Medium Chain Triglycerides Market by Fatty Acid Type (Caproic, Caprylic, Capric and Lauric), Application (Nutritional Supplements, Infant Formula, Sports Drinks, Pharmaceutical Products), Form, Source and Region - Global Forecast to 2026

Medium chain Triglycerides Market Size & Trends Overview

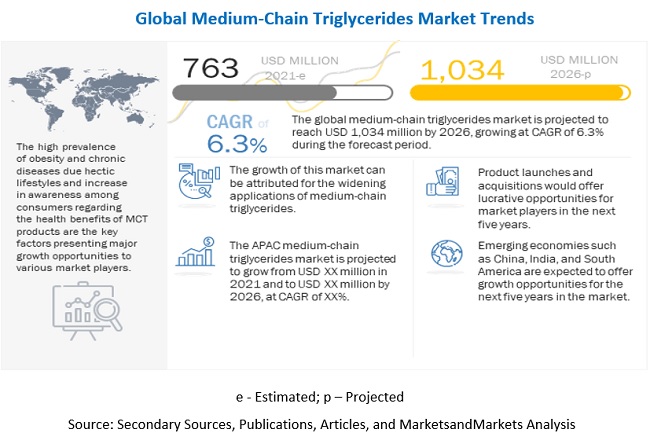

The global medium chain triglycerides market was valued at $763 million in 2021, and is projected to reach $1,034 million by 2026, growing at a CAGR of 6.3% from 2021 to 2026. MCTs (medium chain triglycerides) are fats synthesized in a laboratory from coconut and palm kernel oils.

Due to the rising demand for MCT oil in dietary supplements and functional foods, as well as the rising public awareness of the health advantages of MCT, the medium chain triglycerides (MCT) market is expanding significantly. Coconut oil, palm oil, and dairy products all include MCTs, a kind of saturated fatty acid. MCTs are metabolised differently and are quickly absorbed by the body than long-chain fatty acids, which has increased their appeal as an ingredient in energy bars, sports drinks, and weight-loss supplements. The most widely used type of MCTs on the market is MCT oil, which is largely made from coconut oil. It comes in a variety of categories, including food grade and cosmetic grade. MCT oil is most commonly used in the food and beverage industry, then in the nutritional supplement and cosmetics sectors.

A medium chain triglycerides market report typically covers the following aspects:

Market Segmentation: The market is segmented by product type, application, and geography. Product types include MCT oil, powder, and cream. Applications include food and beverages, dietary supplements, cosmetics, and others. Geographically, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World.

Market Overview: This section provides an overview of the market, including market size, growth rate, and market trends.

Market Dynamics: This section covers key market drivers, restraints, opportunities, and challenges that are impacting the market.

Competitive Landscape: This section provides an overview of the competitive landscape of the medium chain triglycerides market, including market share analysis and profiles of major players operating in the market.

Company Profiles: This section provides detailed information about major players operating in the market, including company overview, product offerings, financial performance, and recent developments.

Conclusion: This section provides a summary of the key findings of the report, including market size, growth rate, and market trends.

To know about the assumptions considered for the study, Request for Free Sample Report

Medium chain Triglycerides Market Growth Trends

Drivers: Increasing incorporation of medium chain triglycerides as an alternative to regular fats in diets

Medium chain triglycerides are often used in nutritional diets, infant formulas, functional foods, pharmaceutical products, personal care products, sports drinks, and dietary supplements, as they rapidly generate energy and enhance the endurance of human body. These triglycerides are rapidly broken down and easily absorbed in the human body due to their shorter chain length of fatty acids, making them less likely to be stored as body fat. This also helps with instant energy generation in the body. Extremely low-carb or ketogenic diets are efficient ways of weight reduction, and these triglycerides can be added in such diets as they produce ketones.

Due to the aforesaid benefits the market is becoming popular among consumers who are health conscious and inclined toward healthy eating habits, resulting in their increased demand.

Restraints: Use of mineral oils as substitute

Mineral oils are often used as substitutes for medium chain triglycerides in cosmetics and personal care products, as the former are more cost-effective. Medium chain triglycerides act as good skin barrier builders when used in personal care products, but not strong enough as mineral oils. These triglycerides are good substitutes for mineral oils only if they are formulated without petrochemicals. Thus, the availability of substitutes such as mineral oils is restraining market growth.

Opportunities: Rise in demand for natural cosmetic products

According to FAOSTAT, the global natural and organic beauty market is estimated to be valued at USD 24 billion in 2024. Over years, the preference for natural products over artificial chemicals has increased in the beauty and personal care industry. Factors such as the increasing millennial population, specifically in the Asia Pacific region, and use of the Internet, growing per capita income, a rising awareness regarding sustainable and environment-friendly products have together driven the medium chain triglycerides market for organic cosmetics and personal care products. This has resulted in an increase in the demand for specialty ingredients such as palm oil and coconut oil for use in the beauty and personal care industries in recent years.

