Textured Soy Protein Market by Type (Non-GMO, Conventional, and Organic), Application (Food (Meat Substitutes, Dairy Alternatives, Infant Nutrition, Bakery) and Feed), Source (Concentrates, Isolates, and Flour), and Region - Global Forecast to 2022

[133 Pages Report] Textured soy protein, also known as textured vegetable protein, is derived from soy flour, soy concentrates, or soy protein isolates, and has major application as meat substitutes. As opposed to natural soy protein, textured soy protein is usually a defatted soy flour product, a by-product of soybean oil extraction.

According to the Soyfoods Association of North America (SANA), “textured soy protein (TSP) may be unflavored or meat/chicken flavored, may appear in chunks, slices, flakes, crumbles, or bits, and is sold at natural food supermarkets, food cooperatives, buying clubs, health food stores, or the natural foods section of traditional supermarkets.

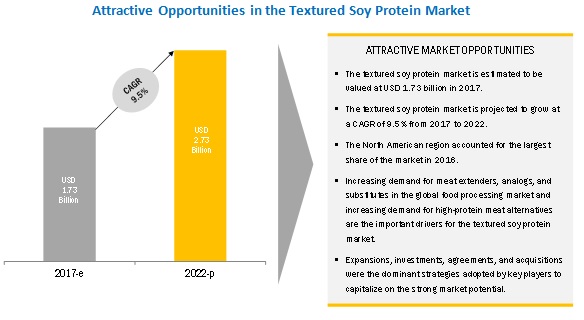

The global textured soy protein market is estimated at USD 1.58 Billion in 2016; it is projected to grow at a CAGR of 9.5% from 2017, to reach USD 2.73 Billion by 2022. The base year considered for the study is 2016, and the forecast period is from 2017 to 2022. The basic objective of the report is to define, segment, and project the global market size for the textured soy protein market based on type, source, application, and region.

By source, soy protein concentrates to account for the largest market share during the forecast period

In this report, the textured soy protein market is broadly segmented into soy protein concentrates, soy protein isolates, and soy flour. Soy protein concentrates to account for the largest market as they are easily digestible, cheap, and available in granule, flour, and spray-dried forms. They are well-suited for consumers of all age groups, including children, pregnant & lactating women, and the geriatric population. In terms of volume, the soy protein isolates segment was the second-largest owing to its higher protein content (90%). Soy protein isolates are also estimated to be the fastest-growing, during the forecast period, both in terms of value and volume.

By type, the non-GMO segment is expected to dominate the textured soy protein market during the forecast period

Non-GMO textured soy proteins are high protein products that are also rich in dietary fibers, minerals, contain no cholesterol, lactose, or casein, and are free from microbiological contamination. The organic segment is projected to grow at the highest CAGR during the forecast period. Natural textured soy proteins are extracted from organic soy, in the form of isolates, concentrates, and flour, and find wide-scale application in snacks, nutritional supplements, meat alternatives, and extenders. The demand for organic soy protein is increasing rapidly, with more people becoming health conscious and demanding organic products. The busy schedules of consumers have led to the rising demand for organic food & beverage products containing textured soy proteins. Manufacturers are focusing on product innovation in organic soy protein to cater to the increasing demand.

g By food application, meat application to dominate the market during the forecast period

With supportive health claims from the Joint Health Claim Initiative (JHCI), soy proteins are developed as essential ingredients in functional foods and nutraceuticals. According to the Commonwealth Scientific and Industrial Research Organization (CSIRO), 60% of the global supermarket products contain textured soy protein. Textured soy proteins are formulated to suit specific applications such as bakery, dairy replacers, or meat alternatives. The feed segment is the fastest-growing application for textured soy protein in the coming years. The rising demand for animal by-products will result in increased attention toward animal care and welfare, which in turn is expected to drive the consumption of textured soy protein in feed. Animals rely on a continuous supply of proteins for healthy functioning, growth, reproduction, and metabolism. Hence, nutritional diets containing an adequate amount of protein fibers are essential in the feed. This has resulted in the rising demand and usage of textured soy protein in feed.

North America to dominate the textured soy protein market during the forecast period

Among consumer soy foods, functional foods, and dairy replacers are projected to be the fastest-growing segments in North America. The demand for textured soy protein is growing at a high rate; changing consumer preference from meat to plant protein is one of the main reasons driving the market for soy protein. Also, soy-based proteins are a major source of protein for vegans worldwide. The high nutritional profile, low carbon footprint, and low price of plant-sourced protein are driving the consumption of these proteins in food applications. The global demand for textured soy protein is increasing significantly, especially in developed countries such as the US and countries in the European Union.

The global textured soy protein market is competitive. It comprises major players such as ADM, Cargill, DuPont, Wilmar International, and Victoria Group, which focus on expansions & investments, agreements, joint ventures, and acquisitions to strengthen their base in the textured soy protein market. Apart from these companies, there are other textured soy protein companies such as Bremil Group, Linyi Shansong Biological Products, Shandong Yuxin Bio-Tech, Crown Soya Protein Group, Sonic Biochem, and Hung Yang Foods, which are also strengthening their position through new product launches and expansions.

Market Dynamics

Driver: Inexpensive source of protein

Increased soy crop cultivation in developing regions such as South America and Asia Pacific, in addition to the already widespread cultivation of soybean across the globe, has increased the availability of soy products such as textured soy proteins. Raw materials for deriving textured soy protein are therefore easy to obtain from contract farmers or oilseed crushers offering soy meal. The low processing costs associated with textured soy proteins are suitable for the operational demands of manufacturers and thereby allow the processors to spend adequately on product development. As a result of these trends, the cost of textured soy protein is cheaper when compared to that of other protein sources such as meat, dairy, and whey proteins. Additionally, the prices of conventional dairy products have increased in the recent past, and textured soy protein, being one of the major plant sources of protein, is one of the most suitable alternatives considered in terms of price.

Restraint: Stringent government regulations for genetically modified crops

The European Union (EU) has stringent regulations in place for genetically modified (GM) crops due to the risks associated with humans and the environment. Soy, one of the largest sources of plant protein and the largest plant-based protein ingredient, if genetically modified in seed form, could have adverse effects if consumed and is hence restricted in the European region.

Genetically modified crops are prohibited in developed regions such as Europe, where several countries as part of the European Union have banned their farmers from cultivating genetically modified crops. The key countries include Germany, France, Northern Ireland, and Scotland. This has affected the genetically modified soybean market in the region and is expected to hamper growth in the future owing to the cultivation and adoption of non-GM soybean crops for food processing applications in European countries. It is also likely to affect exports of soybean from developing countries such as Argentina, where soybean crops are mostly GM-based. This would lead to an overall increase in the prices of products incorporating non-GM soybean.

Opportunity: Increase in soybean production and consumption in emerging markets

Changing lifestyles and the shift from processed food to healthy food products has been observed in developing economies over the past decade, leading to the growth in demand for textured soy proteins, not only for food products but also for applications such as animal feed, cosmetics, and personal care products.

The demand for textured soy protein is high in developed markets such as the US and Europe. The trend of consumer preference for healthy products is rising, wherein marketing campaigns are planned for highlighting their use and health benefit claims. Developing countries such as China and India are projected to experience an increase in demand for textured soy protein in the coming years from these regions. The Asia Pacific region provides a cost advantage in terms of production and processing. High demand, coupled with low cost of production, would aid the suppliers, subsequently driving the growth of the market in the region.

Countries such as India, lack in post-harvest management techniques and lack in an efficient supply chain. However, the increase in per-capita income and consumers’ buying capabilities are expected to drive the growth of the textured soy protein market over the next few years.

Challenge: Unpleasant flavor of soy products

Recent consumer trends toward “cholesterol-free” food products have helped increase the demand for textured soy protein, impacting the demand for animal proteins. The main factor that has limited the use of soy products in western countries was the unpalatable taste of soy products, which is linked to the action of the lipoxygenase enzyme on the soybean oil. During the hydration and milling process, the lipoxygenase in soy breaks down the oil into various chemicals such as hexanal, and these chemicals have unpleasant flavors which are described as ‘beany,’ ‘green,’ ‘bitter,’ ‘grassy,’ ‘painty,’ ‘astringent,’ and ‘rancid.’ Moreover, the unpleasant flavor of soy protein makes it undesirable for consumption. This flavor is caused due to the presence of compounds such as aldehydes, ketones, furans, and alcohols. Medium-chain aldehydes are one of the major reasons for the beany and grassy taste of soy products. The low cost of soy and high nutritional value are the main factors that motivate researchers to develop innovative and likable flavors in soy products. Efforts are being made to identify ways to neutralize the unpleasant flavor during the extraction process or by the addition of sugar compounds during the processing phase.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Value (USD, million), Volume (kilo tons) |

|

Segments covered |

By Type (Conventional. Non-GMO, Organic, Others), By Application (Food, Feed), By Source (Soy Protein Concentrates, Soy Protein Isolates, Soy Flour) |

|

Geographies covered |

North America, Europe, APAC, RoW |

|

Companies covered |

ADM (US), Cargill (US), DowDuPont (US), Wilmar International (Singapore), Victoria Group (Serbia), Bremil Group (Brazil), Linyi Shansong Biological Products (China), Shandong Yuxin Bio-Tech (China), Crown Soya Protein Group (China), Sonic Biochem (India), and Hung Yang Foods (Netherlands) |

This research report categorizes the textured soy protein market based on type, application, source, and region. It forecasts revenue growth and analyzes trends in each of these submarkets.

