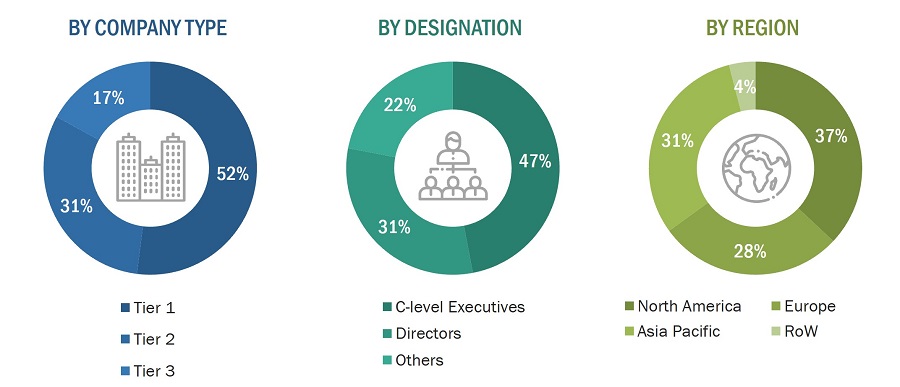

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the people counting system market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the people counting system market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the people counting system market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the people counting system market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the people counting system scenarios through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (people counting system hardware manufacturers/providers) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

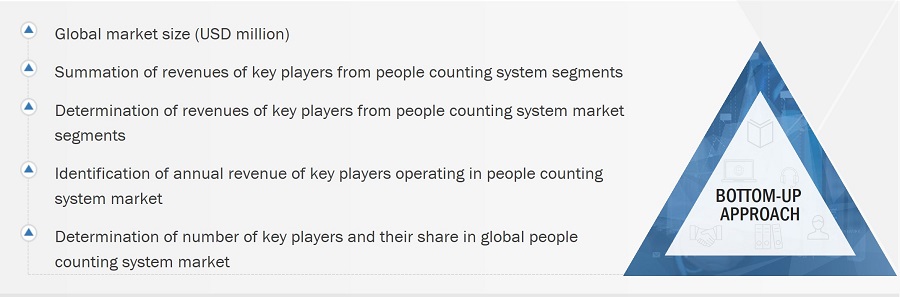

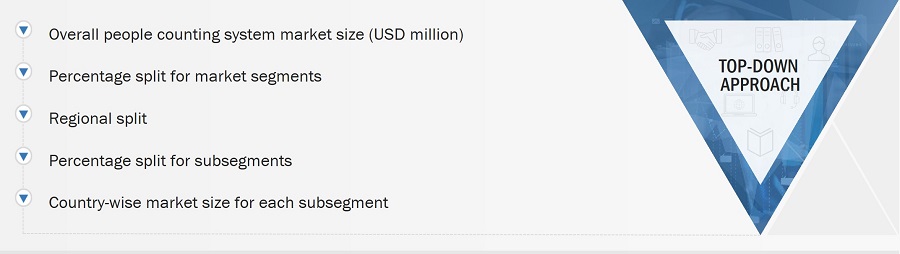

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the people counting system market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

People counting system Market: Bottom-Up Approach

People counting system Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

The people counting system is a device that accurately measures the number of visitors in retail stores, shopping malls, corporate offices, event centers, banks, and other locations. The collected people count data helps end users predict visitors’ behavior in a physical space, determine visitor frequency and buying patterns, and measure the effectiveness of marketing campaigns. End users can optimize operational decisions, improve staff management, and increase sales revenue. With the help of people counting systems. Enterprises can make critical decisions such as improving customer experience, utilizing the space efficiently, ensuring the safety of customers, and managing queues more efficiently.

Key Stakeholders

-

Suppliers of raw materials

-

Technology investors

-

Original equipment manufacturers (OEMs)

-

Third-party service providers

-

Government labs

-

In-house testing labs

-

System integrators

-

Distributors, resellers, and traders

-

Research institutions and organizations

-

Data processing forums, alliances, consortiums, and associations

-

Market research and consulting firms

-

End users

Report Objectives

-

To describe, segment, and forecast the overall people counting system market based on type, technology, offering, and end-use application

-

To describe and forecast the market for various segments with respect to four main regions: North America, Europe, Asia Pacific, and RoW, in terms of value

-

To provide qualitative information about the mounting platforms of people counting systems.

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the said market

-

To provide a comprehensive overview of the people counting system value chain

-

To analyze opportunities for stakeholders by identifying high-growth segments of the people counting system market

-

To strategically analyze the ecosystem, Porter’s five forces, tariffs and regulations, patent landscape, trade landscape, and case studies/use cases pertaining to the market under study

-

To provide a detailed analysis of the impact of the recession on the people counting system market, its segments, and market players

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

-

To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, along with detailing the competitive landscape for market leaders

-

To analyze competitive developments, such as product launches, collaborations, partnerships, and acquisitions in the people counting system market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Ethan

Jan, 2018

Can I buy this report section wise instead of whole? I am interested just in '8 People Counting System Market, By Offering' and '10 People Counting System Market, By End User'.

Jaime

Nov, 2017

We are a Startup based in Southampton. Me and my colleagues are final-year Computer Vision PhD students, with the intention to spin-out a company based on the knowledge acquired during our studies. Our company will provide a cloud-based customer counting and analytics system. Being an early stage startup, our company has no investment or revenue yet. We would use this report to better understand the market we are trying to address and pitch our idea to potential investors. Understanding this market is key for us, but cannot yet afford the cost of such work..

jamie

Feb, 2019

I am conducing an internal research into the footfall counting industry to evaluate potential partners, which work in an adjacent field. Can this report help me with it?.

Oana

Jun, 2017

Hi, I want to include some information about people counting system in my thesis. Could you please advice?.

IGNACIO

Oct, 2019

Can you help us in knowing alternatives, to select possible solutions and suppliers for implementing Passenger counter system in Buses and paid zones of Public Transportation network in Rural zones of Chile (Nearly 10,000 busses and 4,000 Paid Zones)?.

Erik

Feb, 2018

Hi there, I would like to request a sample of the report 'People Counting System Market by Technology (IR Beam, Video Based, Thermal Imaging), Application (Retail, Transportation, Banking & Finance, Hospitality, Sports & Entertainment, Government), and Geography - Global Forecast to 2022'. It is important that the sample contains not just the table of contents, but also a sample of the actual report. Is it possible to purchase parts of the report?.

Philipp

Jan, 2019

Would like to discuss data provided and depth of the respective chapter to validate breadth of the report required for us to purchase. Please get in touch either over the course of the next hour (14. Jan. before 9pm CET) or tomorrow morning (between 9 and 10am CET)..

Jakob

Aug, 2019

Hello, What does 'Transportation' segment entail? Do you have market size for airports? Does the report provide penetration of the technologies in the different market segments? Could you please send me a sample of the report?.

Irene

Apr, 2017

I need information on 3 parts - 1) Video-based people counting market 2) Analysis of relevant players of video-based people counting 3) Video-based people counting market for application in Retail, Transportation, Sports & Entertainment, Government. Does the report cover this exclusively?.

Rathishraj

Mar, 2019

We are looking for growth opportunities in people counting market. We are a startup and want to understand customer preferences and accordingly pitch our ideas with appropriate data..

Jason

Mar, 2019

We are the corporate venture fund. We are trying to map out the players offering solutions regarding people counting, traffic tracking in retail stores for better consumer engagement. I think your report could be interesting for our research but it needs to be updated as the market/players are evolving very drastically..

Paula

Feb, 2019

We're interested in Market Research Reports regarding Automated Passenger Counter and Passenger Information System Markets..

Digvijay

Jan, 2021

I want a sample of this report..