Pharmaceutical Robots Market by Type (Traditional Robots (Articulated Robots, SCARA Robots, Delta Robots, Cartesian Robots), Collaborative Robots), Application (Picking and Packaging, Laboratory Applications) - Global Forecast to 2021

[141 Pages Report] The overall pharmaceutical robotic systems market is expected to grow from USD 64.37 million in 2016 to USD 119.46 million by 2021, at a CAGR of 13.2% from 2016 to 2021. Benefits offered by robotic systems in pharmaceutical manufacturing is a key factor driving the growth of pharmaceutical robots market. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Benefits offered by robotic systems in pharmaceutical manufacturing

- Conferences and exhibitions to raise awareness of robotic systems in pharmaceutical manufacturing

Restraints

- Lack of skilled personnel to work in automated manufacturing units

Opportunities

- Increased demand for collaborative robots in manufacturing facilities

Challenges

- Manufacturing advanced robotic systems that meet the requirements of consumers in the era of Industrial Internet of Things (IIoT)

Benefits offered by robotic systems in pharmaceutical manufacturing drive the global pharmaceutical robotic systems market

In 2015, the U.S. FDA approved 45 new medicines as compared to 27 in 2013. It also approved 98% of high-risk medical devices in 2014 as compared to 86% in 2013 and 70% in 2012. As the demand for new drugs and medicines grows, pharmaceutical companies are continuously looking for new ways to increase productivity, leading to an increased reliance on automated equipment and robotics. Robotic systems provide various benefits to pharmaceutical manufacturing such as lesser space utilization, reduced production downtime, no labor turnover, enhanced health and safety, better waste management, increased production flexibility, improved production output and product quality, and lower operating costs. With the growing pharmaceutical industry and the various benefits offered by robotic automation, the adoption of robots is likely to increase in the coming years.

The following are the major objectives of the study.

- To describe and forecast the pharmaceutical robotic systems market, in terms of value, by type, application, and region

- To describe and forecast the pharmaceutical robotic systems market, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of pharmaceutical robotic systems

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the pharmaceutical robotic systems ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as marketing and promotions, expansions, agreements, alliances, collaborations, partnerships, product launches, acquisitions, product enhancements, market developments, funding, restructuration, and rebranding in the pharmaceutical robotic systems market

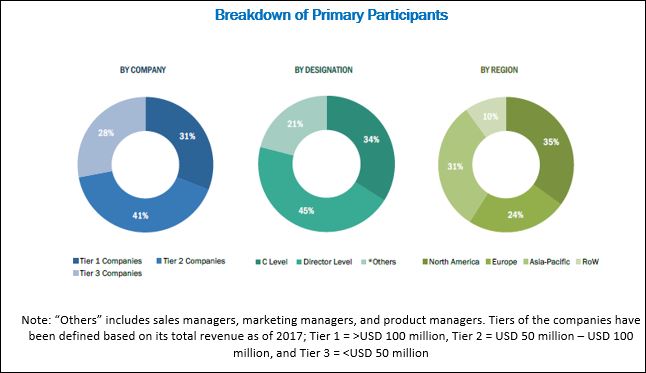

During this research study, major players operating in the pharmaceutical robotic systems market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the pharmaceutical robots market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key players considered in the analysis of the pharmaceutical robotic systems market are Kawasaki Heavy Industries Ltd. (Japan), FANUC Corporation (Japan), KUKA AG (Germany), Mitsubishi Electric Corporation (Japan), ABB Ltd. (Switzerland), Denso Corporation (Japan), Seiko Epson Corporation (Japan), Marchesini Group S.p.A (Italy), Universal Robots A/S (Denmark), Yaskawa Electric Corporation (Japan), and Shibuya Corporation (Japan).

Major Market Developments

- In 2016, Kawasaki opened a Tokyo Robot Center Showroom in Odaiba, Tokyo, Japan. The new facility offers robotics-related information.

