Investment Opportunities in Sustainable Aviation Fuel Industry

The Sustainable Aviation Fuel Market is experiencing rapid growth, driven by escalating environmental concerns and robust regulatory mandates. The global SAF Market presents a prime landscape for investors seeking both ethical impact and substantial returns. The shift toward eco friendly alternatives in aviation is accelerating, making the Sustainable Aviation Fuel Industry a focal point for governments, institutional investors, and forward thinking stakeholders. This blog will navigate the opportunities within the Sustainable Aviation Fuel Industry, revealing evolving Sustainable Aviation Fuel Market Trends and offering actionable insights for investors.

Understanding the SAF Market: Fundamentals and Definitions

The Sustainable Aviation Fuel Market covers the research, production, distribution, and utilization of alternative fuels specifically engineered for aircraft. The SAF Industry is defined by its focus on fuels derived from renewable sources, such as biomass, waste oils, and synthetic processes. These fuels are certified to meet stringent aviation performance and safety standards, offering a lower carbon footprint than conventional jet fuels. Understanding the scope of the Sustainable Aviation Fuel Market Size and current Sustainable Aviation Fuel Market Share is essential for any investor evaluating entry or expansion into the industry.

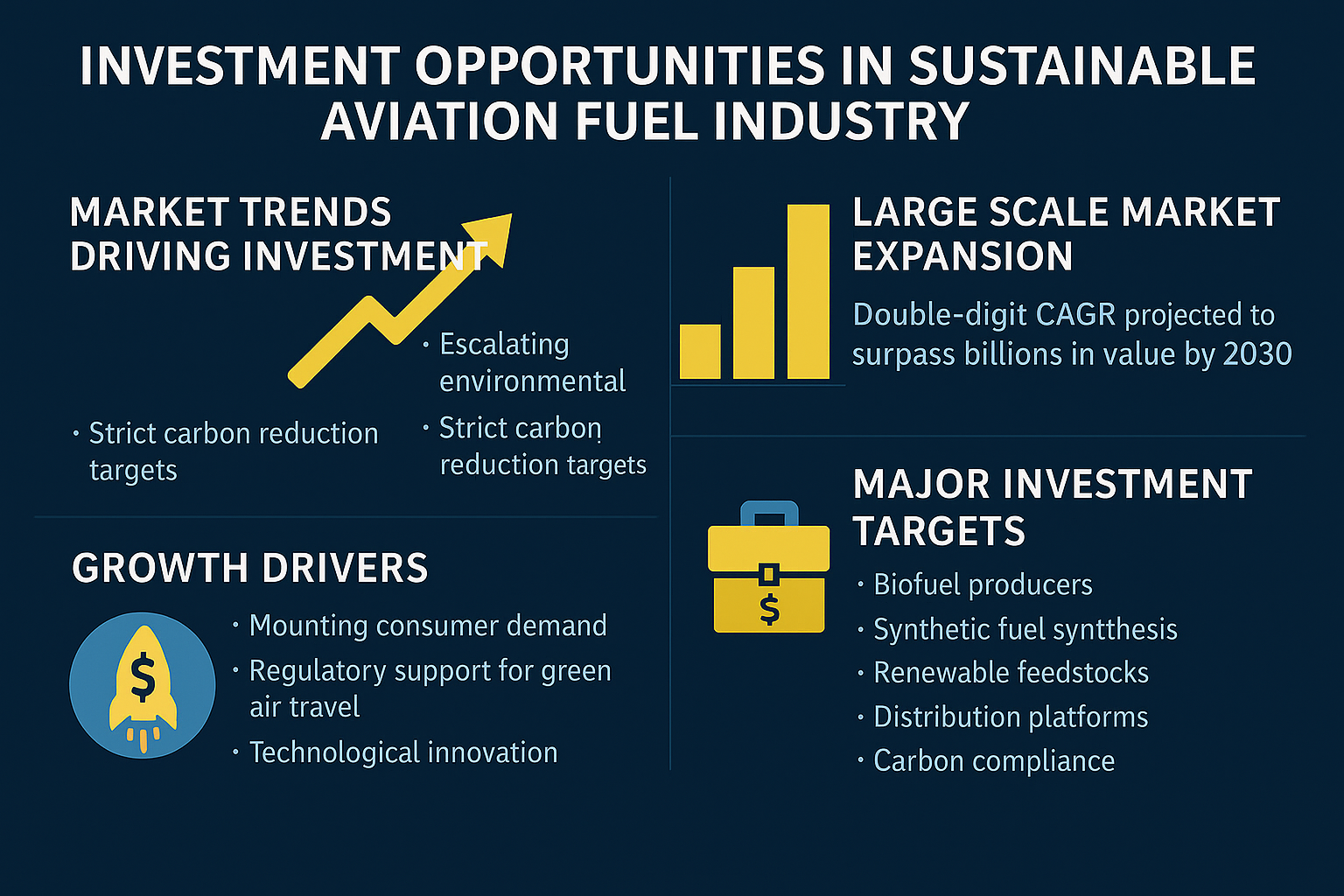

Sustainable Aviation Fuel Market Trends Driving Investment

Several Sustainable Aviation Fuel Market Trends are redefining how investors analyze the SAF Market. First, strict carbon reduction targets set by the International Civil Aviation Organization (ICAO) and national governments have compelled airlines to adopt SAF on a broad scale. Advances in biofuel technology, improved access to feedstocks, and increasing airline partnerships with fuel producers are contributing to expanding Sustainable Aviation Fuel Market Size. Moreover, policy incentives, grants, and mandates are further fueling the rise of the Sustainable Aviation Fuel Industry globally.

Sustainable Aviation Fuel Market Size: Current State and Projections

