The research study involved 4 major activities in estimating the size of the LED packaging market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives.

Primary Research

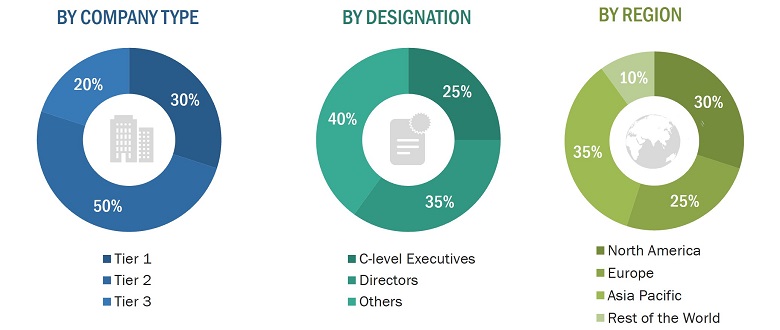

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users and related executives from multiple key companies and organizations operating in the LED packaging market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

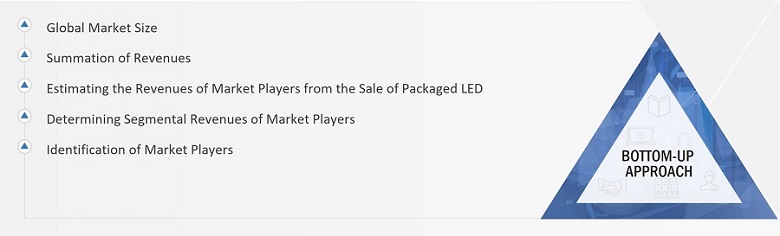

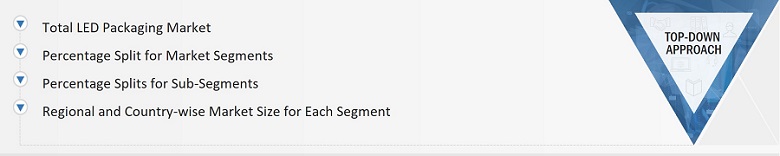

In the market engineering process, both top-down and bottom-up approaches have been used along with data triangulation methods to estimate and validate the size of the LED packaging market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying stakeholders in the LED packaging market that influence the entire market, along with participants across the value chain.

-

Analyzing major manufacturers of LED packaging and studying their product portfolios

-

Analyzing trends related to the adoption of LED packaging

-

Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, partnerships and agreements, as well as forecasting the market size based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to identify the adoption trends of packaged LEDs

-

Segmenting the overall market into various other market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall LED packaging market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

LED packages are defined as assemblies that house LED chip(s). Through packaging, LED chips and welded lead wires are protected from being in contact with the external environment. Also, packaging improves luminescence efficiency and ensures that diode chips function properly, and export visible light effectively. LED packages have empowered the lighting industry to overcome the challenges of high lumen maintenance and high-power consumption and helped in the extension of lifespan and reduction of carbon footprint. Various types of LED packages, including surface-mount device package (SMD), chip-on-board package (COB), chip-scale package (CSP), dual in-line package (DIP), and chip-on-flex (COF) LEDs, are available for various end-use applications. Package type refers to how LED semiconductor dies are integrated into LED technology-based devices used in different applications. Various applications of LED packages include general lighting, automotive lighting, backlighting, flash lighting, and industrial, among others.

Stakeholders

-

Raw material suppliers

-

Equipment manufacturers

-

Material Suppliers

-

Packaged LED manufacturer

-

Semiconductor product designers and fabricators

-

Regulatory bodies

-

Semiconductor intellectual property vendors

-

Assembly, testing, and packaging vendors

-

Distributors and Resellers

-

End Users

The main objectives of this study are as follows:

-

To define, analyze and forecast the LED packaging market size, by package type, packaging component, power range, wavelength, application, and region, in terms of value.

-

To define, analyze and forecast the LED packaging market size, by package type, in terms of volume

-

To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the LED packaging market

-

To study the complete value chain and related industry segments for the LED packaging market

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; and tariff and regulations related to the LED packaging market.

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

-

To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders.

-

To analyze competitive developments such as product launches, partnerships, agreements, and research and development (R&D) activities carried out by players in the LED packaging market.

Customizations Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Information

-

Detailed analysis of additional countries (up to 5)

Growth opportunities and latent adjacency in LED Packaging Market