Calibration Services Market Size, Share, Trends, Statistics, Industry Growth Analysis by Proofreading (In-house, OEM, Third-party Vendor), Application (Mechanical, Electrical, Dimensional, Thermodynamics), Application (Industrial & Automation, Electronics, Aerospace & Defence) and Region - Forecast to 2030

Updated on : October 23, 2024

Calibration Services Market Size & Growth

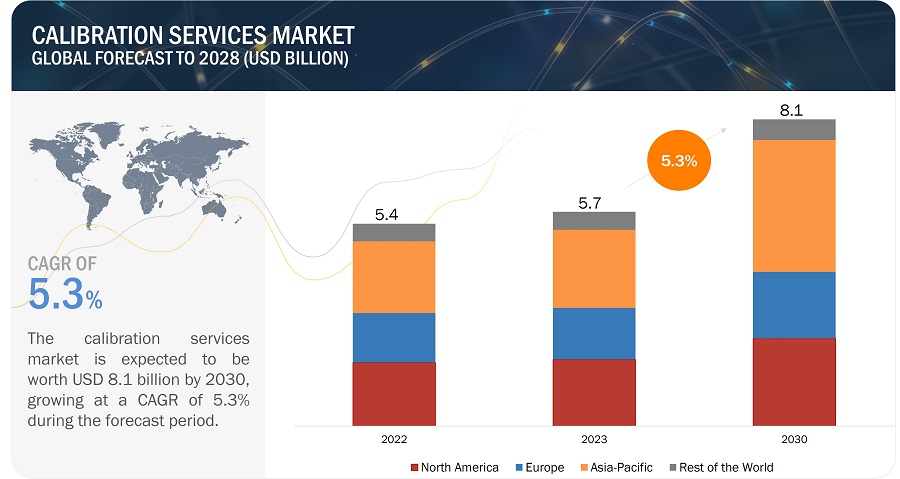

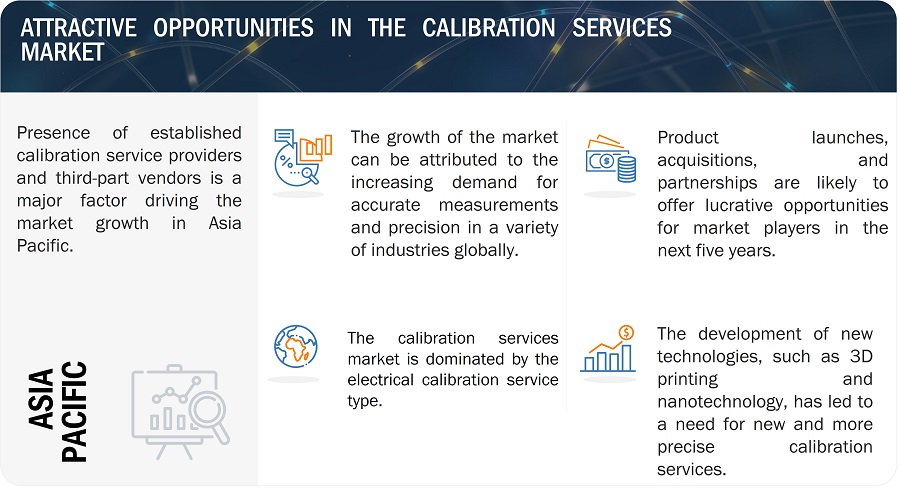

[257 Pages Report] The global calibration services market size is projected to grow from USD 5.7 billion in 2023 to USD 8.1 billion by 2030, growing at a CAGR of 5.3% during the forecast period from 2023 to 2030. The calibration services market has experienced significant growth driven by growing demand for quality and inspection equipment in precision manufacturing, the need for interoperability testing, and strict regulatory standards imposed by governments to ensure product safety and environmental protection. These factors have collectively contributed to the expansion of the market. Additionally, the increasing complexity of technological instruments, the globalization of trade, the emphasis on measurement accuracy for quality control, and risk mitigation in safety-critical sectors are also fueling the demand for calibration services.

Calibration Services Market Statistics and Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Calibration Services Market Trends:

Driver: Growing demand for quality and inspection equipment in precision manufacturing

