5G Industrial IOT Market by Component (Hardware, Solutions, and Services), Organization Size, Application (Predictive Maintenance, Business Process Optimization), End User (Process Industries and Discrete Industries) and Region - Global Forecast to 2026

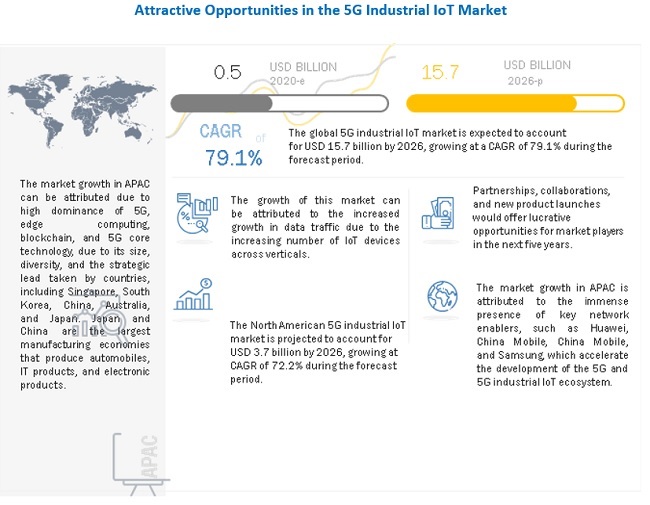

[227 Pages Report] The global 5G Industrial IOT market size is expected to grow from USD 0.5 billion in 2020 to USD 15.7 billion in 2026, at a Compound Annual Growth Rate (CAGR) of 79.1% during the forecast period. The major factors driving the growth of the 5G Industrial IOT market include growth in data traffic due to increasing number of IoT devices across manufacturing industries, increasing demand for high reliability and low latency networks in manufacturing industries, growth in number of M2M connections across manufacturing industries, and rising need of preventive maintenance for critical equipment.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has created significant disruption across every line of businesses, including enterprises, industrial, and government sectors. However, in recent times, with lockdown restrictions getting relaxed in almost every region across the world, businesses in various industry verticals including manufacturing industries, are resuming their operations. The COVID-19 pandemic has forced manufacturing companies to adopt remote working facilities to ensure business continuity. The remote working across widespread geographies demands a high-speed network, such as 5G, for experiencing higher connectivity and improved performance. Further, the manufacturing companies are demanding to switch to predictive analytics-driven processes to streamline their business operations in the most optimized way. In the current scenario, the consumer has become extremely quality conscious. 5G industrial IoT solutions can enhance the analytics process and thus manufacturers can enforce quality checks and thresholds across production lines to get the best output. 5G, due to its higher performance, lower latency, and increased reliability, can provide improved connectivity to IoT-enabled connected assets, as real-time asset data will be increasingly used in the near future to derive actionable insights for the connected equipment, increase productivity, compress costs, and enable intelligent solutions.

Hardware segment to account for a larger market size during the forecast period

The hardware segment of the 5G industrial IoT includes 5G modules, gateways, sensors, and chips. With the growing demand for 5G industrial IoT, the 5G IoT module acts as one of the major components in the hardware segment of the 5G industrial IoT market. The leading IoT module providers are also exploring how they can position specific products in the market. Both components and module providers are investing in R&D while simultaneously considering the chipsets for specialized applications in the manufacturing operations. In addition to developing 5G modules, suppliers are pursuing several other innovations, such as modifications that decrease device size and strategies for the integration with other modules.

Managed service segment to grow at a higher CAGR during the forecast period

The growth of the managed services segment is expected to be driven by the increased monitoring and security requirements, improved regulatory compliances, enhanced productivity, and improved data integrity while meeting strict Service-Level Agreements (SLAs). Manufacturing companies deploy 5G industrial IoT solutions to manage four elements: products, processes, people, and infrastructure. In manufacturing industries, advanced sensors, control systems, and software applications work together to obtain and share real-time information as finished goods make their way down the production line. Managed Service Providers (MSPs) connect people across all business functions and regions and provide them with relevant information related to intelligent design, operations, and maintenance as well as offer higher quality of services and safety.

Large enterprises, by organization size segment to lead the market during the forecast period

Large enterprises are witnessing an increased need to deploy 5G industrial IoT solutions and services to efficiently manage their large number of assets spread across geographies. The adoption of 5G industrial IoT solutions and services in large enterprises is much high as compared to SMEs. The high adoption is due to the affordability and high economies of scale of large enterprises that enable organizations to leverage 5G industrial solutions and services. The market being at the nascent stage, several big firms are launching 5G modules by having partnerships with telecom operators to deploy services at a faster pace.

Real-time workforce tracking and management segment to grow at a higher CAGR during the forecast period

Real-time workforce tracking and management help manufacturing enterprises streamline their processes and identify, deploy, validate, as well as manage their employees and connect with them in real time. 5G technology has the potential to bring unprecedented levels of change in the workplace as well as workforce management. 5G, along with IoT, can automate workforce management activities, such as scheduling tasks and assigning field resources and equipment to various employees on the respective manufacturing floor. 5G combined with IoT-enabled connected worker solution can bring monitoring capabilities to the next level, making workplaces more efficient, transparent, safe, and productive.

Discrete industries, by end user segment to lead the market during the forecast period

The discrete industries are concerned with the manufacturing and production of distinct units, such as automobiles, furniture, toys, smartphones, and airplanes. The growth of IoT is leading to improvements in discrete industries. In discrete industries, IoT-enabled smart connected products provide a way to increase product functionality and generate additional value for customers. The 5G technology increases the overall bandwidth and allows a massive amount of IoT devices to connect, thus helping discrete manufacturers increase their productivity. 5G industrial IoT solutions are expected to increase the operational efficiency of the discrete manufacturing process by offering higher connectivity among IoT devices.

To know about the assumptions considered for the study, download the pdf brochure

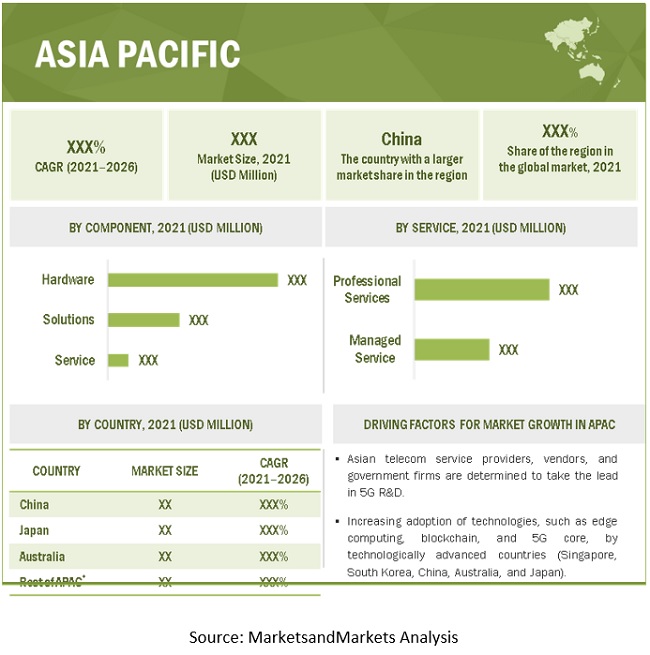

APAC to account for the largest market size during the forecast period

APAC, being an emerging economy, is witnessing dynamic changes in the adoption of new technologies and expected to record the highest market size and CAGR during the forecast period. It is a diversified region that includes a wide range of countries moving toward digital transformation. The region is set to dominate 5G, edge computing, blockchain, and 5G core technology, due to its size, diversity, and the strategic lead taken by countries, including Singapore, South Korea, China, Australia, and Japan. APAC is one of the biggest markets for connected devices. Such a huge number of connected devices requires high-speed and low latency networks, such as 5G. China, Australia, Japan, and South Korea are the prime APAC countries that have started several 5G-related activities. Asian telecom service providers, vendors, and government firms are determined to take the lead in 5G R&D. The region is witnessing dynamic changes in the adoption of new technologies and advancements in manufacturing industries.

Market Dynamics

Driver: Increasing demand for high reliability and low latency networks in manufacturing industries

Ultra-high reliability and low latency are a few of the major factors driving the growth of 5G Industrial IoT market. Latency in computer network refers to the time a data packet takes to travel. Lower latency leads to a higher data transmission rate. The latency of 5G is almost 50 times lower than the current 4G network. The 5G technology is expected to provide a latency of 1 millisecond, whereas, in 4G, the latency rate is 50 milliseconds. Because of this, 5G services would be high in demand for manufacturing applications and connected IoT ecosystems, as these applications and connections need faster and reliable network services. Connectivity plays a crucial role in Industry 4.0. Industrial networks need a stable, secure, reliable, and fast connection to capture and process data in real-time for plant and equipment monitoring. 5G, with low latency and high-reliability attributes, is expected to provide improved connectivity by providing the speed, capacity, and mobility, that manufacturers require for enhanced IoT implementation.

Restraint: High costs required for deployment of 5G network

The transition from 4G to 5G technology would result in huge investments. The costs of 5G infrastructure depend heavily on the required throughput density, periodic interest rate, and base station price. The reduction of these costs is important for effective and ultra-dense small cell deployments. Some have begun to integrate mmWave bands spectrum (28 GHz) into cost modeling heterogeneous networks whereas small cell solutions, such as picocells with mmWave, are deployed in areas of high demand. 5G deployment would require 8–10 times more base stations than 4G and upgrade of the hardware infrastructure by Mobile Network Operators (MNOs). This would result in high capital investments by MNOs. There is a sense of uncertainty among MNOs related to the adoption of 5G. Hence, the huge capital investment required in setting up the infrastructure may act as a restraint to the development of 5G services for industrial IoT.

Opportunity: Rising demand for private 5G network across manufacturing industries

A private 5G network is a local area network that utilizes 5G technology as its communication medium to build a private network. Private 5G networks are referred to as local 5G networks or Mobile Private Networks (MPNs) and offer unified connectivity with numerous advantages and optimized services. In the near future, the private 5G network is expected to become one of the preferred choices, especially for industrial sectors, such as manufacturing. A private network is expected to include all features of 5G public networks, including the reduced latency and higher speeds. A private network delivers several advantages, in terms of efficiency and security, thus various manufacturing organizations and other end users are looking forward to deploying these networks. Private 5G networks have the potential to become the future communication platform of the factory as they will be able to provide increased bandwidth for increased number of connected equipment and the corresponding data being transmitted at the factory floor.

Challenge: Issues related to deployment and coverage of 5G networks

Even though 5G offers significantly high speed and bandwidth, it has a limited range that will require additional infrastructure. 5G antennas can handle more users and data, but they can beam out radio waves over shorter distances. This, in turn, will lead to the installation of extra repeaters to spread waves for an extended range while also maintaining consistent speeds in densely populated regions. Regulations and local authority policies have slowed the deployment of small cells through excessive administrative and financial obligations on operators, thereby reducing investments. Lengthy permitting processes and procuring exercises are among the major constraints for deploying small cells, and the time taken by local authorities to approve planning applications for small cell implementations can take months, resulting in delays. High fees charged by local authorities to utilize street furniture, such as utility poles, are another major challenge faced by companies toward the 5G network deployment.

Key Market Players

The report includes the study of key players offering 5G Industrial IOT market offerings. It profiles major vendors in the global 5G Industrial IOT market. The major vendors include Qualcomm Technologies, Inc. (Qualcomm), Ericsson (Ericsson), Nokia (Nokia), Huawei Technologies Co., Ltd. (Huawei), Cisco Systems (Cisco), AT&T (AT&T), IBM Corporation (IBM), Microsoft Corporation (Microsoft), Siemens AG (Siemens), Verizon (Verizon), Sierra Wireless (Sierra Wireless), Telefónica S.A. (Telefónica), China Mobile Limited (China Mobile), China Unicom (Hong Kong) Limited (China Unicom), Vodafone (Vodafone), Advantech Co., Ltd. (Advantech), ASOCS (ASOCS), T-Mobile USA, INC (T-Mobile), TELUS (TELUS), Honeywell International Inc. (Honeywell), Intel Corporation (Intel), Bosch.IO GmbH (Bosch.IO), Deutsche Telekom AG (Deutsche Telekom), Telit (Telit), Thales Group (Thales), IDEMIA (IDEMIA), KT Corporation (KT), ABB (ABB), and NTT Data Corporation (NTT Data). The study includes an in-depth competitive analysis of these key players in the 5G Industrial IOT market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component (Hardware, Solutions, Services), Organization Size, Application, End User and Regions. |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Qualcomm Technologies, Inc. (US), Ericsson (Sweden), Nokia (Finland), Huawei Technologies Co., Ltd. (China), Cisco Systems (US), AT&T (US), IBM Corporation (US), Microsoft Corporation (US), Siemens AG (Germany), Verizon (US), Sierra Wireless (Canada), Telefónica S.A. (Spain), China Mobile Limited (China), China Unicom (China), Vodafone (UK), Advantech Co., Ltd. (Taiwan), ASOCS (Israel), T-Mobile USA, INC (US), TELUS (Canada), Honeywell International Inc. (US), Intel Corporation (US), Bosch.IO GmbH (Germany), Deutsche Telekom AG (Germany), Telit (UK), Thales Group (France), IDEMIA (France), KT Corporation (South Korea), ABB (Switzerland), and NTT Data Corporation (Japan). |

This research report categorizes the 5G Industrial IoT market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the 5G Industrial IoT market has the following segments:

- Hardware

- Solutions

- Services

Based on Organization Size, the market has the following segments:

- SMEs

- Large Enterprises

Based on Application, the 5G Industrial IoT market has the following segments:

- Predictive Maintenance

- Business Process Optimazation

- Asset Tracking and Management

- Logistics and Supply Chain Management

- Real-Time Workforce Tracking and Management

- Automation Control and Management

- Emergency and Incident Management, and Business Communication

Based on End User, the market has the following segments:

- Process Industries

- Discrete Industries

Based on regions, the 5G Industrial IoT market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

-

APAC

- China

- Japan

- Australia

- Rest of World (RoW)

Recent Developments:

- In January 2021, Ericsson and Ooredoo Group signed a five-year strategic 5G agreement for the supply of 5G radio, core, and transport products and solutions, as well as related implementation and integration services.

- In December 2020, Nokia and Thai mobile operator, dtac, part of Telenor Group, came into partnership wherein dtac selected Nokia as its first 5G RAN partner in a three-year deal covering the North and North Eastern regions of Thailand.

- In December 2020, Huawei and Shenyang Institute of Automation of Chinese Academy of Sciences (SIACAS) collaborated to introduce their ‘5G+Industrial Network’ joint innovation center. ‘5G+Industrial Network’ has become crucial for Industry 4.0 and is improving network connectivity and stability, building a new architecture for industrial interconnections, and is backing up next-generation fully connected smart factories.

- In February 2020, Cisco announced advancements to its IoT portfolio that enable service provider partners to offer optimized management of cellular IoT environments and new 5G use cases. New wireless technologies, such as 5G, Wi-Fi 6 will lead to more devices and new advanced IIoT use cases and will give service providers the tools to create competitive cellular IoT offerings for their customers.

