Sterilization Services Market Size, Growth, Share & Trends Analysis

Sterilization Services Market by Method (Electron Beam, EtO, Steam, Gamma, X-Ray, Hydrogen Peroxide), Type (Contract Sterilization, Validation Services), Mode of Delivery (Off-Site, On-Site), End User & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The sterilization services market is projected to reach USD 4.6 billion by 2030 from USD 3.6 billion in 2025, at a CAGR of 5.0% from 2025 to 2030. The growth of the sterilization services market is driven by the rising incidence of healthcare-associated infections (HAls), growing surgical volumes, and increasing demand for food sterilization to curb food-borne diseases.

KEY TAKEAWAYS

-

BY METHODThe sterilization services market comprises Ethylene Oxide (EtO) Sterilization, Gamma Sterilization, Electron-Beam Radiation Sterilization, X-Ray Irradiation Sterilization, Steam Sterilization, Hydrogen Peroxide Sterilization, and Other Methods

-

BY TYPEThe sterilization services market include Contract Sterilization Services and Sterilization Validation Services

-

BY MODE OF DELIVERYThe sterilization services market include off-site sterilization services and on-site sterilization services

-

BY END USERSThe sterilization services market include Medical Device Companies, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Other End Users.

-

BY REGIONThe sterilization services market covers North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries. North America is the largest market for sterilization services and is home to several prominent sterilization services companies.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, STERIS (US), Sotera Health Company (US), and Servizi Italia (Italy) have entered into a number of agreements and partnerships to cater to the growing demand for sterilization services.

The sterilization services market is evolving rapidly, driven by the rising incidence of healthcare-associated infections (HAls), growing surgical volumes, and increasing demand for food sterilization to curb food-borne diseases. Additionally, the outsourcing of sterilization services to contract research organizations (CROs) is further accelerating market growth. However, safety concerns regarding inadequately sterilized or reprocessed devices continue to pose a restraint. On the other hand, the market benefits from strong opportunities, including the high growth potential of emerging economies, the expanding healthcare sector, and the technological advantages offered by E-beam sterilization.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The sterilization services market is under growing strain from multiple disruptions, including regulatory tightening (especially around EtO emissions), supply chain fragilities, and rising demand from healthcare and medical device end users. Because about 50% of devices depend on ethylene oxide, any constraint regulatory, material, or logistical has wide ripple effects: delays, higher costs, and uneven access. (Supply chain bottlenecks for EtO, longer lead times for gamma radiation due to cobalt-60 shortages; etc.).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing Incidence of HAIs

-

Rising volume of surgical procedures across all healthcare facilities

Level

-

Safety conerns over reprocessed or inadequately sterilized devices

Level

-

Advantages of E-beam sterilization

-

High growth potential of emerging economies

Level

-

Maintenance of sterilization quality for complex and advanced medical instruments

-

End-user non-compliance with sterilization protocols

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing Incidence of HAIs

Hospital-acquired infections (HAls), also known as nosocomial infections, occur during a patient's stay in a healthcare facility and are not present at the time of admission. Over recent years, HAls have emerged as a significant cause of morbidity and mortality worldwide. Common types include central line-associated bloodstream infections, surgical site infections, catheter-associated urinary tract infections, hospital- acquired pneumonia, ventilator-associated pneumonia, and infections caused by Clostridium difficile. Frequent pathogens associated with HAls include Escherichia coli, Klebsiella pneumoniae, Enterococcus species, Pseudomonas aeruginosa, and Candida species.

Restraint: Safety conerns over reprocessed or inadequately sterilized devices

Healthcare providers often reprocess reusable medical devices to lower costs and minimize medical waste. Devices such as surgical forceps, endoscopes, and stethoscopes are commonly reused after reprocessing. However, significant concerns remain regarding the safety and effectiveness of these devices once reprocessed. Inadequate cleaning or sterilization may leave behind blood, tissue, and other biological residues, increasing the risk of surgical-site infections (SSIs). Such debris can enable microorganisms to survive even after disinfection or sterilization, potentially leading to healthcare-associated infections (HAls). Additionally, improper reprocessing can cause adverse outcomes, such as tissue irritation due to residual chemicals from disinfectants. These risks have contributed to hesitation among hospital administrators and physicians in widely accepting device reprocessing.

Opportunity: Advantages of E-beam sterilization

Electron-beam (E-beam) sterilization is emerging as a compelling and sustainable option for pharmaceutical and medical device manufacturers. It delivers rapid, residue-free sterilization using a clean-on/off electron beam, eliminating the need for toxic gases, radioactive sources, or lengthy aeration periods. With cycle times measured in seconds to minutes, E-beam permits immediate product release and seamless integration into production lines, substantially reducing distribution and handling costs. Importantly, it offers significant environmental advantages: by relying solely on electricity and avoiding chemical byproducts, E-beam can reduce energy consumption by up to 80% and cut carbon emissions by approximately 40%.

Challenge: Maintainance of sterilization quality for complex and advanced medical instruments

Reprocessing complex medical devices, particularly endoscopes, remains a significant challenge in healthcare. Despite adherence to guidelines, microbial contamination persists due to inadequate cleaning, use of damaged equipment, and improper drying and storage. Specific concerns include the cleaning, disinfection, and sterilizing sophisticated instruments like endoscopes. Inadequate sterilization can expose patients to healthcare associated infections (HAls). The increasing use of technologically advanced instruments has driven the need for specialized sterilizers compatible with automated endoscope reprocessors (AERs).

Sterilization Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Ethylene oxide (EtO) and gamma irradiation sterilization services for medical devices. | Ensures high sterility assurance levels, compatible with complex devices and materials, supports regulatory compliance, and extends product shelf life. |

|

End-to-end sterilization solutions using EtO, gamma, and e-beam technologies. | Delivers scalable sterilization, enhances safety, reduces microbial contamination risks, and supports large-volume processing for global medtech companies. |

|

Centralized sterilization services for surgical instruments and hospital reprocessing. | Improves infection control in healthcare facilities, reduces hospital operating costs, and ensures consistent quality standards. |

|

Contract sterilization using electron beam technology. | Provides rapid, chemical-free sterilization, reduces cycle times, eco-friendly with minimal residue, and supports high-throughput applications. |

|

Advanced e-beam sterilization solutions with energy-efficient accelerators. | Offers precise dose control, sustainability benefits, lower energy consumption, and compatibility with sensitive polymers and packaging materials. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market of the sterilization services market comprises the elements present in this market, and these elements are defined with a demonstration of the bodies involved. It includes services used, technologies utilized, application areas, and the prominence of end users. The service category includes high, low, and ionizing radiation sterilization services that industries use. It is further divided into the methods and types of sterilization used. End users adopt sterilization services for sterilization methods. These end customers are the key stakeholders in the supply chain of the sterilization services market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

sterilization services Market, By Method

In 2024, the Ethylene oxide (EtO) sterilization segment accounted for the largest share of the sterilization services market. The large share of the ethylene oxide sterilization segment is attributed to the growing demand for single-use medical devices and instruments, innovations in ETO sterilization equipment and processes, and compatibility with heat- and moisture-sensitive materials.

sterilization services Market, By Type

In 2024, the contract sterilization services segment accounted for the largest share of the sterilization services market. Sterilization is often prioritized over sterilization validation services as it directly addresses the immediate need for maintaining hygiene and safety by eliminating pathogens from equipment and surfaces. While validation services are crucial for ensuring that sterilization processes are effective and compliant, contact sterilization is the direct process that ensures that items are free from microorganisms before use. The growing preference for contract sterilization by medical device companies; the increasing incidence of chronic diseases; the growing focus on reducing surgical-site infections (SSIs); and the rising outsourcing of sterile processing by hospitals to specialized third-party vendors for cost reduction are expected to drive the market growth.

sterilization services Market, By Mode of Delivery

In 2024, the off-site sterilization services segment accounted for the largest share of the sterilization services market. In the off-site sterilization process, after use, instruments are transported off-site to a centralized location where sterile processing department (SPD) professionals (either employed by the health system or a third- party service supplier) reprocess them and then send them back to their respective facilities. The limited availability of space in in-house sterile processing departments, enhanced efficiency of contract sterilization processes over in-house sterilization, access to new sterilization technology, higher output with lesser financial risks, and cost-reduction benefits are the key factors supporting the growth

sterilization services Market, By End User

The medical device companies segment accounted for the largest share of the sterilization services market in 2024. This segment is also projected to reach the higher CAGR during the forecast period. This segment's large share and high growth rate is attributed to the high regulatory standards for sterilization in medical device manufacturing. Ensuring that medical devices are free of contaminants is critical for patient safety and compliance with health regulations.

