Key Players Investing in Methanol Marine Propulsion Systems: A Strategic Shift in Green Shipping Technology

As the global shipping industry intensifies efforts to decarbonize, methanol marine fuel technology has emerged as a leading alternative to conventional fuels. Backed by robust regulatory pushes, climate commitments, and corporate ESG mandates, shipbuilders and fleet operators are now aggressively investing in methanol propulsion systems to stay ahead of the curve.

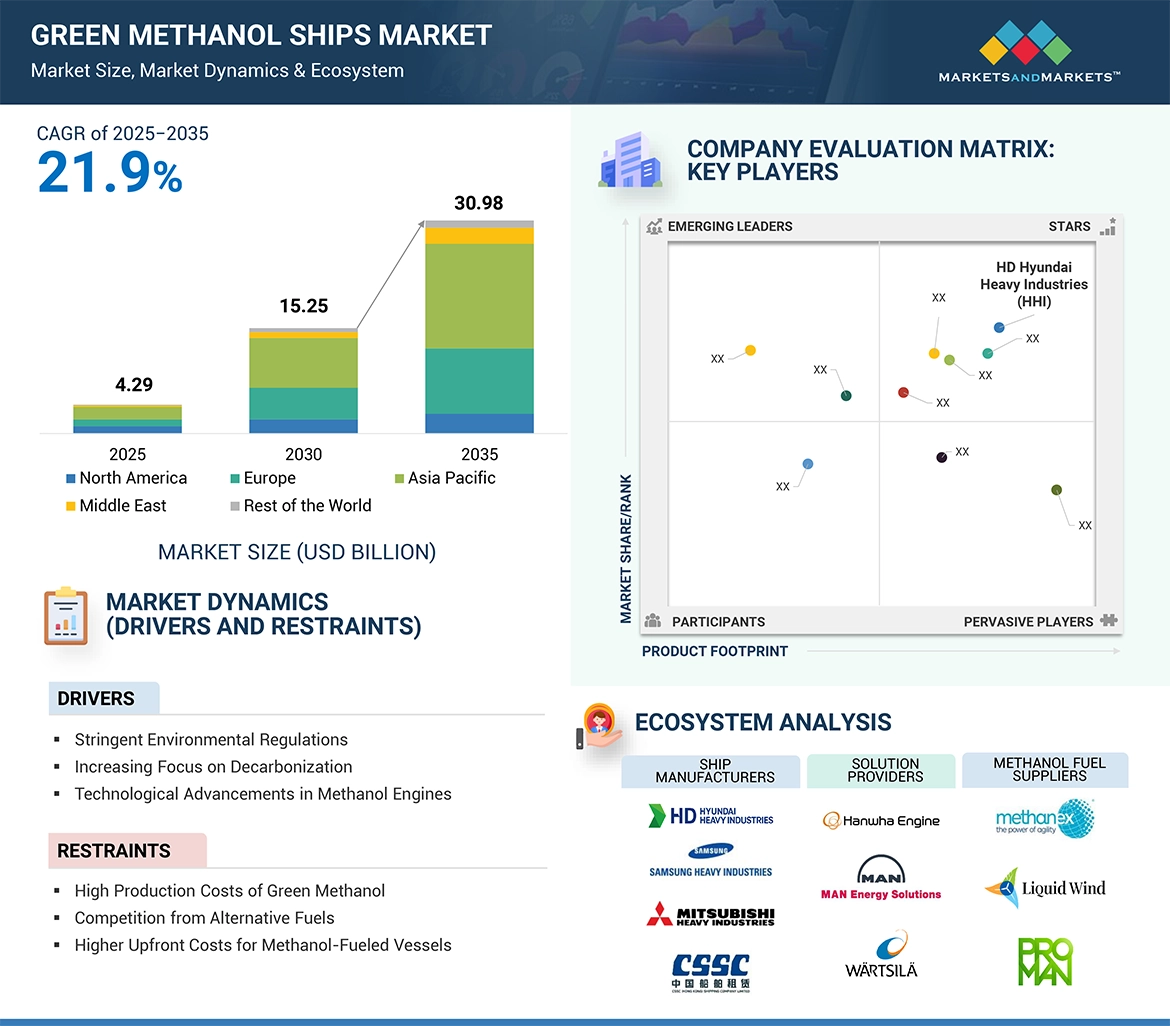

According to the report Methanol Powered Ships market is projected to grow from USD 4.29 billion in 2025 to USD 30.98 billion by 2035, with a strong CAGR of 21.9% between 2025 and 2035. This growth is not merely driven by regulation—it reflects a deep industry pivot to scalable, low-emission technologies like dual-fuel methanol engines, retrofitting programs, and clean fuel supply infrastructure.

Methanol Marine Fuel Technology: Driving Newbuild & Retrofit Investments

Shipping companies are embracing methanol propulsion systems through both newbuild and retrofit strategies. In 2025, around 30 newly built methanol-powered vessels are expected to be delivered, and this number is forecast to rise to 274 by 2035. At the same time, retrofitted methanol vessels will increase from just 4 units in 2025 to 213 by 2035.

This dual pathway enables ship owners to pursue decarbonization with flexibility. While new builds allow for the integration of advanced, fuel-optimized designs from the keel up, retrofits provide an immediate compliance solution for existing fleets.

Why Cargo Vessels and Dual-Fuel Systems Are at the Core

Within the ship type segmentation, cargo vessels are projected to capture the largest share of the green methanol ship industry. These vessels, central to global trade logistics, are under intense scrutiny to reduce emissions due to their heavy fuel consumption. Consequently, key industry players are investing in dual-fuel methanol propulsion systems, which offer the ability to switch between methanol and traditional fuels. This ensures operational flexibility while transitioning to cleaner technologies without disrupting service.

Dual-fuel solutions are also favored for their ability to help operators meet IMO decarbonization mandates while maintaining efficiency and minimizing risk. This segment is expected to dominate due to its practical alignment with both environmental goals and business performance.

The Surge in Newly Built Methanol-Compatible Ships

A significant portion of the market’s value is expected to be driven by newly built and linefit vessels. With sustainability becoming a competitive advantage, ship owners are increasingly demanding vessels that are methanol-ready from day one. These next-gen ships are designed to deliver higher fuel efficiency, optimized hull forms, and advanced engine systems compatible with methanol and hybrid operations.

In parallel, the rapid growth in global trade is fueling orders for new cargo, container, and tanker vessels, many of which are now designed around methanol propulsion as a default standard.

Regional Dynamics: Rest of the World Emerging as a Growth Hotspot

Interestingly, while Europe and Asia currently dominate the methanol marine fuel landscape, the Rest of the World (RoW) region—including Latin America, the Middle East, and Africa—is expected to grow at the highest rate. These emerging economies are scaling up investments in maritime infrastructure and fuel supply chains, driven by international partnerships and rising awareness around sustainable fuels.

In particular, methanol bunkering facilities, green fuel production plants, and government-backed emission reduction schemes are creating fertile ground for the adoption of methanol-based propulsion technologies.

Strategic Moves by Key Players

Major global shipbuilders and maritime solution providers are actively shaping this transformation:

-

HD Hyundai Heavy Industries and Samsung Heavy Industries (South Korea) are at the forefront of building next-gen methanol dual-fuel vessels.

-

COSCO Shipping Industries and Shanghai Waigaoqiao Shipbuilding Co., Ltd. (China) are focusing on high-capacity green cargo vessels with methanol propulsion.

-

European players like Damen Shipyards Group (Netherlands), VARD AS (Norway), and Sanlorenzo Yachts (England) are also investing in both commercial and luxury vessels with sustainable fuel capabilities.

These firms are not only building vessels but are also integrating with fuel producers, engine developers, and port authorities to ensure a full ecosystem for methanol adoption.

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE