Top Companies in Farm Equipment Industry - Deere & Company (US), AGCO Corporation (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), and CLAAS KGAA (Germany)

The farm equipment market is projected to grow from USD 115.58 billion in 2025 to USD 152.79 billion by 2032 at a CAGR of 4.1%. Farm mechanization is expected to remain soft for the next 2–3 years due to a various factor such as low crop prices, high operating costs, tighter profit margins for farmers, and higher interest rates in the US with a stronger US dollar have impacted the farmers spending on farm equipment and their finance option for equipment purchases. According to the Association of Equipment Manufacturers (AEM) and the European Agricultural Machinery (CEMA), the farm equipment market is experiencing a decline due to several interrelated factors, such as a rise in logistics costs, geopolitical uncertainties, high interest rates, and EU CAP Policy and Farmers' Protests. In 2024, net farm income in the US is projected to fall by 25.5% Year-Over-Year to USD 116.1 billion, negatively impacting farmers' purchasing power for new equipment. Whereas going ahead in 2026– 2027, the farm equipment market is expected to increase as equipment prices adjust and interest rates may drop potentially, after which the farmers' spending will become affordable to invest in new equipment. Also, other equipment such as balers, sprayers, and tillers are expected to rise with modern machinery.

Significant farm OEM equipment markets are from Asia, Oceania, Europe, and the US. The top 5 OEMs of the farm equipment market are Deere & Company (US), AGCO Corporation (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), and CLAAS KGAA (Germany). Key players in the farm equipment market are investing in new production lines in the Asia Oceania region to cater to the increase in demand and export the tractors in Europe and North American markets due to lower manufacturing costs for compact and mid-range tractors.

To know about the assumptions considered for the study download the pdf brochure

Deere & Company strongly focuses on developing, manufacturing, and distributing various agricultural and construction equipment. The company is actively making strategic initiatives to strengthen its operations and increase its returns. For instance, in October 2024, the company invested USD 13.5 million to expand its Reman Core Center manufacturing plant in Strafford, Missouri. This investment will increase the plant from 120,000 square feet to 400,000 square feet, starting in mid-2025 and ending in 2026. Moreover, to expand its presence in the US, the company is actively acquiring suppliers in the US. in December 2024, Deere & Company acquired Hutchinson Farm Supply (US), a prominent US player for distributing agricultural and rural property. In the annual report 2024, the company observed a drop of 28% in revenue in 2024 compared to 2023 due to a sudden drop in demand for farm & construction equipment in the US. Also, the company temporarily closed production at its Ottumwa plant from early December 2024 to early January 2025, which reduced its revenue.

CNH Industrial stands in the top 5 companies in the farm equipment market, where the company designs, manufactures, and sales farm machinery and implements, including two-wheel and four-wheel drive tractors, crawler tractors (Quadtrac), combines, cotton pickers, grape & sugarcane harvesters, hay & forage equipment, planting & seeding equipment, soil preparation & cultivation implements, and material handling equipment. The company is actively acquiring other technology players to increase tier offerings in precision farming. For instance, in October 2023, CNH Industrial acquired Hemisphere GNSS (Germany), a leading global satellite navigation technology, to increase its strength in precision agriculture and automation. Also, the company is investing in R&D centers and production units to cater to the global increase in demand for farm equipment. For instance, in January 2024, CNH invested USD 163 million to expand its R&D and production capabilities at the New Holland Harvesting Center of Excellence in Zedelgem, Belgium, which was part of a five-year investment plan totaling USD 163 million and will be completed by 2029. According to the company’s annual report for 2023, the company had faced a decline in sales in the agricultural sector, particularly from South America and Europe.

AGCO Corporation is a prominent player in the farm equipment market, where the company manufactures and distributes agricultural equipment and related replacement parts worldwide. It offers a full range of farming equipment, including tractors, combines, self-propelled sprayers, hay tools, forage equipment, seeding and tillage equipment, implements, and grain storage and protein production systems. The company strategically invests in technology and farming solution providers to enhance its product portfolio and brand name. For instance, in May 2024, AGCO Corporation invested more than USD 10 million in “Innova Ag Innovation Fund VI” to support the next generation of farming by fostering innovations in automation, digitization, and sustainability within the agricultural sector. Also, to increase their presence in the US market, in November 2024, AGCO Corporation started 5 new farm equipment dealerships in Ohio: Circleville, Liberty Center, Salem, Upper Sandusky, and Urbana. These latest sales offices will offer the full lineup of AGCO products, including tractors from Fendt and Massey Ferguson.