Citing the significant growth of the organic beauty and personal care markets, some of the key manufacturers are now investing in and developing innovative cosmetic products that serve the requirements of target customers. In 2018, Malaysia-based IOI Corporation opened a formulation and multinational CARE studio in Hamburg, Germany, where the company aimed at developing natural cosmetic products with the help of palm oil-based natural fatty acids. Similarly, in 2015, Natural Sourcing, one of the key suppliers of natural ingredients to the cosmetics industry, announced the launch of a new line of strawberry specialty oil as a skincare product. Thus, the rising demand for natural cosmetic products paves the way for the growth of the market in the beauty and personal care application sector.

Challenges: High dependence on imports and increasing technology costs leading to high costs of end products

There is a significant gap between the demand and supply of oilseed processed products, including edible oil, owing to the limited availability of oilseeds in some countries. For instance, India and European countries import palm oil on a large scale from Indonesia and Malaysia, which are the leading producers owing to the favorable climatic conditions of these countries. Palm oil is widely used in the confectionery products sector, which experiences high demand in India and other European countries.

Similarly, the European personal care product manufacturers depend on high-cost imports of shea butter from South Africa, which accounts for a significant share of its production. Due to the high dependence of these countries on the imports of palm oil and shea butter, respectively, their imports cost as well as the cost of the end products increase, posing a challenge for the medium chain triglycerides market. For instance, the average import price of palm oil is USD 500 per ton. Considering its use in various food sectors as an ingredient in bakery, confectionery, and processed foods, the overall end use price of the products shoots up to near about 40% of its total initial price. Such differences in marginal prices pose a challenge to the market, specifically in developing countries.

Increasing production cost due to the rising cost of raw materials such as coconut oil, palm oil, and milk fats is one of the major challenges faced by the manufacturers of medium chain triglycerides. Also, the fractionation process requires sophisticated technology, the cost of which is also increasing, thus making it a challenge for manufacturers.

Medium chain Triglycerides Market by Form Insights

The dry form segment dominated the market in 2020

Medium chain triglyceride powder is a white or off-white and free-flowing powder with water solubility capabilities. This powder is derived from sources such as coconut oil, palm oil, or palm kernel oil. It is used in combination with other nutritional ingredients to produce various nutritional formulas, such as infant formula, products for weight management, and sports nutrition.

Medium chain Triglycerides Market by Source Insights

The market for coconut, by source segment dominated the market in 2020

The coconut segment dominated the market& and accounted for USD 303 million and a market share of 42.2% in 2020, owing to rising preferences of consumers for more natural food products. In coconut oil, about half of the fatty acids are lauric acid. As the primary source for MCT oil, more than 60 percent of the fatty acids in coconut oil are MCT. Coconut oil is one of the most important raw materials for the medium chain triglycerides industry, as its fatty acid composition is used as a starting block for many Medium chain triglycerides products. The oil also has health benefits that include cholesterol-lowering effects, regulating blood pressure, reduction of risks of cardiovascular diseases (CVDs), weight loss, improvement of cognitive functions, actions as an antimicrobial agent, and others.

Medium chain Triglycerides Market by Fatty Acid Type Insights

The market for Lauric acid, by fatty acid type, is projected to witness the fastest growth in the market during the forecast period

Lauric acid makes up most of the medium chain triglycerides market in coconut oil. However, it is often removed from MCT oil. Compared to other medium chain triglycerides, lauric acid is the slowest to metabolize but still provides anti-microbial properties and other health benefits.

To know about the assumptions considered for the study, download the pdf brochure

Medium chain Triglycerides Market by Regional Insights

The Asia Pacific region dominated the market and is projected to grow at a significant CAGR of 8.4% by 2026

Asia Pacific is one of the fastest-growing regions for the consumption of medium chain triglycerides, globally. Growing usage in cosmetics, personal care, and food & beverages segment is driving the demand for market such as caprylic, capric, and lauric triglycerides in the region. China, India, and Japan are the leading consuming countries of medium chain triglycerides. With busy lifestyles and increasing disposable incomes, the demand for nutritional food & products is growing in the region. Moreover, the growing use of personal care & cosmetics products such as lotions, gels, creams and cosmetics products for women are fueling the growth of the market in the Asia Pacific region

Key Players in Medium Chain Triglycerides Industry

The key service providers in this market include BASF SE (Germany), Koninklijke DSM N.V. (the Netherlands), Dupont(US), Lonza Group Ltd(Switzerland), Musim Mas Holdings(Singapore), Croda International Plc(UK), P&G Chemicals (US), Acme-Hardesty Company(Bluebell, PA), Wilmar International Limited( Singapore), Stepan Company (US), Sternchemie GmbH & Co. KG(Germany), Emery Oleochemicals Group(US), KLK Oleo(Malaysia), Nutricia(New Zealand), Connoils (US), Now foods(US), Barleans (Washington), Jarrow formula’s(US), Nutiva(US), Henry Lamotte Oils GmbH (Germany).

Medium Chain Triglycerides Market Report Scope

|

Report Metric |

Details |

|

Market valuation in 2021 |

USD 763 Million |

|

Revenue forecast in 2026 |

USD 1034 Million |

|

Progress Rate |

CAGR of 6.3% |

|

Forecast Period |

2021-2026 |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia Pacific |

|

Companies studied |

|

Medium Chain Triglycerides Market Report Segmentation

This research report categorizes the market based on fatty acid type, application, form, source and region.

|

Segment |

Subsegment |

|

Market By Source |

|

|

Market By Form |

|

|

Market By Fatty Acid Type |

|

|

Market By Application |

|

|

Market by Region |

|

Recent Developments

- In April 2021, Strenchemie developed medium chain triglycerides (MCT) oil from coconut which offers same functionalities as medium chain triglycerides Oil from palm products. It is an alternative to palm-sourced MCT Oil.

Frequently Asked Questions (FAQ):

What does MCT stand for?

MCT stands for Medium Chain Triglycerides. MCT are fats that are made in a lab from coconut and palm kernel oils. MCTs are a fat source for people who cannot tolerate other types of fats. These fats might also improve weight loss because the body can more easily break them down into molecules called ketone bodies. These ketone bodies can be used for energy.

How big is the medium chain triglycerides market?

The global medium chain triglycerides market size was valued at USD 763 million in 2021. The market is estimated to expand USD 1034 million in 2026, exhibiting a CAGR of 6.3% over the projected period.

What is the growth rate of medium chain triglycerides market?

The medium chain triglycerides market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2021 to 2026.

Which region has largest share in medium chain triglycerides market?

Asia Pacific is one of the fastest-growing regions for the consumption of medium chain triglycerides, globally. Growing usage in cosmetics, personal care, and food & beverages segment is driving the demand for medium chain triglycerides such as caprylic, capric, and lauric triglycerides in the region.

Which are the key players in the medium chain triglycerides market?

The global market for Medium chain triglycerides is dominated by large-scale players, such as BASF SE (Germany), Koninklijke DSM N.V. (The Netherlands), and Dupont. Moreover, these companies have effective global manufacturing operations and supply chain strategies. Such advantages give these companies an edge over other companies.

What is medium chain triglyceride MCT oil?

The fats known as medium chain triglycerides (MCT) are produced in a laboratory from coconut and palm kernel oils. Long-chain triglycerides are the name for common dietary lipids. For those who cannot tolerate other forms of fat, MCT provide a source of fat.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MEDIUM CHAIN TRIGLYCERIDES MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 MEDIUM CHAIN TRIGLYCERIDES (MCT) MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MEDIUM CHAIN TRIGLYCERIDES (MCT) MARKET SIZE ESTIMATION: SUPPLY SIDE (1/2)

FIGURE 5 MEDIUM CHAIN TRIGLYCERIDES MARKET SIZE ESTIMATION: SUPPLY SIDE (2/2)

FIGURE 6 MARKET SIZE ESTIMATION: DEMAND SIDE

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 STUDY ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 10 COVID-19: GLOBAL PROPAGATION

FIGURE 11 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 12 REVISED GROSS DOMESTIC PRODUCT FORECAST FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 13 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 14 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 15 IMPACT OF COVID-19 ON MEDIUM CHAIN TRIGLYCERIDES MARKET, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 16 MCT MARKET, BY FATTY ACID TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 MARKET, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 18 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 19 MARKET SHARE, BY FORM, 2021 VS. 2026 (IN TERMS OF VALUE)

FIGURE 20 MARKET SHARE (IN TERMS OF VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 21 GROWING HEALTH AWARENESS AMONG CONSUMERS TOWARD USE OF MEDIUM CHAIN TRIGLYCERIDES IN DIET TO DRIVE MARKET GROWTH

4.2 MARKET, BY KEY COUNTRY

FIGURE 22 US DOMINATED GLOBAL MCT MARKET IN 2020

4.3 ASIA PACIFIC: MARKET, BY KEY COUNTRY AND SOURCE

FIGURE 23 CHINA HELD LARGEST SHARE OF THE MARKET IN ASIA PACIFIC IN 2020

4.4 MARKET, BY APPLICATION AND REGION

FIGURE 24 NORTH AMERICA CAPTURED LARGEST MARKET SHARE ACROSS ALL APPLICATIONS IN 2020

4.5 COVID-19 IMPACT ON MCT MARKET

FIGURE 25 CHART OF PRE- & POST-COVID SCENARIOS IN THE MARKET

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 DEVELOPMENTS IN RETAIL INDUSTRY

FIGURE 26 INDIA: RETAIL MARKET SIZE, 2021 (USD BILLION)

FIGURE 27 INDIA: ONLINE RETAIL MARKET SIZE (USD BILLION)

FIGURE 28 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018–2022 (USD MILLION)

5.2.1.1 Vegetable oil consumption

FIGURE 29 PER CAPITA CONSUMPTION OF VEGETABLE OILS IN SELECTED COUNTRIES, 2005–2027 (KG)

