Enterprise Asset Management Market by Offering, Application (Asset Life Cycle Management, Inventory Management, Predictive Maintenance), Deployment Model, Organization Size, Vertical (Manufacturing, Energy & Utilities) & Region - Global Forecast to 2028

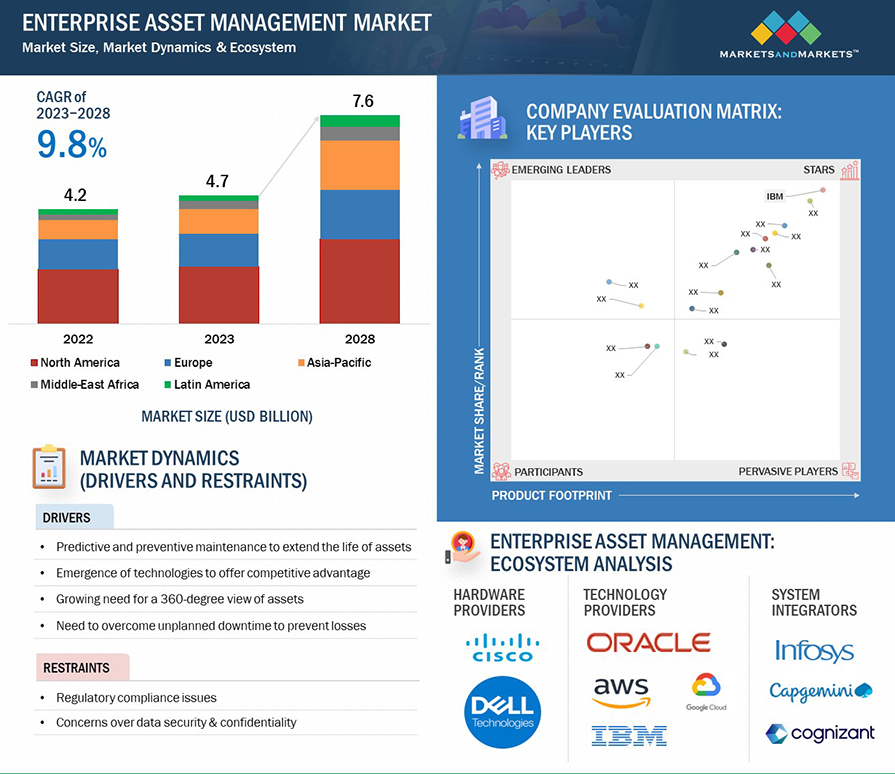

[257 Pages Report] The enterprise asset management market is expected to grow from USD 4.7 billion in 2023 to USD 7.6 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period. Enterprise asset management is a business solution to manage organizations' assets across different departments, facilities, business units, and geographic locations. Companies can view their infrastructures throughout their entire lifecycle, from design, commission, or procurement to operation, maintenance, disposal, and replacement by implementing enterprise asset management solutions. Most market vendors offer robust and comprehensive solutions and encompass the agility and flexibility necessary to provide global organizations with the tools they need to manage their business operations, control costs, and increase overall productivity. Enterprise asset management has evolved. The most primitive form of asset management was using run–to–failure systems for railroads. In 1950, preventive maintenance systems were installed in railways and railroads. Since the 1980s, asset management practices, such as reliability-centered and condition-based maintenance, have been used in airline, military, and power verticals. After that, enterprises felt that tracking and managing assets and activities would significantly impact organizational efficiency regarding profit and resource optimization. Since the 20th century, advanced enterprise asset management solutions and services have been used in all asset-intensive verticals, including energy & utilities, transportation & logistics, government & defense, manufacturing, and healthcare & life sciences.

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact on the Enterprise Asset Management Market

The global enterprise asset management (EAM) market is intricately connected to various economic and geopolitical factors, and the simultaneous occurrence of a recession, the Russia-Ukraine war, inflation, and rising interest rates have profound implications for this sector. Recessionary periods often lead businesses to prioritize cost-cutting measures, prompting a reevaluation of asset management strategies. The Russia-Ukraine conflict introduces geopolitical uncertainties, disrupting global supply chains and affecting enterprises' ability to manage and maintain assets efficiently. Inflation poses a dual challenge, increasing operational costs and potentially diminishing purchasing power for EAM solutions. Rising interest rates can add further pressure by increasing the cost of capital for businesses looking to invest in EAM technologies. In such a complex environment, companies often reduce output and manufacturing activity during recessions due to the rising cost of raw materials. A drop in exports and economic activity might follow such a shift. Therefore, the enterprise asset management market will experience a transformation as it moves away from broad-based upgrading toward a focus on producing specific business value.

Enterprise Asset Management Market Dynamics

Driver: Emergence of technologies to offer competitive advantage

Organizations increasingly recognize the strategic importance of technology-driven solutions in optimizing asset performance. Continuous innovation in sensor technologies, data analytics, and artificial intelligence has enabled the development of advanced EAM systems, fostering a paradigm shift from reactive to proactive asset management. Companies like IBM, SAP, and Oracle are at the forefront of incorporating predictive analytics and AI-driven insights into EAM solutions, enabling organizations to make data-driven decisions for maintenance, asset performance optimization, and overall operational efficiency. These technological advancements streamline asset management processes and contribute to significant cost savings and increased asset reliability. The rise of the Internet of Things (IoT) has been particularly impactful, as it allows for real-time monitoring of assets, enabling predictive maintenance and minimizing downtime.

Additionally, Artificial Intelligence (AI) and Machine Learning (ML) play a crucial role in EAM by analyzing vast datasets to predict equipment failures, optimize maintenance schedules, and improve overall asset performance. For instance, IBM's Maximo Asset Performance Management leverages AI to provide insights into equipment health, helping organizations make informed decisions. These technological advancements collectively contribute to more efficient asset management, reduced operational costs, and increased productivity, defining a new era for EAM solutions.

Restraint: Concerns over data security & confidentiality

As organizations increasingly rely on digital platforms to manage their assets, the vulnerability of sensitive information becomes a paramount issue. Data breaches and cyberattacks have raised apprehensions among businesses, as EAM systems often store critical data related to asset performance, maintenance schedules, and operational details. Instances such as the SolarWinds cyberattack in 2020, which impacted various sectors globally, including critical infrastructure, have underscored the vulnerability of digital systems. According to a study by IBM Security and the Ponemon Institute, the average cost of a data breach reached USD 4.24 million in 2021. In the context of EAM, industries dealing with sensitive information, like healthcare and finance, are particularly wary of adopting comprehensive asset management solutions due to the potential exposure of critical operational data. The fear of unauthorized access, data leaks, or malicious activities has made many enterprises hesitate to adopt EAM solutions, particularly in industries such as healthcare, finance, and defense dealing with highly confidential information. Compliance with data protection regulations, like the General Data Protection Regulation (GDPR) in Europe, adds a layer of complexity and scrutiny.

Opportunity: Data-driven asset management

Data is the driving force for change in many organizations. Today, organizations are creating data-driven business intelligence to gain deeper insights into their clients' needs and better understand businesses. To achieve this, enterprises need strong data science capabilities to implement the cross-functional model across different functionalities. Intelligent asset management provides real-time data-driven insights for predictive maintenance, monitoring, and management across industries. For example, in January 2022, IBM enhanced its Enterprise Asset Management platform, IBM Maximo Application Suite (MAS), with IBM Cloud Pak for Data to provide a framework for combining various data from different areas of an organization. Data-driven asset management offers the ability to make informed business decisions to avoid unplanned downtime due to critical problems and identify ways for cost saving and process optimization. According to IFS EAM Trend Report 2023, Among asset managers surveyed, 54% expressed a positive response, while 38% indicated a negative response, citing a lack of access to such data. Despite this, participants were questioned about the significance of data analytics and predictive modeling in enhancing asset management decisions, with more than 50% expressing that it holds either very or somewhat important; this implies that even among those without current access to the data, there is a shared belief that possessing such information would prove advantageous in optimizing asset management decisions.

Challenge: Cybersecurity concerns

The adoption of Enterprise Asset Management (EAM) solutions brings forth significant cybersecurity concerns that organizations must address to safeguard sensitive asset data and maintain the integrity of their operations. EAM systems, often reliant on interconnected networks and cloud-based platforms, become potential targets for cyber threats. The digitization of asset management processes increases the attack surface, exposing vulnerabilities that malicious actors may exploit. Breaches in EAM security could lead to unauthorized access to critical asset information, disruption of operations, and compromise of sensitive data. As organizations integrate EAM solutions with other enterprise systems, the potential for cyber threats grows, necessitating robust measures such as encryption, access controls, and continuous monitoring. Furthermore, the evolving nature of cyber threats demands a proactive approach, including regular software updates, employee training on cybersecurity best practices, and collaboration with cybersecurity experts to stay ahead of emerging threats. As EAM adoption continues to rise, prioritizing cybersecurity is paramount to ensure the resilience and reliability of asset management systems in the face of an ever-evolving threat landscape.

To know about the assumptions considered for the study, download the pdf brochure

Based on application, the predictive maintenance segment will grow at a higher CAGR during the forecast period.

Predictive maintenance is a proactive approach that relies on data analytics, sensor technology, and machine learning algorithms to analyze real-time and historical data from assets. By monitoring equipment conditions, performance patterns, and potential failure indicators, predictive maintenance aims to optimize asset performance. This approach minimizes unplanned downtime, reduces maintenance costs, and extends the lifespan of critical assets. EAM systems with predictive maintenance capabilities enable organizations to transition from reactive and scheduled maintenance to a more efficient and strategic model. The integration of predictive maintenance into EAM enhances overall operational efficiency. It empowers organizations to make data-driven decisions, prioritize maintenance tasks, and allocate resources more effectively for sustained asset reliability.

Based on vertical, the transportation & logistics segment will grow at the highest CAGR during the forecast period.

In the dynamic and complex world of transportation, EAM solutions play a pivotal role in optimizing the maintenance, tracking, and utilization of diverse assets, ranging from vehicles and trailers to warehouse equipment. These solutions offer real-time visibility into the condition and location of assets, enabling companies to implement proactive maintenance strategies, minimize downtime, and extend the lifespan of their fleets. EAM systems also contribute to efficient inventory management, helping logistics providers track spare parts and manage the maintenance supply chain effectively. With route optimization and performance analytics features, EAM solutions enhance overall operational efficiency, reduce fuel consumption, and improve asset utilization in transportation and logistics operations. Integrating EAM with other systems, such as Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), ensures a seamless flow of information, enabling organizations to make data-driven decisions and adapt quickly to changing logistics requirements.

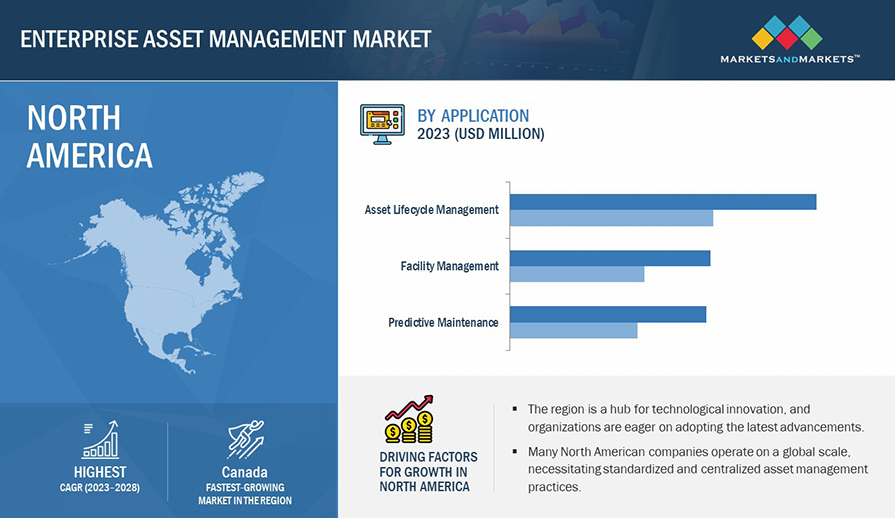

Based on region, North America holds the largest market share during the forecast period.