Based on Type, the textured soy protein market has been segmented into:

- Non-GMO

- Conventional

- Organic

Based on Source, the market has been segmented into:

- Soy protein concentrates

- Soy protein isolates

- Soy flour

Based on Application, the textured soy protein market has been segmented into:

-

Food

- Meat substitutes

- Dairy alternatives

- Infant nutrition

- Bakery products

- Cereals & snacks

- Feed

Based on Region, the market has been segmented into:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East & Africa)

Key Market Players

ADM (US), Cargill (US), DowDuPont (US), Wilmar International (Singapore), Victoria Group (Serbia)

Recent Developments

- In November 2017, Cargill North America protein business planned to expand its Nashville facility to cater to the increasing demand for proteins. The company invested USD 146.0 million.

- In September 2017, DuPont and Dow Chemicals entered into a merger agreement to form the new company–DowDuPont. The value of the merger stood at USD 130.00 billion. Post-merger, the companies will operate into three independent divisions, namely, agriculture, materials science, and specialty products.

- In June 2016, Soja protein expanded its presence in the Asian and African markets. Following this expansion, the company would cater to Jordan, Egypt, Tunisia, Morocco, South Korea, the Philippines, Indonesia, Vietnam, and other Asian & African countries.

- In May 2016, Adani Wilmar and Ruchi Soya (India) entered into a joint venture to combine their procurement, marketing, distribution, and sales businesses for soya foods, by-products, and all other food products. Wilmar expanded its footprint in the Indian soy market through this joint venture.

- In February 2016, ADM signed an agreement with Harvest Innovations (US), engaged in the manufacture of textured soy protein and other soy products, to purchase more than 50% stake in the company. ADM expanded its product portfolio with this agreement.

Critical questions the report answers:

- What are the industry trends that would be seen over the next five years?

- Which vertical of the textured soy protein market is likely to lead the market during the forecast period?

- Which end-user segment is expected to witness the maximum growth during the forecast period?

- Which would be the leading region with the highest share in the textured soy protein market during the forecast period?

- How many companies implementing organic and inorganic strategies are expected to gain increased market share?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in this Market

4.2 Market, By Source, 2017

4.3 North America: Textured Soy Protein Market, By Country & Type

4.4 Market, By Food Application

4.5 Market: Key Countries

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Inexpensive Source of Protein

5.2.1.2 High Nutritional Value of Soy

5.2.1.3 Preferred Alternative for Meat & Dairy Products

5.2.1.4 Growing Health-Conscious Population

5.2.2 Restraints

5.2.2.1 Stringent Government Regulations for Genetically Modified Crops

5.2.3 Opportunities

5.2.3.1 Demand for Plant-Based Protein as A Result of the Growing Vegan Population

5.2.3.2 Growing End-Use Applications

5.2.3.3 Increase in Soybean Production and Consumption in Emerging Markets

5.2.4 Challenges

5.2.4.1 Unpleasant Flavor of Soy Products

5.2.4.2 Low Consumer Awareness

5.3 Supply Chain Analysis

5.4 Regulations

5.4.1 International Body for Food Safety Standards and Regulations

5.4.1.1 Codex Alimentarius Commission (CAC)

5.4.1.2 European Vegetable Protein Federation (Euvepro)

6 Textured Soy Protein Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Non-GMO

6.3 Conventional

6.4 Organic

6.5 Other Types

7 Textured Soy Protein Market, By Source (Page No. - 49)

7.1 Introduction

7.2 Soy Protein Concentrates

7.3 Soy Protein Isolates

7.4 Soy Flour

8 Textured Soy Protein Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Food

8.2.1 Meat Substitutes

8.2.2 Dairy Alternatives

8.2.3 Infant Nutrition

8.2.4 Bakery Products

8.2.5 Cereal & Snacks

8.2.6 Other Food Applications

8.3 Feed

9 Textured Soy Protein Market, By Region (Page No. - 68)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Rest of Asia Pacific

