Functional Proteins Market by Type (Whey Protein Concentrates, Isolates, Hydrolysates, Casein, Soy Protein), Source (Animal, Plant), Form (Dry, Liquid), Application and Region - Trends and Forecast to 2030

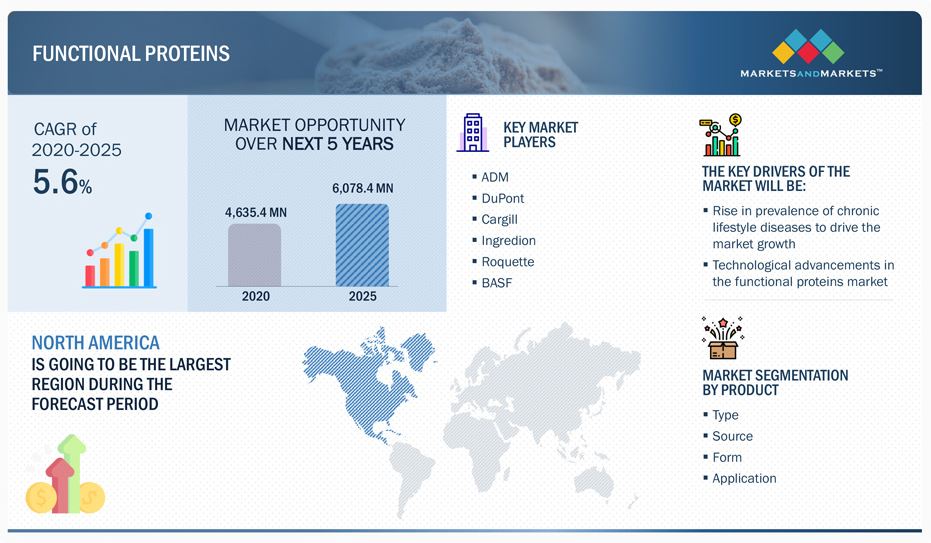

The global functional proteins market is expected to reach at a CAGR of 5.6% during forecast period, the global market will reach a value of 6.1 BN by 2025. The base value is considered USD 4.6 Bn in 2020. Hectic lifestyles, busy schedules, and the rise of chronic diseases such as diabetes and obesity are shifting consumer preferences toward adopting healthier diets and nutritional supplements to prevent the onset of chronic ailments. Hence, the inclusion of functional proteins in consumers’ diets is on the rise. Furthermore, the steadfast economic development of countries and the rising per capita income of the millennial population is fueling the demand for functional proteins, as consumers can now afford to purchase higher-priced functional food products on account of their increased disposable income.

To know about the assumptions considered for the study, download the pdf brochure

Functional Proteins Market Dynamics

Drivers : Rise in prevalence of chronic lifestyle diseases to drive the market growth

There is a significant rise in the number of people suffering from chronic ailments, such as obesity, diabetes, blood pressure, and cardiovascular diseases. Hence, consumers across regions have become more health-conscious and are focusing on adopting a healthier balanced diet. This shift in consumer preferences has risen on account of the high degree of chronic diseases prevailing in the population. Diseases like diabetes, cholesterol anomalies, and obesity are key factors that are projected to drive the overall functional proteins market.

The growing health and wellness trends among consumers due to chronic diseases will further drive the demand for functional proteins in the daily dietary intake of consumers. Consumers are also seeking options that provide the right combination of nutrition and taste, which leads to a rise in demand for functional proteins, which is further projected to contribute to the growth of the market.

The millennial population is increasingly adopting functional food products into their diets as these products suit their lifestyle and complement their hectic schedules in an ample way, thus increasing the demand for functional proteins. Furthermore, with the rising income levels of consumers and subsequent economic development, functional proteins have become a sought-after product owing to the associated health benefits and the consumers’ ability to purchase them.

Restraints: High cost of plant-based functional proteins

Science and technology are helping people identify foods that will help people manage their weight and overall health. Plant-based functional food and dietary supplements involve significantly high costs, which could restrain the growth of the functional proteins market. Plant-based functional proteins' development and commerce aspects are complex, expensive, and uncertain. Substantial investment is required for the R&D of a strain to be used to produce new functional ingredients such as proteins. As a result of the high cost of production, the price of the final product is also high.

Although consumers are aware of the health benefits of these expensive plants sourced functional proteins such as pea protein, their high prices restrict them from buying the product. These less economical products might restrict the market's growth, particularly in price-sensitive countries such as South Africa and Mexico.

Also, animal-based proteins are facing restraints as the vegan population is on the rise, and the health benefits of vegetarianism are trending among consumers. The rising demand for plant-based proteins is adversely affecting the sale and consumption of animal-based proteins, hindering the market growth.

Opportunities: Technological advancements in the functional proteins market

The recent advancements in technologies, such as microarray technology, protein hydrolysis, and protein powder manufacturing, to promote health benefits are highly likely to present growth opportunities for the key players in the functional proteins market. Numerous innovations have been observed in high throughput protein production.

New technological developments, such as the heat-stable form of whey protein, are expected to impact the global functional proteins market positively. Novel varieties of soy proteins that do not change the texture of baked goods have also been developed. Furthermore, recent advancements in the development of colostrum milk on account of exhibiting significant functional properties aimed at improving hormone growth are expected to drive the increase in consumption of functional proteins, creating growth opportunities for the market.