The calibration services market share is experiencing significant growth due to the rising demand for quality and inspection equipment within the precision manufacturing sector. As industries increasingly prioritize precision and accuracy in their manufacturing processes, the need for regularly calibrated instruments and equipment becomes paramount. Calibration services ensure these tools maintain precision, meeting strict quality standards and regulatory requirements. This synergy between precision manufacturing and calibration services underscores the market's expansion as industries seek to enhance product quality, reduce defects, and adhere to industry regulations. Metrology is important in two ways for parts manufacturing. Before production begins, metrological instruments are used to calibrate the machinery and tooling that will be used, ensuring accurate and precise parts. Parts that have been optimized for manufacturability will also include specific tolerances, ensuring that minor variations in exact component size do not affect their final fit or function, potentially reducing quality risks. Post-production metrology is used to confirm that the parts meet design requirements and customer expectations. If the measurements don't meet the requirements, the manufacturing machinery may need to be realigned or adjusted. New manufacturing processes require smaller tolerances in terms of quality and dimensions to achieve the desired quality and reliability. Besides, component designers and machine manufacturers need to better understand the potential sources of errors. Calibration helps manufacturers by providing the analysis of errors. The calibration services also help in achieving higher productivity and accuracy. Improving the production quality necessitates the proportional improvement in measuring accuracy, along with the in-process and post-process control over the dimensional and geometrical accuracies of the product.

Restraint: Increased Complexity of Standards

Calibration service providers use standard heat, pressure, temperature, optical, electrical, and photoelectric calibration devices. Multiple OEMs provide standard devices for reference. OEMs such as Fluke, Siemens, and GE, have already developed standards for various types of calibration. Thus, competition among major OEMs also leads to complexity in selecting the standards for calibration. Use of different standards for calibrating the same instrument may affect the instrument's performance over time. The complexity of standards presents a notable restraint to the calibration services industry . As industries evolve and technology advances, standards governing accuracy, precision, and calibration procedures become more intricate and varied. This complexity can make it challenging for calibration service providers to stay updated, interpret standards accurately, and implement them consistently across diverse industries. Navigating a landscape of intricate and often rapidly changing standards demands additional resources, expertise, and adaptability, potentially leading to delays in calibration processes and increased costs for both service providers and clients. This restraint underscores the need for calibration service providers to invest in ongoing training and robust quality assurance mechanisms to effectively address the complexities of evolving standards and maintain their relevance in the industry .

Opportunity: Advent of 5G technology and deployment of LTE and LTE-Advanced (4G) networks

The advent of 5G technology has presented a significant opportunity for the calibration service market growth . 5G networks operate at higher frequencies than previous generations of cellular networks, which requires more accurate and precise calibration of communication equipment and testing instruments. This is because even small errors in calibration can significantly impact the performance of 5G networks. In addition, 5G technology is enabling a wide range of emerging applications, such as the Internet of Things (IoT), autonomous vehicles, augmented reality, and virtual reality. These applications require seamless and reliable communication, which makes precise calibration services indispensable for their success. The 5G networks are rolled out worldwide, the demand for calibrated instruments for network testing, optimization, and troubleshooting is increasing. Calibration services play a vital role in verifying the accuracy and functionality of these instruments, which are critical for the successful deployment and maintenance of 5G networks.

The complexity of 5G technology also presents challenges in terms of calibration. Higher frequencies and complex modulation schemes require specialized calibration methods and equipment. Calibration service providers need to stay at the forefront of technological developments to meet the ever-evolving requirements of 5G networks and devices. In conclusion, the rise of 5G technologies is driving the demand for precision and accurate calibration services. This makes it a prominent driver in the growth of the calibration service market. As 5G continues to revolutionize the telecommunications landscape and enables transformative applications, calibration services become increasingly critical in ensuring the seamless and efficient operation of 5G networks and devices.

Challenge: Built-in self-calibration feature of electrical & electronic instrument

The rapid development of technology is evident from its growing importance and the increasing investments in R&D. These developments are spanning across multiple industries including oil and gas, power generation, chemicals, water, telecommunication, semiconductors, aerospace and defense, and healthcare, and life science. There is increasing awareness regarding self-calibrated devices to reduce the cost of maintenance. Furthermore, there is a growing emphasis on calibrating devices through software technologies to easily accomplish such services within the facility. Hence, such technological developments may affect calibration service providers, which may lead them to the stage of strategic inflection.

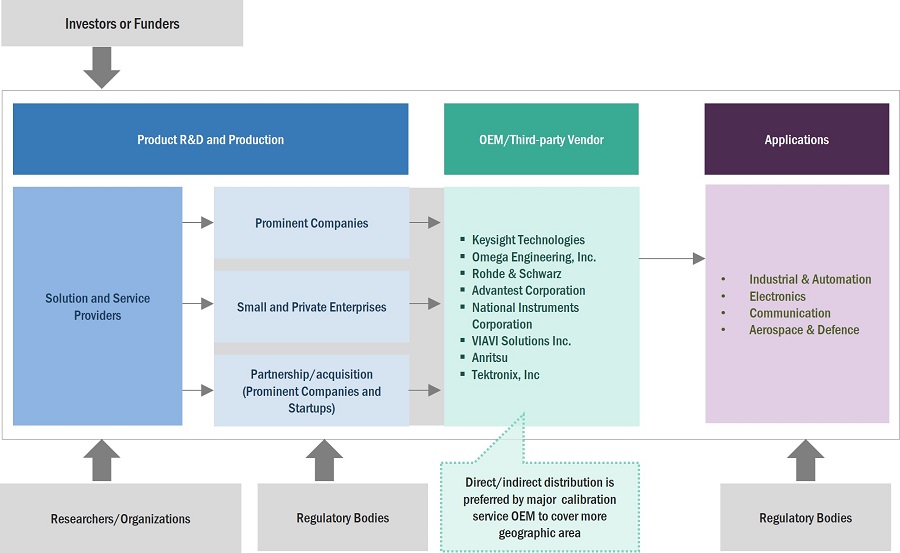

Calibration Services Market Ecosystem

The calibration services market ecosystem consists of various entities and components that contribute to developing, producing, distributing, and utilizing calibration services products. Dominant companies in this market include Keysight Technologies (US), Hexagon AB (Sweden), Rohde & Schwarz (Germany), Tektronix, Inc. (US), VIAVI Solutions Inc. (US), Omega Engineering, Inc. (US), Advantest Corporation (Japan), National Instruments Corporation (US), Anritsu (Japan), Trescal, Inc. (France), Pratt and Whitney Measurement Systems, Inc. (US), Kolb & Baumann GmbH & Co KG. (Germany), Renishaw plc. (UK), Feinmess Suhl GmbH (Germany), Octagon Precision India Pvt. Ltd. (India), TESA Brown & Sharpe (Part of Hexagon AB) (Switzerland), Mitutoyo (Japan), Hexagon AB (Sweden), MSI Viking (US), Master Gage & Tool Co. (US), Tanson Instrument (India), Micro Precision Calibration (US), Mettler Toledo (US), Testo (Germany), Tradinco Instruments (India), TGCI Group (US), Mahr GmbH (Germany), and Essco Calibration Laboratory (US).

By Proofreading, third-party vendor to record for the highest growth of the calibration services market

Third-party calibration services are calibration offerings provided by independent companies or vendors that are not affiliated with the original equipment manufacturer (OEM) of the measuring instruments or equipment. These calibration service providers specialize in calibrating a wide range of instruments from various manufacturers, offering calibration solutions to diverse industries. Choosing third-party calibration services provides organizations with several benefits. Firstly, it allows for impartiality and objectivity in the calibration process, as the calibration vendor does not have a vested interest in selling specific equipment. This ensures that calibration results are unbiased and conform to industry standards. Secondly, third-party calibration vendors often have extensive experience calibrating instruments from different manufacturers, allowing them to offer calibration solutions for diverse equipment within an organization. Third-party calibration services are particularly valuable for companies that use equipment from multiple manufacturers. It streamlines the calibration process, making it more convenient and cost-effective, as organizations can send various instruments to a single vendor for calibration. Moreover, third-party calibration services are known for their expertise, technical proficiency, and adherence to recognized calibration procedures. They typically employ highly skilled technicians and use state-of-the-art calibration equipment to ensure accurate and reliable results.

By application, the aerospace & defence is expected to grow at the highest rate during the forecast period

the stringent quality and safety requirements within the aerospace & defense industries. Calibration services play a crucial role in ensuring that measurement and testing equipment used in these sectors meet the exacting standards required for aircraft, spacecraft, military hardware, and related components. Accurate calibration guarantees the precision of instruments like avionics systems, radar equipment, navigational tools, and weapons systems, contributing to the overall performance, safety, and reliability of aerospace and defense systems. As these industries continue to advance and adopt cutting-edge technologies, the demand for specialized calibration services is expected to rise further, driven by the need to maintain strict compliance with industry regulations and ensure optimal functionality in critical applications.

Calibration is one of the most essential services during the stages of production and maintenance of aircraft. Calibration is undertaken in aircraft to ensure the correctness of the design with regard to aerodynamics and communication. Calibration services for pressure, flow, temperature, length, angle, torque, and so on are essential to ensure a risk-free flight period. The military and defense sector uses calibration services for its production units, which produce equipment such as gun barrels, cannons, covers, radar, etc. To ensure efficient performance of such equipment, testing is essential. The main test objects in military and defense are complex components, composite enclosures, control rod ends, skin and edge assemblies, components of helicopters, aircraft engine turbine blades, RF materials, straps, and ejects handles. Such testing devices require regular calibration services over time.

Medical Equipment Calibration Services Market

Calibration Services Market Regional Analysis

Asia Pacific is projected to account for the largest share of the overall calibration services market by 2030

Calibration Services Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia-Pacific (APAC) is expected to be Kone of the key markets for calibration services in the future, due to its high growth potential for industries as compared to the other regions. The other major factors favoring the APAC market include the emergence of industries and high-cost benefits due to the lower wages in the region. The APAC region includes some of the leading markets such as China, Japan, and India. The growth of the calibration services market share in the APAC region is mainly attributed to the increasing investments, growing manufacturing activities in the region, and significant research and development activities. The growing quality consciousness among consumers, coupled with a preference for accredited manufacturers is driving the demand for calibration services among companies in APAC. Factors such as the rapid industrial growth, increasing focus on quality, and need to adhere to international standards are also fueling the growth of calibration and repair services. Tektronix (US), a Danaher Corporation subsidiary, has added new calibration labs in Japan, Malaysia, China, and India to increase the company's global reach. It also gained accreditation from China National Accreditation Service (CNAS) for Conformity Assessment for electrical calibration services. These countries and the Asia Pacific region offer enormous opportunities for industrial R&D cooperation to other countries in terms of facilities and skilled personnel.

Top Calibration Services Companies - Key Market Players:

- Keysight Technologies (US),

- Hexagon AB (Sweden),

- Rohde & Schwarz (Germany),

- Tektronix, Inc. (US), and

- VIAVI Solutions Inc. (US) are some of the key players in the calibration services Companies.

Calibration Services Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 5.7 billion in 2023 |

| Projected Market Size | USD 8.1 billion by 2030 |

| Growth Rate | CAGR of 5.3% |

|

Market Size Availability for Years |

2019–2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Billion & Million) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

Keysight Technologies (US), Hexagon AB (Sweden), Rohde & Schwarz (Germany), Tektronix, Inc. (US), and VIAVI Solutions Inc. (US). More than 25 companies profiled |

Calibration Services Market Highlights

This research report categorizes the calibration services market based on service type, proofreading, application, and region.

|

Segment |

Subsegment |

|

By Proofreading: |

|

|

By Service Type: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Calibration Services Industry

- In June 2023, Keysight Technologies, Inc. acquired the entire share capital of ESI Group SA (Euronext Paris Symbol: ESI). ESI Group is a leading innovator of virtual prototyping solutions in automotive and aerospace end markets.

- In June 2023, Viavi Solutions Inc. released TM500 Cloud to test cloud-deployed O-RAN components. As operators progressively shift core network services to the cloud via hyperscale’s and other cloud providers, the TM500 Cloud is specifically designed to assess and address potential risks related to the Quality of Service (QoS) for end users.

- In March 2023, Rohde & Schwarz introduced the R&S EVSD1000 VHF/UHF NAV/drone analyser, a cutting-edge solution for precise and efficient inspection of terrestrial navigation and communications systems for drones. This analyser offers exceptional accuracy and measurement repeatability, catering to customers' stringent requirements in this field.

- In April 2023, LAPP, a leading provider of integrated cable and connection technology solutions, partnered with BASF to incorporate a new bio-based plastic into their product range. This plastic, known as Organic ETHERLINE, is developed by BASF and offers a sustainable alternative for various cable applications.

- In November 2022, Tektronix Inc. partnered with BRIDG, a not-for-profit, public-private partnership focused on advanced system integration and integrated circuit packaging. Through this partnership, advanced semiconductor package testing capabilities in the United States will be expanded.

- In June 2022, Hexagon's Manufacturing Intelligence division agreed to collaborate with ESAB, a global fabrication technology leader, to develop a streamlined welding solution that combines Hexagon's powerful simulation software with ESAB's InduSuite solutions to help fabricators perform more efficient and successful welding operations. Hexagon's simulation intelligence, embedded in ESAB's software and automation portfolio, will provide users with the tools they need to consistently manufacture high-quality products without the need for costly trial and error.

Frequently Asked Questions (FAQ):

Who are the key players in the calibration services market? What are the major growth strategies they had taken to strengthen their position in the market?

Major companies operating in the calibration services market include Keysight Technologies (US), Hexagon AB (Sweden), Rohde & Schwarz (Germany), Tektronix, Inc. (US), and VIAVI Solutions Inc. (US), Omega Engineering, Inc. (US), Advantest Corporation (Japan), National Instruments Corporation (US), Anritsu (Japan), and Trescal, Inc. (France). These companies offer advanced calibration services with a global presence to meet the needs of their customers. Product launches and developments, acquisitions, collaborations, partnerships, and expansions were among the major strategies adopted by these players to compete in the market.

What are the new opportunities for emerging players in the calibration services market?

Maintaining consistent and accurate measurements is crucial for quality control and assurance in various industries. Calibration ensures that instruments are operating within specified tolerances, leading to improved product quality and reduced defects.

Which application is likely to drive the calibration services market growth in the next five years?

