The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the automated passenger counting and information system market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the automated passenger counting and information system market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the automated passenger counting and information system market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

Various sources were used in the secondary research process to identify and collect information important for this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of market players, the market classification according to industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the automated passenger counting and information system market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about automated passenger counting and information system market scenarios through secondary research. Several primary interviews have been conducted with experts from the demand (end use and region) and supply side (image detection technique, type) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

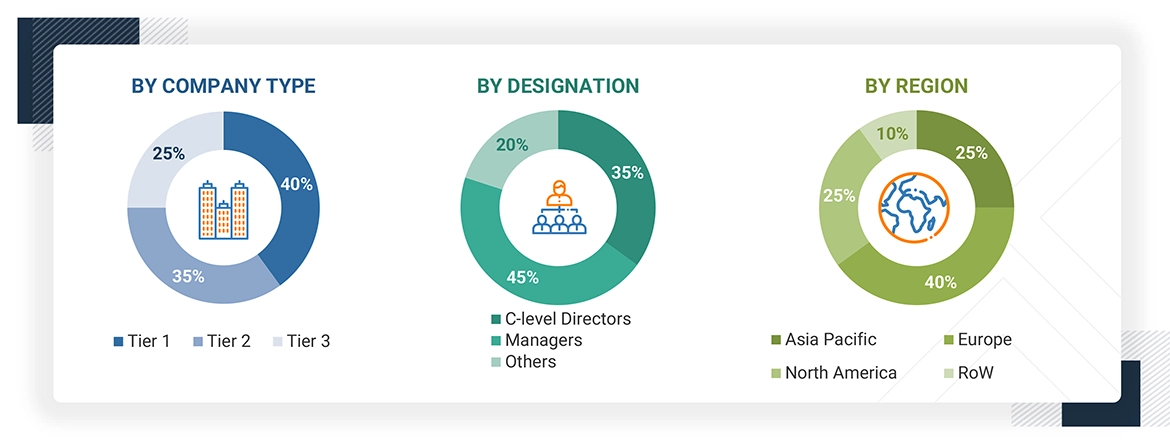

Notes: The three tiers of the companies have been defined based on their total/segmental revenue as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 1 billion–USD 500 million, and Tier 3 = USD 500 million.

‘Others’ include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the automated passenger counting and information system market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Automated Passenger Counting and Information System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Automated passenger counting (APC) systems comprise electronic devices that count the number of passengers boarding and alighting transit vehicles, including buses, trains, and ferries. These systems offer more accurate and reliable results than the traditional method of counting passengers manually. With the help of the automatic passenger counter, every passenger who goes on board and alights a public transit vehicle at each stop of any route can be monitored and recorded easily. This helps simplify data collection and enables far greater accuracy and scope for generating database reports on ridership information.

Passenger information systems (PIS) are electronic information systems that provide passengers with real-time information. This information can include the arrival and departure times of transit vehicles and the nature and cause of disruptions in case of delays. These systems are installed at transportation hubs or can be used remotely through web browsers and smartphones.

Key Stakeholders

-

End users

-

Government bodies, venture capitalists, and private equity firms

-

Technology providers

-

Technology distributors

-

System integrators

-

Mobile application developers

-

Networking and communication service providers

-

Passenger information system software providers

-

Automated passenger counting and information system industry associations

-

Professional service/solution providers

-

Research institutions and organizations

-

Standards organizations and regulatory authorities

-

Technology consultants

Report Objectives

-

To define, describe, and forecast the automated passenger counting and information system market, based on offering and installation type in terms of value

-

To define, describe, and forecast the automated passenger counting system market based on technology and application, in terms of value

-

To define, describe, and forecast the passenger information system market based on type and application, in terms of value

-

To forecast the automated passenger counting and information system market size, in terms of volume

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the total market

-

To study the complete value chain and allied industry segments and perform a value chain analysis of the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

-

To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

-

To understand the impact of AI on the automated passenger counting and information system market

-

To understand the 2025 US tariff impact

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Dirk

Jul, 2016

We are most interested in the Automatic People Counting portion of the report, specifically for bus and rail transit in USA and EMEA. Moreover, we want to know more about respective market's leaders / shares, average pricing, unit volumes, trends, etc..

vijay

Dec, 2017

I am working with Urban Mass Transit Company (we are the leading consulting company in India dealing in urban mobility). Our project envisages to have 41 jetties and 82 boats and is the first of its kind in India and 2nd in terms of boats used for the mass transit in the world. As part of the project, we are proposing to include ITM system. An intelligent transportation system aims to provide innovative services relating to different modes of transport and traffic management and enable various users to be better informed and make safer, more coordinated, and 'smarter' use of transport networks. Knowing your strengths in ITMS , we would be very happy if you can let us know if you would be interested in being the part of this project and help us understand how your solutions can benefit our purpose. I am here by attaching basic requirements for the proposed system for your reference. Hope this clarifies and do let me know if you need any further clarifications. .

Roshan

Feb, 2015

Is this report includes Passenger Survey - Primary & Secondary, Preparation of Civil Aviation Development Plan, Preparation of Aerodrome License, Airport Security Program, SMS Manual things?.