The study involved major segments in estimating the current size of the aquafeed market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the Aquafeed market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

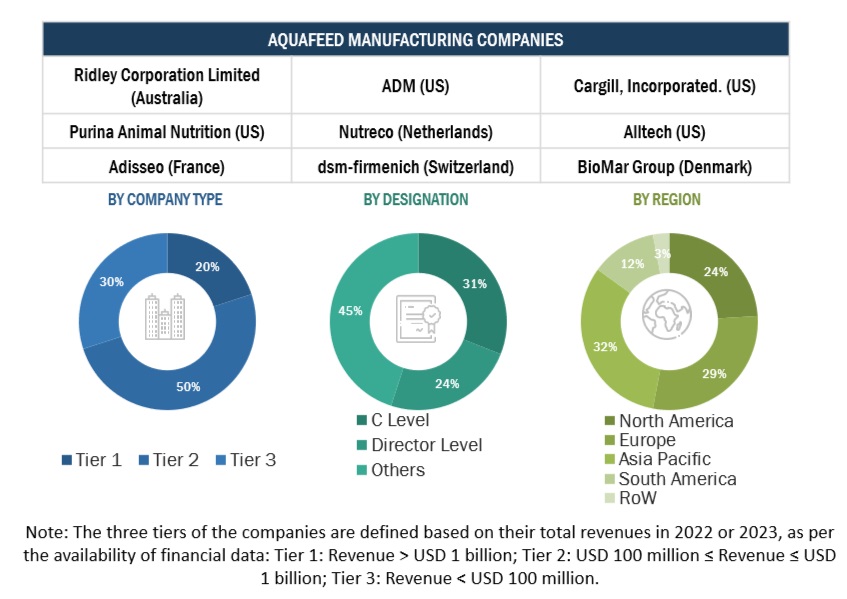

Extensive primary research was conducted after obtaining information regarding the aquafeed market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to aquafeed ingredients, form, lifecycle, species, function, and region. Stakeholders from the demand side, such as aquaculture farmers/producers and fish hatcheries who use aquafeed, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of aquafeed and the outlook of their business, which will affect the overall market.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

designation

|

|

ADM (US)

|

Regional Sales Manager

|

|

Cargill, Incorporated (US)

|

Marketing Manager

|

|

Ridley Corporation Limited (Australia)

|

General Manager

|

|

Nutreco (Netherlands)

|

Sales Manager

|

|

Alltech (US)

|

Sales Manager

|

|

Purina Animal Nutrition LLC (US)