- In September 2019, Qualcomm launched a commercial chipset solution combining modem, RF transceiver, and RF front-end, which is named as Qualcomm Snapdragon 5G Modem-RF System. The company allows Original Equipment Manufacturers (OEMs) to quickly develop cutting-edge 5G devices through the solution.

Frequently Asked Questions (FAQ):

How big is the 5G industrial IOT market?

What is growth rate of the 5G industrial IOT market?

What are the applications in 5G industrial IOT market?

What are the top 5G industrial IOT market companies?

Who will be the leading hub for 5G industrial IOT market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT¡ªSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.7 YEARS CONSIDERED FOR THE STUDY

1.8 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017¨C2019

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL 5G INDUSTRIAL IOT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 RESEARCH METHODOLOGY: APPROACH

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY©¤ APPROACH 1 (SUPPLY SIDE): REVENUE OF 5G INDUSTRIAL IOT COMPONENTS OF MARKET 45

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY ©¤ APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL 5G INDUSTRIAL IOT COMPONENT (HARDWARE, SOLUTIONS, AND SERVICES) OF 5G INDUSTRIAL IOT MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 13 5G INDUSTRIAL IOT MARKET SIZE, 2020¨C2026

FIGURE 14 SOLUTIONS SEGMENT TO GROW AT HIGHEST GROWTH DURING FORECAST PERIOD

FIGURE 15 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET IN 2021

FIGURE 16 LARGE ENTERPRISES SEGMENT TO SHOW HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 17 ASSET TRACKING AND MANAGEMENT SEGMENT TO LEAD MARKET IN 2021

FIGURE 18 GROWING SEGMENTS IN MARKET, 2021¨C2026

FIGURE 19 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN 5G INDUSTRIAL IOT MARKET

FIGURE 20 INCREASING DEMAND FOR HIGH RELIABILITY AND LOW LATENCY NETWORKS DRIVES MARKET GROWTH DURING FORECAST PERIOD FROM 2020 TO 2026

4.2 ASIA PACIFIC MARKET, BY COMPONENT AND COUNTRY

FIGURE 21 HARDWARE AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 22 JAPAN TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G INDUSTRIAL IOT MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in data traffic due to increasing number of IoT devices across manufacturing industries

5.2.1.2 Increasing demand for high reliability and low latency networks in manufacturing industries

5.2.1.3 Growth in number of M2M connections across manufacturing industries

5.2.1.4 Rising need of preventive maintenance for critical equipment

5.2.2 RESTRAINTS

5.2.2.1 High costs required for deployment of 5G network

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for private 5G network across manufacturing industries

5.2.3.2 Rising development of smart infrastructure such as 5G-enabled factory

5.2.4 CHALLENGES

5.2.4.1 Delay in spectrum harmonization across geographies

5.2.4.2 Issues related to deployment and coverage of 5G networks

5.3 CASE STUDY ANALYSIS

5.3.1 QUALCOMM

5.3.2 ERICSSON

5.3.3 NOKIA

5.3.4 T-MOBILE

5.4 TECHNOLOGY ANALYSIS

5.4.1 INTRODUCTION

5.4.2 SUB-6 GHZ AND MMWAVE

5.4.3 WI-FI

5.4.4 EDGE COMPUTING

5.4.5 LTE NETWORK

5.4.6 BIG DATA AND ANALYTICS

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 5G INDUSTRIAL IOT MARKET: VALUE CHAIN ANALYSIS

5.5.1 HARDWARE

5.5.2 MACHINES/DEVICES

5.5.3 CONNECTIVITY

5.5.4 PLATFORM/SOFTWARE

5.5.5 SERVICES

5.5.6 END USERS/APPLICATIONS

5.6 ECOSYSTEM

FIGURE 25 ECOSYSTEM: MARKET

5.7 PORTER¡¯S FIVE FORCES MODEL

FIGURE 26 PORTER¡¯S FIVE FORCES ANALYSIS: 5G INDUSTRIAL IOT MARKET

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 COMPETITIVE RIVALRY

5.8 PATENT ANALYSIS

TABLE 3 EUROPE PATENT APPLICATION, BY COUNTRY

TABLE 4 EUROPE PATENT APPLICATION, BY TECHNOLOGY FIELD

FIGURE 27 EUROPE PATENT APPLICATION: DIGITAL TECHNOLOGY, BY APPLICANT

FIGURE 28 STANDARD ESSENTIAL PATENTS: 5G

FIGURE 29 4G AND 5G DECLARED PATENT PORTFOLIOS BY DECLARING THE COMPANY

5.9 IMPACT OF COVID-19 ON 5G INDUSTRIAL IOT MARKET DYNAMICS ANALYSIS

FIGURE 30 INCREASING NUMBER OF IOT DEVICES ACROSS INDUSTRIES TO BE KEY DRIVER FOR GROWTH IN DATA TRAFFIC

FIGURE 31 HIGH COSTS REQUIRED FOR DEPLOYMENT OF 5G NETWORK TO BE KEY ISSUE

5.10 PRICING ANALYSIS

5.11 REGULATORY IMPLICATIONS

5.11.1 GENERAL DATA PROTECTION REGULATION

5.11.2 CALIFORNIA CONSUMER PRIVACY ACT

5.11.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.11.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11.5 HEALTH LEVEL SEVEN

5.11.6 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.11.7 SOC2

5.11.8 COMMUNICATIONS DECENCY ACT

5.11.9 SARBANES-OXLEY ACT

5.11.10 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.12 DIFFERENT MODES OF 5G TECHNOLOGY

5.12.1 ENHANCED MOBILE BROADBAND

5.12.2 MASSIVE IOT

5.12.3 ULTRA-RELIABLE LOW LATENCY CONNECTIVITY

6 5G INDUSTRIAL IOT MARKET, BY COMPONENT (Page No. - 77)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 32 SOLUTIONS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD 79

TABLE 5 MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE: MARKET DRIVERS

TABLE 6 HARDWARE: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

6.3 SOLUTIONS

6.3.1 SOLUTIONS: MARKET DRIVERS

TABLE 7 SOLUTION: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

6.4 SERVICES

FIGURE 33 MANAGED SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 8 SERVICES: 5G INDUSTRIAL IOT MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

6.4.1 PROFESSIONAL SERVICES

6.4.1.1 Professional services: market drivers

TABLE 10 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

6.4.2 MANAGED SERVICES

6.4.2.1 Managed services: market drivers

TABLE 11 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

7 5G INDUSTRIAL IOT MARKET, BY ORGANIZATION SIZE (Page No. - 86)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 34 LARGE ENTERPRISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 12 MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 13 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 14 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8 5G INDUSTRIAL IOT MARKET, BY APPLICATION (Page No. - 91)

8.1 INTRODUCTION

8.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 35 REAL-TIME WORKFORCE TRACKING AND MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

8.3 PREDICTIVE MAINTENANCE

8.3.1 PREDICTIVE MAINTENANCE: MARKET DRIVERS

TABLE 16 PREDICTIVE MAINTENANCE: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8.4 BUSINESS PROCESS OPTIMIZATION

8.4.1 BUSINESS PROCESS OPTIMIZATION: MARKET DRIVERS

TABLE 17 BUSINESS PROCESS OPTIMIZATION: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8.5 ASSET TRACKING AND MANAGEMENT

8.5.1 ASSET TRACKING AND MANAGEMENT: 5G INDUSTRIAL IOT MARKET DRIVERS

TABLE 18 ASSET TRACKING AND MANAGEMENT: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8.6 LOGISTICS AND SUPPLY CHAIN MANAGEMENT

8.6.1 LOGISTICS AND SUPPLY CHAIN MANAGEMENT: MARKET DRIVERS

TABLE 19 LOGISTICS AND SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8.7 REAL-TIME WORKFORCE TRACKING AND MANAGEMENT

8.7.1 REAL-TIME WORKFORCE TRACKING AND MANAGEMENT: MARKET DRIVERS

TABLE 20 REAL-TIME WORKFORCE TRACKING AND MANAGEMENT: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8.8 AUTOMATION CONTROL AND MANAGEMENT

8.8.1 AUTOMATION CONTROL AND MANAGEMENT: MARKET DRIVERS

TABLE 21 AUTOMATION CONTROL AND MANAGEMENT: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

8.9 EMERGENCY AND INCIDENT MANAGEMENT, AND BUSINESS COMMUNICATION

8.9.1 EMERGENCY AND INCIDENT MANAGEMENT, AND BUSINESS COMMUNICATION: 5G INDUSTRIAL IOT MARKET DRIVERS

TABLE 22 EMERGENCY AND INCIDENT MANAGEMENT, AND BUSINESS COMMUNICATION: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

9 5G INDUSTRIAL IOT MARKET, BY END USER (Page No. - 101)

9.1 INTRODUCTION

9.2 END USERS: COVID-19 IMPACT

FIGURE 36 DISCRETE INDUSTRIES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 23 MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

9.3 PROCESS INDUSTRIES

9.3.1 PROCESS INDUSTRIES: MARKET DRIVERS

TABLE 24 PROCESS INDUSTRIES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

9.3.1.1 Energy and utilities

9.3.1.2 Chemicals and materials

9.3.1.3 Food and beverage

9.3.1.4 Water and waste management

9.3.1.5 Other end users

9.4 DISCRETE INDUSTRIES

9.4.1 DISCRETE INDUSTRIES: 5G INDUSTRIAL IOT MARKET DRIVERS

TABLE 25 DISCRETE INDUSTRIES: MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

9.4.1.1 Automotive

9.4.1.2 Machine manufacturing

9.4.1.3 Semiconductor and electronics

9.4.1.4 Medical devices

9.4.1.5 Logistics and transportation

10 5G INDUSTRIAL IOT MARKET, BY REGION (Page No. - 109)

10.1 INTRODUCTION

FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MARKET SIZE, BY REGION, 2020¨C2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

10.2.1.1 COVID-19 impact: North America

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: 5G INDUSTRIAL IOT MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 31 NORTH AMERICA: OT MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020¨C2026 (USD MILLION)

10.2.2 UNITED STATES

10.2.2.1 United States: 5G industrial IOT market drivers

TABLE 33 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 34 UNITED STATES: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 35 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 36 UNITED STATES: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 37 UNITED STATES: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Canada: 5G industrial IOT market drivers

TABLE 38 CANADA: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 39 CANADA: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 40 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 42 CANADA: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: 5G INDUSTRIAL IOT MARKET REGULATORY IMPLICATIONS

10.3.1.1 COVID-19 impact: Europe

TABLE 43 EUROPE: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY COUNTRY, 2020¨C2026 (USD MILLION)

10.3.2 UNITED KINGDOM

10.3.2.1 United Kingdom: 5G industrial IOT market drivers

TABLE 49 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 50 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 51 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 52 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 53 UNITED KINGDOM: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Germany: 5G industrial IOT market drivers

TABLE 54 GERMANY: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 55 GERMANY: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 56 GERMANY: 5G IOT MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 57 GERMANY: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 58 GERMANY: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: 5G INDUSTRIAL IOT MARKET REGULATORY IMPLICATIONS

10.4.1.1 COVID-19 impact: Asia Pacific

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020¨C2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China: 5G industrial IOT market drivers

TABLE 65 CHINA: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 66 CHINA: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 67 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 68 CHINA: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 69 CHINA: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Japan: 5G industrial IOT market drivers

TABLE 70 JAPAN: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 71 JAPAN: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 72 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 73 JAPAN: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 74 JAPAN: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Australia: 5G industrial IOT market drivers

TABLE 75 AUSTRALIA: MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 76 AUSTRALIA: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 77 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 78 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 79 AUSTRALIA: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

TABLE 80 REST OF THE WORLD: 5G INDUSTRIAL IOT MARKET SIZE, BY COMPONENT, 2020¨C2026 (USD MILLION)

TABLE 81 REST OF THE WORLD: MARKET SIZE, BY SERVICE, 2020¨C2026 (USD MILLION)

TABLE 82 REST OF THE WORLD: MARKET SIZE, BY ORGANIZATION SIZE, 2020¨C2026 (USD MILLION)

TABLE 83 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2020¨C2026 (USD MILLION)

TABLE 84 REST OF THE WORLD: MARKET SIZE, BY END USER, 2020¨C2026 (USD MILLION)

10.5.1 MIDDLE EAST AND AFRICA

10.5.1.1 Middle East and Africa: 5G industrial IoT market drivers

10.5.2 LATIN AMERICA

10.5.2.1 Latin America: market drivers

11 COMPETITIVE LANDSCAPE (Page No. - 140)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 41 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING PLAYERS

11.4 MARKET SHARE ANALYSIS

11.4.1 INTRODUCTION

FIGURE 42 MARKET SHARE ANALYSIS OF 5G INDUSTRIAL IOT PLAYERS

11.5 KEY PLAYERS IN 5G INDUSTRIAL MARKET, 2020

12 COMPETITIVE EVALUATION MATRIX AND COMPANY PROFILE (Page No. - 143)

12.1 COMPANY EVALUATION MATRIX, 2020

12.1.1 STAR

12.1.2 EMERGING LEADERS

12.1.3 PERVASIVE

12.1.4 PARTICIPANTS

FIGURE 43 5G INDUSTRIAL IOT MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

12.2 STRENGTH OF PRODUCT PORTFOLIO

12.3 BUSINESS STRATEGY EXCELLENCE

13 COMPANY PROFILES (Page No. - 147)

13.1 INTRODUCTION

(Business Overview, solutions and products offered, Recent Developments, SWOT Analysis, MnM View, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats)*

13.2 QUALCOMM

FIGURE 44 QUALCOMM: COMPANY SNAPSHOT

13.3 ERICSSON

FIGURE 45 ERICSSON: COMPANY SNAPSHOT

13.4 NOKIA

FIGURE 46 NOKIA: COMPANY SNAPSHOT

13.5 HUAWEI

FIGURE 47 HUAWEI: COMPANY SNAPSHOT

13.6 CISCO

FIGURE 48 CISCO: COMPANY SNAPSHOT

13.7 AT&T

FIGURE 49 AT&T: COMPANY SNAPSHOT

13.8 IBM

FIGURE 50 IBM: COMPANY SNAPSHOT

13.9 MICROSOFT

FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

13.10 SIEMENS

FIGURE 52 SIEMENS: COMPANY SNAPSHOT

13.11 VERIZON

FIGURE 53 VERIZON: COMPANY SNAPSHOT

13.12 SIERRA WIRELESS

FIGURE 54 SIERRA WIRELESS: COMPANY SNAPSHOT

13.13 TELEFONICA

FIGURE 55 TELEFONICA: COMPANY SNAPSHOT

13.14 CHINA MOBILE

13.15 CHINA UNICOM

13.16 VODAFONE

13.17 ADVANTECH

13.18 ASOCS

13.19 T-MOBILE

13.20 TELUS

13.21 HONEYWELL

13.22 INTEL

13.23 BOSCH.IO

13.24 DEUTSCHE TELEKOM

13.25 TELIT

13.26 THALES GROUP

13.27 IDEMIA

13.28 KT CORPORATION

13.29 ABB

13.30 NTT DATA

*Details on Business Overview, solutions and products offered, Recent Developments, SWOT Analysis, MnM View, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

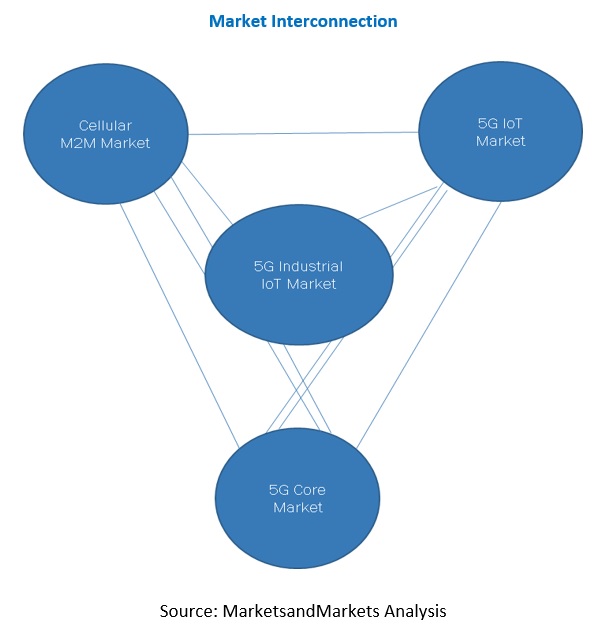

14 ADJACENT/RELATED MARKETS (Page No. - 195)

14.1 CELLULAR M2M MARKET

14.1.1 MARKET DEFINITION

14.1.2 LIMITATIONS OF THE CELLULAR M2M MARKET

14.1.3 MARKET OVERVIEW

14.1.4 CELLULAR M2M MARKET, BY APPLICATION

TABLE 85 CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 86 CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 87 CELLULAR M2M MARKET SIZE IN ASSET TRACKING AND MONITORING, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 88 CELLULAR M2M MARKET SIZE IN ASSET TRACKING AND MONITORING ASSET TRACKING AND MONITORING, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 89 CELLULAR M2M MARKET SIZE IN TELEMEDICINE, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 90 CELLULAR M2M MARKET SIZE IN TELEMEDICINE, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 91 CELLULAR M2M MARKET SIZE IN FLEET MANAGEMENT, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 92 CELLULAR M2M MARKET SIZE IN FLEET MANAGEMENT, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 93 CELLULAR M2M MARKET SIZE IN WAREHOUSE MANAGEMENT, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 94 CELLULAR M2M MARKET SIZE IN WAREHOUSE MANAGEMENT, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 95 CELLULAR M2M MARKET SIZE IN SMART METERS, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 96 CELLULAR M2M MARKET SIZE IN SMART METERS, BY REGION, 2019¨C2025 (USD MILLION)

14.1.5 CELLULAR M2M MARKET, BY SERVICE

TABLE 97 CELLULAR M2M MARKET SIZE, BY SERVICE, 2016¨C2019 (USD MILLION)

TABLE 98 CELLULAR M2M MARKET SIZE, BY SERVICE, 2019¨C2025 (USD MILLION)

TABLE 99 PROFESSIONAL SERVICES: CELLULAR M2M MARKET SIZE, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 100 PROFESSIONAL SERVICES: CELLULAR M2M MARKET SIZE, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 101 MANAGED SERVICES: CELLULAR M2M MARKET SIZE, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 102 MANAGED SERVICES: CELLULAR M2M MARKET SIZE, BY REGION, 2019¨C2025 (USD MILLION)

14.1.6 CELLULAR M2M MARKET, BY END USER

TABLE 103 CELLULAR M2M MARKET SIZE, BY END USER, 2016¨C2019 (USD MILLION)

TABLE 104 CELLULAR M2M MARKET SIZE, BY END USER, 2019¨C2025 (USD MILLION)

TABLE 105 HEALTHCARE: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 106 HEALTHCARE: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 107 TRANSPORTATION AND LOGISTICS: CELLULAR M2M MARKET SIZE, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 108 TRANSPORTATION AND LOGISTICS: CELLULAR M2M MARKET SIZE, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 109 MANUFACTURING: CELLULAR M2M MARKET SIZE, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 110 MANUFACTURING: CELLULAR M2M MARKET SIZE, BY REGION, 2019¨C2025 (USD MILLION)

14.1.7 CELLULAR M2M MARKET, BY REGION

TABLE 111 CELLULAR M2M MARKET SIZE, BY REGION, 2016¨C2019 (USD MILLION)

TABLE 112 CELLULAR M2M MARKET SIZE, BY REGION, 2019¨C2025 (USD MILLION)

TABLE 113 NORTH AMERICA: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 114 NORTH AMERICA: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 115 EUROPE: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016¨C2019 (USD MILLION)

TABLE 116 EUROPE: CELLULAR M2M MARKET SIZE, BY SERVICE, 2019¨C2025 (USD MILLION)

TABLE 117 EUROPE: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 118 EUROPE: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 119 ASIA PACIFIC: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 120 ASIA PACIFIC: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 121 ASIA PACIFIC: CELLULAR M2M MARKET SIZE, BY END USER, 2016¨C2019 (USD MILLION)

TABLE 122 ASIA PACIFIC: CELLULAR M2M MARKET SIZE, BY END USER, 2019¨C2025 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: CELLULAR M2M MARKET SIZE, BY END USER, 2016¨C2019 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: CELLULAR M2M MARKET SIZE, BY END USER, 2019¨C2025 (USD MILLION)

TABLE 127 LATIN AMERICA: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016¨C2019 (USD MILLION)

TABLE 128 LATIN AMERICA: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2019¨C2025 (USD MILLION)

TABLE 129 LATIN AMERICA: CELLULAR M2M MARKET SIZE, BY END USER, 2016¨C2019 (USD MILLION)

TABLE 130 LATIN AMERICA: CELLULAR M2M MARKET SIZE, BY END USER, 2019¨C2025 (USD MILLION)

14.2 5G IOT MARKET

14.2.1 MARKET DEFINITION

14.2.2 LIMITATIONS OF 5G IOT MARKET STUDY

14.2.3 MARKET OVERVIEW

14.2.4 5G IOT MARKET, BY RADIO TECHNOLOGY

TABLE 131 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020¨C2025 (USD MILLION)

TABLE 132 5G NEW RADIO STANDALONE ARCHITECTURE: 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

TABLE 133 5G NEW RADIO NON-STANDALONE ARCHITECTURE: 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

14.2.5 5G IOT MARKET, BY RANGE

TABLE 134 5G IOT MARKET SIZE, BY RANGE, 2020¨C2025 (USD MILLION)

TABLE 135 SHORT-RANGE IOT DEVICES: 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

TABLE 136 WIDE-RANGE IOT DEVICES: 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

14.2.6 5G IOT MARKET, BY VERTICAL

TABLE 137 5G IOT MARKET SIZE, BY VERTICAL, 2020¨C2025 (USD MILLION)

TABLE 138 ENERGY AND UTILITIES: 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

TABLE 139 HEALTHCARE: 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

14.2.7 5G IOT MARKET, BY REGION

TABLE 140 5G IOT MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

TABLE 141 5G IOT CONNECTIONS, BY REGION, 2020¨C2025 (MILLION)

TABLE 142 NORTH AMERICA: 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020¨C2025 (USD MILLION)

TABLE 143 EUROPE: 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020¨C2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020¨C2025 (USD MILLION)

TABLE 145 ASIA PACIFIC: 5G IOT MARKET SIZE, BY RANGE, 2020¨C2025 (USD MILLION)

TABLE 146 REST OF THE WORLD: 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020¨C2025 (USD MILLION)

TABLE 147 REST OF THE WORLD: 5G IOT MARKET SIZE, BY RANGE, 2020¨C2025 (USD MILLION)

15 APPENDIX (Page No. - 221)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS¡¯ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

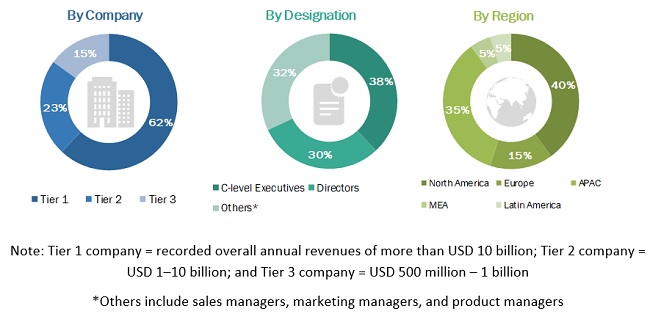

The study involved four major activities to estimate the current market size for the 5G Industrial IoT market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of 5G Industrial IoT market.

Secondary Research

In the secondary research process, various secondary sources, such as D & B Hoovers and Bloomberg BusinessWeek, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The 5G Industrial IoT market comprises several stakeholders, such as IoT hardware vendors, IoT platform and software vendors, IoT connectivity providers, Managed Service Providers (MSPs), Communications Service Providers (CSPs), Consulting and advisory firms, 5G core alliances/groups, Regional and global government organizations, Investors and venture capitalists, Independent Software Vendors (ISVs), Value-Added Resellers (VARs) and distributors, System integrators, Distributors and resellers, and Network enablers. The demand side of the 5G Industrial IoT market consists of the firms that deploy the 5G Industrial IoT components (hardware, solutions and services). The supply side includes 5G Industrial IoT providers, offering 5G Industrial IoT components (hardware, solutions and services). Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global 5G Industrial market and various other dependent submarkets in the overall market. An exhaustive list of all the players offering services in the 5G Industrial market was prepared while using the top-down approach. The market share for all the players in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each player was evaluated based on its components (hardware, solutions, and services) organization size, application, and end user. The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global 5G industrial IoT market by component (hardware, solutions, and services), organization size, application, end user, and region from 2020 to 2026, and analyze the various macroeconomic and microeconomic factors that affect market growth.

- To forecast the size of the market segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the 5G industrial IoT market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Industrial IOT Market