Marketing Resource Management Market by Component (Solutions and Services), Deployment Type, Organization Size, Industry Vertical (Consumer Goods and Retail, BFSI, and Manufacturing), Region - Global Forecast to 2026

Marketing Resource Management Market Size, Global Forecast

The marketing resource management market is anticipated to expand at a CAGR of 10.9% from USD 3.2 billion in 2021 to USD 5.5 billion by 2026. Because of the increased need for enhanced marketing practises to recover sales losses in COVID-19 lockdowns, the increased pace of digitalization across enterprises of all sizes, and the emergence of cutting-edge technologies such as AI and ML, the market will continue to grow post-COVID-19.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

Due to the COVID-19 outbreak, organisations across the globe are experiencing huge changes in the way products and services are bought and sold. Many studies and survey organizations, including large enterprises and SMEs, have increased their marketing spend during and after the COVID-19 lockdown situation. For instance, Merkle, one of the leading performance marketing agencies, released the Customer Engagement Report COVID-19 Special Edition. The report shows how the global COVID-19 pandemic is affecting marketers and highlights the importance of putting customers first in a changing environment. The report also shows that the COVID-19 outbreak has accelerated the companies' marketing spending. As marketers reported a major loss in terms of revenues, profits, and customer acquisitions during the pandemic, organizations’ budgets too witnessed a decline during this period. According to Merkle’s Customer Engagement Report, about 52% of marketers across various industries have increased budgets, and 74% of the marketers changed their approach to customer content to cope with the losses of the previous years. Spending increases during the past few months allowed marketers to implement new content, strategies, and technologies that would serve consumers during this time of crisis. The focus on continuing and expanding these innovations in the future will encourage consumer retention and brand loyalty. According to the report, industries, including healthcare and life sciences, BFSI, and retail and consumer goods, noticed the largest increase in spending. The following figure shows the effect of COVID-19 on marketing spending across different industry verticals.

Marketing Resource Management Market Dynamics

Drivers: Benefits of modular suites with interconnected solutions and third-party integrations

The changing market landscape and the need for properly educating customers about brands and products compel companies to adopt robust systems. According to Brandworkz Brand Management Survey 2019, about 48% of the participants surveyed believed that the inconsistent use of brand poses the greatest risk to devaluing the very brand; while about 24% of the participants considered a lack of internal education related to the brand as a big factor. This means that the employees working in the marketing operations team not only require complying with the brand guidelines while engaging with customers but also need to have a real-time collaboration on the content to avoid duplicity, redundancy, and brand devaluation. MRM solutions help manage brands through compliance with brand and corporate design guidelines and the localization of content as per the local legislation. To correctly inform the stakeholders about the products and brands, MRM systems with advanced PIM capabilities also help comply with product-associated regulations. For instance, the censhare platform encompasses both MRM and PIM capabilities to ensure a single source of truth on products and brands, which helps in enhancing customer experience and increasing the brand value among customers.

Restraints: Persistent growth in cyber-attacks and security issues

Digital transformation has led to the generation of an ample amount of data in organizations. At present, the globalization of businesses has made business processes and the flow of data of utmost importance in organizations. Companies are concerned about sharing their critical business data, which is significantly rising in the market. Security hazards such as malware, hacker attacks, or data thefts pose major threats to the reliable execution of marketing business processes. Any such attack or malware can negatively affect the companies’ profit, shareholder value, or reputation. According to the Breach Level Index 2018 report, there were 945 reported data breaches and almost 4.5 billion compromised data records worldwide in the first half of 2018. Industries such as social media and healthcare, where MRM has applicability, were affected. This data represents the existing barriers to the adoption of MRM, especially in the industries mentioned above.

Challenges: Dilemma of choosing the right, comprehensive platform

With rising competition, companies want a robust and comprehensive system that can help them streamline their marketing processes. However, with the presence of a variety of tools and technologies in the market, several companies get confused over which technology to choose that would complement their existing IT infrastructure, best aligns with their strategies, and effortlessly integrates with their other business applications. Companies in a rush often tend to choose an incomplete or inappropriate marketing system. Owing to the complexities involved, several small companies refrain from implementing MRM solutions. However, with the advantages of flexibility, experience, and expertise associated with consulting and implementation services, such challenges are ephemeral.

Opportunities: Increase in adoption of hybrid cloud services

By integrating the Artificial Intelligence (AI) technology MRM smarter by offering the ability to digitalize, formalize, optimize, and automate a wide variety of tasks currently performed by skilled human experts with Machine Learning (ML), MRM solutions continually evaluate data to predict the future and suggest data-driven improvements to enhance marketing performance. With the help of AI, marketing teams are also exploring advanced marketing systems to deliver personalized experiences. A survey by performance-driven digital marketing agency, QueryClick, reports that 66% of the UK CMOs of large retail brands plan to invest in ML to enhance their digital marketing strategies.

Furthermore, ML-enabled systems can sense customer preferences and suggest an apt strategy to trigger their behavior. These systems can also improve the workflow by initializing personalized customer interactions. Instead of delivering usual content to all customers, AI-driven MRM systems can help deliver curated content, which is content based on customer preferences and devices. This not only helps deliver consistent and frictionless engagement but also drives revenue growth among companies. According to a study by Harvard Business Review, omnichannel customers are more valuable, spending 10% more online than single-channel customers.

Marketing Resource Management Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on component, solutions segment to be a larger contributor to the marketing resource management market growth during the forecast period

MRM solutions are modularized and interconnected, yet comprehensive marketing operations management technology that addresses critical business issues related to the management of marketing budgets, marketing calendars, and digital assets. Vendors in the market offer such solutions in the form of an integrated platform, as a capability, as standalone solutions, or as differentiated yet interconnected bundled solutions. MRM solutions enable companies to create, update, and maintain content to optimize content sharing and collaboration and publishing, ensure faster TTM, increase brand awareness, drive online traffic and sales, and enhance customer experience and satisfaction. Emerging technologies, such as AI, and the integration capabilities of MRM solutions with various business platforms, such as ERP, CRM, and marketing platforms, have facilitated streamlined marketing operations and better resource management.

Based on solutions, the planning and budget management segment to be a larger contributor to the marketing resource management market during the forecast period

The planning and budget management solution helps establish marketing objectives and align investments with the strategies. While enabling the management of budgets, marketing spends, and vendors, the solutions also help marketers assess the impact of marketing plans and maximize RoI. Companies are increasingly investing in solutions to scale their marketing with a real-time view of the entire marketing spend. Moreover, MRM solutions enable users to plan and track financial resources and establish a structured approval process. They can prepare and manage budget requests across different levels of the marketing hierarchy, including organization, plan, brands or product line, industry, and geography. It also supports the full life cycle of marketing expenses, including tracking detailed line-item expenses and generating purchase orders and invoices so that users can track forecasted, committed, and actual costs at any budgetary level. Users can ensure that every marketing program and a budget request is reviewed by the appropriate people. Using these solutions, users can circulate, review, and approve important marketing items, including proposed marketing plans and tactics, budget requests, and marketing content. Marketing managers can easily submit items for review, forward items for feedback, and approve or decline requests.

Based on services, the consulting and implementation segment to be a larger contributor to the marketing resource management market growth during the forecast period

Consulting and implementation are professional services practice for enterprise infrastructure that involves advising customers for managing organization’s IT infrastructure and improving infrastructure performance, including security and workflow processes. They also help them implement a solution. Before implementing a required solution, business needs must be assessed and understood thoroughly to ensure hassle-free and proper deployment and integration of MRM solutions. MRM vendors offer consulting services to users that have limited awareness related to the market and how to adopt the solutions depending upon their business. The implementation service helps users to manage the implementation and site going forward and helps their team to assist via virtual meetings and handling questions, and helps to manage decisions that are best for their teams. The segment growth can be attributed to the growing integration of MRM solutions in marketing business operations. Marketers are more focused on improving business processing speed, streamlining the customer experience, and offering faster results. Marketers need solutions that allow them to effectively manage all their marketing assets as efficiently and fast as possible to keep up with production. This is expected to drive the consulting and implementation segment growth over the forecast period.

Based on organization size, the large enterprises segment to be a larger contributor to the marketing resource management market growth during the forecast period

The trend of digitalization has been increasing extensively among large enterprises. These enterprises have an annual turnover much more significant than one billion dollars. Large institutions accounted for the largest revenue share, and the segment is expected to witness considerable growth during the forecast period due to a large customer base, and advanced technology-enabled platform with high budget and large marketing spend. Business enterprises and organizations of all sizes are benefitting from the improved collaboration over digital platforms. Marketing budgets comprise approximately 5¬–11% of the total company’s budgets on average, and large enterprises spend heavily on marketing and client engagement, so they are inclined towards MRM solutions. The adoption of MRM solutions among large enterprises is significantly high as these solutions help large enterprises in effectively managing their extensive product portfolio and allocating marketing budgets. The increasing focus on customer experience is expected to further drive the adoption of MRM solutions in large enterprises. These factors are expected to contribute to the growth of the large enterprise segment.