5.3 MARKET DYNAMICS

FIGURE 30 MARKET DYNAMICS: MEDIUM CHAIN TRIGLYCERIDES MARKET

5.3.1 DRIVERS

5.3.1.1 Increasing use of medium chain triglycerides in diets as alternative energy source

5.3.1.2 Growing focus of global population on adding healthy food to their diet

FIGURE 31 TRENDS IN DIETARY FACTORS AND OTHER EXERCISE TO MAINTAIN HEALTHY LIFESTYLE, 2020

5.3.1.3 Rising incidences of chronic diseases

FIGURE 32 CHRONIC DISEASES WERE AMONG TOP TEN CAUSES OF DEATH AMONG ALL AGES, 2019 (MILLION)

5.3.2 RESTRAINTS

5.3.2.1 Availability of mineral oils as substitute

5.3.2.2 Unsuitability of medium chain triglycerides for patients with certain medical conditions

5.3.3 OPPORTUNITIES

5.3.3.1 Surging demand for natural and organic beauty products

5.3.3.2 Growing trend of microencapsulation of fats and oils

5.3.4 CHALLENGES

5.3.4.1 High cost of food products due to overdependence on imports significant gap in their demand and supply

5.4 IMPACT OF COVID-19 ON MARKET

5.4.1 COVID-19 BOOSTS DEMAND FOR HIGH-QUALITY NATURAL PRODUCTS

5.4.2 IMPACT ON RAW MATERIAL AVAILABILITY AND DISRUPTIONS IN SUPPLY CHAIN

5.4.3 SHIFT TOWARD PLANT-BASED INGREDIENTS

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 33 PRODUCT DEVELOPMENT AND MANUFACTURING PLAY VITAL ROLE IN SUPPLY CHAIN OF MEDIUM CHAIN TRIGLYCERIDES

6.3 ECOSYSTEM

FIGURE 34 MCTs MARKET MAP

TABLE 2 MCTs MARKET: ECOSYSTEM

6.3.1 UPSTREAM

6.3.2 INGREDIENT MANUFACTURERS

6.3.3 TECHNOLOGY PROVIDERS

6.3.4 END USERS

6.3.4.1 Downstream

6.3.5 REGULATORY BODIES

6.3.6 STARTUPS/EMERGING COMPANIES

6.4 VALUE CHAIN ANALYSIS

FIGURE 35 MEDIUM CHAIN TRIGLYCERIDES MARKET: VALUE CHAIN

6.4.1 RAW MATERIAL SOURCING AND RESEARCH & PRODUCT DEVELOPMENT

6.4.2 PRODUCTION & PROCESSING

6.4.3 DISTRIBUTION AND MARKETING & SALES

6.5 TECHNOLOGY ANALYSIS

6.5.1 MICROENCAPSULATION

6.5.1.1 Encapsulation of omega-3 to mask odor

6.5.2 USE OF ROBOTICS IN MANUFACTURING

6.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 36 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7.1 INTENSITY OF COMPETITIVE RIVALRY

6.7.2 BARGAINING POWER OF SUPPLIERS

6.7.3 BARGAINING POWER OF BUYERS

6.7.4 THREAT OF NEW ENTRANTS

6.7.5 THREAT OF SUBSTITUTES

6.8 PATENTS ANALYSIS

FIGURE 37 BREAKDOWN OF SAMPLES INTERVIEWED FOR PATENTS RELATED TO MEDIUM CHAIN TRIGLYCERIDES (2020)

TABLE 4 KEY PATENTS PERTAINING TO MEDIUM CHAIN TRIGLYCERIDES

6.9 TRADE ANALYSIS

FIGURE 40 MAJOR EXPORTERS OF PALM OIL, 2008–2011 (MILLION TONS)

FIGURE 41 CHINA: VEGETABLE OIL IMPORTS, 2000–2018 (MILLION TONS)

FIGURE 42 ROW: EDIBLE OIL EXPORTS, BY KEY COUNTRY, 2019 (USD THOUSAND)

6.10 CASE STUDIES

6.10.1 USE CASE 1: TASTEWISE’S AI AND MACHINE LEARNING SOLUTION HELPED MEET INCREASING DEMAND

6.10.2 USE CASE 2: MINDRIGHT’S BARS HELPED COMBAT MENTAL HEALTH ISSUES

7 MEDIUM CHAIN TRIGLYCERIDES MARKET, BY FATTY ACID TYPE (Page No. - 84)

7.1 INTRODUCTION

TABLE 5 MEDIUM CHAIN TRIGLYCERIDES: FATTY ACIDS & CHEMICAL FORMULA

FIGURE 44 MARKET, BY FATTY ACID TYPE, 2021–2026 (USD MILLION)

TABLE 6 MARKET, BY FATTY ACID TYPE, 2015–2020 (USD MILLION)

TABLE 7 MARKET, BY FATTY ACID TYPE, 2021–2026 (USD MILLION)

7.2 CAPRYLIC ACID

7.2.1 INCREASING USE OF CAPRYLIC ACID IN VARIOUS PHARMACEUTICAL, PERSONAL CARE, BEAUTY, AND FOOD PRODUCTS PROPELS MARKET GROWTH

TABLE 8 CAPRYLIC ACID: MCTs MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 9 CAPRYLIC ACID: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 CAPRIC ACID