The Sustainable Aviation Fuel Market Size is slated for significant growth over the next decade. Market forecasts show that the SAF Market is expected to surpass billions in value by 2030, with double digit compound annual growth rates (CAGR). Both the established Sustainable Aviation Fuel Industry and emerging SAF Industry start ups are capturing a growing portion of the Sustainable Aviation Fuel Market Share. Investors can expect expansion in regions such as North America, Europe, and Asia Pacific, with new production facilities and R&D initiatives contributing to overall market enlargement.

Current Investment Landscape in the SAF Industry

The present investment environment within the Sustainable Aviation Fuel Industry is marked by robust M&A activity, venture capital inflows, and government backed financing. Institutional investors are increasingly evaluating SAF Market players whose business models emphasize scalable production, strong supply chain integration, innovative feedstock usage, and compliance with shifting regulatory regimes. As the Sustainable Aviation Fuel Market Share diversifies, investors are witnessing heightened competition and the entry of major oil & gas conglomerates into the SAF Industry.

Key Growth Drivers Fueling the Sustainable Aviation Fuel Market

Economic viability, regulatory support, technological innovation, and mounting consumer demand for “green” air travel serve as the backbone for Sustainable Aviation Fuel Market Trends. Emission reduction requirements for airlines, carbon credits, and international agreements, such as CORSIA, are accelerating the transition from fossil derived fuels. The SAF Market is further propelled by increasing mandates for blending quotas, grants for production projects, and expanding private public partnerships across the Sustainable Aviation Fuel Industry.

Major Players and Investment Targets in the SAF Industry

Major corporations and dynamic start ups are claiming greater Sustainable Aviation Fuel Market Share. Established energy companies are collaborating with leading airlines, while biofuel specialists are scaling innovative technologies for cost effective, large scale production. Key investment targets within the SAF Industry include:

- Biofuel producers utilizing waste-to-fuel pathways.

- Technology developers working on synthetic fuel synthesis.

- Upstream suppliers providing renewable feedstocks.

- Downstream distribution and fuel logistics platforms.

- Compliance monitoring and carbon credit service providers.

Assessing the strategic positioning and scalability potential of these players is critical for investment success in the Sustainable Aviation Fuel Market.

