Potato Protein Market Size, Share, Industry Growth, Trends Report by Type (Isolates and Concentrates), Nature (Organic and Conventional), Application (Food & Beverages and Feed), and Region (North America, Europe, Asia Pacific and Rest of the World) - Global Forecast to 2028

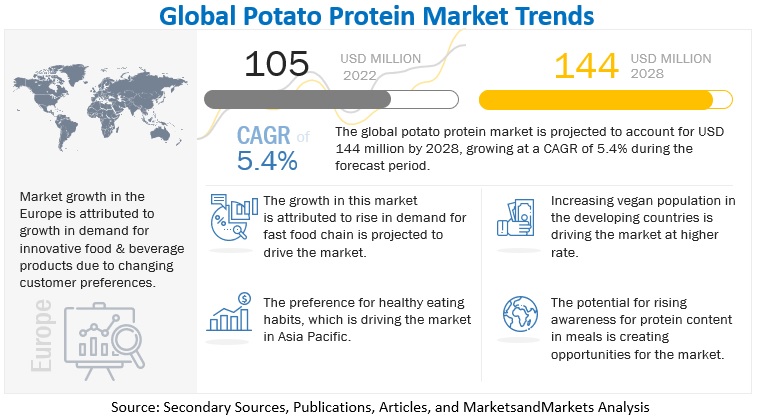

The potato protein market globally was valued at USD 105 million in 2022 and is anticipated to reach USD 144 million by 2028, expanding at a CAGR of 5.4% from 2022 to 2028. Potato protein is a plant-based protein derived from potatoes. It is a high-quality protein source that contains all essential amino acids and is low in fat and cholesterol-free too. As a result, it can be a healthy addition to a well-balanced diet, particularly for those who follow a plant-based diet. It is used to increase the protein content of food products, making them more nutritious and appealing to health conscious consumers.

Potato protein improve the texture and mouthfeel of food products and helps to create a more desirable texture of food products. It has similar binding qualities as egg, with excellent gelation and emulsification properties that can be inculcated in the bakery and confectionery food-making procedures. Due to their high functionality, potato is a crucial ingredient in new product development (NPD) in plant-based foods. Adding potato protein in different food and beverages items gives the food a full amino acid score with good functionality. In animal feed it is being used for anaerobic digestion in animals. All these benefits associated with potato protein, from being an ideal egg white replacement in bakery products to being added in food and feed products due to its superior functionality, will boost its demand in the global market.

To know about the assumptions considered for the study, Request for Free Sample Report

Potato Protein Market Dynamics

Drivers : There is rise in consumer preference towards vegan diet

According to data from Redefine Meat Ltd., in September 2021, there were an estimated 79 million vegans globally, which is just over one percent of the whole population. In the US, 2% of the population is identified as vegan; three-quarters are female. Only 40% of the world’s population is projected to eat meat by 2040. This, in turn, drives the demand for vegetable proteins such as potato proteins. Most countries worldwide are studied to have a vegan population ranging from around 4% to 10%. However, some countries have a higher percentage of the vegan population; for example, India was estimated to have a vegan population of 31%, due to religious beliefs, among other reasons. Three out of four Indians are lactose intolerant, according to a 2015 study done by the Sanjay Gandhi Post Graduate Institute of Medical Sciences. Further, studies are going on in this area, and increased concern regarding lactose intolerance will result in a growing need for meat and dairy alternatives since the country has a large flexitarian market.

The rising shift in consumer preference toward a vegan diet is being observed worldwide. According to the World population review, in 2019, the UK had the highest population of vegans, followed by Australia, Israel, New Zealand, Switzerland, Austria & Germany, and Sweden Currently, London alone has 200 vegan restaurants. The countries with the highest percentage of vegans are the UK, Australia, Israel, Austria, New Zealand, and India. This shift in consumer preference is largely attributed to the health concerns associated with meat & meat-based products and other animal-based products such as milk & milk-based products; health & wellness trends; rising ecological and food safety concerns; and rising consumer awareness about weight loss & management.

Thus, an increasing shift in preference of consumers toward the vegan diet to lead a healthy life is a major driving factor for the potato protein market.

Restraints: Potential fear of replacement of potato protein in food and feed industries

The use of potato protein in the food industry is largely limited to confectionery, bakeries, processed meat products, and dairy products. This is due to the limitations in the properties of potato protein that are not found to be suitable in food product formulations owing to issues regarding solubility, stability, and loss of its native properties. Moreover, extensive availability, broad distribution network, superior functionality, and suitability of substitute protein sources such as soy, milk, gelatine, whey, and egg in an extensive range of food applications have further limited the growth in demand and consumption potato protein in the food industry.

A similar scenario is observed in the feed industry wherein the consumption of potato protein in feed products is curbed by the lower price and easy availability of alternate sources such as soy meal, legumes, and fishmeal. Also, many feed-producing companies are unaware of the potato protein content benefits in feed, which also lessens its usage in the market.

Such unawareness of the nutritional benefits of potato protein in feed products and limited consumption of potato protein in the food & beverage industry restrains the growth of the potato protein market in the major developed and developing regions.

Opportunities: Adoption of new technologies in potato protein industry

Potato proteins can be easily extracted by various separation techniques, including an ion exchange (IEX) and expanded bed adsorption (EBA), and their functional properties can be modified for desired purposes. The most common emerging technologies in the potato protein industry are acid precipitation, ion exchange method, expanded bed adsorption, separation, and coagulation. The recent newly developed technique that has come up in the market is spray drying which is used to convert potato proteins into powdered forms. Other emerging technologies still under development include salting. Salting out is also an important method of protein isolation. The use of ammonium sulphate enabled the production of potato proteins with high efficacy but at a comparatively low protein concentration. Additionally, the incorporation of ferric chloride salt accelerated the precipitation of protein from juice, resulting in a recovery efficiency exceeding 86%. The use of the acid precipitation technique contributed to an increase in the solubility of the preparation and improved the stability of the emulsions formed with its participation. Natural adsorbents, such as clay minerals, were also used in the process of isolating proteins from potato fruit juice enabling the reduction of the number of glycoalkaloids in the obtained protein preparations.

Potato protein is a rich source of patatin and is used as a thickening agent to produce gel-like mixtures. Potato protein is healthy because of its nutritional benefits, such as gluten and allergen-free solutions. Potato protein concentrates are high in carbohydrates and fiber and low in fat, and an economical source of protein. It is used in various food applications, such as bakery, confectionery, and beverages, Owing to its gelling, texturizing, and thickening properties.

A potato plant protein for use in vegan and vegetarian meals is being developed by the UK potato supplier Branston in collaboration with the new technology company Root Extracts in 2022. It will transform secondary grade, low-value potatoes unfit for selling into usable plant protein. In 2013, Branston started investigating potato proteins in the lab to expand it into a profitable business. Moreover, Israeli entrepreneur PoLoPo has created a method that allows egg protein (ovalbumin) to be produced in potatoes. The startup is developing a protein extraction method that will express the protein in the potato itself.

Thus, the adoption of the upcoming technologies and the newer developed techniques in the market for the production of potato protein from potato fruit juices and potato starch are great opportunities for the global potato protein market in the near future.

Challenges: Low production and distribution of potato protein in global markets

Currently, the production of potato-based starch and protein is largely concentrated in Europe and, to a lesser extent, in other regions. The low production and distribution of potato protein in regions such as North America, Asia Pacific, South America, Africa, and the Middle East are largely attributed to the low production of potato starch, subsequently leading to limited availability of juice as a by-product, which acts as a raw material for potato protein; and established regional preferences for proteins such as animal-based in protein in North America and soy-based protein in Asia Pacific.

For example, in August 2022, Royal Avebe joined the United Nations global compact to meet its demand for sustainability as a part of its growth strategy. The market-driving strategy of Royal Avebe is to focus on high-quality raw materials grown sustainably and will help hold the company in a unique position in the market. However, the rules and regulations on raw materials create hurdles and challenges for the company to produce and distribute products in the market. Some of the regulations are mentioned below.

Food Standards Australia New Zealand (FSANZ) is an independent statutory agency established by the Food Standards Australia New Zealand Act 1991 (FSANZ Act). FSANZ is part of the Australian Government's Health portfolio. The agency classifies modified starches as food additives, and it proposes that any unmodified or modified starch that has been changed by physical or enzymatic treatment must be labelled as “starch.” For starch obtained from potato, wheat, peas, barley, oats, or hybridized strains of cereals, the specific name of the cereal must be declared, for instance: “potato starch.” According to the Food Safety and Standards Authority of India (FSSAI), all food classified as ‘Starches, other than chemically modified starches’ should be labelled as to its class title ‘Starch.’

As per USDA, China does not allow market access for fresh potato (other than seed potatoes) imports from any supplier due to SPS concerns. The US government agencies continue to work with their Chinese counterparts on negotiating market access of the US chipping potatoes to China.

Rising Trend of Plant-Based and Vegan Diet is Driving the Demand for Potato Protein in Japan

The demand for potato protein in Japan has been increasing due to the rising consumption trend of plant-based and vegan diets. Moreover, the increasing focus on healthy eating habits and the rising awareness of the benefits of protein consumption have also contributed to the growth of the potato protein market.

According to a report published by the Ministry of Agriculture, Forestry, and Fisheries of Japan in 2020, there has been a growing trend of health consciousness among Japanese consumers, leading to an increase in demand for functional food ingredients that can improve health and well-being. Food items that use potato protein in Japan includes meat substitutes for healthier alternative to meat, bakery products like breads, cakes and cookies, protein-rich beverages such as protein shakes and smoothies, pet food and nutritional supplements. This trend has led to the growth of the plant-based protein market, including potato protein.

In addition, the Ministry of Health, Labour and Welfare of Japan recommends that Japanese adults consume 0.8 grams of protein per kilogram of body weight per day for optimal health. However, according to a 2019 survey by the ministry, many Japanese adults were not meeting this recommended daily protein intake. This awareness of the importance of protein consumption may also contribute to the growth of the market in This is because potato protein is a high-quality protein source that can help to increase the protein intake of Japanese adults and meet their nutritional needs.

Therefore, the rising trend of plant-based and vegan diets, increasing health consciousness, and the growing awareness of the benefits of protein consumption are likely contributing to the growth of the potato protein market in Japan.

Potato Proteins in Feed Offers High Digestibility of Protein

Potato protein, a high-quality source of protein is used as an ingredient in animal feed. It is derived from potato processing by-products, such as potato starch. Also, it is sustainable and cost-effective alternative to other protein sources, such as soybean meal and fishmeal. It contains a high protein content and is rich in essential amino acids, which are important for animal growth and health. It is also low in anti-nutritional factors. For feed formulations, potato protein is used as a partial or complete replacement for other protein sources, depending on the animal species, age and production stage. Potato protein is commonly used in pig, poultry and aquaculture diets that improve feed efficiency and growth performance. Thus, the functional properties of potato protein improve feed processing, texture and palatability. The market for potato protein in feed is driven by various factors which include need for sustainable protein sources, increasing demand for animal protein, health benefits for animals, etc.

Regional Analysis:

Asia Pacific is one of the Major Market for Potato Protein Concentrates

The large base of the vegan population in the Asia Pacific region is a major driver for potato protein; however, the predominant preference for soy protein in food applications, the lack of awareness about the benefits of potato protein, constrained supply issues, and drawbacks associated with potato protein market restricts its growth in the food industry. A recession is unlikely to begin in the Asia Pacific (APAC) region in the coming year, the region will experience headwinds from rising interest rates and slower global trade growth. According to the International Monetary Fund (IMF), inbound investment and productivity gains in technology and agriculture might accelerate growth. However, if high inflation persists, the Reserve Bank of India is expected to raise its repo rate well over by 6%, forcing GDP growth to slow down. The IMF projected global growth of 3.2% in 2022 and 2.7% in 2023 in its World Economic Outlook released in October 2022. One potential impact of a recession on the market would be a decrease in demand. If consumers and businesses cut back on spending, they may be less likely to purchase products containing potato protein, leading to a drop in demand for this ingredient. Potato farmers may cut back on production or even go out of business if potato farmers and processors struggle financially during a recession. This could decrease the supply of potato protein, which could drive up prices for the ingredient. However, it is worth noting that other factors, such as shifts in consumer preferences, government policies, and technological advancements, also influence the market in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Potato Protein Market Key Players

The key players in this market include Avebe (Netherlands), Tereos (France), Kerry Group PLC (Ireland), Sudzucker AG (US), Roquette Freres (France), Emsland Group (Germany), KMC Ingredients (Denmark), Pepees Group (Poland), AKV Langholt (Denmark), PPZ Niechlow (Poland), The Scoular Company (US), Finnamyl (Finland), Kemin Industries (USA), Bioriginal (Canada), and Duynie (Netherlands).

Potato Protein Market Report Scope

|

Report Metric |

Details |

|

Market Size Valuation in 2022 |

USD 105 million |

|

Market Size Forecast in 2028 |

USD 144 million |

|

Growth Rate |

CAGR of 5.4% from 2022 - 2028 |

|

Units Considered |

Value (USD), Volume (TONS) |

|

Driving Factors |

Rise in consumer preference towards vegan diet |

|

Largest Growing Region |

Asia Pacific |

|

Companies Studied |

|

Potato Protein Market Segmentation

This research report categorizes the market, based on type, nature, application, and region.

|

Aspect |

Details |

|

By Type |

|

|

By Nature |

|

|

By Application |

|

|

By Region |

|

Potato Protein Market Stakeholders:

- Potato protein manufacturers and suppliers

- Potato protein associations and industry bodies

- Public and commercial research institutions/agencies/laboratories

-

Government regulatory authorities and agricultural research organizations on agricultural genetics

- US Department of Agriculture (USDA)

- Food and Drug Administration (FAO)

-

Crop farmer associations and cooperative societies

- National Potato Council

-

Other related associations, research organizations, and industry bodies:

- European Vegetable Protein Association (EUVEPRO)

- Canadian Celiac Association (CCA)

- North American Millers’ Association (NAMA)

- Food and Agriculture Organization (FAO)

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the potato protein market?

The market is expected to grow in Europe and is expected to dominate during the forecast period. The European potato protein market is projected to grow in the coming years due to increasing demand for plant-based protein sources and government support for sustainable agriculture and food production.

How big is the global potato protein market?

According to MarketsandMarkets, potato protein market is projected to reach USD 144 million by 2028 from USD 105 million by 2022, at a CAGR of 5.4% during the forecast period in terms of value.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Avebe (Netherlands), Tereos (France), Kerry Group PLC (Ireland), Sudzucker AG (US), Roquette Freres (France), Emsland Group (Germany), KMC Ingredients (Denmark), Pepees Group (Poland), AKV Langholt (Denmark), PPZ Niechlow (Poland), The Scoular Company (US), Finnamyl (Finland), Kemin Industries (USA), Bioriginal (Canada), and Duynie (Netherlands).

The global potato protein market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of potato protein are investing a considerable proportion of their revenues in research and development activities.

Which type is projected to account for the largest share of the potato protein market?

Potato protein concentrate is expected to dominate the potato protein market during the forecast period. In Western countries, it is a popular replacement for dairy protein or egg- white. It has better bioavailability and can be more concentrated than animal protein sources.

What is the potato protein market?

The potato protein market refers to the global industry involved in the production, supply, and consumption of proteins derived from potatoes. Potato protein is a plant-based protein known for its high nutritional value, commonly used in food and beverage products, animal feed, and various other applications.

What is driving the growth of the potato protein market?

The growth of the potato protein market is driven by the increasing demand for plant-based proteins due to the rising preference for vegan and vegetarian diets, as well as the growing awareness of the health benefits of plant-based foods. Additionally, the market is expanding due to the increasing demand for protein-rich ingredients in various industries like food, cosmetics, and animal feed.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISE IN CONSUMPTION OF PLANT-BASED DIETSINCREASE IN DEMAND FOR GLUTEN-FREE FOOD PRODUCTS

-

5.3 MARKET DYNAMICSDRIVERS- Increase in vegan population- Consumer concerns regarding food allergens in products- Nutritional benefits of potato protein- Increased demand for fast-food chainsRESTRAINTS- High production cost of potato protein- Potential fear of replacement of potato protein in food and feed industriesOPPORTUNITIES- Growth in investments in new production facilities- Adoption of new technologies in potato protein industryCHALLENGES- Low global production and distribution of potato protein

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTSOURCING OF RAW MATERIALSPRODUCTION & PROCESSINGDISTRIBUTION, MARKETING, AND SALES

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM OF POTATO PROTEIN MARKETPOTATO PROTEIN: DEMAND SIDEPOTATO PROTEIN: SUPPLY SIDEECOSYSTEM MAP

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS IN POTATO PROTEIN MARKET

-

6.6 TECHNOLOGY ANALYSISSPRAY DRYING- Atomization- Dehydration- Powder collectionSEPARATION AND COAGULATION

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY TYPESELLING PRICE CHARGED BY KEY PLAYERS IN TERMS OF TYPESAVERAGE SELLING PRICE, BY TYPE

-

6.8 POTATO PROTEIN MARKET: PATENT ANALYSIS

-

6.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.12 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Rest of the World

-

6.13 CASE STUDIESKMC INGREDIENTS: DEVELOPMENT OF POTATO PROTEIN FOR INCORPORATION IN NUTRITIOUS SNACKS AND BEVERAGESKERRY GROUP PLC: DEVELOPMENT OF POTATO PROTEIN FOR CHEESE-FLAVORED SNACKS

- 6.14 KEY CONFERENCES & EVENTS

- 7.1 INTRODUCTION

-

7.2 ISOLATESMULTIFUNCTIONAL USE IN FOOD & BEVERAGE INDUSTRY

-

7.3 CONCENTRATESHIGH PROTEIN CONTENT PREFERRED IN FEED APPLICATIONS AND VEGAN OPTIONS

- 8.1 INTRODUCTION

-

8.2 ORGANICGROWTH IN CUSTOMER AWARENESS REGARDING SAFETY ASSURANCE

-

8.3 CONVENTIONALCOST EFFICIENCY OF CONVENTIONAL PROTEINS

- 9.1 INTRODUCTION

-

9.2 FOOD & BEVERAGESGROWTH IN DEMAND FOR ALLERGEN-FREE FOOD & BEVERAGE PRODUCTSBAKERY & CONFECTIONERY- Increase in demand for gluten-free bakery items- Breads- Pastries- Cookies & Crackers- Other Bakery & Confectionery ApplicationsBEVERAGES- Increase in working population in need of ready-to-drink beveragesPROCESSED FOOD- Demand for healthy and gluten-free snack items among young individualsDAIRY ALTERNATIVES- Consumer awareness toward health benefits associated with dairy alternativesMEAT PRODUCTS- High biological value with high amino acid score of potato proteinSPORTS NUTRITION- Demand for higher body metabolism and lower blood pressure levels in sportsINFANT NUTRITION- Rise in awareness of lactose intolerance and milk allergiesMEAT ALTERNATIVES- Preference for frying crust texture and binding ingredientsOTHER FOOD & BEVERAGE APPLICATIONS

-

9.3 FEEDHIGH PROTEIN DIGESTIBILITY OFFERED BY POTATO PROTEIN IN FEED

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAINTRODUCTIONNORTH AMERICA: RECESSION IMPACTUS- Government investments and increase in exportsCANADA- Increase in demand for plant-based protein sources and sustainable food optionsMEXICO- Government initiatives and rise in use of potato protein in food & beverage industry

-

10.3 EUROPEINTRODUCTIONEUROPE: RECESSION IMPACTGERMANY- Technological advancementsFRANCE- Active promotion of plant-based proteins by governmentUK- Versatility in food & beverage applicationsITALY- High prevalence of celiac diseaseREST OF EUROPE

-

10.4 ASIA PACIFICINTRODUCTIONASIA PACIFIC: RECESSION IMPACTCHINA- Rise in application of potato protein in feed sectorJAPAN- Rise in trend of plant-based and vegan dietsINDIA- Rise in popularity of vegetarian and vegan dietsAUSTRALIA- Increase in popularity of health and functional foodsREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)INTRODUCTIONROW: RECESSION IMPACTSOUTH AMERICA- Large-scale production of potatoesMIDDLE EAST & AFRICA- Increase in demand for plant-based foods

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

11.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.7 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

12.1 KEY COMPANIESAVEBE- Business overview- Products offered- Recent developments- MnM viewTEREOS- Business overview- Products offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products offered- Recent developments- MnM viewSÜDZUCKER AG- Business overview- Products offered- Recent developments- MnM viewROQUETTE FRÈRES- Business overview- Products offered- Recent developments- MnM viewEMSLAND GROUP- Business overview- Products offered- Recent developments- MnM viewKMC INGREDIENTS- Business overview- Products offered- Recent developments- MnM viewPEPEES GROUP- Business overview- Products offered- Recent developments- MnM viewAKV LANGHOLT- Business overview- Products offered- Recent developments- MnM viewPPZ NIECHLOW- Business overview- Products offered- Recent developments- MnM viewTHE SCOULAR COMPANY- Business overview- Products offered- Recent developments- MnM viewFINNAMYL- Business overview- Products offered- Recent developments- MnM viewKEMIN INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewBIORIGINAL- Business overview- Products offered- Recent developments- MnM viewDUYNIE- Business overview- Products offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSAMINOLA B.V.- Business overview- Products offered- Recent developments- MnM viewGAOYUAN- Business overview- Products offered- Recent developments- MnM viewHEALTHMARQUE- Business overview- Products offered- Recent developments- MnM viewHJHERB- Business overview- Products offered- Recent developments- MnM viewKINGS DEHYDRATED FOODS PRIVATE LIMITED- Business overview- Products offered- Recent developments- MnM viewZETPEZETSÜDSTÄRKEROYAL INGREDIENTS GROUPMEELUNIEEQUISTRO

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 TEXTURED VEGETABLE PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEWTEXTURED VEGETABLE PROTEIN MARKET, BY TYPETEXTURED VEGETABLE PROTEIN MARKET, BY REGION

-

13.4 PLANT-BASED PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEWPLANT-BASED PROTEIN MARKET, BY TYPEPLANT-BASED PROTEIN MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2022

- TABLE 2 LIMITATIONS & ASSOCIATED RISKS

- TABLE 3 POTATO PROTEIN MARKET SNAPSHOT (VALUE)

- TABLE 4 NUMBER OF VEGAN RESTAURANTS IN TOP FIVE VEGAN COUNTRIES

- TABLE 5 CHINA: COST AND PROFIT ANALYSIS OF POTATO STARCH PRODUCTION LINE, 2019

- TABLE 6 APPLICATION OF POTATO PROTEIN VS. OTHER PROTEIN SOURCES

- TABLE 7 POTATO PROTEIN MARKET: ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE FOR TYPE, 2022 (USD/KG)

- TABLE 9 POTATO PROTEIN ISOLATES: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 10 POTATO PROTEIN CONCENTRATES: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 11 LIST OF KEY PATENTS PERTAINING TO POTATO PROTEIN, 2013–2022

- TABLE 12 TOP 10 IMPORTERS OF POTATO STARCH, 2021 (USD THOUSAND)

- TABLE 13 TOP 10 EXPORTERS OF POTATO STARCH, 2021 (USD THOUSAND)

- TABLE 14 POTATO PROTEIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR POTATO PROTEIN APPLICATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 AVEBE: SOLANIC100 POTATO PROTEIN

- TABLE 24 KERRY GROUP PLC: CHEESE-FLAVORED SNACKS

- TABLE 25 POTATO PROTEIN MARKET: LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 26 POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 27 POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 28 POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (TON)

- TABLE 29 POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 30 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 31 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 32 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2017–2022 (TON)

- TABLE 33 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2023–2028 (TON)

- TABLE 34 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 35 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 36 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2017–2022 (TON)

- TABLE 37 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2023–2028 (TON)

- TABLE 38 POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 39 POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 40 ORGANIC POTATO PROTEIN MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 41 ORGANIC POTATO PROTEIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 42 CONVENTIONAL POTATO PROTEIN MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 43 CONVENTIONAL POTATO PROTEIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 44 POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 45 POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 46 FOOD & BEVERAGES APPLICATION MARKET, BY SUBAPPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 47 FOOD & BEVERAGES APPLICATION MARKET, BY SUBAPPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 48 FOOD & BEVERAGES APPLICATION MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 49 FOOD & BEVERAGES APPLICATION MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 50 BAKERY & CONFECTIONERY APPLICATION MARKET, BY SUBAPPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 51 BAKERY & CONFECTIONERY APPLICATION MARKET, BY SUBAPPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 52 BAKERY & CONFECTIONERY APPLICATION MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 53 BAKERY & CONFECTIONERY APPLICATION MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 54 BREAD APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 55 BREAD APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 56 PASTRY APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 57 PASTRY APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 58 COOKIE & CRACKER APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 59 COOKIE & CRACKER APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 60 OTHER BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 61 OTHER BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 62 BEVERAGE APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 63 BEVERAGE APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 64 PROCESSED FOOD APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 65 PROCESSED FOOD APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 66 DAIRY ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 67 DAIRY ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 68 MEAT PRODUCT APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 69 MEAT PRODUCT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 70 SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 71 SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 72 INFANT NUTRITION APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 73 INFANT NUTRITION APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 74 MEAT ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 75 MEAT ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 76 OTHER FOOD APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 77 OTHER FOOD APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 78 FEED APPLICATIONS MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 79 FEED APPLICATIONS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 80 POTATO PROTEIN MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 81 POTATO PROTEIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 82 POTATO PROTEIN MARKET, BY REGION, 2017–2022 (TON)

- TABLE 83 POTATO PROTEIN MARKET, BY REGION, 2023–2028 (TON)

- TABLE 84 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 85 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 86 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2017–2022 (TON)

- TABLE 87 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 88 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 89 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 90 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (TON)

- TABLE 91 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 92 NORTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 93 NORTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 95 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 96 NORTH AMERICA: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 97 NORTH AMERICA POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 98 US: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 99 US: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 100 US: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 101 US: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 102 US: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 103 US: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 104 CANADA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 105 CANADA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 106 CANADA: NORTH AMERICAN POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 107 CANADA: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 108 CANADA: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 109 CANADA: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 110 MEXICO: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 111 MEXICO: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 112 MEXICO: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 113 MEXICO: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 114 MEXICO: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 115 MEXICO: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 116 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 117 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 118 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2017–2022 (TON)

- TABLE 119 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 120 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 121 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 122 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (TON)

- TABLE 123 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 124 EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 125 EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 126 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 127 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 128 GERMANY: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 129 GERMANY: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 130 GERMANY: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 131 GERMANY: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 132 GERMANY: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 133 GERMANY: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 134 FRANCE: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 135 FRANCE: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 136 FRANCE: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 137 FRANCE: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 138 FRANCE: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 139 FRANCE: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 140 UK: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 141 UK: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 142 UK: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 143 UK: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 144 UK: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 145 UK: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 146 ITALY: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 147 ITALY: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 148 ITALY: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 149 ITALY: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 150 ITALY: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 151 ITALY: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 152 REST OF EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 153 REST OF EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 154 REST OF EUROPE: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 155 REST OF EUROPE: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 156 REST OF EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 157 REST OF EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 158 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 159 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 160 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2017–2022 (TON)

- TABLE 161 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 162 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 163 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 164 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (TON)

- TABLE 165 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 166 ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 167 ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 168 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 169 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 170 ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 171 ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 172 CHINA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 173 CHINA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 174 CHINA: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 175 CHINA: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 176 CHINA POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 177 CHINA POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 178 JAPAN: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 179 JAPAN: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 180 JAPAN POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 181 JAPAN: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 182 JAPAN: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 183 JAPAN: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 184 INDIA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 185 INDIA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 186 INDIA: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 187 INDIA: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 188 INDIA: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 189 INDIA: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 190 AUSTRALIA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 191 AUSTRALIA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 192 AUSTRALIA: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 193 AUSTRALIA: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 194 AUSTRALIA: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 195 AUSTRALIA: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 196 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 197 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 198 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 199 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 200 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 201 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 202 ROW: POTATO PROTEIN MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 203 ROW: POTATO PROTEIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 204 ROW: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 205 ROW: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 206 ROW: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (TON)

- TABLE 207 ROW: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 208 ROW: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 209 ROW: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 210 ROW: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 211 ROW: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 212 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 213 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 214 SOUTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 215 SOUTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 216 SOUTH AMERICA: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 217 SOUTH AMERICA: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 218 SOUTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 219 SOUTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 220 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 221 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 222 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY NATURE, 2017–2022 (USD THOUSAND)

- TABLE 223 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 224 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 225 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 226 POTATO PROTEIN MARKET: DEGREE OF COMPETITION

- TABLE 227 STRATEGIES ADOPTED BY KEY POTATO PROTEIN MANUFACTURERS

- TABLE 228 COMPANY FOOTPRINT, BY TYPE

- TABLE 229 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 230 COMPANY FOOTPRINT, BY REGION

- TABLE 231 OVERALL COMPANY FOOTPRINT

- TABLE 232 POTATO PROTEIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 233 POTATO PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 234 POTATO PROTEIN MARKET: DEALS, APRIL 2021–OCTOBER 2022

- TABLE 235 POTATO PROTEIN MARKET: OTHER DEVELOPMENTS, MARCH 2019–JANUARY 2023

- TABLE 236 AVEBE: COMPANY OVERVIEW

- TABLE 237 AVEBE: PRODUCTS OFFERED

- TABLE 238 AVEBE: DEALS

- TABLE 239 AVEBE: OTHER DEVELOPMENTS

- TABLE 240 TEREOS: BUSINESS OVERVIEW

- TABLE 241 TEREOS: PRODUCTS OFFERED

- TABLE 242 TEREOS: DEALS

- TABLE 243 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 244 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 245 KERRY GROUP PLC: DEALS

- TABLE 246 KERRY GROUP PLC: OTHER DEVELOPMENTS

- TABLE 247 SÜDZUCKER AG: BUSINESS OVERVIEW

- TABLE 248 SÜDZUCKER AG: PRODUCTS OFFERED

- TABLE 249 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 250 ROQUETTE FRÈRES: PRODUCTS OFFERED

- TABLE 251 ROQUETTE FRÈRES: DEALS

- TABLE 252 EMSLAND GROUP: BUSINESS OVERVIEW

- TABLE 253 EMSLAND GROUP: PRODUCTS OFFERED

- TABLE 254 EMSLAND GROUP: DEALS

- TABLE 255 KMC INGREDIENTS: BUSINESS OVERVIEW

- TABLE 256 KMC INGREDIENTS: PRODUCTS OFFERED

- TABLE 257 KMC INGREDIENTS: OTHER DEVELOPMENTS

- TABLE 258 PEPEES GROUP: BUSINESS OVERVIEW

- TABLE 259 PEPEES GROUP: PRODUCTS OFFERED

- TABLE 260 AKV LANGHOLT: BUSINESS OVERVIEW

- TABLE 261 AKV LANGHOLT: PRODUCTS OFFERED

- TABLE 262 AKV LANGHOLT: DEALS

- TABLE 263 PPZ NIECHLOW: BUSINESS OVERVIEW

- TABLE 264 PPZ NIECHLOW: PRODUCTS OFFERED

- TABLE 265 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 266 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 267 THE SCOULAR COMPANY: OTHER DEVELOPMENTS

- TABLE 268 FINNAMYL: BUSINESS OVERVIEW

- TABLE 269 FINNAMYL: PRODUCTS OFFERED

- TABLE 270 KEMIN INDUSTRIES: BUSINESS OVERVIEW

- TABLE 271 KEMIN INDUSTRIES: PRODUCTS OFFERED

- TABLE 272 KEMIN INDUSTRIES: DEALS

- TABLE 273 KEMIN INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 274 BIORIGINAL: BUSINESS OVERVIEW

- TABLE 275 DUYNIE: BUSINESS OVERVIEW

- TABLE 276 DUYNIE: PRODUCTS OFFERED

- TABLE 277 AMINOLA B.V.: BUSINESS OVERVIEW

- TABLE 278 AMINOLA B.V.: PRODUCTS OFFERED

- TABLE 279 GAOYUAN: BUSINESS OVERVIEW

- TABLE 280 GAOYUAN: PRODUCTS OFFERED

- TABLE 281 HEALTHMARQUE: BUSINESS OVERVIEW

- TABLE 282 HEALTHMARQUE: PRODUCTS OFFERED

- TABLE 283 HJHERB: BUSINESS OVERVIEW

- TABLE 284 HJHERB: PRODUCTS OFFERED

- TABLE 285 KINGS DEHYDRATED FOODS PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 286 KINGS DEHYDRATED FOOD PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 287 MARKETS ADJACENT TO POTATO PROTEIN

- TABLE 288 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 289 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 290 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 291 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 292 PLANT-BASED PROTEIN MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 293 PLANT-BASED PROTEIN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 294 PLANT-BASED PROTEIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 295 PLANT-BASED PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 POTATO PROTEIN: GEOGRAPHIC SEGMENTATION

- FIGURE 3 POTATO PROTEIN MARKET: RESEARCH DESIGN

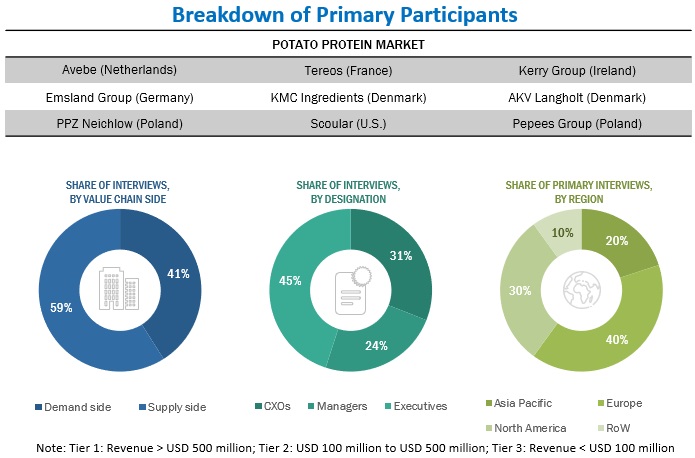

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 POTATO PROTEIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 POTATO PROTEIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 POTATO PROTEIN MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 POTATO PROTEIN MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS OF STUDY

- FIGURE 11 INDICATORS OF RECESSION

- FIGURE 12 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 13 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 14 RECESSION INDICATORS AND THEIR IMPACT ON POTATO PROTEIN MARKET

- FIGURE 15 POTATO PROTEIN MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST (USD MILLION)

- FIGURE 16 POTATO PROTEIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 17 POTATO PROTEIN MARKET, BY TYPE, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 18 POTATO PROTEIN MARKET, BY REGION, 2022

- FIGURE 19 DEMAND FOR FAST FOOD AND PLANT-BASED FOOD FOR POTATO PROTEIN MARKET

- FIGURE 20 US WAS LARGEST MARKET GLOBALLY IN 2022

- FIGURE 21 GERMANY AND FEED WERE LARGEST POTATO PROTEIN MARKET SEGMENTS IN EUROPE IN 2022

- FIGURE 22 POTATO PROTEIN CONCENTRATES PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 CONVENTIONAL POTATO PROTEIN TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 FEED APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 25 EUROPE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 26 US: PLANT-BASED FOOD MARKET SALES, 2017 VS. 2019 (USD BILLION)

- FIGURE 27 US: SALES OF GLUTEN-FREE PRODUCTS, 2020 VS. 2026 (USD BILLION)

- FIGURE 28 POTATO PROTEIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 PROTEIN FRACTIONS OF POTATO PROTEIN

- FIGURE 30 POTATO PROTEIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 POTATO PROTEIN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 POTATO PROTEIN MARKET: MARKET MAP

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 SELLING PRICE OF KEY PLAYERS FOR POTATO PROTEIN TYPE, 2022 (USD/KG)

- FIGURE 35 AVERAGE SELLING PRICE, BY TYPE, 2018–2022 (USD/TON)

- FIGURE 36 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 37 REGIONAL ANALYSIS OF PATENTS GRANTED FOR POTATO PROTEIN, 2013–2022

- FIGURE 38 IMPORT VALUE OF POTATO STARCH FOR KEY COUNTRIES, 2017–2021 (USD THOUSAND)

- FIGURE 39 EXPORT VALUE OF POTATO STARCH FOR KEY COUNTRIES, 2017–2021 (USD THOUSAND)

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING FOR TOP APPLICATIONS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 42 US ACCOUNTED FOR LARGEST SHARE OF POTATO PROTEIN MARKET IN 2022

- FIGURE 43 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR OF POTATO PROTEIN MARKET

- FIGURE 44 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 45 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 46 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 47 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 48 EUROPE: POTATO PROTEIN MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 50 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 51 ASIA PACIFIC: POTATO PROTEIN MARKET SNAPSHOT

- FIGURE 52 AFRICA: INFLATION RATES, 2017–2021

- FIGURE 53 ROW: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 54 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 55 POTATO PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 56 POTATO PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 57 AVEBE: COMPANY SNAPSHOT

- FIGURE 58 TEREOS: COMPANY SNAPSHOT

- FIGURE 59 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 60 SÜDZUCKER AG: COMPANY SNAPSHOT

- FIGURE 61 AGRANA GROUP: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of potato protein market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), International Society for Horticulture Sciences (ISHS), Portuguese Association for Horticulture, Confederation of Horticulture Association of India, National Institute of Post-Harvest Technology, American Horticulture Society, Indian Academy of Horticulture Science (IAHS), International Association of Horticultural Producers (AIPH), Union Fleurs-International Flower Trade association, Floriculture International, European Association for Flower Growers, European Botanical and Horticultural Libraries Group (EBHL), were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The potato protein market comprises several stakeholders, including potato protein solution manufacturers and suppliers, agrochemical manufacturers, floriculture and horticulture organizations, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, potato protein solution distributors and wholesalers, importers & exporters of potato protein solution, potato protein solution manufacturers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of horticulture and floriculture companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Potato Protein Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the potato protein market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent market—the crop protection market—was considered to validate further the market details of potato protein.

Bottom-up approach:

- The market size was analyzed based on the share of each type of potato protein and its penetration within the crop type at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include demand within the supply chain including floriculture and horticulture industry; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting potato protein market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Potato Protein Market Report Objectives

- To define, segment, and project the global market for potato protein on the basis of type, nature, application and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies.

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the potato protein market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European potato protein market, by key country

- Further breakdown of the Rest of South America market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Potato Protein Market