7.3.1 GROWING NUMBER OF END USERS AND RISING INDUSTRIAL APPLICATIONS DRIVE DEMAND FOR CAPRIC ACID

TABLE 10 CAPRIC ACID: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 11 CAPRIC ACID: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 LAURIC ACID

7.4.1 RISING NEED FOR LAURIC ACID IN PHARMACEUTICALS INDUSTRY FUELS MARKET GROWTH

TABLE 12 LAURIC ACID: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 13 LAURIC ACID: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 CAPROIC ACID

7.5.1 INCREASING DEMAND FOR CAPROIC ACID FROM FRAGRANCE AND FLAVOR INDUSTRY TO MAKE CONFECTIONERY PRODUCTS SUPPORTS MARKET GROWTH

TABLE 14 CAPROIC ACID: MCTs MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 15 CAPROIC ACID: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

8 MEDIUM CHAIN TRIGLYCERIDES MARKET, BY SOURCE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 45 MARKET SHARE, BY SOURCE, 2021 VS. 2026 (IN TERMS OF VALUE)

TABLE 16 MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 17 MARKET, BY SOURCE, 2021–2026 (USD MILLION)

8.2 COCONUT

8.2.1 HIGHER CONCENTRATION OF LAURIC ACID AND ITS HEALTH BENEFITS, INCLUDING CHOLESTEROL-LOWERING EFFECTS, WEIGHT LOSS, AND REGULATING BLOOD PRESSURE, ACCELERATE MARKET GROWTH

TABLE 18 COCONUT: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 19 COCONUT: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 PALM

8.3.1 INTENSE CONCERNS FOR HARMFUL EFFECTS OF CHEMICALS USED IN TOILETRY PRODUCTS AND COSMETICS BOOST MARKET GROWTH

FIGURE 46 GLOBAL PRODUCTION OF PALM OIL, 2000–2018

TABLE 20 PALM: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 PALM: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 OTHER SOURCES

TABLE 22 OTHER SOURCES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 OTHER SOURCES: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 MEDIUM CHAIN TRIGLYCERIDES MARKET, BY FORM (Page No. - 97)

9.1 INTRODUCTION

FIGURE 47 MARKET, BY FORM, 2021 VS. 2026 (USD MILLION)

TABLE 24 MARKET, BY FORM, 2015–2020 (USD MILLION)

TABLE 25 MARKET, BY FORM, 2021–2026 (USD MILLION)

9.2 DRY

9.2.1 SIGNIFICANT USE OF DRY MEDIUM CHAIN TRIGLYCERIDES IN NUTRITIONAL SUPPLEMENTS AND INFANT FORMULA TO DRIVE MARKET GROWTH

TABLE 26 DRY: MCT MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 DRY: MCTs MARKET, BY FORM, 2021–2026 (USD MILLION)

9.3 LIQUID

9.3.1 HIGH CONVENIENCE AND WIDE RANGE OF APPLICATIONS OF LIQUID MEDIUM CHAIN TRIGLYCERIDE OIL TO BOOST MARKET GROWTH

TABLE 28 LIQUID: MCT MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 LIQUID: MCTs MARKET, BY FORM, 2021–2026 (USD MILLION)

10 MEDIUM CHAIN TRIGLYCERIDES MARKET, BY APPLICATION (Page No. - 101)

10.1 INTRODUCTION

FIGURE 48 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 30 MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 31 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 COVID-19 IMPACT ON THE MCT MARKET, BY APPLICATION

10.2.1 OPTIMISTIC SCENARIO

TABLE 32 OPTIMISTIC SCENARIO: MCTs MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 33 REALISTIC SCENARIO: MCTs MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 34 PESSIMISTIC SCENARIO: MCTs MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

10.3 NUTRITIONAL SUPPLEMENTS

10.3.1 THERMOGENESIS AND HYPOGLYCEMIC EFFECTS OF MEDIUM CHAIN TRIGLYCERIDES STIMULATE MARKET GROWTH

TABLE 35 NUTRITIONAL SUPPLEMENTS: MCTs MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 36 NUTRITIONAL SUPPLEMENTS: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 PERSONAL CARE PRODUCTS

10.4.1 HIGH DEMAND FOR MEDIUM CHAIN TRIGLYCERIDES IN COSMETICS INDUSTRY AS ALTERNATIVE TO MINERAL OIL BOOSTS MARKET GROWTH

TABLE 37 PERSONAL CARE PRODUCTS: MCTs MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 38 PERSONAL CARE PRODUCTS: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 PHARMACEUTICAL PRODUCTS

10.5.1 INCREASED USE OF MEDIUM CHAINTRIGLYCERIDES IN PHARMACEUTICALS INDUSTRY OWING TO THEIR LOW VISCOSITY AND EXCELLENT OXIDATIVE STABILITY PROPELS MARKET GROWTH

TABLE 39 PHARMACEUTICAL PRODUCTS: MEDIUM CHAIN TRIGLYCERIDES MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 40 PHARMACEUTICAL PRODUCTS: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 SPORTS DRINKS