REGION

Asia Pacific to be fastest-growing region in global sterilization services market during forecast period

The high growth rate of the Asia Pacific region is propelled by the expanding pharmaceutical & biotechnology industries; the rising number of surgical procedures, favorable government regulations, increasing hospital establishments, and the rapid expansion of the medical tourism industry, coupled with a large footfall.

Sterilization Services Market: COMPANY EVALUATION MATRIX

In the sterilization services market matrix, STERIS secures the top position in the global sterilization services market owing to its comprehensive service portfolio, including steam, low-temperature, gamma, EtQ, and electron beam sterilization, backed by strong sterility assurance solutions. The company's consistent revenue growth (2022-2024) and leadership in Applied Sterilization Technologies reinforce its global market dominance. Sotera Health secures the second position in the global sterilization services market due to its strong brand presence and diversified portfolio spanning medical device, pharmaceutical, and food industry sterilization needs. In 2024, the company generated USD 1.10 billion in revenues, marking steady growth supported by US and European expansions. Servizi Italia S.p.A. ranks third in the global sterilization services market, supported by its strong presence in Italy, Brazil, and Turkey. In 2024, the company reported USD 314.2 million in net revenues, with steady growth driven by inflation adjustments and heightened demand in Italy.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- STERIS (US)

- Sotera Health (US)

- Servizi Italia S.p.A (Italy)

- E-Beam Services, Inc. (US)

- BGS Beta-Gamma-Service GmbH & Co. KG (Germany)

- Medistri SA (Switzerland)

- Life Science Outsourcing, Inc. (US)

- Cretex Companies (US)

- MICROTROL Sterilisation Services Pvt Ltd. (India)

- H.W. Andersen Products (UK)

- Avantti Medi Clear (Mexico)

- Centerpiece (US)

- Europlaz (UK)

- Prince Sterilization Services, LLC (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.4 Billion |

| Market Forecast in 2030 (value) | USD 4.6 Billion |

| Growth Rate | CAGR of 5.0% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: Sterilization Services Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- January 2025 : Medistri launched a new facility in Székesfehérvár, Hungary, with a sterilization capacity of up to 15,000 pallets/year and a chamber accommodating 16 pallets at a time. These USD 4.3 million (CHF 3.5 million) investments includes in-house laboratory services and is ISO 13485 audited for enhanced logistical reach and client proximity in Central Europe.

- September 2024 : BGS is focused on its expansion in the US market, establishing a 100,000 sq ft state-of-the-art electron beam sterilization facility in Imperial, Pennsylvania, near Pittsburgh International Airport. The new venture, expected to be operational by mid-2025, will operate as BGS US LLC and incorporate fully automated electron beam irradiation capabilities in the US, targeting the high-growth sterilization market for medical devices.

- June 2024 : In June 2024, Servizi Italia (Italy) merged with Ekolav S.r.l (Italy). This merger is part of a corporate simplification and reorganization initiated by Servizi Italia S.p.A. Both firms under the merger aim to enhance production synergies in commercial prospects and provide optimal customer service, thus containing general structural costs.

Table of Contents

Methodology

The study involved primary activities in estimating the current market size for sterilization services. Exhaustive secondary research was done to collect information on the sterilization services industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Sterilization services market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases, white papers, annual reports, investor presentations, SEC filings of companies, and publications from government sources [such as the US FDA, World Health Organization (WHO), CDC, ISO, Agency for Healthcare Research and Quality] were referred to identify and collect information for the Sterilization services market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

