size, By Region, 2014–2022 (USD Million)

Table 9 Xanthan Gum Market Size, By Function, 2014–2022 (USD Million)

Table 10 Xanthan Gum: Thickeners Market Size, By Region, 2014–2022 (USD Million)

Table 11 Xanthan Gum: Stabilizers Market Size, By Function, 2014–2022 (USD Million)

Table 12 Xanthan Gum: Gelling Agents Market Size, By Region, 2014–2022 (USD Million)

Table 13 Xanthan Gum: Fat Replacers Market Size, By Region, 2014–2022 (USD Million)

Table 14 Xanthan Gum: Coat Materials Market Size, By Region, 2014–2022 (USD Million)

Table 15 Xanthan Gum: Other Functions Market Size, By Region, 2014–2022 (USD Million)

Table 16 Market for Xanthan Gum Size, By Form, 2014-2022 (USD Million)

Table 17 Dry XG Market Size, By Region, 2014-2022 (USD Million)

Table 18 Liquid Xanthan Gum Market Size, By Region, 2014-2022 (USD Million)

Table 19 Xanthan Gum Brands and Functions

Table 20 Market for Xanthan Gum Size, By Region, 2014–2022 (USD Million)

Table 21 Market Size, By Region, 2014–2022 (KT)

Table 22 North America: Xanthan Gum Market Size, By Application, 2014–2022 (USD Million)

Table 23 North America: Market Size, By Function, 2014–2022 (USD Million)

Table 24 North America: Market Size, By Form, 2014–2022 (USD Million)

Table 25 North America: Market Size, By Country, 2014–2022 (USD Million)

Table 26 North America: Market Size, By Country, 2014–2022 (KT)

Table 27 U.S.: Market, By Application, 2014–2022 (USD Million)

Table 28 Canada: Market Size, By Application, 2014–2022 (USD Million)

Table 29 Mexico: Market Size, By Application, 2014–2022 (USD Million)

Table 30 Europe: Xanthan Gum Market Size, By Application, 2014-2022 (USD Million)

Table 31 Europe: Market Size, By Function, 2014-2022 (USD Million)

Table 32 Europe: Market Size, By Form, 2014-2022 (USD Million)

Table 33 Europe: Market Size, By Country, 2014-2022 (USD Million)

Table 34 Europe: Market Size, By Country, 2014-2022 (KT)

Table 35 France: Market Size, By Application, 2014-2022 (USD Million)

Table 36 U.K.: Market Size, By Application, 2014-2022 (USD Million)

Table 37 Germany: Market Size, By Application, 2014-2022 (USD Million)

Table 38 Spain: Market Size, By Application, 2014-2022 (USD Million)

Table 39 Italy: Market Size, By Application, 2014-2022 (USD Million)

Table 40 Denmark: Market Size, By Application, 2014-2022 (USD Million)

Table 41 Russia: Market Size, By Application, 2014-2022 (USD Million)

Table 42 Rest of Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 43 Asia-Pacific: Xanthan Gum Market Size, By Application, 2014–2022 (USD Million)

Table 44 Asia-Pacific: Market Size, By Function, 2014–2022 (USD Million)

Table 45 Asia-Pacific: Market Size, By Form, 2014–2022 (USD Million)

Table 46 Asia-Pacific: Market Size, By Country, 2014–2022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Country, 2014–2022 (KT)

Table 48 China: Xanthan Gum Market Size, By Application, 2014–2022 (USD Million)

Table 49 Japan: Market Size, By Application, 2014–2022 (USD Million)

Table 50 India: Market Size, By Application, 2014–2022 (USD Million)

Table 51 Australia: Market Size, By Application, 2014–2022 (USD Million)

Table 52 Rest of Asia-Pacific: Market Size, By Application, 2014–2022 (USD Million)

Table 53 RoW: Xanthan Gum Market Size, By Application, 2014-2022 (USD Million)

Table 54 RoW: Market Size, By Function, 2014-2022 (USD Million)

Table 55 RoW: Market Size, By Form, 2014-2022 (USD Million)

Table 56 RoW: Market Size, By Country, 2014-2022 (USD Million)

Table 57 RoW: Market Size, By Country, 2014-2022 (KT)

Table 58 Brazil: Market, By Application, 2014-2022 (USD Million)

Table 59 Argentina: Market, By Application, 2014-2022 (USD Million)

Table 60 South Africa: Market, By Application, 2014-2022 (USD Million)

Table 61 Others in RoW: Market, By Application, 2014-2022 (USD Million)

Table 62 Global Xanthan Gum Market: Company Rankings (2011–2017)

Table 63 Expansions & Investments, 2011–2017

Table 64 Acquisitions, 2011–2017

Table 65 Joint Ventures, Agreements, and Partnerships, 2011–2017

Table 66 New Product Launches, 2011–2017

List of Figures (49 Figures)

Figure 1 Xanthan Gum Market Segmentation

Figure 2 Geographic Scope

Figure 3 Xanthan Gum Market: Research Methodology

Figure 4 Top 10 Economies Based on GDP (USD Billion) in 2015

Figure 5 Middle-Income Population in Asia-Pacific is Projected to Grow and Account for The Largest Share in The Global Market By 2030

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation & Methodology

Figure 9 Assumptions of The Research Study

Figure 10 Limitations of The Research Study

Figure 11 Food & Beverages Segment is Expected to Be The Fastest-Growing During The Forecast Period

Figure 12 Market for Xanthan Gum Snapshot (2016 vs 2022): Thickeners Segment is Projected to Be Largest

Figure 13 North America Dominated The Market in 2015

Figure 14 Attractive Growth Opportunities in The Market for Manufacturers Between 2016 and 2022

Figure 15 Xanthan Gum Market: Asia-Pacific to Grow at The Highest Rate From 2016 to 2022

Figure 16 China is Estimated to Account for The Largest Share in The Market in Asia-Pacific in 2016

Figure 17 Fat Replacers Segment to Grow at The Highest CAGR From 2016 to 2022, in Terms of Value

Figure 18 Food & Beverages Segment Dominated The Market Across All Regions in 2015

Figure 19 Chinese XG Market to Grow at The Highest CAGR From 2016 to 2022

Figure 20 Market for Xanthan Gum, By Application

Figure 21 Market for Xanthan Gum, By Function

Figure 22 Market, By Form

Figure 23 Market, By Region

Figure 24 Xanthan Gum Market: Drivers, Restraints, Opportunities, and Challenges

Figure 25 Supply Chain Analysis: Market for Xanthan Gum

Figure 26 Xanthan Gum Market, By Application

Figure 27 Market, By Application, 2016 vs 2022 (USD Million)

Figure 28 Xanthan Gum: Food & Beverages Market, By Region, 2016 vs 2022 (USD Million)

Figure 29 Gelling Agents are Estimated to Dominate The Market in 2016

Figure 30 Thickeners Segment to Lead The Market During The Forecast Period

Figure 31 Asia-Pacific is Projected to Be The Fastest Growing Region

Figure 32 Market for Xanthan Gum, By Form

Figure 33 Dry Xanthan Gum Market in Asia-Pacific Projected to Grow at The Highest Rate From 2016 to 2022 (USD Million)

Figure 34 North America: Xanthan Gum Market Snapshot

Figure 35 Asia-Pacific: Xanthan Gum Market Snapshot

Figure 36 Expansions & Investments: Leading Approach of Key Companies, 2011–2017

Figure 37 Expansions & Investments Fueled Growth in The Xanthan Gum Market

Figure 38 Expansions & Investments: Key Strategy, 2011–2017

Figure 39 Cargill, Incorporated: Company Snapshot

Figure 40 Cargill: SWOT Analysis

Figure 41 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 42 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 43 Archer Daniels Midland Company: Company Snapshot

Figure 44 Archer Daniels Midland Company: SWOT Analysis

Figure 45 Solvay: Company Snapshot

Figure 46 Solvay: SWOT Analysis

Figure 47 Fufeng Group Company Ltd: Company Snapshot

Figure 48 Fufeng Group Company Ltd.:SWOT Analysis

Figure 49 Ingredion, Incorporated : Company Snapshot

Growth opportunities and latent adjacency in Xanthan Gum Market