Oncology Information System Market by Product and Service, Application, End User (Hospitals & diagnostic imaging centers, Ablation & Cancer Care Centers, Government Institutions and Research Facilities) & Region - Global Forecast to 2027

Market Growth Outlook Summary

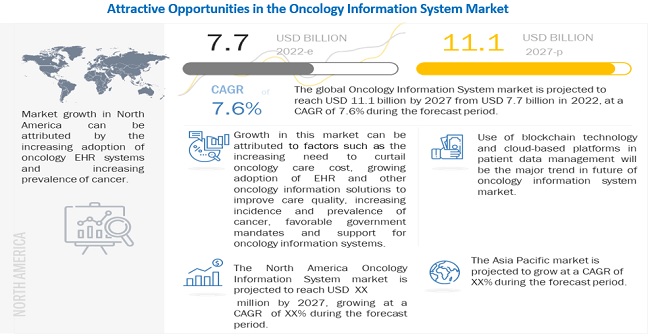

The global oncology information system market growth forecasted to transform from $7.7 billion in 2022 to $11.1 billion by 2027, driven by a CAGR of 7.6%. Key growth drivers include the rising cancer incidence, which reached 19.29 million cases globally in 2020, and the urgent need to lower oncology care costs. Major players in the market include Siemens Healthineers, Elekta AB, Koninklijke Philips, McKesson Corporation, and GE Healthcare. The market's expansion is supported by software and services that effectively manage cancer patient data, improve treatment planning, and enhance care outcomes. However, challenges such as a shortage of skilled IT professionals and data privacy concerns may hinder progress. The growing healthcare IT sector, projected to hit $821.1 billion by 2026, presents significant opportunities, particularly in the Asia Pacific region, which is anticipated to see substantial growth due to rising cancer rates and healthcare IT investments.

To know about the assumptions considered for the study, Request for Free Sample Report

Oncology Information System Market Dynamics

Driver: Increasing incidence and prevalence of cancer

The primary driver of the oncology information system industry is the increasing global incidence of cancer. According to GLOBOCAN 2020, there were 19.29 million new cancer cases in 2020, expected to rise to 28.4 million by 2040—an increase of 47%. The global 5-year prevalence is estimated at 50.6 million. In the U.S., over 1.9 million new cases were diagnosed in 2021 alone. The growing prevalence of cancer necessitates effective OIS for better patient information management, thus fueling market demand. Additional factors include the need to reduce oncology care costs and the rising adoption of electronic health records (EHR).

Restraint: Dearth of skilled IT professionals in the healthcare industry

A significant barrier to OIS implementation is the shortage of qualified IT professionals in healthcare. The demand for healthcare IT specialists far exceeds supply, evident even in developed markets like the U.S. and Europe. For example, a 2020 Canadian report indicated that about 79% of clinical IT workers required further training. The increasing number of healthcare IT initiatives only exacerbates this challenge.

Opportunity: Growing healthcare IT Industry

The healthcare IT market is projected to grow from $326.1 billion in 2021 to $821.1 billion by 2026, intersecting various sectors such as medical technology and digital health. This growth supports an integrated healthcare IT environment that addresses gaps in oncology care while reducing inefficiencies. By implementing solutions like EMR and treatment planning systems, healthcare organizations can lower operational costs and enhance care quality, driving demand across major end-user segments.

Challenge: Concerns regarding data privacy

Cyberhacking incidents in healthcare organizations surged by 42% in 2020 compared to 2019, according to Protenus. In total, there were 470 hacking cases in 2020, up from 330 in the previous year. The extensive exchange of patient information raises privacy and security risks, with healthcare accounting for 35.5% of all breaches tracked in the U.S. in 2019. Developing secure OIS platforms remains a significant challenge for vendors.

Software to account for the largest share of the oncology information system industry during the forecast period

The software segment represented 83.6% of the OIS market in 2021. This dominance is largely due to the need to manage rising oncology care costs and improve service efficiency by reducing medical errors. Software acts as the crucial interface between databases and end users.

Radiation oncology to account for the largest share of the oncology information system industry during the forecast period

The radiation oncology segment accounted for 53.8% of the market in 2021. Increased demand for radiosurgeries and the significant volume of cancer-related data generated in radiological departments are driving this trend.

Hospitals & Diagnostic Imaging Centers to account for the largest share of the oncology information system industry during the forecast period

Hospitals and diagnostic imaging centers dominate the market as major end users due to the extensive data generated during cancer diagnosis and treatment. Government initiatives to equip hospitals with advanced systems also contribute to this segment's growth.

