Satellite Modem Market Size, Share & Industry Growth Analysis Report by Application (Mobile & Backhaul, Offshore Communication, Tracking & Monitoring), End-User Industry (Telecom, Marine, Military), Channel Type, Data Rate, Technology, & Geography - Global Growth Driver and Industry Forecast to 2035

Updated on : October 23, 2024

Satellite Modem Market Size & Growth

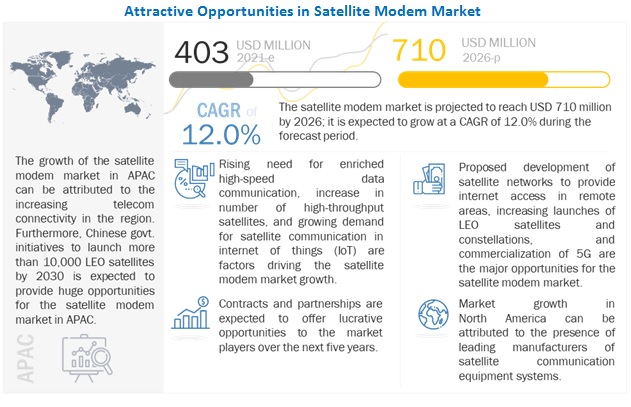

Global Satellite modem market size is expected to reach USD 710 million by 2026 from USD 403 million in 2021, growing at a CAGR of 12.0% during the forecast period from 2021 to 2026.

The satellite modem market is experiencing significant growth driven by the increasing demand for high-speed internet connectivity, especially in remote and underserved regions where traditional broadband infrastructure is lacking. Satellite modems play a crucial role in facilitating satellite communication, enabling various applications such as broadband internet, television broadcasting, and mobile backhaul. Key trends influencing the market include the rising adoption of satellite-based services in the telecommunications sector, advancements in satellite technology, and the proliferation of low Earth orbit (LEO) satellite constellations that promise enhanced connectivity and lower latency. Furthermore, the growing need for reliable communication systems in sectors like maritime, aviation, and disaster recovery is also contributing to market expansion. As businesses and consumers alike seek uninterrupted and high-quality internet access, the satellite modem market is poised for continued growth.

It was observed that the growth rate was compound annual growth rate (CAGR) of 8.89% from 2021 to 2022. VSAT Technology segment is expected to grow at a highest CAGR of 7.87%. In the upcoming years, the market for satellite modems is anticipated to expand rapidly due to the rising need for high-speed data connectivity in rural and distant places. The increasing use of satellite communication in a variety of sectors, including as oil and gas, defence, and aerospace, is one of the other reasons boosting the market.

A few key factors driving the growth of the satellite modem market are rising need for enriched high-speed data communication, increase in the number of high-throughput satellites (HTS), and growing demand for satellite communication in internet of things (IoT).

To know about the assumptions considered for the study, Request for Free Sample Report

Satellite Modem Market Trends and Dynamics

Driver: Rising need for enriched high-speed data communication

The rising demand for real-time and high-speed communication has generated demand for advanced high-speed satellite modems from different end-user industries such as marine, transportation, telecommunications, oil and gas, and education, among others. To address this growing need, satellite modem manufacturers, such as ST Engineering (Singapore) Viasat, Inc. (US), Teledyne Technologies (US), and Comtech EF Data Corporation (US), are designing high-speed satellite modems. Such continuous developments in satellite modem technology have enabled users to transmit large amounts of data efficiently.

Restraint: Ambiguity in regulatory framework pertaining to satellite communication protocols and standards

Ambiguous regulatory frameworks make it difficult for satellite operators to identify if and to what extend regulations apply to them. Furthermore, there is a lack of a harmonized approach to licensing and frequency authorizations from national authorities. Frequency licensing can also be problematic for small satellite operators as the frequencies they commonly use—the VHF and UHF bands—are often unfamiliar to national authorities compared to ranges in the L, S, C, Ku, and Ka bands. This poses a major difficulty for satellite modem manufacturers as they have to incorporate all such standards and communication protocols while manufacturing modems for use for different counties or regions.

Opportunity: Increasing launches of LEO satellites and constellations

CubeSats and other small satellites are also gaining attention; many companies in the satellite modem market space have proposed or are implementing plans to build satellite constellations. For example, Starlink had 356 satellites in orbit from 2019 to May 2020. As of August 2021, there were 1600 Starlink satellites in the orbit. SpaceX is also in the race to deploy small LEO satellites and has filed paperwork for up to 42,000 satellites for the constellation. Amazon is investing over USD 10 billion to build a constellation of 3,236 low-earth orbit satellites as a part of its global space internet initiative, Project Kuiper.

Challenge: Vulnerability of SATCOM devices to cybersecurity attacks

Incidents of cybersecurity breaches have increased across the world in the past few years. Security is the most significant area of technical concern for most organizations deploying IoT systems, and now 5G networks, with multiple devices connected across networks, platforms, and devices. This is also true for satellites, given the size and scope, as well as the number of earth station access points.

IoT proliferation means if one single device isn't encrypted or the communication isn't protected, a bad actor can manipulate it and potentially a whole network of connected devices. It isn't just the devices themselves that need to be protected, but it is also every stage of data transmission too.

Satellite Modem Market Segmentation

“The satellite modem market for MCPC satellite modem is expected to grow at a higher CAGR from 2021 to 2026.”

The satellite modem industry for MCPC channel type is expected to grow at a higher CAGR from 2021 to 2026. The growth of this segment is attributed to the unparalleled channel efficiency offered by these modems, which is the core requirement of high-data-traffic applications, such as mobile communication, internet, and broadband services. MCPC satellite modems can be integrated with IP networks to provide seamless connection for voice, video, and data traffic. Broadband internet services for enterprise networks are possible through MCPC modem technology because of its high data rate capacity over satellite technology.

“High speed data rate satellite modems expected to hold the largest satellite modem market share during forecast period.”