The aerospace & defence application of calibration services is poised to be a key market driver in the next five years. This is because calibration services are pivotal in the aerospace and defense sectors, where high-quality and safety demands are rigorous. They guarantee that measurement and testing tools meet stringent aircraft, spacecraft, and military equipment standards.

Which region will likely offer lucrative growth for the calibration services market by 2030?

Asia Pacific is likely to lead the calibration services market during the forecast period. Also, the region is expected to witness the highest growth rate between 2023 and 2030.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for high-quality inspection equipment in precision manufacturing- Increasing requirement for interoperability testing with rising adoption of IoT devices- Strict government regulations to ensure product safety and environmental protection- Growing adoption of electronic devicesRESTRAINTS- Shortage of skilled technicians to carry out calibration and maintenance tasks- High competition due to increased price sensitivity- Complexities in calibration standardsOPPORTUNITIES- Advent of 5G technology and deployment of LTE and LTE-advanced (4G) networks- Rapid penetration of IoT devices- Constant technological changes and advancementsCHALLENGES- Difficulties faced by vendors in keeping up with constantly changing technologies- Emergence of electrical and electronic instruments with in-built self-calibration feature

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY SERVICE TYPE (KEY PLAYERS)

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISCOMMERCIALIZATION OF IOT TECHNOLOGYCOMBINING CMM WITH INDUSTRIAL INTERNET OF THINGS (IIOT)SMART IN-LINE CT INSPECTION SYSTEMSARTIFICIAL INTELLIGENCE IN INDUSTRIAL METROLOGY3D MEASUREMENT SENSORSSMART SENSORSVIDEO MEASUREMENT SYSTEMS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISKEYSIGHT TECHNOLOGIES DEMONSTRATES ITS N5244B PNA NETWORK ANALYZER TO DEVELOP 5G ANTENNA MODULESAMSUNG FOUNDRY ADOPTS KEYSIGHT E4727B ADVANCED LOW-FREQUENCY NOISE ANALYZER TO MEASURE AND ANALYZE FLICKER NOISEEXFO INC. PROVIDES OX1 TO CONVERGE ICT SOLUTIONS THAT EASE TROUBLESHOOTING

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2025

-

5.14 TARIFFS AND REGULATORY LANDSCAPETARIFFSSTANDARDSREGULATORY LANDSCAPE

-

5.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK- Canada- US- Europe- Asia Pacific

- 6.1 INTRODUCTION

-

6.2 MECHANICALCONTRIBUTION TO BETTER PRODUCT QUALITY TO DRIVE MARKET

-

6.3 ELECTRICALGROWING DEMAND FOR ELECTRICAL EQUIPMENT WITH GLOBALIZATION AND URBANIZATION TO DRIVE DEMAND

-

6.4 DIMENSIONALGROWING COMPLEXITY IN MANUFACTURING PROCESSES TO DRIVE DEMANDCOORDINATE MEASURING MACHINES (CMM)- Fixed CMM- Portable CMMMEASURING INSTRUMENTS- Measuring microscope- Profile projector- Autocollimator- Vision system- Multisensory measuring systemFORM MEASUREMENT EQUIPMENT

-

6.5 THERMODYNAMICSNEED TO MAINTAIN CONSISTENT AND RELIABLE MEASUREMENTS TO DRIVE MARKET

- 7.1 INTRODUCTION

- 7.2 IN-HOUSE

- 7.3 BETTER TRACEABILITY OF CALIBRATION DATA TO DRIVE MARKET

-

7.4 OEMSREDUCED DOWNTIME AND COMPLIANCE WITH INDUSTRY STANDARDS TO DRIVE MARKET

-

7.5 THIRD-PARTY VENDORSTECHNICAL PROFICIENCY AND ADHERENCE TO RECOGNIZED CALIBRATION PROCEDURES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 INDUSTRIAL & AUTOMATIONADVANCEMENT IN MANUFACTURING SECTOR TO DRIVE MARKET

-

8.3 ELECTRONICSGROWING TREND OF USING INSPECTION SERVICES SUCH AS INDUSTRIAL RADIOGRAPHY TO DRIVE MARKET

-

8.4 AEROSPACE & DEFENSEASSURITY OF DESIGN CORRECTNESS WITH REGARD TO AERODYNAMICS AND COMMUNICATION TO DRIVE MARKET

-

8.5 COMMUNICATIONGROWING NUMBER OF MOBILE COMMUNICATION DEVICES TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Presence of established players from various sectors to boost market growthCANADA- Rising demand for broadband services and communication testing to drive market expansionMEXICO- Government-led green energy initiatives to benefit market

