Food Fortifying Agents Market by Type (Minerals, Vitamins, Carbohydrates, Prebiotics, Probiotics), Application (Cereal & Cereal-based Products, Bulk Food Items), Process (Drum Drying, Dusting) and Region - Global Forecast to 2027

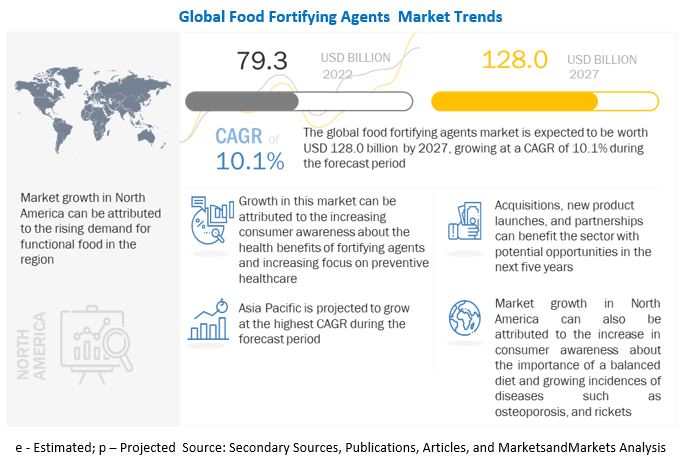

The global food fortifying agents market is estimated to reach $128.0 billion by 2027, growing at a 10.1% compound annual growth rate (CAGR). The global market size was valued $79.3 billion in 2022. With such remarkable figures on the horizon, the global market is undoubtedly one to watch out for.The food fortifying agents industry is poised for significant expansion in response to the growing emphasis on health and wellness among consumers. With a surge in demand for products that offer added nutritional benefits, there is a unique opportunity for innovation and growth in the market. As the aging population grows and health concerns become more prevalent, the adoption of food fortifying agents for a variety of applications is expected to increase on a large scale. This trend is set to drive the market forward, creating new avenues for manufacturers and suppliers to cater to the evolving needs of health-conscious consumers.

The Evolution of the Food Fortifying Agents Market

Over the past few decades, the food fortifying agents market has undergone a significant transformation. What began as a simple process of adding iodine to salt to prevent goiter has evolved into a sophisticated industry that produces a wide range of additives to fortify foods with essential nutrients. The growth of the market can be attributed to a number of factors. One of the main drivers has been the increasing awareness about the importance of a balanced diet and the role that essential nutrients play in maintaining optimal health. With the rise of chronic diseases such as obesity and diabetes, consumers are becoming more interested in eating foods that are not only tasty but also good for them.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Fortifying Agents Market Dynamics

Increasing demand for fortifying agents in dietary supplements

The major driving factor for food fortifying agents is rising demand for dietary supplements. Consumer awareness about dietary supplements is increasing due to their changing lifestyle. The usage of vitamins, minerals, and food that enhances immunity, organic goods, supplements, and other dietary aids has considerably expanded. People have been encouraged to switch to nutraceuticals such as dietary supplements because of rising disposable incomes and expanding consumer health awareness. People are more likely to take multivitamins and minerals in the form of capsules and tablets as a result of lifestyle changes and increased knowledge of fitness and health.

High cost involved in R&D activities

These restrictions include a lack of national regulations on food augmentation and a low private-public partnership. Small and Medium Enterprises' limited technological and economic capacity, involvement with subject matter experts, and lack of rules and food laws are the bottlenecks in development of food fortification initiatives. Food fortifying agents require high investment in product development and innovations, which lead to an increase in the product’s cost. Additionally, the control and monitoring of products to evaluate the quality of fortified foods are prevented by a lack of high-quality laboratories, thereby hampering the market growth.

Technical assistance by governments

The FAO supports and strengthens fortification initiatives across various areas as a result of the need for technical assistance for a number of additional components across several sectors. Providing technical support to establish new food laws or review existing ones, strengthen the legal ramifications of fortification, and related food control are some of the initiatives being undertaken by the organization. Strengthening in the food control systems by providing assistance to personnel, inspection services, and laboratories for the assurance of product quality as well as gathering and analysing trustworthy data for monitoring and evaluation purposes, collaboration with different industry groups, national or regional laboratories are also being undertaken by the government organizations.