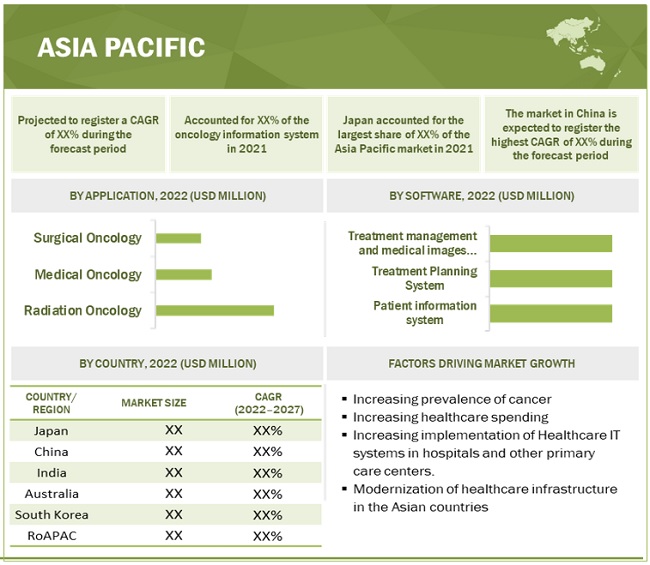

The APAC oncology information system industry is projected to grow at the highest rate during the forecast period.

In 2021, the Asia Pacific region comprised 17.8% of the global OIS market. Growth is driven by rising cancer prevalence and increased investment in healthcare IT solutions. For instance, Japan recorded 883,395 new cancer cases in 2020, with projections of 997,537 cases by 2040. The adoption of electronic medical records is a key focus, with only 34.4% of hospitals utilizing them in 2019.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the oncology information system market include Koninklijke Philips N.V., McKesson Corporation, Siemens Healthineers, Elekta AB, Epic Systems Corporation, IBM, Cerner Corporation, Advanced Data Systems, Bogardus Medical Systems, Inc., F. Hoffmann-La Roche AG, Altai Oncology, LLC, GE Healthcare, Accuray Incorporated, OPTUM, Allscripts Healthcare Solutions, Inc., MICA Information Systems, Inc., CureMD Healthcare, EndoSoft LLC, MIM Software Inc., and RaySearch Laboratories AB.

Scope of the Oncology Information System Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$7.7 billion |

|

Projected Revenue Size by 2027 |

$11.1 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 7.6% |

|

Market Driver |

Increasing incidence and prevalence of cancer |

|

Market Opportunity |

Growing healthcare IT Industry |

This study categorizes the global oncology information system market to forecast revenue and analyze trends in each of the following submarkets:

By Product and Service

- Software

- Patient Information Systems

- Radiology Information Systems

- Oncology Electronic Medical Record (EHR)

- Laboratory Information Systems

- Chemotherapy Information System

- Treatment Planning Systems

- Clinical Decision Support Systems

- Radiotherapy Treatment Planning Systems

- Brachytherapy Treatment Planning Systems

- Treatment Management Systems & Medical Image Analysis Systems

- Population Health Management

- Clinical Integration Solutions

- Picture Archiving and Communication System (PACS) & VNA

- Advanced Visualization & Image Analysis Solutions

- Radiation Dose Management Solutions

- Professional Services

- Consulting/Optimization Services

- Implementation Services

- Post-Sale and Maintenance Services

By Application

- Radiation Oncology

- Medical Oncology

- Surgical Oncology

By End User

- Hospitals & Diagnostic Imaging Centers

- Ablation Care Centers and Cancer Care Centers

- Government Institutions

- Research Facilities

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (ROE)

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoPAC)

-

Latin America

- Brazil

- Mexico

- Middle East & Africa

Recent Developments in the Oncology Information System Industry

- In August 2021, Siemens Healthineers acquired Varian Medical Systems to create a unique, integrated portfolio of oncology information system workflows.

- In June 2021, Koninklijke Philips N.V. partnered with Elekta to develop advanced, personalized cancer care through precision oncology information solutions.

- In December 2020, McKesson Corporation launched Ontada, an oncology technology and insights business focused on advancing cancer research and care.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global oncology information system market?

The global oncology information system market boasts a total revenue value of $11.1 billion by 2027.

What is the estimated growth rate (CAGR) of the global oncology information system market?

The global oncology information system market has an estimated compound annual growth rate (CAGR) of 7.6% and a revenue size in the region of $7.7 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ONCOLOGY INFORMATION SYSTEM INDUSTRY SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 SECONDARY RESEARCH

2.1.3 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.3.1 Key data from primary sources

FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

2.1.3.2 Breakdown of primary sources

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 6 PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 ONCOLOGY INFORMATION SYSTEM MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET: TOP-DOWN APPROACH

FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 10 MARKET (2021): SUPPLY-SIDE MARKET SIZE ESTIMATION

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MARKET (2022–2027)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 13 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 14 ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 ONCOLOGY INFORMATION SYSTEM MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 17 TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 18 TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 19 ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 20 ONCOLOGY INFORMATION SYSTEM MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 21 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 22 GEOGRAPHICAL SNAPSHOT OF THE ONCOLOGY INFORMATION SYSTEM INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 68)

4.1 ONCOLOGY INFORMATION SYSTEM MARKET OVERVIEW

FIGURE 23 INCREASING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

4.2 MARKET, BY PRODUCT & SERVICE (2022–2027)

FIGURE 24 CONSULTING & OPTIMIZATION SERVICES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.3 APAC: MARKET SHARE, BY APPLICATION AND COUNTRY (2021)

FIGURE 25 RADIATION ONCOLOGY SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.4 ONCOLOGY INFORMATION SYSTEM MARKET: DEVELOPED VS. DEVELOPING MARKETS (USD MILLION)

FIGURE 26 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

4.5 ONCOLOGY INFORMATION SYSTEM INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 27 CHINA TO WITNESS HIGHEST GROWTH FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 ONCOLOGY INFORMATION SYSTEM INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need to curtail oncology care costs

FIGURE 29 GLOBAL ONCOLOGY SPENDING, 2015–2021 (USD BILLION)

5.2.1.2 Growing adoption of EHRs and other oncology healthcare IT solutions to improve care quality

FIGURE 30 PERCENTAGE OF PRIMARY CARE PHYSICIANS IN SELECTED COUNTRIES USING ELECTRONIC MEDICAL RECORDS (2019)

5.2.1.3 Increasing incidence and prevalence of cancer

TABLE 3 CANCER INCIDENCE PER MILLION POPULATION, BY COUNTRY, 2016–2020

5.2.1.4 Favorable government mandates and support for oncology information systems

5.2.1.5 Potential benefits of and technological advancements in oncology information systems

5.2.2 RESTRAINTS

5.2.2.1 Interoperability issues

5.2.2.2 Dearth of skilled IT professionals in healthcare industry

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare IT Industry

5.2.3.2 Integration of EMR with treatment planning systems

5.2.4 CHALLENGES

5.2.4.1 Concerns regarding data privacy

6 INDUSTRY INSIGHTS (Page No. - 83)

6.1 INTRODUCTION

6.2 TECHNOLOGY ANALYSIS: ONCOLOGY INFORMATION SYSTEMS

6.2.1 ARTIFICIAL INTELLIGENCE

6.2.2 MACHINE LEARNING

6.2.3 INTERNET OF THINGS

6.2.4 BLOCKCHAIN

6.3 PRICING ANALYSIS: ONCOLOGY INFORMATION SYSTEMS

6.4 ECOSYSTEM LANDSCAPE: ONCOLOGY INFORMATION SYSTEM MARKET

FIGURE 31 MARKET: ECOSYSTEM

6.5 REGULATORY ANALYSIS

6.5.1 NORTH AMERICA

6.5.2 EUROPE

6.5.3 ASIA PACIFIC

6.5.4 MIDDLE EAST & AFRICA

6.5.5 LATIN AMERICA

6.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 DEGREE OF COMPETITION IS HIGH IN THE MARKET

TABLE 9 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7.1 THREAT OF NEW ENTRANTS

6.7.2 THREAT OF SUBSTITUTES

6.7.3 BARGAINING POWER OF SUPPLIERS

6.7.4 BARGAINING POWER OF BUYERS

6.7.5 INTENSITY OF COMPETITIVE RIVALRY

6.8 KEY STAKEHOLDERS & BUYING CRITERIA

6.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ONCOLOGY INFORMATION SYSTEMS

TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

6.9 KEY BUYING CRITERIA BY END USERS

FIGURE 34 BUYING CRITERIA OF END USERS

TABLE 11 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6.10 PATENT ANALYSIS

6.10.1 PATENT PUBLICATION TRENDS FOR ONCOLOGY INFORMATION SYSTEMS

FIGURE 35 GLOBAL PATENT PUBLICATION TRENDS IN MARKET, 2018–2022

6.10.2 TOP APPLICANTS (COMPANIES) FOR ONCOLOGY INFORMATION SYSTEM PATENTS

FIGURE 36 TOP COMPANIES THAT APPLIED FOR ONCOLOGY INFORMATION SYSTEM PATENTS, 2018–2022

6.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 12 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.12 COVID-19 IMPACT ON MARKET

7 ONCOLOGY INFORMATION SYSTEM MARKET, BY PRODUCT & SERVICE (Page No. - 100)

7.1 INTRODUCTION

TABLE 13 ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

7.2 SOFTWARE

TABLE 14 ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 15 ONCOLOGY INFORMATION SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 PATIENT INFORMATION SYSTEMS

