Battlefield Management Systems Market by Solution (Hardware, Software) Platform (Armored Vehicles, Headquarter, and Command Centers, Soldier Systems), System, Component, Installation Type, End-User, Region (2020-2025)

Update: 12/05/2024

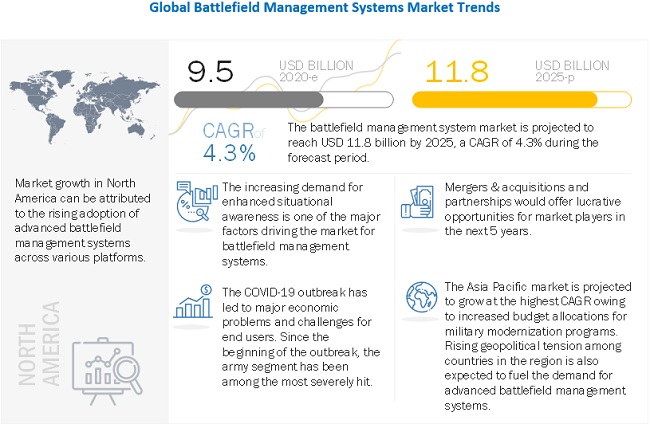

The Battlefield Management Systems (BMS) industry is expected to grow due to the increasing demand for enhanced situational awareness, which is crucial for decision-making during combat operations. Advanced intelligence, surveillance, and reconnaissance technologies, along with real-time data collection and secure communication systems, are key drivers for this growth. Key developments include contracts awarded to companies like Rheinmetall AG and Systematic AS for integrating BMS in military platforms. The Asia Pacific region is expected to experience the highest growth, driven by military modernization efforts and rising defense expenditures amid geopolitical tensions.

Battlefield Management Systems Market Seize & Growth

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Battlefield Management Systems Market

The battlefield management systems market includes major players such as Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Collins Aerospace (US), Leonardo SPA (Italy), BAE Systems (UK), Atos SE (France), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, and Rest of World. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect battlefield management systems by 5-10% globally in 2020.

The rapid spread of COVID-19 in Europe, the US & Asia Pacific has led to a significant drop in overall defense related budget allocations which led to depleted interests in military moderinization programs globally. This resulted into stagnant demand for battlefield management system globally, with a corresponding reduction in revenues for various battlefield management system providers across all markets owing to late delivery, manufacturing shutdown, and limited availability of equipment. As per industry experts, the global battlefield management system demand is anticipated to recover by 2022 fully.

Battlefield Management Systems Market Trends

Driver: Demand for enhanced situational awareness to support decision making process

Situational awareness provides the capability to identify, process, and analyze critical information from various sources to the decision-makers during combat. Success of any air, naval, and military operation depends upon the accuracy of situational awareness intelligence. Advanced intelligence, surveillance, and reconnaissance technologies integrated with command and control capabilities provide air, ground, and maritime solutions with real-time situational awareness information for strategic decision making. High-bandwidth sensor processing, video management systems, secure network routers, and switches play a crucial role in effective decision-making in a mission. The demand for situation awareness is rapidly increasing owing to the need to track enemy forces. The intelligence regarding situational awareness provided by various sensors helps in effective planning of mission. In April 2020, Rheinmetall AG secured a contract from British armed forces for Mission Master combat ground vehicles. The agreement is signed under United Kingdom’s robotic platoon vehicle program. The Mission Master combat vehicles are integrated with a battlefield management systems for precise and real-time situational awareness. In July 2020, Systematic AS was awarded a contract to develop and provide an advanced battlefield management system to enable Joint All Domain Command and Control. This contract is a part of the multi-platform security system.

Restraint: High development and maintenance costs

Battle management system is a vital component in modern-day warfare. However, high costs need to be incurred in the development and adoption of these systems into the defense capabilities of any nation. BMS involves the integration of various defense systems, command and control systems, and intelligence, surveillance, and reconnaissance systems into a working multi-domain platform. The development, installation, and maintenance of these systems are expensive. Thus, both, cost and time required for the development and deployment of BMS systems is major factor restraining the growth of this market. For instance, in 2019, US Navy provided a contract to General Dynamics worth USD 731.8 million to provide secured voice and data communication for armed forces across all platforms.

Opportunity: Increased system reliability due to real-time data collection and distribution

Improved system reliability is a crucial factor in the selection of battlefield management systems by any country. Incorporation of advanced data distribution units is helping to gather and distribute real-time situational intelligence across various defense platforms, such as combat vehicles and command headquarters. Furthermore, use of GPS tools to provide overall picture of battlefield is providing crucial information required for mission planning and control. Research & development activities are conducted to increase the overall capabilities of BMS in the space of delivering secure communication and Weapons integration. For instance, in March 2020, General Dynamics developed a power management system for TACLANE-FLEX which provides secured communication across battlefield. The updated version provides greater control in tactical and strategic situations over communication device’s power consumption.

Challenge: Lack of communication technology infrastructure

Battlefield management systems collect data from sources such as handheld sensors, electro-optic sensors, and radars. The data generated by these sources is enormous, and the size and volume of this data pose significant transmission and storage challenges. Communicating and distributing such huge volume of data affects the processing speeds in real-time and could result in damage to the decision-making process, thus threatening the execution of missions of armed forces. Sophisticated communication technology infrastructure which is based on big data and efficient data centers is required to make real-time communication more effective. Such infrastructure need a substantial amount of investments which is a major challenge for the battlefield management market.

Battlefield Management Systems Market Segments

Based on solution, the hardware segment is projected to grow at the highest CAGR during the forecast period.

Based on solution, the hardware segment is projected to grow at the highest CAGR during the forecast period. The growth of the hardware segment is driven by the increasing demand for various components in a battlefield management system, such as, communication devices and computing devices among others, to improve operational efficiency.

Based on system, the computing system segment is projected to grow at the highest CAGR during forecast period.

Based on system, the computing system segment is projected to grow at the highest CAGR during forecast period. The demand for sophisticated computing system to support decision making process by several defense organizations is driving the computing system segment growth globally.

Based on end user, the army segment is projected to grow at the highest CAGR during forecast period

Based on end user, the army segment is projected to grow at the highest CAGR during forecast period. Increasing use of battlefield management systems for real-time intelligence distribution is projected to drive the growth of this segment.

Battlefield Management Systems Market Regions

The battlefield management systems market in Asia Pacific is projected to grow at the highest CAGR from 2020 to 2025.

The Asia Pacific battlefield management systems market is projected to grow at the highest CAGR during the forecast period. The growth of the Asia Pacific battlefield management systems market is primarily driven by increasing focus on modernization of existing military systems by major economies in this region. In addition, factors including increasing geopolitical tensions and increased defense related expenditure are expected to drive the demand for battlefield management systems in the region.

To know about the assumptions considered for the study, download the pdf brochure

Battlefield Management Systems Companies: Top Key Market Players

The global Battlefield Management Systems Market are dominated by a few globally established players such as:

- Lockheed Martin Corporation (US)

- Northrop Grumman Corporation (US)

- Thales Group (France)

- Collins Aerospace (US)

- Leonardo SPA (Italy)

- BAE Systems (UK)

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 10.7 billion in 2023 |

|

Projected Market Size |

USD 11.8 billion by 2025 |

|

Growth Rate |

4.3% |

|

Forecast Period |

2020-2025 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

|

Key Market Driver |

Increasing focus on obtaining precise situational awareness |

|

Key Market Opportunity |

Increased system reliability due to real-time data collection and distribution |

|

Largest Growing Region |

Asia Pacific |

|

Largest Market Share Segment |

Hardware Segment |

|

Highest CAGR Segment |

Computing System Segment |

|

Largest Application Market Share |

Army Segment |

The study categorizes the battlefield management systems market based on Component, Deployment, Application, End User and region.

By Component

- Communication Devices

- Imaging Devices

- Display Devices

- Tracking Devices

- Computer Hardware Devices

- Data Distribution Unit

- Night Vision Devices

- Software

- Others

By Solution

- Hardware

- Software

By Platform

- Armored Vehicles

- Headquarter and Command Centers

- Soldier Systems

By Installation Type

- New Installation

- Upgradation

By System

- Computing

- Communication & Networking

- Command & Control

- Navigation, Imaging, and Mapping

By End User

- Army

- Navy

- Air Force

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In June 2020, Leonardo DRS received a contract from US Army to provide next generation mission command mounted computing system, MFoCS II. The contract is valued at USD 104 million. The system is aimed to support on-going modernization of US Army.

- In February 2020, Saab secured an agreement with Australian Department of Defense. The company will supply battle management solutions for Royal Australian Navy. Saab will also undertake modernization work of 9LV CMS that are being deployed on Anzac class frigates.

- In July 2020, BAE Systems acquired the Global Positioning System (GPS) business from Collins Aerospace. This acquisition is aimed at expanding product portfolio that strengthens BAE Systems’ global position in battlefield management systems industry. The company is aiming to integrating advanced GPS into numerous applications including their battlefield management systems for effective geolocation communication purposes.

- In June 2020, Systematic AS showcased recently developed dismounted command and control system, SitaWare Edge 2.0. The updated suite enables advanced mapping solutions to enhance user experience.

- In March 2020, General Dynamics developed a power management system for TACLANE-FLEX which provides secured communication across battlefield. The updated version provides greater control in tactical and strategic situations over communication device’s power consumption.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the battlefield management systems market?

The battlefield management systems market is expected to grow substantially owing to the growing trend of military modernization globally.

What are the key sustainability strategies adopted by leading players operating in the battlefield management systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the battlefield management systems market. The major players include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Collins Aerospace (US), Leonardo SPA (Italy), BAE Systems (UK), Atos SE (France), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the battlefield management systems market?

Some of the major emerging technologies and use cases disrupting the market include integration of cloud computing and big data technology in battlefield management system applications.

Who are the key players and innovators in the ecosystem of the battlefield management systems market?

The key players in the battlefield management systems market include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Collins Aerospace (US), Leonardo SPA (Italy), BAE Systems (UK), Atos SE (France), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US) and others.

Which region is expected to hold the highest market share in the battlefield management systems market?

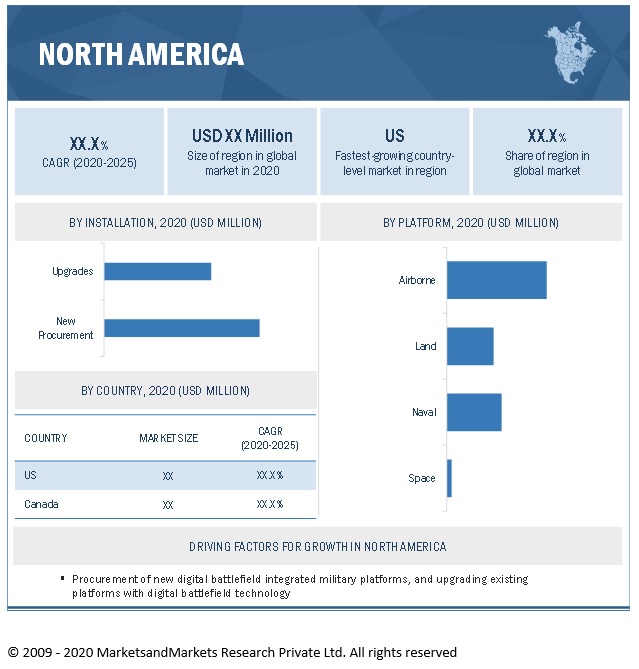

Battlefield management systems market in North America is projected to hold the highest market share during the forecast period due to the presence of several battlefield management systems providers in the region.

Which platform is expected to drive the growth of the market in the coming years?