10.6.1 MEDIUM CHAIN TRIGLYCERIDES ACT AS EXTRA ENERGY SOURCE FOR ATHLETES AND SPORTSPERSONS, THEREBY ACCELERATING MARKET GROWTH

TABLE 41 SPORTS DRINKS: MCTMARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 42 SPORTS DRINKS: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 INFANT FORMULA

10.7.1 INCREASED INCORPORATION OF MEDIUM CHAIN TRIGLYCERIDES IN MILK FORMULATION FOR INFANTS STIMULATES MARKET GROWTH

TABLE 43 INFANT FORMULA: MCT MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 44 INFANT FORMULA: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHER APPLICATIONS

TABLE 45 OTHER APPLICATIONS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 46 OTHER APPLICATIONS: MCTs MARKET, BY REGION, 2021–2026 (USD MILLION)

11 MARKET, BY REGION (Page No. - 113)

11.1 INTRODUCTION

FIGURE 49 GEOGRAPHICAL SNAPSHOT (2021–2026): ASIA PACIFIC EMERGING AS NEW HOTSPOT FOR MEDIUM CHAIN TRIGLYCERIDES

TABLE 47 MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 COVID-19 IMPACT ON MCT MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 49 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON MCT MARKET, BY REGION, 2018–2021 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 50 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET, BY REGION, 2018–2021 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 51 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON MCT MARKET, BY REGION, 2018–2021 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 50 NORTH AMERICA: MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: MEDIUM CHAIN TRIGLYCERIDES MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY FATTY ACID TYPE, 2015–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY FATTY ACID TYPE, 2021–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY FORM, 2015–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY FORM, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Strong presence of key market players and rising prevalence of obesity to drive market growth

TABLE 62 US: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 63 US: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Supportive government policies and growing consumer awareness regarding healthy diet to fuel market growth

TABLE 64 CANADA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 65 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Increased per capita expenditure on nutritious and healthy foods to boost demand for medium chain triglycerides

FIGURE 51 MEXICO: PER CAPITA EXPENDITURE ON FOOD, 2010–2018

TABLE 66 MEXICO: MCT MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 67 MEXICO: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4 EUROPE

TABLE 68 EUROPE: MEDIUM CHAIN TRIGLYCERIDES MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY FATTY ACID TYPE, 2015–2020 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY FATTY ACID TYPE, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY FORM, 2015–2020 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY FORM, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Robust presence of key market players and huge base of elderly population create opportunities for MCT products in country

TABLE 78 GERMANY: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 79 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 High preference for better eating habits, especially in women, leads to increased adoption of MCTs as alternatives to meals, supporting market growth

TABLE 80 FRANCE: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 81 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Increased awareness of consumers regarding functional ingredients and other wellness ingredients drives market growth

TABLE 82 UK: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 83 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Changing food pattern consumption, coupled with increasing number of chronic patients, leads to growing adoption of medium chain triglycerides in daily diet

TABLE 84 ITALY: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 85 ITALY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.5 REST OF EUROPE

TABLE 86 REST OF EUROPE: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 87 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 88 ASIA PACIFIC: MEDIUM CHAIN TRIGLYCERIDES (MCT) MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 89 ASIA PACIFIC: MEDIUM CHAIN TRIGLYCERIDES MARKETMARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY FATTY ACID TYPE, 2015–2020 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY FATTY ACID TYPE, 2021–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY FORM, 2015–2020 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY FORM, 2021–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Changing lifestyles of consumers and high preference for fortified food & beverage products to spur market growth in China

TABLE 98 CHINA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 99 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.2 JAPAN

11.5.2.1 Westernized food consumption patterns, along with inclination toward balance and healthy diets, projected to drive market growth in Japan

TABLE 100 JAPAN: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 101 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Rising hospitalization costs drive consumer demand for medium chain triglycerides

TABLE 102 INDIA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 103 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.4 AUSTRALIA & NEW ZEALAND

11.5.4.1 Consumer preference to spend on nutritional food products to foster market in Australia & New Zealand

TABLE 104 AUSTRALIA & NEW ZEALAND: MCT MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 105 AUSTRALIA & NEW ZEALAND: MCT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.5 REST OF ASIA PACIFIC

TABLE 106 REST OF ASIA PACIFIC: MCT MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 107 REST OF ASIA PACIFIC: MCT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

FIGURE 53 ROW: RISING PER CAPITA FOOD EXPENDITURE, BY KEY COUNTRY, 2012–2018 (USD)

TABLE 108 ROW: MEDIUM CHAIN TRIGLYCERIDES MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 109 ROW: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 110 ROW: MARKET, BY FATTY ACID TYPE, 2015–2020 (USD MILLION)

TABLE 111 ROW: MARKET, BY FATTY ACID TYPE, 2021–2026 (USD MILLION)

TABLE 112 ROW: MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 113 ROW: MARKET, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 114 ROW: MARKET, BY FORM, 2015–2020 (USD MILLION)

TABLE 115 ROW: MARKET, BY FORM, 2021–2026 (USD MILLION)

TABLE 116 ROW: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 117 ROW: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.1 SOUTH AMERICA