TABLE 16 PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 PATIENT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.1 Oncology electronic medical records

7.2.1.1.1 Adoption of oncology electronic medical records is growing significantly in emerging countries

TABLE 18 KEY PLAYERS OFFERING ONCOLOGY ELECTRONIC MEDICAL RECORDS

TABLE 19 ONCOLOGY ELECTRONIC MEDICAL RECORDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.2 Laboratory information systems

7.2.1.2.1 Need for accurate, efficient, and rapid transfer of lab results across networks to drive market growth

TABLE 20 KEY PLAYERS OFFERING LABORATORY INFORMATION SYSTEMS

TABLE 21 LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.3 Radiology information systems

7.2.1.3.1 Integration of RIS with HIS and PACS has attracted attention from stakeholders

TABLE 22 KEY PLAYERS OFFERING RADIOLOGY INFORMATION SYSTEMS

TABLE 23 RADIOLOGY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.4 Chemotherapy information systems

7.2.1.4.1 Chemotherapy is increasingly being adopted as primary mode of treatment for various cancer types

TABLE 24 KEY PLAYERS OFFERING CHEMOTHERAPY INFORMATION SYSTEMS

TABLE 25 CHEMOTHERAPY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 TREATMENT PLANNING SYSTEMS

TABLE 26 TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 27 TREATMENT PLANNING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2.1 Radiotherapy treatment planning systems

7.2.2.1.1 Radiotherapy treatment planning systems to witness increased adoption for treatment of deep-seated tumors

TABLE 28 KEY MARKET PLAYERS OFFERING RADIOTHERAPY TREATMENT PLANNING SOLUTIONS

TABLE 29 RADIOTHERAPY TREATMENT PLANNING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2.2 Clinical decision support systems

7.2.2.2.1 Need to minimize errors and ensure regulatory compliance to drive adoption of CDSS

TABLE 30 KEY PLAYERS OFFERING CLINICAL DECISION SUPPORT SYSTEMS

TABLE 31 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2.3 Brachytherapy treatment planning systems

7.2.2.3.1 Better patient care with pulsed-dose rate brachytherapy to drive demand for these systems

TABLE 32 BRACHYTHERAPY TREATMENT PLANNING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3 TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS

TABLE 33 TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 34 TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.1 Population health management solutions

7.2.3.1.1 PHM solutions aggregate and provide wide range of cancer data for providers

TABLE 35 KEY PLAYERS OFFERING POPULATION HEALTH MANAGEMENT SOLUTIONS

TABLE 36 POPULATION HEALTH MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.2 Clinical integration solutions

7.2.3.2.1 Increasing number of cancer patient admissions in inpatient facilities is key factor driving market growth

TABLE 37 KEY PLAYERS OFFERING CLINICAL INTEGRATION SOLUTIONS

TABLE 38 CLINICAL INTEGRATION SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.3 Picture archiving and communication systems & vendor-neutral archive solutions

7.2.3.3.1 Rising demand for PACS and increasing generation of image data will ensure sustained demand for these solutions

TABLE 39 KEY PLAYERS OFFERING PICTURE ARCHIVING AND COMMUNICATION SYSTEMS & VENDOR-NEUTRAL ARCHIVE SOLUTIONS

TABLE 40 PICTURE ARCHIVING AND COMMUNICATION SYSTEMS & VENDOR-NEUTRAL ARCHIVE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.4 Advanced visualization & image analysis solutions

7.2.3.4.1 Increasing demand for imaging modalities in various indications of oncology to drive segment growth

TABLE 41 ADVANCED VISUALIZATION & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.5 Radiation dose management solutions

7.2.3.5.1 Use of these solutions enables optimization of radiation dose administration and management

TABLE 42 KEY PLAYERS OFFERING RADIATION DOSE MANAGEMENT SOLUTIONS

TABLE 43 RADIATION DOSE MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 PROFESSIONAL SERVICES

TABLE 44 ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 IMPLEMENTATION SERVICES

7.3.1.1 Healthcare organizations are increasingly outsourcing implementation services

TABLE 46 KEY PLAYERS OFFERING IMPLEMENTATION SERVICES

TABLE 47 IMPLEMENTATION SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 POST-SALE & MAINTENANCE SERVICES

7.3.2.1 Rising trend of outsourcing is driving market for post-sale & maintenance services

TABLE 48 KEY PLAYERS OFFERING POST-SALE & MAINTENANCE SERVICES

TABLE 49 POST-SALE & MAINTENANCE SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.3 CONSULTING & OPTIMIZATION SERVICES

7.3.3.1 Consulting services deliver optimum guidance to healthcare providers for implementing oncology information solutions

TABLE 50 KEY PLAYERS OFFERING CONSULTING SERVICES

TABLE 51 CONSULTING & OPTIMIZATION SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 ONCOLOGY INFORMATION SYSTEM MARKET, BY APPLICATION (Page No. - 139)

8.1 INTRODUCTION

TABLE 52 ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 RADIATION ONCOLOGY

8.2.1 INTRODUCTION OF AI-BASED RADIOTHERAPY TREATMENT PLANNING SYSTEMS TO DRIVE MARKET GROWTH

TABLE 53 US: RADIATION-TREATED CANCER SURVIVORS, 2016–2030 (THOUSAND)

TABLE 54 KEY PRODUCTS IN RADIATION ONCOLOGY MARKET

TABLE 55 MARKET FOR RADIATION ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 MEDICAL ONCOLOGY

8.3.1 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

TABLE 56 KEY PRODUCTS IN MEDICAL ONCOLOGY MARKET

FIGURE 37 NUMBER OF ONCOLOGY CLINICAL TRIALS WORLDWIDE, 2012–2018

TABLE 57 ONCOLOGY INFORMATION SYSTEM MARKET FOR MEDICAL ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 SURGICAL ONCOLOGY

8.4.1 NEED FOR STRUCTURED HEALTHCARE INFORMATION SYSTEMS TO BOOST MARKET GROWTH

TABLE 58 KEY PRODUCTS IN SURGICAL ONCOLOGY MARKET

TABLE 59 MARKET FOR SURGICAL ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

9 ONCOLOGY INFORMATION SYSTEM MARKET, BY END USER (Page No. - 147)

9.1 INTRODUCTION

TABLE 60 ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2 HOSPITALS & DIAGNOSTIC IMAGING CENTERS

9.2.1 HOSPITALS & DIAGNOSTIC IMAGING CENTERS ARE LARGEST END USERS OF ONCOLOGY INFORMATION SYSTEMS

TABLE 61 NUMBER OF HOSPITALS, BY COUNTRY (2021)

TABLE 62 ONCOLOGY INFORMATION SYSTEM MARKET FOR HOSPITALS & DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 ABLATION & CANCER CARE CENTERS

9.3.1 INITIATION OF CANCER CARE PROGRAMS AND SUPPORTING REIMBURSEMENT PLANS TO BOOST SEGMENT GROWTH

TABLE 63 MARKET FOR ABLATION & CANCER CARE CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 GOVERNMENT INSTITUTES

9.4.1 RISING GOVERNMENT INITIATIVES TO DRIVE MARKET GROWTH

TABLE 64 MARKET FOR GOVERNMENT INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

9.5 RESEARCH FACILITIES

9.5.1 GROWING NUMBER OF CANCER RESEARCH STUDIES TO DRIVE MARKET GROWTH

TABLE 65 MARKET FOR RESEARCH FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

10 ONCOLOGY INFORMATION SYSTEM MARKET, BY REGION (Page No. - 155)

10.1 INTRODUCTION

FIGURE 38 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 66 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: ONCOLOGY INFORMATION SYSTEM MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising adoption of oncology information systems in hospitals to drive market growth

FIGURE 40 US: HOSPITAL EHR ADOPTION (2010–2018)

TABLE 76 US: KEY MACROINDICATORS

TABLE 77 US: ONCOLOGY INFORMATION SYSTEM MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 78 US: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 US: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 US: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 US: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 US: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Deployment of digital healthcare initiatives is boosting market growth in Canada

FIGURE 41 CANADA: EMR ADOPTION BY PRIMARY CARE PHYSICIANS, 2013–2018

TABLE 83 CANADA: KEY MACROINDICATORS

TABLE 84 CANADA: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 85 CANADA: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 CANADA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 CANADA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 CANADA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 CANADA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3 EUROPE

FIGURE 42 EUROPE: CANCER PREVALENCE, BY COUNTRY, 2012–2030

TABLE 90 EUROPE: ONCOLOGY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 EUROPE: ONCOLOGY INFORMATION SYSTEM MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 92 EUROPE: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 EUROPE: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 EUROPE: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 EUROPE: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 EUROPE: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 EUROPE: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High adoption of EHR systems among healthcare practitioners to drive market growth in Germany

TABLE 99 GERMANY: KEY MACROINDICATORS

TABLE 100 GERMANY: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 101 GERMANY: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 GERMANY: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 GERMANY: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 GERMANY: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 GERMANY: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 UK is rapidly transforming its organizations into paperless environments through EHRs