9.5 Rest of the World (RoW)

9.5.1 South America

9.5.2 The Middle East & Africa

10 Competitive Landscape (Page No. - 98)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 Expansions & Investments

10.3.2 Mergers & Acquisitions

10.3.3 Agreements, Partnerships, Collaborations, and Joint Ventures

11 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.1 ADM

11.2 Cargill

11.3 DowDuPont

11.4 Wilmar International

11.5 Victoria Group

11.6 Bremil Group

11.7 Linyi Shansong Biological Products

11.8 Shandong Yuxin Bio-Tech

11.9 Crown Soya Protein Group

11.10 Sonic Biochem

11.11 Dutch Protein & Services

11.12 Hung Yang Foods

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 124)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (84 Tables)

Table 1 Us Dollar Exchange Rate Considered for the Study, 2014–2016

Table 2 Textured Soy Protein Market Size, By Type, 2015–2022 (USD Million)

Table 3 Market Size, By Type, 2015–2022 (KT)

Table 4 Non-GMO Market Size, By Region, 2015–2022 (USD Million)

Table 5 Non-GMO Market Size, By Region, 2015–2022 (KT)

Table 6 Conventional Market Size, By Region, 2015–2022 (USD Million)

Table 7 Conventional Market Size, By Region, 2015–2022 (KT)

Table 8 Organic Market Size, By Region, 2015–2022 (USD Million)

Table 9 Organic Market Size, By Region, 2015–2022 (KT)

Table 10 Other Types Market Size, By Region, 2015–2022 (USD Million)

Table 11 Other Types Market Size, By Region, 2015–2022 (KT)

Table 12 Textured Soy Protein Market, By Source, 2015–2022 (USD Million)

Table 13 Market, By Source, 2015–2022 (KT)

Table 14 Soy Protein Concentrates Market, By Region, 2015–2022 (USD Million)

Table 15 Soy Protein Concentrates Market, By Region, 2015–2022 (KT)

Table 16 Soy Protein Isolates Market Size, By Region, 2015–2022 (USD Million)

Table 17 Soy Protein Isolates Market Size, By Region, 2015–2022 (KT)

Table 18 Soy Flours Market Size, By Region, 2015–2022 (USD Million)

Table 19 Soy Flour Market Size, By Region, 2015–2022 (KT)

Table 20 Market Size for Textured Soy Protein, By Application, 2015–2022 (USD Million)

Table 21 Market Size, By Application, 2015–2022 (KT)

Table 22 Textured Soy Protein Market Size in Food, By Sub-Application, 2015–2022 (USD Million)

Table 23 Market Size in Food, By Sub-Application, 2015–2022 (KT)

Table 24 Textured Soy Protein Market Size in Food, By Region, 2015–2022 (USD Million)

Table 25 Market Size in Food, By Region, 2015–2022 (KT)

Table 26 Textured Soy Protein Market Size in Meat Substitutes, By Region, 2015–2022 (USD Million)

Table 27 Market Size in Meat Substitutes, By Region, 2015–2022 (KT)

Table 28 Textured Soy Protein Market Size in Dairy Alternatives, By Region, 2015–2022 (USD Million)

Table 29 Market Size in Dairy Alternatives, By Region, 2015–2022 (KT)

Table 30 Textured Soy Protein Market Size in Infant Nutrition, By Region, 2015–2022 (USD Million)

Table 31 Market Size in Infant Nutrition, By Region, 2015–2022 (KT)

Table 32 Textured Soy Protein Market Size in Bakery Products, By Region, 2015–2022 (USD Million)

Table 33 Market Size in Bakery Products, By Region, 2015–2022 (KT)

Table 34 Textured Soy Protein Market Size in Cereal & Snacks, By Region, 2015–2022 (USD Million)

Table 35 Market Size in Cereal & Snacks, By Region, 2015–2022 (KT)

Table 36 Textured Soy Protein Market Size in Other Food Applications, By Region, 2015–2022 (USD Million)

Table 37 Market Size in Other Food Applications, By Region, 2015–2022 (KT)

Table 38 Textured Soy Protein Market Size in Feed, By Region, 2015-2022 (USD Million)

Table 39 Market Size in Feed, By Region, 2015-2022 (KT)

Table 40 Market Size for Textured Soy Protein, By Region, 2015–2022 (USD Million)

Table 41 Market Size, By Region, 2015–2022 (KT)

Table 42 North America: Market Size for Textured Soy Protein, By Source, 2015–2022 (USD Million)

Table 43 North America: Market Size, By Source, 2015–2022 (KT)

Table 44 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 45 North America: Market Size, By Type, 2015–2022 (KT)

Table 46 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 47 North America: Market Size, By Application, 2015–2022 (KT)

Table 48 North America: Market Size, By Sub-Application, 2015–2022 (USD Million)

Table 49 North America: Market Size, By Sub-Application, 2015–2022 (KT)

Table 50 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 51 North America: Market Size, By Country, 2015–2022 (KT)

Table 52 Europe: Market Size for Textured Soy Protein, By Source, 2015–2022 (USD Million)

Table 53 Europe: Market Size, By Source, 2015–2022 (KT)

Table 54 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 55 Europe: Market Size, By Type, 2015–2022 (KT)

Table 56 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 57 Europe: Market Size, By Application, 2015–2022 (KT)

Table 58 Europe: Market Size, By Subapplication, 2015–2022 (USD Million)

Table 59 Europe: Market Size, By Subapplication, 2015–2022 (KT)

Table 60 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 61 Europe: Market Size, By Country, 2015–2022 (KT)

Table 62 Asia Pacific: Market Size for Textured Soy Protein, By Type, 2015–2022 (USD Million)

Table 63 Asia Pacific: Market Size, By Type, 2015–2022 (KT)

Table 64 Asia Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 65 Asia Pacific: Market Size, By Application, 2015–2022 (KT)

Table 66 Asia Pacific: Market Size, By Subapplication, 2015–2022 (USD Million)

Table 67 Asia Pacific: Market Size, By Subapplication, 2015–2022 (KT)

Table 68 Asia Pacific: Market Size, By Source, 2015–2022 (USD Million)

Table 69 Asia Pacific: Market Size, By Source, 2015–2022 (KT)

Table 70 Asia Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 71 Asia Pacific: Market Size, By Country, 2015–2022 (KT)

Table 72 RoW: Textured Soy Protein Market Size, By Source, 2015–2022 (USD Million)

Table 73 RoW: Market Size, By Source, 2015–2022 (KT)

Table 74 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 75 RoW: Market Size, By Type, 2015–2022 (KT)

Table 76 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 77 RoW Market Size, By Application, 2015–2022 (KT)

Table 78 RoW: Market Size in Food, By Sub-Application, 2015–2022 (USD Million)

Table 79 RoW: Market Size in Food, By Sub-Application, 2015–2022 (KT)

Table 80 RoW: Market Size, By Country, 2015–2022 (USD Million)

Table 81 RoW: Market Size, By Region, 2015–2022 (KT)

Table 82 Expansions & Investments, 2012–2017

Table 83 Mergers & Acquisitions, 2014–2017

Table 84 Agreements, Partnerships, Collaborations, and Joint Ventures, 2014–2017

List of Figures (36 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 Textured Soy Protein Market, By Type, 2016

Figure 9 Market, By Source, 2017 vs 2022

Figure 10 Textured Soy Protein Market, By Application, 2017 vs 2022

Figure 11 Regional Snapshot

Figure 12 Increasing Demand for Meat Applications to Drive the Market During the Forecast Period

Figure 13 Soy Protein Concentrates Accounted for the Largest Share in All Regions, 2017

Figure 14 Non-GMO Segment Accounted for the Largest Share in North America in 2016

Figure 15 Meat Application to Dominate the Market Across All Regions, 2016

Figure 16 India and China: Growing Markets for the Textured Soy Protein Industry

Figure 17 Textured Soy Protein Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Supply Chain Analysis: Major Value Added During Sourcing & Production Phase

Figure 19 Non-GMO Textured Soy Protein to Dominate the Market Throughout the Forecast Period

Figure 20 Soy Protein Concentrate to Dominate the Global Market Throughout the Forecast Period

Figure 21 Textured Soy Protein Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 22 Geographic Snapshot (2017–2022): Rapidly Growing Markets are Emerging as New Hotspots

Figure 23 North America: Market Snapshot

Figure 24 Europe Market: Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Key Developments By Leading Players in this Market From 2014 to 2017

Figure 27 Market Developments, By Growth Strategy, 2012–2017

Figure 28 Top Five Companies in the Tartaric Acid Market, 2016

Figure 29 ADM: Company Snapshot

Figure 30 ADM: SWOT Analysis

Figure 31 Cargill: Company Snapshot

Figure 32 Cargill: SWOT Analysis

Figure 33 DowDuPont: Company Snapshot

Figure 34 DowDuPont: SWOT Analysis

Figure 35 Wilmar International: Company Snapshot

Figure 36 Wilmar International: SWOT Analysis

Growth opportunities and latent adjacency in Textured Soy Protein Market