Vaccines Market Size, Growth, Share & Trends Analysis

Vaccines Market by Technology (Conjugate, Recombinant, Inactivated, Live Attenuated, Viral Vector, mRNA), Type (Monovalent, Multivalent), Disease (Pneumococcal, Flu, Hepatitis, MMR, RSV), Route of Administration (IM, SC, Oral)-Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global vaccines market (excluding COVID-19 vaccines), valued at USD 49.59 billion in 2024, stood at USD 47.65 billion in 2025 and is projected to advance at a resilient CAGR of 7.3% from 2025 to 2030, culminating in a forecasted valuation of USD 67.91 billion by the end of the period. The market is growing due to several factors, including the rapid development and global commercialization of vaccines, the increasing prevalence of infectious diseases that require vaccination for prevention, the rising number of immunization programs, advancements in technology that support vaccine development, and increased government support through investments and funding aimed at creating new vaccines for various disease indications.

KEY TAKEAWAYS

- The North America vaccines market accounted for a 52.3% revenue share in 2024.

- By disease indication, the pneumococcal disease segment is expected to register the highest CAGR of 10.6%.

- By technology, the inactivated & subunit vaccines segment is projected to grow at the fastest rate from 2025 to 2030.

- By type, the multivalent vaccines segment is expected to dominate the market.

- By route of administration, the intramuscular & subcutaneous administration segment will grow the fastest during the forecast period.

- By end user, the adult vaccines segment accounted for a larger share of 54.0% of the market in 2024.

- Companies such as GSK Plc, Merck & Co., Inc., Pfizer Inc. were identified as some of the star players in the vaccines market (global), given their strong market share and product footprint.

- Companies such as Sinovac, Incepta Pharmaceuticals Ltd., Valneva SE among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The vaccines market is projected to experience substantial growth over the next decade. This expected expansion can be attributed to several key factors: an increasing emphasis on the development and global commercialization of vaccines, a rise in the prevalence of infectious diseases that necessitate vaccination for prevention, a growing number of immunization programs, advancements in technology that support vaccine development, and enhanced government support through investments and funding aimed at creating new vaccines for various diseases.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Consumer behavior is influenced by customer trends and disruptions. Key trends include a shift towards adult and maternal immunization, as well as the acceleration of research and development facilitated by digital technology and AI.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Focus on vaccine development and launches

-

Rising prevalence of infectious diseases

Level

-

High cost of vaccine development

Level

-

Rising focus on therapeutic vaccines

-

Extensive R&D for vaccines and increased investments in clinical trials

Level

-

Stringent regulatory processes

-

Product recalls

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Focus on vaccine development and launches

The vaccines market is experiencing significant growth, primarily driven by a steady increase in new vaccine approvals, label expansions, and initial rollouts that create new patient populations and geographic markets. Regulators have approved several high-value products, including the US FDA's approval of Merck’s adult-specific 21-valent pneumococcal conjugate vaccine, Capvaxive, in June 2024, which expands the market for adult pneumococcal vaccines. There is a continued focus on vaccine development and a regular schedule of new launches aimed at various pathogens and age groups. For instance, respiratory syncytial virus (RSV) has evolved from being an area of unmet medical need into a fully commercialized category. Overall, increased initiatives supported by financial investments are key drivers of growth in the vaccines market.

Restraint: High cost of vaccine development

Vaccine research and development (R&D) is typically a lengthy process that is prone to failures and requires significant capital investment. Additionally, scaling up production carries high risks. Factors such as variability in yield, complex analytics, and strict quality assurance and quality control (QA/QC) increase the likelihood of batch failures and the need for working capital. Unlike small-molecule drugs, vaccines require specialized process development, facilities that meet Biosafety Level (BSL) standards, and sterile biologics manufacturing, all of which are costly to build, validate, and maintain. Furthermore, regulatory requirements mandate large, well-structured prophylactic trials, leading to higher trial sizes and costs compared to many therapeutic products. This is because endpoints must demonstrate effectiveness in preventing disease within healthy populations. All of these factors contribute to a high break-even point in vaccine development.

Opportunity: Rising focus on therapeutic vaccines

Therapeutic vaccines are shifting the focus from disease prevention to treatment, creating valuable opportunities in oncology, chronic infections, and immune-mediated disorders. These vaccines aim to enhance T-cell responses that are specific to tumors or pathogens, making them effective partners for checkpoint inhibitors and standard treatments. As a result, clinical successes can lead to higher pricing and broader adoption. In addition to cancer, therapeutic candidates for hepatitis B virus (HBV), herpes simplex virus (HSV), and tuberculosis (TB) target large populations of chronic patients. Even achieving partial functional cures or reducing relapses in these patients would be economically beneficial and supported by health policies. The transition from public tender pediatric channels to specialty pharmacy and oncology delivery models allows for higher average selling prices (ASPs), improved outcome tracking, and bundled contracting with immunotherapies.

Challenge: Stringent regulatory processes

Vaccines are subject to stricter regulations than most other medicines, primarily because they are often administered to children. Regulators typically require extensive, multi-year studies to demonstrate that a vaccine effectively prevents disease, rather than just alleviating symptoms. This necessity leads to longer development timelines. Additionally, safety databases must be comprehensive enough to identify very rare side effects, which increases the size and cost of trials. On the manufacturing side, the Chemistry-Manufacturing-Controls (CMC) package is significant and includes components like sterility, potency, consistency, and stability, all of which require complete validation. Each batch of vaccine may also need to undergo official control or lot release testing, which can add weeks to the process and tie up inventory. Furthermore, cold-chain qualification, packaging, and country-specific labeling require separate approvals and detailed documentation.

vaccines market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Moderna’s new center at the Harwell science campus, which is home to over 250 organizations in health, technology, and energy, will manufacture mRNA vaccines for the NHS’s seasonal immunization programs. The facility already has a license to produce COVID-19 vaccines and is preparing to apply for regulatory approval to manufacture flu vaccines as well. | Strengthens domestic mRNA vaccine manufacturing capacity, enhancing the UK’s preparedness against emerging infectious diseases and seasonal threats | Accelerates the availability of advanced vaccines within the NHS, reducing reliance on international supply chains | The new facility also encourages further innovation in mRNA vaccine technology and supports rapid scale-up during future public health emergencies |

|

After a series of vaccine expansion projects, Sanofi is pursuing a new strategy to extend the reach of its immunizations in Vietnam. Partnering with the Vietnam Vaccine Company (VNVC), Sanofi has initiated a technology transfer for vaccine production, aiming to eventually manufacture select Sanofi vaccines locally within Vietnam. | Crucial as it expands local manufacturing capabilities, reducing dependence on imports and strengthening supply chain resilience in Southeast Asia | Access and affordability could significantly improve, helping to address public health needs more efficiently |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The vaccines market ecosystem consists of key players, including vaccine manufacturers, regulatory agencies, and end users such as academic and research institutions, hospitals, diagnostic laboratories, pharmaceutical and biotech companies, and medical device manufacturers. These stakeholders collaborate and interact with one another to foster growth and innovation within the vaccine landscape.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Vaccines Market, By Disease Indication

The vaccines market is divided into different segments based on disease indications, including combination vaccines, HPV, meningococcal disease, herpes zoster, rotavirus, MMR, pneumococcal disease, influenza, varicella, hepatitis, DTP, polio, and other disease indications. In 2024, the pneumococcal disease segment held the largest share of the vaccines market. This can be attributed to several key factors: an increasing incidence of pneumococcal infections worldwide, greater government funding for vaccination programs, and heightened public awareness of the serious health risks related to pneumococcal complications, such as pneumonia, meningitis, and bloodstream infections. Additionally, ongoing innovation and the development of next-generation pneumococcal vaccines—including the recently approved 20-valent and 21-valent conjugate vaccines—are expanding immunization options and further enhancing market growth and public health outcomes.

Vaccines Market, By Type

By type, the vaccines market is categorized into monovalent and multivalent vaccines. In 2024, the multivalent vaccines segment accounted for the largest share of the market. This is primarily because multivalent vaccines simplify immunization programs by offering broad protection in a single formulation. Additionally, advancements in vaccine technologies, such as recombinant and conjugate platforms, have made multivalent formulations more feasible and effective in terms of immunology, which has further contributed to their market growth. Economically and logistically, multivalent vaccines also provide greater efficiency in production, distribution, and administration, ultimately reducing costs and alleviating the burden on healthcare systems.

Vaccines Market, By Technology

The vaccines market is categorized based on technology into several types: conjugate vaccines, recombinant vaccines, inactivated & subunit vaccines, live attenuated vaccines, toxoid vaccines, viral vector vaccines, mRNA vaccines, and other technologies. Among these, conjugate vaccines hold the largest market share. This is primarily due to their ability to generate strong, long-lasting immunity by linking weak polysaccharide antigens to potent protein carriers. This process elicits powerful T-cell-dependent responses and creates lasting immunologic memory, which leads to high-affinity antibody formation and sustained immune response.

Vaccines Market, By Route of Administration

By route of administration, the vaccines market is segmented into intramuscular & subcutaneous administration, oral administration, and other routes of administration. The intramuscular & subcutaneous segment holds the largest market share due to the ability of this route of administration to enable rapid and reliable absorption, resulting in strong and consistent immune responses. These administration methods are well-established and supported by decades of clinical experience. Additionally, they are compatible with most current vaccine formulations, making them the preferred choice for routine immunizations.

Vaccines Market, By End user

The vaccines market is segmented based on end users into two categories: adults and pediatrics. Adult end users represent the largest share of the vaccines market. This is largely due to the increasing incidence of infectious diseases among adults and the significant rise in the global aging population, which is more vulnerable to severe infections. Additionally, widespread government immunization initiatives, heightened awareness of the importance of booster and catch-up vaccinations, and a growing range of vaccines targeted at adults contribute to this trend.

REGION

Asia Pacific to be fastest-growing region in global vaccines market during forecast period

The Asia Pacific region is projected to experience significant growth at a considerable CAGR during the forecast period. This growth is primarily driven by increased public health awareness, the expansion of national immunization programs, and greater government investment in healthcare infrastructure. These efforts are further supported by public-private partnerships and international collaborations aimed at improving vaccine equity. Additionally, technological advancements are facilitating the development of advanced vaccines and more cost-effective production methods. Moreover, the region's large and rapidly growing populations, particularly in countries like China and India, present a substantial market for both established and new vaccines. These factors underscore the Asia Pacific region's leadership in the vaccine industry.

vaccines market: COMPANY EVALUATION MATRIX

The company evaluation matrix offers insights into the top 16 players in the vaccine and related products market, highlighting the performance of each vendor. In this sector, Merck & Co., Ltd. (US) stands out as a leader, boasting a robust market presence and a diverse product portfolio. Meanwhile, Bavarian Nordic (Denmark), considered an Emerging Leader, is experiencing significant growth in both revenue and geographic reach.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Merck & Co., Inc. (US)

- Pfizer, Inc. (US)

- GSK Plc (UK)

- Sanofi (France)

- CSL (Australia)

- Emergent BioSolutions (US)

- Johnson & Johnson Services, Inc. (US)

- AstraZeneca (UK)

- Serum Institute of India Pvt. Ltd. (India)

- Bavarian Nordic (Denmark)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- Daiichi Sankyo (Japan)

- Panacea Biotec (India)

- Biological E Limited (India)

- Bharat Biotech (India)

- Novavax (US)

- Inovio Pharmaceuticals (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 49.58 BN |

| Market Forecast in 2030 (Value) | USD 67.91 BN |

| Growth Rate | CAGR of 7.3% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Doses) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

| Related Segment & Geographic Reports |

Conjugate Vaccines Market Europe Vaccines Market Respiratory Syncytial Virus (RSV) Vaccines Market Asia Pacific Vaccines Market North America Vaccines Market |

WHAT IS IN IT FOR YOU: vaccines market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| China, India, and Southeast Asia Vaccines Volume Estimation (Doses) | China, India and Southeast Asian region vaccines volume market estimation and forecast I Key players in each country/region | Enables strategic planning I Helps to anticipate demand, allocate resources efficiently, and optimize production and supply chain operations across diverse, high-growth countries |

| Latin America Vaccines Market |

|

Helps analyze competitor strategies for strategic planning I Helps to anticipate demand |

| Market Growth Trends, Pipeline Analysis, and Manufacturing Capacity Trends |

|

|

RECENT DEVELOPMENTS

- January 2025 : GSK Plc (UK) invested approximately USD 67 million in collaboration with the University of Oxford (UK) to advance research in immune system science, vaccine development, and cancer biology.

- February 2024 : GSK Plc (UK) received US FDA approval for its RSV vaccine, Arexvy, to prevent RSV disease in adults aged 50–59.

- February 2024 : Pfizer released positive top-line data for season two efficacy of ABRYSVO, a bivalent vaccine, for RSV in adults 60 and older.

- September 2023 : Merck & Co., Inc. (US) received approval from the European Commission (EC) for an expanded indication for ERVEBO. This vaccine is intended for the active immunization of individuals aged one year and older to protect against Ebola Virus Disease (EVD) caused by the Zaire ebolavirus.

- May 2023 : CSL (Australia) invested USD 800 million in building a new state-of-the-art manufacturing facility by utilizing innovative technology to produce seasonal and pandemic cell-based influenza vaccines.