Analyzing Sustainable Aviation Fuel Market Trends and Risks

Investors must scrutinize ongoing and emerging Sustainable Aviation Fuel Market Trends for risk assessment. Core risks include feedstock supply volatility, high upfront capital expenditure, and the pace of regulatory changes. However, the SAF Market also reveals robust hedges against risk, such as long term offtake agreements with airlines, government backed financing, and diversified feedstock sourcing. Monitoring the Sustainable Aviation Fuel Market Share among industry incumbents and new entrants informs long term investment allocation in the Sustainable Aviation Fuel Industry.

Sustainable Aviation Fuel Market, Request Pdf Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70301163

Sustainable Aviation Fuel Market Share: Geographical Hotspots for Investment

Sustainable Aviation Fuel Market Share is not uniform across regions. North America and Europe currently lead, owing to strong policy frameworks and established airline commitments. Asia Pacific is expected to capture a significant portion of future SAF Market growth due to increasing commercial aviation demand and supportive regulatory initiatives. Investors should analyze geopolitical factors, logistics infrastructure, and local incentives while mapping the most lucrative markets within the Sustainable Aviation Fuel Industry.

Technology Innovations and Their Investment Impact

Groundbreaking developments in fuel processing, feedstock optimization, and emissions certification are accelerating the rate of change in the Sustainable Aviation Fuel Industry. The SAF Industry is witnessing rapid advancements in algae based fuels, gasification, pyrolysis, and synthetic fuel creation from captured carbon. Investors evaluating Sustainable Aviation Fuel Market Trends should prioritize companies leveraging proprietary or patented technology platforms that demonstrate scalability, efficiency, and regulatory compliance.

Policy and Regulation Shaping the Sustainable Aviation Fuel Market

Sustainable Aviation Fuel Market Trends are intrinsically linked to policy dynamics and evolving international standards. Mandates such as the EU’s ReFuelEU initiative and U.S. Renewable Fuel Standard create investment demand by imposing minimum SAF blending ratios. Carbon pricing mechanisms and grant programs contribute to reducing investment risk while growing the Sustainable Aviation Fuel Market Size and incentivizing innovation across the Sustainable Aviation Fuel Industry.

Case Studies of Successful SAF Market Investments

Examining high profile investment cases in the SAF Market reveals the value of strategic alliances, long term contracts, and vertical integration. Airline producer partnerships have been key to scaling early stage breakthroughs to commercial scale and boosting Sustainable Aviation Fuel Market Share. Large scale capital deployment from private equity, sovereign funds, and conglomerates underscores the wide range of investor participation in the Sustainable Aviation Fuel Industry.

Assessing Sustainable Aviation Fuel Market Trends for Future Investment

Forward looking Sustainable Aviation Fuel Market Trends indicate a continued shift towards net zero aviation goals. Investors who focus on companies with integrated operations, diversified feedstock sources, agile R&D, and adaptive supply chains will gain a competitive edge as the Sustainable Aviation Fuel Market Size expands. Monitoring trends, such as the growing demand for carbon neutral airports and regional SAF mandates, is essential for sustained investor returns within the SAF Industry.

Sustainability and ESG Considerations in the SAF Industry

The Sustainable Aviation Fuel Industry is a central component in aviation’s sustainability journey. Investors are giving increasing weight to ESG (environmental, social, and governance) metrics when assessing potential investments in the SAF Market. Firms with transparent emissions reporting, strong community relations, and verifiable supply chain sustainability will likely outperform their competitors in market valuation and resilience.

Strategies to Capitalize on Sustainable Aviation Fuel Market Opportunities

The evolving landscape of the Sustainable Aviation Fuel Market, robust growth in SAF Market investments, and widespread innovation throughout the Sustainable Aviation Fuel Industry all point toward a future of dynamic opportunity for investors. Strategic entry, rigorous due diligence, long term partnerships, and alignment with global market trends are essential to capturing maximum Sustainable Aviation Fuel Market Share and benefiting as the Sustainable Aviation Fuel Market Size continues to grow.

Related Reports:

Sustainable Aviation Fuel Market by Fuel type(Biofuel, Hydrogen, PtL, GtL), by Biofuel Conversion Pathways (HEFA, FT, ATJ, Co-processing), by biofuel blending capacity (below 30%, 30% to 50%, Above 50%), Aircraft type and Region - Global Forecast to 2030

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE