Passenger Information System Market by Offering (Solutions and Services), Location (On-board and In-station), Transportation Mode (Railways (Trains and Trams), Roadways, and Airways & Waterways) and Region - Global Forecast to 2028

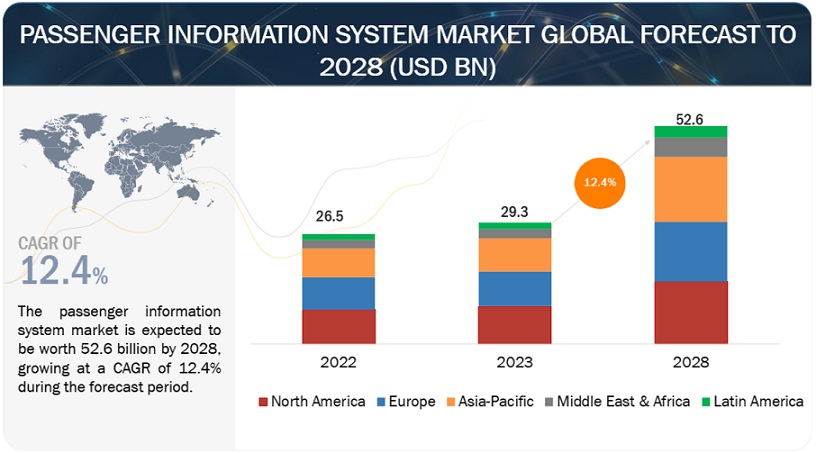

[261 Pages Report] The passenger information system market is estimated to be worth USD 29.3 billion in 2023 and is projected to reach USD 52.6 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 12.4% during the forecast period. The PIS system market is expected to substantially surge in the coming years. This growth is fueled by several key trends such as passengers demanding better experiences, technological advancements such as AI and IoT, a focus on cost efficiency, the rise of cloud-based solutions, increasing urbanization and public transport use, and supportive government initiatives. These factors will combine to create a booming market for PIS systems, making them an essential tool for transportation providers seeking to attract and retain passengers while optimizing operations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Passenger Information System Market Trends

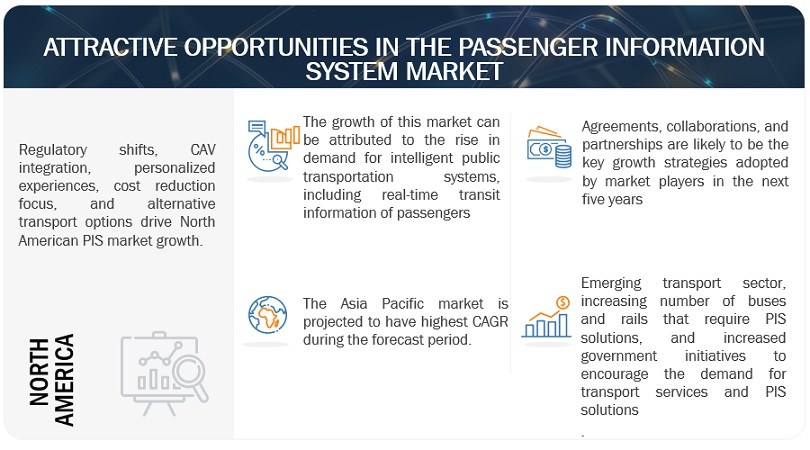

Driver: Rise in demand for intelligent public transportation systems, including real-time transit information of passengers

Intelligent public transportation systems are promoting the passenger information system (PIS) market in several ways. Firstly, the demand for reliable real-time information, for instance exact arrival times and delays, is crucial for passengers and drives the need for advanced PIS solutions. Secondly, these systems prioritize a positive user experience, and PIS plays a key role by reducing stress and empowering passengers through information. Additionally, PIS acts as a core component, integrating data from various sources to provide a unified picture for passengers, necessitating further market growth. Furthermore, government investments in these intelligent systems directly impact PIS demand as accurate and timely data delivery is essential. Finally, advancements in technology further enhance the capabilities of PIS, making it more valuable and driving the market forward. In essence, the rise of intelligent public transportation creates a strong demand for reliable passenger information, propelling the growth of the PIS market. Vendors in this market offer real-time information to passengers through different modes, such as smartphones, platform-level signage, third-party applications, and automated public-address systems. The information comprises both predictions about arrival and departure times, as well as information about the nature and causes of delays or disruptions.

Restraint: High costs involved in implementing and maintaining the passenger information systems

The overall cost of a PIS system includes the implementation and maintenance costs that can restrain the PIS market growth. The implementation costs primarily consist of the cost of designing the system, purchasing and installing the equipment needed for the system to work (including conduit), and monitoring the system's quality before it is released to the public. The maintenance costs comprise the entire cost of all inputs required to operate and maintain the real-time PIS solutions and services. It also includes operating costs that consist of electricity costs required to power the systems, the cost of data transfer between units of the system, and the parts and equipment utilized by maintenance staff in conducting their work. Maintaining the PIS system requires special attention as the information about passengers and public transport keeps changing. PIS systems also provide information about including new Passenger Transport (PT) operators in the Integrated Passenger Information (IPI) system, vehicle fleet changes as per requirements, and vehicle equipment breakdowns. Thus, PIS encompasses complex operational procedures due to the integration of associated additional components, increasing the overall costs due to technical hitches associated with the installation and the cost of employing experienced and skilled professionals related to the PIS market. PIS solutions and services further require regular upgrades to ensure the efficient functionality and reliability of the system, which leads to a rise in the overall maintenance costs, inhibiting the growth of the global PIS market.

Opportunity: Adoption of IoT, 5G, and automation technologies to enhance technological optimization

The evolution of IoT has enabled the exchange of information between different electronic devices without the need for direct human interaction. The convergence of IoT platforms with PIS is projected to help drive the market's growth. IoT is a combination of storing, processing, and computing sensor data using data analytics to achieve and assist the management of traffic systems effectively. IoT-based Intelligent Transportation Systems (ITS) help automate railways, roadways, airways, and marine lines, enhancing passengers' travel experiences. Smart devices integrated for improved connectivity, automation, and control are projected to become more self-governing and intelligent in terms of sharing data with transportation management control centers and the cloud.

Moreover, logistics vendors are finding ways to face new economic challenges with the help of technologies, such as Radio-Frequency Identification (RFID), Global System for Mobile Communications-Railway (GSM-R), and collaboration platforms. In addition, according to The Mobile Economy 2020, IoT will be an integral part of the 5G era. Between 2019 and 2025, the number of global IoT connections will be more than double, reaching nearly 25 billion, while global IoT revenue would triple to USD 1.1 trillion. The transportation industry is gradually adopting 5G networks for performing its business operations. These next-generation wireless networks would be an essential weapon for the successful adoption of IoT. The policies to support R&D activities and commercialize 5G that have been drawn globally, which would help increase IoT usage. The high speed and low latency of the 5G networks enable the passengers to get real-time data about their journeys quickly. For instance, China plans to implement the 5G technology for many life-transforming applications, from 3D video to immersive media and autonomous vehicles. China is projected to reach 576 million 5G connections by 2025, which covers nearly 40% of 5G connections globally. Hence, 5G is projected to provide improved connectivity by providing the speed, reliability, capacity, and mobility manufacturers require for a successful IoT implementation.

Challenge: Complexities in the integration over the legacy infrastructure and communication networks

Legacy systems are outdated computer software and hardware that remain in use even after the installation of modern technologies. Legacy systems are crucial for organizations as they support some key functionalities of the business. Organizations require to upgrade their legacy systems as it becomes difficult to continue with systems whose services are discontinued from vendors. Many of the legacy systems do not have the configuration required to connect with smart devices and enhanced communication networks. The PIS market vendors face challenges in integrating these legacy systems with various components present in the smart public transportation ecosystem. The smart public transportation ecosystem integrates multiple technology elements, such as software, hardware, and network elements, and involves multiple vendors. The integration of smart technology elements with legacy transportation systems is highly complex due to the lack of an open interface and protocol issues. These integration issues would then lead to communication gaps between traditional systems and technologically advanced systems. In addition, the upgradation of legacy systems requires high investments. These complexities are expected to restrict the PIS market growth in the coming years.