For the battlefield management systems market, headquarter and command centers is projected to grow at the highest CAGR during the forecast period from 2020 to 2025. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 BATTLEFIELD MANAGEMENT SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

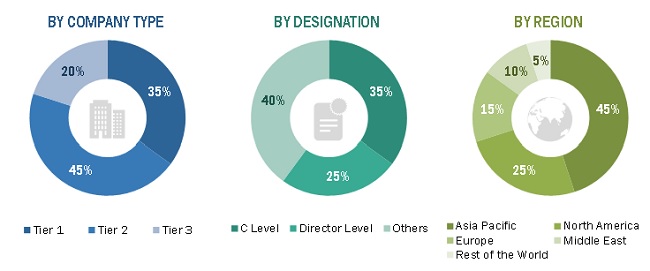

2.1.2.1 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET DEFINITION & SCOPE

2.2.1 SEGMENT DEFINITIONS

2.2.1.1 Battlefield management systems market, by platform

2.2.1.2 Market, by solution

2.2.1.3 Market, by component

2.2.1.4 Market, by system

2.2.1.5 Market, by installation type

2.2.1.6 Market, by end user

2.2.2 INCLUSIONS & EXCLUSIONS

2.3 MARKET SIZE ESTIMATION & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.1 COVID-19 impact on market analysis

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION: BATTLEFIELD MANAGEMENT SYSTEMS MARKET

2.5 MARKET SIZING & FORECASTING

2.6 RESEARCH ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 8 NEW INSTALLATION PROJECTED TO LEAD BATTLEFIELD MANAGEMENT SYSTEMS MARKET FROM 2020 TO 2025

FIGURE 9 COMMUNICATION DEVICES TO DOMINATE BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 10 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN BATTLEFIELD MANAGEMENT SYSTEMS MARKET

FIGURE 11 DEMAND FOR ENHANCED SITUATIONAL AWARENESS KEY FACTOR DRIVING BATTLEFIELD MANAGEMENT SYSTEMS MARKET

4.2 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY SYSTEM

FIGURE 12 COMPUTING SEGMENT TO LEAD BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 13 ARMORED VEHICLES SEGMENT EXPECTED TO LEAD BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

4.3 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, MAJOR COUNTRIES

FIGURE 14 BATTLEFIELD MANAGEMENT SYSTEMS MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 BATTLEFIELD MANAGEMENT SYSTEMS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for enhanced situational awareness to support decision-making process

5.2.1.2 Increasing modernization of existing defense capabilities

TABLE 2 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD MILLION)

5.2.1.3 Need to counter increasing threats to border security

5.2.1.4 Enhanced interoperability between security devices

5.2.1.5 Integration of cloud computing and advanced data storage solutions

5.2.2 RESTRAINTS

5.2.2.1 High development and maintenance costs

5.2.2.2 Threats from cyberattacks

5.2.3 OPPORTUNITIES

5.2.3.1 Increased system reliability due to real-time data collection and distribution

5.2.3.2 Incorporation of satellite-based geospatial analytical tools

5.2.4 CHALLENGES

5.2.4.1 Lack of communication technology infrastructure

5.2.4.2 Geopolitical unrest, resulting in trade restrictions

5.3 IMPACT OF COVID-19 ON BATTLEFIELD MANAGEMENT SYSTEMS MARKET

FIGURE 16 IMPACT OF COVID-19 ON BATTLEFIELD MANAGEMENT SYSTEMS MARKET

5.4 RANGES AND SCENARIOS

FIGURE 17 IMPACT OF COVID-19 ON BATTLEFIELD MANAGEMENT SYSTEMS MARKET: 3 GLOBAL SCENARIOS

5.5 BATTLEFIELD MANAGEMENT SYSTEMS MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 18 MARKET ECOSYSTEM MAP: BATTLEFIELD MANAGEMENT SYSTEM

FIGURE 19 BATTLEFIELD MANAGEMENT SYSTEMS MARKET: MARKET ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

5.7 AVERAGE SELLING PRICE OF BATTLEFIELD MANAGEMENT COMPONENTS

TABLE 3 AVERAGE SELLING PRICE TREND OF BATTLEFIELD MANAGEMENT COMPONENTS (2018–2020) (USD)

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR BATTLEFIELD MANAGEMENT SYSTEM MANUFACTURERS

FIGURE 21 REVENUE SHIFT IN BATTLEFIELD MANAGEMENT SYSTEMS MARKET

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 KEY BATTLEFIELD MANAGEMENT SYSTEMS MARKET: PORTER’S FIVE FORCE ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 USE CASE ANALYSIS: BATTLEFIELD MANAGEMENT SYSTEMS

5.10.1 ELECTRONICALLY SCANNED ARRAY SEEING INCREASED ADOPTION BY MAJOR ARMED FORCES

5.11 TRADE ANALYSIS

TABLE 5 COUNTRY-WISE IMPORT, NAVIGATIONAL INSTRUMENTS AND APPARATUS, 2018-2019 (USD THOUSAND),

TABLE 6 COUNTRY-WISE EXPORTS, NAVIGATIONAL INSTRUMENTS AND APPARATUS, 2018-2019 (USD THOUSAND)

TABLE 7 COUNTRY-WISE EXPORTS, RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, 2018-2019 (USD THOUSAND)

TABLE 8 COUNTRY-WISE IMPORTS, RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, 2018-2019 (USD THOUSAND)

TABLE 9 COUNTRY-WISE EXPORTS, PHOTOSENSITIVE SEMICONDUCTOR DEVICES, 2018-2019 (USD THOUSAND)

TABLE 10 COUNTRY-WISE IMPORTS, PHOTOSENSITIVE SEMICONDUCTOR DEVICES, 2018-2019 (USD THOUSAND),

6 INDUSTRY TRENDS (Page No. - 82)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 WEAPONS INTEGRATED BATTLEFIELD MANAGEMENT SYSTEM (WINBMS)