Challenges: Regulatory influence

The stringent regulatory legislations regarding animal-derived proteins are projected to be challenging for the growth of the functional proteins market. The Federal Meat and Poultry Inspection Program of the US permit animal-derived proteins in functional foods. There are various regulations regarding processed animal proteins derived from ruminants. The import of processed animal-sourced functional proteins is allowed under the US Veterinary Permit to import and transport controllable materials. According to regulation EC 999/2001, processed animal proteins are banned for animal nutrition. This is projected to restrict the use of functional proteins for applications in animal nutrition. The European Commission and the EPA have framed regulations for the production of functional proteins in light of rising concerns about reducing greenhouse emissions.

Additionally, regulations related to the use of allergens such as soy concentrates in functional foods and beverages are projected to hamper certain proteins' growth.

By type, the whey protein concentrates segment dominated the functional proteins market.

As the major segment in the functional protein market, the growing demand for whey protein concentrates is attributed to its multi-faceted functionalities. They are used as emulsifiers, viscosity, binding agents, foaming agents, and flavor enhancers in functional food and beverages. The major whey proteins are á-lactalbumin and â-lactoglobulin, which are widely preferred in the food processing industry. WPCs are often used in protein-based product innovation owing to their versatility. Key players such as Arla Foods (UK) and DSM (Netherlands) continually invest in WPCs to develop innovative formulations and products.

By source, the animal source segment will continue to dominate the functional proteins market during the forecast period.

The market for functional proteins is segmented into animal and plant sources. The animal source segment has seen considerable growth, as it is widely preferred as a reliable protein source. Animal protein is proven to have positive health benefits and is used as an ingredient in dietary supplements. Major segments under animal-sourced proteins include dairy, egg, and gelatin.

The plant-based protein market is expected to grow significantly in the forecast period, as an increasing number of consumers vouch for its credibility and are inclined towards veganism.

To know about the assumptions considered for the study, download the pdf brochure

North America is projected to account for the largest market during the forecast period

North America is projected to dominate the market during the forecast period owing to the high prevalence of chronic diseases in countries such as the US. Whey protein concentrates are gaining traction as consumers are shifting to dairy proteins to fulfill their nutritional requirements. On the other hand, there has been an increase in the number of vegan consumers, majorly in the North American and European regions. Emerging markets in economies such as the Asia Pacific countries are going to be potential markets for functional protein manufacturers.

World’s Largest Functional Protein Brands

Key players in this market include ADM (US), DuPont (US), Cargill (US), Ingredion (US), Arla Foods (UK), Roquette (France), BASF (Germany), Glanbia (Ireland), Fonterra (New Zealand), DSM (Netherlands), FrieslandCampina (Netherlands), Essentia Protein Solutions (UK), Amai Proteins (Israel), Mycorena (Sweden), Merit Functional Foods (Canada), Plantible Foods (US), BENEO (Germany), ProtiFarm (Gelderland), Omega Protein (US)

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 4.6 billion |

|

Revenue forecast in 2025 |

USD 6.1 billion |

|

Growth Rate |

CAGR of 5.6% from 2022 to 2027 |

|

Base year for estimation |

2019 |

|

Historical data |

2015-2025 |

|

Forecast period |

2020-2025 |

|

Quantitative units |

Value (USD million) |

|

Segments covered |

Type, Source, Form, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

ADM (US), DuPont (US), Cargill (US), Ingredion (US), Arla Foods (UK), Roquette (France), BASF (Germany), Glanbia (Ireland), Fonterra (New Zealand), DSM (Netherlands), FrieslandCampina (Netherlands), Essentia Protein Solutions (UK), Amai Proteins (Israel), Mycorena (Sweden), Merit Functional Foods (Canada), Plantible Foods (US), BENEO (Germany), ProtiFarm (Gelderland), Omega Protein (US) |

This research report categorizes the functional proteins market based on type, source, form, application and region.

Based on type, the market has been segmented as follows:

- Whey protein concentrates

- Whey protein isolates

- Hydrolysates

- Casein/Caseinates

- Soy protein

- Other types (egg protein, wheat protein, rice protein, pea protein, rapeseed protein, sunflower protein)

Based on source, the market has been segmented as follows:

- Animal

- Plant

Based on form, the market has been segmented as follows:

- Dry

- Liquid

Based on application, the market has been segmented as follows:

- Functional food

- Functional beverages

- Dietary supplements

- Animal nutrition

- Sports nutrition

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments

- In December 2020, Cargill expanded its European ingredient portfolio with the addition of pea protein. This product launch enabled Cargill to get access to the pea protein market.

- In December 2020, Ocean Spray (US) partnered with Amai Proteins to incorporate healthy, sweet proteins into its product portfolio. The joint venture gave considerable visibility to the company and established a popular brand identity.

- In September 2002, ADM expanded its protein portfolio with textured wheat and pea proteins. These high-functionality proteins would improve the meat-like texture of alternative meats. This new launch ensured ADM’s leadership in the plant proteins market.

- In November 2020, Ingredion acquired Verdient Foods (Vanscoy, SK) with 100% ownership. The acquisition enabled net sales growth and expanded the manufacturing capability of Ingredion with the addition of two manufacturing facilities in Canada.

- In September 2020, ADM expanded its protein portfolio with textured wheat and pea proteins. These high-functionality proteins improve the meat-like texture of alternative meats. This new launch ensured ADM’s leadership in the plant protein market.

- In May 2020, Ingredion invested in NorQuin (CA), extending its plant-based protein portfolio to globally distribute Quinoa flours. The investment broadened the company’s protein range to include Quinoa flours in its extensive portfolio.

