Natural Food Colors & Flavors Market by Color Type (caramel, carotenoids, anthocyanins, curcumin, annatto, and copper chlorophyllin), Flavor Type (natural extracts, aroma chemicals, & essential oils), Application & Region - Global Forecast to 2025

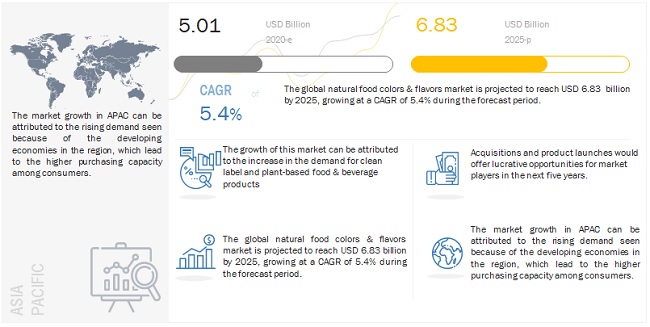

[257 Pages Report] According to MarketsandMarkets, the natural food colors & flavors ingredient market size is estimated to be valued at USD 5.0 billion in 2020 and projected to reach USD 6.8 billion by 2025, recording a CAGR of 5.4%. The growing demand for clean label products among the consumers is expected to drive the market. The European segment is poised to dominate the market due to its high population demanding natural ingredient infused food, whereas the South America region is projected to be the fastest-growing, owing to the larger demand of clean label and plant based food, among its millennial population.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Growth in the demand for natural and clean label products

The demand for food with natural ingredients and clean labels is increasing in almost all regions, owing to the increasing health awareness, increasing spending power of consumers, and increasing food adulteration instances. Hence, manufacturers are focusing on expanding their natural food & beverage portfolio.

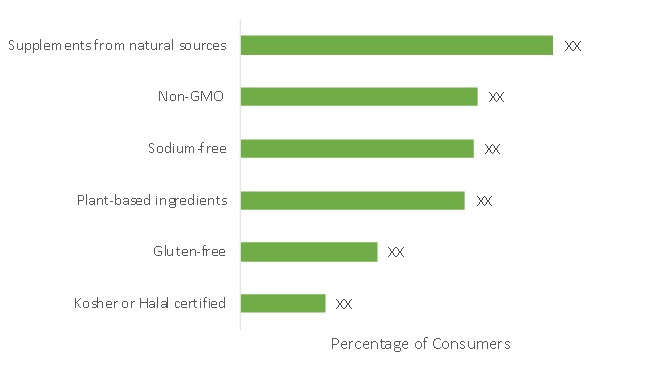

Clean-label products are organic, natural, non-GMO, and minimally processed consumer-friendly products. According to the Clean Label Alliance, it is observed that nearly 75% of the consumers are willing to pay high prices for clean-label products. Increasing health awareness among consumers drives the demand for natural and clean-label products, which, in turn, will drive the demand for natural food colors & flavors. Consumers are becoming inclined toward clean-label products, as they are becoming more aware of non-synthetic ingredients and their negative effects. This will drive them to adopt products and diets with clean-label ingredients.

Clean label is one of the most important features of packaged foods. Consumer awareness is strengthening the clean label trend, which, in turn, will prompt them to move away from synthetic ingredients and adopt plant-based and natural diets, further supporting the growth of the natural food colors & flavors ingredients market. Retailers are also addressing the growing demand for clean-label products from consumers by offering their private label brands. The recent outbreak of COVID-19 has led consumers to buy more ’clean label’ products, owing to their safe consumption and positive health benefits. This will promote the growth of the natural food colors & flavors industry.

To know about the assumptions considered for the study, download the pdf brochure

Restraints: High cost and limited raw material availability

Many natural food and flavor ingredients are sourced from crops. Limited availability of such raw materials is a key factor causing an increase in the prices of ingredients sourced from them. Farmers are adopting new practices such as precision farming to increase the production of crops to source ingredients. The availability of raw materials for natural food ingredients is subject to seasonal changes. Eastern Australia and the Midwestern US have observed a substantial decline in agricultural output due to extreme heat. Thus, limited raw material availability is projected to be one of the major factors for the rising prices of ingredients, restricting the market growth. However, there are certain countries, such as Russia that have huge untapped production potential.

Opportunities: Rise in the number of end-use applications

The rising number of end-use applications, owing to the multifunctional attributes of various natural ingredients, is projected to create opportunities for growth within the natural food colors & flavors market. The food processing industry mostly uses these colors and flavors in bakery & confectionery, convenience foods, dairy & frozen desserts, and meat products. Flavors and colors are also mostly used for bakery and beverage applications.

Challenges: Lack of consistency in regulations pertaining to various ingredients

The natural food colors & flavors industry faces a legal obligation to abide by the norms and standards of various regulatory standards. International bodies such as the National Food Safety and Quality Service (SENASA), Argentina; Canadian Food Inspection Agency (CFIA), Canada; Food and Drug Administration (FDA); World Health Organization (WHO); and Committee on the Environment; Public Health and Food Safety (EU) are associated with food safety and quality regulations. These organizations have control over the usage of different ingredients and chemicals, including bitterness, used in food processing, directly or indirectly.

The regulations set by different countries also emphasize the usage of natural food colors & flavors and the proper labeling of food products. These stringent regulations can delay or prevent the launch of new products, increase the prices of any new product/ingredient introduced in the market, and may lead to food recalls. Therefore, a lack of harmonization of new regulations and existing regulations can negatively affect the growth of the market. For instance, vanillin continues to be listed as GRAS, despite its ability to inhibit the liver enzyme, dopamine sulfotransferase, by 50%.

In the US, the Food and Drug Administration (FDA) is the key regulating body for food additives. It regulates the inclusion of ingredients in food & beverages. Such regulations have restricted the use and demand for different types of natural food colors & flavors. For instance, ingredients derived from genetically engineered plants must meet food safety requirements similar to ingredients derived from traditionally grown plants. New EU regulations were introduced in May 2018 related to primary food ingredient labeling. Such regulations are likely to hinder the growth of SMEs in the natural food colors & flavors market.

The lack of harmony in regulatory norms and labeling guidelines for the use of organic and natural food ingredients in different countries is also restraining market growth. For instance, Blue #1, Brilliant Blue, which is banned in France, is widely used in other European countries.

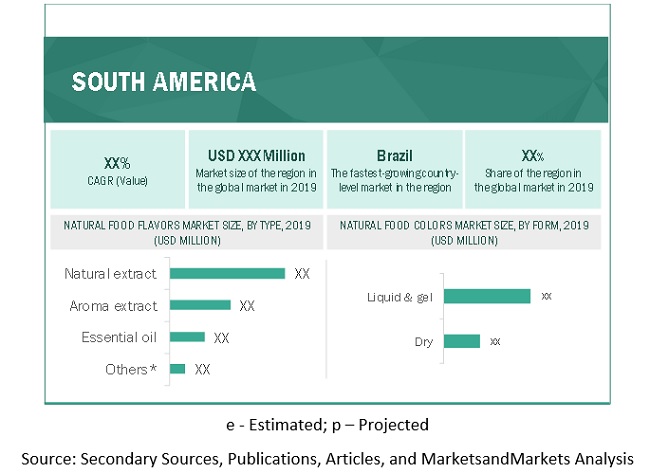

South America is projected to account for the fastest-growing market during the forecast period

Due to the high population in the region and the high purchasing capacity, consumers are looking for various comfort and functional food. The shift in the consumption habits of the population due to an increase in the awareness regarding healthy food and beverages is also increasing the demand for natural food colors & flavors ingredients. This has created the demand for natural food , natural colors & flavors,. The millennial population is increasing the demand for clean label food & beverages, which is again a driving factor for the natural food colors & flavors market.

Key Market Players:

DuPont (US), Archer Daniels Midland (ADM) (US), Givaudan (Switzerland), Kerry Group, Plc (Ireland), International Flavors & Fragrances (IFF) (Israel), Mane (France), Sensient (US), T. Hasegawa (Japan), Firmenich (Switzerland), Robertet (France), Symrise (Germany), Synergy Flavors (US), Amar Bio-Organics India Pvt. Ltd. (India), Taiyo International (Japan), The Foodie Flavors Ltd (UK), Besmoke Ltd (UK), Aromata Group (Italy), Gulf Flavors and Food Ingredients FZCO (UAE), Seluz Fragrances & Flavors Company (Turkey), and Takasago (Japan).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) |

|

Markets Covered |

|

|

Regions covered |

|

|

Companies studied |

|

This research report categorizes the natural food colors & flavors market based on type and region.

Type

- Colors

- Caramel

- Carotenoids

- Anthocyanin

- Curcumin

- Copper Chlorophyllin

- Annatto

- Curcumin

- Others* (lutein, betanin, spirulina, chlorophyll, canthaxanthin, and gardenia.)

- Flavors

- Natural extracts

- Aroma extracts

- Essential oils

- Others* (spices & microorganisms)

Form

- Liquid & gel

- Dry

Application

-

Flavor

- Food

- Beverage

-

Flavor

-

Food

- Dairy & dairy products

- Confectionary

- Bakery products

- Meat products

- Savory & snacks

- Frozen products

- Others (breakfast cereals, fruit & vegetable extracts, soups, condiments & spices, dressings, and sauces.

- Beverage

-

Food

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- March 2020, IFF (Israel) entered into a collaboration with Evolva (Switzerland), a biotech company, to further develop and expand the commercialization of vanillin. Under the terms of this agreement, IFF would be responsible for the commercialization of the vanillin product that Evolva developed. This collaboration would extensively improve the reach of Evolva developed products and provide newly developed products in the product portfolio of IFF.

- Mar 2020, Mane (France) MANE Kancor, a global pioneer in spice extracts, announced an investment of USD 21 million in the next couple of months for the expansion of existing manufacturing facilities in Kerala, Karnataka, and Uttar Pradesh, India.

- Dec 2019, Givaudan (Switzerland) completed the acquisition of Ungerer (US) to strengthen its natural ingredients capabilities and leadership in the fast-growing local and regional customer segments.

- June 2019, Kerry Group (Ireland) opened its production facility in India as an investment in the expansion of taste and nutrition profiles.

- March 2019, Archer Daniels Midland (US) recently announced an agreement to acquire the Ziegler Group (Germany), a leading European provider of natural citrus ingredients. Ziegler offered its citrus flavors and produced citrus oils, extracts, and concentrates. This acquisition would benefit ADM in finding a strong footing in the citrus flavoring market.

Frequently Asked Questions (FAQ):

Does the report covers the market size and estimations for the alcoholic and non alcoholic beverage market for natural food colors & flavors?

The report has overall beverage number at regional and country level. However, the further analysis of alcoholic and non alcoholic can be provided. Please let us know your geography/application preferences.

Does the scope covers nature-identical colors & flavors?

No. Only plant based natural colors & flavor are included in the study. Further analysis of natural like flavors can also be provided. Please let us know your geography/application preferences.