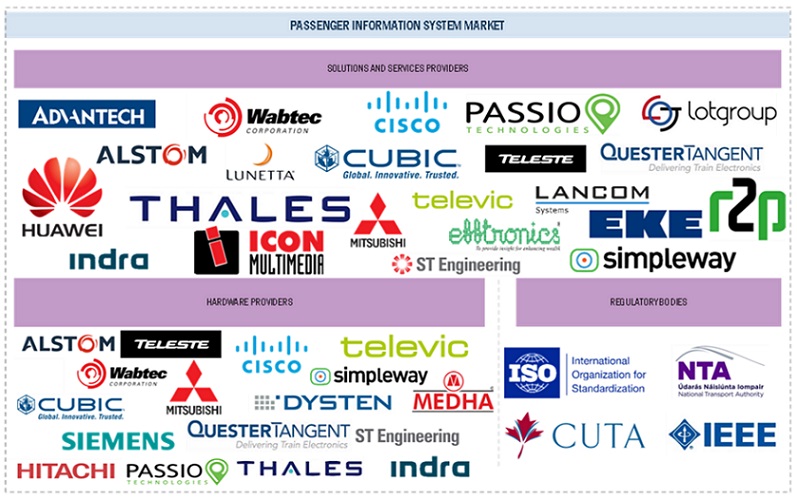

Ecosystem Of Passenger Information System Market

The prominent players in the passenger information system market include Advantech Co., Ltd. (Taiwan), Alstom SA (France), Wabtec Corporation (US), Cisco Systems (US), Cubic Corporation (US), and so on. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies with a well-established geographic footprint.

"By location, on-board segment to hold the largest market size during the forecast period.”

Passengers demand real-time travel updates, and on-board PIS systems delivery. Fueled by better connectivity, safety concerns, and wider applications, these systems are projected to dominate the market (2023-2028). From trains navigating delays to planes displaying gate information, location-specific benefits solidify their lead. Cost-effectiveness and integration with other technologies further enhance the deal, making on-board PIS systems the go-to solution for a seamless and informed passenger experience.

“Roadways segment is expected to have the fastest growth rate during the forecast period.”

Roadways are anticipated to have the fastest growth rate during the forecast period 2023-2028. The market growth is driven by connected and autonomous vehicles relying on PIS for navigation. It’s a key player for cities focused on efficient public transport which displays live bus arrival info and optimizes the routes. Cost-effective and flexible, PIS appeals to both private and public providers. Additionally, mobile app integration lets passengers access information on the go. Safety is paramount, with PIS displaying accident alerts and emergency procedures.

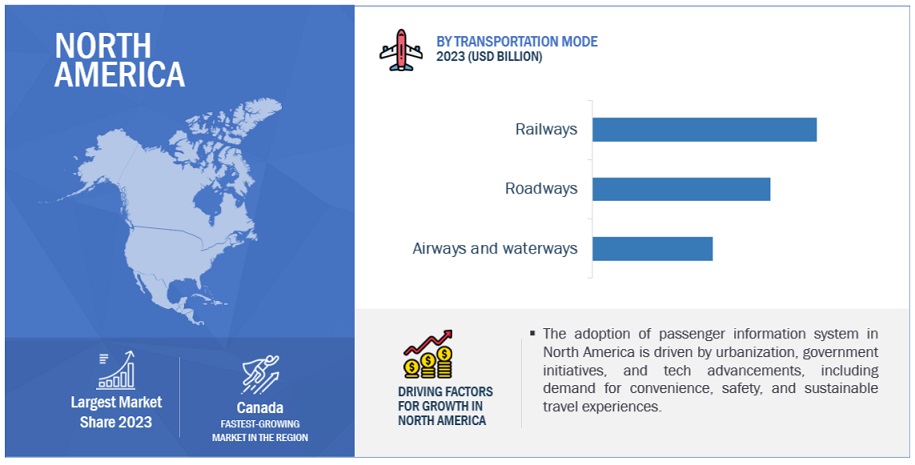

“North America to have the largest market size during the forecast period.”

North America is projected to have a stronghold in the on-board PIS market, with the largest market size during the forecast period. Tech-savvy citizens demand the latest PIS features, from real-time displays to AI chatbots. The region's vast transportation network demands robust solutions, and government support for smart cities and ITS fuels market growth. PIS systems enhance passenger’s experience with real-time information and reduced wait times, boosting market demand and providing a solid foundation for future growth.