The Kubota Corporation is a prominent player from Japan that offers farm equipment under various brands, including Kverneland Group, Great Plains Manufacturing, Vicon, and Land Pride. The company is investing in sustainable practices such as electric tractors, and it showcased its new electric autonomous tractor in January 2024 at the CES 2024 event, which was held in Las Vegas. The vehicle was fully electric and had six independent drive motors, which allowed it to perform various agricultural tasks, including tillage and transport. Moreover, the company has a strong sales network in North America, Thailand, and Japan, offering a wide range of products. Also, with better opportunities in the Asia-Oceania market, the company invested USD 0.5 billion to develop a new manufacturing facility in Uttar Pradesh, India. This strategic investment is part of the company's efforts to double its tractor production capacity to 3.4 lakh units annually and to establish new engine and construction equipment lines.

Market Share

Market share represents the proportion of a farm equipment market that a company controls. It's typically expressed as a percentage and offers a valuable measure of a company's performance relative to its competitors. The parameters considered for the market share analysis are revenue and regional presence (company level), Inorganic growth strategies, organic growth strategies, infrastructure/capacity, product offerings, and product launches. The market share was derived by considering a certain percentage of each company's segmental revenue.

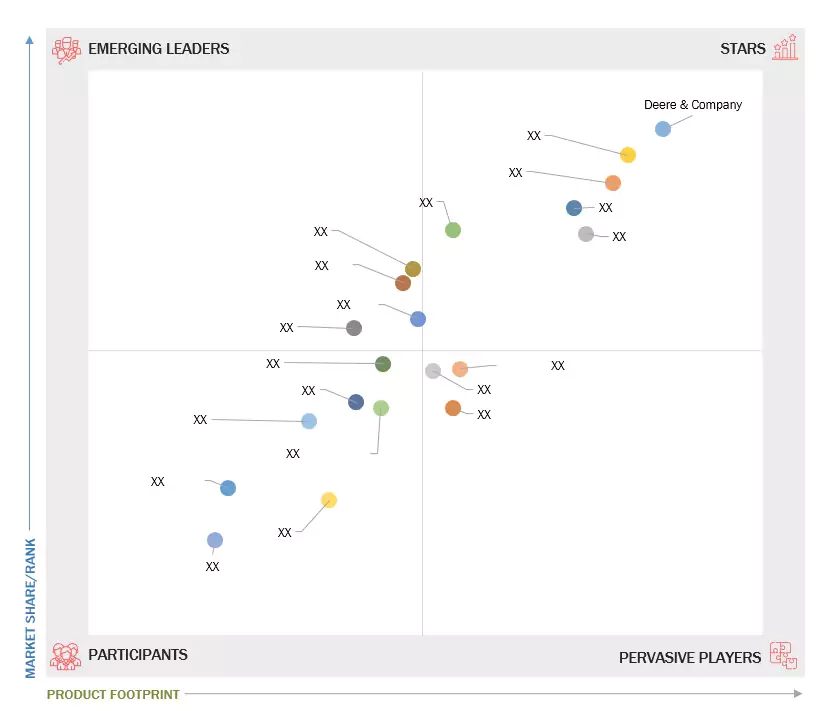

Company Evaluation Matrix: Key Players

Micro-quadrant provides information on major players that offer farm equipment and outlines the findings and analysis of how well each vendor performs within the predefined criteria. Vendor evaluations are based on two broad categories: product offerings and business strategy. Each category includes criteria based on which the vendors are evaluated. The evaluation criteria considered under product offerings include the breadth and depth of offerings, product features, functionality, focus on product innovation, and product branding. The evaluation criteria considered under business strategy include the overall revenue and growth rate (last four years), regional presence (based on the geographic presence and presence in emerging markets), the effectiveness of growth strategy-organic and inorganic (new product developments, expansions, mergers & acquisitions, joint ventures, and partnerships & collaborations), vision alignment, and channel strategy and fit.

Related Reports:

Farm Equipment Market by Power (<30, 31-70, 71-130, 131-250, >250HP), Type (Tractors, Balers, Sprayers, Harvesters), Function, Tractor Drive Type, Forestry Machinery, Electric Tractor, Type & Propulsion, Rental, & Region - Global Forecast to 2032

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets Inc.

1615 South Congress Ave.

Suite 103,

Delray Beach, FL 33445

USA : 1-888-600-6441

sales@marketsandmarkets.com

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE