Smart Cities Market by Focus Area, Smart Transportation, Smart Buildings, Smart Utilities, Smart Citizen Services (Public Safety, Smart Healthcare, Smart Education, Smart Street Lighting, and E-Governance) and Region - Global Forecast to 2028

Smart Cities Market - Analysis, Industry Size & Forecast

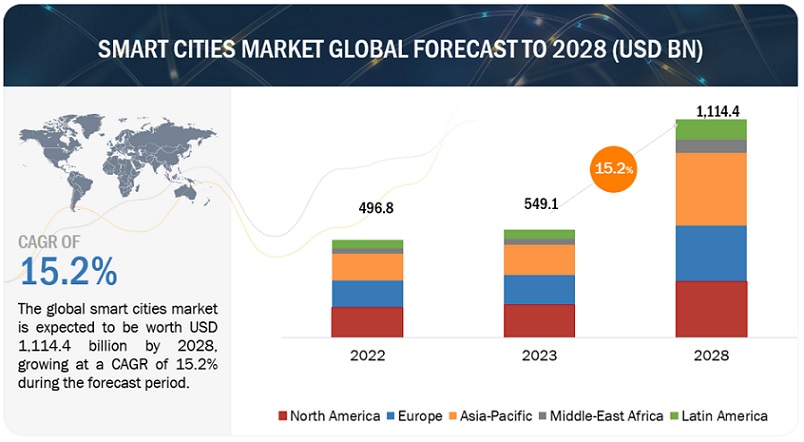

The global Smart Cities Market size was valued at USD 549.1 billion in 2023 and is expected to grow at a CAGR of 15.2% from 2023 to 2028. The revenue forecast for 2028 is projected to reach $1,114.4 billion. The base year for estimation is 2022, and the historical data spans from 2023 to 2028. Rising concerns over environmental sustainability propel the adoption of smart city technologies for efficient resource management and environmental monitoring, influencing market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Smart Cities Market Dynamics

Driver: Enhancing Public Safety in Smart Cities Through Technological Innovation

In smart urban environments, technologies such as video surveillance, DNA phenotyping, real-time license plate tracking, and facial recognition are extensively deployed for public safety, highlighting the importance of surveillance in safeguarding citizens. Smart city solutions aggregate data from diverse urban sources to facilitate traffic safety, data-driven policing, and optimized emergency response protocols. This proactive approach not only enhances crime-fighting capabilities but also ensures safer conditions for first responders. Utilizing smart systems can streamline call center and field operations, while preemptive traffic signal management prioritizes clear pathways for emergency vehicles. According to McKinsey, technologically empowered smart cities could potentially reduce crime rates by 30-40% through expedited first responder arrival times. Advanced applications like gunshot detection, intelligent surveillance, and home security systems further augment law enforcement responses. For example, New York City has trialed gunshot detection technology in police precincts, while San Diego utilizes streetlight-integrated cameras to monitor pedestrian traffic and manage congestion during peak hours.

Restraint: High cost of implementation

Smart city solutions integrated with analytics help save energy and cut operational and maintenance costs. However, economies with tight budgets cannot implement smart city solutions due to the cost of deploying these systems. Integrating major functions like big data analytics involves the significant design, coding, testing, and documentation tasks. Determining the correct software and hardware configuration to meet computing, storage, networking, and software integration requirements consumes time. It needs a highly expert team of software and hardware engineers with knowledge across numerous technology domains.

End users must know that costs primarily depend on integration complexities related to specific applications. They demand cost-effective systems for energy savings but need to realize the extent of the energy savings and associated long-term cost savings. The cost incurred in transforming the existing infrastructure prevents governments from continuing large-scale investments. Though smarter infrastructure helps reduce operating costs and increase energy efficiency, initial costs are a significant barrier. Smart city projects in Amsterdam, Chengdu, and Masdar City have stood out as exceptions, as they have substantial government backing for new technology deployment and project funding.

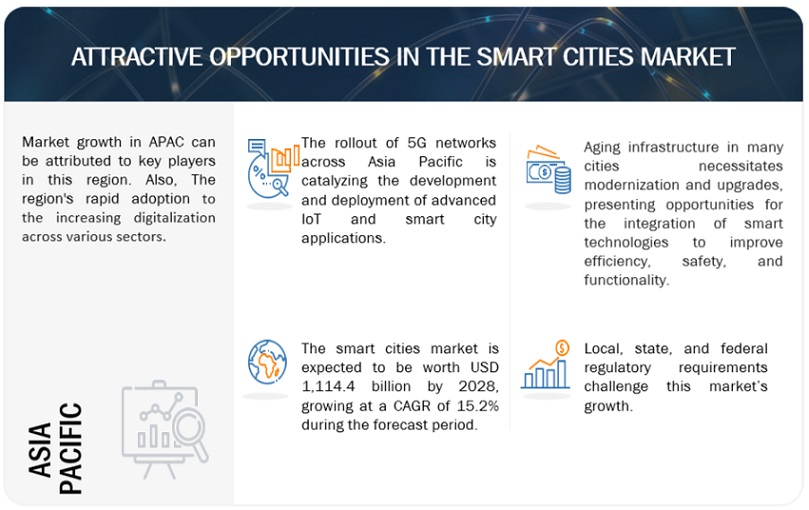

Opportunity: Rise of 5G

The integration of 5G technology has substantially impacted the realm of cloud computing. The high-speed, low-latency connectivity facilitated by 5G has revolutionized communication and expedited data transfers. For example, a 5G-connected streetlight equipped with a video camera or gunshot detection sensor can relay information swiftly to public safety officials, enhancing response times. Furthermore, 5G enables rapid video analytics and AI access, contributing to heightened city safety. Drones in various 5G use cases are crucial in ensuring public safety, particularly for first responders utilizing low latency 5G video cameras scattered across the city. In the healthcare sector, a 5G-connected ambulance constantly communicates with traffic signals, opting for congestion-free routes while maintaining real-time communication with hospital staff. The advent of 5G also empowers cities to leverage AI for analyzing extensive data from sensors and cameras, aiding decision-making for city managers, building owners, and facility managers. Significant cost savings are anticipated as countries actively upgrade their networks to implement smart city initiatives through 5G. According to Accenture, applying smart city solutions to manage vehicle traffic and electrical grids could result in USD 160 billion in benefits, including reductions in energy usage, traffic congestion, and fuel costs. This implies reduced commute times and signifies improvements in public safety and smart grid efficiency. While the full transformative potential of 5G still needs to be realized, it presents substantial growth opportunities for the smart cities market.

Challenge: Crafting Future-Ready Smart Cities for Sustainable Urban Living

In the pursuit of developing smart cities in the digital era, numerous challenges emerge that necessitate careful consideration and strategic solutions. Beyond the existing legal, regulatory, and socio-economic factors inherent in regional markets, key stakeholders face hurdles in cybersecurity, data stewardship, and ownership. The need for interoperability and cross-border portability further complicates the landscape, requiring collaborative efforts to create seamless smart city ecosystems. Additionally, proving ESG (Environmental, Social, and Governance) consciousness with reliable metrics becomes imperative for sustainable urban development. In this highly volatile, risk-prone, hyper-connected, and hyper-virtualized economic landscape, business leaders must adapt by crafting innovative business models capable of addressing the unique demands of the digital era. Traditional approaches no longer suffice, demanding a paradigm shift to ensure the design and construction of future-ready, sustainable urban living for the well-being of subsequent generations.

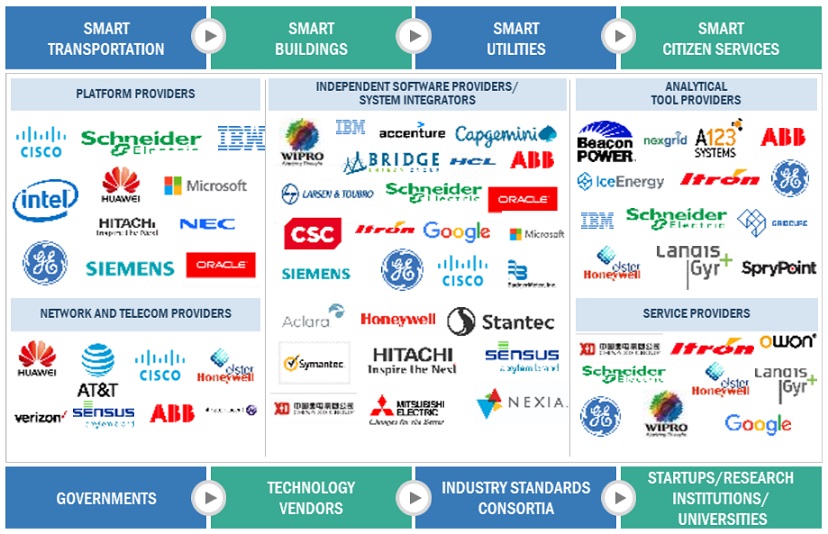

Ecosystem Of Smart Cities Market

By smart citizen service, smart healthcare service registered the highest CAGR in the smart cities market during the forecast period.

Increasing digitalization and connectivity within the modern healthcare landscape and ongoing innovations are expected to drive the market. The healthcare industry is witnessing a significant surge in adopting Internet of Things (IoT) technologies, revolutionizing patient care delivery. Smart healthcare solutions are instrumental in addressing various challenges encountered in caregiving and narrowing the gap between patients and care providers. The evolution of these smart healthcare solutions is reshaping the healthcare delivery model, enhancing efficiency, improving patient outcomes, and optimizing resource utilization. As healthcare organizations increasingly adopt these technologies, they are poised to unlock new opportunities for delivering personalized and accessible care to patients, thereby driving the growth of the smart healthcare market.

By smart utilities solution, advanced metering infrastructure will account for the largest market size during the forecast.

Enterprises rely on sophisticated meter data management (MDM) solutions to streamline the handling of smart metering data and other utilities-related information. These solutions, integrated into enterprise applications, serve as centralized hubs for collecting, processing, and storing vast volumes of meter data. By centralizing data management, MDM simplifies IT integration efforts and consolidates data from diverse collection systems into a unified repository. Once the data undergoes processing, it becomes accessible across utility organizations, offering many applications. These applications span billing processes, revenue assurance, leak detection and management, analysis of losses, capacity planning, and fostering consumer engagement. Advanced metering solutions enable utilities to harness the data generated by metering systems, transforming it into actionable insights to enhance operational efficiency and customer satisfaction.

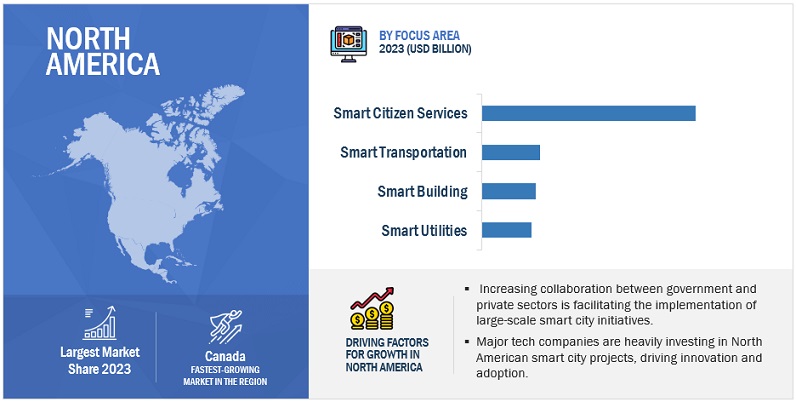

Based on region, North America is expected to hold the largest market size during the forecast.