Based on deployment, the on-premises segment to be a larger contributor to the marketing resource management market growth during the forecast period

On-premises deployment of MRM solutions empowers organizations by giving them the ownership of their data; the flexibility to customize the solution as per their requirements; an option to integrate with the existing business applications, such as ERP, CRM, marketing automation, and sales enablement platforms; manage risks, business processes, and organization’s internal policies; and adhere to external compliance requirements. Organizations across industry verticals, such as BFSI and healthcare and life sciences, are expected to prefer the on-premises deployment of MRM solutions because these organizations deal with critical and sensitive data, unauthorized accesses, losses, or misuse of that which might incur hefty losses to them. Moreover, due to the variety of benefits related to the system pattern and customization, the acceptance of on-premises resolutions increases. The on-premises deployment of resolutions gives power to businesses by giving them possession of their information. Besides, this deployment technique permits businesses to administer and possess total control above their integrations of the organization. The installation of the on-premises MRM solution is massive owing to the associated advantages of configuration and multiple customization options and low vendor dependency.

Based on verticals, the consumer goods and retail segment to be a larger contributor to the marketing resource management market growth during the forecast period

The consumer goods and retail industry vertical is highly customer-centric and is one of the fastest-growing verticals with respect to the adoption of advanced technologies and services. Owing to the presence of a high number of players in this vertical, the marketing budget is usually huge. They always try to maintain a certain brand image and cater to specific customer needs and demographics. With the help of MRM software, it becomes easy to market their products and target customers based on their digital footprint. In this highly competitive market of retail and consumer goods, brand positioning is the key to higher revenues. Several retailers and consumer goods companies are leveraging the internet by launching their eCommerce sites. Hence, MRM software can be used to increase the footfall in eCommerce sites. The proper planning and execution of digital marketing campaigns can also be done with the help of MRM software. Search Engine Optimization (SEO) improves organically with proper digital marketing.

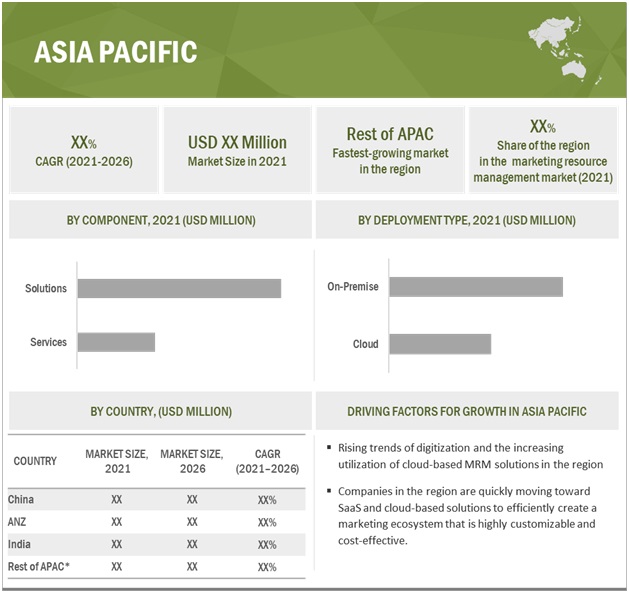

APAC to grow at the highest CAGR during the forecast period

The APAC region is among the digital hubs of the world. Businesses in this region have been quick to identify the benefits of tech-enabled marketing solutions as a facilitator of digital transformation. The high growth of the market in APAC can be attributed to the high consumer spending and internet penetration, rising number of business processes, springing startups having limited IT budgets, and increasing adoption of cloud technologies. Furthermore, various global MRM solution providers, including Oracle, IBM, SAP, HCL Technologies, have their businesses in the region due to the region's low-cost benefits and high availability of the workforce, with which adoption of MRM solutions is expected to increase rapidly in future across the region. The region has witnessed increasing support from the government for the growth of SMEs and has a growing retail and e-commerce market, which drives the demand for MRM solutions. Furthermore, the adoption of cloud-based solutions and services is further boosting the market growth in the region. Additionally, the growing number of startups focusing on developing MRM solutions for enterprises across various verticals is expected to drive the regional marketing resource management market growth during the forecast period.

Key Market Leader

The marketing resource management market is dominated by companies such as Oracle (US), SAP (Germany), SAS (US), Adobe (US), Aprimo (US), Brandmaker (US), Allocadia (Canada), HCL Technologies (India), Wedia (France), Welcome(US), Infor (US), inMotionNow (US), Seismic (US), Sitecore (US), Contentserv (Switzerland), IBM (US), Smartsheet (US), Capital ID (Netherlands), BrandMaster (Norway), Simple (Australia), Wrike (US), Widen (US), Marcom Central (US), TapClicks(US), Admation (Australia), Marvia (Netherlands), Resolut (Sweden), IntelligenceBank (Australia), MRMCentral (US), Bynder (Netherlands), Hive9 (US), Plannuh (US), Shopperations (US), Central De Marca (Spain), Optimatica (Russia), Dreamdata (Denmark), SharpSpring (US), and myBrand (Netherlands). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of the Report

|

Report Metrics |

Details |

|

Market Size value in 2021 |

USD 3.3 billion |

|

Market Size value for 2026 |

USD 5.5 billion |

|

Growth Rate |

10.9% CAGR |

|

Largest Market |

APAC |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Market Segmentation |

Component (Solutions and Services), Deployment Type, Organization Size, Verticals, and Regions |

|

Marketing Resource Management Market Growth Drivers |

|

|

Marketing Resource Management Market Opportunities |

|

|

Regions covered |

Middle East and Africa |

|

Companies covered |

Oracle (US), SAP (Germany), SAS (US), Adobe (US), Aprimo (US), Brandmaker (US), Allocadia (Canada), HCL Technologies (India), Wedia (France), Welcome(US), Infor (US), inMotionNow (US), Seismic (US), Sitecore (US), Contentserv (Switzerland), IBM (US), Smartsheet (US), Capital ID (Netherlands), BrandMaster (Norway), Simple (Australia), Wrike (US), Widen (US), Marcom Central (US), TapClicks(US), Admation (Australia), Marvia (Netherlands), Resolut (Sweden), IntelligenceBank (Australia), MRMCentral (US), Bynder (Netherlands), Hive9 (US), Plannuh (US), Shopperations (US), Central De Marca (Spain), Optimatica (Russia), Dreamdata (Denmark), SharpSpring (US), and myBrand (Netherlands). |

This research report categorizes the marketing resource management market to forecast revenue and analyze trends in each of the following submarkets:

Market Based on the components:

- Solutions

- Services

Marketing Resource Management Market Based on the solutions:

- Planning and Budget Management

- Asset Management

- Channel Marketing Management

- Performance Management

- Others (Brand management and campaign management)

Market Based on the services:

- Consulting and Implementation

- Training, Support and Maintenance

Market Based on the Deployment Type:

- On-premises

- Cloud

Market Based on the Organization Size:

- Large Enterprises

- Mid-sized Enterprises

- Small Enterprises

Market Based on the vertical:

- BFSI

- Consumer Goods and Retail

- Manufacturing

- IT and ITeS

- Telecommunications

- Healthcare and Life Sciences

- Media and Entertainment

- Travel and Hospitality

- Education

- Energy and Utilities

- Others (Food and beverages and gaming)

Market Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- ANZ

- India

- Rest of APAC

-

Middle East

- Saudi Arabia

- South Africa

- Rest of Middle East

-

Latinf America

- Brazil

- Rest of Latin America

Recent Developments

- In June 2021, Aprimo launched a new marketing calendar that brings broader functionality and additional capabilities to its content operations platform. The Aprimo Marketing Calendar adds an actionable, flexible layer to its work management solution, providing marketers a single, comprehensive view of all projects.

Frequently Asked Questions (FAQ):

What is the market size of the marketing resource management market?

What is the growth rate of the marketing resource management market?

What are some of the drivers in marketing resource management market?

COVID-19 pandemic boosted the adoption of cloud based solutions across the globe.

Benefits of modular suites with interconnected solutions and third-party integrations .

Which region has the highest market share in the marketing resource management market?

Which are the major vendors in the marketing resource management market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 6 MARKETING RESOURCE MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

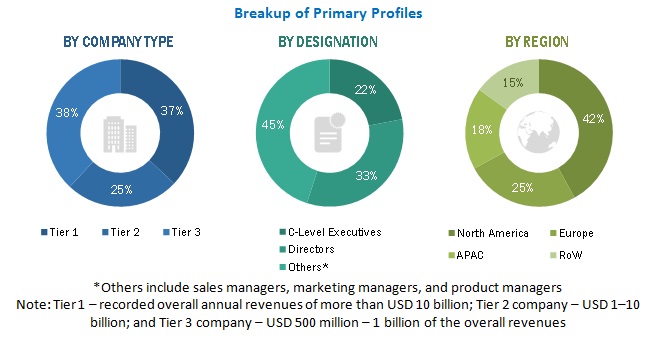

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MRM MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MRM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF MEA CLOUD COMPUTING FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF MRM VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

FIGURE 15 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 16 TOP-GROWING SEGMENTS IN THE MARKETING RESOURCE MANAGEMENT MARKET

FIGURE 17 SOLUTIONS SEGMENT, BY COMPONENT, IS EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 BY SOLUTION, THE PLANNING AND BUDGET MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 BY SERVICE, THE CONSULTING AND IMPLEMENTATION SEGMENT IS EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 BY DEPLOYMENT, THE ON-PREMISES SEGMENT IS EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 21 BY ORGANIZATION SIZE, THE LARGE ENTERPRISES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 22 BY INDUSTRY VERTICAL, THE CONSUMER GOODS AND RETAIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 23 NORTH AMERICA IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE MARKETING RESOURCE MANAGEMENT MARKET

FIGURE 24 INCREASING NEED TO AUTOMATE MARKETING OPERATIONS TO DRIVE OPERATIONS EFFICIENCY AND LOWER CAPEX

4.2 MARKET, BY COMPONENT AND COUNTRY

FIGURE 25 SOLUTIONS SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER MARKET SHARE IN NORTH AMERICA IN 2021

4.3 ASIA PACIFIC MARKET, BY COMPONENT AND COUNTRY

FIGURE 26 SOLUTIONS SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER MARKET SHARE IN APAC IN 2021

4.4 MARKET, BY COMPONENT, 2021 VS. 2026

FIGURE 27 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.5 MARKET, BY SERVICE, 2021 VS. 2026

FIGURE 28 CONSULTING SEGMENT IS EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.6 MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 29 ON-PREMISES SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

4.7 MARKET, BY ORGANIZATION SIZE, 2021

FIGURE 30 LARGE ENTERPRISES SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4.8 MARKET, BY INDUSTRY VERTICAL, 2021 VS. 2026

FIGURE 31 THE CONSUMER GOODS AND RETAIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKETING RESOURCE MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 COVID-19 pandemic boosting the adoption of marketing and branding software among several verticals

FIGURE 33 COVID-19 EFFECTS ON MARKETING SPENDING ACROSS INDUSTRIES

5.2.1.2 Benefits of modular suites with interconnected solutions and third-party integrations

5.2.1.3 Growing need for ensuring brand and regulatory compliance

5.2.1.4 Indispensable requirements for reducing the cycle time projections through content deduplication and distribution

5.2.2 RESTRAINTS

5.2.2.1 Upfront cost associated with new systems

5.2.2.2 Persistent growth in cyber-attacks and security issues

5.2.3 OPPORTUNITIES

5.2.3.1 Scope of expansion for emerging market players due to divestiture of major marketing resource management businesses

5.2.3.2 Integration of artificial intelligence and machine learning technologies

5.2.4 CHALLENGES

5.2.4.1 Growing cultural barriers to adopt advanced solutions over traditional systems

5.2.4.2 Dilemma of choosing the right, comprehensive platform

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: PRODUCTIVITY DEPLOYMENT

5.4.2 CASE STUDY 2: MARKETING INVESTMENT MANAGEMENT DEPLOYMENT

5.4.3 CASE STUDY 3: DIGITAL ASSET MANAGEMENT

5.4.4 CASE STUDY 4: ACHIEVING ASSET CENTRALIZATION AND CONSISTENT BRAND COMPLIANCE ACROSS GEOGRAPHIES TO IMPROVE MARKETING PERFORMANCE

5.5 VALUE CHAIN ANALYSIS

FIGURE 34 VALUE CHAIN ANALYSIS: MARKETING RESOURCE MANAGEMENT MARKET

5.6 ECOSYSTEM

FIGURE 35 ECOSYSTEM ANALYSIS: MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE

5.7.2 MACHINE LEARNING

5.7.3 CLOUD

5.7.4 MARKETING ANALYTICS

5.8 PRICING ANALYSIS

5.8.1 INTRODUCTION

5.9 REVENUE SHIFT – YC/YCC SHIFT

FIGURE 36 YC/YCC SHIFT

5.10 PATENT ANALYSIS

FIGURE 37 TOP FIVE PATENT OWNERS IN THE UNITED STATES

FIGURE 38 PATENT DOCUMENT COUNT, 2011-2020

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 39 MARKETING RESOURCE MANAGEMENT: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 CLOUD COMPUTING SOFTWARE: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 REGULATIONS

5.12.1 NORTH AMERICA

5.12.2 EUROPE

5.12.3 ASIA PACIFIC

5.12.4 MIDDLE EAST & AFRICA

5.12.5 LATIN AMERICA

6 MARKETING RESOURCE MANAGEMENT MARKET, BY COMPONENT (Page No. - 82)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 SOLUTIONS AND SERVICES: COVID-19 IMPACT

FIGURE 40 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 6 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 7 COMPONENTS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 8 COMPONENTS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 41 PERFORMANCE MANAGEMENT SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 10 MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

6.2.1 PLANNING AND BUDGETING MANAGEMENT

TABLE 11 PLANNING AND BUDGET MANAGEMENT: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 PLANNING AND BUDGET MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2 ASSET MANAGEMENT

TABLE 13 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.3 CHANNEL MARKETING MANAGEMENT

TABLE 15 CHANNEL MARKETING MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 CHANNEL MARKETING MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.4 PERFORMANCE MANAGEMENT

TABLE 17 PERFORMANCE MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 PERFORMANCE MANAGEMENT: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.5 OTHERS

TABLE 19 OTHER MRM SOLUTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 OTHER MRM SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 42 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 22 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

6.3.1 CONSULTING AND IMPLEMENTATION

TABLE 23 CONSULTING AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 CONSULTING AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 TRAINING, SUPPORT, AND MAINTENANCE

TABLE 25 TRAINING, SUPPORT, AND MAINTENANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 TRAINING, SUPPORT, AND MAINTENANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 MARKETING RESOURCE MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 96)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 43 SMALL AND MID-SIZED ENTERPRISES SEGMENTS TO GROW AT HIGHER CAGRS DURING THE FORECAST PERIOD

TABLE 27 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 28 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

TABLE 29 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 MID-SIZED ENTERPRISES

TABLE 31 MID-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 MID-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 SMALL ENTERPRISES

TABLE 33 SMALL ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 SMALL ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 MARKETING RESOURCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE (Page No. - 102)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODELS: MARKETING MARKET DRIVERS

8.1.2 DEPLOYMENT MODELS: COVID-19 IMPACT

FIGURE 44 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 35 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 36 MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 37 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

TABLE 39 CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 MARKETING RESOURCE MANAGEMENT MARKET, BY INDUSTRY VERTICAL (Page No. - 108)

9.1 INTRODUCTION

9.1.1 INDUSTRY VERTICAL: MARKET DRIVERS

9.1.2 INDUSTRY VERTICALS: COVID-19 IMPACT

FIGURE 45 CONSUMER GOODS AND RETAIL VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 41 MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 42 MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: MAMARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 CONSUMER GOODS AND RETAIL

TABLE 45 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 MANUFACTURING

TABLE 47 MANUFACTURING: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES

TABLE 49 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 TELECOMMUNICATIONS

TABLE 51 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 HEALTHCARE AND LIFE SCIENCES

TABLE 53 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 MEDIA AND ENTERTAINMENT

TABLE 55 MEDIA AND ENTERTAINMENT: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 TRAVEL AND HOSPITALITY

TABLE 57 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.10 EDUCATION

TABLE 59 EDUCATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 60 EDUCATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.11 ENERGY AND UTILITIES

TABLE 61 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.12 OTHERS

TABLE 63 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MARKETING RESOURCE MANAGEMENT MARKET, BY REGION (Page No. - 126)

10.1 INTRODUCTION

FIGURE 46 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

TABLE 65 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 66 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020(USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 81 UNITED STATES: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 82 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 83 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 84 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.2.4 CANADA

TABLE 85 CANADA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 86 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 87 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MRM MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 89 EUROPE: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 103 UNITED KINGDOM: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 104 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 105 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 106 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.3.4 GERMANY

TABLE 107 GERMANY: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 109 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 110 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.3.5 FRANCE

TABLE 111 FRANCE: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 112 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 113 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 114 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 115 REST OF EUROPE: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MRM MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 119 ASIA PACIFIC: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.3 CHINA

TABLE 133 CHINA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 134 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 135 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 136 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 137 AUSTRALIA AND NEW ZEALAND: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 138 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 139 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 140 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.4.5 INDIA

TABLE 141 INDIA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 142 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 143 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 144 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 145 REST OF APAC: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 146 REST OF APAC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 147 REST OF APAC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 148 REST OF APAC: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: MRM MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 149 MIDDLE EAST & AFRICA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.3 SAUDI ARABIA

TABLE 163 SAUDI ARABIA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 164 SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 165 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 166 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.5.4 SOUTH AFRICA

TABLE 167 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 168 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 169 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 170 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.5.5 REST OF THE MIDDLE EAST & AFRICA

TABLE 171 REST OF MIDDLE EAST & AFRICA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 172 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 173 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKETING RESOURCE MANAGEMENT MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 175 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.3 BRAZIL

TABLE 189 BRAZIL: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 190 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 191 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 192 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

TABLE 193 REST OF LATIN AMERICA: MARKETING RESOURCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 194 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 195 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 196 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 180)

11.1 INTRODUCTION

FIGURE 49 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

FIGURE 50 MARKET RANKING IN 2020

11.3 MARKET SHARE OF TOP VENDORS

TABLE 197 MARKETING RESOURCE MANAGEMENT: DEGREE OF COMPETITION

FIGURE 51 MRM MARKET: VENDOR SHARE ANALYSIS

11.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 52 HISTORICAL REVENUE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 DEFINITIONS AND METHODOLOGY

TABLE 198 COMPANY EVALUATION QUADRANT: CRITERIA

11.5.2 STARS

11.5.3 EMERGING LEADERS

11.5.4 PERVASIVE PLAYERS

11.5.5 PARTICIPANTS

FIGURE 53 MARKETING RESOURCE MANAGEMENT MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

11.6 SME EVALUATION QUADRANT

11.6.1 DEFINITIONS AND METHODOLOGY

TABLE 199 SME EVALUATION QUADRANT: CRITERIA

11.6.2 PROGRESSIVE COMPANIES

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

11.6.5 STARTING BLOCKS

FIGURE 54 MARKETING RESOURCE MANAGEMENT MARKET (GLOBAL): SME EVALUATION QUADRANT, 2020

TABLE 200 COMPANY SOLUTION FOOTPRINT

TABLE 201 COMPANY VERTICAL FOOTPRINT

TABLE 202 COMPANY REGION FOOTPRINT

TABLE 203 COMPANY FOOTPRINT

11.7 COMPETITIVE SCENARIO

TABLE 204 MARKET: NEW LAUNCHES, 2019-2021

TABLE 205 MARKETING RESOURCE MANAGEMENT MARKET: DEALS, 2018-2021

12 COMPANY PROFILES (Page No. - 193)

12.1 MAJOR PLAYERS

12.1.1 ORACLE

(Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View)*

TABLE 206 ORACLE: BUSINESS OVERVIEW

FIGURE 55 ORACLE: COMPANY SNAPSHOT

TABLE 207 ORACLE: MARKET: NEW LAUNCHES

TABLE 208 ORACLE: MARKETING RESOURCE MANAGEMENT MARKET: DEALS

12.1.2 SAP

TABLE 209 SAP: BUSINESS OVERVIEW

FIGURE 56 SAP: COMPANY SNAPSHOT

TABLE 210 SAP: MARKET: NEW LAUNCHES

TABLE 211 SAP: MARKET: DEALS

12.1.3 SAS

TABLE 212 SAS: BUSINESS OVERVIEW

FIGURE 57 SAS: COMPANY SNAPSHOT

TABLE 213 SAS: MARKET: NEW LAUNCHES

TABLE 214 SAS: MARKETING RESOURCE MANAGEMENT MARKET: DEALS

12.1.4 ADOBE

TABLE 215 ADOBE: BUSINESS OVERVIEW

FIGURE 58 ADOBE: COMPANY SNAPSHOT

TABLE 216 ADOBE: MARKET: NEW LAUNCHES

TABLE 217 ADOBE: MARKET: DEALS

12.1.5 APRIMO

TABLE 218 APRIMO: BUSINESS OVERVIEW

TABLE 219 APRIMO: MARKET: NEW LAUNCHES

TABLE 220 APRIMO: MARKETING RESOURCE MANAGEMENT MARKET: DEALS

12.1.6 BRANDMAKER

TABLE 221 BRANDMAKER BUSINESS OVERVIEW

TABLE 222 BRANDMAKER: MARKET: NEW LAUNCHES

TABLE 223 BRANDMAKER: MARKET: DEALS

12.1.7 ALLOCADIA

TABLE 224 ALLOCADIA: BUSINESS OVERVIEW

TABLE 225 ALLOCADIA: MARKET: NEW LAUNCHES

TABLE 226 ALLOCADIA: MARKET: DEALS

12.1.8 HCL TECHNOLOGIES

TABLE 227 HCL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 59 HCL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 228 HCL: MARKETING RESOURCE MANAGEMENT MARKET: NEW LAUNCHES

TABLE 229 HCL: MARKET: DEALS

12.1.9 WEDIA

TABLE 230 WEDIA: BUSINESS OVERVIEW

TABLE 231 WEDIA: MARKET: NEW LAUNCHES

TABLE 232 WEDIA: MARKET: DEALS

12.1.10 WELCOME

TABLE 233 WELCOME: BUSINESS OVERVIEW

TABLE 234 WELCOME: MARKETING RESOURCE MANAGEMENT MARKET: NEW LAUNCHES

12.1.11 INFOR

12.1.12 INMOTIONNOW

12.1.13 SEISMIC

12.1.14 SITECORE

12.1.15 CONTENTSERV

12.1.16 IBM

12.1.17 SMARTSHEET

12.1.18 CAPITAL ID

12.1.19 BRANDMASTER

12.1.20 SIMPLE

12.1.21 WRIKE

12.1.22 WIDEN

12.1.23 MARCOM CENTRAL

12.1.24 TAPCLICKS

12.1.25 ADMATION

12.1.26 MARVIA

12.1.27 RESOLUT

12.1.28 INTELLIGENCEBANK

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 STARTUP / SME PLAYERS

12.2.1 MRM CENTRAL

12.2.2 BYNDER

12.2.3 HIVE9

12.2.4 PLANNUH

12.2.5 SHOPPERATIONS

12.2.6 CENTRAL DE MARCA

12.2.7 OPTIMATICA

12.2.8 DREAMDATA

12.2.9 SHARPSPRING

12.2.10 MYBRAND.CENTER

13 ADJACENT MARKETS (Page No. - 260)

13.1 INTRODUCTION

13.2 MARKETING AUTOMATION MARKET

TABLE 235 MARKETING AUTOMATION MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 236 MARKETING AUTOMATION MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 237 MARKETING AUTOMATION MARKET SIZE, BY DEPLOYMENT TYPE, 2017–2024 (USD MILLION)

TABLE 238 MARKETING AUTOMATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 239 MARKETING AUTOMATION MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

TABLE 240 MARKETING AUTOMATION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14 APPENDIX (Page No. - 263)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved 4 major activities to estimate the current market size of marketing resource management. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, The Software Alliance, CCA, MENA Cloud Alliance, International Trade Administration (ITA), Telecommunications Industry Association, United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), Arab Information and Communication Technology Organization (AICTO) to identify and collect information useful for this technical, market-oriented, and commercial study of the marketing resource management market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing MRM solutions. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the marketing resource management market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the Marketing Resource Management market.

Report Objectives

- To describe and forecast the Global MRM component (solutions and services), deployment types, organization size, industry verticals, and regions from 2021 to 2026, and analyze the various macro and microeconomic factors that affect the market growth

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the marketing resource management market

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and business expansion activities, in the market

- To track and analyze COVID-19 and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Channel Marketing Management Market & Its Impact on Marketing Resource Management Market:

Channel Marketing Management involves managing the relationships and activities with various partners and intermediaries that are involved in the distribution and promotion of a company's products or services. This can include managing relationships with distributors, retailers, wholesalers, and other intermediaries, as well as developing marketing programs and promotions that are targeted towards specific channels.

In the context of the Marketing Resource Management (MRM) market, Channel Marketing Management solutions are often included as part of the overall offering. This is because effective management of channel partners and intermediaries is a critical component of successful marketing resource management. By incorporating channel management capabilities into their solutions, vendors in the Marketing Resource Management market are able to offer a more comprehensive set of tools to their customers to manage their marketing activities end-to-end.

Channel Marketing Management (CMM) is a specific area of marketing that focuses on managing the relationships and activities of various partners and intermediaries that are involved in the distribution and promotion of a company's products or services. CMM solutions can help organizations manage their channel partners, develop marketing programs targeted at specific channels, and measure the performance of channel activities.

The impact of CMM on the MRM market is also reflected in the growing demand for integrated solutions that can provide end-to-end management of marketing activities. Vendors in the MRM market are increasingly offering CMM capabilities as part of their overall solution, and this trend is likely to continue as organizations look for ways to improve their marketing efficiency and effectiveness.

Industries getting Impacted in the Future by Channel Marketing Management Market:

Below are the few industries that would get impacted in the future because of Channel Marketing Management:

- Retail: Retail is a major industry that is heavily reliant on effective channel management. CMM can help retailers manage relationships with their suppliers, distributors, and other intermediaries, as well as develop marketing programs and promotions that are targeted towards specific channels.

- Healthcare: In the healthcare industry, CMM can help manage relationships with healthcare providers and insurers. This can include developing targeted marketing programs and promotions that are designed to reach specific healthcare providers and insurance companies.

- Technology: The technology industry relies heavily on channel partners for distribution and promotion of products and services. CMM can help technology companies manage relationships with their channel partners, including distributors, resellers, and other intermediaries.

- Finance: The finance industry is another industry that can benefit from CMM. Banks, for example, can use CMM to manage relationships with their channel partners, including brokers, financial advisors, and other intermediaries.

- Manufacturing: In the manufacturing industry, CMM can help companies manage relationships with their suppliers and distributors, as well as develop marketing programs and promotions that are targeted towards specific channels.

New Business Opportunities in Channel Marketing Management Market

- Channel partner relationship management (CPRM): As more companies rely on channel partners to distribute and promote their products, there is a growing need for solutions that can help manage these relationships effectively. CPRM solutions can help companies manage their channel partner data, communicate more effectively, and track performance metrics.

- Predictive analytics: Predictive analytics can help companies identify patterns and trends in channel performance data. By using predictive analytics, companies can make better decisions about channel investments and optimize their channel marketing programs for maximum impact.

- Artificial intelligence (AI): AI can help companies automate many of the manual tasks involved in channel marketing management, such as data entry and reporting. By using AI-powered solutions, companies can save time and improve the accuracy of their channel marketing data.

- Mobile channel management: As more consumers rely on mobile devices for their shopping and purchasing needs, there is a growing need for solutions that can help companies manage their mobile channel activities. Mobile channel management solutions can help companies develop and execute mobile marketing campaigns and track their performance.

- Channel data management: With the increasing amount of data generated by channel marketing activities, there is a growing need for solutions that can help companies manage and analyze this data effectively. Channel data management solutions can help companies consolidate their channel marketing data, analyze it, and use it to make better decisions about their marketing investments.

Top Players in Channel Marketing Management Market

- Salesforce

- Zift Solutions

- Impartner

- Suttle-Straus

- SproutLoud

- BrandMuscle

- TIE Kinetix

- Ansira

- Allbound

- Gorilla Corporation

Speak to our Analyst today to know more about "Channel Marketing Management Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marketing Resource Management Market