Multi-page labelling on the rise

Every manufacturer and packer of fortified food is required to make a commitment to quality assurance and provide the Food Authority or another authority that the Food Authority may designate with documentation of the actions taken in this respect. Certification from a food laboratory has been informed by the Food Authority that the fortified food complies with the Act's requirements and the rules and standards. Policies and implementation plans for fortification must take into account how they will affect noncommunicable diseases caused by nutrition. All fortified foods, whether voluntarily fortified or required to undergo mandatory fortification, must be produced, packed, labelled, handled, distributed, and sold, whether for profit or under a government-funded programme, only in accordance with the standards set forth under the provisions of the Act and the regulations.

The rising consumption of omega-3 fatty acids to reduce the risk if chronic heart diseases

Lipids are a group of naturally occurring molecules that include waxes, fats, sterols, fat-soluble vitamins (such as vitamins A, D, E, and K), monoglycerides, triglycerides, diglycerides, and phospholipids, among others. Omega-3 and 6 are most commonly used essential lipids.

Omega-3 fatty acids, also known as polyunsaturated fatty acids (PUFAs), are considered essential fatty acids. Omega-3 fatty acids are found in fish such as tuna, salmon, and halibut; and also in algae, krill, some plants, and nut oils. The consumption of omega-3 fatty acids reduces the risk of heart disease, prostate cancer, breast cancer, high-blood pressure, osteoporosis, bipolar disorder, depression, skin disorders, asthma, and arthritis. The American Heart Association recommends consuming fish (particularly fatty fish such as mackerel, lake trout, herring, sardines, albacore tuna, and salmon) at least twice a week, for better health.

Increasing popularity of fortified edible oil among consumers

Fats & oils form another significant application of food fortifying agents. It involves the fortification of margarine and oil. Margarine is a spread that has been widely used as a substitute for butter. Fortification of margarine involves the addition of vitamins A and D. The vitamin A requirement is met using B-carotene along with oil-soluble vitamin A esters. The oil-soluble vitamins are added in the required proportion to a portion of warm oil, which is then added to the bulk prior to homogenization. Fortification of oil also includes the addition of vitamins. Vitamin A-fortified oil showed good vitamin retention after 5 months of storage in sealed metal containers at high temperatures and humidity

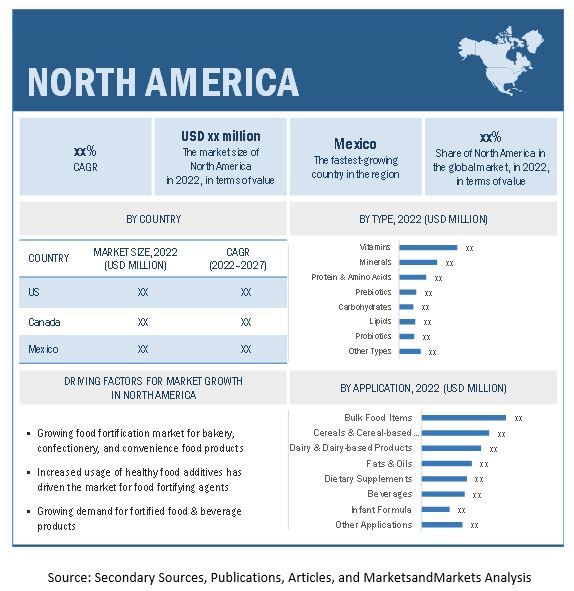

North America: Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

North America dominated the food fortifying agents market, and is projected to grow with a CAGR of 9.8% during the forecast period (2022 - 2027)

The key players in the North American market include Cargill (US) and FMC Corporation (US). Technological advancements have made food fortifying agents available for a wide range of applications in the food & beverage sector, which is estimated to drive the growth of the market in the region. The North American market is witnessing continued growth in sectors such as bulk food items, fats & oils, dietary supplements, and fortified cereals & beverages. Increased consumer demand and innovations in technologies are the key factors driving the market. Fortifying agents are extensively researched and scientifically proven functional food ingredients. In Canada, the situation of food fortification is changing. For many years, food fortification has been tightly regulated. The policy currently being crafted is likely to result in expanded options for food fortification, particularly in the area of discretionary fortification.

Key Market Players

The key players involved in food fortifying agents market include Cargill, (US), DSM (Netherlands), Chr. Hansen Holdings A/S (Denmark), DuPont (US), BASF SE (Germany), Arla Foods Amba (Denmark), Tate & Lyle (UK), Ingredion (US), Archer Daniels Midland Company (US), and Nestle SA (Switzerland).

Food Fortifying Agents Market Report Scope

|

Report Metric |

Details |

|

Market reach in 2027 |

USD 128.0 billion |

|

Financial projection in 2022 |

USD 79.3 billion |

|

Expansion rate |

CAGR of 10.1% |

|

Historical data |

2019-2027 |

|

Base year for estimation |

2021 |

|

Study period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report coverage |

Revenue forecast, company ranking, driving factors, competitive landscape, and analysis |

|

Largest market

|

North America |

|

Fastest growing market |

Asia Pacific |

|

Key companies profiled |

Cargill, (US), DSM (Netherlands), Chr. Hansen Holdings A/S (Denmark), DuPont (US), BASF SE (Germany), Arla Foods Amba (Denmark), Tate & Lyle (UK), Ingredion (US), Archer Daniels Midland Company (US), and Nestle SA (Switzerland) |

|

Report Highlights |

|

Target Audience

- Food fortifying agents manufacturers

- Research institutions

- Raw material suppliers

- Government bodies

- Distributors

- End user (food industry)

Food Fortifying Agents Market Report Highlights

This research report categorizes the market based on type, application, process, and region

|

By Process |

By Type |

By Application |

By Region |

|

|

|

|

Recent Developments

- In January 2022, Cargill, opened its new innovation center in India to serve growing consumer demand for healthy, nutritious food solutions. Cargill partners with its F&B customers in India to identify consumer demands, that will translate global industry trends into local application and accelerate customer product innovation pipelines by co-developing healthy, nutritious food options for consumers.

- In December 2021, DSM, announced the acquisition of Vestkorn Milling for an enterprise value of USD 68.4 million. It is of one of Europe’s leading producers of pea- and bean-derived ingredients for plant-based protein products.

- In August 2021, CHR. Hansen launched science-based probiotics for pet foods and supplements, empowering every pet’s life stage with good bacteria.

- In October 2020, DSM, announced the acquisition of Erber's Biomin, its specialty product for animal nutrition and health & Romer Labs food/feed safety diagnostics businesses.

Frequently Asked Questions (FAQs):

How big is the food fortifying agents market?

The global food fortifying agents market is estimated to be worth $79.3 billion in 2022 and more than $128.0 billion by the end of 2027, with a compound annual growth rate of more than 10.1% between 2022 and 2027.

Which players are involved in the manufacturing of food fortifying agents market?

The key players in this market include Cargill (US), DSM (Netherlands), Chr. Hansen Holdings A/S (Denmark), DuPont (US), BASF SE (Germany), Arla Foods Amba (Denmark), Tate & Lyle (UK), Ingredion (US), Archer Daniels Midland Company (US), and Nestle SA (Switzerland).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for food fortifying agents market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the food fortifying agents market?

The future growth potential of the food fortifying agents market is significant, driven by several factors that reflect changing consumer preferences, government regulations, and advancements in food science and technology. There is a growing awareness among consumers about the importance of nutrition and its role in maintaining overall health and well-being. As a result, there is an increasing demand for foods that offer additional health benefits beyond basic nutrition, such as fortified foods and beverages. Government initiatives aimed at addressing malnutrition and nutrient deficiencies are also driving the demand for food fortifying agents. Many countries have implemented regulations mandating the fortification of staple foods with essential nutrients like vitamins and minerals to improve public health outcomes. These regulations create a favorable regulatory environment for the food fortifying agents market to thrive.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 FOOD FORTIFYING AGENTS (FFA) MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE ANALYSIS

2.2.2.1 Rising population

FIGURE 4 GLOBAL POPULATION, 1950-2050

2.2.2.1.1 Increase in middle-class population, 2009–2030

2.2.2.2 Growth of the food & beverage industry

2.2.2.2.1 Key segments in the food sector

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Regulatory bodies and organizations in different countries

2.2.3.2 Changing and improvised technologies

2.3 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

FIGURE 8 ASSUMPTIONS

2.5.2 LIMITATIONS

FIGURE 9 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 2 GLOBAL MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 10 FOOD FORTIFYING AGENT MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 FOOD FORTIFYING AGENT MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 13 INCREASING DEMAND FOR FORTIFYING AGENTS IN DIETARY SUPPLEMENTS DRIVES THE MARKET GROWTH