|

Sales Executive

|

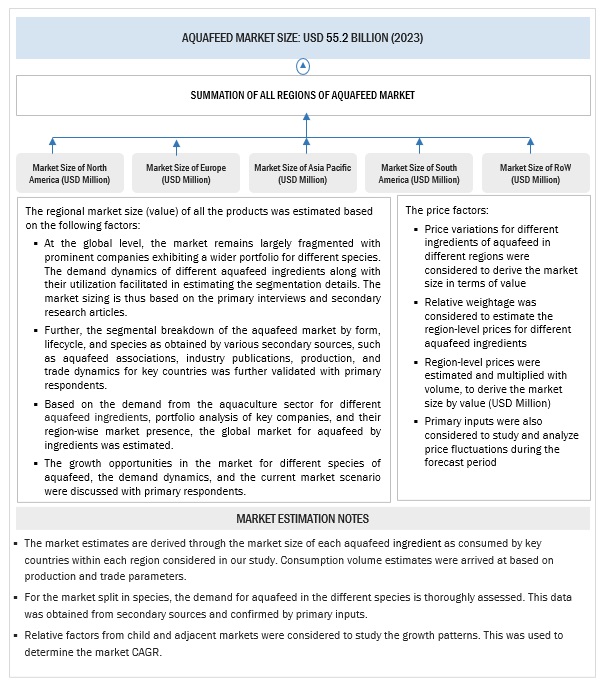

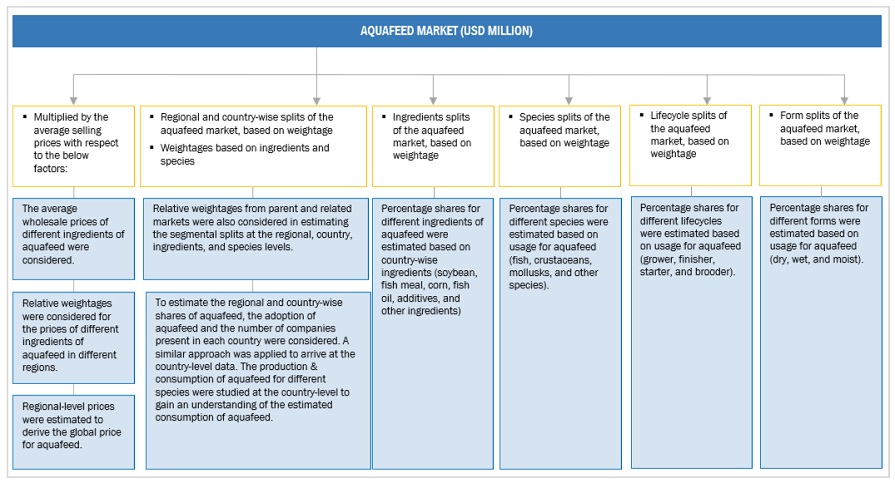

Aquafeed Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global aquafeed market size. These approaches were also used to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets were identified through extensive secondary research.

-

All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Aquafeed Market: Bottom-Up Approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Aquafeed Market: Top-Down Approach.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall Aquafeed market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides, providing valuable insights for market analysis. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Aquafeed comprises one or more artificial and/or natural feedstuffs in the form of pellets or extruded bits for aquatic animals—fish, crustaceans, and mollusks—contributing to the global aquafeed market share. The report focuses only on commercial aquafeed; farm-made aquafeed has been excluded from the study scope.

According to NOAA Fisheries, any food provided to aquatic farm animals is referred to as an aquafeed. To grow, fish (both farmed and wild) need a well-balanced mixture of vital nutrients such vitamins, fatty acids, and amino acids. Utilizing feed components that promote the aquaculture industry's sustainable growth and protect the special blend of nutrients required to maintain healthy fish and healthy people is a crucial aspect of sustainable aquaculture.

Key Stakeholders

-

Supply-side: Aquafeed manufacturers, suppliers, distributors, importers, and exporters

-

Feed additive manufacturers and traders

-

Demand-side: Fish farmers, farmer organizations, and seafood processors

-

Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies.

-

Associations and industry bodies such as:

-

Food and Agriculture Organization (FAO)

-

International Feed Industry Federation (IFIF)

-

International Fishmeal and Fish Oil Organization (IFFO)

-

United States Department of Agriculture (USDA)

Report Objectives

-

To define, segment, and forecast the global aquafeed market based on ingredients, form, lifecycle, species, and region from 2020 to 2023, this aquafeed market analysis will also include a forecast period from 2024 to 2029

-

To provide detailed information about the key factors, including drivers, restraints, opportunities, and challenges influencing the growth of the market segments in the aquafeed market.

-

To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

To analyze the demand-side factors based on the following:

-

Impact of macro and microeconomic factors on the market

-

Shifts in demand patterns across different subsegments and regions

-

Strategically profile the key players and comprehensively analyze their core competencies

-

Competitive developments, such as partnerships, mergers & acquisitions, new product developments, and expansions & investments in the aquafeed market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company.

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

-

Further breakdown of the Rest of the European Aquafeed market into key countries

-

Further breakdown of the Rest of Asia Pacific Aquafeed market into key countries

-

Further breakdown of the South American Aquafeed market into key countries

COMPANY INFORMATION

-

Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Aquafeed Market