Molluscicides Market by Type (Chemical [Metaldehyde, Methiocarb, Ferric Phosphate] And Biological Molluscicides), Application (Agricultural and Non-Agricultural), Form (Pellets, and Liquid & Gel), and Region - Global Trends & Forecast to 2026

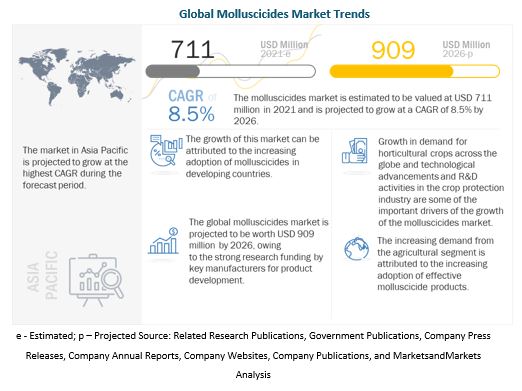

[225 Pages Report] The global molluscicides market is estimated at USD 711 million in 2021 and is projected to grow at a CAGR of 8.5%, to reach USD 909 million by 2026. Factors such as the growing demand for horticultural crops have significantly fueled the market for molluscicides due to the increasing consumer awareness about controlling snail and slug infestations in the fields.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on Molluscicides market

The outbreak of COVID-19 and the measures taken to control the pandemic are having a crippling effect on the agriculture sector across the globe. Even though the demand for pest control products such as insecticides and molluscicides has increased, the supply has been significantly impacted by the COVID-19 pandemic. A rapid and unexpected spike in the demand for pest control during the pandemic resulted in manufacturers, suppliers, and retailers struggling to ensure a continued supply of active ingredients in the market. Movement restrictions and illnesses are resulting in labor shortages and reduced supply of raw materials. The disruption in supply routes has further led to delays in active ingredients, which are used as raw materials for chemical pest control products.

Market Dynamics

Driver: Increase in adoption of agrochemicals in developing countries

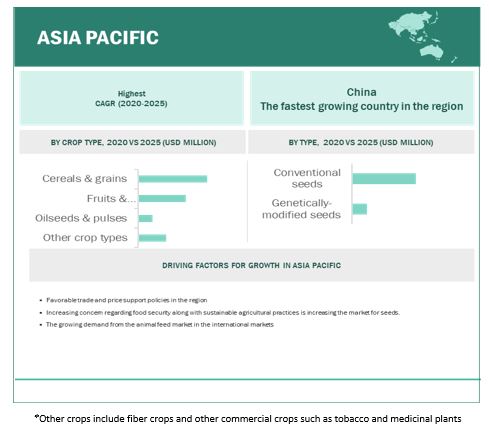

Continuous advancements in the technology used in agriculture have led to a shift in farming practices. With the increased export and import of agricultural commodities across different geographies, especially in developing regions, new types of harmful organisms have emerged, leading to an increase in the demand for novel active ingredient products to safeguard crops. Globalization of the agrochemical industry has a huge impact on the Asian crop protection markets. With the highest rate of population growth, increasing the need for food production, and economic growth, the demand for various agrochemicals such as herbicides and pesticides are increasing. While the demand for food products is increasing in the developing countries of Asia Pacific, the available land mass for agriculture is shrinking due to the increased effect of urbanization that propels farmers to use various agrochemicals to maintain soil health and increase land productivity.

Constraint: Regulatory restrictions on the use of molluscicide products

Different control methods are employed by farmers against slugs and snails, which causes significant damage to crops. When these measures are not found sufficient, chemical control options are seen as a last resort. Strict guidelines and frameworks are in place to prevent the rampant use of harmful pesticides due to their high toxicity levels and drastic effects on the environment when they enter food chains. For instance, the European Union has banned the use of methiocarb slug pellets due to their hazardous effect on grain-eating farm birds such as finches and sparrows. The other major slug pellet product used is metaldehyde, which is considered an emerging pollutant and is more frequently found in watercourses above the EU statutory drinking water limit of 0.1 μg L?¹ for a pesticide.

Opportunity: Introduction of “green eco-friendly” molluscicide products and the growing awareness for mollusk control

Major manufacturing players have begun producing environment-friendly molluscicide products by utilizing natural and non-harmful by-products. There are no efficient biological controls to combat invasive mollusks. The application of synthetic molluscicides has a toxic effect on non-target organisms; it affects crop establishment and causes problems of algal blooms and pesticide residue. This gives rise to the need for botanical molluscicides as an alternative. However, there is currently no effective, safe, and economically viable molluscicidal formulation. Platcom Ventures Sdn Bhd (Malaysia) developed a polyherbal molluscicide, which is an effective formulation to combat invasive mollusks, especially golden apple snails. In contrast to synthetic molluscicides that have a toxic effect on non-target organisms, this polyherbal formulation is a biological control method with low toxicity against non-target organisms and is also biodegradable.

Challenge: Excessive use of harmful chemicals causing a threat to the environment

The mode of action of many molluscicides causes stress to the water balance system of mollusk species. Metaldehyde and methiocarb are the two common active ingredients used in the manufacturing of molluscicide products by major global players around the world. Risks to human health or the environment, including toxicity or ill health to humans or animals, hazards to non-target organisms such as natural garden predators, and risks to endangered species are some issues faced by players in the market. Moreover, low concentrations of these chemicals have been found in drinking water, causing water pollution and damaging the food chain of the ecosystem.

Market Ecosystem

By type, the chemical molluscicides is projected to dominate the market during the forecast period.

Chemical molluscicides accounted for the larger share, followed by biological molluscicides, in 2020. The growth of the chemical molluscicides market is attributed to the increasing adoption of agrochemicals and their use in the growing high-value horticultural crops. Chemical molluscicides are easily available and affordable; they are exported to various regions across the globe. These factors significantly contribute to the high demand for chemical molluscicides across the globe.

By application, agricultural segment is projected to dominate the market during the forecast period.

The global market, on the basis of application, is segmented into the agricultural and non-agricultural segments. Agricultural application accounted for the larger share in 2020, followed by non-agricultural applications. The overall increase in the usage of molluscicides in the agricultural application is largely because of the application of molluscicides to crops such as corn, rice, and wheat.

By form, pellet segment is projected to dominate the market during the forecast period.

On the basis of form, the pellets segment accounted for the larger share in 2020. Owing to their ease of handling, pellets have gained the larger market share as compared to the liquid & gel form. Pelleting is the most common and effective technique used to control slugs and snails. The effectiveness of pellets depends upon their chemical content, especially, the presence of constituents that attract slugs and their durability under field conditions.

Asia Pacific to be the fastest-growing market during the forecast period.

The Asia Pacific is projected to be the fastest-growing market during the forecast period. Emerging economies such as China and India play an important role in supplying active ingredients (chemicals such as metaldehyde) as raw materials to the North American and European markets.

Key Market Players

Some of the major players operating in the molluscicides market are Lonza Group (Switzerland), Bayer AG (Germany), American Vanguard Corporation (US), BASF SE (Germany), and Adama Agricultural Solutions (Israel) have acquired leading market positions through their broad product portfolios, along with a focus on diverse end-user segments. They are also focused on innovations and are geographically diversified.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD) and Volume (Tons) |

|

Segments covered |

Type, Application, Form, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, RoW |

|

Companies covered |

BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), Lonza Group (Switzerland), UPL Limited (India), Adama Agricultural Solutions (Israel), Marrone Bio Innovations (US), De Sangosse (UK), Doff Portland (UK), Certis Europe (Netherlands), PI Industries (India), Neudorff GmbH (Germany), Liphatech (US), Monterey Lawn & Garden (US), Agro Advanced International Ltd (China), Westland Horticulture (UK), Animal Control Technologies Ltd (Australia), Agro-Unitek (China), Impex Europa S.L.(Spain), Industriachimca (Italy), Garden Safe (US) and Nufarm (Australia) |

This research report categorizes the molluscicides market based on application, type, form, and region.

By application:

- Agricultural

- Fruits & vegetables

- Cereals & grains

- Oilseeds & pulses

- Non-agricultural

- Commercial

- Residential

By type:

- Chemical molluscicides

- Biological molluscicides

By form:

- Pellet

- Liquids & gels

By region:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes the Middle East & Africa

Recent Developments:

- In October 2020, American Vanguard Corporation announced the acquisition of Agrinos (US), a privately-owned technology leader in biological crop inputs. This would enable the company to expand its product portfolio in North America.

- In August 2020, Marrone Bio Innovations announced an agreement with Vive Crop Protection (Canada) for the extraction of active ingredients in the molluscicides market.

- In January 2020, BASF SE inaugurated its new crop protection facility in Singapore to increase its production capacity in the Asia Pacific region. This will cater to the rising demand from the farmers in the region for quality products for cultivation.

- In November 2019, Adama Ltd acquired the French-Swiss crop protection company, SFP. This would enable the company to produce some of the active ingredients of SFP.

- In June 2018, Bayer AG acquired Monsanto (US) for USD 128 per share in an all-cash transaction. The combination would bring together both companies’ innovation capabilities and R&D technology platforms to offer enhanced seed business operations

- In January 2018, Adama Agricultural Solutions acquired Hubei Sanonda Co., Ltd. (China) to increase its presence in the Asian market.

- In September 2018, Lonza Group established a new production facility of specialty ingredients in Greenwood, SC, US, to expand its production capacity.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the molluscicides market, and how intense is the competition?

Some of the major players operating in the molluscicides market include BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), Lonza Group (Switzerland), Land O’ Lakes (US), Marrone Bio Innovations (US), and UPL Limited (India).

How are the current R&D activities and M&A’s in the molluscicides market projected to create a disrupting environment in the coming years?

Major players in the molluscicides market are undertaking acquisitions and are focusing on developing an innovative product portfolio by making significant investments in R&D activities.

How would COVID-19 impact the fluctuations in active ingredient and raw material prices of chemical molluscicides products?

Based on inputs from industry experts, the prices of different types of active ingredients such as metaldehyde, methiocarb, etc. were considered to be lower than their regular ranges due to the COVID-19 impact on the molluscicides market.

What are the upcoming trends for the molluscicides market?

Major manufacturing players have begun producing environment-friendly molluscicide products by utilizing natural and non-harmful by-products.

Which are the key brands offered by the major players in the molluscicides market?

Key molluscicides brands such as Axcela Metarex INOV and Nemaslug offered by major players, projected to experience significant growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 MARKET FOR MOLLUSCICIDES: GEOGRAPHIC SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE CONSIDERED, 2015–2020

1.6 UNITS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 MARKET FOR MOLLUSCICIDES: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries, by company type, designation, and region

2.1.2.2 Key Industry Insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.5.1 SCENARIO-BASED MODELLING

2.6 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 12 IMPACT OF COVID-19 ON THE MOLLUSCICIDES MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 13 MOLLUSCICIDES MARKET SNAPSHOT, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MOLLUSCICIDES MARKET SNAPSHOT, BY FORM, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MOLLUSCICIDES MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 MOLLUSCICIDES MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 OPPORTUNITIES IN THE MOLLUSCICIDES MARKET

FIGURE 17 EMERGING ECONOMIES AND INCREASING DEMAND FOR HORTICULTURE CROPS OFFER OPPORTUNITIES FOR GROWTH

4.2 MOLLUSCICIDES MARKET, BY KEY COUNTRY

FIGURE 18 JAPAN TO BE THE FASTEST-GROWING COUNTRY IN THE MOLLUSCICIDES MARKET BY 2026

4.3 MOLLUSCICIDES MARKET, BY TYPE & REGION

FIGURE 19 NORTH AMERICA TO DOMINATE THE MOLLUSCICIDES MARKET ACROSS ALL TYPES IN 2021

4.4 MOLLUSCICIDES MARKET, BY FORM

FIGURE 20 PELLETS SEGMENT TO DOMINATE THE MOLLUSCICIDES MARKET ON THE BASIS OF FORM

4.5 NORTH AMERICA: MOLLUSCICIDES MARKET, BY KEY CROP APPLICATION & COUNTRY, 2021

FIGURE 21 THE US IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN 2021

4.6 COVID-19 IMPACT ON THE MOLLUSCICDES MARKET

FIGURE 22 PRE- AND POST-COVID-19 IMPACT ON THE MOLLUSCICDES MARKET

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASING POPULATION DENSITY

TABLE 2 GLOBAL POPULATION DENSITY, 2019 (PEOPLE/SQ. M.)

FIGURE 23 POPULATION GROWTH TREND, 1950–2050

5.2.2 EFFECTS OF RAPID URBANIZATION ON PEST POPULATION

FIGURE 24 MOST URBANIZED COUNTRIES, 2020

5.3 MARKET DYNAMICS

FIGURE 25 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Rain-fast characteristic—an important attribute for the increasing demand for molluscicides

5.3.1.2 Increase in adoption of agrochemicals in developing countries

5.3.1.3 Infestation of golden apple snail in the rice fields of Asia

5.3.1.4 Demand for high-value and industrial crops

FIGURE 26 AREA HARVESTED UNDER HIGH-VALUE CROPS, 2015–2019 (MILLION HA)

5.3.2 RESTRAINTS

5.3.2.1 Limited applicability

5.3.2.2 Geographical limitation on molluscicides usage

5.3.2.3 Regulatory restrictions on the use of molluscicide products

5.3.2.4 Lack of competence and adequate resources

5.3.2.5 Traditional pest control methods used by farmers

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging markets for molluscicides in Asia Pacific

5.3.3.2 Introduction of “green eco-friendly” molluscicide products and the growing awareness for mollusk control

5.3.4 CHALLENGES

5.3.4.1 Growth in pest resistance against chemical compounds

FIGURE 27 GLOBAL INCREASE IN UNIQUE PESTICIDE-RESISTANT CASES, 1970–2020

5.3.4.2 Excessive use of harmful chemicals causing a threat to the environment

5.3.4.2.1 Metaldehyde poisoning risks and extreme usage of other harmful chemicals

5.3.4.2.2 Bioaccumulation

5.3.4.2.3 Toxicity for non-target organisms

5.3.4.2.4 Molluscicide-tolerant organisms

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 COVID-19 TO DRIVE THE DEMAND FOR PEST CONTROL AS AN “ESSENTIAL SERVICE”

5.4.2 COVID-19 IMPACT ON THE MOLLUSCICIDES SUPPLY CHAIN

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 28 RESEARCH & PRODUCT FORMULATION CONTRIBUTE THE MOST TO THE VALUE OF THE OVERALL PRICE OF MOLLUSCICIDES

6.3 REGULATORY FRAMEWORK

6.3.1 EUROPE

6.3.2 US

6.3.3 AUSTRALIA

6.3.4 BRAZIL

7 MOLLUSCICIDES MARKET, BY APPLICATION (Page No. - 66)

7.1 INTRODUCTION

FIGURE 29 AGRICULTURAL APPLICATIONS TO DOMINATE THE MARKET THROUGH 2026 (USD MILLION)

TABLE 3 MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 4MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 COVID-19 IMPACT ON THE MOLLUSCICIDES MARKET, BY APPLICATION

7.2.1 OPTIMISTIC SCENARIO

TABLE 5 OPTIMISTIC SCENARIO: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.2.2 REALISTIC SCENARIO

TABLE 6 REALISTIC SCENARIO: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

7.2.3 PESSIMISTIC SCENARIO

TABLE 7 PESSIMISTIC SCENARIO: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.3 AGRICULTURAL

TABLE 8 MOLLUSCICIDES MARKET SIZE IN AGRICULTURAL APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 9 MARKET SIZE IN AGRICULTURAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

7.3.1 FRUITS & VEGETABLES

7.3.1.1 The increase in horticulture and adoption of integrated pest management results in fueling the growth

TABLE 10 MOLLUSCICIDES MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2021–2026 (USD MILLION)

7.3.2 CEREALS & GRAINS

7.3.2.1 Significant yield loss from slugs to boost the adoption of molluscicides

TABLE 12 MOLLUSCICIDES MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2021–2026 (USD MILLION)

7.3.3 OILSEEDS & PULSES

7.3.3.1 The current scenario is boosting the consumption of oilseeds & pulses and consequent use of molluscicide

TABLE 14 MOLLUSCICIDES MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2021–2026 (USD MILLION)

7.4 NON-AGRICULTURAL

TABLE 16 MOLLUSCICIDES MARKET SIZE IN NON-AGRICULTURAL APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 MARKET SIZE IN NON-AGRICULTURAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

7.4.1 COMMERCIAL

7.4.1.1 Treatment of diseases using molluscicides is recommended by WHO

TABLE 18 MOLLUSCICIDES MARKET SIZE IN COMMERCIAL APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 MARKET SIZE IN COMMERCIAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

7.4.2 RESIDENTIAL

7.4.2.1 Non-toxic molluscicides are needed for residential usage

TABLE 20 MOLLUSCICIDES MARKET SIZE IN RESIDENTIAL APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 MARKET SIZE IN RESIDENTIAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8 MOLLUSCICIDES MARKET, BY TYPE (Page No. - 79)

8.1 INTRODUCTION

FIGURE 30 CHEMICAL MOLLUSCICIDES TO DOMINATE THE MARKET THROUGH 2026 (USD MILLION)

TABLE 22 MOLLUSCICIDES MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 23 MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 24 MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (TON)

TABLE 25 MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (TON)

8.2 COVID-19 IMPACT ON THE MOLLUSCICIDES MARKET, BY TYPE

8.2.1 OPTIMISTIC SCENARIO

TABLE 26 OPTIMISTIC SCENARIO: MOLLUSCICIDES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 27 REALISTIC SCENARIO: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2018–2021 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 28 PESSIMISTIC SCENARIO: MOLLUSCICIDES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.3 CHEMICAL MOLLUSCICIDES

TABLE 29 CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 31 CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 32 CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (TON)

8.3.1 METALDEHYDE

8.3.1.1 Metaldehyde negatively affects humans and the environment

TABLE 33 METALDEHYDE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 METALDEHYDE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 35 METALDEHYDE MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 36 METALDEHYDE MARKET SIZE, BY REGION, 2021–2026 (TON)

8.3.2 METHIOCARB

8.3.2.1 It affects the food chain and causes loss of biodiversity

TABLE 37 METHIOCARB MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 METHIOCARB MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 39 METHIOCARB MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 40 METHIOCARB MARKET SIZE, BY REGION, 2021–2026 (TON)

8.3.3 FERROUS PHOSPHATE

8.3.3.1 Ferrous phosphate is less toxic as it is an essential mineral for plants and animals

TABLE 41 FERROUS PHOSPHATE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 FERROUS PHOSPHATE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 43 FERROUS PHOSPHATE MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 44 FERROUS PHOSPHATE MARKET SIZE, BY REGION, 2021–2026 (TON)

8.3.4 OTHER CHEMICAL MOLLUSCICIDES

8.3.4.1 Metal sulfate can also be used as molluscicides

TABLE 45 OTHER CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 OTHER CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 OTHER CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 48 OTHER CHEMICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (TON)

8.4 BIOLOGICAL MOLLUSCICIDES

8.4.1 THE DEMAND FOR BIOPESTICIDES IS INCREASING TO PROTECT SOIL FROM DETORIATING

TABLE 49 BIOLOGICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 BIOLOGICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 BIOLOGICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 52 BIOLOGICAL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (TON)

9 MOLLUSCICIDES MARKET, BY FORM (Page No. - 95)

9.1 INTRODUCTION

FIGURE 31 MOLLUSCICIDES MARKET SIZE, BY FORM, 2021 VS. 2026 (USD MILLION)

TABLE 53 MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2016–2020 (USD MILLION)

TABLE 54 MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2021–2026 (USD MILLION)

9.2 COVID-19 IMPACT ON THE MOLLUSCICIDES MARKET, BY FORM

9.2.1 OPTIMISTIC SCENARIO

TABLE 55 OPTIMISTIC SCENARIO: MOLLUSCICIDES MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 56 REALISTIC SCENARIO: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2018–2021 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 57 PESSIMISTIC SCENARIO: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2018–2021 (USD MILLION)

9.3 PELLETS

9.3.1 PELLETS ARE EASY TO USE AND CAN BE CONVERTED INTO LIQUID FORM

TABLE 58 PELLET MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 PELLET MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 LIQUIDS & GELS

9.4.1 DEMAND FOR LIQUID & GEL MOLLUSCICIDES IS INCREASING IN NON-AGRICULTURAL APPLICATIONS

TABLE 60 LIQUID & GEL MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 LIQUID & GEL MOLLUSCICIDES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MOLLUSCICIDES MARKET, BY BRAND (Page No. - 101)

10.1 INTRODUCTION

10.2 AXCELA: LONZA GROUP

10.3 METAREX INOV: BAYER AG

10.4 NEMASLUG: BASF SE

10.5 DEADLINE M-PS: AMVAC CHEMICAL CORPORATION

10.6 SLUGGO: NEUDORFF GMBH

10.7 ZEQUANOX: MARRONE BIO INNOVATIONS

10.8 SLUXX HP: CERTIS EUROPE

11 MOLLUSCICIDES MARKET, BY REGION (Page No. - 103)

11.1 INTRODUCTION

TABLE 62 MOLLUSCICIDES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 MARKET SIZE FOR MOLLUSCICIDES, BY REGION, 2021–2026 (USD MILLION)

TABLE 64 MARKET SIZE FOR MOLLUSCICIDES, BY REGION, 2016–2020 (TON)

TABLE 65 MARKET SIZE FOR MOLLUSCICIDES, BY REGION, 2021–2026 (TON)

11.2 COVID-19 IMPACT ON THE MOLLUSCICIDES MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 66 OPTIMISTIC SCENARIO: MOLLUSCICIDES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 67 REALISTIC SCENARIO: MARKET SIZE FOR MOLLUSCICIDES, BY REGION, 2018–2021 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 68 PESSIMISTIC SCENARIO: MARKET SIZE FOR MOLLUSCICIDES, BY REGION, 2018–2021 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 32 NORTH AMERICAN MOLLUSCICIDES MARKET SNAPSHOT: HIGH SALES & DEMAND IN THE MATURE MARKET

TABLE 69 NORTH AMERICA: MOLLUSCICIDES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2016–2020 (TON)

TABLE 72 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (TON)

TABLE 73 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (TON)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (TON)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2016–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2021–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Production of a large amount of corn leads to an increase in demand for molluscicides

TABLE 81 US: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 82 US: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Canadian farmers are more inclined toward biopesticides, and hence many companies have launched new innovative products

TABLE 83 CANADA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 84 CANADA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 The government has taken many measures toward sustainable agriculture methods

TABLE 85 MEXICO: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 86 MEXICO: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.4 EUROPE

TABLE 87 EUROPE: MOLLUSCICIDES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2016–2020 (TON)

TABLE 90 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (TON)

TABLE 91 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (TON)

TABLE 96 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (TON)

TABLE 97 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2016–2020 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2021–2026 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Large production of oilseed results in the usage of molluscicides

TABLE 99 GERMANY: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 The ever-increasing demand for food in France has led to the adoption of molluscicides for crop protection

TABLE 101 FRANCE: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.3 SPAIN

11.4.3.1 Spain’s second-largest proportion of land devoted to agricultural purposes increases the demand for molluscicides

TABLE 103 SPAIN: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 104 SPAIN: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Rice is majorly produced in Italy that is a favorable target of gastropods, leading to an increase in demand for molluscicides

TABLE 105 ITALY: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 106 ITALY: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.5 UK

11.4.5.1 The UK has a huge demand for molluscicides since farmers are still using traditional farming methods

TABLE 107 UK: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 108 UK: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.6 REST OF EUROPE

TABLE 109 REST OF EUROPE: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC MOLLUSCICIDES MARKET SNAPSHOT: HIGH-GROWTH POTENTIAL DUE TO EXPANSIONS BY LEADING PLAYERS IN THE REGION

TABLE 111 ASIA PACIFIC: MOLLUSCICIDES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2016–2020 (TON)

TABLE 114 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (TON)

TABLE 115 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (TON)

TABLE 120 ASIA PACIFIC: MOLLUSCICIDES MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 121 ASIA PACIFIC: MOLLUSCICIDES MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: MOLLUSCICIDES MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Population growth leads to increase in consumption of food and, ultimately, molluscicides

TABLE 123 CHINA: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 124 CHINA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.2 INDIA

11.5.2.1 Increase in R&D and growth in GDP resulted in growing farmers’ preference toward crop protection chemicals

TABLE 125 INDIA: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 126 INDIA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.3 JAPAN

11.5.3.1 To avoid infestation of snails through water bodies, molluscicides are used by farmers in Japan

TABLE 127 JAPAN: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 128 JAPAN: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.4 NEW ZEALAND

11.5.4.1 Vast majority of mollusk species encourage farmers and the government to use molluscicides

TABLE 129 NEW ZEALAND: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 130 NEW ZEALAND: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.5 AUSTRALIA

11.5.5.1 Climate in Australia is responsible for the increase in demand for molluscicides

TABLE 131 AUSTRALIA: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 132 AUSTRALIA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.6 REST OF ASIA PACIFIC

TABLE 133 REST OF ASIA PACIFIC: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 135 ROW: MOLLUSCICIDES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 136 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 137 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2016–2020 (TON)

TABLE 138 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY COUNTRY, 2021–2026 (TON)

TABLE 139 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 140 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 141 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 142 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 143 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2016–2020 (TON)

TABLE 144 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY TYPE, 2021–2026 (TON)

TABLE 145 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2016–2020 (USD MILLION)

TABLE 146 ROW: MARKET SIZE FOR MOLLUSCICIDES, BY FORM, 2021–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Need to increase the crop yield is the major driver for pesticides in the country

TABLE 147 BRAZIL: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 148 BRAZIL: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Production of grains and cereals is a major factor for the growth of pesticides such as molluscicides in Argentina

TABLE 149 ARGENTINA: MOLLUSCICIDES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 150 ARGENTINA: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.3 OTHERS IN ROW

TABLE 151 OTHERS IN ROW: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 152 OTHERS IN ROW: MARKET SIZE FOR MOLLUSCICIDES, BY APPLICATION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 149)

12.1 OVERVIEW

FIGURE 34 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE MOLLUSCICIDES MARKET FROM 2018 TO 2020

12.2 COMPETITIVE SCENARIO

FIGURE 35 MARKET EVALUATION FRAMEWORK

12.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.3.1 STAR

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE

12.3.4 PARTICIPANT

FIGURE 36 MOLLUSCICIDES MARKET EVALUATION QUADRANT, 2019 (KEY PLAYERS)

12.4 COMPANY EVALUATION QUADRANT (SME/STARTUPS)

12.4.1 PROGRESSIVE COMPANIES

12.4.2 STARTING BLOCKS

12.4.3 RESPONSIVE COMPANIES

12.4.4 DYNAMIC COMPANIES

FIGURE 37 MOLLUSCICIDES MARKET EVALUATION QUADRANT (STARTUPS/SMES), 2019

12.5 COMPETITIVE SCENARIO & TRENDS

12.5.1 NEW PRODUCT LAUNCHES

TABLE 153 MOLLUSCICIDES MARKET: NEW PRODUCT LAUNCHES, JUNE 2020

12.5.2 DEALS

TABLE 154 MOLLUSCICIDES MARKET: DEALS, JANUARY 2018–OCTOBER 2020

12.5.3 OTHERS

TABLE 155 MOLLUSCICIDES MARKET: OTHERS, SEPTEMBER 2018–MARCH 2019

13 COMPANY PROFILES (Page No. - 157)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 LONZA GROUP

TABLE 156 LONZA GROUP: BUSINESS OVERVIEW

FIGURE 38 LONZA GROUP: COMPANY SNAPSHOT

TABLE 157 LONZA GROUP: OTHERS

13.1.2 BAYER AG

TABLE 158 BAYER AG: BUSINESS OVERVIEW

FIGURE 39 BAYER AG: COMPANY SNAPSHOT

TABLE 159 BAYER AG: DEALS

13.1.3 BASF SE

TABLE 160 BASF SE: BUSINESS OVERVIEW

FIGURE 40 BASF SE: COMPANY SNAPSHOT

TABLE 161 BASF SE: OTHERS

13.1.4 ADAMA AGRICULTURAL SOLUTIONS

TABLE 162 ADAMA AGRICULTURAL SOLUTIONS: BUSINESS OVERVIEW

FIGURE 41 ADAMA AGRICULTURAL SOLUTIONS: COMPANY SNAPSHOT

TABLE 163 ADAMA AGRICULTURAL SOLUTIONS: NEW PRODUCT LAUNCHES

TABLE 164 ADAMA AGRICULTURAL SOLUTIONS: DEALS

TABLE 165 ADAMA AGRICULTURAL SOLUTIONS: OTHERS

13.1.5 MARRONE BIO INNOVATIONS

TABLE 166 MARRONE BIO INNOVATIONS: BUSINESS OVERVIEW

FIGURE 42 MARRONE BIO INNOVATIONS: COMPANY SNAPSHOT

TABLE 167 MARRONE BIO INNOVATIONS: DEALS

13.1.6 AMERICAN VANGUARD CORPORATION

TABLE 168 AMERICAN VANGUARD CORPORATION: BUSINESS OVERVIEW

FIGURE 43 AMERICAN VANGUARD CORPORATION: COMPANY SNAPSHOT

TABLE 169 AMERICAN VANGUARD CORPORATION: DEALS

13.1.7 DE SANGOSSE

TABLE 170 DE SANGOSSE: BUSINESS OVERVIEW

13.1.8 NEUDORFF GMBH

TABLE 171 NEUDORFF GMBH: BUSINESS OVERVIEW

13.1.9 DOFF PORTLAND

TABLE 172 DOFF PORTLAND: BUSINESS OVERVIEW

13.1.10 CERTIS EUROPE

TABLE 173 CERTIS EUROPE: BUSINESS OVERVIEW

13.1.11 SYNGENTA GROUP

TABLE 174 SYNGENTA GROUP: BUSINESS OVERVIEW

FIGURE 44 SYNGENTA GROUP: COMPANY SNAPSHOT

13.1.12 PI INDUSTRIES

TABLE 175 PI INDUSTRIES: BUSINESS OVERVIEW

FIGURE 45 PI INDUSTRIES: COMPANY SNAPSHOT

13.1.13 UPL LIMITED

TABLE 176 UPL LIMITED:BUSINESS OVERVIEW

FIGURE 46 UPL LIMITED: COMPANY SNAPSHOT

TABLE 177 UPL LIMITED: DEALS

13.1.14 LIPHATECH

TABLE 178 LIPHATECH: BUSINESS OVERVIEW

13.1.15 GRAZERS

TABLE 179 GRAZERS: BUSINESS OVERVIEW

13.2 OTHER PLAYERS

13.2.1 FARMCO AGRITRADING LTD

TABLE 180 FARMCO AGRITRADING LTD: BUSINESS OVERVIEW

13.2.2 MONTEREY LAWN & GARDEN

TABLE 181 MONTEREY LAWN & GARDEN: BUSINESS OVERVIEW

13.2.3 AGRO ADVANCED INTERNATIONAL LTD

TABLE 182 AGRO ADVANCED INTERNATIONAL LTD: BUSINESS OVERVIEW

13.2.4 WESTLAND HORTICULTURE LTD.

TABLE 183 WESTLAND HORTICULTURE LTD.: BUSINESS OVERVIEW

13.2.5 ANIMAL CONTROL TECHNOLOGIES LTD.

TABLE 184 ANIMAL CONTROL TECHNOLOGIES LTD.: BUSINESS OVERVIEW

13.2.6 QINGDAO AGRO-UNITEK CROPSCIENCE CO., LTD

TABLE 185 QINGDAO AGRO-UNITEK CROPSCIENCE CO., LTD.: BUSINESS OVERVIEW

13.2.7 IMPEX EUROPA S.L.

TABLE 186 IMPEX EUROPA S.L.: BUSINESS OVERVIEW

13.2.8 INDUSTRIALCHIMICA

TABLE 187 INDUSTRIALCHIMICA: BUSINESS OVERVIEW

13.2.9 GARDEN SAFE

TABLE 188 GARDEN SAFE: BUSINESS OVERVIEW

13.2.10 NUFARM

TABLE 189 NUFARM: BUSINESS OVERVIEW

FIGURE 47 NUFARM: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 195)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 RODENTICIDES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.4 RODENTICIDES MARKET, BY END USE

14.4.1 INTRODUCTION

TABLE 190 RODENTICIDES MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 191 RODENTICIDES MARKET SIZE, BY END USE, 2020–2026 (USD MILLION)

14.4.2 AGRICULTURAL FIELDS

TABLE 192 RODENTICIDES MARKET SIZE IN AGRICULTURAL FIELDS, BY REGION, 2016–2019 (USD MILLION)

TABLE 193 RODENTICIDES MARKET SIZE IN AGRICULTURAL FIELDS, BY REGION, 2020–2026 (USD MILLION)

14.4.3 WAREHOUSES

TABLE 194 RODENTICIDES MARKET SIZE IN WAREHOUSES, BY REGION, 2016–2019 (USD MILLION)

TABLE 195 RODENTICIDES MARKET SIZE IN WAREHOUSES, BY REGION, 2020–2026 (USD MILLION)

14.4.4 RESIDENTIAL

TABLE 196 RODENTICIDES MARKET SIZE IN RESIDENTIAL END USES, BY REGION, 2016–2019 (USD MILLION)

TABLE 197 RODENTICIDES MARKET SIZE IN RESIDENTIAL END USES, BY REGION, 2020–2026 (USD MILLION)

14.4.5 COMMERCIAL

TABLE 198 RODENTICIDES MARKET SIZE IN COMMERCIAL END USES, BY REGION, 2016–2019 (USD MILLION)

TABLE 199 RODENTICIDES MARKET SIZE IN COMMERCIAL END USES, BY REGION, 2020–2026 (USD MILLION)

14.5 RODENTICIDES MARKET, BY REGION

14.5.1 NORTH AMERICA

TABLE 200 NORTH AMERICA: RODENTICIDES MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 201 NORTH AMERICA: RODENTICIDES MARKET SIZE, BY END USE, 2020–2026 (USD MILLION)

14.5.2 EUROPE

TABLE 202 EUROPE: RODENTICIDES MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 203 EUROPE: RODENTICIDES MARKET SIZE, BY END USE, 2020–2026 (USD MILLION)

14.5.3 ASIA PACIFIC

TABLE 204 ASIA PACIFIC: RODENTICIDES MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 205 ASIA PACIFIC: RODENTICIDES MARKET SIZE, BY END USE, 2020–2026 (USD MILLION)

14.5.4 SOUTH AMERICA

TABLE 206 SOUTH AMERICA: RODENTICIDES MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 207 SOUTH AMERICA: RODENTICIDES MARKET SIZE, BY END USE, 2020–2026 (USD MILLION)

14.5.5 REST OF THE WORLD (ROW)

TABLE 208 REST OF THE WORLD: RODENTICIDES MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 209 REST OF THE WORLD: RODENTICIDES MARKET SIZE, BY END USE, 2020–2026 (USD MILLION)

14.6 INSECT PEST CONTROL MARKET

14.6.1 LIMITATIONS

14.6.2 MARKET DEFINITION

14.6.3 MARKET OVERVIEW

14.6.4 INSECT PEST CONTROL MARKET, BY INSECT TYPE

TABLE 210 INSECT PEST CONTROL MARKET SIZE, BY INSECT TYPE, 2015–2023 (USD MILLION)

14.6.4.1 Termites

TABLE 211 TERMITE PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.4.2 Cockroaches

TABLE 212 COCKROACH PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.4.3 Bedbugs

TABLE 213 BEDBUG PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.4.4 Mosquitoes

TABLE 214 MOSQUITO PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.4.5 Flies

TABLE 215 FLY PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.4.6 Ants

TABLE 216 ANT PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.4.7 Others

TABLE 217 OTHER INSECT PEST CONTROL MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

14.6.5 INSECT PEST CONTROL MARKET, BY REGION

14.6.5.1 North America

TABLE 218 NORTH AMERICA: INSECT PEST CONTROL MARKET SIZE, BY INSECT TYPE, 2015–2023 (USD MILLION)

TABLE 219 NORTH AMERICA: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2015–2023 (USD MILLION)

14.6.5.2 Europe

TABLE 220 EUROPE: INSECT PEST CONTROL MARKET SIZE, BY INSECT TYPE, 2015–2023 (USD MILLION)

TABLE 221 EUROPE: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2015–2023 (USD MILLION)

14.6.5.3 Asia Pacific

TABLE 222 ASIA PACIFIC: INSECT PEST CONTROL MARKET SIZE, BY INSECT TYPE, 2015–2023 (USD MILLION)

TABLE 223 ASIA PACIFIC: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2015–2023 (USD MILLION)

14.6.5.4 South America

TABLE 224 SOUTH AMERICA: INSECT PEST CONTROL MARKET SIZE, BY INSECT TYPE, 2015–2023 (USD MILLION)

TABLE 225 SOUTH AMERICA: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2015–2023 (USD MILLION)

14.6.5.5 Rest of the world (RoW)

TABLE 226 ROW: INSECT PEST CONTROL MARKET SIZE, BY INSECT TYPE, 2015–2023 (USD MILLION)

TABLE 227 ROW: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2015–2023 (USD MILLION)

15 APPENDIX (Page No. - 219)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

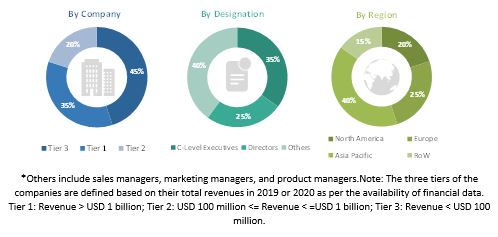

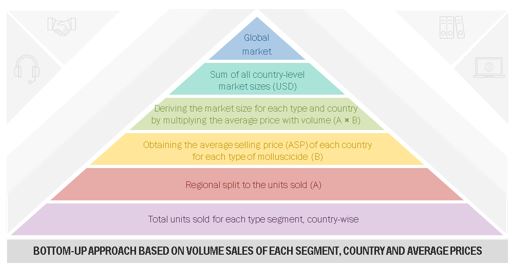

The study involves four major activities to estimate the current market size of the molluscicides market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of new chemicals and traps designed to exterminate or repel pests. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the molluscicides market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data.

Global Molluscicides Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the molluscicides market.

Report Objectives

- To define, segment, and project the global market size of the molluscicides market.

- To understand the molluscicides market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

1 Core competencies of companies include their key developments and strategies adopted by them to sustain their position in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe molluscicides market into Belgium, Portugal, Austria, Denmark, and Ireland

- Further breakdown of the Rest of Asia-Pacific molluscicides market into Thailand, Vietnam, and South Korea.

- Further breakdown of the Rest of RoW in molluscicides market into Middle East and Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molluscicides Market