Frequently Asked Questions (FAQ):

What is the current size of the global functional proteins market?

The global functional proteins market was valued at USD 4.6 billion in 2020 to reach USD 6.1 billion by 2025, at a compound annual growth rate (CAGR) of 5.6% during the forecast period.

Does the scope cover functional proteins in liquid and dry form?

The report covers functional proteins in liquid and dry form as given under by form segment.

Is it possible to provide further segmentation and analysis of functional proteins?

Yes, further country-level analysis can be provided for the functional proteins market on the basis of sources such as egg protein, dairy proteins, and plant-based proteins.

We are looking for quantification at each stage in the supply chain. Can this be provided?

The report covers value chain analysis and supply chain analysis at global levels. Further drill down at the regional level can be provided for required products.

Can you provide an estimation for countries of the Middle Eastern region?

Yes, customization for the Middle Eastern market for various segments can be provided on various aspects, including market size, forecast, market trends, company profiles & competitive landscape. We can provide additional country-wise estimations for countries such as Egypt, Sudan, Turkey, Jordan, Oman, and Saudi Arabia.

Also, you can let us know if any other countries are interested. .

Why is functional proteins market growing?

The major drivers of the functional proteins market include increasing demand for functional foods and dietary supplements, growing awareness about the health benefits of functional proteins, and the increasing prevalence of chronic diseases such as diabetes and obesity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 FUNCTIONAL PROTEINS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH 1

2.2.1.1 Market estimation notes

2.2.2 APPROACH 2

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 58)

TABLE 2 FUNCTIONAL PROTEINS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 9 MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 MARKET SIZE, BY SOURCE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 MARKET, BY FORM, 2020 VS. 2025 (USD MILLION)

FIGURE 13 MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 BRIEF OVERVIEW OF THE FUNCTIONAL PROTEINS MARKET

FIGURE 14 INCREASING DEMAND FOR CONSUMER HEALTH AND WELLNESS TO DRIVE THE GROWTH OF THE FUNCTIONAL PROTEINS MARKET

4.2 FUNCTIONAL PROTEIN MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 15 US IS THE LARGEST MARKET GLOBALLY FOR FUNCTIONAL PROTEINS IN 2020

4.3 NORTH AMERICA: FUNCTIONAL PROTEIN MARKET, BY TYPE AND COUNTRY

FIGURE 16 CANADA IS ESTIMATED TO GROW AT THE HIGHEST RATE IN NORTH AMERICA IN 2020

4.4 FUNCTIONAL PROTEIN MARKET, BY TYPE AND REGION

FIGURE 17 WHEY PROTEIN CONCENTRATES SEGMENT IS ESTIMATED TO DOMINATE THE FUNCTIONAL PROTEINS MARKET IN 2020

4.5 FUNCTIONAL PROTEIN MARKET, BY APPLICATION

FIGURE 18 FUNCTIONAL FOOD SEGMENT PROJECTED TO DOMINATE THE MARKET

4.6 FUNCTIONAL PROTEIN MARKET, BY SOURCE

FIGURE 19 ANIMAL SOURCE SEGMENT PROJECTED TO DOMINATE THE FUNCTIONAL PROTEINS MARKET

4.7 FUNCTIONAL PROTEIN MARKET, BY FORM

FIGURE 20 DRY FORM PROJECTED TO DOMINATE THE FUNCTIONAL PROTEIN MARKET

5 FUNCTIONAL PROTEIN MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

FIGURE 21 HIGH DEMAND FOR PROTEIN WITNESSED IN THE DAILY DIET OF CONSUMERS IN NORTH AMERICA IN 2018 (%)

FIGURE 22 US: WHEY PROTEIN PRODUCTION, 2016 VS. 2017 (MILLION POUNDS)

5.2 MARKET DYNAMICS

FIGURE 23 FUNCTIONAL PROTEINS MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing instances of chronic diseases

FIGURE 24 PERCENTAGE OF THE US POPULATION WITH MULTIPLE CHRONIC ILLNESSES, 2017

FIGURE 25 CHRONIC DISEASES WERE AMONG THE TOP TEN CAUSES OF DEATH WORLDWIDE AMONGST ALL AGES, 2016

5.2.1.2 Rising healthcare burden due to chronic ailments

5.2.1.3 Rising health awareness among consumers

FIGURE 26 CONSUMER INTEREST IN SPECIFIC NUTRIENTS IN DIETS

5.2.1.4 Increasing applications of functional proteins

5.2.2 GROWING DEMAND FOR FUNCTIONAL PROTEINS FOR ANIMAL NUTRITION

5.2.2.1 Growing consumption of functional foods

FIGURE 27 RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS IN AUSTRALIA (USD MILLION), 2018-2022

5.2.3 RESTRAINTS

5.2.3.1 Increasing allergies and intolerances related to a few functional proteins

5.2.3.2 High cost of plant-based functional proteins

5.2.4 OPPORTUNITIES

5.2.4.1 Rising middle-class income in emerging economies

FIGURE 28 PER CAPITA GDP (USD), BY COUNTRY, 2019

5.2.4.2 Technological advancements in the functional protein market

5.2.5 MICROARRAYS

5.2.5.1 Growing popularity of functional proteins for sports nutrition

FIGURE 29 NUMBER OF HEALTH CLUB CONSUMERS IN THE US (MILLIONS), 2008 VS. 2018

5.2.6 CHALLENGES

5.2.6.1 Regulatory influence

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 IMPACT OF COVID-19 ON SPORTS NUTRITION, WHICH IS ONE OF THE MAJOR APPLICATIONS OF FUNCTIONAL PROTEINS