High speed data rate satellite modems are expected to hold the largest share of the market from 2021 to 2026. This is due to the growing demand for high-data rate and high-bandwidth applications such as mobile & backhaul and offshore communication. Satellite service providers enable internet, cellular, and data network connectivity for remote locations. To keep pace with the high demand for data while controlling operational expenses, high-speed data rate satellite modems are necessary.

Additionally, the growing demand from the commercial and military sectors for on-the-move communications at high data rates further drives the satellite modem market for the high-data rate satellite modems.

“The satellite modem market for transportation and logistics end-user industry is expected to grow at the highest CAGR during the forecast period.”

The market for transportation and logistics end-user industry is expected to grow at the highest CAGR during the forecast period. In transportation and logistics, there is a constant need to transfer real-time data, including vehicle location, traffic density, video and audio, temperature range of vehicles transporting perishables, and emergency notifications. To transmit and receive such data, high-speed data rate satellite modems, which can set up a communication channel between the vehicle and the monitoring center, are used. Satellite modems also increase the accuracy and speed of the Global Positioning System (GPS).

“Metal processing end-user industry expected to grow at the highest CAGR during the forecast period.”

Metal processing end-user industry is expected to grow at the highest CAGR during the forecast period. Satellite modems market are used in different stages of the diverse process of metal processing industries such as forging, rolling, extrusion, and others. Also, metal companies are seeking more satellite modem devices than other temperature measurement solutions such as thermocouples owing to their robust, accurate, and standalone temperature measurement capabilities.

“Satcom-on-the-move (SOTM) technology based satellite modem market expected to grow at the highest CAGR during the forecast period.”

Satcom on-the-move (SOTM) terminals are being increasingly used in military and commercial applications. In military applications, these terminals are used primarily for tactical communication. SOTM terminals are used for broadband communication by maritime vessels, trains, airplanes, land vehicles, and other means of transport. However, in commercial applications, these terminals are primarily used for broadband Internet services. Satellite modems such as EBEM MD-1366 and CBM-400 of Viasat, Inc.; 9800 AR of ST Engineering iDirect, HM400 of Hughes Networks Systems, and QMultiFlex-400 Point-to-Multipoint Satellite Modem of Teledyne Technologies provide the functionality of communications on the move.

To know about the assumptions considered for the study, download the pdf brochure

“Satellite modem market in APAC to grow at highest CAGR during the forecast period.”

The satellite modem industry analysis in APAC is expected to grow at the highest CAGR from 2020 to 2025. This market will be driven by the growing demand for metals such as steel for complex industrial applications. China, Japan, South Korea, and India are expected to drive the market in APAC. China remains the largest satellite modem market for satellite modems and is anticipated to remain dominant throughout the forecast period. Investments for the expansion of glass manufacturing and government support for steel production are set to offer huge opportunities for the market in APAC.

Top Satellite Modem Companies - Key Market Players

Comtech Telecommunications Corp. (US), ST Engineering (Singapore), Teledyne Technologies (US), Gilat Satellite Networks Ltd. (Israel), Viasat, Inc. (US), ORBCOMM Inc. (US), NOVELSAT (Israel), Datum Systems (US), Hughes Network Systems (US), WORK Microwave GmbH (Germany), ND SATCOM (Germany), Amplus Communication (Singapore), AYECKA Ltd (Israel), and SatixFy (Israel) are few major players in satellite modem companies.

Satellite Modem Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 403 Million |

| Expected Value | USD 710 Million |

| Growth rate | CAGR of 12.0% |

|

Forecast period |

2021–2026 |

|

On Demand Data Available |

2030 |

|

Years considered |

2017–2026 |

|

Forecast units |

Value (USD million), Volume (Units) |

|

Segments covered |

|

|

Regions covered |

|

| Market Leaders | ST Engineering (Singapore), Gilat Satellite Networks Ltd. (Israel), NOVELSAT (Israel), WORK Microwave GmbH (Germany), ND SATCOM (Germany), Amplus Communication (Singapore), AYECKA Ltd (Israel), and SatixFy (Israel) |

| Top Companies in North America | Comtech Telecommunications Corp. (US), Teledyne Technologies (US), Viasat, Inc. (US), ORBCOMM Inc. (US), Datum Systems (US), Hughes Network Systems (US). |

| Key Market Driver | Rising need for enriched high-speed data communication |

| Key Market Opportunity | Increasing launches of LEO satellites and constellations |

| Largest Growing Region | Asia Pacific |

|

Highest CAGR Segment |

Transportation and Logistics End-user Industry, Metal Processing End-user Industry |

This report categorizes the satellite modem market analysis based on Channel type, Data rate, Application, End-user Industry and Technology.

On the basis of Channel Type, the satellite modem market has been segmented as follows:

- SCPC Modem

- MCPC Modem

On the basis of Data Rate, the satellite modem market has been segmented as follows:

- High Speed

- Mid Range

- Entry Level

On the basis of Application, the satellite modem market has been segmented as follows:

- Mobile & Backhaul

- IP Trunking

- Offshore Communication

- Tracking & Monitoring

- Enterprise & Broadband

- In-flight Connectivity

- Media & Broadcast

- Others (Government, education, emergency response, and disaster recovery applications)

On the basis of End-user Industry, the satellite modem market has been segmented as follows:

- Energy & Utilities

- Mining

- Telecommunications

- Marine

- Military & Defense

- Transportation & Logistics

- Oil & Gas

- Others ( Media & entertainment, agriculture & forestry, banks, and education and research centers)

On the basis of Technology, the satellite modem market has been segmented as follows:

- VSAT

- Satcom-on-the-Move

- Satcom-on-the-Pause

- Satellite Telemetry

- Satcom Automatic Identification System (AIS)

On the basis of Geography, the satellite modem market has been segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments in Satellite Modem Industry

- In June 2021, ST Engineering iDirect, a subsidiary of ST Engineering, and Intelsat (US), an operator of the world’s largest integrated satellite and terrestrial network, entered into a long-term partnership with a local VSAT service provider to expand the provision of broadband internet services across the Philippines, utilizing the iDirect Evolution platform which includes satellite modem.