6.2.2 AUTONOMOUS MISSION MANAGEMENT SYSTEM FOR UGV

6.2.3 COMBAT SYSTEMS AND C5ISR

6.2.4 WEARABLE COMPUTING UNIT FOR DISMOUNTED SOLDIERS

6.2.5 CLOUD COMPUTING

6.2.6 INTEGRATION OF OPEN ARCHITECTURE

6.2.7 GEOGRAPHIC INFORMATION SYSTEM (GIS)-BASED BATTLEFIELD MANAGEMENT SYSTEMS

6.3 TECHNOLOGY ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.5 INNOVATIONS & PATENT REGISTRATIONS

TABLE 11 INNOVATIONS & PATENT REGISTRATIONS, 2012–2019

6.6 TARIFF REGULATORY LANDSCAPE BATTLEFIELD MANAGEMENT SYSTEM

6.6.1 NORTH AMERICA

6.6.2 EUROPE

7 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY COMPONENT (Page No. - 90)

7.1 INTRODUCTION

FIGURE 22 COMMUNICATION DEVICES PROJECTED TO DOMINATE BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 12 BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 13 BY COMPONENT, 2020–2025 (USD MILLION)

7.2 COMMUNICATION DEVICES

TABLE 14 COMMUNICATION DEVICES BY TYPE, 2017—2025 (USD MILLION)

TABLE 15 COMMUNICATION DEVICES BY TYPE, 2020–2025 (USD MILLION)

7.2.1 WIRED COMMUNICATION DEVICES

7.2.1.1 Demand for dedicated bandwidth for military communication purposes to increase demand for wired devices

7.2.2 WIRELESS COMMUNICATION DEVICES

7.2.2.1 Procurement of wireless communication devices is high for faster data transfer among platforms

7.3 IMAGING DEVICES

7.3.1 DEMAND FOR HIGH-DEFINITION IMAGING DEVICES FOR BATTLEFIELD OBSERVATION PURPOSES FUELS DEMAND FOR IMAGING DEVICES

7.4 DISPLAY DEVICES

7.4.1 INTEGRATION OF RUGGED LCD DISPLAY SYSTEMS FOR BATTLEFIELD APPLICATIONS BOOSTS DEMAND FOR DISPLAY DEVICES

7.5 TRACKING DEVICES

7.5.1 DEMAND FOR RELIABLE ASSET TRACKING DEVICES FUELS TRACKING DEVICES MARKET GROWTH

7.6 COMPUTER HARDWARE DEVICES

7.6.1 COMPUTER HARDWARE DEVICES SEGMENT DRIVEN BY ADOPTION OF TECHNOLOGICALLY ADVANCED COMPUTING DEVICES

7.7 DATA DISTRIBUTION UNITS

7.7.1 DEMAND FOR SAFE COMMUNICATION INTERFACE FOR VARIOUS MILITARY EQUIPMENT DRIVES SEGMENT

7.8 NIGHT VISION DEVICES

7.8.1 DEMAND FOR ENHANCED VISIBLE IMAGING BOOSTS NIGHT VISION DEVICES SEGMENT

7.9 SOFTWARE

7.9.1 COMMAND & CONTROL SOFTWARE

7.9.2 MILITARY SITUATIONAL AWARENESS

7.9.3 SECURITY MANAGEMENT

7.9.4 OTHERS

8 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY SOLUTION (Page No. - 97)

8.1 INTRODUCTION

FIGURE 23 HARDWARE SEGMENT PROJECTED TO DOMINATE BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 16 BY SOLUTION, 2017–2019 (USD MILLION)

TABLE 17 BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 18 HARDWARE BY REGION, 2017–2019 (USD MILLION)

TABLE 19 HARDWARE BY REGION, 2020–2025 (USD MILLION)

TABLE 20 SOFTWARE BY REGION, 2017–2019 (USD MILLION)

TABLE 21 SOFTWARE BY REGION, 2020–2025 (USD MILLION)

8.2 HARDWARE

8.2.1 DEMAND FOR SECURE COMMUNICATION AND DATA TRANSFER BETWEEN VARIOUS MILITARY PLATFORMS EXPECTED TO DRIVE THIS SEGMENT

8.3 SOFTWARE

8.3.1 EFFECTIVE SOFTWARE MODULES EXPECTED TO MANAGE VARIOUS FUNCTIONS FOR REAL-WORLD COMBAT SITUATIONS

9 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY PLATFORM (Page No. - 102)

9.1 INTRODUCTION

FIGURE 24 ARMORED VEHICLES PROJECTED TO DOMINATE BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 22 BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 23 BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 24 FOR ARMORED VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 25 FOR ARMORED VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 26 FOR ARMORED VEHICLES, BY REGION, 2017–2019 (USD MILLION)

TABLE 27 FOR ARMORED VEHICLES, BY REGION, 2020–2025 (USD MILLION)

TABLE 28 FOR COMBAT VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 29 FOR COMBAT VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 30 FOR COMBAT SUPPORT VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 31 FOR COMBAT SUPPORT VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 32 FOR HEADQUARTER & COMMAND CENTERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 33 FOR HEADQUARTER & COMMAND CENTERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 34 FOR SOLDIER SYSTEMS, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 FOR SOLDIER SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

9.2 ARMORED VEHICLES

9.2.1 NEED TO COUNTER EMERGENCIES CAUSED BY INSURGENCIES AND MILITANT ATTACKS DRIVES SEGMENT GROWTH

9.2.1.1 Combat vehicles

9.2.1.1.1 Main Battle Tanks (MBTs)

9.2.1.1.1.1 Procurement of battlefield management system-enabled MBTs for border security purposes is high

9.2.1.1.2 Infantry Fighting Vehicles (IFVs)

9.2.1.1.2.1 Demand for advanced infantry vehicles fuels growth of battlefield management systems market

9.2.1.1.3 Air defense vehicles

9.2.1.1.3.1 Technological advancements in radar systems drive market for air defense vehicles

9.2.1.1.4 Self-propelled howitzers

9.2.1.1.4.1 Increasing use of in-built electronic suites in howitzers drives market

9.2.1.1.5 Armored amphibious vehicles

9.2.1.1.5.1 Demand for improved command over land and water surface during combat boost market growth

9.2.1.2 Combat support vehicles

9.2.1.2.1 Armored command & control vehicles

9.2.1.2.1.1 Integration of battlefield management systems in modern armored vehicles drives market

9.2.1.2.2 Armored supply trucks

nbsp; 9.2.1.2.2.1 Segment driven by increased use of advanced protection systems for military transportation