Market Players:

The major players in the passenger information system Advantech Co., Ltd. (Taiwan), Alstom SA (France), Wabtec Corporation (US), Cisco Systems (US), Cubic Corporation (US), Siemens AG (Germany), Hitachi Ltd. (Japan), Huawei Technologies Co., Ltd. (China), Mitsubishi Electric Corporation (Japan), Televic (Belgium), ST Engineering Ltd (Singapore), Indra (Spain), Medha Servo Drives (India), Efftronics Systems Pvt. Ltd. (India), Dysten (Poland), Lunetta (India), r2p Group (Germany), Icon Multimedia (Spain), Passio Technologies (US), Teleste (Finland), Lancom D.O.O (Slovenia), Simpleway (Czech Republic), Eke-Electronics (Finland), Quester Tangent (Canada), and LOT Group (Ukraine). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their passenger information system market footprint.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments Covered |

By offering (solution, services), location (on-board, in-station), transportation mode (railways, roadways, airways and waterways) |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Advantech Co., Ltd. (Taiwan), Alstom SA (France), Wabtec Corporation (US), Cisco Systems (US), Cubic Corporation (US), Siemens AG (Germany), Hitachi Ltd. (Japan), Huawei Technologies Co., Ltd. (China), Mitsubishi Electric Corporation (Japan), Televic (Belgium), ST Engineering Ltd (Singapore), Indra (Spain), Medha Servo Drives (India), Efftronics Systems Pvt. Ltd. (India), Dysten (Poland), Lunetta (India), r2p Group (Germany), Icon Multimedia (Spain), Passio Technologies (US), Teleste (Finland), Lancom D.O.O (Slovenia), Simpleway (Czech Republic), Eke-Electronics (Finland), Quester Tangent (Canada), LOT Group (Ukraine) |

This research report categorizes the passenger information system market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

-

Solution

- Display systems

- Announcement systems

- Emergency communication systems

- Mobile applications

- Infotainment System

- Video Surveillance System

- Other solutions (Content Management System, In-station and On-board Wi-Fi System, and Passenger Counting & Occupancy Information System)

-

Services

- Consulting

- Deployment & Integration

- Support & Maintenance

Based on location:

- On-board

- In-station

Based on Transportation Mode:

-

Railways

- Trains

- Trams

- Roadways

- Airways and waterways

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordic countries

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In December 2023, Alstom launched its largest Digital Experience Centre for developing next generation Signaling solutions in India with a total investment of USD 43 million over the last decade.

- In January 2022, Siemens Mobility developed a new Passenger Info Plus system by collaborating with Wiener Linien to meet the special public transport requirements in Vienna.

Frequently Asked Questions (FAQ):

What is the definition of the passenger information system market?

Passenger information system (PIS) is responsible for automatically providing visual and audio information to passengers at stations and transfer facilities, or by programming manually. It includes information management on routes and their display via different display elements deployed at passenger platforms.

What is the market size of the passenger information system market?

The passenger information system market is estimated at USD 29.3 billion in 2023 to USD 52.6 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 12.4% from 2023 to 2028.

What are the major drivers in the passenger information system market?

The major drivers in the passenger information system market are the Rising Demand for Real-time Travel Information, Growing Adoption of Smart City Technologies, Focus on Improved Passenger Experience, Government Initiatives and Regulations, and Advancements in Technology.

Who are the key players operating in the passenger information system market?

The key market players profiled in the passenger information system market are Advantech Co., Ltd. (Taiwan), Alstom SA (France), Wabtec Corporation (US), Cisco Systems (US), Cubic Corporation (US), Siemens AG (Germany), Hitachi Ltd. (Japan), Huawei Technologies Co., Ltd. (China), Mitsubishi Electric Corporation (Japan), Televic (Belgium), ST Engineering Ltd (Singapore), Indra (Spain), Medha Servo Drives (India), Efftronics Systems Pvt. Ltd. (India), Dysten (Poland), Lunetta (India), r2p Group (Germany), Icon Multimedia (Spain), Passio Technologies (US), Teleste (Finland), Lancom D.O.O (Slovenia), Simpleway (Czech Republic), Eke-Electronics (Finland), Quester Tangent (Canada), LOT Group (Ukraine).

What are the key technology trends prevailing in the passenger information system market?

The key technology trends in passenger information system include IoT, 5G, Cloud computing, AI. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