5.3.2 COVID-19 IMPACT ON FUNCTIONAL PROTEINS SUPPLY CHAIN AND AVAILABILITY OF RAW MATERIALS

5.3.3 COVID-19 HAS BENEFITTED THE FUNCTIONAL FOODS MARKET, FURTHER DRIVING THE DEMAND FOR FUNCTIONAL PROTEINS

6 FUNCTIONAL PROTEIN INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

FIGURE 30 WHEY PROTEINS: CONSTITUENTS AND APPLICATIONS

6.2 VALUE CHAIN ANALYSIS

FIGURE 31 FUNCTIONAL PROTEINS: VALUE CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.3.1 HYDROLYSIS

6.3.2 MEMBRANE FILTRATION TECHNOLOGY

6.3.3 FOOD MICROENCAPSULATION

6.3.4 BIOTECHNOLOGY

6.4 PRICING ANALYSIS: FUNCTIONAL PROTEINS MARKET

TABLE 3 PRICING ANALYSIS, BY TYPE, 2019 (USD/KG)

FIGURE 32 PRICING TREND OF WHEY PROTEIN CONCENTRATES, 2016–2020 (USD/TON)

6.5 ECOSYSTEM MAP

6.5.1 FUNCTIONAL PROTEIN MARKET: ECOSYSTEM VIEW

6.5.2 FUNCTIONAL PROTEIN MARKET: MARKET MAP

6.5.2.1 Upstream

6.5.3 TECHNOLOGY PROVIDER

6.5.4 INGREDIENT AND RAW MATERIAL PROVIDERS

6.5.4.1 Downstream

6.5.5 REGULATORY BODIES & CERTIFICATION PROVIDERS

6.5.6 KEY REGULATORY BODIES FOR THE FUNCTIONAL PROTEINS AND OTHER NUTRACEUTICAL INGREDIENTS

6.6 YC-YCC SHIFT

FIGURE 34 REVENUE SHIFT FOR FUNCTIONAL PROTEINS MARKET

6.7 PATENT ANALYSIS

FIGURE 35 PATENT INSIGHTS (2018-2020)

FIGURE 36 PATENT ANALYSIS, BY DOCUMENT COUNT (2011-2020)

TABLE 4 KEY PATENTS PERTAINING TO FUNCTIONAL PROTEINS, 2018-2020

6.8 TRADE ANALYSIS

TABLE 5 KEY IMPORTING COUNTRIES WITH IMPORT VALUE OF PROTEIN CONCENTRATES, 2019 (USD MILLION)

TABLE 6 KEY EXPORTING COUNTRIES WITH EXPORT VALUE OF FUNCTIONAL PROTEINS, 2019 (USD MILLION)

TABLE 7 IMPORT DATA OF PROTEIN: CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES, BY COUNTRY, 2020

TABLE 8 EXPORT DATA OF PROTEIN: CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES, BY COUNTRY, 2020

TABLE 9 RE-EXPORT DATA OF PROTEIN: CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES, BY COUNTRY, 2020

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 FUNCTIONAL PROTEINS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.1 CASE STUDIES

6.10.1 SUSTAINABLE TRANSITION TO PLANT-PROTEIN PRODUCTION AND CONSUMPTION

TABLE 11 FUNCTIONAL PROTEINS MARKET: SUSTAINABLE PLANT-PROTEIN PRODUCTION

6.10.2 GROWING CONSUMER DEMAND FOR INNOVATIVE SOURCES OF FUNCTIONAL PROTEINS

TABLE 12 FUNCTIONAL PROTEIN MARKET: GROWING DEMAND FOR INNOVATIVE PROTEIN SOURCES

7 REGULATORY FRAMEWORK (Page No. - 97)

7.1 INTRODUCTION

7.1.1 REGULATIONS RELATED TO THE INTENDED USE OF FUNCTIONAL PROTEINS BY COMPANIES

7.1.2 REGULATIONS PERTAINING TO PLANT-BASED FUNCTIONAL PROTEINS (PEA PROTEINS)

7.1.3 REGULATIONS PERTAINING TO PROTEIN INTAKE

7.2 NORTH AMERICA

7.2.1 CANADA

7.2.2 US

7.3 EUROPEAN UNION

7.4 ASIA PACIFIC

7.4.1 CHINA

7.4.2 INDIA

8 FUNCTIONAL PROTEINS MARKET, BY TYPE (Page No. - 102)

8.1 INTRODUCTION

FIGURE 37 FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 13 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2015–2019 (USD MILLION)

TABLE 14 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 15 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2015–2019 (KT)

TABLE 16 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020-2025 (KT)

8.1.1 COVID-19 IMPACT ON THE FUNCTIONAL PROTEINS MARKET, BY TYPE

8.1.1.1 Realistic Scenario

TABLE 17 REALISTIC SCENARIO: COVID-19 IMPACT ON GLOBAL MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.2 Optimistic Scenario

TABLE 18 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON GLOBAL MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE 19 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON FUNCTIONAL PROTEIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.2 HYDROLYSATES

8.2.1 ALLERGY AVERSION AND FLAVOR ENHANCEMENT QUALITIES OF HYDROLYSATES MAKE THEM A POPULAR INGREDIENT IN DIETARY SUPPLEMENTS AND INFANT NUTRITION PRODUCTS

TABLE 20 HYDROLYSATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2015–2019 (USD MILLION)

