The study involved four major activities to estimate the current size of the radiation dose management market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of Radiation Dose Management Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Radiation Dose Management market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), primary care clinics, and stakeholders in corporate & government bodies.

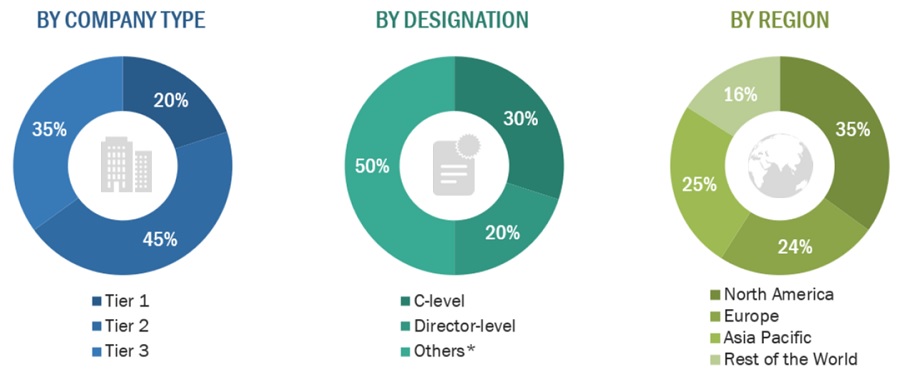

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Others include sales managers, marketing managers, and product managers.

Note 1: Tiers of companies are defined on the basis of their total revenues in 2022. Tier 1 = >USD 500 million, Tier 2 = USD 100 million to USD 500 million, and Tier 3 = <USD 500 million.

Note 2: The RoW includes Latin America and the Middle East & Africa.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

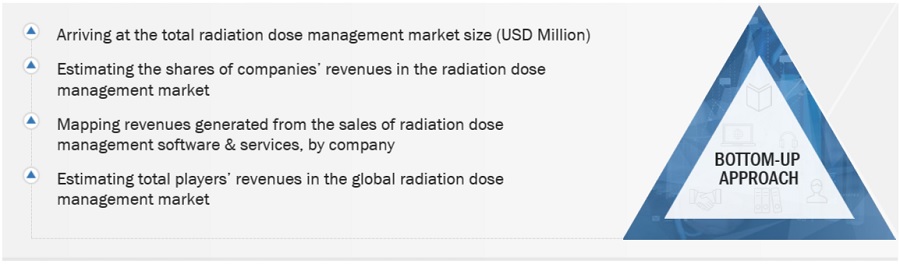

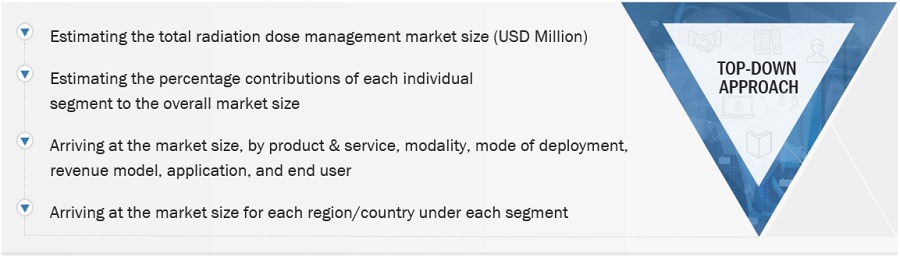

Both top-down and bottom-up approaches were used to estimate and validate the total size of the radiation dose management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Radiation Dose Management Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Radiation Dose Management Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the radiation dose management industry.

Market Definition:

Radiation Dose Management Software Solution refers to a specialized software application designed to monitor, analyze, and manage the amount of ionizing radiation exposure that patients receive during medical imaging procedures. These solutions play a crucial role in enhancing patient safety by ensuring that healthcare providers can optimize radiation doses while maintaining diagnostic image quality. By employing Radiation Dose Management Software Solutions, healthcare providers can enhance their ability to deliver high-quality care while minimizing the risks associated with unnecessary or excessive radiation exposure. These solutions contribute to the ongoing effort to strike a balance between the benefits of medical imaging and the importance of radiation safety.

Key Stakeholders

-

Radiation dose management solution providers

-

Radiation dose management service providers

-

Imaging system providers

-

Academic research institutes

-

Government institutes

-

Market research and consulting firms

-

Venture capitalists and investors

Report Objectives

-

To define, describe, and forecast the global radiation dose management market on the basis of product & service, modality, mode of deployment, revenue-model, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, opportunities, and challenges)

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall radiation dose management market

-

To analyze the opportunities in the market for stakeholders and to provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

-

To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

-

To track and analyze competitive developments such as product launches, partnerships, and expansions in the radiation dose management market

-

To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

-

Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

-

Geographic Analysis: Further breakdown of the Latin American radiation dose management into specific countries and, the Middle East, and Africa radiation dose management into specific countries and further breakdown of the European radiation dose management into specific countries

Growth opportunities and latent adjacency in Radiation Dose Management Market