Table of Contents

Methodology

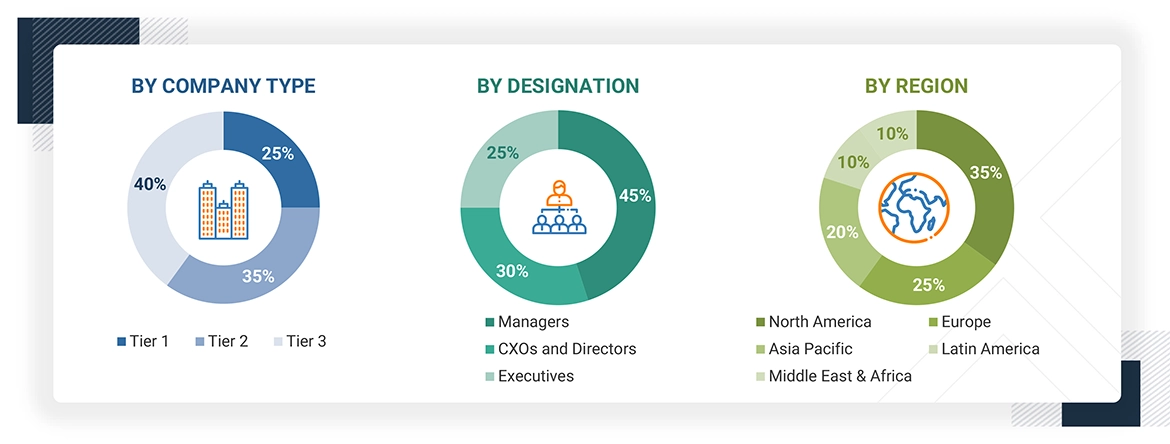

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global vaccines market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the vaccines market. The secondary sources used for this study include World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), National Center for Biotechnology Information (NCBI), Centers for Disease Control and Prevention (CDC), the Global Cancer Observatory (GLOBOCAN), the National Institutes of Health (NIH), Center of Disease Control & Prevention (CDC), US Department of Health and Human Services, National Institutes of Health (NIH), National Library of Medicine, National Center for Biotechnology Information (NCBI), National Institute of Allergy and Infectious Diseases (NIAID), World Cancer Research Fund International (WCRF International), European Medicines Agency (EMA), The National Medical Products Administration (NMPA), Global Alliance for Vaccines and Immunization (GAVI), United States Food & Drug Administration (US FDA), Orange book, Purple book, Clinical trials.gov, Pan American Health Organization (PAHO), United Nation International Children’s Emergency Fund (UNICEF), Department of health and Human Services (HHS), and International Society for Vaccines (ISV). Corporate filings include annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global vaccines market, which was validated through primary research. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were employed to estimate and validate the overall size of the vaccines market. These methods were also widely used to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After estimating the overall market size through the market size estimation process, the total market was divided into several segments and subsegments. Data triangulation and market breakdown techniques were used where applicable to finalize the overall market analysis and obtain precise statistics for all segments and subsegments. The data was triangulated by examining various factors and trends from both demand and supply sides.

Market Definition

A vaccine is a biologically formulated product designed to trigger active acquired immunity against a specific infectious or malignant disease. Vaccines work by stimulating the immune system to identify and fight harmful agents, such as viruses or bacteria. They generally consist of parts that resemble the disease-causing microorganism, often in weakened or deactivated forms, along with their toxins or surface proteins. The report solely focuses on human vaccines and does not include veterinary vaccines, which are outside the scope of this study.

Stakeholders

- Vaccine product manufacturers and suppliers

- Distributors and suppliers of vaccine products

- Vaccine research institutes

- Biotechnology and biopharmaceutical companies

- Contract manufacturing organizations (CMOs)

- Contract development and manufacturing organizations (CDMO)

- Suppliers and distributors of pharmaceutical products

- Research and development (R&D) companies

- Drug Manufacturers, Vendors, and Distributors

- Immunization centres

- Hospitals and laboratories

- Trade associations and industry bodies

- Regulatory bodies and government organizations

- Venture capitalists and investors

- Hospitals

- Specialty Clinics

Report Objectives

- To define, describe, and forecast the vaccines market by technology, type, disease indication, route of administration, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall vaccines market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments, such as product launches, agreements, partnerships, acquisitions, regulatory approvals, and research & development activities

- To analyze and provide funding & investment activities, brand/product comparative analysis, and vendor valuation & financial metrics of the vaccines market.

Key Questions Addressed by the Report

Who are the key players in the vaccines market?

Key players include GSK plc (UK), Merck & Co Inc (US), Pfizer Inc (US), Sanofi (France), CSL (Australia), Emergent (US), Johnson and Johnson Services, Inc. (US), AstraZeneca (UK), Serum Institute of India Pvt Ltd (India), Bavarian Nordic (Denmark), Mitsubishi Tanabe Pharma Corporation (Japan), and Daiichi Sankyo Company, Limited (Japan).

Which type of vaccine is expected to grow at the highest rate during the forecast period?

The multivalent vaccines segment is expected to grow at the highest rate during the forecast period of 2025 to 2030.

Which disease indication held the largest share in the vaccines market in 2024?

Pneumococcal disease indication held the largest share in the vaccines market in 2024.

Which route of administration segment held the largest share in the vaccines market?

In 2024, the intramuscular and subcutaneous routes segment held the largest share of the vaccines market by routes of administration.

What is the vaccines market size and CAGR for the forecast period 2025–2030?

The global vaccines market is expected to reach USD 63.66 million by 2030 from USD 50.46 million in 2025, at a CAGR of 4.8% over the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vaccines Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Vaccines Market

Frederick

May, 2022

What are the growing opportunities in Vaccines Market Size, Share, Growth, Covid-19 Impact Analysis, forecasts to 2028 ?.

Ross

Dec, 2022

Which are some of the significant growth strategies adopted by leading companies in this market?.

Harry

Dec, 2022

According to this report which are the top 3 companies operating in the global vaccine market?.

Ralph

Mar, 2022

How the Asia Pacific region in the Global Vaccines Market is Expecting a Highest Growth Rate During the Forecast Period?.

Eugene

Mar, 2022

Which end user segment holds the largest share of the Global Vaccines Market?.