-

9.3 EUROPEEUROPE: IMPACT OF RECESSIONUK- Increased demand for test and measurement equipment in automotive industry to support demand for calibration servicesGERMANY- Established automotive industry to propel market growthFRANCE- Increasing use of test and measurement tools in aerospace & defense to boost marketITALY- Initiatives taken to develop defense sector to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Manufacturing hub for various industries to boost demand for calibration servicesJAPAN- Growing adoption of automation in calibration to drive marketSOUTH KOREA- Presence of major electronics and semiconductor manufacturers to drive marketINDIA- Increasing FDIs and government-led initiatives to benefit marketREST OF ASIA PACIFIC

-

9.5 ROWROW: IMPACT OF RECESSIONMIDDLE EAST & AFRICA- Presence of robust healthcare infrastructure to boost marketSOUTH AMERICA- Expanding manufacturing and mining sector to benefit market significantly

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 MARKET SHARE ANALYSIS, 2022

- 10.4 FIVE-YEAR REVENUE ANALYSIS OF TOP COMPANIES, 2018–2022

-

10.5 CALIBRATION SERVICES MARKET: COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCALIBRATION SERVICES MARKET: COMPANY FOOTPRINT

-

10.6 CALIBRATION SERVICES MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 CALIBRATION SERVICES MARKET: COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SCENARIOS AND TRENDSCALIBRATION SERVICES MARKET- Product launches- Deals

-

11.1 KEY PLAYERSKEYSIGHT TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEXAGON AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROHDE & SCHWARZ- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEKTRONIX, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVIAVI SOLUTIONS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOMEGA ENGINEERING, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsRENISHAW PLC.- Business overview- Products/Solutions/Services offered- Recent developmentsTRESCAL, INC.- Business overview- Products/Solutions/Services offeredMICRO PRECISION CALIBRATION- Business overview- Products/Solutions/Services offered- Recent developmentsOCTAGON PRECISION INDIA PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsTANSON INSTRUMENT- Business overview- Products/Solutions/Services offeredMSI VIKING- Business overview- Products/Solutions/Services offered

-

11.2 OTHER PLAYERSMITUTOYO CORPORATIONMASTER GAGE & TOOL CO.PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.ADVANTEST CORPORATIONNATIONAL INSTRUMENTS CORPORATIONANRITSUKOLB & BAUMANN GMBH & CO KG.FEINMESS SUHL GMBHTESA BROWN & SHARPE (PART OF HEXAGON AB)METTLER TOLEDOTESTO SE & CO. KGAATRADINCO INSTRUMENTSTGCI GROUPMAHR GMBHESSCO CALIBRATION LABORATORY

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ROLE OF PARTICIPANTS IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICES OF CALIBRATION SERVICES OFFERED BY KEY PLAYERS (USD/HOUR)

- TABLE 4 CALIBRATION SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 IMPORT DATA FOR COMPLIANT PRODUCTS, HS CODE 9030, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 8 EXPORT DATA FOR COMPLIANT PRODUCTS, HS CODE 9030, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 9 MARKET: LIST OF KEY PATENTS, 2020–2022

- TABLE 10 MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 11 MFN TARIFFS FOR PRODUCTS INCLUDED UNDER HS CODE 9030 EXPORTED BY CHINA

- TABLE 12 MARKET: REGULATORY LANDSCAPE

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 CALIBRATION SERVICES MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 18 MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 19 MECHANICAL: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 20 MECHANICAL: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 21 MECHANICAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 MECHANICAL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 23 ELECTRICAL: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 ELECTRICAL: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 25 ELECTRICAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 ELECTRICAL: CALIBRATION SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 27 DIMENSIONAL: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 DIMENSIONAL: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 29 DIMENSIONAL: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 DIMENSIONAL: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 31 DIMENSIONAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 DIMENSIONAL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 33 THERMODYNAMICS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 THERMODYNAMICS: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 35 THERMODYNAMICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 THERMODYNAMICS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 37 MARKET, BY PROOFREADING, 2019–2022 (USD MILLION)

- TABLE 38 CALIBRATION SERVICES MARKET, BY PROOFREADING, 2023–2030 (USD MILLION)

- TABLE 39 IN-HOUSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 IN-HOUSE: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 41 OEM: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 OEM: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 43 THIRD-PARTY VENDORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 THIRD-PARTY VENDORS: CALIBRATION SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 45 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 47 INDUSTRIAL & AUTOMATION: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 48 INDUSTRIAL & AUTOMATION: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 49 ELECTRONICS: CALIBRATION SERVICES MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 50 ELECTRONICS: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 51 AEROSPACE & DEFENSE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 52 AEROSPACE & DEFENSE: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 53 COMMUNICATION: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 54 COMMUNICATION: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 55 OTHERS: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 56 OTHERS: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 57 CALIBRATION SERVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: CALIBRATION SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY PROOFREADING, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY PROOFREADING, 2023–2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 67 US: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 68 US: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 69 US: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 US: CALIBRATION SERVICES MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 71 CANADA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 72 CANADA: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 73 CANADA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 CANADA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 79 EUROPE: CALIBRATION SERVICES MARKET, BY PROOFREADING, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY PROOFREADING, 2023–2030 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: CALIBRATION SERVICES MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 83 UK: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 84 UK: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 85 UK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 UK: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 87 GERMANY: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 88 GERMANY: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 89 GERMANY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 GERMANY: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 91 FRANCE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 92 FRANCE: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 93 FRANCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 FRANCE: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CALIBRATION SERVICES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY PROOFREADING, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: CALIBRATION SERVICES MARKET, BY PROOFREADING, 2023–2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 104 CHINA: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 CHINA: CALIBRATION SERVICES MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 107 JAPAN: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 108 JAPAN: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 109 JAPAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 JAPAN: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 111 SOUTH KOREA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 113 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 115 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 116 ROW: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 117 ROW: CALIBRATION SERVICES MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 118 ROW: MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 119 ROW: MARKET, BY PROOFREADING, 2019–2022 (USD MILLION)

- TABLE 120 ROW: MARKET, BY PROOFREADING, 2023–2030 (USD MILLION)

- TABLE 121 ROW: CALIBRATION SERVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 ROW: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 123 OVERVIEW OF STRATEGIES ADOPTED BY CALIBRATION SERVICE PROVIDERS

- TABLE 124 MARKET: DEGREE OF COMPETITION

- TABLE 125 COMPANY FOOTPRINT

- TABLE 126 SERVICE TYPE FOOTPRINT

- TABLE 127 APPLICATION FOOTPRINT

- TABLE 128 REGION FOOTPRINT

- TABLE 129 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 130 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 131 CALIBRATION SERVICES MARKET: PRODUCT LAUNCHES (2021–2023)

- TABLE 132 MARKET: DEALS 2021–2023

- TABLE 133 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 134 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 136 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 138 TEKTRONIX, INC.: BUSINESS OVERVIEW

- TABLE 139 TEKTRONIX, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 VIAVI SOLUTIONS INC.: BUSINESS OVERVIEW

- TABLE 141 VIAVI SOLUTIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 OMEGA ENGINEERING, INC.: BUSINESS OVERVIEW

- TABLE 143 OMEGA ENGINEERING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 RENISHAW PLC.: BUSINESS OVERVIEW

- TABLE 145 RENISHAW PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 TRESCAL, INC.: BUSINESS OVERVIEW

- TABLE 147 TRESCAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 MICRO PRECISION CALIBRATION: BUSINESS OVERVIEW

- TABLE 149 MICRO PRECISION CALIBRATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 OCTAGON PRECISION INDIA PVT. LTD.: COMPANY SNAPSHOT

- TABLE 151 OCTAGON PRECISION INDIA PVT. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 152 TANSON INSTRUMENT: COMPANY SNAPSHOT

- TABLE 153 TANSON INSTRUMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 MSI VIKING: BUSINESS OVERVIEW

- TABLE 155 MSI VIKING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 CALIBRATION SERVICES MARKET SEGMENTATION

- FIGURE 2 GEOGRAPHICAL SCOPE

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET: RESEARCH APPROACH

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS) – REVENUES GENERATED BY COMPANIES FROM CALIBRATION SERVICES

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE ANALYSIS) – SHARE OF CALIBRATION SERVICES IN EACH REGION

- FIGURE 9 MARKET: BOTTOM-UP APPROACH

- FIGURE 10 MARKET: TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 CALIBRATION SERVICES MARKET, 2019–2030 (USD MILLION)

- FIGURE 13 DIMENSIONAL CALIBRATION SERVICE TYPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 THIRD-PARTY VENDOR SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 AEROSPACE & DEFENSE APPLICATION TO DISPLAY HIGHEST GROWTH RATE FROM 2023 TO 2030

- FIGURE 16 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INCREASING DEMAND FOR ACCURATE MEASUREMENTS AND PRECISIONS IN VARIOUS INDUSTRIES TO DRIVE MARKET

- FIGURE 18 THIRD-PARTY VENDOR SEGMENT ESTIMATED TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ELECTRICAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE THROUGHOUT FORECAST PERIOD

- FIGURE 20 INDUSTRIAL & AUTOMATION APPLICATION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 CALIBRATION SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 MARKET: DRIVERS

- FIGURE 24 MARKET: RESTRAINTS

- FIGURE 25 MARKET: OPPORTUNITIES

- FIGURE 26 MARKET: CHALLENGES

- FIGURE 27 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 29 AVERAGE SELLING PRICE OF CALIBRATION SERVICES OFFERED BY KEY PLAYERS

- FIGURE 30 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN CALIBRATION SERVICES MARKET

- FIGURE 31 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 IMPORT DATA FOR COMPLIANT PRODUCTS, HS CODE 9030, BY COUNTRY, 2017–2021

- FIGURE 36 EXPORT DATA FOR COMPLIANT PRODUCTS, HS CODE 9030, BY COUNTRY, 2017–2021

- FIGURE 37 TOP 10 COMPANIES WITH LARGEST NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 38 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2022

- FIGURE 39 MARKET: BY SERVICE TYPE

- FIGURE 40 DIMENSIONAL SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 41 MARKET: BY PROOFREADING

- FIGURE 42 THIRD-PARTY VENDOR (TPV) SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 43 CALIBRATION SERVICES MARKET: BY APPLICATION

- FIGURE 44 AEROSPACE & DEFENSE SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 45 ELECTRICAL SEGMENT TO ACCOUNT LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 46 MARKET: BY REGION

- FIGURE 47 CHINA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC REGION PROJECTED TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: RECESSION IMPACT

- FIGURE 50 NORTH AMERICA: CALIBRATION SERVICES MARKET SNAPSHOT

- FIGURE 51 EUROPE: IMPACT OF RECESSION

- FIGURE 52 EUROPE: MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 54 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 55 REST OF THE WORLD: IMPACT OF RECESSION

- FIGURE 56 ROW: MARKET SNAPSHOT

- FIGURE 57 MARKET SHARE ANALYSIS, 2022

- FIGURE 58 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 59 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 60 CALIBRATION SERVICES MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 61 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 62 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 63 VIAVI SOLUTIONS INC.: COMPANY SNAPSHOT

- FIGURE 64 RENISHAW PLC.: COMPANY SNAPSHOT

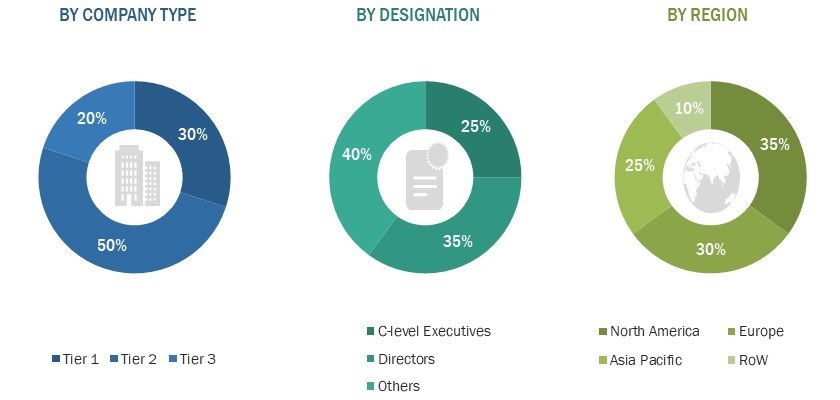

The study involved four major activities in estimating the calibration services market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the calibration services s market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the calibration services market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions-Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the calibration services market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall calibration services s market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players' annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Calibration Services Market Size: Bottom-Up Approach

Global Calibration Services Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The calibration services market is a specialized industry that offers calibration services to various sectors and industries, ensuring the accuracy and reliability of measuring instruments and equipment. It involves comparing and adjusting instruments against traceable standards, providing calibration certificates, and complying with regulatory requirements for quality assurance. As industries increasingly rely on precise measurements, calibration services play a crucial role in maintaining accuracy and meeting standards, driving the market's growth and evolving to adapt to changing technological needs. The calibration services market is the market for services that verify and adjust the accuracy of measuring instruments. These services are essential for ensuring the accuracy of measurements in a wide range of industries, including manufacturing, healthcare, and energy.

Key Stakeholders

- Original Equipment Manufacturers

- Third-Party Service Providers

- Communication Network Providers

- Government Labs

- In-House Testing Labs

- Software Solution Providers

- Distributors and Traders

- Research Organizations

- Forums, Alliances, and Associations

- End-User Industries

Report Objectives

- To define, describe, and forecast the calibration services market on the basis of proofreading, service type, application, and geography

- To forecast the market size, in terms of value, for various segments with regard to four main regions, namely, the North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To understand and analyze the impact of evolving technologies on the overall value chain of the calibration services market and upcoming trends in the ecosystem

- To highlight the impact of porter's five forces on the calibration services ecosystem and analyze the underlying market opportunities

- To analyze the associated use cases in the calibration services business and their impact on the business strategies adopted by key players

- To provide key industry trends and associated important regulations impacting the global calibration services market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the global calibration services market

- To forecast and compare the market size of pre-recession with that of the post-recession at global, and regional levels

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, expansions, and research & development in the global calibration services market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Growth opportunities and latent adjacency in Calibration Services Market