Impact of Covid-19 on Air Filter Media Market by Type (Nonwoven Fabrics, Fiberglass, Filter Paper), End-use Industry (Food & Beverage, Metal & Mining, Chemical, Pharmaceutical, Power Generation), and Region - Global Forecast to 2021

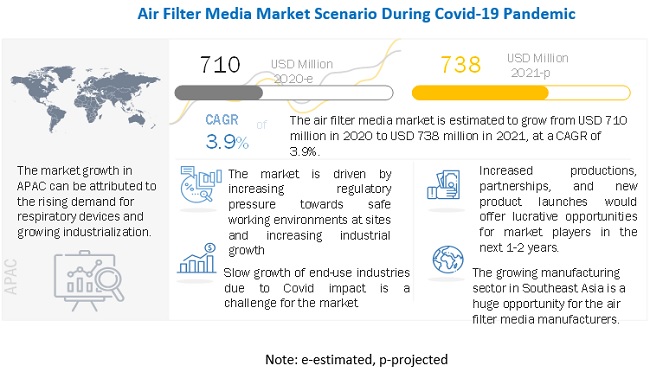

[56 Pages Report] The global air filter media market size during this pandemic is projected to grow from USD 710 million in 2020 to USD 738 million by 2021, at a Compound Annual Growth Rate (CAGR) of 3.9% during the forecast period. The major reasons for the growth in the air filter media industry are growing industrialization and urbanization in APAC region, necessity for safe working environment at production sites and the growing demand for respiratory devices and face masks to prevent the transmission of Covid-19 virus.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Air Filter Media - Market Dynamics

Driver: Growing industrialization and urbanization in APAC

Growing industrialization has led to the increase in urbanization along with economic growth, globally. This increase in industrialization has created a demand for industrial filters as there is an increase in air, liquid, and soil pollution. Air filter media is one of the markets with the most growth potential as it involves industrial process and emission controlDeveloping and developed countries, both, are major business hubs for the air filter media market. For example, manufacturing is one of the rapidly growing sectors for several developed and developing countries including China, India, Brazil, Chile, Indonesia, US, Germany, Japan, South Korea, France, and Italy. The manufacturing sector is a major contributor to the GDP of these countries. The increase in manufacturing establishments are expected to drive the industrial air purification and emission control market as there are stringent regulations such as Clean Air Act, Air Quality Directive, and others regarding release of harmful air pollutants to the environment.

Opportunity: Growing manufacturing sector in Southeast Asia

The Southeast Asian economy has witnessed tremendous growth for the past five years. The GDP growth of the region is expected to be around 4.9% from 2020 to 2024, as per Medium Term Projection Framework 2020 (OECD). The GDP growth in the Philippines and Vietnam is projected to be around 6.2% and 6.5%, respectively, for 2020 – 2024, mainly due to the increased private participation, trade agreements, and strong foreign direct investments. In the near future, Southeast Asian economies are expected to outperform more developed APAC economies, such as South Korea, Australia, and Japan. All this industrial development is expected to boost requirement for air purification and emission control thus providing opportunity for the growth of air filter media market.

Challenge: Slow growth in various end-use industries due to Covid -19

Covid-19 has impacted industries in as severe manner. Food & beverage industry experienced decline in restaurant sales. Lapse in tourism, cancellation of major sporting events, have also effected consumption of processed foods and beverages, globally. Chemical industry was impacted by supply chain disruptions, demand fall, workforce unavailability, and so on. Similarly, O&G, textile, Pulp &Paper industries have also been effected due to this pandemic. Pulp & Paper and textile industry are affected by the slowdown in fast moving consumer goods. In the next few years, normalization of supply chains, reduction in stringent measures, increase in retail consumption, growth in construction activities, stabilization of manufacturing activities, and others are expected to boost economic activities and thereby increase demand for air filter media.

Nonwoven fabric segment is projected to lead the air filter media market during the forecast period.

Based on type, the nonwoven fabrics are expected to be the largest segment during the forecast period. Nonwoven fabrics are made of long fibers that are bonded together through the application of heat, solvent, chemicals, or mechanical treatment. These are generally made out of polymers. Polymers or plastics have experienced fluctuations in demand due to this pandemic. Industries such as healthcare, pharmaceutical, chemicals, and other essential sectors experienced a growth in demand for polymers. Increase in demand for respiratory devices such as ventilators is also propelling consumption of air filter media in healthcare sector.

Food & Beverage is projected to be the fastest growing end-use industry during the forecast period

Based on end-use industry, the food & beverage segment is expected to register the highest CAGR between 2020 and 2021. For better product quality, to control odors & humidity, and to minimize air-borne contamination of food, air filtration is used in the food & beverage industry. The food & beverage industry witnessed both growth and decline scenarios. Consumption of groceries, fresh food products, and frozen foods increased due to panic buying and stockpiling effect in the pandemic period, while demand from restaurants, cafes and other food-service outlets decreased due to temporary closures amidst lockdowns and social distancing measures.

To know about the assumptions considered for the study, download the pdf brochure

APAC is projected to be the largest air filter media market during the projected period.

APAC is expected to be the largest air filter media market during the forecast period. This growth is attributed to large manufacturing base in the region for commodities, equipments, consumables, and medical instruments, equipment, and devices. Increasing requirement of these medical equipments such as ventilators from other COVID effected economies such as India, Indonesia, and others is boosting the production of air filter media in the region. In addition, growing manufacturing sector in Southeast Asia is also driving the air filter media market.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

|

|

Base year |

2019 |

|

Forecast period |

2020–2021 |

|

Units considered |

Value (USD) |

|

Segments |

Type, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, and RoW |

|

Companies |

Ahlstrom-Munksjo (Finland), Lydall, Inc. (US), Valmet (Finland), 3M (US), Freudenberg Filtration Technologies (Germany) and Camfil (Sweden) |

This research report categorizes the air filter media market based on type, end-use industry, and region.

By Type:

- Nonwoven Fabrics

- Fiberglass

- Filter Paper

By End-use Industry:

- Food & Beverage

- Metal & Mining

- Chemical

- Pharmaceutical

- Power Generation

- Others (Pulp & paper and Textile)

By Region:

- Asia-Pacific

- North America

- Europe

- Rest of the World

Key market Players:

Ahlstrom-Munksjo (Finland), Lydall, Inc. (US), Valmet (Finland), 3M (US), Freudenberg Filtration Technologies (Germany) and Camfil (Sweden) are some of the leading air filter media market players. They have adopted short, mid, and long term growth strategies such as donations, partnerships, new product development, and others to serve their customers efficiently and improve their future market shares.

Recent Developments

- In January 2020, Alhstrom-Munksjo increased production of healthcare and medical related products to safeguard end-users in fight against the pandemic. The company showcased broad offering of face masks like civil face mask, surgical face mask and respiratory face mask for different purposes.

- In April 2020, Alhstrom-Munksjo increased its production capacity at its Turin plant in Italy, to 60 million face mask per month from previously adopted 20 million face masks per month. This will see an increase in production to about 500 million by the end of 2020.

- In July 2020, Lydall signed a USD 13.5 million contract with US Department of Defense for increasing domestic capacity of meltblown filtration media required in production of N95 respirators and surgical masks. The company added two new meltdown filtration media production lines in Rochester plant, to support this demand increase.

- In February 2020, Valmet responded to covid-19 outbreak in the beginning by establishing Global Incident Management Team (IMT) and local China IMT to ensure employees worldwide have up-to-date information and guidelines about the pandemic situation.

- In September 2020, Freudenberg developed medical face mask TYPE II (EN 14683) which provides high protection against COVID-19 virus and is comfortable to wear.

Frequently Asked Questions (FAQ):

What is the current size of the global air filter media market?

Global air filter media market size is estimated at USD 710.8 million in 2020 and is projected to reach USD 738.1 billion by 2021, at a CAGR of 3.9%.

What are the upcoming trends for air filter media during this period?

Air purification has become a major focal point for the air filter media market due to the current situation. The production of face masks and respiratory devices has also increased.

Who are the leading players in the global air filter media market?

Ahlstrom-Munksjo (Finland), Lydall, Inc. (US), Valmet (Finland), 3M (US), Freudenberg Filtration Technologies (Germany) and Camfil (Sweden) are some of the leading air filter media market players. These companies cater to the requirements of their customers by developing new technologies and products. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on air filter media manufacturers?