4.2 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION AND COUNTRY

FIGURE 14 US TO ACCOUNT FOR THE LARGEST SHARE IN THE APPLICATION SEGMENT IN NORTH AMERICA IN 2022

4.3 FOOD FORTIFYING AGENT MARKET, BY TYPE

FIGURE 15 VITAMINS SEGMENT IS ESTIMATED TO HOLD THE LARGEST SHARE OF THE MARKET IN 2022

4.4 FOOD FORTIFYING AGENT MARKET, BY APPLICATION

FIGURE 16 BULK FOOD ITEMS SEGMENT IS ESTIMATED TO DOMINATE THE MARKET IN 2022

4.5 FOOD FORTIFYING AGENT MARKET, BY APPLICATION AND REGION

FIGURE 17 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

FIGURE 18 INCREASING DEMAND FOR FORTIFYING AGENTS IN DIETARY SUPPLEMENTS DRIVES THE MARKET

5.1.1 DRIVERS

5.1.1.1 Consumer awareness about the health benefits of fortifying agents and increasing focus on preventive healthcare

5.1.1.2 Increasing demand for fortifying agents in dietary supplements

5.1.1.3 Increase in application profiling and existing applications finding new markets

5.1.1.4 Increasing cases of chronic diseases

FIGURE 19 MAIN CAUSES OF DEATH WORLDWIDE ACROSS ALL AGES, 2019

5.1.2 RESTRAINTS

5.1.2.1 High cost involved in R&D activities

5.1.3 OPPORTUNITIES

5.1.3.1 Growing applications of food fortifying agents

5.1.3.2 Technical assistance by governments

5.1.3.3 Growing demand from emerging economies

5.1.4 CHALLENGES

5.1.4.1 Price differences in fortified vs. non-fortified products

5.1.4.2 Multi-page labeling on the rise

6 INDUSTRY TRENDS (Page No. - 54)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 20 SUPPLY CHAIN INTEGRITY IN THE FOOD FORTIFYING AGENT MARKET

6.3 KEY INDUSTRY INSIGHTS

FIGURE 21 NEW FORMULATIONS: EASING THE APPLICATION OF FOOD FORTIFYING AGENTS

6.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

6.4.1 THREAT OF NEW ENTRANTS

6.4.2 THREAT OF SUBSTITUTES

6.4.3 BARGAINING POWER OF SUPPLIERS

6.4.4 BARGAINING POWER OF BUYERS

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

6.5 KEY CONFERENCES & EVENTS IN 2022–2023

7 REGULATORY FRAMEWORK (Page No. - 62)

7.1 OVERVIEW

TABLE 3 DEFINITIONS & REGULATIONS FOR FOOD FORTIFYING AGENTS WORLDWIDE

7.2 NORTH AMERICA

7.2.1 CANADA

7.2.2 US

7.2.3 MEXICO

7.3 EUROPEAN UNION (EU)

7.4 ASIA PACIFIC

7.4.1 JAPAN

7.4.2 CHINA

7.4.3 INDIA

7.4.4 AUSTRALIA & NEW ZEALAND

7.5 REST OF THE WORLD (ROW)

7.5.1 BRAZIL

7.6 DIETARY TRENDS

TABLE 4 PREVALENCE OF MICRONUTRIENT DEFICIENCY AND RISK FACTORS ATTACHED

7.6.1 RECOMMENDED NUTRIENT INTAKES

TABLE 5 FAO/WHO-RECOMMENDED NUTRIENT INTAKES (RNIS) FOR SELECTED POPULATION SUBGROUPS

8 FOOD FORTIFYING AGENTS MARKET, BY TYPE (Page No. - 69)

8.1 INTRODUCTION

TABLE 6 MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 7 MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

FIGURE 23 MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2022 VS. 2027 (USD MILLION)

8.2 MINERALS

8.2.1 INCREASING APPLICATION OF MINERALS IN FOOD PRODUCTS DUE TO RISING HEALTH BENEFITS

TABLE 8 MINERALS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 9 MINERALS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.3 VITAMINS

8.3.1 GROWING CONSUMER AWARENESS OF CARDIOVASCULAR HEALTH

TABLE 10 FAT- & WATER-SOLUBLE VITAMINS

TABLE 11 VITAMINS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 12 VITAMINS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.4 LIPIDS

8.4.1 RISING CONSUMPTION OF OMEGA-3 FATTY ACIDS TO REDUCE THE RISK OF CHRONIC HEART DISEASES

TABLE 13 LIPIDS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 14 LIPIDS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.5 CARBOHYDRATES

8.5.1 GROWING APPLICATION OF NUTRIENTS IN FOOD & BEVERAGE PRODUCTS

TABLE 15 CARBOHYDRATES: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 16 CARBOHYDRATES: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.6 PROTEINS & AMINO ACIDS

8.6.1 INCREASING HEALTH BENEFITS OF PROTEINS & AMINO ACIDS TO SUPPORT MARKET GROWTH

TABLE 17 RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PROTEINS IN DIFFERENT AGE GROUPS

TABLE 18 FUNCTIONS OF PROTEIN

TABLE 19 PROTEINS & AMINO ACIDS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 20 PROTEINS & AMINO ACIDS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.7 PREBIOTICS

