This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global protein expression market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The market for the companies offering protein expression solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives. Secondary data was analyzed to arrive at the overall size of the global protein expression market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global protein expression market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from pharmaceutical and biopharmaceutical industries, CDMOs and CROs, academic and research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World (including Latin America, the Middle East, and Africa). Approximately 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

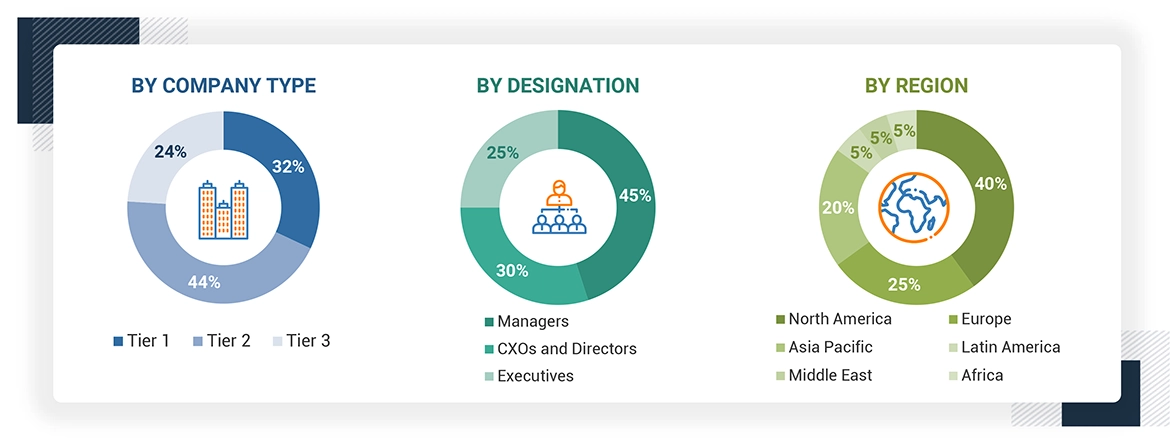

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the protein expression market was estimated and validated through multiple approaches such as the top-down and bottom-up approaches. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive primary and secondary research.

-

The revenues generated from the protein expression business of leading players have been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Market Definition

The protein expression market encompasses the technologies, products, and services required for the production and analysis of recombinant proteins. This market includes various expression systems (mammalian, bacterial, yeast, algal, insect, and cell-free), reagents and instruments for transfection and cloning, growth reagents for cell culture during translation, and reagents and kits for downstream processes like purification and characterization. It serves industries like pharmaceuticals, biotechnology, academic research institutes, CROs & CDMOs, and other industrial users, supporting applications in drug discovery, therapeutic development, and biochemical research, as well as supporting other industries such as food and beverages, cosmetics, and textile among others.

Stakeholders

-

Biopharmaceutical Companies

-

Contract Research Organizations (CROs)

-

Contract Manufacturing Organizations (CMOs)

-

Biotechnology Companies

-

Academic and Research Institutions

-

Clinical Research Laboratories

-

Pharmaceutical Companies

-

Diagnostic Companies

-

Food & Beverage Companies

-

Suppliers of Expression Systems

-

Protein Expression Instrument & Reagent Manufacturers

-

Regulatory Agencies

Report Objectives

-

To define, describe, and forecast the protein expression market based on system type, offerings, workflow, application, product end user, service end user, and region

-

To provide detailed information regarding the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

-

To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall protein expression market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

-

To forecast the revenue of the market segments with respect to six main regions, namely, North America (US and Canada), Europe (Germany, UK, France, Italy, Spain, Netherlands, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Africa and the Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina and Rest of Latin America, the Middle East (GCC countries and rest of the Middle East) and Africa.

-

To profile the key market players and comprehensively analyze their market shares and core competencies2

-

To track and analyze competitive developments such as product launches, agreements, partnerships, acquisitions, business expansions, and research & development activities in the protein expression market

Growth opportunities and latent adjacency in Protein Expression Market