North America stands at the forefront of global technological innovation, with robust technology and IT adoption across its diverse landscape. Organizations in North America are leveraging advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) to enhance the capabilities of EAM systems. Integrating IoT sensors with assets allows for real-time monitoring, predictive maintenance, and data-driven decision-making. This approach minimizes downtime, reduces maintenance costs, and prolongs the lifespan of critical assets. For example, in the energy sector, companies utilize IoT-enabled sensors to monitor equipment health, predict potential failures, and optimize maintenance schedules. Moreover, the shift towards mobile EAM applications has gained traction, allowing maintenance teams to access and update asset information on the go, enhancing overall operational efficiency.

Key Market Players

The enterprise asset management market is dominated by a few globally established players such as IBM (US), SAP (Germany), Oracle (US), Hexagon (Sweden), and IFS (Sweden), among others, are the key vendors that secured enterprise asset management contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the enterprise asset management market.

Scope of Report

|

Report Metrics |

Details |

|

Market Size Available For Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Application, Deployment Model, Organization Size, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

IBM (US), SAP (Germany), Oracle (US), Hexagon (Sweden), IFS (Sweden), Hitachi Energy (Switzerland), IFS Intelligent Process Solutions (Germany), Accruent (US), AVEVA (UK), Aptean (US), eMaint (US), CGI (Canada), UpKeep (US), RFgen Software (US), AssetWorks (US), Ramco Systems (India), and others |

This research report categorizes the enterprise asset management market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

- Software

- Services

- Professional Services

- Managed Services

By Application:

- Asset Lifecycle Management

- Inventory Management

- Work Order Management

- Labor Management

- Predictive Maintenance

- Facility Management

- Other Applications

By Deployment Model:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- Manufacturing

- Energy & Utilities

- Healthcare & Life Sciences

- Transportation & Logistics

- IT & Telecom

- Government & Public Sector

- Education

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- Saudi Arabia

- UAE

-

Rest of the GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2023, American racing team AJ Foyt Racing announced a multi-year partnership with IFS to utilize IFS Ultimo's asset management solution for parts management, lifting, and maintenance.

- In October 2022, Hexagon expanded its customer base in Asia Pacific through organic growth and partnerships to optimize digital asset management with the help of HxGN EAM.

- In October 2022, Oracle introduced a new asset-based service solution for Oracle Fusion Cloud Applications Suite. It would help businesses predict and prevent asset downtime by reducing costs, optimizing service efficiency, and enhancing the overall customer experience.

- In September 2022, Hitachi Energy announced that Energinet accelerated its digital transformation by utilizing the Lumada APM solution. The collaboration between the companies would support TSO in better assessing the grid reinvestments needed to achieve their 2030 carbon neutrality goals.

- In January 2021, IBM collaborated with Atos to accelerate digital transformation in enterprises with AI and RedHat Open Shift technologies. The collaboration offers asset life cycle management solutions, asset monitoring and MRO optimization solutions, SMART waste/energy monitoring and optimization solutions, and packaging, transportation, and logistics optimization solutions to end users.

Frequently Asked Questions (FAQ):

What is Enterprise Asset Management?

Enterprise Asset Management refers to the combination of software, systems, and services used by enterprises to manage the life cycle of physical assets and equipment to maximize their lifetime, reduce costs, and improve quality and efficiency, the health of assets, and environmental safety. It mainly offers functionalities, such as planning, organizing, and implementing maintenance activities carried out by employees of organizations or third-party entities. Enterprise Asset Management applications include asset lifecycle management, inventory management, work order management, labor management, predictive maintenance, facility management, reporting & analytics, Computerized Maintenance Management System (CMMS), and Field Service Management (FSM).

Which country was the early adopter of enterprise asset management solutions?

The US was at the initial stage of enterprise asset management solutions.

Which are the key vendors exploring Enterprise Asset Management Solutions?

Some of the significant vendors offering enterprise asset management solutions across the globe include IBM (US), SAP (Germany), Oracle (US), Hexagon (Sweden), IFS (Sweden), Hitachi Energy (Switzerland), IFS Intelligent Process Solutions (Germany), Accruent (US), AVEVA (UK), Aptean (US), eMaint (US), CGI (Canada), UpKeep (US), RFgen Software (US), AssetWorks (US), and Ramco Systems (India).

What is the total CAGR recorded for the Enterprise asset management market during 2023-2028?

The Enterprise asset management market will record a CAGR of 9.8% from 2023-2028

What is the projected market value of the enterprise asset management market?

The enterprise asset management market will grow from USD 4.7 billion in 2023 to USD 7.6 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

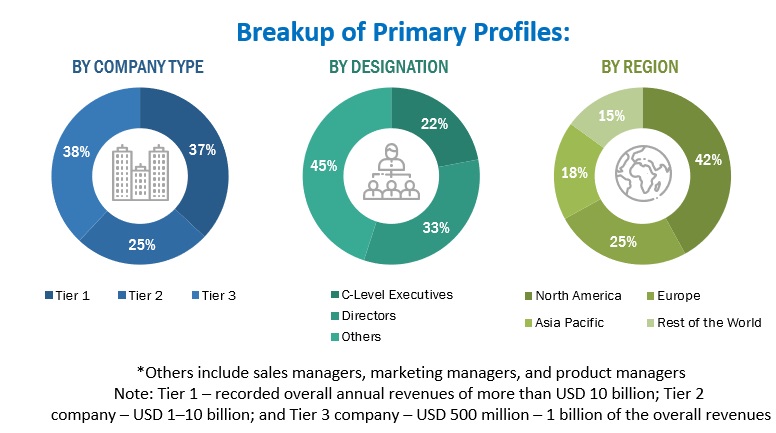

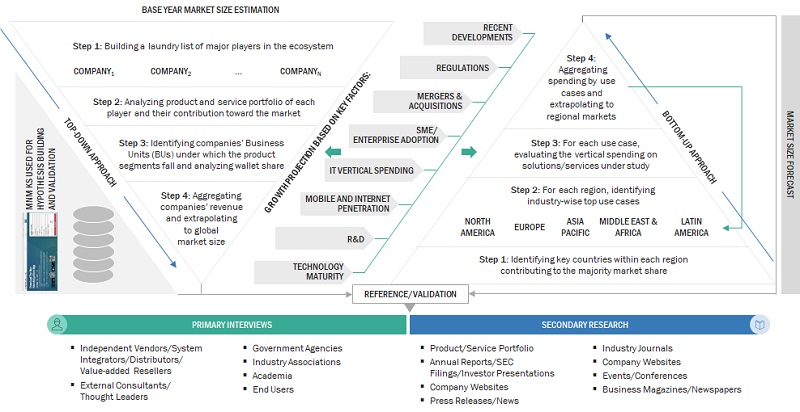

The study involved four major activities in estimating the enterprise asset management market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the enterprise asset management market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We used these sources to identify and collect valuable information for this technical, market-oriented, and commercial enterprise asset management market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using enterprise asset management solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall enterprise asset management market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the enterprise asset management market and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the enterprise asset management market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Enterprise asset management market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying several factors and trends from both the demand and supply sides in the enterprise asset management market.

Market Definition

Enterprise Asset Management refers to the combination of software, systems, and services used by enterprises to manage the life cycle of physical assets and equipment to maximize their lifetime, reduce costs, improve quality and efficiency, and maintain the health of assets and environmental safety. It mainly offers functionalities, such as planning, organizing, and implementing maintenance activities carried out by employees of organizations or third-party entities. Enterprise Asset Management applications include asset lifecycle management, inventory management, work order management, labor management, predictive maintenance, facility management, reporting & analytics, Computerized Maintenance Management System (CMMS), and Field Service Management (FSM).

Key Stakeholders

- Technology Service Providers

- Cloud Service Providers (CSPs)

- Colocation Providers

- Government Organizations

- Networking Companies

- Consultants/Consultancies/Advisory Firms

- Support and Maintenance Service Providers

- Telecom Service Providers

- Information Technology (IT) Infrastructure Providers

- System Integrators (SIS)

- Regional Associations

- Independent Software Vendors (ISVS)

- Value-added Resellers and Distributors

Report Objectives

- To define, describe, and forecast the enterprise asset management market based on offerings, applications, deployment models, organization sizes, industry verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the macro and micromarkets1 concerning growth trends, prospects, and their contributions to the overall market

- To analyze the industry trends, patents and innovations, and pricing data related to the enterprise asset management market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Asset Management Market