Is it possible to provide the source segmentation and analysis of natural colors & flavors market?

Yes, further source segmentation is possible for functional food market. It can be categorized as:

- Plant based

- Animal Based

We are looking for quantification at each stage in the supply chain. Can this be provided?

The report covers value chain analysis and supply chain analysis at global levels. Further drill down at regional level can be provided for required products.

What level of coverage is covered for the market size in each application by type?

The report covers market size for applications at regional level. The further criss cross for types can be provided.

Can you provide estimation for countries of Middle Eastern region?

We can provide additional country wise estimation for different regions, such as: Egypt, Sudan, Turkey, Jordan, Oman, and Saudi Arabia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

FIGURE 1 NATURAL FOOD COLORS & FLAVORS MARKET: MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2015–2019

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 NATURAL FOOD COLORS & FLAVORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 9 NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 NATURAL FOOD COLORS & FLAVORS MARKET SHARE (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 BRIEF OVERVIEW OF THE NATURAL FOOD COLORS & FLAVORS MARKET

FIGURE 12 GROWING DEMAND FOR CLEAN LABEL IS PROJECTED TO DRIVE THE GROWTH OF THE NATURAL FOOD COLORS & FLAVORS MARKET

4.2 NATURAL FOOD COLORS & FLAVORS: MAJOR REGIONAL SUBMARKETS

FIGURE 13 US HELD THE LARGEST SHARE GLOBALLY FOR NATURAL FOOD COLORS & FLAVORS IN 2019

4.3 EUROPE: NATURAL FOOD COLORS & FLAVORS MARKET, BY APPLICATION AND KEY COUNTRY

FIGURE 14 GERMANY ACCOUNTED FOR THE LARGEST SHARE IN THE EUROPEAN MARKET IN 2019

4.4 NATURAL FOOD COLORS & FLAVORS MARKET, BY REGION

FIGURE 15 EUROPE IS PROJECTED TO DOMINATE THE NATURAL FOOD COLORS & FLAVORS MARKET, 2020 VS. 2025

4.5 NATURAL FOOD COLORS MARKET, BY FORM

FIGURE 16 LIQUID & GEL FORM IS PROJECTED TO DOMINATE THE NATURAL FOOD COLORS MARKET, 2020 VS. 2025

4.6 NATURAL FOOD FLAVORS MARKET, BY FORM

FIGURE 17 LIQUID & GEL FORM IS PROJECTED TO DOMINATE THE NATURAL FOOD FLAVORS MARKET, 2020 VS. 2025

4.7 NATURAL FOOD COLORS MARKET, BY TYPE

FIGURE 18 CARAMEL IS PROJECTED TO DOMINATE THE NATURAL FOOD COLORS MARKET, 2020 VS. 2025

4.8 NATURAL FOOD FLAVORS MARKET, BY TYPE

FIGURE 19 NATURAL EXTRACTS PROJECTED TO DOMINATE THE NATURAL FOOD FLAVORS MARKET, 2020 VS. 2025

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 NATURAL FOOD COLORS & FLAVORS: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in the demand for natural and clean label products

FIGURE 21 US: CONSUMER PREFERENCE FOR CLEAN-LABEL PRODUCTS AND INGREDIENTS, 2015

5.2.1.2 High demand for natural food ingredients owing to the rising instances of chronic diseases

FIGURE 22 PERCENTAGE OF THE US POPULATION WITH MULTIPLE CHRONIC ILLNESSES, 2017

FIGURE 23 CHRONIC DISEASES WERE AMONG THE TOP TEN CAUSES OF DEATH WORLDWIDE ACROSS ALL AGES, 2016

5.2.1.3 Shift in consumer preferences for food & beverages

FIGURE 24 US: CONSUMER CHECKS FOR LABEL AND NUTRITIONAL INFORMATION PANEL (NIP) OF FOOD PRODUCTS (% OF CONSUMERS), 2019

5.2.1.4 Health benefits of certain natural colors

TABLE 2 NATURAL COLORING AGENTS AND THEIR HEALTH BENEFITS

5.2.1.5 Rising inclination toward premium and branded products

5.2.2 RESTRAINTS

5.2.2.1 High cost and limited raw material availability

5.2.2.2 Low stability of natural colors

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in the number of end-use applications

5.2.3.2 Increasing ventures in Asia Pacific and South America

5.2.3.3 Multifunctional flavors and colors

5.2.3.4 Rapidly growing sales of beverages and functional drinks

FIGURE 25 US: IMPORT OF BEVERAGE PRODUCTS, 2009–2017 (USD MILLION)

5.2.3.5 Product-based and technological innovations in the ingredient industry

5.2.3.6 Emerging economies to present high-growth opportunities due to growing food processing investments

FIGURE 26 ANNUAL GDP GROWTH OF EMERGING ECONOMIES, 2011–2018

FIGURE 27 INDIA: CONTRIBUTION OF THE FOOD PROCESSING INDUSTRY TO GDP THROUGH MANUFACTURING, 2016

5.2.4 CHALLENGES

5.2.4.1 Lack of consistency in regulations pertaining to various ingredients

5.3 IMPACT OF COVID-19 ON THE MARKET DYNAMICS

5.3.1 COVID-19 BOOSTS THE DEMAND FOR HIGH-QUALITY AND PREMIUM PRODUCTS

5.3.2 COVID-19 TO REFORMULATE THE DEMAND FOR FOOD TO LOWER COSTS

5.3.3 COVID-19 IMPACT ON RAW MATERIAL AVAILABILITY AND SUPPLY CHAIN DISRUPTION

5.3.4 COVID-19 TO SHIFT THE DEMAND TOWARD PLANT-SOURCED INGREDIENTS

6 INDUSTRY TRENDS (Page No. - 76)

6.1 INDUSTRY INSIGHTS

TABLE 3 NATURAL SOURCE OF RAW MATERIALS USED IN FLAVORING COMPOUNDS

TABLE 4 CLASSIFICATION OF NATURAL FLAVORS

6.2 VALUE CHAIN ANALYSIS

FIGURE 28 NATURAL FOOD COLORS & FLAVORS MARKET: VALUE CHAIN ANALYSIS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN ANALYSIS

6.3.1 PROMINENT COMPANIES

6.3.2 SMALL & MEDIUM ENTERPRISES

6.3.3 END USERS (MANUFACTURERS/CONSUMERS)

6.3.4 KEY INFLUENCERS

6.4 TECHNOLOGY ANALYSIS

TABLE 5 NATURAL FOOD COLORS & FLAVORS MARKET: TECHNOLOGY ANALYSIS

6.5 EXPORT-IMPORT DATA FOR NATURAL FOOD COLORS & FLAVORS

FIGURE 30 IMPORT VALUE OF COLORS IN INDIA, 2013-2016 (USD)

FIGURE 31 IMPORT VALUE OF FLAVORS IN INDIA, 2013-2016 (USD)

TABLE 6 EXPORTING COUNTRIES: NATURAL FLAVORS 2015-2019 (USD THOUSAND)

TABLE 7 IMPORTING COUNTRIES: NATURAL FLAVORS 2015-2019 (USD THOUSAND)

6.6 ASP TREND

FIGURE 32 ASP OF NATURAL FOOD COLORS, BY COUNTRY, 2018 (USD/KG)

FIGURE 33 ASP OF NATURAL FOOD COLORS, BY TYPE, 2018 (USD/KG)

6.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

6.7.1 INTENSITY OF COMPETITIVE RIVALRY

6.7.1.1 Market concentration

6.7.1.2 Low entry/exit barriers

6.7.1.3 Large number of mergers & acquisitions

6.7.1.4 Availability of technologies with new entrants

6.7.2 BARGAINING POWER OF SUPPLIERS

6.7.2.1 Availability of raw materials

6.7.2.2 Supplier concentration & confidence

6.7.2.3 High government intervention in some regions

6.7.3 BARGAINING POWER OF BUYERS

6.7.3.1 Increasing health concerns among consumers

6.7.3.2 Price sensitivity

6.7.3.3 Low switching cost

6.7.4 THREAT OF NEW ENTRANTS

6.7.4.1 Focus on technology innovation

6.7.4.2 Low entry barriers

6.7.5 THREAT OF SUBSTITUTES

6.7.5.1 Artificial colors & flavors are harmful to health

6.7.5.2 Availability of substitute products

6.7.5.3 Increasing price of substitutes

6.8 CASE STUDIES

6.8.1 TECHNOLOGICAL ADVANCEMENT

6.8.1.1 Allergen sensor for consumers

6.8.2 TRENDS IN THE FOOD INDUSTRY

6.8.2.1 Sensory experience to remain a key priority for consumers

6.8.3 INORGANIC GROWTH ATTEMPTS

6.8.3.1 M&A to remain a key inorganic strategy for market growth

6.9 ECOSYSTEM MAP

6.9.1 FLAVORS, COLORS, AND FRAGRANCES: ECOSYSTEM VIEW

6.9.2 FLAVORS, COLORS, AND FRAGRANCES: MARKET MAP

7 REGULATIONS (Page No. - 93)

7.1 INTRODUCTION

7.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

7.2.1 INTERNATIONAL ORGANIZATION OF FLAVOR INDUSTRY (IOFI)

7.2.1.1 International Flavor Legislation

7.2.1.2 US Department of Health and Human Services

7.2.1.3 Flavor Extract Manufacturers Association

7.3 NORTH AMERICA

7.3.1 US REGULATIONS

7.3.1.1 US Department of Agriculture

7.3.1.2 FFDCA Section 201(s) Limitations

7.3.2 CANADA

7.3.2.1 Canadian food and drugs law

7.3.2.2 Canadian Food Inspection Agency (CFIA)

7.3.3 MEXICO

7.3.3.1 Mexican food regulations

7.4 SOUTH AMERICA

7.4.1 BRAZIL

7.4.1.1 Brazilian Health Regulatory Agency (ANVISA)

7.4.2 SECTION II) FOOD ADDITIVE REGULATIONS

7.4.2.1 Brazilian food and regulations and standards

7.4.3 REGULATORY BODIES IN BRAZIL

7.4.4 ARGENTINA

7.4.4.1 The Argentina food safety act

7.4.5 REST OF SOUTH AMERICA

7.5 EUROPE

7.5.1 NATURAL FLAVORS ARE DEFINED IN THE EU IN REGULATION (EC) 1334/2008

7.5.2 FOOD AND AGRICULTURAL IMPORT REGULATIONS AND STANDARDS (BERLIN, GERMANY)

7.5.3 UK REGULATION

7.5.3.1 In regulation 2(1)

7.5.4 FRANCE

7.5.4.1 Food and Agriculture Imports Regulations and Standards

7.5.5 ADDITIVES MUST BE MENTIONED ON THE FOOD LABEL

7.5.6 ITALY

7.5.7 EU REGULATIONS

7.6 ASIA PACIFIC

7.6.1 CHINA

7.6.1.1 In the following cases, food additives can be introduced into foods through ingredients (including food additives)

7.6.2 INDIA

7.6.3 JAPAN

7.6.3.1 Japan Flavor and Fragrance Materials Association (JFFMA)

7.6.3.2 Japanese Ministry of Health, Labour and Welfare

7.6.3.3 Japan Food Chemical Research Foundation (JFCRF)

7.6.4 KOREA

7.6.4.1 Ministry of food and drug safety (MFDS)

7.6.5 AUSTRALIA & NEW ZEALAND

7.6.5.1 Australia New Zealand Food Standards Code - Standard 1.3.1 - Food Additives

7.7 REST OF THE WORLD

7.7.1 SOUTH AFRICA

7.7.1.1 South African Association of the Flavor & Fragrance industry (SAAFI)

7.7.2 MIDDLE EAST

7.7.2.1 Food, agricultural, and water import regulations and standards - Dubai, United Arab Emirates

7.7.2.2 Codex Alimentarius

8 PATENT ANALYSIS (Page No. - 106)

8.1 OVERVIEW

FIGURE 35 PATENT ANALYSIS: FOOD FLAVORS MARKET, BY REGION, 2015–2020

FIGURE 36 PATENT ANALYSIS: FOOD COLORS MARKET, BY REGION, 2015–2020

TABLE 8 KEY PATENTS GRANTED WITH RESPECT TO FOOD FLAVORS

9 NATURAL FOOD COLORS & FLAVORS MARKET, BY CATEGORY (Page No. - 111)

9.1 INTRODUCTION

FIGURE 37 NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2020 VS. 2025 (USD MILLION)

TABLE 9 NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE NATURAL FOOD COLORS AND FLAVORS MARKET, BY REGION, 2018-2021 (USD MILLION)

9.1.1.1 Realistic scenario

TABLE 10 REALISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

9.1.1.2 Optimistic scenario

TABLE 11 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 12 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

9.2 NATURAL FOOD COLORS

9.2.1 COLORING FOOD HAS BEEN MAJOR TREND IN NATURAL COLORS MARKET

TABLE 13 NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 14 NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (KT)

9.3 NATURAL FOOD FLAVORS

9.3.1 EXTRACT FROM FLOWERS AND FRUITS IS KEY TREND IN THE NATURAL FLAVORS MARKET

TABLE 15 NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10 NATURAL FOOD COLORS MARKET, BY TYPE (Page No. - 117)

10.1 INTRODUCTION

FIGURE 38 NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 16 NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

10.2 CARAMEL

10.2.1 BEER, GRAVY PREMIX, SAUCES, AND CONFECTIONARIES ARE KEY APPLICATIONS OF THE CARAMEL COLOR

TABLE 17 CARAMEL: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.3 CAROTENOIDS

10.3.1 HEALTH BENEFITS ASSOCIATED WITH COLORING IS DRIVING CAROTENOIDS MARKETS

TABLE 18 CAROTENOIDS: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.4 ANTHOCYANINS

10.4.1 COLORFUL CONFECTIONARIES IS A KEY TREND FOR ANTHOCYANINS

TABLE 19 ANTHOCYANINS: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.5 CURCUMIN

10.5.1 CURCUMIN IS WIDELY USED AS SUBSTITUTE FOR SYNTHETIC YELLOW COLOR

TABLE 20 CURCUMIN: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.6 COPPER CHLOROPHYLLIN

10.6.1 DE-ESTERIFICATION OF CHLOROPHYLL IS CARRIED OUT TO FORM COPPER CHLOROPHYLLIN

TABLE 21 COPPER CHLOROPHYLLIN: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.7 ANNATTO

10.7.1 ANNATTO IS RICH SOURCE OF MINERALS

TABLE 22 ANNATTO: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.8 CAPSANTHIN

10.8.1 CAPSANTHIN OFFERS FLAVORS AND COLOR BENEFITS TO FOOD PRODUCTS

TABLE 23 CAPSANTHIN: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

10.9 OTHERS

10.9.1 LUTEIN AND BETAIN ARE KEY OTHER COLOR TYPES

TABLE 24 OTHERS: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11 NATURAL FOOD FLAVORS MARKET, BY TYPE (Page No. - 127)

11.1 INTRODUCTION

FIGURE 39 NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 25 NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

11.2 NATURAL EXTRACTS

11.2.1 FRESH FRUITS AND FLOWERS IS MAJOR SOURCE FOR FLAVOR EXTRACTS

TABLE 26 NATURAL EXTRACTS: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.3 AROMA CHEMICALS

11.3.1 AROMA CHEMICALS ARE LARGELY USED IN FLAVOR BLEND MANUFACTURING

TABLE 27 AROMA CHEMICALS: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.4 ESSENTIAL OIL

11.4.1 DISTILLATION IS A KEY TECHNOLOGY USED IN ESSENTIAL OIL MANUFACTURING

TABLE 28 ESSENTIAL OILS: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.5 OTHERS

11.5.1 SPICES AND MICRO-ORGANISMS ARE MAJOR OTHER TYPES OF NATURAL FLAVORS

TABLE 29 OTHERS: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

12 NATURAL FOOD COLORS MARKET, BY APPLICATION (Page No. - 133)

12.1 INTRODUCTION

FIGURE 40 NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 30 NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