11.6.1.1 Prevalence of undernourishment to elevate demand for medium chain triglycerides in South America

FIGURE 54 NUTRITION TREND IN ARGENTINA, 2012–2019

TABLE 118 SOUTH AMERICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 119 SOUTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Increased incorporation of medium chain triglycerides in local diet fuels market growth

TABLE 120 AFRICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 121 AFRICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.3 MIDDLE EAST

11.6.3.1 High influence of Western culture to push demand for medium chain triglycerides

TABLE 122 MIDDLE EAST: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 123 MIDDLE EAST: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 158)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS

TABLE 124 MEDIUM CHAIN TRIGLYCERIDES MARKET: DEGREE OF COMPETITION

12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 55 THREE-YEAR TOTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2015–2019 (USD BILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.4.1 BASF SE

12.4.2 KONINKLIJKE DSM N.V.

12.4.3 DUPONT

12.4.4 MUSIM MAS HOLDINGS

12.4.5 LONZA GROUP LTD.

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE PLAYER

12.5.4 PARTICIPANT

FIGURE 56 MCT MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.6 PRODUCT FOOTPRINT

TABLE 125 COMPANY FOOTPRINT, BY SOURCE

TABLE 126 COMPANY FOOTPRINT, BY APPLICATION

TABLE 127 COMPANY FOOTPRINT, BY REGION

TABLE 128 COMPANY FOOTPRINT

12.7 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

12.7.1 PROGRESSIVE COMPANY

12.7.2 STARTING BLOCK

12.7.3 RESPONSIVE COMPANY

12.7.4 DYNAMIC COMPANY

FIGURE 57 MCT MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 129 MCT MARKET: PRODUCT LAUNCHES, APRIL 2021

12.8.2 DEALS

TABLE 130 MEDIUM CHAIN TRIGLYCERIDES MARKET: DEALS, MARCH 2016–SEPTEMBER 2016

13 COMPANY PROFILES (Page No. - 170)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 BASF SE

TABLE 131 BASF SE: BUSINESS OVERVIEW

FIGURE 58 BASF SE: COMPANY SNAPSHOT

TABLE 132 BASF SE: PRODUCTS OFFERED

13.1.2 DUPONT

TABLE 133 DUPONT: BUSINESS OVERVIEW

FIGURE 59 DUPONT: COMPANY SNAPSHOT

TABLE 134 DUPONT: PRODUCTS OFFERED

13.1.3 KONINKLIJKE DSM N.V.

TABLE 135 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

FIGURE 60 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 136 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

13.1.4 LONZA GROUP LTD.

TABLE 137 LONZA GROUP LTD.: BUSINESS OVERVIEW

FIGURE 61 LONZA GROUP LTD.: COMPANY SNAPSHOT

TABLE 138 LONZA GROUP LTD.: PRODUCTS OFFERED

13.1.5 MUSIM MAS HOLDINGS

TABLE 139 MUSIM MAS HOLDINGS: BUSINESS OVERVIEW

TABLE 140 MUSIM MAS HOLDINGS: PRODUCTS OFFERED

13.1.6 CRODA INTERNATIONAL PLC.

TABLE 141 CRODA INTERNATIONAL PLC.: BUSINESS OVERVIEW

FIGURE 62 CRODA INTERNATIONAL PLC.: COMPANY SNAPSHOT

TABLE 142 CRODA INTERNATIONAL PLC.: PRODUCTS OFFERED

13.1.7 P&G CHEMICALS

TABLE 143 P&G CHEMICALS: BUSINESS OVERVIEW

FIGURE 63 P&G CHEMICALS: COMPANY SNAPSHOT

TABLE 144 P&G CHEMICALS: PRODUCTS OFFERED

13.1.8 ACME-HARDESTY COMPANY

TABLE 145 ACME-HARDESTY COMPANY: BUSINESS OVERVIEW

TABLE 146 ACME-HARDESTY COMPANY: PRODUCTS OFFERED

13.1.9 WILMAR INTERNATIONAL LTD.

TABLE 147 WILMAR INTERNATIONAL LTD.: BUSINESS OVERVIEW

FIGURE 64 WILMAR INTERNATIONAL LTD.: COMPANY SNAPSHOT

TABLE 148 WILMAR INTERNATIONAL LTD.: PRODUCTS OFFERED

13.1.10 STEPAN COMPANY

TABLE 149 STEPAN COMPANY: MEDIUM CHAIN TRIGLYCERIDES MARKET BUSINESS OVERVIEW

FIGURE 65 STEPAN COMPANY: COMPANY SNAPSHOT

TABLE 150 STEPAN COMPANY.: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 STERNCHEMIE GMNH & CO. KG

TABLE 151 STERNCHEMIE GMBH & CO KG: BUSINESS OVERVIEW

TABLE 152 STERNCHEMIE GMBH & CO KG.: PRODUCTS OFFERED

TABLE 153 MEDIUM CHAIN TRIGYCERIDES MARKET: PRODUCT LAUNCH, APRIL 2021

13.2.2 EMERY OLEOCHEMICALS GROUP

TABLE 154 EMERY OLEOCHEMICALS GROUP: BUSINESS OVERVIEW

TABLE 155 EMERY OLEOCHEMICALS GROUP: PRODUCTS OFFERED

13.2.3 KLK OLEO

TABLE 156 KLK OLEO: BUSINESS OVERVIEW

TABLE 157 KLK OLEO: PRODUCTS OFFERED

13.2.4 NUTRICIA

TABLE 158 NUTRICIA: BUSINESS OVERVIEW

TABLE 159 NUTRICIA.: PRODUCTS OFFERED

13.2.5 CONNOILS

TABLE 160 CONNOILS: BUSINESS OVERVIEW

TABLE 161 CONNOILS: PRODUCTS OFFERED

13.2.6 BARLEAN’S

13.2.7 JARROW FORMULAS

13.2.8 HENRY LAMOTTE OILS GMBH

13.2.9 NOW FOODS

13.2.10 NUTIVA

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 207)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 FUNCTIONAL FOOD INGREDIENTS MARKET

14.3 FUNCTIONAL FOOD INGREDIENTS MARKET

14.3.1 MEDIUM CHAIN TRIGLYCERIDES MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

TABLE 162 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 163 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

14.3.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

TABLE 164 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 165 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

14.4 OMEGA-3 MARKET

14.4.1 LIMITATIONS

14.4.2 MARKET DEFINITION

14.4.3 MARKET OVERVIEW

14.4.4 OMEGA-3 MARKET, BY APPLICATION

TABLE 166 OMEGA-3 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

14.4.5 OMEGA-3 MARKET, BY REGION

14.4.5.1 Introduction

TABLE 167 OMEGA-3 MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 168 OMEGA-3 MARKET, BY REGION, 2017–2025 (KT)

15 APPENDIX (Page No. - 215)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.2 AUTHOR DETAILS

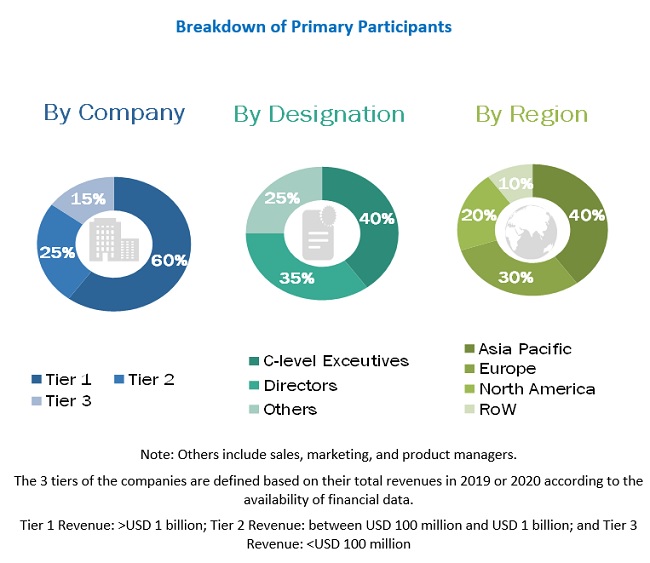

The study involved four major activities in estimating the medium chain triglycerides (MCT) market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases and investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold- & silver-standard websites, regulatory bodies, trade directories, and databases have been referred to for the identification and collection of information.

Secondary research has been mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the medium chain triglycerides market.

After the complete market engineering, (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation types, industry trends, key players, competitive landscape of medium chain triglycerides supplied by different types of market players and key market dynamics such as drivers, restraints, opportunities, industry trends, and key player strategies.

In the complete market engineering process, top-down and bottom-up approaches have been extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Medium Chain Triglycerides Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The medium chain triglycerides value chain and market size in terms of both value and volume have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affect the growth of the medium chain triglycerides market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the most precise estimations for all segments and sub-segments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Medium Chain Triglycerides (MCTs) Market Report Objectives

- To describe and forecast the medium chain triglycerides market based on sources, forms, fatty acid types, and applications

- To describe and forecast the market, in terms of value, by regions—Asia Pacific, Europe, North America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets, with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of medium chain triglycerides.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the medium chain triglycerides ecosystem

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as acquisitions and divestments; expansions and investments; product launches and approvals; agreements; and collaborations and partnerships in the market

Target Audience

- Raw material suppliers

- Medium chain triglyceride manufacturers

- Ingredient processors

- Traders, distributors, and suppliers

- Functional food, nutraceutical, and dietary supplement manufacturers

- Personal care and pharmaceutical product manufacturers

- Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- EUROPA

- Codex Alimentarius

- Food Safety Australia and New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers such as traders, distributors, and suppliers of ingredients and end products

- End users

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe medium chain triglycerides market into Switzerland, Ireland, Austria, Belgium, Sweden, Spain, the Netherlands, Poland, and Norway

- Further breakdown of the Rest of Asia Pacific market into Thailand, Vietnam, Malaysia, and Indonesia

- Further breakdown of the RoW market into South America, Africa and the Middle East

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medium Chain Triglycerides Market