- In March 2021, Comtech EF Data Corp., a subsidiary of Comtech Telecommunications Corp., introduced the CDM-650 Satellite Modem. It leverages the heritage and feature set of Comtech’s SLM-5650B/C, CDM-625A, and CDM-425 modems, which have been adopted and deployed globally to support government and commercial applications.

- In March 2021, NOVELSAT was awarded a contract by System Integrator Precision Electronics Ltd. (PEL) on behalf of BSNL, the Indian state-owned telecommunications company, to provide high-capacity satellite-based connectivity for broadband and backhaul services under a Universal Service Obligation (USO) project funded by the Department of Telecommunications (India). BSNL is looking to increase its network capacity to address the growing demand for broadband in the middle of the sharp rise in data consumption across users and locations such as Lakshadweep, Andaman, and Nicobar Islands.

Frequently Asked Questions (FAQ):

Why is there an increasing need of satellite modems?

A few key factors driving the growth of this market are rising need for enriched high-speed data communication, increase in the number of high-throughput satellites (HTS), and growing demand for satellite communication in internet of things (IoT). Furthermore, the major opportunities in the market are increasing launches of LEO satellites and constellations, proposed development of satellite networks to provide internet access in remote areas, and commercialization of 5G.

Which are the major companies in the satellite modem market? What are their major strategies to strengthen their market presence?

Comtech Telecommunications Corp. (US), ST Engineering (Singapore), Teledyne Technologies (US), Gilat Satellite Networks Ltd. (Israel), Viasat, Inc. (US), ORBCOMM Inc. (US), NOVELSAT (Israel), Datum Systems (US), Hughes Network Systems (US), WORK Microwave GmbH (Germany), ND SATCOM (Germany), Amplus Communication (Singapore), AYECKA Ltd (Israel), and SatixFy (Israel) are few major players in satellite modem market. Most of the leading companies have used contracts and partnerships as key strategies to boost their revenues.

Which regions are expected to pose significant demand for satellite modems from 2021 to 2026?

North America, APAC, and South America are expected to pose significant demand from 2021 to 2026.

Which are the major end-user industries of the satellite modem market?

Telecommunications, military and defense, and transportation and logistics are the most lucrative end-user industries in the satellite modem market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 SATELLITE MODEM MARKET: INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key primary respondents

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND SIDE ANALYSIS

2.2.1.1 Approach for capturing Satellite Modem Market share by bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: (SUPPLY SIDE)— REVENUE GENERATED BY COMPANIES IN MARKET

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.4.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 LIMITATIONS

2.6 RISKS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 SATELLITE MODEM MARKET: REALISTIC, PESSIMISTIC, AND OPTIMISTIC RECOVERY SCENARIO

3.1 POST COVID-19: REALISTIC SCENARIO

TABLE 2 POST-COVID-19 REALISTIC SCENARIO: MARKET

3.2 POST COVID-19: OPTIMISTIC SCENARIO

TABLE 3 POST-COVID-19 OPTIMISTIC SCENARIO: MARKET

3.3 POST COVID-19: PESSIMISTIC SCENARIO

TABLE 4 POST-COVID-19 PESSIMISTIC SCENARIO: SATELLITE MODEM MARKET

FIGURE 10 MCPC MODEM SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 11 HIGH SPEED SEGMENT TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 12 MILITARY & DEFENSE SEGMENT IS EXPECTED TO GROW AT SECOND HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 OFFSHORE COMMUNICATION SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE FROM 2021 TO 2026

FIGURE 14 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 15 GROWING DEMAND FOR SATELLITE COMMUNICATION IN INTERNET OF THINGS (IOT) AND INCREASE IN NUMBER OF HIGH-THROUGHPUT SATELLITES TO DRIVE MARKET GROWTH

4.2 MARKET, BY DATA RATE

FIGURE 16 HIGH SPEED SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 SATELLITE MODEM INDUSTRY IN ASIA PACIFIC, BY END-USER INDUSTRY AND COUNTRY

FIGURE 17 TRANSPORTATION AND LOGISTICS AND CHINA TO BE LARGEST SHAREHOLDERS OF MARKET IN ASIA PACIFIC IN 2021

4.4 MARKET, BY APPLICATION

FIGURE 18 OFFSHORE COMMUNICATION SEGMENT TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.5 SATELLITE MODEM INDUSTRY, BY GEOGRAPHY

FIGURE 19 US ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 21 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Rising need for enriched high-speed data communication

5.2.1.2 Increase in number of high-throughput satellites (HTS)

TABLE 5 LATEST HTS LAUNCHES

5.2.1.3 Growing demand for satellite communication in Internet of things (IoT)

TABLE 6 SATELLITE IOT USE CASES

5.2.2 RESTRAINTS

FIGURE 22 MARKET RESTRAINT AND ITS IMPACT

5.2.2.1 Ambiguity in regulatory framework pertaining to satellite communication protocols and standards

5.2.3 OPPORTUNITIES

FIGURE 23 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Increasing launches of LEO satellites and constellations

5.2.3.2 Proposed development of satellite networks to provide internet access in remote areas

5.2.3.3 Commercialization of 5G

5.2.4 CHALLENGES

FIGURE 24 MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Vulnerability of SATCOM devices to cybersecurity attacks

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.4 SATELLITE MODEM ECOSYSTEM

FIGURE 26 ECOSYSTEM OF MARKET

TABLE 7 MARKET: ECOSYSTEM

5.5 REGULATIONS

5.5.1 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

5.5.2 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

5.5.3 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

5.5.4 FCC REGULATIONS

5.5.5 PRIVACY REGULATIONS

5.6 PORTER’S FIVE FORCE ANALYSIS

TABLE 8 IMPACT OF PORTER’S FIVE FORCES ON MARKET, 2020

TABLE 9 IMPACT OF EACH FORCE ON SATELLITE MODEM MARKET, 2021–2026

5.6.1 BARGAINING POWER OF SUPPLIERS

5.6.2 BARGAINING POWER OF BUYERS

5.6.3 THREAT OF NEW ENTRANTS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 CASE STUDIES

5.7.1 BSNL SELECTS NOVELSAT SATELLITE MODEM FOR REMOTE ISLAND CONNECTIVITY

5.7.2 TANZANIA TELECOMMUNICATIONS CORPORATION (TTCL CORPORATION) RURAL BACKHAUL PROJECT

5.7.3 GILAT SATELLITE NETWORK PROVIDES SATELLITE MODEM FOR IN-FLIGHT CONNECTIVITY

5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SATELLITE MODEM MANUFACTURERS

FIGURE 27 REVENUE SHIFT IN MARKET

5.9 PATENT ANALYSIS

FIGURE 28 TOP 10 SATELLITE MODEM COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS RELATED TO SATELLITE MODEM ECOSYSTEM IN LAST 10 YEARS

FIGURE 29 NUMBER OF PATENTS GRANTED IN A YEAR RELATED TO SATELLITE MODEMS OVER THE LAST 10 YEARS

TABLE 10 LATEST PATENTS RELATED TO SATELLITE MODEMS

5.10 TRADE AND TARIFF ANALYSIS

5.10.1 TRADE ANALYSIS

FIGURE 30 IMPORT DATA FOR HS CODE 851762 FOR TOP COUNTRIES IN MARKET, 2016–2020 (USD BILLION)

FIGURE 31 EXPORT DATA FOR HS CODE 851762 FOR TOP FIVE COUNTRIES IN MARKET, 2016–2020 (USD BILLION)

5.10.2 TARIFF ANALYSIS

TABLE 11 TARIFFS IMPOSED ON PRODUCTS WITH HS CODE 851762 EXPORTED BY US

TABLE 12 TARIFFS IMPOSED ON PRODUCTS WITH HS CODE 851762 EXPORTED BY CHINA

TABLE 13 TARIFFS IMPOSED ON PRODUCTS WITH HS CODE 851762 EXPORTED BY GERMANY

TABLE 14 TARIFFS IMPOSED ON PRODUCTS WITH HS CODE 851762 EXPORTED BY MEXICO

TABLE 15 TARIFFS IMPOSED ON PRODUCTS WITH HS CODE 851762 EXPORTED BY SINGAPORE

5.11 TECHNOLOGY TRENDS

5.11.1 SOFTWARE-DEFINED SATELLITE MODEM

5.11.2 SATELLITE MODEMS AND 5G

5.11.3 LOW-COST SATELLITE MODEMS FOR COMMERCIAL PURPOSE

5.12 PRICING ANALYSIS

TABLE 16 ASP TRENDS OF SATELLITE MODEMS (USD)

6 SATELLITE MODEM MARKET, BY CHANNEL TYPE (Page No. - 83)

6.1 INTRODUCTION

FIGURE 32 MCPC MODEM SEGMENT ESTIMATED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 18 MARKET, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 19 MARKET, BY CHANNEL TYPE, 2017–2020 (UNITS)

TABLE 20 MARKET, BY CHANNEL TYPE, 2021–2026 (UNITS)

6.2 SCPC SATELLITE MODEM

6.2.1 SCPC TRANSMISSION SYSTEMS ARE TYPICALLY USED IN MOBILE BACKHAUL, COMMUNICATION ON THE MOVE, AND DISASTER RECOVERY

TABLE 21 SCPC MODEM MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 22 SCPC MODEM MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 23 SCPC MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 25 MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 26 MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 27 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 SCPC MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 MCPC SATELLITE MODEM

6.3.1 MCPC BROADCASTING IS ECONOMICAL METHOD OF UTILIZING SATELLITE TRANSPONDERS BANDWIDTH AND RESULTS IN LOWER TRANSMISSION COSTS PER CHANNEL

TABLE 29 MCPC SATELLITE MODEM MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 30 MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 31 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 33 MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 34 MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 35 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 MCPC MARKET, BY REGION, 2021–2026 (USD MILLION)

7 SATELLITE MODEM MARKET, BY DATA RATE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 33 HIGH SPEED SEGMENT EXPECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 37 MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 38 SATELLITE MODEM INDUSTRY, BY DATA RATE, 2021–2026 (USD MILLION)

7.2 HIGH-SPEED DATA RATE SATELLITE MODEM

7.2.1 HIGH-SPEED DATA RATE MODEMS OFFER HIGH VERSATILITY AND FLEXIBILITY

7.2.2 USE CASE: NATIONAL BROADCASTER IMPROVES SATELLITE BROADCAST EFFICIENCY USING NOVELSAT NS3000 HIGH-SPEED DATA RATE MODEM

TABLE 39 HIGH-SPEED DATA RATE SATELLITE MODEM MARKET, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 40 HIGH-SPEED DATA RATE MARKET, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

7.3 MID-RANGE DATA RATE SATELLITE MODEM

7.3.1 MID-RANGE DATA RATE SATELLITE MODEMS ARE MAINLY USED FOR MOBILE BACKHAUL AND IP TRUNKING APPLICATIONS

7.3.2 USE CASE: TIER 1 DEFENSE CONTRACTOR SELECTED MID-RANGE DATA RATE SATELLITE MODEM FOR ITS NETWORK UPGRADE AND EXPANSION

TABLE 41 MID-RANGE DATA RATE SATELLITE MODEM MARKET, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 42 MID-RANGE DATA RATE MARKET, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

7.4 ENTRY-LEVEL DATA RATE SATELLITE MODEM

7.4.1 ENTRY-LEVEL SATELLITE MODEMS ARE TYPICALLY USED IN TRANSPORTATION AND LOGISTICS, ENTERPRISE, FINANCIAL SECTORS, AND RESEARCH INSTITUTES

7.4.2 USE CASE: ORBCOMM RECEIVED MULTI-MILLION CONTRACT FROM US ARMY FOR LOGISTICS TRACKING, LOCATING, AND MONITORING OF GOVERNMENT ASSETS

TABLE 43 ENTRY-LEVEL DATA RATE SATELLITE MODEM MARKET, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 44 ENTRY-LEVEL DATA RATE MARKET, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

8 MARKET, BY APPLICATION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 34 OFFSHORE COMMUNICATION SEGMENT ESTIMATED TO HOLD THE LARGEST SHARE OF MARKET FROM 2021 TO 2026

TABLE 45 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 46 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 MOBILE & BACKHAUL

8.2.1 SATELLITE MODEMS HELP IN REDUCING LATENCY, INCREASING EFFICIENCY OF SIGNAL, AND INCREASING SPEED OF DATA TRANSMISSION IN MOBILE BACKHAULING

TABLE 47 MARKET FOR MOBILE & BACKHAUL, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR MOBILE & BACKHAUL, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 49 MARKET FOR MOBILE & BACKHAUL, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR MOBILE & BACKHAUL, BY REGION, 2021–2026 (USD MILLION)

8.3 IP TRUNKING

8.3.1 IP TRUNKING ALLOWS ORGANIZATIONS AND AGENCIES TO CONNECT MANY PEOPLE AT ONCE

TABLE 51 MARKET FOR IP TRUNKING, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR IP TRUNKING, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 53 MARKET FOR IP TRUNKING, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR IP TRUNKING, BY REGION, 2021–2026 (USD MILLION)

8.4 OFFSHORE COMMUNICATION

8.4.1 SATELLITE MODEMS HELP TO ESTABLISH RELIABLE AND EFFICIENT COMMUNICATION LINKS IN OFFSHORE COMMUNICATIONS

TABLE 55 MARKET FOR OFFSHORE COMMUNICATION, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR OFFSHORE COMMUNICATION, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 57 MARKET FOR OFFSHORE COMMUNICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 SATELLITE MODEM INDUSTRY FOR OFFSHORE COMMUNICATION, BY REGION, 2021–2026 (USD MILLION)

8.5 TRACKING & MONITORING

8.5.1 SATELLITE MODEMS HELP IN CRITICAL NEAR-REAL-TIME MONITORING IN REMOTE LOCATIONS THAT DO NOT HAVE ACCESS TO CELLULAR COVERAGE

TABLE 59 MARKET FOR TRACKING & MONITORING, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 60 MARKET FOR TRACKING & MONITORING, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 61 MARKET FOR TRACKING & MONITORING, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR TRACKING & MONITORING, BY REGION, 2021–2026 (USD MILLION)

8.6 ENTERPRISE AND BROADBAND

8.6.1 FOR BANKING AND FINANCIAL INSTITUTES, SATELLITE MODEMS HELP IN EFFICIENTLY MANAGING ATMS, CREDIT CARD AUTHORIZATION, AND TRADING AND OTHER FINANCIAL TRANSACTIONS

TABLE 63 SATELLITE MODEM INDUSTRY FOR ENTERPRISE & BROADBAND, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR ENTERPRISE & BROADBAND, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR ENTERPRISE & BROADBAND, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR ENTERPRISE & BROADBAND, BY REGION, 2021–2026 (USD MILLION)

8.7 IN-FLIGHT CONNECTIVITY

8.7.1 IN-FLIGHT CONNECTIVITY SYSTEMS CONSIST OF SATELLITE MODEMS FOR RELIABLE SATELLITE COMMUNICATIONS ON COMMERCIAL AIRCRAFTS

TABLE 67 MARKET FOR IN-FLIGHT CONNECTIVITY, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR IN-FLIGHT CONNECTIVITY, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR IN-FLIGHT CONNECTIVITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR IN-FLIGHT CONNECTIVITY, BY REGION, 2021–2026 (USD MILLION)

8.8 MEDIA AND BROADCAST

8.8.1 USE OF SATELLITE MODEMS OFFERS BROADCASTERS MORE CHANNELS PER MHZ AND HIGHER BANDWIDTH EFFICIENCY

TABLE 71 MARKET FOR MEDIA & BROADCAST, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR MEDIA AND BROADCAST, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 73 MARKET FOR MEDIA & BROADCAST, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR MEDIA & BROADCAST, BY REGION, 2021–2026 (USD MILLION)

8.9 OTHERS

TABLE 75 MARKET FOR OTHER APPLICATIONS, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR OTHER APPLICATIONS, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

9 SATELLITE MODEM MARKET, BY END-USER INDUSTRY (Page No. - 118)

9.1 INTRODUCTION

FIGURE 35 MARKET FOR TRANSPORTATION & LOGISTICS ESTIMATED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 79 MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 80 MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

9.2 ENERGY & UTILITIES

9.2.1 SATELLITE MODEMS HELP IN EFFICIENT DATA TRANSFER FROM SMART GRIDS AND SMART METERS AND ASSIST IN ASSET TRACKING AT REMOTE LOCATIONS

TABLE 81 MARKET FOR ENERGY & UTILITIES, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR ENERGY & UTILITIES, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR ENERGY & UTILITIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR ENERGY & UTILITIES, BY REGION, 2021–2026 (USD MILLION)

9.3 MINING

9.3.1 SATELLITE MODEMS ARE AN ESSENTIAL COMPONENT OF VSAT SYSTEMS USED FOR PROVIDING CONNECTIVITY IN MINING SECTOR

TABLE 85 MARKET FOR MINING, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR MINING, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR MINING, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

9.4 TELECOMMUNICATIONS

9.4.1 GROWING DEMAND FOR SATELLITE COMMUNICATION IN REMOTE LOCATIONS LACKING ACCESS TO CELLULAR NETWORKS DRIVES MARKET GROWTH

TABLE 89 SATELLITE MODEM MARKET FOR TELECOMMUNICATIONS, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR TELECOMMUNICATIONS, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 91 MARKET FOR TELECOMMUNICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR TELECOMMUNICATIONS, BY REGION, 2021–2026 (USD MILLION)

9.5 MARINE

9.5.1 COMMERCIAL VESSELS REQUIRE RELIABLE SATELLITE COMMUNICATIONS TO STAY CONNECTED TO THEIR MAIN OFFICES AND SUPPORT CREW WELFARE ACTIVITIES

TABLE 93 MARKET FOR MARINE, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 94 MARKET FOR MARINE, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 95 MARKET FOR MARINE, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET FOR MARINE, BY REGION, 2021–2026 (USD MILLION)

9.6 MILITARY & DEFENSE

9.6.1 SATELLITE MODEMS ENABLE HIGH-SPEED SATELLITE COMMUNICATIONS FOR ON-THE-MOVE, STATIONARY, POINT-TO-POINT, OR POINT-TO-MULTIPOINT MISSIONS

TABLE 97 MARKET FOR MILITARY & DEFENSE, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 98 MARKET FOR MILITARY & DEFENSE, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 99 MARKET FOR MILITARY & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 100 MARKET FOR MILITARY & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

9.7 TRANSPORTATION & LOGISTICS

9.7.1 NEED FOR TRANSFERRING REAL-TIME DATA DRIVES DEMAND FOR SATELLITE MODEMS IN TRANSPORTATION & LOGISTICS

TABLE 101 MARKET FOR TRANSPORTATION & LOGISTICS, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 102 MARKET FOR TRANSPORTATION & LOGISTICS, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 103 MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2021–2026 (USD MILLION)

9.8 OIL & GAS

9.8.1 GROWING DEMAND FOR HIGH-BANDWIDTH APPLICATIONS SUCH AS VOICE AND HD VIDEO TRANSMISSION FOR CORPORATE AND CREW WELFARE ACTIVITIES DRIVES GROWTH

TABLE 105 MARKET FOR OIL & GAS, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 106 MARKET FOR OIL & GAS, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 107 MARKET FOR OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 108 MARKET FOR OIL & GAS, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHERS

TABLE 109 MARKET FOR OTHER END-USER INDUSTRIES, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 110 MARKET FOR OTHER END-USER INDUSTRIES, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 111 MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 112 MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

10 SATELLITE MODEM MARKET, BY TECHNOLOGY (Page No. - 136)

10.1 INTRODUCTION

FIGURE 36 SOTM SEGMENT TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 113 MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 114 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2 VSAT

10.2.1 VSAT IS IDEAL FOR REMOTE LOCATIONS SUCH AS MINING SITES, MARINE VESSELS, AND OIL & GAS EXPLORATION SITES, WHICH REQUIRE EFFECTIVE BROADBAND INTERNET CONNECTION

10.3 SATCOM ON-THE-MOVE (SOTM)

10.3.1 SATCOM ON-THE-MOVE SATELLITE MODEMS ARE PRIMARILY USED FOR TACTICAL COMMUNICATION IN MILITARY APPLICATIONS

10.4 SATCOM ON-THE-PAUSE (SOTP)

10.4.1 SOTP TECHNOLOGY IS IDEAL FOR COVERING EXTENSIVE GEOGRAPHICAL AREAS

10.5 SATELLITE TELEMETRY

10.5.1 SATELLITE TELEMETRY IS MAINLY USED FOR OIL AND GAS, MILITARY, AND SCIENTIFIC RESEARCH END-USER INDUSTRIES

10.6 SATCOM AUTOMATIC IDENTIFICATION SYSTEM (AIS)

10.6.1 SATCOM AIS IS USED IN MARINE INDUSTRY FOR OFFSHORE APPLICATIONS

11 GEOGRAPHIC ANALYSIS (Page No. - 141)

11.1 INTRODUCTION

FIGURE 37 SATELLITE MODEM MARKET, BY REGION (2021–2026)

TABLE 115 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 116 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 38 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 117 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN NORTH AMERICA, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 120 MARKET IN NORTH AMERICA, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 121 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Growing demand from US military and subsidies by US government for broadband internet service in rural parts of US to boost demand for satellite modems

11.2.2 CANADA

11.2.2.1 Government investments in broadband infrastructure development to drive market growth in Canada

11.2.3 MEXICO

11.2.3.1 Ongoing government efforts to provide broadband services in rural and remote areas of Mexico to drive market growth

11.3 EUROPE

FIGURE 39 SNAPSHOT: SATELLITE MODEM MARKET IN EUROPE

TABLE 123 MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 124 MARKET IN EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 125 MARKET IN EUROPE, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 126 MARKET IN EUROPE, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 128 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Investment in startups for satellite broadband internet offers significant opportunities for market growth in Germany

11.3.2 UK

11.3.2.1 Government investment in next-generation military satellite communications and broadband connectivity through LEO satellites to provide high growth opportunities for market

11.3.3 FRANCE

11.3.3.1 Investment in LEO satellites by French Space Agency, aerospace manufacturers, and satellite operators to drive demand for satellite modems in France

11.3.4 REST OF EUROPE

11.4 APAC

FIGURE 40 SNAPSHOT: SATELLITE MODEM MARKET IN ASIA PACIFIC

TABLE 129 MARKET IN APAC, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 130 MARKET IN APAC, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 131 MARKET IN APAC, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 132 MARKET IN APAC, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 133 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 134 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Aggressive push by Chinese telecommunication companies to launch more than 10,000 satellites in the next 5 years provide opportunities for market growth in China

11.4.2 JAPAN

11.4.2.1 High space budget for Information Gathering Satellite (IGS) program to create opportunities for market in Japan

11.4.3 SOUTH KOREA

11.4.3.1 Proposal by South Korean government for increasing investment in satellite communication to create demand for satellite modems

11.4.4 INDIA

11.4.4.1 Maritime communication services driving market in India

11.4.5 REST OF APAC

11.5 REST OF THE WORLD

TABLE 135 MARKET IN ROW, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 136 MARKET IN ROW, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 137 MARKET IN ROW, BY CHANNEL TYPE, 2017–2020 (USD MILLION)

TABLE 138 MARKET IN ROW, BY CHANNEL TYPE, 2021–2026 (USD MILLION)

TABLE 139 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 140 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Expansion of 3G, LTE, and 4G networks has created new opportunities for cellular backhauling, thereby boosting growth of market in South America