TABLE 106 UK: KEY MACROINDICATORS

TABLE 107 UK: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 108 UK: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 UK: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 UK: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 UK: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 UK: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Growing reforms in digital health will support market growth

TABLE 113 FRANCE: KEY MACROINDICATORS

TABLE 114 FRANCE: ONCOLOGY INFORMATION SYSTEM MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 115 FRANCE: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 FRANCE: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 FRANCE: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 FRANCE: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 FRANCE: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing government initiatives and reforms to drive market growth

TABLE 120 ITALY: KEY MACROINDICATORS

TABLE 121 ITALY: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 122 ITALY: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 ITALY: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 ITALY: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 ITALY: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 ITALY: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing prevalence of cancer to drive adoption of oncology information systems

TABLE 127 SPAIN: KEY MACROINDICATORS

TABLE 128 SPAIN: ONCOLOGY INFORMATION SYSTEM MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 129 SPAIN: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 SPAIN: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 SPAIN: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 SPAIN: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 SPAIN: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 134 ROE: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 135 ROE: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 ROE: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 ROE: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 ROE: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 ROE: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: ONCOLOGY INFORMATION SYSTEMS MARKET SNAPSHOT

TABLE 140 ASIA PACIFIC: ONCOLOGY INFORMATION SYSTEM MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: ONCOLOGY INFORMATION SYSTEM MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan dominates Asia Pacific oncology information systems market

TABLE 149 JAPAN: KEY MACROINDICATORS

TABLE 150 JAPAN: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 151 JAPAN: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 JAPAN: PATIENT INFORMATION SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 JAPAN: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 JAPAN: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 JAPAN: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Strong government support in China to propel market growth

TABLE 156 CHINA: KEY MACROINDICATORS

TABLE 157 CHINA: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 158 CHINA: ONCOLOGY INFORMATION SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 CHINA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 CHINA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 CHINA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 CHINA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rising need for cost-effective technologies has increased demand for oncology information solutions in India

TABLE 163 INDIA: KEY MACROINDICATORS

TABLE 164 INDIA: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 165 INDIA: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 INDIA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 INDIA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 INDIA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 169 INDIA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Supportive government initiatives and strategic developments by market players to drive market growth

TABLE 170 AUSTRALIA: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 171 AUSTRALIA: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 AUSTRALIA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 AUSTRALIA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 AUSTRALIA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 AUSTRALIA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Increasing adoption of oncology information systems to positively impact market growth

TABLE 176 SOUTH KOREA: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 177 SOUTH KOREA: ONCOLOGY INFORMATION SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 SOUTH KOREA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 SOUTH KOREA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 SOUTH KOREA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 181 SOUTH KOREA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 182 ROAPAC: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 183 ROAPAC: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 ROAPAC: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 ROAPAC: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 186 ROAPAC: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 187 ROAPAC: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

TABLE 188 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 189 LATIN AMERICA: ONCOLOGY INFORMATION SYSTEM MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: ONCOLOGY INFORMATION SYSTEM MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Modernization of healthcare infrastructure to drive market growth

TABLE 197 BRAZIL: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 198 BRAZIL: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 199 BRAZIL: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 200 BRAZIL: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 BRAZIL: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 BRAZIL: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Favorable government initiatives and growing medical tourism to drive market growth

TABLE 203 MEXICO: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 204 MEXICO: ONCOLOGY INFORMATION SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 205 MEXICO: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 206 MEXICO: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 207 MEXICO: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 208 MEXICO: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 209 ROLATAM: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 210 ROLATAM: ONCOLOGY INFORMATION SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 ROLATAM: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 212 ROLATAM: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 213 ROLATAM: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 214 ROLATAM: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

TABLE 215 MIDDLE EAST & AFRICA: ONCOLOGY INFORMATION SYSTEMS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: ONCOLOGY INFORMATION SYSTEM , BY TYPE, 2020–2027 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: PATIENT INFORMATION SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: TREATMENT PLANNING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: TREATMENT MANAGEMENT SYSTEMS & MEDICAL IMAGE ANALYSIS SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: ONCOLOGY INFORMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 222 MIDDLE EAST & AFRICA: ONCOLOGY INFORMATION SYSTEM INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 253)

11.1 OVERVIEW

11.2 KEY DEVELOPMENTS BY LEADING PLAYERS IN ONCOLOGY INFORMATION SYSTEMS MARKET, JANUARY 2018–APRIL 2022

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 44 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 223 MARKET: DEGREE OF COMPETITION

11.5 MARKET RANKING ANALYSIS

FIGURE 45 RANK OF COMPANIES IN GLOBAL ONCOLOGY INFORMATION SYSTEMS MARKET (2021)

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 46 ONCOLOGY INFORMATION SYSTEMS MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

11.7 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 47 ONCOLOGY INFORMATION SYSTEMS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

11.8 COMPETITIVE BENCHMARKING

TABLE 224 MARKET: SUPPORTING DATA OF KEY START-UPS/SMES

11.9 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

TABLE 225 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

11.10 MARKET: R&D EXPENDITURE

FIGURE 48 R&D EXPENDITURE OF KEY PLAYERS IN MARKET (2020 VS. 2021)

11.11 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 49 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN ONCOLOGY INFORMATION SYSTEMS MARKET

11.12 COMPANY REGIONAL FOOTPRINT

TABLE 226 COMPANY REGIONAL FOOTPRINT

TABLE 227 COMPANY SOFTWARE FOOTPRINT

TABLE 228 COMPANY SERVICE FOOTPRINT

TABLE 229 COMPANY APPLICATION FOOTPRINT

11.13 COMPETITIVE SITUATION AND TRENDS

11.13.1 PRODUCT LAUNCHES

TABLE 230 ONCOLOGY INFORMATION SYSTEMS MARKET: KEY PRODUCT LAUNCHES

11.13.2 DEALS

TABLE 231 MARKET: KEY DEALS

11.13.3 OTHER DEVELOPMENTS

TABLE 232 ONCOLOGY INFORMATION SYSTEMS MARKET: OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 272)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 KONINKLIJKE PHILIPS N.V.

TABLE 233 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 50 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2021)

12.1.2 SIEMENS HEALTHINEERS

TABLE 234 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

FIGURE 51 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2021)

12.1.3 ELEKTA

TABLE 235 ELEKTA: BUSINESS OVERVIEW

FIGURE 52 ELEKTA: COMPANY SNAPSHOT (2021)

12.1.4 GE HEALTHCARE

TABLE 236 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 53 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

12.1.5 MCKESSON CORPORATION

TABLE 237 MCKESSON CORPORATION: BUSINESS OVERVIEW

FIGURE 54 MCKESSON CORPORATION: COMPANY SNAPSHOT (2021)

12.2 OTHER PLAYERS

12.2.1 CERNER CORPORATION

TABLE 238 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 55 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

12.2.2 ACCURAY INCORPORATED

TABLE 239 ACCURAY INCORPORATED: BUSINESS OVERVIEW

FIGURE 56 ACCURAY INCORPORATED: COMPANY SNAPSHOT (2021)

12.2.3 ALLSCRIPTS HEALTHCARE, LLC

TABLE 240 ALLSCRIPTS HEALTHCARE, LLC.: BUSINESS OVERVIEW

FIGURE 57 ALLSCRIPTS HEALTHCARE, LLC: COMPANY SNAPSHOT (2021)

12.2.4 IBM

TABLE 241 IBM: BUSINESS OVERVIEW

FIGURE 58 IBM: COMPANY SNAPSHOT (2021)

12.2.5 F. HOFFMANN-LA ROCHE AG

TABLE 242 F. HOFFMANN-LA ROCHE AG: BUSINESS OVERVIEW

FIGURE 59 F. HOFFMANN-LA ROCHE AG: COMPANY SNAPSHOT (2021)

12.2.6 EPIC SYSTEMS CORPORATION

TABLE 243 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

12.2.7 RAYSEARCH LABORATORIES

TABLE 244 RAYSEARCH LABORATORIES: BUSINESS OVERVIEW

FIGURE 60 RAYSEARCH LABORATORIES: COMPANY SNAPSHOT (2021)

12.2.8 CUREMD HEALTHCARE

TABLE 245 CUREMD HEALTHCARE: BUSINESS OVERVIEW

12.2.9 BOGARDUS MEDICAL SYSTEMS, INC.

TABLE 246 BOGARDUS MEDICAL SYSTEMS, INC.: BUSINESS OVERVIEW

12.2.10 OPTUM (UNITEDHEALTH GROUP)

TABLE 247 OPTUM: BUSINESS OVERVIEW

FIGURE 61 OPTUM: COMPANY SNAPSHOT (2021)

12.2.11 MICA INFORMATION SYSTEMS, INC.

TABLE 248 MICA INFORMATION SYSTEMS, INC.: BUSINESS OVERVIEW

12.2.12 ADVANCED DATA SYSTEMS

TABLE 249 ADVANCED DATA SYSTEMS: BUSINESS OVERVIEW

12.2.13 ENDOSOFT LLC

TABLE 250 ENDOSOFT LLC: BUSINESS OVERVIEW

12.2.14 ALTAI ONCOLOGY, LLC

TABLE 251 ALTAI ONCOLOGY, LLC: BUSINESS OVERVIEW

12.2.15 MIM SOFTWARE INC.

TABLE 252 MIM SOFTWARE INC.: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 341)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