TABLE 21 HYDROLYSATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

8.3 WHEY PROTEIN CONCENTRATES

8.3.1 EASE OF AVAILABILITY AND LESS COST OF PRODUCTION AID THE POPULARITY OF WHEY PROTEIN CONCENTRATES

TABLE 22 WHEY PROTEIN CONCENTRATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2015–2019 (USD MILLION)

TABLE 23 WHEY PROTEIN CONCENTRATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

8.4 WHEY PROTEIN ISOLATES

8.4.1 WHEY PROTEIN ISOLATES SHOWCASE DIVERSE FUNCTIONALITIES

TABLE 24 WHEY PROTEIN ISOLATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2015–2019 (USD MILLION)

TABLE 25 WHEY PROTEIN ISOLATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

8.5 CASEIN/CASEINATES

8.5.1 CASEIN IS AN ACTIVE INGREDIENT IN DIETARY SUPPLEMENTS AS IT INDUCES LOSS IN BODY WEIGHT

TABLE 26 CASEIN/CASEINATES: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 27 CASEIN/CASEINATES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

8.6 SOY PROTEIN

8.6.1 LOW PROCESSING COST COUPLED WITH ALL-ROUND HEALTH BENEFITS DRIVING MARKET GROWTH

TABLE 28 SOY PROTEIN: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 29 SOY PROTEIN: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

8.7 OTHER TYPES

8.7.1 INCREASE IN DEMAND FOR EGGS, WHEAT, AND PEA PROTEINS

TABLE 30 OTHER TYPES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2015–2019 (USD MILLION)

TABLE 31 OTHER TYPES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

9 FUNCTIONAL PROTEINS MARKET, BY SOURCE (Page No. - 113)

9.1 INTRODUCTION

FIGURE 38 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020 VS. 2025 (USD MILLION)

TABLE 32 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 33 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020-2025 (USD MILLION)

9.1.1 COVID-19 IMPACT ON FUNCTIONAL PROTEINS MARKET, BY SOURCE

9.1.1.1 Realistic Scenario

TABLE 34 REALISTIC SCENARIO: COVID-19 IMPACT ON FUNCTIONAL PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

9.1.1.2 Optimistic Scenario

TABLE 35 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic Scenario

TABLE 36 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON FUNCTIONAL PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

9.2 ANIMAL SOURCE

TABLE 37 ANIMAL SOURCE: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 38 ANIMAL SOURCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

TABLE 39 ANIMAL SOURCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, 2015–2019 (USD MILLION)

TABLE 40 ANIMAL SOURCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, 2020-2025 (USD MILLION)

9.2.1 DAIRY PROTEIN

9.2.1.1 Dairy proteins are preferred among consumers owing to their taste and texture profile

9.2.2 EGG PROTEIN

9.2.2.1 Highest protein content makes egg protein a highly preferred option in the market

9.2.3 GELATIN

9.2.3.1 Exemplary functional properties and associated health benefits propelling the market growth of gelatin

9.3 PLANT SOURCE

TABLE 41 PLANT SOURCE: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 42 PLANT SOURCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

TABLE 43 PLANT SOURCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, 2015–2019 (USD MILLION)

TABLE 44 PLANT SOURCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, 2020-2025 (USD MILLION)

9.3.1 SOY

9.3.1.1 Low cost of processing aids the market growth for soy protein

9.3.2 WHEAT

9.3.2.1 Wheat gluten allergies among consumers have led to an adverse impact on the market

9.3.3 VEGETABLE

9.3.3.1 Pea protein to record a significant growth rate owing to its high nutritious value

10 FUNCTIONAL PROTEINS MARKET, BY APPLICATION (Page No. - 121)

10.1 INTRODUCTION

FIGURE 39 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2020 VS. 2025 (USD BILLION)

TABLE 45 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 46 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2020-2025 (USD MILLION)

10.1.1 COVID-19 IMPACT ON FUNCTIONAL PROTEINS MARKET, BY APPLICATION

10.1.1.1 Realistic Scenario

TABLE 47 REALISTIC SCENARIO: COVID-19 IMPACT ON GLOBAL MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.1.1.2 Optimistic Scenario

TABLE 48 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON GLOBAL MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic Scenario

TABLE 49 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON GLOBAL MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.2 FUNCTIONAL FOOD

10.2.1 POPULARITY OF ON-THE-GO PROTEIN SNACKS AND BARS FUELLING THE DEMAND FOR FUNCTIONAL PROTEINS

TABLE 50 FUNCTIONAL FOOD: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 51 FUNCTIONAL FOOD: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

10.3 FUNCTIONAL BEVERAGES

10.3.1 PROTEIN SHAKES AND JUICES INCREASINGLY PREFERRED BY YOUNG CONSUMERS WITH HECTIC LIFESTYLES

TABLE 52 FUNCTIONAL BEVERAGES: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 53 FUNCTIONAL BEVERAGES: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

10.4 DIETARY SUPPLEMENTS

10.4.1 FUNCTIONAL PROTEINS USED AS AN INTEGRAL INGREDIENT IN DIETARY SUPPLEMENTS

TABLE 54 DIETARY SUPPLEMENTS: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 55 DIETARY SUPPLEMENTS: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

10.5 SPORTS NUTRITION

10.5.1 PROTEIN USED AS AN ACTIVE INGREDIENT IN SPORTS NUTRITION PRODUCTS

TABLE 56 SPORTS NUTRITION: FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 57 SPORTS NUTRITION: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

10.6 ANIMAL NUTRITION

10.6.1 FUNCTIONAL PROTEINS USED AS A NUTRIENT SOURCE IN ANIMAL AND PET FEEDS

TABLE 58 ANIMAL NUTRITION: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2015–2019 (USD MILLION)

TABLE 59 ANIMAL NUTRITION: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020-2025 (USD MILLION)

11 FUNCTIONAL PROTEINS MARKET, BY FORM (Page No. - 131)

11.1 INTRODUCTION

FIGURE 40 FUNCTIONAL PROTEINS MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

TABLE 60 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY FORM, 2015–2019 (USD MILLION)

TABLE 61 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY FORM, 2020-2025 (USD MILLION)

11.2 DRY

11.2.1 LONGER SHELF STABILITY OF THE DRY FORM TO DRIVE THE MARKET GROWTH

TABLE 62 DRY: FUNCTIONAL FOOD MARKET SIZE, BY REGION, 2015-2019 (USD MILLION)

TABLE 63 DRY: FUNCTIONAL FOOD MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

11.3 LIQUID

11.3.1 EASE OF MIXING IN CASE OF THE LIQUID FORM PROJECTED TO DRIVE ITS GROWTH

TABLE 64 LIQUID: FUNCTIONAL FOOD MARKET SIZE, BY REGION, 2015-2019 (USD MILLION)

TABLE 65 LIQUID: FUNCTIONAL FOOD MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

12 FUNCTIONAL PROTEINS MARKET, BY REGION (Page No. - 135)

12.1 INTRODUCTION

FIGURE 41 INDIA AND CHINA TO RECORD THE SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

TABLE 66 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2015–2019 (USD MILLION)

TABLE 67 MARKET SIZE FOR FUNCTIONAL PROTEINS, BY REGION, 2020–2025 (USD MILLION)

12.1.1 COVID-19 IMPACT ON THE FUNCTIONAL PROTEINS MARKET, BY REGION

12.1.1.1 Realistic Scenario

TABLE 68 REALISTIC SCENARIO: COVID-19 IMPACT ON THE FUNCTIONAL PROTEINS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.2 Pessimistic Scenario

TABLE 69 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.3 Optimistic Scenario

TABLE 70 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

FIGURE 42 NORTH AMERICA: FUNCTIONAL PROTEINS MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2015–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY FORM, 2015–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY FORM, 2020–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2020–2025 (USD MILLION)

12.1.2 US

12.1.2.1 Rising health concerns and prevention of lifestyle diseases are the major drivers of functional proteins

TABLE 81 US: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 82 US: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 83 US: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 84 US: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.1.3 CANADA

12.1.3.1 Active involvement of government bodies in the expansion and development of the agri-food sector

TABLE 85 CANADA: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 86 CANADA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 87 CANADA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.1.4 MEXICO

12.1.4.1 Malnutrition and obesity triggering the demand for functional proteins

TABLE 89 MEXICO: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 90 MEXICO: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 91 MEXICO: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 92 MEXICO: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.2 EUROPE

FIGURE 43 EUROPE: FUNCTIONAL PROTEINS MARKET SNAPSHOT

TABLE 93 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY COUNTRY/REGION, 2015–2019 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY COUNTRY/REGION, 2020–2025 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2015–2019 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY FORM, 2015–2019 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY FORM, 2020–2025 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2020–2025 (USD MILLION)

12.2.1 GERMANY

12.2.1.1 Aversion toward meat products fueling the demand for plant-sourced functional proteins

TABLE 103 GERMANY: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 104 GERMANY: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 105 GERMANY: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 106 GERMANY: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.2.2 FRANCE

12.2.2.1 Plant proteins gaining traction in the French market

TABLE 107 FRANCE: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 108 FRANCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 109 FRANCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 110 FRANCE: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.2.3 UK

12.2.3.1 High purchasing power of consumers leading to the growth of the market

TABLE 111 UK: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 112 UK: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 113 UK: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 114 UK: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.2.4 ITALY

12.2.4.1 Multitude of establishments involved in cheese production fueling the demand for dairy-based functional proteins

TABLE 115 ITALY: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 116 ITALY: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 117 ITALY: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 118 ITALY: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.2.5 SPAIN

12.2.5.1 Food-related epidemics and health concerns drive the functional protein market

TABLE 119 SPAIN: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 120 SPAIN: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 121 SPAIN: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 122 SPAIN: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.2.6 REST OF EUROPE

12.2.6.1 Key players based enhancing the growth opportunities for the market

TABLE 123 REST OF EUROPE: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 125 REST OF EUROPE: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 126 REST OF EUROPE: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.3 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: FUNCTIONAL PROTEINS MARKET SNAPSHOT

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2015–2019 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY FORM, 2015–2019 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.3.1 CHINA

12.3.1.1 Increased purchasing power of consumers due to economic development fuels the demand for functional proteins

TABLE 137 CHINA: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 138 CHINA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 139 CHINA: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 140 CHINA: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.3.2 INDIA

12.3.2.1 Demand for functional proteins triggered by surging internet penetration among the millennial population

TABLE 141 INDIA: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 142 INDIA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 143 INDIA: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 144 INDIA: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.3.3 JAPAN

12.3.3.1 Increase in the country’s aging population drives the demand for protein-infused functional food products

TABLE 145 JAPAN: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 146 JAPAN: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 147 JAPAN: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 148 JAPAN: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.3.4 AUSTRALIA & NEW ZEALAND

12.3.4.1 Prevalence of chronic lifestyle diseases such as diabetes propels the demand for functional proteins

TABLE 149 AUSTRALIA & NEW ZEALAND: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 150 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 151 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 152 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.3.5 REST OF ASIA PACIFIC

12.3.5.1 Favorable business environment aiding investments in the region by functional protein manufacturers

TABLE 153 REST OF ASIA PACIFIC: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 155 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 156 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.4 SOUTH AMERICA

TABLE 157 SOUTH AMERICA: FUNCTIONAL PROTEINS MARKET SIZE, BY COUNTRY/REGION, 2015–2019 (USD MILLION)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 161 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 162 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET SIZE, BY FORM, 2015–2019 (USD MILLION)

TABLE 164 SOUTH AMERICA: MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.1 BRAZIL

12.4.1.1 Environmental concerns associated with the current livestock production system driving the functional proteins market

TABLE 167 BRAZIL: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 168 BRAZIL: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 169 BRAZIL: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 170 BRAZIL: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.4.2 ARGENTINA

12.4.2.1 Inclination of consumers toward vegan diets is increasing the demand for plant-based proteins

TABLE 171 ARGENTINA: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 172 ARGENTINA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 173 ARGENTINA: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 174 ARGENTINA: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.4.3 REST OF SOUTH AMERICA

12.4.3.1 Untapped market entering growth stage ergo trending health-conscious regimes and diets

TABLE 175 REST OF SOUTH AMERICA: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 176 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 177 REST OF SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 179 REST OF THE WORLD: FUNCTIONAL PROTEINS MARKET SIZE, BY COUNTRY/REGION, 2015–2019 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (USD MILLION)

TABLE 181 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 182 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 183 REST OF THE WORLD: MARKET SIZE, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 184 REST OF THE WORLD: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

TABLE 185 REST OF THE WORLD: MARKET SIZE, BY FORM, 2015–2019 (USD MILLION)

TABLE 186 REST OF THE WORLD: MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 187 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 188 REST OF THE WORLD: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.1 AFRICA

12.5.1.1 Growing consumer preference for low-calorie diets fueling the demand for functional proteins

TABLE 189 AFRICA: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 190 AFRICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 191 AFRICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 192 AFRICA: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

12.5.2 MIDDLE EAST

12.5.2.1 Use of functional proteins for the dietary supplements and sports nutrition segments

TABLE 193 MIDDLE EAST: FUNCTIONAL PROTEINS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 194 MIDDLE EAST: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 195 MIDDLE EAST: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2015–2019 (USD MILLION)

TABLE 196 MIDDLE EAST: MARKET SIZE FOR FUNCTIONAL PROTEINS, BY SOURCE, 2020–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 193)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2019

TABLE 197 MARKET FOR FUNCTIONAL PROTEINS: DEGREE OF COMPETITION

13.3 REVENUE ANALYSIS OF KEY PLAYERS, 2017-2019

FIGURE 45 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE MARKET, 2017–2019 (USD MILLION)

13.4 COVID-19-SPECIFIC COMPANY RESPONSE

13.5 COMPANY EVALUATION QUADRANT: DEFINITIONS & METHODOLOGY (OVERALL MARKET)

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 46 MARKET FOR FUNCTIONAL PROTEINS: COMPANY EVALUATION QUADRANT, 2019 (OVERALL MARKET)

13.5.5 PRODUCT FOOTPRINT

TABLE 198 FUNCTIONAL PROTEINS MARKET: COMPANY INDUSTRY FOOTPRINT

TABLE 199 MARKET FOR FUNCTIONAL PROTEINS: COMPANY REGION FOOTPRINT

TABLE 200 MARKET FOR FUNCTIONAL PROTEINS: COMPANY TYPE FOOTPRINT

TABLE 201 MARKET FOR FUNCTIONAL PROTEINS: OVERALL COMPANY FOOTPRINT

13.6 COMPANY EVALUATION QUADRANT (START-UPS/SMES)

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 47 FUNCTIONAL PROTEIN MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2019