8.7.1 GROWING PREFERENCE FOR NATURAL ALTERNATIVES OVER CONVENTIONAL MEDICINES

TABLE 21 PREBIOTICS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 22 PREBIOTICS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.8 PROBIOTICS

8.8.1 GROWING APPLICATION OF PROBIOTICS IN DIETARY SUPPLEMENTS

TABLE 23 PROBIOTICS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 24 PROBIOTICS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

8.9 OTHER TYPES

8.9.1 INCREASING APPLICATION OF OTHER FOOD FORTIFYING AGENTS TO MAINTAIN SPINE HEALTH SUPPORTS MARKET GROWTH

TABLE 25 OTHER TYPES: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 26 OTHER TYPES: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION (Page No. - 83)

9.1 INTRODUCTION

TABLE 27 MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 28 MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

FIGURE 24 MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

9.2 CEREALS & CEREAL-BASED PRODUCTS

9.2.1 FORTIFIED BREAKFAST CEREALS PLAY A SIGNIFICANT ROLE IN ENSURING NUTRITIONAL ADEQUACY

TABLE 29 CEREALS & CEREAL-BASED PRODUCTS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 30 CEREALS & CEREAL-BASED PRODUCTS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.3 DAIRY & DAIRY-BASED PRODUCTS

9.3.1 ENHANCES THE NUTRITIONAL VALUE OF DAIRY & DAIRY-BASED PRODUCTS

TABLE 31 DAIRY & DAIRY-BASED PRODUCTS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 32 DAIRY & DAIRY-BASED PRODUCTS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.4 FATS & OILS

9.4.1 INCREASING POPULARITY OF FORTIFIED EDIBLE OIL AMONG CONSUMERS

TABLE 33 FATS & OILS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 34 FATS & OILS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.5 BULK FOOD ITEMS

9.5.1 FORTIFICATION OF BULK FOOD ITEMS IS AN APPROPRIATE VEHICLE FOR MICRONUTRIENTS

TABLE 35 BULK FOOD ITEMS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 36 BULK FOOD ITEMS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.6 BEVERAGES

9.6.1 THERE IS INCREASING AWARENESS AMONG CONSUMERS REGARDING GUT HEALTH AND IMMUNITY

TABLE 37 BEVERAGES: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 38 BEVERAGES: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.7 INFANT FORMULA

9.7.1 RISING ECONOMIC GROWTH OF CONSUMERS WITH A PREFERENCE FOR CONVENIENCE FOODS

TABLE 39 INFANT FORMULA: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 40 INFANT FORMULA: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.8 DIETARY SUPPLEMENTS

9.8.1 GROWING OMEGA-3 SUPPLEMENTS’ DEMAND DUE TO NUMEROUS HEALTH BENEFITS

TABLE 41 DIETARY SUPPLEMENTS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 42 DIETARY SUPPLEMENTS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

9.9 OTHER APPLICATIONS

9.9.1 INCREASING FOCUS ON FEED, WITH INCREASED OPPORTUNITIES IN DAIRY AND MEAT INDUSTRIES, CONTRIBUTES TO THE GROWTH OF THIS SEGMENT

TABLE 43 OTHER APPLICATIONS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 44 OTHER APPLICATIONS: MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

10 FOOD FORTIFYING AGENTS MARKET, BY PROCESS (Page No. - 95)

10.1 OVERVIEW

10.2 TYPES OF TECHNOLOGIES AND PROCESSES USED IN FOOD FORTIFICATION

10.2.1 POWDER ENRICHMENT

10.2.2 PREMIXES AND COATINGS

10.2.3 DRUM DRYING

10.2.4 DUSTING

10.2.5 SPRAY DRYING UNDER THE MICROENCAPSULATION PROCESS

11 FOOD FORTIFYING AGENTS MARKET, BY REGION (Page No. - 97)

11.1 INTRODUCTION

FIGURE 25 INDIA IS PROJECTED TO BE THE FASTEST-GROWING MARKET FOR FOOD FORTIFYING AGENTS

TABLE 45 MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 46 MARKET FOR FOOD FORTIFYING AGENTS, BY REGION, 2019–2027 (KT)

11.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (KT)

TABLE 49 NORTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 51 NORTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.2.1 US

11.2.1.1 US is a growing food fortifying agents market for bakery, confectionery, and convenience food products

TABLE 53 US: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 54 US: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 55 US: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 56 US: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.2.2 CANADA