- In 2016, Yaskawa launched the MOTOMAN-MH5BM, a six-axis vertical articulated robot. The robot is ideal for sterile or hygienic environments such as the biomedical field, which includes drug discovery research, pharmaceutical and medical industry, as well as the beverage industry.

- In 2016, FANUC collaborated with NVIDIA (U.S.) to implement Artificial Intelligence on the FANUC Intelligent Edge Link and Drive (FIELD) system. This is aimed to increase robotics productivity and bring new capabilities to automated factories across the globe. Moreover, the advances in artificial intelligence aim to allow robots to watch & learn, and improve its capabilities.

- In 2016, Mitsubishi established two new Factory Automation ("FA") centers in Italy and South Africa. With this expansion, the company aimed at expanding the FA product support network in Southern Europe and Africa, along with strengthening and accelerating local customer service.

- In 2015, ABB established a new robotics plant at its existing facility in Auburn Hills, Michigan. The expansion is aimed at elevating its product offerings and services to robotics customers in the U.S., Mexico, and Canada. With the expansion, the company becomes the first global industrial robotics company to invest in and fully commit to the North American robotics-manufacturing footprint.

Target Audience

- Industrial robots manufacturers

- Pharmaceutical manufacturing units

- Technology investors

- Distributors of industrial robots

- Market research and consulting firms

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

- Community centers

- Regulatory bodies

Report Scope

Pharmaceutical Robotic Systems Market, By Type

-

Traditional Robots

- Articulated Robots

- Scara Robots

- Delta/Parallel Robots

- Cartesian Robots

- Other Robots

- Collaborative Pharmaceutical Robots

Pharmaceutical Robotic Systems Market, By Application

- Traditional Robots

- Picking and Packaging

- Inspection of Pharmaceutical Drugs

- Laboratory Applications

Pharmaceutical Robotic Systems Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Rest of Asia Pacific

- Rest of the World (RoW)

Critical questions which the report answers

- What are new technology trends which the pharmaceutical robotic systems companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in RoW region into Latin America and Middle East & Africca

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall pharmaceutical robotic systems market is expected to grow from grow from USD 64.37 million in 2016 to USD 119.46 million by 2021, at a CAGR of 13.2% from 2016 to 2021. Benefits offered by robotic systems in pharmaceutical manufacturing is a key factor driving the growth of pharmaceutical robots market.

A robotic system is a type of automation that has multiple axes of motion and can be programmed to perform a function. Some of the benefits of automation include efficiency, saving workers from hazardous environments or repetitive tasks, reducing training overhead, eliminating human error, increasing repeatability and reproducibility, and in cleanrooms, removing the potential for human contamination.

On the basis of application, the global pharmaceutical robotic systems market is segmented into picking and packaging, inspection of pharmaceutical drugs, and laboratory applications. The picking and packaging segment accounted for the largest share of the global pharmaceutical robotic systems market. Factors such as demand for personalized packaging configurations and advantages of robots in pharmaceutical manufacturing such as high speed, accuracy, ability to track and trace, error-free operation, fewer accidents, and better utilization of the floor space are contributing to the large share of the picking and packaging segment.

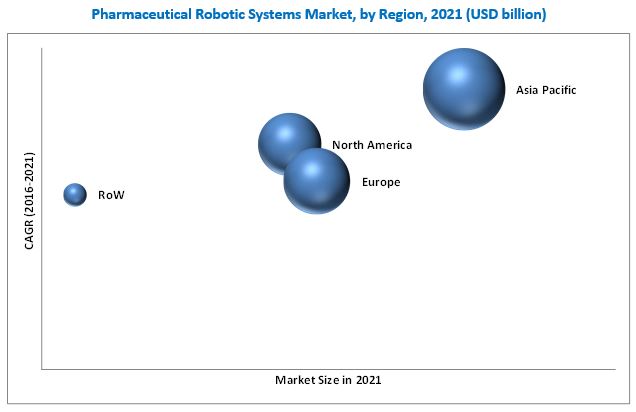

The pharmaceutical robotic systems market in APAC is expected to grow at the highest CAGR during the forecast period owing to factors such as the increase in domestic industrial robots companies, flourishing pharmaceutical industry, increasing number of conferences and exhibitions, investments and funding in the industrial robots industry, and Japan’s Robot Strategy.