12.2 FOOD

12.2.1 BAKERY AND CONFECTIONARY IS AMONG KEY FOOD APPLICATIONS OF FOOD COLOR TO ENHANCE PRODUCT APPEAL

TABLE 31 FOOD: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

12.2.2 BAKERY & CONFECTIONERY PRODUCTS

12.2.3 DAIRY PRODUCTS

12.2.4 MEAT, POULTRY & SEAFOOD

12.2.5 FROZEN PRODUCTS

12.2.6 OTHERS

12.3 BEVERAGES

12.3.1 FORTIFIED BEVERAGES ARE FUELING MARKET GROWTH, WITH RISING HEALTH AWARENESS AMONG CONSUMERS

TABLE 32 BEVERAGES: NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

13 NATURAL FOOD FLAVORS MARKET, BY APPLICATION (Page No. - 138)

13.1 INTRODUCTION

FIGURE 41 NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 33 NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

13.2 FOOD

13.2.1 GROWING INNOVATIONS IN FOOD INDUSTRY TO FUEL ADOPTION OF NATURAL FLAVORS AT LARGE EXTENT

TABLE 34 FOOD: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 35 FOOD: NATURAL FOOD FLAVORS MARKET SIZE, BY SUB-APPLICATION, 2018-2025 (USD MILLION)

13.2.2 DAIRY & DAIRY PRODUCTS

13.2.2.1 Ice creams

13.2.2.2 Other dairy products

13.2.3 CONFECTIONERY PRODUCTS

13.2.3.1 Chocolates

13.2.3.2 Other confectionery products

13.2.4 BAKERY PRODUCTS

13.2.5 MEAT PRODUCTS

13.2.6 SAVORIES & SNACKS

13.2.7 FROZEN PRODUCTS

13.2.8 OTHER FOOD APPLICATIONS

13.3 BEVERAGES

13.3.1 NATURAL FLAVORS ACCOUNT FOR SIGNIFICANT MARKET SIZE IN THE JUICES SEGMENT

TABLE 36 BEVERAGES: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

13.3.2 HOT DRINKS

13.3.3 SOFT DRINKS

13.3.4 ALCOHOLIC DRINKS

13.3.5 OTHER DRINKS

14 NATURAL FOOD COLORS & FLAVORS MARKET, BY FORM (Page No. - 145)

14.1 INTRODUCTION

FIGURE 42 NATURAL FOOD COLORS MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

FIGURE 43 NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

TABLE 37 NATURAL FOOD COLORS MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 38 NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

14.2 LIQUID & GEL

14.2.1 ENCAPSULATION IS A MAJOR TREND DRIVING THE LIQUID SEGMENT IN MARKET

TABLE 39 LIQUID & GEL: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

14.3 DRY

14.3.1 INCREASING DEMAND FOR DRY MIX FOR FOOD & BEVERAGES DRIVES THE GROWTH OF THE DRY FORM IN THE MARKET

TABLE 40 DRY: NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

15 NATURAL FOOD COLORS & FLAVORS MARKET, BY REGION (Page No. - 150)

15.1 INTRODUCTION

FIGURE 44 AUSTRALIA & NEW ZEALAND TO GROW AT THE HIGHEST CAGR IN THE NATURAL FOOD COLORS & FLAVORS MARKET

TABLE 41 NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15.1.1 COVID-19 IMPACT ON THE NATURAL FOOD COLORS & FLAVORS MARKET, BY REGION

15.1.1.1 Realistic Scenario

TABLE 42 REALISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 43 REALISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

15.1.1.2 Optimistic Scenario

TABLE 44 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 45 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

15.1.1.3 Pessimistic Scenario

TABLE 46 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD FLAVORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 47 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE NATURAL FOOD COLORS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

15.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: NATURAL FOOD COLORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

15.2.1 US

15.2.1.1 Established players in the market are focusing on developing natural food colors & flavors

TABLE 57 US: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 US: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.2.2 CANADA

15.2.2.1 Consumer concerns regarding health are leading to a rise in demand for natural-based products

TABLE 59 CANADA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 CANADA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.2.3 MEXICO

15.2.3.1 Increase in the export of agricultural commodities is driving the market for natural food colors & flavors

TABLE 61 MEXICO: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 62 MEXICO: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.3 EUROPE

FIGURE 46 EUROPE: MARKET SNAPSHOT

TABLE 63 EUROPE: NATURAL FOOD COLORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: NATURAL FOOD FLAVORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: NATURAL FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 EUROPE: NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

15.3.1 UK

15.3.1.1 High focus on innovation of natural and organic flavors & colors to cater to the increasing vegan population in the UK

TABLE 72 UK: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 73 UK: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.3.2 GERMANY

15.3.2.1 Presence of various food processing industry and strong retail channels in Germany

TABLE 74 GERMANY: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 75 GERMANY: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.3.3 FRANCE

15.3.3.1 The use of exotic flavors in the production of bakery items and wine in France

TABLE 76 FRANCE: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 77 FRANCE: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.3.4 ITALY

15.3.4.1 The demand for flavored cocktails and spirits to drive the market in Italy

TABLE 78 ITALY: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 79 ITALY: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.3.5 SPAIN

15.3.5.1 Spain faces increased demand for flavored and colored varieties of non-alcoholic beverages

TABLE 80 SPAIN: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION,2018-2025 (USD MILLION)

TABLE 81 SPAIN: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.3.6 NETHERLANDS

15.3.6.1 The presence of a wide number of breweries utilizing various flavors and colors of the Netherlands

TABLE 82 NETHERLANDS: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 83 NETHERLANDS: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.3.7 REST OF EUROPE

15.3.7.1 Growing consumption of canned food to drive the market in Rest of Europe

TABLE 84 REST OF EUROPE: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 85 REST OF EUROPE: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 86 ASIA PACIFIC: NATURAL FOOD COLORS & FLAVORS MARKET SIZE,BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: NATURAL FOOD COLORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 88 ASIA PACIFIC: NATURAL FOOD FLAVORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

TABLE 90 ASIA PACIFIC: NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 ASIA PACIFIC: NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 ASIA PACIFIC: NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE,2018–2025 (USD MILLION)

TABLE 94 ASIA PACIFIC: NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

15.4.1 CHINA

15.4.1.1 Higher international trade of the food products is fueling demand in the country

TABLE 95 CHINA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 96 CHINA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.4.2 INDIA

15.4.2.1 The growing investments and government support in food processing project offers opportunity

TABLE 97 INDIA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 98 INDIA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.4.3 JAPAN

15.4.3.1 Favorable regulatory environment to offer support for advancement of the market growth

TABLE 99 JAPAN: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 100 JAPAN: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.4.4 SOUTH KOREA

15.4.4.1 Rise in demand for healthy, natural, and organic food in South Korea

TABLE 101 SOUTH KOREA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 102 SOUTH KOREA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.4.5 AUSTRALIA & NEW ZEALAND

15.4.5.1 Increasing demand for fortification to offer opportunities to launch advanced flavors & colors in the countries

TABLE 103 AUSTRALIA & NEW ZEALAND: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 104 AUSTRALIA & NEW ZEALAND: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.4.6 REST OF ASIA PACIFIC

15.4.6.1 Rising living standard is key factor for market boost in the region

TABLE 105 REST OF ASIA PACIFIC: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018-2025 (USD MILLION)

15.5 SOUTH AMERICA

FIGURE 48 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 107 SOUTH AMERICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY COUNTRY, 2018–2025(USD MILLION)

TABLE 108 SOUTH AMERICA: NATURAL FOOD COLORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 109 SOUTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 110 SOUTH AMERICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE,BY CATEGORY, 2018–2025 (USD MILLION)

TABLE 111 SOUTH AMERICA: NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 112 SOUTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 113 SOUTH AMERICA: NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 SOUTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 115 SOUTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

15.5.1 BRAZIL

15.5.1.1 Growing demand for processed food and soft drinks driving the market in Brazil

TABLE 116 BRAZIL: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 117 BRAZIL: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.5.2 ARGENTINA

15.5.2.1 Growing investments and increasing government funding to fuel the demand for natural colors & flavors in the country

TABLE 118 ARGENTINA: FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 119 ARGENTINA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.5.3 REST OF SOUTH AMERICA

15.5.3.1 The demand for ethnic flavors and plant-based formulation in Rest of South America

TABLE 120 REST OF SOUTH AMERICA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 121 REST OF SOUTH AMERICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.6 REST OF THE WORLD (ROW)

TABLE 122 ROW: NATURAL FOOD COLORS MARKET SIZE, BY COUNTRY/REGION,2018–2025 (USD MILLION)

TABLE 123 ROW: NATURAL FOOD FLAVORS MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 124 ROW: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

TABLE 125 ROW: NATURAL FOOD COLORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 126 ROW: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 127 ROW: NATURAL FOOD COLORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 ROW: NATURAL FOOD FLAVORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 129 ROW: NATURAL FOOD FLAVORS MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

15.6.1 SOUTH AFRICA

15.6.1.1 Increase in the food processing opportunities witnessed in the country

TABLE 130 SOUTH AFRICA: NATURAL FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 131 SOUTH AFRICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.6.2 MIDDLE EAST

15.6.2.1 The dessert and savory flavors drive the demand for flavors in the Middle East

TABLE 132 MIDDLE EAST: FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 133 MIDDLE EAST: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

15.6.3 REST OF AFRICA

15.6.3.1 Increasing government support for international trade to boost demand in the region

TABLE 134 REST OF AFRICA: FOOD FLAVORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 135 REST OF AFRICA: NATURAL FOOD COLORS & FLAVORS MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 201)

16.1 INTRODUCTION

16.2 MARKET EVALUATION FRAMEWORK

FIGURE 49 MARKET EVALUATION FRAMEWORK, 2017–2020

16.3 REVENUE ANALYSIS OF KEY PLAYERS, 2017-2019

FIGURE 50 REVENUE ANALYSIS OF KEY PLAYERS IN NATURAL FOOD COLORS MARKET, 2017-2019 (USD MILLION)

FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS IN NATURAL FOOD FLAVORS MARKET, 2017-2019 (USD MILLION)

16.4 MARKET SHARE OF KEY PLAYERS, 2019

FIGURE 52 SENSIENT LED THE NATURAL FOOD COLORS MARKET IN 2019

FIGURE 53 IFF LED THE NATURAL FOOD FLAVORS MARKET IN 2019

16.5 COVID-19-SPECIFIC COMPANY RESPONSE

16.6 KEY MARKET DEVELOPMENTS

16.6.1 EXPANSIONS

TABLE 136 EXPANSIONS, 2017–2020

16.6.2 MERGER & ACQUISITIONS

TABLE 137 ACQUISITIONS, 2017-2019

16.6.3 JOINT VENTURES, AGREEMENTS, AND PARTNERSHIPS

TABLE 138 JOINT VENTURES, COLLABORATIONS, AND PARTNERSHIPS, 2019

17 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 208)

17.1 OVERVIEW

17.2 COMPANY EVALUATION MATRIX: DEFINITIONS & METHODOLOGY

17.2.1 STARS

17.2.2 EMERGING LEADERS

17.2.3 PERVASIVE PLAYERS

17.2.4 PARTICIPANTS

17.3 COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

FIGURE 54 GLOBAL NATURAL FOOD COLORS & FLAVORS MARKET: COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

17.4 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

17.4.1 DUPONT

FIGURE 55 DUPONT: COMPANY SNAPSHOT

17.4.2 ARCHER DANIELS MIDLAND (ADM)

FIGURE 56 ARCHER DANIELS MIDLAND (ADM): COMPANY SNAPSHOT

17.4.3 GIVAUDAN

FIGURE 57 GIVAUDAN: COMPANY SNAPSHOT

17.4.4 KERRY GROUP

FIGURE 58 KERRY GROUP: COMPANY SNAPSHOT

17.4.5 INTERNATIONAL FLAVORS AND FRAGRANCES (IFF)

FIGURE 59 INTERNATIONAL FLAVORS AND FRAGRANCES (IFF): COMPANY SNAPSHOT

17.4.6 MANE

FIGURE 60 MANE: COMPANY SNAPSHOT

17.4.7 SENSIENT

FIGURE 61 SENSIENT: COMPANY SNAPSHOT

17.4.8 T. HASEGAWA

FIGURE 62 T. HASEGAWA: COMPANY SNAPSHOT

17.4.9 FIRMENICH

17.4.10 ROBERTET

FIGURE 63 ROBERTET: COMPANY SNAPSHOT

17.5 COMPETITIVE LEADERSHIP MAPPING (START-UP/SME)

17.5.1 PROGRESSIVE COMPANIES

17.5.2 STARTING BLOCKS

17.5.3 RESPONSIVE COMPANIES

17.5.4 DYNAMIC COMPANIES

FIGURE 64 NATURAL FOOD COLORS & FLAVORS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUP/SME PLAYERS, 2019

17.6 STARTUPS/SME PROFILES

17.6.1 SYMRISE

FIGURE 65 SYMRISE: COMPANY SNAPSHOT

17.6.2 SYNERGY FLAVORS

17.6.3 AMAR BIO-ORGANICS

17.6.4 TAIYO INTERNATIONAL

17.6.5 THE FOODIE FLAVORS

17.6.6 BESMOKE LIMITED

17.6.7 AROMATA GROUP

17.6.8 GULF FLAVORS & FOOD INGREDIENTS FZCO

17.6.9 SELUZ FRAGRANCE & FLAVOR COMPANY

17.6.10 TAKASAGO

FIGURE 66 TAKASAGO: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 247)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATION

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

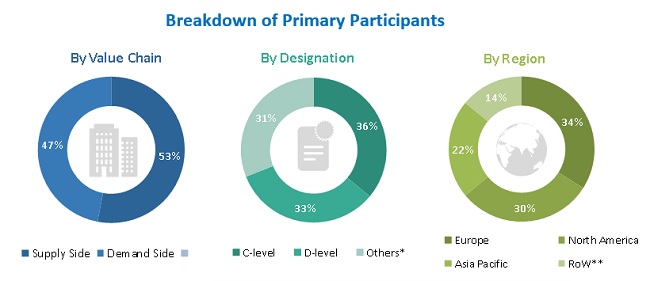

The study involved four major activities in estimating the natural food colors & flavors market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of enzyme manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the natural food colors & flavors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

Approach 1

- The key players in the industry and the markets were identified through extensive secondary research.

- The revenues of major natural food colors and flavors players were determined through primary and secondary research such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players for each ingredient type from all regions, we arrived at the final market size of the natural food colors & flavors market.

-

For distribution channel calculations, we analyzed revenue generated and market share by region for key distribution companies of the food ingredients.

- Based on this, we arrived at global and regional market share for ingredients by distribution vs direct from manufacturers.

- Further this split was validated with primary interviews and insights on each ingredient were gathered.

Approach 2

- The demand for each ingredient type in each application was analyzed by region, and other factors such as the production of food & beverage, pricing trends, the adoption rate, patents registered, and organic & inorganic growth attempts was derived from various secondary sources, such as publications by companies, industry publications, trade data providers, and paid databases.

- Demand analysis was conducted for each type by application and region.

- Pricing analysis was conducted on the basis of the cost of each type in the key regions.

- From this, we derived the market sizes for each region.

- Summing up the above, we arrived at the market size of the global natural food colors & flavors market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the natural food colors & flavors market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

Market Intelligence

- Determining and projecting the size of the natural food colors and flavors market, with respect to type, application, distribution channel, and regional markets, over a five-year period ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

-

Competitive Intelligence

- Identifying and profiling the key market players in the natural food colors & flavors market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Products offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

- Providing insights into key product innovations and investments in the natural food colors & flavors market

Target Audience:

- Raw material suppliers

- Natural food colors & flavors manufacturers and suppliers

- Food safety agencies

- Food & beverage manufacturers/suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Importers and exporters of natural food colors & flavors

- Food & beverage traders, distributors, and suppliers

- Government organizations, research organizations, consulting firms, trade associations, and industry bodies

- Associations, regulatory bodies, and other industry-related bodies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Segmental Analysis

- A further breakdown of other types of natural food flavors & colors at the regional or country level

- Further criss-cross of type by application for natural food flavors & colors

Geographic analysis

- A further breakdown of the Rest of Asia Pacific natural food colors & flavors market, by key country

- A further breakdown of the Rest of European natural food colors & flavors market, by key country

- A further breakdown of the Rest of South American natural food colors & flavors market, by key country

Company information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Natural Food Colors & Flavors Market