11.2.2.1 Increasing usage of healthy food additives is driving the market for food fortifying agents

TABLE 57 CANADA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 58 CANADA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 59 CANADA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 60 CANADA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.2.3 MEXICO

11.2.3.1 There is a growing demand for fortified food & beverage products in Mexico

TABLE 61 MEXICO: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 62 MEXICO: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 63 MEXICO: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 64 MEXICO: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3 EUROPE

TABLE 65 EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (KT)

TABLE 67 EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 69 EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.1 GERMANY

11.3.1.1 Growing food & beverage industry is driving the growth of the German food fortifying agents market

TABLE 71 GERMANY: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 72 GERMANY: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 73 GERMANY: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 74 GERMANY: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.2 UK

11.3.2.1 Increasing consumer inclination toward a healthy diet is driving the demand for food fortifying agents in the UK

TABLE 75 UK: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 76 UK: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 77 UK: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 78 UK: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.3 FRANCE

11.3.3.1 The market is driven by increasing health awareness among consumers

TABLE 79 FRANCE: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 80 FRANCE: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 81 FRANCE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 82 FRANCE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.4 ITALY

11.3.4.1 Growing demand for essential oils and omega-3 fatty acids in cuisines is driving the market in Italy

TABLE 83 ITALY: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 84 ITALY: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 85 ITALY: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 86 ITALY: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.5 SPAIN

11.3.5.1 Growing consumer awareness for clean label products

TABLE 87 SPAIN: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 88 SPAIN: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 89 SPAIN: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 90 SPAIN: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.6 NETHERLANDS

11.3.6.1 Increasing demand for innovative food fortifying agents

TABLE 91 NETHERLANDS: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 92 NETHERLANDS: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 93 NETHERLANDS: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 94 NETHERLANDS: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.7 POLAND

11.3.7.1 Rapid development in the field of food flavors in the food processing industry

TABLE 95 POLAND: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 96 POLAND: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 97 POLAND: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 98 POLAND: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.3.8 REST OF EUROPE

TABLE 99 REST OF EUROPE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 101 REST OF EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET SNAPSHOT

TABLE 103 ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (KT)

TABLE 105 ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 107 ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4.1 CHINA

11.4.1.1 Rising demand for high-quality processed food drives the food fortifying agents market

TABLE 109 CHINA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 110 CHINA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 111 CHINA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 112 CHINA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4.2 JAPAN

11.4.2.1 Increasing incidences of chronic conditions leading to the growth of the food fortifying agents market

TABLE 113 JAPAN: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 114 JAPAN: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 115 JAPAN: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 116 JAPAN: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4.3 INDIA

11.4.3.1 Consistent rise in demand for dietary supplements fuels the growth of the market

TABLE 117 INDIA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 118 INDIA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 119 INDIA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 120 INDIA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4.4 SOUTH KOREA

11.4.4.1 Growing demand for canned food and beverages

TABLE 121 SOUTH KOREA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 122 SOUTH KOREA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 123 SOUTH KOREA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 124 SOUTH KOREA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4.5 AUSTRALIA & NEW ZEALAND

11.4.5.1 Rapid increase in demand for nutritional food products with low-calorie food ingredients is driving the market growth

TABLE 125 AUSTRALIA & NEW ZEALAND: FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 126 AUSTRALIA & NEW ZEALAND: FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (KT)

TABLE 127 AUSTRALIA & NEW ZEALAND: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 128 AUSTRALIA & NEW ZEALAND: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.4.6 REST OF ASIA PACIFIC

TABLE 129 REST OF ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 130 REST OF ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 131 REST OF ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.5 SOUTH AMERICA

TABLE 133 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 134 SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (KT)

TABLE 135 SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 136 SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 137 SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 138 SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.5.1 BRAZIL

11.5.1.1 Thriving food processing sector in Brazil to drive the market growth

TABLE 139 BRAZIL: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 140 BRAZIL: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 141 BRAZIL: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 142 BRAZIL: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.5.2 ARGENTINA

11.5.2.1 Growing bakery industry and increasing consumption of bakery products to fuel the market growth in Argentina

TABLE 143 ARGENTINA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 144 ARGENTINA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 145 ARGENTINA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 146 ARGENTINA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.5.3 REST OF SOUTH AMERICA

TABLE 147 REST OF SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 148 REST OF SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 149 REST OF SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 150 REST OF SOUTH AMERICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.6 REST OF THE WORLD (ROW)

TABLE 151 ROW: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 152 ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY COUNTRY, 2019–2027 (KT)

TABLE 153 ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (USD MILLION)

TABLE 154 ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 155 ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 156 ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.6.1 UAE

11.6.1.1 Increasing convenience for ready-to-eat food products is driving the UAE market for food fortifying agents

TABLE 157 UAE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 158 UAE: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 159 UAE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 160 UAE: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.6.2 SAUDI ARABIA

11.6.2.1 Growth in the retail channels is driving the Saudi Arabian market for food fortifying agents

TABLE 161 SAUDI ARABIA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 162 SAUDI ARABIA: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 163 SAUDI ARABIA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 164 SAUDI ARABIA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.6.3 SOUTH AFRICA

11.6.3.1 Growing oilseed processing industry fuels the demand for food fortifying agents

TABLE 165 SOUTH AFRICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 166 SOUTH AFRICA: FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (KT)

TABLE 167 SOUTH AFRICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 168 SOUTH AFRICA: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

11.6.4 OTHERS IN ROW

11.6.4.1 Rising demand for premium food products will fuel the market growth in this region

TABLE 169 OTHERS IN ROW: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 170 OTHERS IN ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY TYPE, 2019–2027 (KT)

TABLE 171 OTHERS IN ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 172 OTHERS IN ROW: MARKET FOR FOOD FORTIFYING AGENTS, BY APPLICATION, 2019–2027 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 169)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 173 FOOD FORTIFYING AGENTS: MARKET SHARE ANALYSIS, 2021

12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 28 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017–2021 (USD BILLION)

12.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

12.4.1 STARS

12.4.2 PERVASIVE PLAYERS

12.4.3 EMERGING LEADERS

12.4.4 PARTICIPANTS

FIGURE 29 FOOD FORTIFYING AGENTS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS (2021)

12.4.5 FOOD FORTIFYING AGENTS: FOOTPRINT, BY TYPE (KEY PLAYERS)

TABLE 174 COMPANY FOOTPRINT, BY TYPE

TABLE 175 COMPANY FOOTPRINT, BY APPLICATION

TABLE 176 COMPANY FOOTPRINT, BY REGION

TABLE 177 OVERALL COMPANY FOOTPRINT

12.5 COMPANY EVALUATION MATRIX FOR OTHER PLAYERS

12.5.1 PROGRESSIVE COMPANIES

12.5.2 STARTING BLOCKS

12.5.3 RESPONSIVE COMPANIES

12.5.4 DYNAMIC COMPANIES

FIGURE 30 FOOD FORTIFYING AGENT MARKET: COMPANY EVALUATION MATRIX FOR OTHER PLAYERS (2021)

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 178 FOOD FORTIFYING AGENTS MARKET: NEW PRODUCT LAUNCHES, 2019–2022

12.6.2 DEALS

TABLE 179 FOOD FORTIFYING AGENT MARKET: DEALS, 2019–2022

12.6.3 OTHER DEVELOPMENTS

TABLE 180 FOOD FORTIFYING AGENT MARKET: OTHER DEVELOPMENTS, 2019–2022

13 COMPANY PROFILES (Page No. - 184)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 CARGILL

TABLE 181 CARGILL: BUSINESS OVERVIEW

FIGURE 31 CARGILL: COMPANY SNAPSHOT

TABLE 182 CARGILL: PRODUCTS OFFERED

TABLE 183 CARGILL: NEW PRODUCT LAUNCHES

13.1.2 INGREDION

TABLE 184 INGREDION: BUSINESS OVERVIEW

FIGURE 32 INGREDION: COMPANY SNAPSHOT

TABLE 185 INGREDION: PRODUCTS OFFERED

TABLE 186 INGREDION: NEW PRODUCT LAUNCHES

TABLE 187 INGREDION: DEALS

TABLE 188 INGREDION: OTHER DEVELOPMENTS

13.1.3 TATE & LYLE

TABLE 189 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 33 TATE & LYLE: COMPANY SNAPSHOT

TABLE 190 TATE & LYLE: PRODUCTS OFFERED

TABLE 191 TATE & LYLE: DEALS

13.1.4 DSM

TABLE 192 DSM: BUSINESS OVERVIEW

FIGURE 34 DSM: COMPANY SNAPSHOT

TABLE 193 DSM: PRODUCTS OFFERED

TABLE 194 DSM: DEALS

13.1.5 ARLA FOODS AMBA

TABLE 195 ARLA FOODS AMBA: BUSINESS OVERVIEW

FIGURE 35 ARLA FOODS AMBA: COMPANY SNAPSHOT

TABLE 196 ARLA FOODS AMBA: PRODUCTS OFFERED

TABLE 197 ARLA FOODS AMBA: NEW PRODUCT LAUNCHES

TABLE 198 ARLA FOODS AMBA: OTHER DEVELOPMENTS

13.1.6 CHR. HANSEN HOLDING A/S

TABLE 199 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

FIGURE 36 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

TABLE 200 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

TABLE 201 CHR. HANSEN HOLDING A/S: DEALS

TABLE 202 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES

13.1.7 DUPONT

TABLE 203 DUPONT: BUSINESS OVERVIEW

FIGURE 37 DUPONT: COMPANY SNAPSHOT

TABLE 204 DUPONT: PRODUCTS OFFERED

TABLE 205 DUPONT: DEALS

TABLE 206 DUPONT: PRODUCT LAUNCHES

13.1.8 ARCHER DANIELS MIDLAND COMPANY

TABLE 207 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 38 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 208 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS OFFERED

TABLE 209 ARCHER DANIELS MIDLAND COMPANY: DEALS

TABLE 210 ARCHER DANIELS MIDLAND COMPANY: OTHERS

13.1.9 BASF SE

TABLE 211 BASF SE: BUSINESS OVERVIEW

FIGURE 39 BASF SE: COMPANY SNAPSHOT

TABLE 212 BASF SE: PRODUCTS OFFERED

TABLE 213 BASF SE: PRODUCT LAUNCHES

TABLE 214 BASF SE: DEALS

13.1.10 NESTLE SA

TABLE 215 NESTLE SA: BUSINESS OVERVIEW

FIGURE 40 NESTLE SA: COMPANY SNAPSHOT

TABLE 216 NESTLE SA: PRODUCTS OFFERED

TABLE 217 NESTLE SA: NEW PRODUCT LAUNCHES

TABLE 218 NESTLE SA: DEALS

TABLE 219 NESTLE SA: OTHERS

13.1.11 WENDA INGREDIENTS, LLC

TABLE 220 WENDA INGREDIENTS, LLC: BUSINESS OVERVIEW

TABLE 221 WENDA INGREDIENTS, LLC: PRODUCTS OFFERED

13.1.12 ROYAL COSUN

TABLE 222 ROYAL COSUN: BUSINESS OVERVIEW

FIGURE 41 ROYAL COSUN: COMPANY SNAPSHOT

TABLE 223 ROYAL COSUN: PRODUCTS OFFERED

13.1.13 STRATUM NUTRITION

TABLE 224 STRATUM NUTRITION: BUSINESS OVERVIEW

TABLE 225 STRATUM NUTRITION: PRODUCTS OFFERED

13.1.14 A&B INGREDIENTS, INC.

TABLE 226 A&B INGREDIENTS, INC.: BUSINESS OVERVIEW

TABLE 227 A&B INGREDIENTS, INC.: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 227)

14.1 INTRODUCTION

TABLE 228 ADJACENT MARKETS TO THE FOOD FORTIFYING AGENTS MARKET

14.2 LIMITATIONS

14.3 SPECIALTY FOOD INGREDIENTS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 229 ACIDULANTS MARKET, BY FOOD APPLICATION, 2022–2027 (USD MILLION)

14.4 FUNCTIONAL FOOD INGREDIENTS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 230 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 230)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

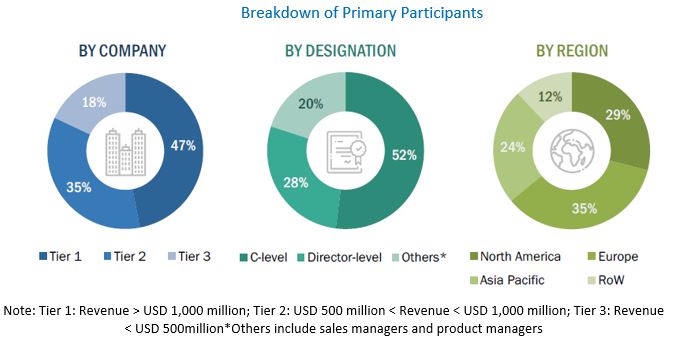

This research study involved the extensive use of secondary sources-directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of Food Fortifying Agents market. In-depth interviews were conducted with various primary respondents-such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food fortifying agent market.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- To define, segment, and project the global market size for food fortifying agents on the basis of type, application, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food fortifying agent market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe into Belgium, Switzerland, Sweden, and other EU & non-EU countries.

- Further breakdown of the Rest of Asia Pacific into Thailand, the Philippines, Malaysia, Singapore, and Vietnam.

- Further breakdown of the Rest of South America into Chile, Colombia, Paraguay, and other South American countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Fortifying Agents Market