13.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

13.7.1 NEW PRODUCT LAUNCHES

TABLE 202 NEW PRODUCT LAUNCHES, 2019–2020

13.7.2 DEALS

TABLE 203 DEALS, 2018–2020

13.7.3 OTHER DEVELOPMENTS

TABLE 204 OTHER DEVELOPMENTS, 2019–2020

14 COMPANY PROFILES (Page No. - 207)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

14.1 KEY PLAYERS

14.1.1 ARCHER DANIELS MIDLAND COMPANY (ADM)

TABLE 205 ARCHER DANIELS MIDLAND COMPANY (ADM): BUSINESS OVERVIEW

FIGURE 48 ARCHER DANIELS MIDLAND COMPANY (ADM): COMPANY SNAPSHOT

TABLE 206 ARCHER DANIELS MIDLAND COMPANY (ADM): PRODUCTS OFFERED

14.1.2 DSM

TABLE 207 DSM: BUSINESS OVERVIEW

FIGURE 49 DSM: COMPANY SNAPSHOT

TABLE 208 DSM: PRODUCTS OFFERED

14.1.3 BASF

TABLE 209 BASF: BUSINESS OVERVIEW

FIGURE 50 BASF: COMPANY SNAPSHOT

TABLE 210 BASF: PRODUCTS OFFERED

14.1.4 INGREDION

TABLE 211 INGREDION: BUSINESS OVERVIEW

FIGURE 51 INGREDION: COMPANY SNAPSHOT

TABLE 212 INGREDION: PRODUCTS OFFERED

14.1.5 FONTERRA

TABLE 213 FONTERRA: BUSINESS OVERVIEW

FIGURE 52 FONTERRA: COMPANY SNAPSHOT

TABLE 214 FONTERRA: PRODUCTS OFFERED

14.1.6 CARGILL

TABLE 215 CARGILL: BUSINESS OVERVIEW

FIGURE 53 CARGILL: COMPANY SNAPSHOT

TABLE 216 CARGILL: PRODUCTS OFFERED

14.1.7 SUNOPTA

TABLE 217 SUNOPTA: BUSINESS OVERVIEW

FIGURE 54 SUNOPTA: COMPANY SNAPSHOT

TABLE 218 SUNOPTA: PRODUCTS OFFERED

14.1.8 DUPONT

TABLE 219 DUPONT: BUSINESS OVERVIEW

FIGURE 55 DUPONT: COMPANY SNAPSHOT

TABLE 220 DUPONT: PRODUCTS OFFERED

14.1.9 ROQUETTE

TABLE 221 ROQUETTE: BUSINESS OVERVIEW

TABLE 222 ROQUETTE: PRODUCTS OFFERED

14.1.10 GLANBIA

TABLE 223 GLANBIA: BUSINESS OVERVIEW

FIGURE 56 GLANBIA: COMPANY SNAPSHOT

TABLE 224 GLANBIA: PRODUCTS OFFERED

14.1.11 OMEGA PROTEIN

TABLE 225 OMEGA PROTEIN: BUSINESS OVERVIEW

TABLE 226 OMEGA PROTEIN: PRODUCTS OFFERED

14.2 START-UPS/SMES

14.2.1 ARLA FOODS

TABLE 227 ARLA FOODS: BUSINESS OVERVIEW

FIGURE 57 ARLA FOODS: COMPANY SNAPSHOT

TABLE 228 ARLA FOODS: PRODUCTS OFFERED

14.2.2 EESENTIA PROTEIN SOLUTIONS

TABLE 229 ESSENTIA PROTEIN SOLUTIONS: BUSINESS OVERVIEW

TABLE 230 ESSENTIA PROTEIN SOLUTIONS: PRODUCTS OFFERED

14.2.3 PROTIFARM

TABLE 231 PROTIFARM: BUSINESS OVERVIEW

TABLE 232 PROTIFARM: PRODUCTS OFFERED

14.2.4 FRIESLANDCAMPINA

TABLE 233 FRIESLANDCAMPINA: BUSINESS OVERVIEW

FIGURE 58 FRIESLANDCAMPINA: COMPANY SNAPSHOT

TABLE 234 FRIESLANDCAMPINA: PRODUCTS OFFERED

14.2.5 AMAI PROTEINS

TABLE 235 AMAI PROTEINS: BUSINESS OVERVIEW

TABLE 236 AMAI PROTEINS: PRODUCTS OFFERED

14.2.6 BENEO

TABLE 237 BENEO: BUSINESS OVERVIEW

TABLE 238 BENEO: PRODUCTS OFFERED

14.2.7 PLANTIBLE FOODS

TABLE 239 PLANTIBLE FOODS: BUSINESS OVERVIEW

TABLE 240 PLANTIBLE FOODS: PRODUCTS OFFERED

14.2.8 MERIT FUNCTIONAL FOODS

TABLE 241 MERIT FUNCTIONAL FOODS: BUSINESS OVERVIEW

TABLE 242 MERIT FUNCTIONAL FOODS: PRODUCTS OFFERED

14.2.9 MYCORENA

TABLE 243 MYCORENA: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 247)

15.1 INTRODUCTION

TABLE 244 ADJACENT MARKETS TO FUNCTIONAL PROTEINS

15.2 LIMITATIONS

15.3 PROTEIN INGREDIENTS MARKET

15.3.1 MARKET DEFINITION

FIGURE 59 PROTEIN INGREDIENTS MARKET SIZE, 2018-2025 (USD MILLION)

TABLE 245 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2018- 2025 (USD BILLION)

15.4 DAIRY INGREDIENTS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

FIGURE 60 DAIRY INGREDIENTS MARKET SIZE, 2017–2025 (USD MILLION)

TABLE 246 DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017-2025 (USD BILLION)

16 APPENDIX (Page No. - 252)

16.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.2 FUNCTIONAL PROTEIN MARKET: AVAILABLE CUSTOMIZATIONS

16.3 RELATED REPORTS

16.4 AUTHOR DETAILS

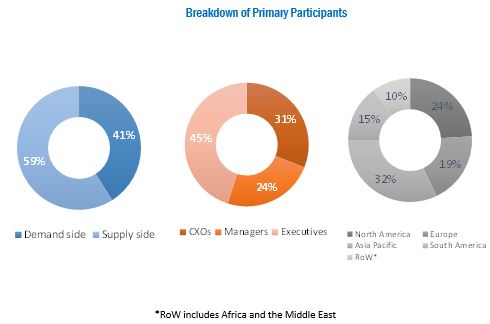

The study involved four major activities in estimating the functional proteins market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Functional Protein Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the functional protein market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of functional proteins was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the functional protein market, with respect to type, application, form, source, and regional markets, over a five-year period, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the region

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the functional protein market

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the functional protein market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global functional proteins market

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe functional protein market, by key country

- Further breakdown of the Rest of Asia Pacific functional protein market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of functional proteins

- Further bifurcation of types by applications of functional proteins

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Functional Proteins Market

What is the functional difference between fibrous and globular proteins?

I would like to know types of proteins in food and beverages which can be easily available in the industry