Applications in picking and packaging, inspection of pharmaceutical drugs, and laboratory applications drive the growth of pharmaceutical robotic systems market

Picking and Packaging

Automation is becoming an increasingly important part of pharmaceutical manufacturing. A robotic system is a type of automation. Robots offer various advantages, such as high efficiency, save workers from hazardous environments and repetitive tasks, reduce training overheads, eliminate human errors, and increase repeatability and reproducibility. The common applications of robots include pick and place operations that often use SCARA robots.

Inspection of Pharmaceutical Drugs

Inspection of pharmaceutical drugs is an important step to ensure the quality of drugs that are provided to the end consumers. Automatic inspection, as part of a robotic system, enables 100% part inspection. A robotic system consists of several cameras which capture images and identify minor imperceptible flaws in products. This ensures that only perfect products are sent out for packaging. The vision-sensing technology in robots is used in Pharmaceutical Packaging to verify serialization numbers for compliance with track-and-trace regulations.

Laboratory Applications

Robots are increasingly being used in laboratories to improve quality and efficiency. Many tests associated with research, discovery, and development involve repetitive tasks such as moving fluids between wells in a plate. Pharmaceutical laboratories are now using robots to perform these tests as they are easy to automate. Moreover, robots offer a high degree of consistency and accuracy executing test protocols, while at the same time allowing researchers to focus on higher-value tasks. The success of robots in pharmaceutical laboratories has encouraged companies to incorporate the machines into closely-related production operations such as pilot and small-batch manufacturing lines.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for pharmaceutical robotic systems?

Lack of skilled personnel is a major factor restraining the growth of the market. Industrial Robotics is a multidisciplinary field where acquiring and retaining qualified workers is a major issue. There is a scarcity of people specializing in disciplines such as electrical, embedded, software, and mechanical engineering, which make up industrial robotics. There is also a deficit of highly qualified employees with specific educational backgrounds and skills, especially those needed to produce high value-added robots integrated with advanced technologies. In developing economies such as India, Thailand, and Brazil, there is a shortage of skilled labor to handle industrial robots. This is because knowledge of four to five engineering disciplines is required to become an expert in this field, and faculty shortages are a major problem in these countries. Moreover, there are limited branches of engineering which focus on robotics. Thus, the dearth of skilled talent inhibits the growth of robot automation in the pharmaceutical industry.

Key players in the Pharmaceutical Robots Market include Kawasaki Heavy Industries Ltd. (Japan), FANUC Corporation (Japan), KUKA AG (Germany), Mitsubishi Electric Corporation (Japan), ABB Ltd. (Switzerland), Denso Corporation (Japan), Seiko Epson Corporation (Japan), Marchesini Group S.p.A (Italy), Universal Robots A/S (Denmark), Yaskawa Electric Corporation (Japan), and Shibuya Corporation (Japan). These players are increasingly undertaking marketing and promotions, expansions, agreements, alliances, collaborations, partnerships, product launches, acquisitions, product enhancements, market developments, funding, restructuration, and rebranding to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Pharmaceutical Robots Market: Introduction (Page No. - 16)

1.1 Objectives of Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Pharmaceutical Robots Market: Research Methodology (Page No. - 19)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.2 Primary Research

2.2.3 Key Industry Insights

2.3 Key Data From Primary Sources

2.4 Key Insights From Primary Sources

2.5 Market Size Estimation Methodology

2.6 Research Design

2.7 Market Data Validation and Triangulation

2.8 Assumptions for the Study

3 Pharmaceutical Robots Market: Executive Summary (Page No. - 28)

4 Pharmaceutical Robots Market: Premium Insights (Page No. - 32)

4.1 Pharmaceutical Robotic Systems: Market Overview (2016–2021)

4.2 Pharmaceutical Robotic Systems Market Size, By Type, 2016 vs 2021 (USD Million)

4.3 Geographic Analysis: Pharmaceutical Robotics Market, By Type of Traditional Robot (2016)

4.4 Geographic Snapshot of the Pharmaceutical Robotic Systems Market

4.5 Pharmaceutical Robotic Systems Market, By Application (2016 vs 2021)

5 Pharmaceutical Robots Market: Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Benefits Offered By Robotic Systems in Pharmaceutical Manufacturing

5.2.1.2 Conferences and Exhibitions to Raise Awareness of Robotic Systems in Pharmaceutical Manufacturing

5.2.2 Restraint

5.2.2.1 Lack of Skilled Personnel to Work in Automated Manufacturing Units

5.2.3 Opportunity

5.2.3.1 Increased Demand for Collaborative Robots in Manufacturing Facilities

5.2.4 Challenge

5.2.4.1 Manufacturing Advanced Robotic Systems That Meet the Requirement of Consumers in the Era of Industrial Internet of Things (IIoT)

6 Pharmaceutical Robots Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Traditional Robots

6.2.1 Articulated Robots

6.2.2 Scara Robots

6.2.3 Delta/Parallel Robots

6.2.4 Cartesian Robots

6.2.5 Other Robots

6.3 Collaborative Pharmaceutical Robots

7 Pharmaceutical Robots Market, By Application (Page No. - 61)

7.1 Introduction

7.2 Picking and Packaging

7.3 Inspection of Pharmaceutical Drugs

7.4 Laboratory Applications

8 Pharmaceutical Robots Market, By Region (Page No. - 70)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.1.1 Presence of Major Pharmaceutical Companies in the U.S.

8.2.1.2 Increasing Number of Conferences and Exhibitions

8.2.2 Canada

8.2.2.1 Government Initiatives to Increase Robotic Automation in the Country

8.2.2.2 Increasing Number of Conferences and Exhibitions to Propel Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Growing Pharmaceutical Industry in Germany

8.3.1.2 Conferences and Exhibitions in Germany to Boost the Growth of the Market

8.3.2 Rest of Europe

8.3.2.1 Focus of Major Players to Enhance Their Presence in the RoE Pharmaceutical Robots Market

8.3.2.2 Growing Number of Conferences and Exhibitions to Raise Awareness

8.4 Asia-Pacific

8.4.1 Japan

8.4.1.1 New Robot Strategy (2015) Adopted By Japan

8.4.1.2 Conferences and Exhibitions

8.4.2 China

8.4.2.1 Rising Number of Domestic Players, Growth of the Pharmaceutical Industry

8.4.2.2 Low-Quality Robots From Domestic Suppliers, A Key Restraint to the Overall Adoption of Pharmaceutical Robots in China

8.4.2.3 Conferences and Exhibitions

8.4.3 Rest of Asia-Pacific

8.4.3.1 Government Investments in Robotic R&D in South Korea

8.4.3.2 High Growth in the Asian Pharmaceutical Industry

8.4.3.3 Conferences & Exhibitions

8.5 Rest of the World (RoW)

8.5.1 Favorable Business Environment for Pharmaceutical & Biotechnology Industries in the Middle East

8.5.2 Increasing Number of Conferences and Exhibitions

9 Pharmaceutical Robots Market: Competitive Landscape (Page No. - 99)

9.1 Overview

9.2 Competitive Situation and Trends

9.2.1 Introduction

9.2.2 Marketing and Promotions

9.2.3 Expansions

9.2.4 Agreements, Alliances, Collaborations, and Partnerships

9.2.5 Product Launches

9.2.6 Acquisitions

9.2.7 Product Enhancements

9.2.8 Other Strategies

10 Company Profiles (Page No. - 106)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

10.1 Introduction

10.2 Kawasaki Heavy Industries Ltd

10.3 Fanuc Corporation

10.4 Kuka AG

10.5 ABB Ltd.

10.6 Yaskawa Electric Corporation

10.7 Mitsubishi Electric Corporation

10.8 Denso Wave Incorporated (A Subsidiary of Denso Corporation)

10.9 Seiko Epson Corporation

10.10 Marchesini Group S.P.A.

10.11 Universal Robots A/S.

10.12 Shibuya Corporation

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 131)

11.1 Discussion Guide

11.2 Other Developments (2013–2016)

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (98 Tables)

Table 1 Indicative List of Conferences/Exhibitions on Industrial Robots and Pharmaceutical Manufacturing Globally

Table 2 Global Pharmaceutical Robotic Systems Market Size, By Type, 2014-2021 (USD Million)

Table 3 Global Market, By Type, 2014-2021 (Units)

Table 4 Global Traditional Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 5 Global Traditional Market Size, By Type, 2014-2021 (Units)

Table 6 Global Traditional Pharmaceutical Robots Market Size, By Region, 2014-2021 (USD Million)

Table 7 North America: Traditional Market Size, By Country, 2014-2021 (USD Million)

Table 8 Europe: Traditional Pharmaceutical Robots Market Size, By Country, 2014-2021 (USD Million)

Table 9 Asia-Pacific: Traditional Market Size, By Country, 2014-2021 (USD Million)

Table 10 Global Articulated Robots Market Size, By Region, 2014-2021 (USD Million)

Table 11 North America: Articulated Robots Market Size, By Country, 2014-2021 (USD Million)

Table 12 Europe: Articulated Robots Market Size, By Country, 2014-2021 (USD Million)

Table 13 Asia-Pacific: Articulated Robots Market Size, By Country, 2014-2021 (USD Million)

Table 14 Global Scara Robots Market Size, By Region, 2014-2021 (USD Million)

Table 15 North America: Scara Robots Market Size, By Country, 2014-2021 (USD Million)

Table 16 Europe: Scara Robots Market Size, By Country, 2014-2021 (USD Million)

Table 17 Asia-Pacific: Scara Robots Market Size, By Country, 2014-2021 (USD Million)

Table 18 Global Delta/Parallel Robots Market Size, By Region, 2014-2021 (USD Million)

Table 19 North America: Delta/Parallel Robots Market Size, By Country, 2014-2021 (USD Million)

Table 20 Europe: Delta/Parallel Robots Market Size, By Country, 2014-2021 (USD Million)

Table 21 Asia-Pacific: Delta/Parallel Robots Market Size, By Country, 2014-2021 (USD Million)

Table 22 Global Cartesian Robots Market Size, By Region, 2014-2021 (USD Million)

Table 23 North America: Cartesian Robots Market Size, By Country, 2014-2021 (USD Million)

Table 24 Europe: Cartesian Robots Market Size, By Country, 2014-2021 (USD Million)

Table 25 Asia-Pacific: Cartesian Robots Market Size, By Country, 2014-2021 (USD Million)

Table 26 Global Other Robots Market Size, By Region, 2014-2021 (USD Million)

Table 27 North America: Other Robots Market Size, By Country, 2014-2021 (USD Million)

Table 28 Europe: Other Robots Market Size, By Country, 2014-2021 (USD Million)

Table 29 Asia-Pacific: Other Robots Market Size, By Country, 2014-2021 (USD Million)

Table 30 Global Collaborative Pharmaceutical Robots Market Size, By Region, 2014-2021 (USD Million)

Table 31 North America: Collaborative Market Size, By Country, 2014-2021 (USD Million)

Table 32 Europe: Collaborative Pharmaceutical Robots Market Size, By Country, 2014-2021 (USD Million)

Table 33 Asia-Pacific: Collaborative Pharmaceutical Robots Market Size, By Country, 2014-2021 (USD Million)

Table 34 Global Pharmaceutical Robotic Systems Market Size, By Application, 2014-2021 (USD Million)

Table 35 Global Market Size for Picking and Packaging, By Region, 2014-2021 (USD Million)

Table 36 North America: Pharmaceutical Robotic Systems Market Size for Picking and Packaging, By Country, 2014-2021 (USD Million)

Table 37 Europe: Pharmaceutical Robots Market Size for Picking and Packaging, By Country, 2014-2021 (USD Million)

Table 38 Asia-Pacific: Pharmaceutical Robotic Systems Market Size for Picking and Packaging, By Country, 2014-2021 (USD Million)

Table 39 Global Pharmaceutical Robotic Systems Market Size for the Inspection of Pharmaceutical Drugs, By Region, 2014-2021 (USD Million)

Table 40 North America: Pharmaceutical Robots Market Size for the Inspection of Pharmaceutical Drugs, By Country, 2014-2021 (USD Million)

Table 41 Europe: Pharmaceutical Robotic Systems Market Size for the Inspection of Pharmaceutical Drugs, By Country, 2014-2021 (USD Million)

Table 42 Asia-Pacific: Pharmaceutical Robots Market Size for the Inspection of Pharmaceutical Drugs, By Country, 2014-2021 (USD Million)

Table 43 Global Market Size for Laboratory Applications, By Region, 2014-2021 (USD Million)

Table 44 North America: Pharmaceutical Robotic Systems Market Size for Laboratory Applications, By Country, 2014-2021 (USD Million)

Table 45 Europe: Pharmaceutical Robotic Systems Market Size for Laboratory Applications, By Country, 2014-2021 (USD Million)

Table 46 Asia-Pacific: Pharmaceutical Robots Market Size for Laboratory Applications, By Country, 2014-2021 (USD Million)

Table 47 Global Pharmaceutical Robotic Systems Market Size, By Region, 2014-2021 (USD Million)

Table 48 North America: Pharmaceutical Robotic Systems Market Size, By Country, 2014–2021 (USD Million)

Table 49 North America: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 50 North America: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 51 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 52 Indicative List of Conferences/Exhibitions on Pharmaceutical Manufacturing in the U.S. in 2017

Table 53 U.S.: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 54 U.S.: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 55 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 56 Indicative List of Conferences/Exhibitions on Pharmaceutical Manufacturing in Canada

Table 57 Canada: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 58 Canada: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 59 Canada: Pharmaceutical Robotic Systems Market Size, By Application, 2014-2021 (USD Million)

Table 60 Europe: Pharmaceutical Robots Market Size, By Country, 2014–2021 (USD Million)

Table 61 Europe: Pharmaceutical Robotic Systems Market Size, By Type, 2014-2021 (USD Million)

Table 62 Europe: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 63 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 64 Indicative List of Conferences/Exhibitions on Pharmaceutical Manufacturing in Germany

Table 65 Germany: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 66 Germany: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 67 Germany: Market Size, By Application, 2014-2021 (USD Million)

Table 68 Indicative List of Conferences/Exhibitions on Industrial Robots and Pharmaceutical Manufacturing in Europe

Table 69 RoE: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 70 RoE: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 71 RoE: Pharmaceutical Robotic Systems Market Size, By Application, 2014-2021 (USD Million)

Table 72 Asia-Pacific: Pharmaceutical Robots Market Size, By Country, 2014–2021 (USD Million)

Table 73 Asia-Pacific: Pharmaceutical Robotic Systems Market Size, By Type, 2014-2021 (USD Million)

Table 74 Asia-Pacific: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 75 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 76 Indicative List of Conferences/Exhibitions on Pharmaceutical Manufacturing in Japan

Table 77 Japan: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 78 Japan: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 79 Japan: Pharmaceutical Robotic Systems Market Size, By Application, 2014-2021 (USD Million)

Table 80 Indicative List of Conferences/Exhibitions on Pharmaceutical Manufacturing in China

Table 81 China: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 82 China: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 83 China: Market Size, By Application, 2014-2021 (USD Million)

Table 84 Indicative List of Conferences/Exhibitions on Pharmaceutical Manufacturing in RoAPAC

Table 85 RoAPAC: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 86 RoAPAC: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 87 RoAPAC: Pharmaceutical Robotic Systems Market Size, By Application, 2014-2021 (USD Million)

Table 88 Indicative List of Conferences/Exhibitions on Industrial Robots and Pharmaceutical Manufacturing in the RoW

Table 89 RoW: Pharmaceutical Robots Market Size, By Type, 2014-2021 (USD Million)

Table 90 RoW: Traditional Robots Market Size, By Type, 2014-2021 (USD Million)

Table 91 RoW: Pharmaceutical Robotic Systems Market Size, By Application, 2014-2021 (USD Million)

Table 92 Marketing and Promotions, 2013–2016

Table 93 Expansions, 2013-2016

Table 94 Agreements, Alliances, Collaborations, and Partnerships, 2013–2016

Table 95 Product Launches, 2013–2016

Table 96 Acquisitions, 2013–2016

Table 97 Product Enhancements, 2013–2016

Table 98 Other Strategies, 2013-2016

List of Figures (40 Figures)

Figure 1 Global Pharmaceutical Robotic Systems Market Segmentation

Figure 2 Global Pharmaceutical Robotic Systems Market: Research Methodology Steps

Figure 3 Key Data From Secondary Sources

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Research Design Diagram

Figure 8 Data Triangulation Methodology

Figure 9 Collaborative Robots Segment to Register the Highest CAGR From 2016 to 2021

Figure 10 Cartesian Robots to Be the Fastest-Growing Segment of the Traditional Pharmaceutical Robots Market From 2016 to 2021

Figure 11 Picking and Packaging Segment Accounted for the Largest Share of the Global Pharmaceutical Robotic Systems Market in 2016

Figure 12 Asia-Pacific to Register the Highest CAGR in the Forecast Period

Figure 13 Benefits Offered By Robotic Systems in Pharmaceutical Manufacturing, A Major Growth Driver of the Pharmaceutical Robotic Systems Market

Figure 14 Collaborative Robots to Register the Highest CAGR During the Forecast Period

Figure 15 Articulated Robots Accounted for the Largest Market Share in 2016

Figure 16 Asia-Pacific to Register the Highest CAGR During the Forecast Period

Figure 17 Picking and Packaging Segment Will Continue to Dominate the Pharmaceutical Robotic Systems Market in 2021

Figure 18 Pharmaceutical Robotic Systems Market: Drivers, Restraints, Opportunities, & Challenges

Figure 19 Pharmaceutical Robots Market, By Type

Figure 20 Collaborative Robots Segment to Register the Highest CAGR During the Forecast Period

Figure 21 Traditional Pharmaceutical Robots Market, By Type

Figure 22 Cartesian Robots to Register the Highest Growth Rate in the Forecast Period

Figure 23 Global Pharmaceutical Robotic Systems Market, By Application

Figure 24 Inspection of Pharmaceutical Drugs Segment to Register the Highest CAGR During the Forecast Period

Figure 25 Asia-Pacific Dominated the Global Pharmaceutical Robotic Systems Market in 2016

Figure 26 North America: Pharmaceutical Robots Market Overview

Figure 27 Europe: Pharmaceutical Robotic Systems Market Overview

Figure 28 Asia-Pacific: Pharmaceutical Robotic Systems Market Overview

Figure 29 RoW: Pharmaceutical Robots Market Overview

Figure 30 Top 5 Strategies Adopted By Players Over the Last Three Years (2013–2016)

Figure 31 Battle for Market Share: Marketing and Promotions Was the Key Strategy for Companies, During 2013-2016

Figure 32 Product Mix of Key Players in the Market (2016)

Figure 33 Kawasaki Heavy Industries Ltd: Company Snapshot (2015)

Figure 34 Fanuc Corporation: Company Snapshot (2015)

Figure 35 Kuka AG: Company Snapshot (2015)

Figure 36 ABB Ltd.: Company Snapshot (2015)

Figure 37 Yaskawa Electric Corporation: Company Snapshot (2015)

Figure 38 Mitsubishi Electric Corporation: Company Snapshot (2015)

Figure 39 Denso Corporation: Company Snapshot (2015)

Figure 40 Seiko Epson Corporation: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pharmaceutical Robots Market