9.2.1.3 Unmanned armored ground vehicles

9.2.1.3.1 Integration of battlefield management system in UAGVs for human-inconvenient mission operations is high

9.3 HEADQUARTER & COMMAND CENTERS

9.3.1 DEVELOPMENT OF EFFECTIVE SOFTWARE MODULES TO MANAGE VARIOUS FUNCTIONS FOR REAL-WORLD COMBAT SITUATIONS FUELS SEGMENT GROWTH

9.4 SOLDIER SYSTEMS

9.4.1 INCREASING BUDGET ALLOCATIONS FOR SOLDIER MODERNIZATION PROGRAMS DRIVE SEGMENT GROWTH

10 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY SYSTEM (Page No. - 112)

10.1 INTRODUCTION

FIGURE 25 COMPUTING SEGMENT PROJECTED TO LEAD BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 36 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 37 BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 38 FOR COMPUTING, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 FOR COMPUTING, BY REGION, 2020–2025 (USD MILLION)

TABLE 40 FOR COMMUNICATION & NETWORKING, BY REGION, 2017–2019 (USD MILLION)

TABLE 41 FOR COMMUNICATION & NETWORKING, BY REGION, 2020–2025 (USD MILLION)

TABLE 42 FOR COMMAND & CONTROL, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 FOR COMMAND & CONTROL, BY REGION, 2020–2025 (USD MILLION)

TABLE 44 FOR NAVIGATION, IMAGING, AND MAPPING, BY REGION, 2017–2019 (USD MILLION)

TABLE 45 FOR NAVIGATION, IMAGING, AND MAPPING, BY REGION, 2020–2025 (USD MILLION)

10.2 COMPUTING

10.2.1 INCREASING USE OF PORTABLE AND WEARABLE COMPUTING SYSTEMS DRIVES MARKET

10.3 COMMUNICATION & NETWORKING

10.3.1 DEMAND FOR NETWORK-CENTRIC AND DATA-CENTRIC COMMUNICATION

10.4 COMMAND & CONTROL

10.4.1 USE OF CLOUD COMPUTING AND DATA STORAGE SOLUTIONS FOR COMMAND & CONTROL IN BATTLEFIELD MANAGEMENT IS INCREASING

10.5 NAVIGATION, IMAGING, AND MAPPING

10.5.1 DEMAND FOR TRACKING AND LOCATING ENEMY FORCES BOOSTS SEGMENT GROWTH

11 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY INSTALLATION TYPE (Page No. - 119)

11.1 INTRODUCTION

FIGURE 26 NEW INSTALLATION SEGMENT PROJECTED TO DOMINATE BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 46 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 47 INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 48 FOR NEW INSTALLATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 49 FOR NEW INSTALLATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 50 FOR UPGRADATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 FOR UPGRADATION, BY REGION, 2020–2025 (USD MILLION)

11.2 NEW INSTALLATION

11.2.1 GROWING DEFENSE BUDGET ALLOCATIONS FOR NEW INSTALLATION OF ADVANCED BATTLEFIELD MANAGEMENT SYSTEM WILL DRIVE THIS SEGMENT

11.3 UPGRADATION

11.3.1 NEED FOR UPGRADING EXISTING BATTLEFIELD MANAGEMENT SYSTEMS WILL DRIVE THIS SEGMENT

12 BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY END USER (Page No. - 123)

12.1 INTRODUCTION

FIGURE 27 ARMY SEGMENT PROJECTED TO LEAD BATTLEFIELD MANAGEMENT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 52 MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 53 MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 54 FOR ARMY, BY REGION, 2017–2019 (USD MILLION)

TABLE 55 FOR ARMY, BY REGION, 2020–2025 (USD MILLION)

TABLE 56 FOR NAVY, BY REGION, 2017–2019 (USD MILLION)

TABLE 57 FOR NAVY, BY REGION, 2020–2025 (USD MILLION)

TABLE 58 FOR AIR FORCE, BY REGION, 2017–2019 (USD MILLION)

TABLE 59 FOR AIR FORCE, BY REGION, 2020–2025 (USD MILLION)

12.2 ARMY

12.2.1 INCREASING USE OF BATTLE MANAGEMENT SYSTEMS FOR REAL-TIME INFORMATION SHARING IS DRIVING THE MARKET

12.3 NAVY

12.3.1 MODERNIZATION OF BATTLEFIELD MANAGEMENT SYSTEMS IS DRIVING THE MARKET

12.4 AIR FORCE

12.4.1 ADVANCED BATTLEFIELD MANAGEMENT SYSTEMS ARE USED TO ENHANCE INTEROPERABILITY OF DEFENSE PLATFORMS

13 REGIONAL ANALYSIS (Page No. - 129)

13.1 INTRODUCTION

FIGURE 28 BATTLEFIELD MANAGEMENT SYSTEMS MARKET IN ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

13.2 COVID-19 IMPACT ON BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY REGION

FIGURE 29 BATTLEFIELD MANAGEMENT SYSTEMS MARKET POST-COVID-19 SCENARIO

13.3 NORTH AMERICA

13.3.1 COVID-19 RESTRICTIONS IN NORTH AMERICA

13.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA BATTLEFIELD MANAGEMENT SYSTEMS MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.3.3 US

13.3.3.1 Focus on the development of advanced management systems for armed forces expected to drive the market in the US

TABLE 72 US: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 73 US: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 74 US: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 75 US: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 76 US: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 77 US: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 78 US: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 79 US: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.3.4 CANADA

13.3.4.1 Focus on improvement of existing battlefield management technology fuel the market in this country

TABLE 80 CANADA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 81 CANADA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 82 CANADA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 83 CANADA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 84 CANADA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 85 CANADA: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 86 CANADA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 87 CANADA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