Covd-19 pandemic has seen a shift in the demand pattern of the consumers. Consumption of air filter media in various industries such as automotive and construction has decreased whereas, there has been an increase in demand in the healthcare and pharmaceutical sector. The major manufacturers have adapted to these changes by shifting their focus towards rising sectors. Covid-19 has also influenced the manufacturers to develop new technologies and partnerships for fighting against the virus.

What are some of the drivers in the market?

Some of the major drivers for market growth are growing industrialization and urbanization in APAC, necessity for safe working environment at production sites and current requirement for face masks and respiratory devices. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 9)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 AIR FILTER MEDIA

1.2.2 COVID-19

1.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

1.4 MARKET SCOPE

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 COVID-19 IMPACT ON AIR FILTER MEDIA ECOSYSTEM (Page No. - 13)

2.1 INTRODUCTION

2.2 VALUE CHAIN OF AIR FILTER MEDIA INDUSTRY

2.2.1 RAW MATERIAL SUPPLIERS

2.2.2 MANUFACTURERS

2.2.3 DISTRIBUTORS

2.2.4 END USERS

2.3 MARKET OVERVIEW

2.3.1 DRIVERS

2.3.1.1 Growing industrialization and urbanization in APAC

2.3.1.2 Stringent regulations regarding emissions and treatment of industrial effluents

2.3.1.3 Necessity for safe working environment at production sites

2.3.1.4 Current requirement for face masks and respiratory devices

2.3.2 OPPORTUNITIES

2.3.2.1 Growing manufacturing sector in Southeast Asia

2.3.3 CHALLENGES

2.3.3.1 Slow growth due to COVID-19 impact on industries

3 CUSTOMER ANALYSIS (Page No. - 18)

3.1 INTRODUCTION

3.1.1 SHIFT IN END-USE INDUSTRIES

3.1.2 DISRUPTION IN THE INDUSTRY

3.1.2.1 Food & Beverage

3.1.2.2 Metal & Mining

3.1.2.3 Chemical

3.1.2.4 Pharmaceutical

3.1.2.5 Power Generation

3.1.2.6 Impact on customers’ output & strategies to improve production

3.1.2.7 Impact on customers’ revenues

3.1.2.8 Customers’ most crucial regions

3.1.2.9 Short-term strategies to manage cost structure and supply chains

3.1.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

3.1.3.1 Measures taken by customers

3.1.3.2 Industry Specific Measures

3.1.3.3 Customers’ perspective on growth outlook

4 IMPACT OF COVID-19 ON AIR FILTER MEDIA SEGMENTS (Page No. - 26)

4.1 IMPACT ON TYPES

4.1.1 NONWOVEN FABRICS

4.1.2 FIBERGLASS

4.1.3 FILTER PAPER

4.2 IMPACT ON END-USE INDUSTRIES

4.2.1 FOOD & BEVERAGE

4.2.2 METAL & MINING

4.2.3 CHEMICAL

4.2.4 PHARMACEUTICAL

4.2.5 POWER GENERATION

4.2.6 OTHERS

5 IMPACT OF COVID-19 IN FILTER MEDIA MARKET, BY REGION (Page No. - 32)

5.1 INTRODUCTION

5.2 APAC

5.2.1 CHINA

5.2.2 INDIA

5.2.3 JAPAN

5.3 EUROPE

5.3.1 ITALY

5.3.2 GERMANY

5.3.3 UK

5.3.4 SPAIN

5.3.5 FRANCE

5.3.6 REST OF EUROPE

5.4 US

5.5 REST OF WORLD

6 STRATEGIES OF AIR FILTER MEDIA COMPANIES DURING COVID-19 PANDEMIC (Page No. - 44)

6.1 AHLSTROM-MUNKSJO

6.1.1 IMPACT ON COMPANY’S PORTFOLIO

6.1.1.1 Product/Material

6.1.1.2 Application

6.1.1.3 COVID-19-related developments/strategies

6.2 LYDALL, INC.

6.2.1 IMPACT ON COMPANY’S PORTFOLIO

6.2.1.1 Product/Material

6.2.1.2 Application

6.2.1.3 COVID-19-related developments/strategies

6.3 VALMET

6.3.1 IMPACT ON COMPANY’S PORTFOLIO

6.3.1.1 Product/Material

6.3.1.2 Application

6.3.1.3 COVID-19-related developments/strategy

6.4 OTHER RELATED PLAYERS

7 APPENDIX (Page No. - 49)

7.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

7.2 AUTHOR DETAILS

LIST OF TABLES (15 Tables)