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Opportunities in cellular backhaul, mobility, and broadcasting services to drive market in Middle East and Africa

12 COMPETITIVE LANDSCAPE (Page No. - 167)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 141 OVERVIEW OF STRATEGIES DEPLOYED BY COMPANIES IN MARKET

12.3 FIVE-YEAR COMPANY REVENUE MARKET ANALYSIS

FIGURE 41 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

12.4 MARKET SHARE ANALYSIS, 2020

TABLE 142 SATELLITE MODEM MARKET: DEGREE OF COMPETITION

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 42 GLOBAL MARKET: COMPANY EVALUATION QUADRANT, 2020

12.6 STARTUP/SME EVALUATION QUADRANT, 2020

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 43 MARKET: STARTUP/SME EVALUATION QUADRANT, 2020

12.7 SATELLITE MODEM MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 143 PRODUCT FOOTPRINT OF COMPANIES

FIGURE 44 APPLICATION FOOTPRINT OF COMPANIES

FIGURE 45 END-USER INDUSTRY FOOTPRINT OF COMPANIES

TABLE 144 REGIONAL FOOTPRINT OF COMPANIES

12.8 COMPETITIVE SCENARIO

TABLE 145 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2020 TO AUGUST 2021

TABLE 146 MARKET: DEALS AND OTHER DEVELOPMENTS, JANUARY 2020 TO AUGUST 2021

13 COMPANY PROFILES (Page No. - 181)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products Offered, Product Launches, Deals, Others, and MnM View)*

13.2.1 VIASAT, INC.

TABLE 147 VIASAT, INC.: COMPANY OVERVIEW

FIGURE 46 VIASAT, INC.: COMPANY SNAPSHOT

13.2.2 COMTECH TELECOMMUNICATIONS CORP.

TABLE 148 COMTECH TELECOMMUNICATIONS CORP.: COMPANY OVERVIEW

FIGURE 47 COMTECH TELECOMMUNICATIONS CORP.: COMPANY SNAPSHOT

13.2.3 ST ENGINEERING

TABLE 149 ST ENGINEERING: COMPANY OVERVIEW

FIGURE 48 ST ENGINEERING: COMPANY SNAPSHOT

13.2.4 TELEDYNE TECHNOLOGIES

TABLE 150 TELEDYNE TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 49 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

13.2.5 GILAT SATELLITE NETWORKS LTD.

TABLE 151 GILAT SATELLITE NETWORKS LTD.: COMPANY OVERVIEW

FIGURE 50 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

13.2.6 ORBCOMM INC.

TABLE 152 ORBCOMM: COMPANY OVERVIEW

FIGURE 51 ORBCOMM: COMPANY SNAPSHOT

13.2.7 NOVELSAT

TABLE 153 NOVELSAT: COMPANY OVERVIEW

13.2.8 DATUM SYSTEMS

TABLE 154 DATUM SYSTEMS: COMPANY OVERVIEW

13.2.9 HUGHES NETWORK SYSTEMS

TABLE 155 HUGHES NETWORK SYSTEMS: COMPANY OVERVIEW

* Business Overview, Products Offered, Product Launches, Deals, Others, and MnM View might not be captured in case of unlisted companies.

13.3 OTHER KEY PLAYERS

13.3.1 WORK MICROWAVE GMBH

13.3.2 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

13.3.3 AYECKA COMMUNICATION SYSTEMS, LTD.

13.3.4 AMPLUS COMMUNICATION PTE LTD

13.3.5 ND SATCOM

13.3.6 ASELSAN AS

13.3.7 SATIXFY

13.3.8 BENTEK SYSTEMS

13.3.9 THISS TECHNOLOGIES

13.3.10 FLIGHTCELL INTERNATIONAL LTD

13.3.11 ENENSYS TECHNOLOGIES

13.3.12 SWARM TECHNOLOGIES, INC.

13.3.13 NAL RESEARCH CORPORATION

13.3.14 TXMISSION INC

13.3.15 METOCEAN TELEMATICS

14 APPENDIX (Page No. - 223)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

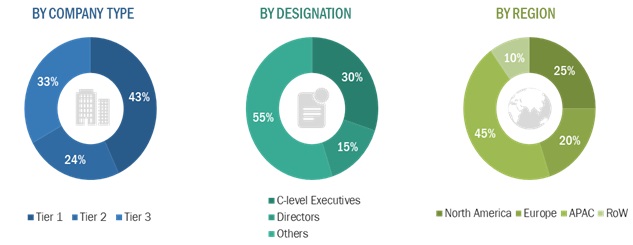

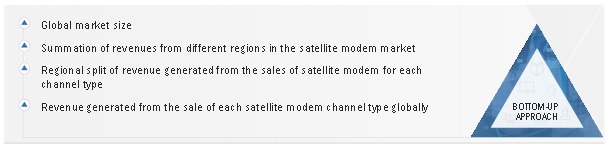

The study involved 4 major activities to estimate the size of the satellite modem market. Exhaustive secondary research has been conducted to collect information on the satellite modem. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, machine condition monitoring related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. International Telecommunications Satellite Organization, International Mobile Satellite Organization, Satellite Industry Association, and EMEA Satellite Operator's Association are a few examples of secondary sources.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed with to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the satellite modem market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the overall satellite modem market and the market based on subsegments. The research methodology used to estimate the market size has been given below:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both demand and supply sides of the satellite modem market.

Outlook and Growth on Satellite Modem and High-speed Satellite Modem Market Approach:

The satellite modem market enables communication between satellite-based systems and terrestrial networks, and it is used for transmitting and receiving data over satellite links in various industries, including aerospace, defense, and maritime. The increasing demand for reliable and high-speed satellite communication solutions is driving the growth of the satellite modem market. In contrast, the high-speed satellite modem market specifically caters to applications requiring data transfer speeds above 100 Mbps, such as high-definition video streaming, enterprise connectivity, and government communications. The increasing demand for high-speed data transfer capabilities in industries such as media and entertainment, oil and gas, and transportation is driving the growth of the high-speed satellite modem market. Both markets are expected to grow as the demand for satellite communication solutions increases, but the high-speed satellite modem market may experience faster growth due to the increasing demand for high-speed data transfer capabilities.