13.4 EUROPE

13.4.1 COVID-19 IMPACT ON EUROPE

13.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 31 EUROPE BATTLEFIELD MANAGEMENT SYSTEMS MARKET SNAPSHOT

TABLE 88 EUROPE: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY SOLUTION, 2017–2019 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.4.3 UK

13.4.3.1 Rapid growth in military expenditure and upgradation of armored vehicles are driving the market in the UK

TABLE 100 UK: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 101 UK: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 102 UK: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 103 UK: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 104 UK: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 105 UK: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 106 UK: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 107 UK: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.4.4 RUSSIA

13.4.4.1 The market in this country is driven by rising investments in digitizing armored vehicle platforms to improve command and control capability

TABLE 108 RUSSIA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 109 RUSSIA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 110 RUSSIA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 111 RUSSIA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 112 RUSSIA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 113 RUSSIA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 114 RUSSIA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 115 RUSSIA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.4.5 GERMANY

13.4.5.1 Increasing need for interoperability, control, and tracking hostile activities to check the entry of illegal immigrants drive the market

TABLE 116 GERMANY: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 119 GERMANY: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 120 GERMANY: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 122 GERMANY: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 123 GERMANY: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.4.6 FRANCE

13.4.6.1 Rise in demand for new generation battlefield management system for the defense forces of France is driving the market

TABLE 124 FRANCE: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 128 FRANCE: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 130 FRANCE: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 131 FRANCE: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.4.7 ITALY

13.4.7.1 Focus on development of battlefield management system for target acquisition drive the market in Italy

TABLE 132 ITALY: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 133 ITALY: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 134 ITALY: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 135 ITALY: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 136 ITALY: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 137 ITALY: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 138 ITALY: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 139 ITALY: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.4.8 REST OF EUROPE

13.4.8.1 Increased demand for situational awareness and next-generation communication technology expected to drive the market in this region

TABLE 140 REST OF EUROPE: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 144 REST OF EUROPE: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5 ASIA PACIFIC

13.5.1 ASIA PACIFIC COVID-19 IMPACT

13.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 32 ASIA PACIFIC BATTLEFIELD MANAGEMENT SYSTEMS MARKET SNAPSHOT

TABLE 148 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5.3 CHINA

13.5.3.1 Increased investment to strengthen military capabilities due to cross border conflicts expected to drive the market

TABLE 160 CHINA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 161 CHINA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 162 CHINA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 163 CHINA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 164 CHINA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 165 CHINA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 166 CHINA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 167 CHINA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5.4 INDIA

13.5.4.1 Rising terrorist activities, and border disputes with Pakistan and China fuel the market in India

TABLE 168 INDIA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 169 INDIA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 170 INDIA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 171 INDIA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 172 INDIA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 173 INDIA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 174 INDIA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 175 INDIA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5.5 JAPAN

13.5.5.1 Technologically advanced indigenous defense systems drive the market in this country

TABLE 176 JAPAN: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 177 JAPAN: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 178 JAPAN: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 179 JAPAN: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 180 JAPAN: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 181 JAPAN: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 182 JAPAN: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 183 JAPAN: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5.6 SOUTH KOREA

13.5.6.1 Focus on the development and procurement of advanced battlefield management systems projected to fuel the market in South Korea

TABLE 184 SOUTH KOREA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 185 SOUTH KOREA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 186 SOUTH KOREA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 187 SOUTH KOREA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 188 SOUTH KOREA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 189 SOUTH KOREA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 190 SOUTH KOREA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 191 SOUTH KOREA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5.7 AUSTRALIA

13.5.7.1 Procurement of advanced battlefield management system to modernize armed forces propel the market

TABLE 192 AUSTRALIA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 193 AUSTRALIA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 194 AUSTRALIA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 195 AUSTRALIA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 196 AUSTRALIA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 197 AUSTRALIA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 198 AUSTRALIA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 199 AUSTRALIA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.5.8 REST OF ASIA PACIFIC

13.5.8.1 Increased budget allocations for modernization of armed forces drive the market in this region

TABLE 200 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 202 REST OF ASIA PACIFIC: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 203 REST OF ASIA PACIFIC: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.6 MIDDLE EAST

13.6.1 MIDDLE EAST COVID-19 IMPACT

13.6.2 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 33 MIDDLE EAST MARKET SNAPSHOT

TABLE 208 MIDDLE EAST: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 209 MIDDLE EAST: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 210 MIDDLE EAST: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 211 MIDDLE EAST: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 212 MIDDLE EAST: MARKET, BY SOLUTION, 2017–2019 (USD MILLION)

TABLE 213 MIDDLE EAST: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 214 MIDDLE EAST: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 215 MIDDLE EAST: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 216 MIDDLE EAST: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 217 MIDDLE EAST: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 218 MIDDLE EAST: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 219 MIDDLE EAST: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.6.3 SAUDI ARABIA

13.6.3.1 Demand for combat vehicle segment is driving the market in this country

TABLE 220 SAUDI ARABIA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 221 SAUDI ARABIA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 222 SAUDI ARABIA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 223 SAUDI ARABIA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 224 SAUDI ARABIA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 225 SAUDI ARABIA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 226 SAUDI ARABIA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 227 SAUDI ARABIA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.6.4 ISRAEL

13.6.4.1 The market in this country is driven by the presence of major manufacturers of battlefield management system

TABLE 228 ISRAEL: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 229 ISRAEL: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 230 ISRAEL: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 231 ISRAEL: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 232 ISRAEL: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 233 ISRAEL: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 234 ISRAEL: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 235 ISRAEL: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.6.5 TURKEY

13.6.5.1 Increase defense and security budget expected to fuel the market in Turkey

TABLE 236 TURKEY: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 237 TURKEY: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 238 TURKEY: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 239 TURKEY: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 240 TURKEY: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 241 TURKEY: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 242 TURKEY: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 243 TURKEY: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.6.6 REST OF MIDDLE EAST

13.6.6.1 Increased geopolitical instability expected to drive the market in this region

TABLE 244 REST OF MIDDLE EAST: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 246 REST OF MIDDLE EAST: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 247 REST OF MIDDLE EAST: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 249 REST OF MIDDLE EAST: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 250 REST OF MIDDLE EAST: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 251 REST OF MIDDLE EAST: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.7 REST OF THE WORLD

13.7.1 COVID-19 IMPACT ON REST OF THE WORLD

TABLE 252 REST OF THE WORLD: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 253 REST OF THE WORLD: MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 254 REST OF THE WORLD: MARKET, BY SOLUTION, 2017–2019 (USD MILLION)

TABLE 255 REST OF THE WORLD: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 256 REST OF THE WORLD: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 257 REST OF THE WORLD: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 258 REST OF THE WORLD: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 259 REST OF THE WORLD: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 260 REST OF THE WORLD: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 261 REST OF THE WORLD: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 262 REST OF THE WORLD: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 263 REST OF THE WORLD: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.7.2 LATIN AMERICA

13.7.2.1 Focus on the development of next-generation and secure communication technology is driving the market in this region

TABLE 264 LATIN AMERICA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 265 LATIN AMERICA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 266 LATIN AMERICA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 267 LATIN AMERICA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 268 LATIN AMERICA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 269 LATIN AMERICA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 270 LATIN AMERICA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 271 LATIN AMERICA: MARKET, BY END USER, 2020–2025 (USD MILLION)

13.7.3 AFRICA

13.7.3.1 Increased investments in communication infrastructure fuel the market in Africa

TABLE 272 AFRICA: MARKET, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 273 AFRICA: MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 274 AFRICA: MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 275 AFRICA: MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 276 AFRICA: MARKET, BY INSTALLATION TYPE, 2017–2019 (USD MILLION)

TABLE 277 AFRICA: MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 278 AFRICA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 279 AFRICA: BATTLEFIELD MANAGEMENT SYSTEMS MARKET, BY END USER, 2020–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 206)

14.1 INTRODUCTION

TABLE 280 KEY DEVELOPMENTS BY LEADING PLAYERS IN BATTLEFIELD MANAGEMENT SYSTEMS MARKET BETWEEN 2015 AND 2020

14.2 COMPETITIVE LEADERSHIP MAPPING

14.2.1 STAR

14.2.2 EMERGING LEADER

14.2.3 PERVASIVE

14.2.4 PARTICIPANT

FIGURE 34 COMPETITIVE LEADERSHIP MAPPING, 2019

14.3 MARKET SHARE OF KEY PLAYERS, 2019

FIGURE 35 MARKET SHARE ANALYSIS OF TOP PLAYERS IN BATTLEFIELD MANAGEMENT SYSTEMS MARKET, 2019

14.4 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2019

FIGURE 36 MARKET RANKING OF TOP PLAYERS IN BATTLEFIELD MANAGEMENT SYSTEMS MARKET, 2019

FIGURE 37 REVENUE ANALYSIS OF BATTLEFIELD MANAGEMENT SYSTEMS MARKET PLAYERS, 2015-2019

14.5 COMPETITIVE SCENARIO

14.5.1 NEW PRODUCT LAUNCHES

TABLE 281 NEW PRODUCT LAUNCHES, 2015-2020

14.5.2 AGREEMENTS, PARTNERSHIPS, ACQUISITIONS, AND COLLABORATIONS

TABLE 282 AGREEMENTS, PARTNERSHIPS, ACQUISITIONS, AND COLLABORATIONS, 2015–2020

14.5.3 CONTRACTS

TABLE 283 CONTRACTS, 2015-2020

15 COMPANY PROFILES (Page No. - 215)

15.1 INTRODUCTION

15.2 KEY PLAYERS

(Business Overview, Products & Solutions Offered, Recent Developments, and MnM View)*

15.2.1 ROLTA INDIA LIMITED

FIGURE 38 ROLTA INDIA LIMITED: COMPANY SNAPSHOT

15.2.2 COBHAM LIMITED

FIGURE 39 COBHAM LIMITED: COMPANY SNAPSHOT

15.2.3 COLLINS AEROSPACE

FIGURE 40 COLLINS AEROSPACE: COMPANY SNAPSHOT

15.2.4 ATOS SE

FIGURE 41 ATOS SE: COMPANY SNAPSHOT

15.2.5 RHEINMETALL AG

FIGURE 42 RHEINMETALL AG: COMPANY SNAPSHOT

15.2.6 KONGSBERG GRUPPEN ASA

FIGURE 43 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

15.2.7 SYSTEMATIC AS

15.2.8 GENERAL DYNAMICS

FIGURE 44 GENERAL DYNAMICS: COMPANY SNAPSHOT

15.2.9 AIRBUS DEFENSE AND SPACE

FIGURE 45 AIRBUS DEFENSE AND SPACE: COMPANY SNAPSHOT

15.2.10 RAFAEL ADVANCED DEFENSE SYSTEMS LIMITED

15.2.11 BAE SYSTEMS

FIGURE 46 BAE SYSTEMS: COMPANY SNAPSHOT

15.2.12 INDRA COMPANY

FIGURE 47 INDRA COMPANY: COMPANY SNAPSHOT

15.2.13 SAAB AB

FIGURE 48 SAAB AB: COMPANY SNAPSHOT

15.2.14 ELBIT SYSTEMS LTD

FIGURE 49 ELBIT SYSTEMS LTD: COMPANY SNAPSHOT

15.2.15 ISRAEL AEROSPACE INDUSTRIES

FIGURE 50 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

15.2.16 LEONARDO S.P.A

FIGURE 51 LEONARDO S.P.A: COMPANY SNAPSHOT

15.2.17 LOCKHEED MARTIN CORPORATION

FIGURE 52 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

15.2.18 THALES GROUP

FIGURE 53 THALES GROUP: COMPANY SNAPSHOT

15.2.19 ASELSAN AS

FIGURE 54 ASELSAN AS: COMPANY SNAPSHOT

15.2.20 L3HARRIS TECHNOLOGIES INC.

FIGURE 55 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

15.2.21 NORTHROP GRUMMAN CORPORATION

FIGURE 56 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

15.2.22 SAPURA SECURED TECHNOLOGIES

15.2.23 TELEPLAN GLOBE AS

15.2.24 NEXTER SYSTEMS

15.2.25 ANDURIL INDUSTRIES, INC.

* Business Overview, Products & Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

16 ADJACENT MARKET (Page No. - 262)

16.1 COMMAND AND CONTROL SYSTEMS MARKET

16.1.1 COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION

FIGURE 57 COMMERCIAL SEGMENT PROJECTED TO GROW AT A HIGHER CAGR AS COMPARED TO GOVERNMENT & DEFENSE SEGMENT DURING FORECAST PERIOD

TABLE 284 COMMAND AND CONTROL SYSTEMS MARKET SIZE, BY APPLICATION, 2017—2025 (USD MILLION)

16.2 GOVERNMENT & DEFENSE

TABLE 285 COMMAND AND CONTROL SYSTEMS MARKET IN GOVERNMENT & DEFENSE, BY SUBAPPLICATION, 2017—2025 (USD MILLION)

16.2.1 MILITARY

16.2.1.1 Battle management

16.2.1.1.1 Increasing use of battle management systems for real-time information sharing is driving the market

16.2.1.2 Air and missile defense

16.2.1.2.1 Need for early warning systems to counter aerial threats is driving the market

16.2.1.3 Nuclear defense

16.2.1.3.1 Upgradation and modernization of nuclear command and control systems are driving the market

16.2.1.4 Combat management

16.2.1.4.1 Modernization of combat management systems is driving the market

16.2.1.5 Artillery control

16.2.1.5.1 Need for a centralized structure for artillery control is driving the market

16.2.1.6 Space asset management

16.2.1.6.1 Need for space asset management control satellites for various missions is driving the market

16.2.1.7 Defense cybersecurity

16.2.1.7.1 Need for robust cybersecurity solutions to protect the increasing electronics systems and wearables used by soldiers is driving the market

16.2.1.8 Unmanned control

16.2.1.8.1 Increasing use of UAVs in surveillance and intelligence gathering applications is driving the unmanned control segment

16.2.2 HOMELAND SECURITY & CYBER PROTECTION

TABLE 286 COMMAND AND CONTROL SYSTEMS MARKET IN HOMELAND SECURITY & CYBER PROTECTION, BY SUBAPPLICATION, 2017—2025 (USD MILLION)

16.2.2.1 Disaster management and first responders

16.2.2.1.1 Use of disaster management systems for dispatching first responders and giving instructions is driving the market

16.2.2.2 Public safety & law enforcement

16.2.2.2.1 Public safety & law enforcement Increasing demand for physical security information management (PSIM) systems is driving the market

16.2.2.2.1.1 Integrated command and control centers

16.2.2.2.1.2 Public transport command and control centers

16.2.2.2.1.3 Utilities command and control centers

16.2.2.3 Government critical infrastructure security

16.2.2.3.1 Need to protect critical infrastructures such as metros and railways is driving the market

TABLE 287 COMMAND AND CONTROL SYSTEMS MARKET IN GOVERNMENT & DEFENSE, BY APPLICATION, 2017—2025 (USD MILLION)

TABLE 288 COMMAND AND CONTROL SYSTEMS MARKET IN GOVERNMENT & DEFENSE, BY REGION, 2017—2025 (USD MILLION)

16.3 COMMERCIAL

16.3.1 INDUSTRIAL

16.3.1.1 Industrial uses of command and control systems include security management of various manufacturing facilities

16.3.2 CRITICAL INFRASTRUCTURE

16.3.2.1 Various command & and control systems are used for the security management of critical infrastructure

16.3.3 TRANSPORTATION

16.3.3.1 Air traffic management

16.3.3.1.1 Increase in passenger traffic is driving the market of air traffic management

16.3.3.2 Vessel tracking management

16.3.3.2.1 Increase in commercial shipping has led to investment in vessel tracking systems

16.3.3.3 Metro and rail control room solutions

16.3.3.3.1 Metro expansions in various countries are driving the market

16.3.4 SMART CITY COMMAND CENTER

16.3.4.1 Increase in investment in smart cities is driving the market

16.3.5 GROUND CONTROL STATION FOR SPACE

16.3.5.1 Increase in use of constellations of satellites for missions is driving the demand for ground control stations for space

16.3.6 OTHERS

TABLE 289 COMMAND AND CONTROL SYSTEMS MARKET IN COMMERCIAL, BY SUBAPPLICATION, 2017—2025 (USD MILLION)

TABLE 290 COMMAND AND CONTROL SYSTEMS MARKET IN COMMERCIAL, BY REGION, 2017—2025 (USD MILLION)

17 APPENDIX (Page No. - 272)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved various activities in estimating the market size for battlefield management system. Exhaustive secondary research was undertaken to collect information on the battlefield management systems market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the battlefield management systems market.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, Secondary sources include Publications of Statista, Clarksons Research, the International Maritime Organization (IMO), the Stockholm International Peace Research Institute (SIPRI), and the US Department of Defence: Publications, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the battlefield management systems market.

Primary Research

The battlefield management systems market comprises several stakeholders such as army, navy, air forces, regulatory bodies, research institutes and organizations, wholesalers, retailers, and distributors of battlefield management system software and hardware in its supply chain. The supply side is characterized by technological advancements taking place in the field of battlefield management systems such as the artificial intelligence, and cloud computing. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the battlefield management systems market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the battlefield management systems market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the battlefield management systems market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the battlefield management systems market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the battlefield management systems market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the battlefield management systems market based on technology, application, end user, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the battlefield management systems market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the battlefield management systems market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the battlefield management systems market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the battlefield management systems market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Battlefield Management Systems Market