TABLE 1 STRATEGIES UNDERTAKEN BY KEY AIR FILTER MEDIA COMPANIES

TABLE 2 AIR FILTER MEDIA MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 3 AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 4 AIR FILTER MEDIA MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 5 CHINA: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 6 INDIA: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 7 JAPAN: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 8 ITALY: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 9 GERMANY: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 10 UK: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 11 SPAIN: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 12 FRANCE: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 13 REST OF EUROPE: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 14 US: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 15 ROW: AIR FILTER MEDIA MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

LIST OF FIGURES (8 Figures)

FIGURE 1 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

FIGURE 2 AIR FILTER MEDIA MARKET SEGMENTATION

FIGURE 3 REGIONS COVERED

FIGURE 4 YEARS CONSIDERED FOR THE STUDY

FIGURE 5 OVERVIEW OF AIR FILTER MEDIA VALUE CHAIN

FIGURE 6 NONWOVEN FABRICS TO HAVE SUSTAINED DEMAND IN AIR FILTER MEDIA MARKET

FIGURE 7 FOOD & BEVERAGE INDUSTRY EXPECTED TO HAVE GOOD DEMAND FOR AIR FILTER MEDIA IN 2021

FIGURE 8 APAC TO BE THE LARGEST MARKET FOR AIR FILTER MEDIA

The study involved four major activities in estimating the global air filter media market size. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the air filter media market study. The secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; news sources, articles from recognized authors; authenticated directories; and databases. Secondary research was conducted primarily to obtain key information about the supply chain of the industry, the monetary chain of the market, the total market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand side were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as marketing directors, consultants, R&D managers, and related key executives from major companies and organizations operating in the market. The primary sources from the demand side included engineers, OEMs, and sales/purchase managers from end-use industries.

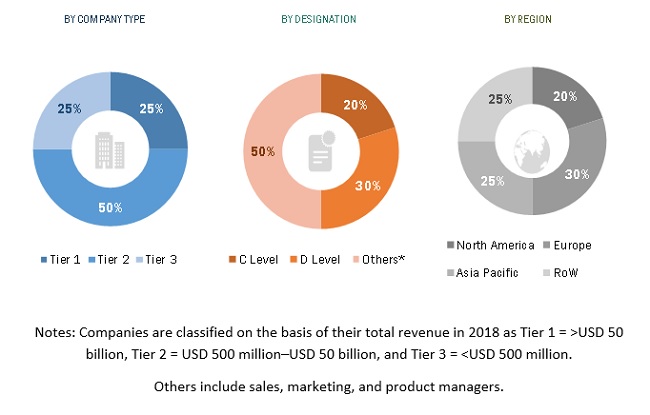

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the air filter media market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All the percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the air filter media market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the various sectors.

Objectives of the Study:

- To analyze the impact of COVID-19 on the air filter media market by type, end-use industry, and region

- To provide detailed information about the major factors (drivers and challenges) influencing the trends in the air filter media market during the COVID-19 pandemic

- To analyze the impact of a prolonged pandemic on the supply-demand scenario on the air filter media demand

- To study the health and economic impact of COVID-19 on various industries

- To analyze the shift in the expenditure and revenue patterns of critical end-use industries of air filter media such as food & beverage, metal & mining, chemical, pharmaceutical, power generation and others

- To examine the shift in expenditure of air filter media manufacturers in 2020 as well as 2021 and their capabilities to address emerging demand during this global COVID-19 pandemic

- To analyze the change in short-term strategies of manufacturers and end users in the air filter media market

- To track key developments, such as new product launches, partnerships, agreements, and collaborations, in the context of the COVID-19 pandemic in the air filter media market

Growth opportunities and latent adjacency in Impact of Covid-19 on Air Filter Media Market