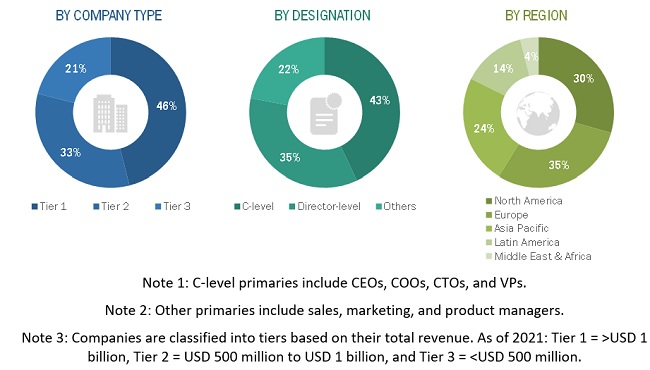

This research study involved the extensive use of secondary sources, directories, and databases (such as D&B Hoovers, Bloomberg Businessweek, and Factiva) to identify and collect information useful to the study. Primary sources were several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and technology developers. Primary sources also included standard and certification organizations from companies and organizations related to all segments of this industry’s value chain.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the oncology information system market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research. These secondary sources include World Health Organization (WHO), FDI World Dental Federation, International Federation of Endodontic Association (IFEA), National Dental Association (NDA), American Dental Association (ADA), Canadian Dental Association (CDA), Association for Dental Education in Europe (ADEE), European Association of Dental Public Health (EADPH), European Society of Cosmetic Dentistry (ESCD), European Academy of Esthetic Dentistry (EAED), British Dental Association (BDA), French Dental Association (FDA) (Association Dentaire Française), Asia Pacific Dental Federation (APDF), Japan Dental Association (JDA), Australian Dental Prosthetics Association (ADPA), Indian Dental Association (IDA), 3D Printing Association Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the oncology information system market. The primary sources from the demand side include oncology information system, dental lab groups, laboratory technicians, dental lab directors, traditional laboratories, and digital laboratories. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the oncology information system market and other dependent submarkets.

The research methodology used to estimate the market size includes the following details:

- The market value of software such as patient information system, treatment planning system, treatment management system and medical image analysis system has been extracted from the repository and validated through secondary and primary research.

- Oncology information system services market shares have been extracted from the repository and validated through secondary and primary research.

- The market shares of the application segments have been extracted from the repository and validated through secondary and primary research.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- The bottom-up approach has been applied to different regions and other segments of the oncology information system market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Approach to calculate the revenue of different players in the Oncology information system market

In this report, the global oncology information system market size was arrived at by using the revenue share analysis of leading players. For this purpose, major players in the market were identified, and their revenues from the oncology information system business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key market players’ marketing executives.

Approach to derive the market size and estimate market growth

The total size of the oncology information system market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Bottom-up Approach: In this report, the global market size was arrived at using the revenue share analysis of leading players in the indirect restorative materials and lab equipment market. Wherever feasible, revenue share analysis was also employed to determine segmental market size by identifying leading players for the respective industry programs. For this purpose, major players in the market were identified through secondary research, and their revenues from the oncology information systemmaterials and equipment business were determined through various insights gathered during the primary and secondary research. Secondary research included studying the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders such as CEOs, directors, and marketing executives of key market players.

Top-up Approach: The overall oncology information system market size was used in the top-down approach to estimate the sizes of other individual markets (product and services, application, end user and region) through percentage splits from secondary and primary research. To calculate each type of specific market segment, the most appropriate, immediate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues.

Geographic market assessment (by region & country): The geographic assessment was conducted using the following approaches:

- Approach 1: The geographic revenue contributions/splits of leading players in the product and services market (wherever available) and respective growth trends.

- Approach 2: Geographic adoption trends for individual application segments for the demand side and growth prospects for each segment (assumptions and indicative estimates validated from primary interviews).

- Approach 3: Geographic market size of end user and growth prospects for each segment (assumptions and indicative estimates validated from primary interviews).

Report Objectives

- To define, describe, and forecast the global oncology information system market based on product and services, application, end user and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall oncology information system market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for key market players

- To forecast the size of the oncology information system market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players in the global oncology information system market and comprehensively analyze their core competencies2 and market shares in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as mergers and acquisitions, expansions, partnerships, product launches, collaborations, and agreements of leading players in the global oncology information system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix: Detailed comparison of the product portfolios of the top companies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Oncology Information System Market

Which is the most influencing segment growing in the oncology information systems market?

What are the key trends in the oncology information systems market report?

Which of the mentioned segments is leading the global growth of Oncology Information System Market during the forecast period?