North America is poised to dominate the smart cities market during the forecast period. The United States, in particular, demonstrates robust adoption of smart city technologies within the region. North America leads the global landscape in smart city utilization, with the US and Canada taking the lead. These nations boast resilient and well-established economies, providing a solid foundation for substantial investments in research and development endeavors, thus facilitating the advancement of novel technologies.

Furthermore, network operators across North America consistently invest in expanding and enhancing their telecommunications infrastructure, notably transitioning towards 5G networks. This strategic move enhances connectivity and unlocks the potential for technologies like cloud edge computing and network slicing. Consequently, integrating such cutting-edge technologies contributes to the widespread adoption of smart city solutions, enabling efficient urban management at a relatively lower cost.

Market Players:

The major vendors in smart cities market include Cisco (US), IBM (US), Siemens (Germany), Microsoft (US), Hitachi (Japan), Schneider Electric (France), Huawei (China), Intel (US), NEC (Japan), ABB (Switzerland), Ericsson (Sweden), Oracle (US), Fujitsu (Japan), Honeywell (US), Accenture (Ireland), Vodafone (UK), AWS (US), Thales (France), Signify (Netherlands), Kapsch (Austria), Motorola (US), GE (US), Google (US), TCS (India), AT&T (US), Nokia (Finland), Samsung (South Korea), SAP (Germany), TomTom (Netherlands), AppyWay (UK), Ketos (US), Gaia (India), TaKaDu (Israel), FlamencoTech (India), XENIUS (India), Bright Cities (Brazil), Maydtech (Mexico), Zencity (Israel), Itron (US), and IXDen (Israel). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their smart city footprint.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Focus area, smart transportation, smart building, smart utility, smart citizen service, and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

The major players in the smart cities market are Cisco (US), IBM (US), Siemens (Germany), Microsoft (US), Hitachi (Japan), Schneider Electric (France), Huawei (China), Intel (US), NEC (Japan), ABB (Switzerland), Ericsson (Sweden), Oracle (US), Fujitsu (Japan), Honeywell (US), Accenture (Ireland), Vodafone (UK), AWS (US), Thales (France), Signify (Netherlands), Kapsch (Austria), Motorola (US), GE (US), Google (US), TCS (India), AT&T (US), Nokia (Finland), Samsung (South Korea), SAP (Germany), TomTom (Netherlands), AppyWay (UK), Ketos (US), Gaia (India), TaKaDu (Israel), FlamencoTech (India), XENIUS (India), Bright Cities (Brazil), Maydtech (Mexico), Zencity (Israel), Itron (US), and IXDen (Israel). |

This research report categorizes the smart cities market to forecast revenues and analyze trends in each of the following submarkets:

By Focus Area Type:

- Smart Transportation

- Smart Building

- Smart Utilities

- Smart Citizen Services

By Smart Transportation

-

By Offering:

-

Solutions

- Smart Ticketing

- Traffic Management

- Parking Management

- Traffic Surveillance

- Passenger Information Management

- Connected Logistics

- Other Solutions

-

Services

- Consulting

- Deployment and Integration

- Infrastructure Monitoring and Management

-

Solutions

-

By Type:

- Roadway

- Railway

- Airway

By Smart Building

-

BY Offering:

-

Solutions

-

Building Infrastructure Management

- Parking Management System

- Smart Water Management System

- Elevator and Escalators Management System

-

Safety and Security Management

- Access Control System

- Video Surveilliance System

- Safety System

-

Energy Management

- HVAC System

- Lighting System

- Network Management

- Integrated Workspace Management System

-

Building Infrastructure Management

-

Services

- Consulting

- Deployment and integration

- Infrastructure monitoring and management

-

Solutions

-

By Type:

- Residential

- Commercial

- Industrial

By Smart Utilities

-

By Offering:

-

Solutions

-

Advanced metering infrastructure

- Meter Data Management

- Meter Data Analytics

- Smart Meter

- Others

- Distribution management system

- Substation automation

- Others

-

Advanced metering infrastructure

-

Services

- Consulting

- Deployment and integration

- Infrastructure monitoring and management

-

Solutions

-

By Type:

- Energy/power

- Water

- Gas

- Others

By Smart Citizen Services Type:

-

Smart healthcare

- Medical Devices

- System and Software

- Services

-

Smart Education

- Solution

- Services

-

Smart public safety

- Solution

- Services

-

Smart street lighting

- Solution

- Services

-

E-governance

- Solution

- Services

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Spain

- Italy

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South East Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2022, Siemens Smart Infrastructure (SI) signed an agreement to acquire Brightly Software, a leading U.S.-based software-as-a-service (SaaS) asset and maintenance management solutions provider. The acquisition elevates SI to lead in the building and infrastructure software market.

- In February 2022, IBM acquired Neudesic, a leading Microsoft Azure Consultancy. This acquisition aims to expand IBM's portfolio of hybrid multi-cloud services and further influence the company's hybrid cloud and AI strategy.

- In December 2021, Schneider Electric launched EcoStruxure for eMobility in buildings. It is an end-to-end EV charging solution for efficient, resilient, sustainable electric mobility and net-zero buildings. It provides energy management capabilities to accommodate the increased power demand.

Frequently Asked Questions (FAQ):

What are smart cities?

Smart cities utilize advanced technologies and data analytics to enhance urban living by optimizing transportation, energy usage, healthcare, public safety, and governance. By integrating digital solutions with physical infrastructure, smart cities aim to improve resource management, reduce environmental impact, and enhance the quality of life for residents. The goal is to create sustainable, resilient, and inclusive urban environments for present and future generations.

What is the market size of the smart cities market?

The smart cities market size is projected to grow from USD 549.1 billion in 2023 to USD 1,114.4 billion by 2028 at a CAGR of 15.2% during the forecast period.

What are the major drivers in the smart cities market?

Urbanization, technological advancements, and supportive government policies drive the smart cities market. Innovations like IoT and AI drive efficiency and sustainability, while government initiatives and public demand further fuel growth. With a focus on connectivity and quality of life, the market is set for substantial.

Who are the key players operating in the smart cities market?

The key vendors operating in the smart cities market include Cisco (US), IBM (US), Siemens (Germany), Microsoft (US), Hitachi (Japan), Schneider Electric (France), Huawei (China), Intel (US), NEC (Japan), ABB (Switzerland), Ericsson (Sweden), Oracle (US), Fujitsu (Japan), Honeywell (US), Accenture (Ireland), Vodafone (UK), AWS (US), Thales (France), Signify (Netherlands), Kapsch (Austria), Motorola (US), GE (US), Google (US), TCS (India), AT&T (US), Nokia (Finland), Samsung (South Korea), SAP (Germany), TomTom (Netherlands), AppyWay (UK), Ketos (US), Gaia (India), TaKaDu (Israel), FlamencoTech (India), XENIUS (India), Bright Cities (Brazil), Maydtech (Mexico), Zencity (Israel), Itron (US), and IXDen (Israel)

What are the opportunities for new market entrants in the smart cities market?

New smart city market entrants can seize opportunities as urban development shifts towards sustainability and efficiency. Governments' heavy investments in smart city initiatives create demand for diverse solutions in transportation, energy, healthcare, and safety. Leveraging emerging technologies like data analytics and IoT, new entrants can differentiate and offer tailored services. Collaborations with established players and government agencies provide access to resources and market insights essential for success in this dynamic landscape. Overall, the smart cities market offers exciting prospects for newcomers to contribute to shaping future urban environments. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

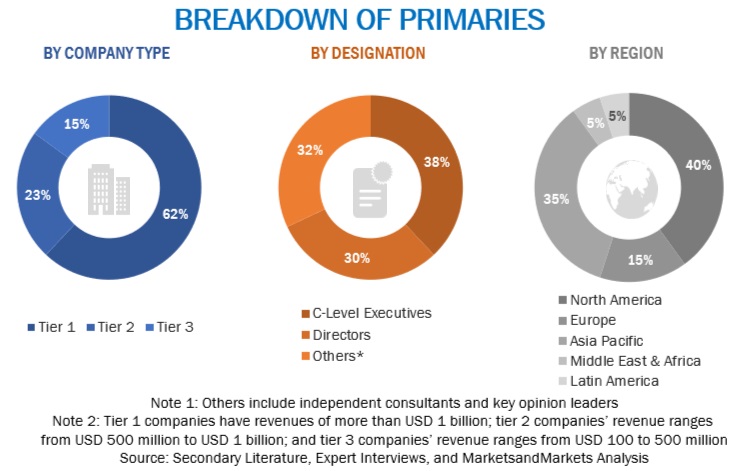

The research study involved four major activities in estimating the smart cities market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations were referred to, such as the US Department of Transportation, SmartAmerica Project, European Innovation Partnership on Smart Cities and Communities (EIP-SCC), European Business and Technology Centre (EBTC), and Smart Cities Council India. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing smart city solutions. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

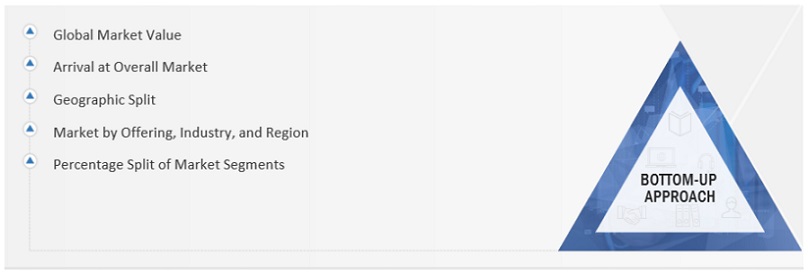

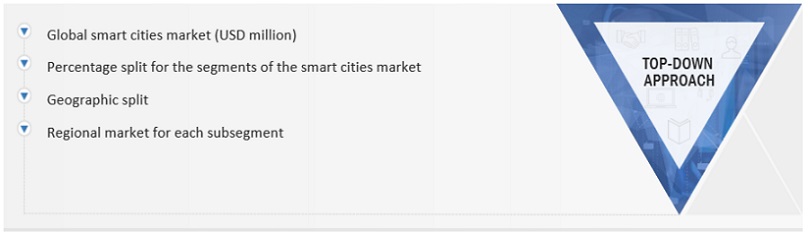

In the market engineering process, top-down and bottom-up approaches and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information. Primary research was undertaken to identify the segmentation types, industry trends, key players, the competitive landscape of different market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and multiple data triangulation methods were used to estimate and validate the size of the smart cities' market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the critical market area have been considered.

- Tracking the recent and upcoming developments in the smart cities market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to know about diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The smart cities market has been split into segments and sub-segments after arriving at the overall market size from the abovementioned estimation process. Where applicable, data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The smart cities market size has been validated using top-down and bottom-up approaches.

Market Definition

A smart city is a city that efficiently deploys its Information and Communications Technology (ICT) infrastructure to improve the quality of life, along with augmented efficiency in urban operations and services. This guarantees that the present and future generations' economic, social, and environmental requirements are addressed. An existing city can be considered smart only if it adheres to the following components: smart transportation, smart buildings, smart utilities, and smart citizen services. Therefore, for the market analysis, smart homes, energy management, building and industry automation, smart transportation systems, water management systems, healthcare, and digital education systems were considered.

Stakeholders

- National/State Governments

- Municipal Authorities

- Real-estate Developers

- Information Technology (IT) Solution Providers

- Platform Providers

- System Integrators

- Telecom Service Providers

- Networking Solution Providers

- Utility Companies

- Transportation Service Providers

- Independent Software Vendors (ISVs)

- Network Equipment Providers

- Communication Service Providers (CSPs)

Report Objectives

- To determine and forecast the global smart cities market based on focus areas: smart transportation, smart buildings, smart utilities, smart citizen services, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- Analyze each submarket concerning individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the smart cities market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Cities Market