Military Displays Market Size, Share, Trends & Growth Analysis by End Market (Land, Airborne, Naval), Technology (LED, LCD, OLED, AMOLED), Type, Panel Size (Microdisplays, Small & Medium-Sized Panels, Large Panels), Product Type, and Region (2021-2026)

Updated on : Oct 22, 2024

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Military displays Market

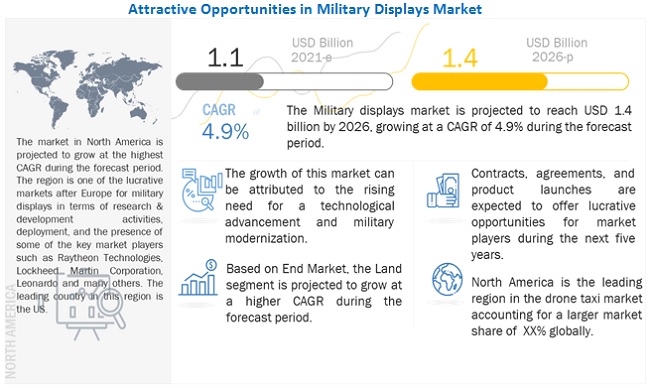

The impact of COVID-19 supply chains across all regions. The defense industry saw production plants being shut down and logistical activities be shut down. The program timeline of most major programs had been disrupted like temporary shut down of the F-35 production sites in Japan and Italy in March 2020, and by April 2020, the US military officials suspended all travel, deployments, and exercises as it tried to handle situation. Though programs were able to recover, often in a matter of months, nearly USD 5 billion in federal aids and efforts to push money to suppliers were spent. The industries in US spent around USD 10 billion to restructure production lines and build infrastructure for remote working. Small industries have all been drastically impacted by the pandemic with 1 in 7 companies expected to not be able to reach pre-pandemic levels. Most key players in the military displays market like Lockheed Martin, Raytheon Technologies and BAE systems have declared that business has largely be returned to normal but acknowledged the impact of cost and schedules on most programs.

Military Displays Market Dynamics:

Driver: Need for technological advanced systems

Technological advancements in equipment are one of the key requirements for the military. Innovators need to constantly stay on top of the ever-evolving mobile warfare approach and meet their highly specialized and highly advanced requirements. Monitors and displays will have to withstand extreme weather conditions, high vibrations and shocks, withstand interferences, and should able to be used in a wide ranging of platforms including tanks, armoured personnel carriers, submarines, aircrafts and all types of autonomous land, air, water, space and autonomous vehicles and systems. So, to be able to meet this requirements player in the market are constantly investing in R&D and are all driven to bring out the most advanced systems

Opportunity: Newer Technologies

The application for imaging and display for defense and aerospace applications have been limitless. One of the applications of imaging and display that most land, air and water vehicles can incorporate is imaging using an array of sensors like radar, sonar, magnetic anomaly detection, diesel fume sniffers, data links, TV cameras and thermal imaging to help create an image of the situation or environment. Operators should be able to select and merge data received from each sensor to create an image of the situation and environment. Such technologies are already being used in maritime patrol helicopters, but other vehicles could also benefit from them.

Challenge: Bulky support equipment

Head mounted gears are being an integral part of soldiers on the battlefield. It is integral to the soldiers as it provides enhanced situational awareness, optimized night vision, enhances lethality and helps maximize the survivability for the soldiers. But one of the main challenges soldiers had to face with this equipment is the support system they must carry around. The three main things they need to carry to a battlefield are batteries, water and ammo and any reduced weight from the system side could benefit the soldiers. The soldiers also have to be plugging and unplugging things in the battlefield and need to be aware of the environmental factors that the systems can withstand. These factors could pose challenges to the soldiers on the efficiency of soldiers on the battlefield. Developments are being made to optimize systems make it more lightweight, have more environmental resistance, be rugged and have blind mating connection possible.

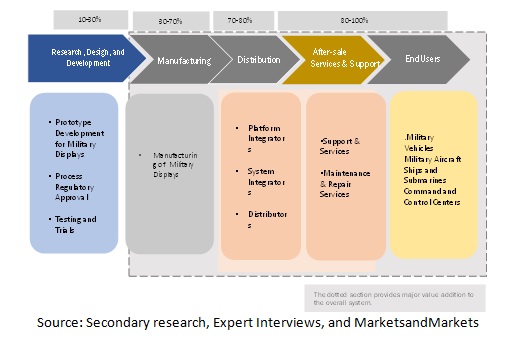

Military Displays Market Ecosystem

Prominent companies providing Military Displays, private and small enterprises, distributors/suppliers/retailers, and end customers are the key stakeholders in Military Displays market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries also serve as major influencers in the market.

Market Ecosystem MAP: Military Displays Market

To know about the assumptions considered for the study, download the pdf brochure

Based on the end market, the land segment of the military displays market is projected to grow at the highest CAGR is expected to account for the largest market share during the forecasted period.

This growth is attributed to an increase in demand for higher resolution displays at headquarters and command center. Military and other industries use displays for monitoring their operations, identifying enemies, and many other tactical operations. Displays are expected to handle data fast and effectively, be elegant and small, and operate smoothly in a hostile environment. The growing defense sector, along with the high defense budgets of countries such as the US, China, and Saudi Arabia, are some of the key factors driving the Military displays market worldwide

Based on Technology LCD makes the largest share of the market during the forecasted year.

The requirement for the LCD display module is increasing because of expanded assembling of electronic items such avionics cockpit shows, PC screens, LCD TVs, indoor and open air signs, and instrument boards. The structure of these military LCD panels uses high-strength components that can improve performance at high temperatures, shock-absorbing technology that prevents vibrations and shocks, and non-corrosive materials that can resist the effects of moisture and salt.

“North America is projected to grow at the highest CAGR during the forecast period.”

The market in North America is estimated to record a CAGR of 5.7% during the forecast period. This market is led by the US, which is increasingly investing in Military displays to maintain its combat superiority and displays for monitoring their operations, identifying enemies, and many other tactical options. The US plans to increase its spending on the Military displays to gain a competitive edge over other countries

This region is expected to lead the market from 2021 to 2026, owing to increased investments and the adoption of advanced multifunctional displays in military technologies by countries in this region. The presence of prominent manufacturers and integrators of these military displays, including Lockheed Martin (US), Northrop Grumman (US), L3Harris Technologies, Inc. (US), and Raytheon Technologies (US), is also expected drive the market in the region over the forecast period.

Key Market Players

Major players operating in the Military Displays Market include Raytheon Technologies (US), Lockheed Martin Corporation (US), Elbit Systems (Israel), Bae Systems (US). These key players offer Military Display products and strong distribution networks across North America, Europe, Asia Pacific, Middle East and Latin America.

Scope of the Report

|

Report Metric |

Details |

| Estimated Market Size |

USD 1.1 Billion by 2021 |

|

Projected Market Size

|

USD 1.4 Billion by 2026 |

|

CAGR |

4.9% |

|

Market size available for years |

2018-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Based on Product Type, Type, Panel Size, End Market, Technology |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East, and Latin America |

|

Companies covered |

Raytheon Technologies (US), Elbit Systems (Israel), BAE Systems (US), Lockheed Martin Corporation (US). |

This research report categorizes the Military Displays Market based on industry, forecasting type, purpose, organization size, and region.

Military Displays Market, By Product Type.

- Handheld

- Wearables

- Vehicle Mounted

- Simulators

- Computer Displays

Military Displays Market, By Type

- Smart Displays

- Conventional Displays

Military Displays Market, By Technology

- LED

- LCD

- AMOLED

- OLED

Military Displays Market, By End Market

- Naval

- Airborne

- Land.

Military Displays Market, By Computer Display

- Microdisplays

- Small & Medium-Sized Panels

- Large Panels

Military Displays Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In June 2021, L3Harris will supply its Fused Night Vision System (FNVS), which combines image intensification technology with thermal imagery to improve Situational Awareness, targeting, and identification for soldiers. Soldiers will be able to see where they are and where they are going, it will include an individual heads-up display that shows direction and location information.

- During the recently completed Aero India-2021, HAL (Hindustan Aeronautics Ltd) signed an agreement with Elbit Systems Electro Optics Elop Ltd., Israel, for the delivery of Digital Overhead Head Up Display Systems (DOHS). The Digital Overhead HUDs will be made in HAL's Division's Korwa factory at first, according to a press release

- In April 2020, Under a recent contract awarded by the US Air Force, Lockheed Martin Skunk Works is continuing to develop the U-2 Dragon Lady to meet future battlespace demands. One of the three upgrades is the installation of new, modern cockpit displays, which will make routine pilot jobs easier while also improving the presentation of data collected by the aircraft, allowing for faster, more informed choices.

Frequently Asked Questions (FAQ):

What is the current size of the Military Displays market?

The Military Displays market size is forecasted to grow from an estimated USD 1.1 billion in 2021 to USD 1.4 billion by 2026, at a CAGR of 4.9% during the forecast period.

Who are the winners in the Military Displays market?

Raytheon Technologies (US), Lockheed Martin Corporation (US), Elbit Systems (Israel), Bae Systems (US) are some of the winners in the market.

What is the COVID-19 impact on Military Displays market?

The impact of COVID-19 supply chains across all regions. The defense industry saw production plants being shut down and logistical activities be shut down. The program timeline of most major programs had been disrupted like temporary shut down of the F-35 production sites in Japan and Italy in March 2020, and by April 2020, the US military officials suspended all travel, deployments, and exercises as it tried to handle situation. Though programs were able to recover, often in a matter of months, nearly USD 5 billion in federal aids and efforts to push money to suppliers were spent. The industries in US spent around USD 10 billion to restructure production lines and build infrastructure for remote working.

What are some of the technological advancements in the market?

In recent times developments Transparent displays have been where the technology has taken a leap forward with freestanding transparent displays using OLED technology and innovative backlighting solutions, thereby eliminating the need to box, contain, and redirect the light. Its now possible to use these transparent displays as “window” allowing people to see each other and interact on opposite sides of the display.

What are the factors driving the growth of the market?

Technological advancements in equipment are one of the key requirements for the military. Innovators need to constantly stay on top of the ever-evolving mobile warfare approach and meet their highly specialized and highly advanced requirements. Monitors and displays will have to withstand extreme weather conditions, high vibrations and shocks, withstand interferences, and should able to be used in a wide ranging of platforms including tanks, armoured personnel carriers, submarines, aircrafts and all types of autonomous land, air, water, space and autonomous vehicles and systems. So, to be able to meet this requirements player in the market are constantly investing in R&D and are all driven to bring out the most advanced systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MILITARY DISPLAYS MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

1.8 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 MILITARY DISPLAYS MARKET: RESEARCH FLOW

FIGURE 3 MILITARY DISPLAYS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing defense spending

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Advancements in displays technology

2.2.4 MARKET DEFINITION & SCOPE

2.2.5 SEGMENT DEFINITIONS

2.2.5.1 Military displays market, by end user

2.2.5.2 Military displays market, by product type

2.2.5.3 Military displays market, by size

2.2.5.4 Military displays market, by technology

2.2.5.5 Military displays market, by type

2.2.6 KEY INDUSTRY INSIGHTS

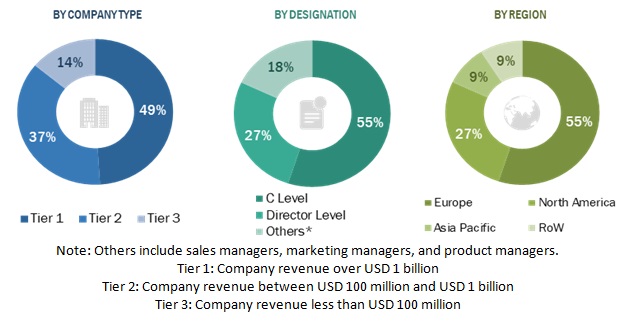

TABLE 1 PRIMARY INTERVIEWEES DETAILS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 RESEARCH APPROACH & METHODOLOGY

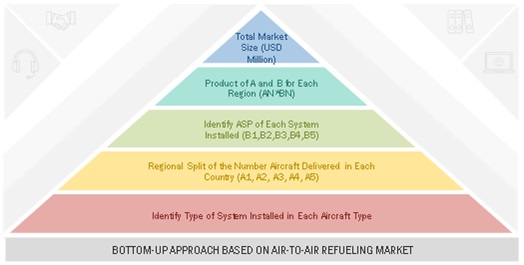

2.3.1 BOTTOM-UP APPROACH

TABLE 2 GLOBAL MARKET SUMMATION

FIGURE 5 MARKET SIZE ESTIMATION M THODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

FIGURE 8 ASSUMPTIONS OF THE RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 9 VEHICLE-MOUNTED PROJECTED TO DOMINATE THE MARKET DURING FORECAST PERIOD

FIGURE 10 HEAD-MOUNTED DISPLAYS PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 BASE STATIONS PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN MILITARY DISPLAYS MARKET, 2021–2026

4.2 MILITARY DISPLAYS MARKET, BY REGION

FIGURE 12 NORTH AMERICA IS EXPECTED TO LEAD THE MILITARY DISPLAYS MARKET DURING THE FORECAST PERIOD

4.3 MILITARY DISPLAYS MARKET, BY END USER

FIGURE 13 NAVAL SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

4.4 MILITARY DISPLAYS MARKET, BY TECHNOLOGY

FIGURE 14 THE LCD SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET BY 2026

4.5 MILITARY DISPLAYS MARKET, BY PRODUCT TYPE

FIGURE 15 THE VEHICLE-MOUNTED SEGMENT EXPECTED TO LEAD THE MARKET DURING FORECAST PERIOD

4.6 MILITARY DISPLAYS MARKET, BY COUNTRY

FIGURE 16 THE MARKET IN CHINA IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MILITARY DISPLAYS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in defense spending expected to increase procurement of military displays

TABLE 3 DEFENSE SPENDING ACROSS COUNTRIES (USD MILLION)

5.2.1.2 Need for advanced systems in military displays for optimizing military activities

5.2.2 RESTRAINTS

5.2.2.1 Regulatory restrictions causing restraints for military displays

5.2.3 OPPORTUNITIES

5.2.3.1 Newer technologies in military displays and integrated systems to optimize military activities

5.2.4 CHALLENGES

5.2.4.1 Bulky support equipment to head-mounted gears posing challenges for soldiers

5.3 VALUE CHAIN ANALYSIS

5.4 VOLUME DATA

TABLE 4 VOLUMETRIC DATA FOR MILITARY DISPLAYS (MILLION UNITS)

5.5 PRICE ANALYSIS

TABLE 5 AVERAGE SELLING PRICE FOR HEADS-UP DISPLAY, 2020

TABLE 6 AVERAGE PRICE OF MILITARY DISPLAYS, BY NAVAL PLATFORM, 2020

TABLE 7 AVERAGE PRICE OF MILITARY DISPLAYS, BY AIRBORNE PLATFORM, 2020

5.6 RANGES AND SCENARIOS

5.7 MILITARY DISPLAYS MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 18 MILITARY DISPLAYS MARKET ECOSYSTEM

TABLE 8 MILITARY DISPLAYS MARKET: MARKET ECOSYSTEM

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.8.1 REVENUE SHIFT AND & NEW REVENUE POCKETS FOR MILITARY DISPLAYS

5.9 CASE STUDY ANALYSIS: MILITARY DISPLAYS MARKET

5.10 TRADE DATA ANALYSIS

TABLE 9 TRADE DATA TABLE FOR MILITARY DISPLAYS MARKET

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS FOR MILITARY DISPLAYS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

6.3 EMERGING TECHNOLOGY TRENDS

FIGURE 20 EMERGING TECHNOLOGY TRENDS IN THE MILITARY DISPLAYS

6.3.1 TRANSPARENT DISPLAYS

6.3.2 AUGMENTED REALITY

6.3.3 TOUCH TECHNOLOGY

6.3.4 VIDEO WALL DISPLAYS

6.4 TECHNOLOGY ANALYSIS

6.5 IMPACT OF MEGATRENDS

6.6 INNOVATION AND PATENT ANALYSIS

7 MILITARY DISPLAYS MARKET, BY PRODUCT TYPE (Page No. - 70)

7.1 INTRODUCTION

FIGURE 21 THE VEHICLE-MOUNTED SEGMENT IS PROJECTED TO LEAD THE MARKET DURING FORECAST PERIOD

TABLE 11 MILITARY DISPLAYS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 12 MILITARY DISPLAYS MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

7.2 HANDHELD

FIGURE 22 TACTICAL RADIOS PROJECTED TO LEAD THE MILITARY HANDHELD DISPLAYS MARKET DURING FORECAST PERIOD

TABLE 13 MILITARY HANDHELD DISPLAYS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 14 MILITARY HANDHELD DISPLAYS MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2.1 SMARTPHONES

7.2.1.1 Increased demand for lightweight handheld smartphones is driving this segment

7.2.2 TACTICAL RADIOS

7.2.2.1 Creation for advanced networked force to fuel the growth

7.2.3 TABLETS

7.2.3.1 Emergence of security and emergency cross border operations is expected to drive the market

7.2.4 GPS

7.2.4.1 Demand for satellite navigation and communication to drive the market

7.3 COMPUTER DISPLAYS

FIGURE 23 BASE STATIONS PROJECTED TO DOMINATE COMPUTER DISPLAYS MARKET DURING FORECAST PERIOD

TABLE 15 MILITARY COMPUTER DISPLAYS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 16 MILITARY COMPUTER DISPLAYS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.3.1 BASE STATIONS

7.3.1.1 Incorporation of smart displays at base stations is expected to drive this segment

7.3.2 AIR AND NAVAL BASES

7.3.2.1 Concern for better security at a base station to fuel the market

7.4 VEHICLE-MOUNTED

FIGURE 24 THE NAVAL SEGMENT PROJECTED TO DOMINATE MILITARY VEHICLE-MOUNTED DISPLAYS MARKET DURING FORECAST PERIOD

TABLE 17 MILITARY VEHICLE-MOUNTED DISPLAYS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 18 MILITARY VEHICLE-MOUNTED DISPLAYS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.4.1 AIRBORNE

7.4.1.1 Heavy investments in advanced helmet-mounted display systems for their pilots propel this segment

7.4.2 LAND

7.4.2.1 Government investments in the defense sector to enhance the combat capability fuel this segment

7.4.3 NAVAL

7.4.3.1 Customer expectations in terms of design and viewability are currently in great demand

7.5 WEARABLES

FIGURE 25 HEAD-MOUNTED WEARABLES PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 WEARABLES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 20 WEARABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.5.1 HEAD-MOUNTED

7.5.1.1 Increased adoption of advanced technologies like virtual reality and augmented reality to fuel the growth of the segment

7.5.2 SMARTWATCHES

7.5.2.1 Smartwatches enable to deliver of crucial information via data and radio broadcasts

7.5.3 MULTIFUNCTION DISPLAYS (MFDS)

7.5.3.1 Introduction of reflecting micro-display technologies will drive this segment

7.6 SIMULATORS

7.6.1 GROWING NEED FOR MILITARY VEHICLES IS EXPECTED TO FUEL THE MARKET

8 MILITARY DISPLAYS MARKET, BY END USER (Page No. - 80)

8.1 INTRODUCTION

FIGURE 26 THE LAND SEGMENT PROJECTED TO DOMINATE THE MILITARY DISPLAYS MARKET DURING FORECAST PERIOD

TABLE 21 MILITARY DISPLAYS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 22 MILITARY DISPLAYS MARKET, BY END USER, 2021–2026 (USD MILLION)

8.2 LAND

FIGURE 27 COMMAND CENTERS PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2018–2020 (USD MILLION)

TABLE 24 MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2021–2026 (USD MILLION)

8.2.1 ARMORED VEHICLES

8.2.1.1 Rising demand for MAVs to be used in the cross border conflict

8.2.2 COMMAND CENTERS

8.2.2.1 Growing need for cybersecurity to protect headquarters and command centers

8.2.3 SOLDIER SYSTEMS

8.2.3.1 Increasing requirement for support systems for soldiers will drive this segment

8.2.4 WEAPON AND MUNITION SYSTEMS

8.2.4.1 Rising preference for weapon systems to enhance combat operations drive this segment

8.3 NAVAL

FIGURE 28 THE AIRCRAFT CARRIERS SEGMENT IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 25 MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2018–2020 (USD MILLION)

TABLE 26 MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2021–2026 (USD MILLION)

8.3.1 DESTROYERS

8.3.1.1 Growing procurement of destroyers by the US, Saudi Arabia, and Germany will drive this segment

8.3.2 FRIGATES

8.3.2.1 Procurement and upgrade programs will lead to greater demand for frigates

8.3.3 CORVETTES

8.3.3.1 A corvette is extensively used in search & rescue and combat operations

8.3.4 SUBMARINES

8.3.4.1 Increased focus on developing next-generation submarines will drive this segment

8.3.5 OFFSHORE PATROL VESSELS (OPVS)

8.3.5.1 Growing application of OPVS in the fight against terrorism and piracy drive this segment

8.3.6 AIRCRAFT CARRIERS

8.3.6.1 Growing search & rescue and combat operations drive the demand for these carriers

8.4 AIRBORNE

FIGURE 29 SPECIAL MISSION AIRCRAFT PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 27 MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 28 MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2021–2026 (USD MILLION)

8.4.1 COMBAT AIRCRAFT

8.4.1.1 Increasing requirement for combat missions expected to drive the market

8.4.2 SPECIAL MISSION AIRCRAFT

8.4.2.1 Increased strategic military operations are expected to drive demand for these aircraft

8.4.3 TRANSPORT AIRCRAFT

8.4.3.1 Growing application in military supplies operations

8.4.4 HELICOPTERS

8.4.4.1 Helicopters are increasingly used in search & rescue and combat operations

9 MILITARY DISPLAYS MARKET, BY TECHNOLOGY (Page No. - 90)

9.1 INTRODUCTION

FIGURE 30 LCD PROJECTED TO DOMINATE THE MILITARY DISPLAYS MARKET DURING FORECAST PERIOD

TABLE 29 MILITARY DISPLAYS MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 30 MILITARY DISPLAYS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.2 LCD

9.2.1 INCREASING DEMAND FOR ELECTRONICS IN MILITARY VEHICLES IS EXPECTED TO FUEL THE MARKET

9.3 LED

9.3.1 DEMAND FOR BRIGHTER AND POWER-EFFICIENT DISPLAYS IS EXPECTED TO BOOST THE MARKET

9.4 OLED

9.4.1 SIMPLE STRUCTURE AND LESS POWER CONSUMPTION ARE PROJECTED TO INCREASE THE DEMAND FOR OLED

9.5 AMOLED

9.5.1 NEED FOR LIGHTER AND FLEXIBLE VISION SYSTEM EXPECTED TO DRIVE THE MARKET

10 MILITARY DISPLAYS MARKET, BY TYPE (Page No. - 94)

10.1 INTRODUCTION

FIGURE 31 THE CONVENTIONAL DISPLAYS SEGMENT IS PROJECTED TO LEAD THE MARKET DURING FORECAST PERIOD

TABLE 31 MILITARY DISPLAYS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 32 MILITARY DISPLAYS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2 SMART DISPLAYS

10.2.1 DEVELOPMENT OF DISPLAYS FOR MILITARY VEHICLES EXPECTED TO FUEL THE MARKET

10.3 CONVENTIONAL DISPLAYS

10.3.1 THE HIGH COST OF NEW DISPLAY TECHNOLOGIES WILL HINDER THE GROWTH

11 MILITARY DISPLAYS MARKET, BY SIZE (Page No. - 97)

11.1 INTRODUCTION

FIGURE 32 LARGE PROJECTED TO DOMINATE THE MARKET DURING FORECAST PERIOD

TABLE 33 MILITARY DISPLAYS MARKET, BY SIZE, 2018–2020 (USD MILLION)

TABLE 34 MILITARY DISPLAYS MARKET, BY SIZE, 2021–2026 (USD MILLION)

11.2 MICRODISPLAYS

11.2.1 EXTENSIVE USE IN SMARTWATCHES TO FUEL THE MARKET

11.3 SMALL AND MEDIUM-SIZED

11.3.1 GEOPOLITICAL TENSIONS ARE EXPECTED TO BOOST THE MARKET

11.4 LARGE

11.4.1 RISING DEMAND FOR 4K AND 8K SCREENS WILL DRIVE THIS SEGMENT

12 MILITARY DISPLAYS MARKET, BY REGION (Page No. - 100)

12.1 INTRODUCTION

FIGURE 33 MILITARY DISPLAYS MARKET: REGIONAL SNAPSHOT

12.2 IMPACT OF COVID-19 ON MILITARY DISPLAYS MARKET, BY REGION

TABLE 35 MILITARY DISPLAYS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 MILITARY DISPLAYS MARKET BY REGION, 2021–2026 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA: MILITARY DISPLAYS MARKET SNAPSHOT

12.3.1 PESTLE ANALYSIS

TABLE 37 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 38 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2018–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2021–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2018–2020 (USD MILLION)

TABLE 46 NORTH AMERICA: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2018–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.2 US

12.3.2.1 Presence of major manufacturers in the US to foster the adoption of rugged displays for various platforms is expected to drive the market

TABLE 53 US: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 54 US: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 55 US: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 56 US: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Increased deliveries of military aircraft in upcoming years will drive the market

TABLE 57 CANADA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 58 CANADA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 59 CANADA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 60 CANADA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.4 EUROPE

FIGURE 35 EUROPE: MILITARY DISPLAYS MARKET SNAPSHOT

12.4.1 PESTLE ANALYSIS

TABLE 61 EUROPE: MILITARY DISPLAYS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 62 EUROPE: MILITARY DISPLAYS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 64 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 65 EUROPE: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2018–2020 (USD MILLION)

TABLE 66 EUROPE: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 68 EUROPE: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2018–2020 (USD MILLION)

TABLE 70 EUROPE: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 71 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 72 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 73 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2018–2020 (USD MILLION)

TABLE 74 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2021–2026 (USD MILLION)

TABLE 75 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 76 EUROPE: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.2 UK

12.4.2.1 Modernization of defense programs expected to boost the market in the UK

TABLE 77 UK: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 78 UK: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 79 UK: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 80 UK: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.4.3 GERMANY

12.4.3.1 Increasing concern for border security expected to fuel the military displays market

TABLE 81 GERMANY: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 82 GERMANY: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 83 GERMANY: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 84 GERMANY: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.4.4 RUSSIA

12.4.4.1 Rising heavy exports of defense equipment are expected to drive the market

TABLE 85 RUSSIA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 86 RUSSIA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 87 RUSSIA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 88 RUSSIA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.4.5 FRANCE

12.4.5.1 Technological advancements expected to drive the market

TABLE 89 FRANCE: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 90 FRANCE: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 91 FRANCE: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 92 FRANCE: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.4.6 REST OF EUROPE

12.4.6.1 R&D to boost the market

TABLE 93 REST OF EUROPE: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 94 REST OF EUROPE: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 95 REST OF EUROPE: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 96 REST OF EUROPE: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

FIGURE 36 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SNAPSHOT

12.5.1 PESTLE ANALYSIS

TABLE 97 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2018–2020 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2021–2026 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2018–2020 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2018–2020 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2021–2026 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5.2 SAUDI ARABIA

12.5.2.1 Modernization of defense programs expected to boost the market in the UK

TABLE 111 SAUDI ARABIA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 112 SAUDI ARABIA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 113 SAUDI ARABIA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 114 SAUDI ARABIA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.5.3 ISRAEL

12.5.3.1 Military modernization programs and the development of capabilities of defense organizations drive the market

TABLE 115 ISRAEL: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 116 ISRAEL: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 117 ISRAEL: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 118 ISRAEL: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.5.4 TURKEY

12.5.4.1 Focus on strengthening defense capability fuels growth of the market

TABLE 119 TURKEY: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 120 TURKEY: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 121 TURKEY: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 122 TURKEY: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.5.5 REST OF MIDDLE EAST & AFRICA

12.5.5.1 Technological advancements to drive the market

TABLE 123 REST OF MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 124 REST OF MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 125 REST OF MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 126 REST OF MIDDLE EAST & AFRICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.6 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MILITARY DISPLAYS MARKET SNAPSHOT

12.6.1 PESTLE ANALYSIS

TABLE 127 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2018–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2021–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2018–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2018–2020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2021–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.6.2 JAPAN

12.6.2.1 Technological development and procurement of new aircrafts to fuel the market

TABLE 143 JAPAN: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 144 JAPAN: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 145 JAPAN: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 146 JAPAN: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.6.3 INDIA

12.6.3.1 Modernization of defense forces expected to fuel the market

TABLE 147 INDIA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 148 INDIA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 149 INDIA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 150 INDIA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.6.4 CHINA

12.6.4.1 Increasing expenditure on R&D of military equipment drives the market

TABLE 151 CHINA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 152 CHINA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 153 CHINA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 154 CHINA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.6.5 SOUTH KOREA

12.6.5.1 Increased deliveries of military aircraft in upcoming years will drive the market

TABLE 155 SOUTH KOREA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 156 SOUTH KOREA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 157 SOUTH KOREA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 158 SOUTH KOREA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.6.6 REST OF ASIA PACIFIC

TABLE 159 REST OF ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.7 LATIN AMERICA

FIGURE 38 LATIN AMERICA: MILITARY DISPLAYS MARKET SNAPSHOT

12.7.1 PESTLE ANALYSIS

TABLE 163 LATIN AMERICA: MILITARY DISPLAYS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 164 LATIN AMERICA: MILITARY DISPLAYS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 165 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 166 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 167 LATIN AMERICA: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2018–2020 (USD MILLION)

TABLE 168 LATIN AMERICA: MILITARY DISPLAYS MARKET FOR LAND, BY TYPE, 2021–2026 (USD MILLION)

TABLE 169 LATIN AMERICA: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 170 LATIN AMERICA: MILITARY DISPLAYS MARKET FOR AIRBORNE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 171 LATIN AMERICA: MILITARY DISPLAYS FOR NAVAL MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 172 LATIN AMERICA: MILITARY DISPLAYS MARKET FOR NAVAL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 174 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2018–2020 (USD MILLION)

TABLE 176 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY SIZE, 2021–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 178 LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.7.2 BRAZIL

12.7.2.1 Modernization of armed forces is expected to drive the market

TABLE 179 BRAZIL: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 180 BRAZIL: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 181 BRAZIL: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 182 BRAZIL: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.7.3 REST OF LATIN AMERICA

12.7.3.1 Military modernization programs and development of capabilities of defense organizations drive the market

TABLE 183 REST OF LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2018–2020 (USD MILLION)

TABLE 184 REST OF LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 185 REST OF LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 186 REST OF LATIN AMERICA: MILITARY DISPLAYS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 160)

13.1 INTRODUCTION

13.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 39 RANKING OF LEADING PLAYERS IN MILITARY DISPLAYS MARKET, 2020

13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

TABLE 187 DEGREE OF COMPETITION

FIGURE 40 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN MILITARY DISPLAYS MARKET, 2020

13.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

FIGURE 41 REVENUE ANALYSIS OF LEADING PLAYERS IN MILITARY DISPLAYS MARKET, 2020

13.5 COMPETITIVE OVERVIEW

TABLE 188 KEY DEVELOPMENTS BY LEADING PLAYERS IN MILITARY DISPLAYS MARKET BETWEEN 2016 AND 2020

13.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 189 COMPANY PRODUCT FOOTPRINT

TABLE 190 COMPANY APPLICATION FOOTPRINT

TABLE 191 COMPANY PRODUCT FOOTPRINT

TABLE 192 COMPANY REGION FOOTPRINT

13.7 COMPANY EVALUATION QUADRANT

13.7.1 STAR

13.7.2 EMERGING LEADER

13.7.3 PERVASIVE

13.7.4 PARTICIPANT

FIGURE 42 MILITARY DISPLAY MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

13.8 COMPETITIVE SCENARIO

13.8.1 DEALS

TABLE 193 DEALS, 2019–2021

TABLE 194 PRODUCT LAUNCHES, 2019–2021

14 COMPANY PROFILES (Page No. - 175)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products offered, Services, and Solutions, Key Insights, Recent Developments, MnM View)*

14.2.1 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 195 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 196 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 197 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

14.2.2 BAE SYSTEMS

TABLE 198 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 44 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 199 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 200 BAE SYSTEMS: DEALS

14.2.3 LOCKHEED MARTIN CORPORATION

TABLE 201 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEWS

FIGURE 45 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 202 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 203 LOCKHEED MARTIN CORPORATION: DEALS

14.2.4 THALES GROUP

TABLE 204 THALES GROUP: BUSINESS OVERVIEW

FIGURE 46 THALES GROUP: COMPANY SNAPSHOT

TABLE 205 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.5 L3HARRIS TECHNOLOGIES, INC.

TABLE 206 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 47 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 207 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 208 L3HARRIS TECHNOLOGIES, INC.: PRODUCT DEVELOPMENT

TABLE 209 L3HARRIS TECHNOLOGIES INC: DEALS

14.2.6 ELBIT SYSTEMS LTD.

TABLE 210 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 48 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 211 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 212 ELBIT SYSTEMS LTD.: DEAL

14.3 OTHER PLAYERS

14.3.1 GENERAL DYNAMIC CORPORATION

TABLE 213 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

FIGURE 49 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

TABLE 214 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.2 LEONARDO

TABLE 215 LEONARDO: BUSINESS OVERVIEW

FIGURE 50 LEONARDO: COMPANY SNAPSHOT

TABLE 216 LEONARDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 LEONARDO: DEALS

14.3.3 SAAB AB

TABLE 218 SAAB AB: BUSINESS OVERVIEW

FIGURE 51 SAAB AB: COMPANY SNAPSHOT

TABLE 219 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.4 ASELSAN A.S

TABLE 220 ASELSAN A.S: BUSINESS OVERVIEW

TABLE 221 ASELSAN A.S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.5 CURTISS-WRIGHT CORPORATION

TABLE 222 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

FIGURE 52 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

TABLE 223 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 224 CURTISS-WRIGHT CORPORATION: DEALS

14.3.6 MILCOTS, LLC

TABLE 225 MILCOTS, LLC: BUSINESS OVERVIEW

TABLE 226 MILCOTS, LLC : PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.7 CMC ELECTRONICS

TABLE 227 CMC ELECTRONICS: BUSINESS OVERVIEW

TABLE 228 CMC ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.8 ADVANCED EMBEDDED SOLUTIONS LTD

TABLE 229 ADVANCED EMBEDDED SOLUTIONS LTD: BUSINESS OVERVIEW

TABLE 230 ADVANCED EMBEDDED SOLUTIONS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 ADVANCED EMBEDDED SOLUTIONS LTD: PRODUCT LAUNCH

14.3.9 GENERAL DIGITAL CORPORATION

TABLE 232 GENERAL DIGITAL CORPORATION: BUSINESS OVERVIEW

TABLE 233 GENERAL DIGITAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.10 CRYSTAL GROUP

TABLE 234 CRYSTAL GROUP: BUSINESS OVERVIEW

TABLE 235 CRYSTAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.11 HATTELAND TECHNOLOGY

TABLE 236 HATTELAND TECHNOLOGY: BUSINESS OVERVIEW

TABLE 237 HATTELAND TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 238 HATTELAND TECHNOLOGY: PRODUCT LAUNCH

TABLE 239 HATTELAND TECHNOLOGY: DEALS

14.3.12 WINMATE INC.

TABLE 240 WINMATE INC: BUSINESS OVERVIEW

TABLE 241 WINMATE INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 WINMATE INC: PRODUCT DEVELOPMENT

14.3.13 CP TECHNOLOGIES

TABLE 243 CP TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 244 CP TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 CP TECHNOLOGIES: DEALS

14.3.14 EPSILON SYSTEMS SOLUTION

TABLE 246 EPSILON SYSTEMS SOLUTION: BUSINESS OVERVIEW

TABLE 247 EPSILON SYSTEMS SOLUTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.15 MERCURY SYSTEMS, INC

TABLE 248 MERCURY SYSTEMS: BUSINESS OVERVIEW

TABLE 249 MERCURY SYSTEMS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 250 MERCURY SYSTEMS, INC: PRODUCT DEVELOPMENT

TABLE 251 MERCURY SYSTEMS, INC: DEALS

14.3.16 IMMERSIVE DISPLAY SYSTEMS

TABLE 252 IMMERSIVE DISPLAY SYSTEMS: BUSINESS OVERVIEW

TABLE 253 IMMERSIVE DISPLAY SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.17 XENARC TECHNOLOGIES

TABLE 254 XENARC TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 255 XENARC TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 XENARC TECHNOLOGIES: PRODUCT LAUNCH

14.3.18 MAX VISION

TABLE 257 MAX VISION: BUSINESS OVERVIEW

TABLE 258 MAX VISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.19 NEURO LOGIC SYSTEMS

TABLE 259 NEURO LOGIC SYSTEMS: BUSINESS OVERVIEW

TABLE 260 NEURO LOGIC SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business Overview, Products, Services, and Solutions, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 233)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The research study conducted on the Military displays market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the Military displays market. The primary sources considered included industry experts from the Military displays market consisting of Military displays service providers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the Military display as well as to assess the growth prospects of the market.

Secondary Research

Secondary sources referred for this research study included Boeing and Airbus Market Outlook 2019, General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications; Flight Global World Airforce Fleet; Stockholm International Peace Research Institute, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Military display market. The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with industry experts with knowledge on Military display

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

Market size estimation methodology: Bottom-up approach

Data triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the segments and subsegments of Military display market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the Military display market based on System, Propulsion Type, Passenger Capacity, End use, Range, Autonomy and Region.

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, Middle East and Latin America.

- To profile leading market players based on their product portfolios, financial positions, and key growth strategies

- To analyze the degree of competition in the market by identifying key growth strategies, such as mergers & acquisitions, contracts, agreements, collaborations, new product launches, and funding, adopted by leading market players.

- To provide a detailed competitive landscape of the market, along with rank analysis, revenue share analysis, and market share analysis of key players

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Displays Market

Nice information regarding military displays Really I like this information.