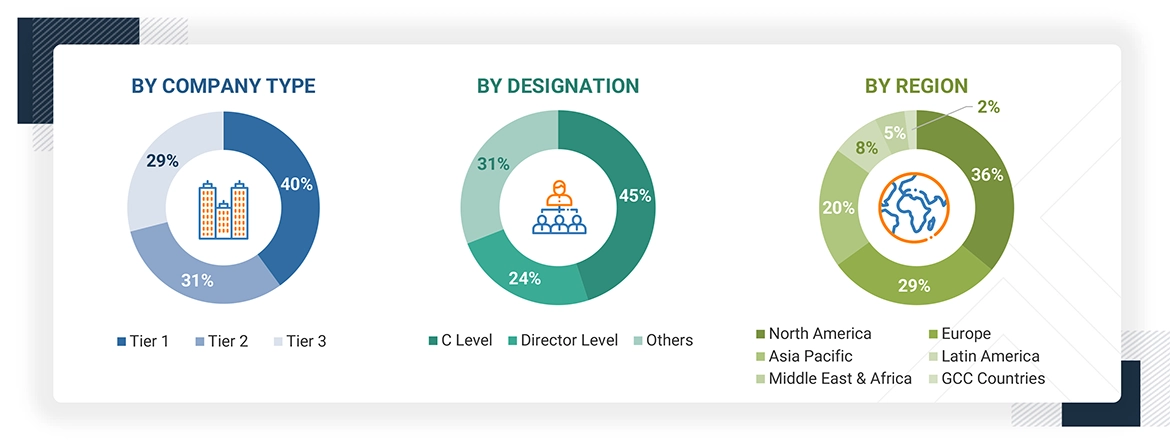

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the Sterilization services market. The primary sources from the demand side include hospitals & clinics, medical device companies, and pharmaceutical & biotechnology companies. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

Note 1: Other designations include sales, marketing, and product & service managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the market value, annual revenues were calculated based on the revenue mapping of leading product & service manufacturers and OEMs active in the sterilization services market. All the major service providers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. The Sterilization services market was split into various segments and sub-segments based on:

- List of major players operating in the services market at the regional and/or country level

- Service mapping of sterilization service providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from sterilization services (or the nearest reported business unit/services category)

- Extrapolation of the revenue mapping of the listed major players to derive the market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the sterilization services market

The above data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

The total market was split into several segments after arriving at the overall market size by applying the abovementioned process. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Sterilization services refer to procedures to eliminate microbial life from surfaces or equipment, including bacteria, viruses, and fungi. These services are crucial in settings such as hospitals, laboratories, and food processing facilities to ensure a sterile environment and prevent contamination. Methods of sterilization include heat (autoclaving), chemicals (ethylene oxide or hydrogen peroxide), and radiation (gamma rays or UV light). The effectiveness of sterilization is monitored through biological indicators and chemical tests. Regular and thorough sterilization helps maintain safety and hygiene standards, protecting patients & products from harmful pathogens.

Stakeholders

- Contract Sterilization Providers

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Food Manufacturing Companies

- Academic & Research Institutes

- Consulting Firms

- Government Associations

- Venture Capitalists and Investors

Report Objectives

- To define, describe, analyze, and forecast the sterilization services market by method, mode of delivery, type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall sterilization services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to six regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC countries

- To profile the key players and comprehensively analyze their service portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product & service excellence

- To study the impact of AI/Generative AI on the market, along with the macroeconomic outlook for each region

Key Questions Addressed by the Report

Which are the top industry players in the sterilization services market?

Key players include STERIS (Ireland), Sotera Health (US), and Servizi Italia S.p.A (Italy), among others.

What are the leading drivers of market growth?

Market growth is driven by the rise in healthcare-associated infections (HAIs) and an increasing number of surgical procedures, both contributing to higher demand for sterilization services.

Which methods have been included in the sterilization services market?

Methods include ethylene oxide (EtO) sterilization, gamma sterilization, electron-beam (E-beam) radiation sterilization, X-ray irradiation sterilization, steam sterilization, hydrogen peroxide sterilization, and other methods.

Which end users have been included in the sterilization services market?

End users include Medical Device Companies, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Other End Users.

Which region is lucrative for growth in the sterilization services market?

Asia Pacific is projected to grow at the highest CAGR due to increasing surgical procedures, favorable regulations, expansion of hospitals, growth in medical tourism, and a large patient base.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sterilization Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Sterilization Services Market

John

May, 2022

What are the Key Opportunities on Offer for Sterilization Service Providers in Sterilization Services Market ?.

James

May, 2022

What are the Factors Restraining Demand for Sterilization Services Market in 2028 and 2030 ?.

Risa

Oct, 2022

Which is the base year calculated in the sterilization services market report?.

Alex

Oct, 2022

I would like to know what are the applications of sterilization services. .

Willie

Mar, 2022

How, the key players, are dominating the Sterilization Services Market?.