The study involved four major activities in estimating the size of the virtual reality market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering virtual reality systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the virtual reality market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of virtual reality systems to identify key players based on their products and prevailing industry trends in the virtual reality market by technology, type, product type, end-user industry, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

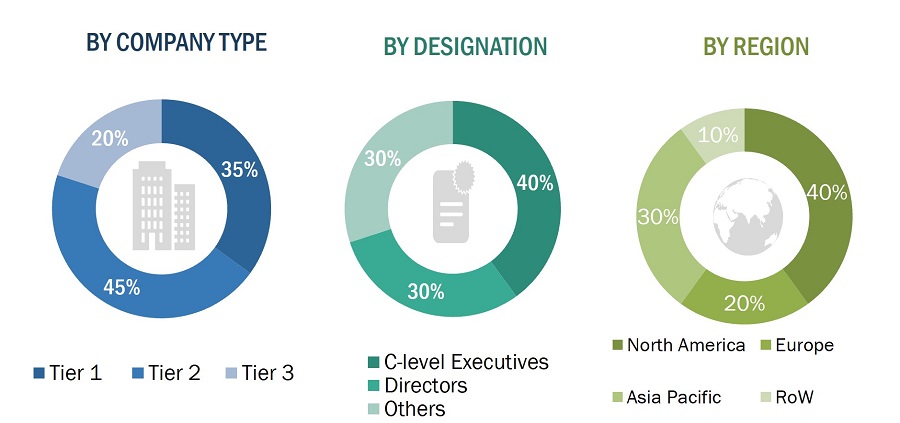

Extensive primary research has been conducted after understanding and analyzing the current scenario of the virtual reality market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the virtual reality market.

-

Identifying application wherein virtual reality systems are deployed or are expected to use

-

Analyzing major providers of virtual reality equipment’s and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

-

Analyzing the average selling price of virtual reality systems powered by different technologies

-

Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

-

Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

-

Tracking the ongoing developments and identifying the upcoming developments in the market that include investments, research and development activities, product launches, contracts, collaborations, and partnerships undertaken, and forecasting the market size based on these developments

-

Carrying out multiple discussions with key opinion leaders to understand the types of virtual reality products, services, and software designed and developed, thereby analyzing the break-up of the scope of work carried out by the major companies in the virtual reality market

-

Arriving at the market estimates by analyzing the revenue generated by key companies providing virtual reality products on the basis of their locations (countries) and then combining the market size for each country to get the market estimate by region

-

Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CXOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

-

Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the virtual reality market.

-

Focusing on top-line investments and expenditures being made in the ecosystems of various applications

-

Calculating the market size, considering revenues from major players through the cost of virtual reality systems

-

Segmenting each application of the virtual reality system in each region and deriving the global market size based on the region

-

Acquiring and analyzing information related to revenues generated by players through their crucial product offerings

-

Conducting multiple on-field discussions with key opinion leaders involved in developing various virtual reality solutions

-

Estimating geographical splits by using secondary sources on the basis of various factors, such as the number of players in a specific country and region, types of virtual reality products/solutions, and levels of services offered across several application

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the virtual reality market.

Market Definition

Virtual Reality (VR) is a simulated experience that employs 3D near-eye displays and pose tracking to give the user an immersive feel of a virtual world. It creates simulated environments that can be similar to or entirely different from the real world, with applications in entertainment, education, healthcare, and marketing These environments are designed to be immersive and interactive, allowing users to feel like they are truly present within the virtual world. VR typically utilizes headsets with near-eye displays and tracking mechanisms to create a sense of movement and position within the simulation. It can also incorporate other sensory elements like sound and haptics to further enhance the experience.

Key Stakeholders

-

Raw material and manufacturing equipment suppliers

-

Semiconductor foundries

-

Original equipment manufacturers (OEMs)

-

Augmented reality and virtual reality device manufacturers

-

Original design manufacturers (ODMs) and OEM technology solution providers

-

Research organizations

-

Technology standard organizations, forums, alliances, and associations

-

Technology investors

-

Governments, financial institutions, and investment communities

-

Analysts and strategic business planners

Report Objectives

-

To describe and forecast the size of the virtual reality market, by technology, offering device type, application, and region, in terms of value

-

To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

-

To forecast the size of the virtual reality market by device type, in terms of volume

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the virtual reality market

-

To analyze the virtual reality value chain and ecosystem, along with the average selling price of virtual reality systems

-

To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments

-

To provide details of the competitive landscape for market leaders

-

To analyze strategies such as product launches, expansion, collaborations, acquisitions, partnerships, and expansions adopted by players in the virtual reality market

-

To profile key players in the virtual reality market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players based on various blocks of the supply chain

BRIZARD

Apr, 2022

Hi, I wanted to understand the VR market in Asia. Could you please share a sample?.

Tomas

Apr, 2022

Valorizar Economicamente el crecimiento del Mercado de Realidad Virtual los próximos 5 años.