The high-speed satellite modem market is expected to experience significant growth in the coming years due to the increasing demand for high-speed data transfer capabilities in a range of industries. The market is being driven by the increasing need for bandwidth-intensive applications such as high-definition video streaming, enterprise connectivity, and government communications.

The high-speed satellite modem market is also being driven by the increasing demand for satellite communication solutions in industries such as media and entertainment, oil and gas, and transportation. The adoption of satellite communication solutions is expected to increase as companies seek to overcome the limitations of terrestrial networks, such as limited coverage in remote areas and susceptibility to natural disasters.

Satellite modems are commonly used in applications such as remote monitoring, video conferencing, and internet connectivity. On the other hand, satellite routers are typically used in more advanced applications such as military communications, disaster recovery, and remote site networking.

How High-speed Satellite Modem or Satellite Routers is going to impact the Satellite Modem Market?

The emergence of high-speed satellite modems and satellite routers is expected to have a significant impact on the satellite modem market, as they are capable of providing data transfer speeds of over 100 Mbps, making them suitable for high-bandwidth applications. This shift towards higher data transfer speeds and more advanced networking capabilities is likely to drive the demand for high-speed satellite modems and satellite routers in various industries. As a result, the growth of the high-speed satellite modem and satellite router market is expected to outpace that of the traditional satellite modem market. However, traditional satellite modems will continue to play a significant role in providing communication solutions for low-speed applications.

Some futuristic growth use-cases of High-speed Satellite Modem market?

The high-speed satellite modem market is expected to continue experiencing growth in the future, driven by a range of applications and industries. Some potential growth use-cases of high-speed satellite modems include:

High-definition video streaming: As demand for high-quality video streaming continues to rise, high-speed satellite modems can provide reliable and fast internet connectivity in remote areas where traditional terrestrial networks are not available.

Autonomous vehicles: Autonomous vehicles require high-speed connectivity for real-time data transfer and communication, and high-speed satellite modems can provide this connectivity in areas with limited or no terrestrial network coverage.

Disaster response: In the event of a natural disaster, satellite networks can provide crucial communication and data transfer capabilities. High-speed satellite modems can improve the speed and reliability of these communications, enabling faster response times and more efficient disaster relief efforts.

IoT and M2M applications: High-speed satellite modems can provide reliable connectivity for Internet of Things (IoT) and machine-to-machine (M2M) applications, which require constant data transfer and communication.

Government and military communications: High-speed satellite modems can support the high-bandwidth requirements of government and military communications, including intelligence gathering, surveillance, and other critical applications.

Industries That Will Be Impacted in the Future by High-speed Satellite Modem

The high-speed satellite modem market is expected to impact a wide range of industries in the future, including:

Media and Entertainment: The demand for high-speed data transfer capabilities is growing in the media and entertainment industry, as streaming services continue to gain popularity. High-speed satellite modems can support high-definition video streaming, making them a valuable tool for this industry.

Oil and Gas: The oil and gas industry requires reliable and high-speed communication solutions to support offshore drilling, pipeline monitoring, and other activities. High-speed satellite modems can provide these capabilities, making them a valuable tool for this industry.

Transportation: The transportation industry, including maritime, aviation, and land-based transportation, can benefit from high-speed satellite modems to support communication and navigation systems.

Government and Military: Government and military organizations require reliable and secure communication solutions for a range of applications, such as disaster response, remote site networking, and intelligence gathering. High-speed satellite modems can provide these capabilities, making them a valuable tool for these industries.

Healthcare: The healthcare industry can benefit from high-speed satellite modems for telemedicine applications, remote patient monitoring, and other healthcare-related communication needs.

Growth Opportunities and Key Challenges for High-speed Satellite Modem in the Future

Growth Opportunities:

- Increased demand for high-bandwidth applications such as high-definition video streaming, enterprise connectivity, and government communications.

- Growing demand for reliable and high-speed satellite communication solutions in industries such as media and entertainment, oil and gas, transportation, and others.

- Emerging markets and economies providing growth opportunities for high-speed satellite modems in areas with poor or no terrestrial network infrastructure.

- Increasing government investments in space-based communication infrastructure, such as satellite constellations, to support the demand for high-speed satellite communication solutions.

- Advancements in satellite technology and manufacturing processes, leading to reduced costs and improved performance of high-speed satellite modems.

Key Challenges:

- High cost of high-speed satellite modems compared to traditional satellite modems, limiting adoption in some industries and regions.

- Technical limitations of satellite technology, such as limited bandwidth and latency issues, may hinder the growth of the high-speed satellite modem market.

- Regulatory hurdles and licensing requirements for satellite communication services in different countries and regions may pose a challenge to the expansion of high-speed satellite modem services.

- Competition from alternative communication technologies such as fiber optic cables, 5G networks, and other wireless communication solutions may impact the growth of the high-speed satellite modem market.

- Security concerns related to satellite communication systems, including potential cyber threats and interference from other satellite systems, may impact the adoption of high-speed satellite modems in some industries.

Report Objectives

- To describe and forecast the satellite modem market size, by channel type, data rate, application, end-user industry, and technology in terms of value

- To describe and forecast the market size across 4 key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To describe and forecast the satellite modem market size, by channel type, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges pertaining to the satellite modem market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the satellite modem market

- To strategically profile key players in the satellite modem market and comprehensively analyze their market share and core competencies2

- To provide a detailed overview of the satellite modem value chain and ecosystem

- To provide a detailed overview of technology trends, average selling price trends, regulations, and trade analysis for the satellite modem market

- To analyze competitive developments such as contracts, acquisitions, product launches and developments, collaborations, and partnerships, along with research & development (R&D), in the satellite modem market

- To analyze the impact of COVID-19 on the growth of the satellite modem market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite Modem Market