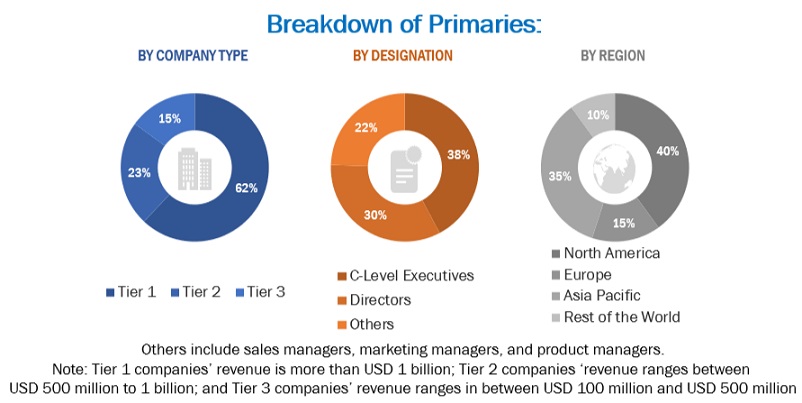

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the passenger information system market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering passenger information system solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the passenger information system market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as Passenger Terminal EXPO 2023, APTA TRANSform Conference & EXPO 2023, International Conference on Information Systems (ICIS) have been referred to for identifying and collecting information for this study on the passenger information system market. The secondary sources included annual reports, press releases investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from passenger information system solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using passenger information system solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of passenger information system solutions which would impact the overall passenger information system market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the passenger information system market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of passenger information system offerings.

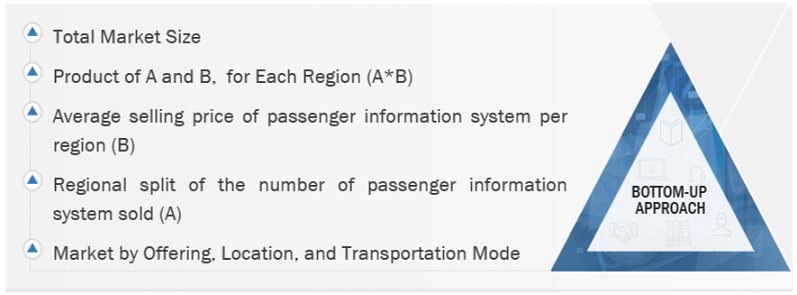

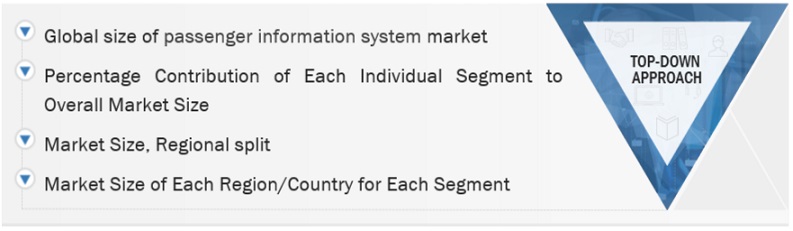

Both top-down and bottom-up approaches were used to estimate and validate the total size of the passenger information system market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Passenger information system Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Passenger information system Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the passenger information system market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

As per Indra, passenger information system (PIS) is responsible for automatically providing visual and audio information to passengers at stations and transfer facilities, or by programming manually. It includes information management on routes and their display via different display elements deployed at passenger platforms.

The passenger information system (PIS) is an automated system used to offer information about the nature and state of the public transport services to the users of public transport systems. It is an operating tool responsible for providing audio and visual information to passengers at stations and transfer facilities at any time, thereby enhancing the rider's comfort and optimizing the communication between drivers, passengers, operations centers, and maintenance crews. The information such systems provide can be static/scheduled or real-time information, which changes continuously because of real-world events. The PIS comprises many subsystems, such as train communication, backbone network, radio, video surveillance, public address, passenger emergency telephony, multichannel voice recorder, and real-time display.

Key Stakeholders

- Transportation Service Providers

- PIS Software providers

- Hardware Component Providers

- Networking and Communication Service Providers

- System Integrators

- Professional Service Providers

- Public Transportation Service Providers

- Transport Operations Management Solution Vendors

- Transportation Technology Solution Providers

- Infrastructure Device Suppliers

- Transportation Research Authorities

- Mobile Application Developers

- Consultancy Firms/Advisory Firms

- Investors and Venture Capitalists

- Independent Software Vendors

- Value-added resellers (VARs) and Distributers

- Governments and Urban Planning Agencies

- Rail Infrastructure Suppliers

- Railway Management Companies (private/public)

- Shipping Operators

- Airport Authorities

- Airport Technology Vendors

- Transport Operators

- Transport Infrastructure Planners

Report Objectives

- To determine, segment, and forecast the passenger information system market based on offering (solution and services), location, transportation mode, and region in terms of value

- To forecast the size of the market segments with respect to 5 main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & Africa market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Passenger Information System Market

What will be the expected growth for Passenger Information System Market during the forecast period in APAC Region