Top Companies in Smart Meter Industry - Landis+Gyr (Switzerland) and Itron Inc. (US) together with Sagemcom (France) and OSAKI ELECTRIC CO., LTD. (EDMI) (Singapore)

The global Smart Meter market is expected to grow at a CAGR of 9.8% from 2024 until it reaches USD 46.14 Billion worth in 2030. Security providers now use smart meter solutions to track power operations and achieve better quality control through real-time data monitoring and control functions. The rising demand for smart meters systems will surge worldwide because these technology solutions deliver current consumption information needed to manage operations involved with power transmission distribution and generation. Smart meter development faces obstacles as a challenge for governments when building sustainable infrastructure. Increased investing in smart meter infrastructure arises from rising access breaches of water supply and sanitation systems as well as water-intensive development patterns combined with expanding populations and water contamination.

Multiple global size organizations operate worldwide and domestic companies maintain solid distribution networks within their national markets define the smart meter market landscape. Landis+Gyr (Switzerland) and Itron Inc. (US) together with Sagemcom (France) and OSAKI ELECTRIC CO., LTD. (EDMI) (Singapore) and Siemens (Germany form the top smart meter market competition. (EDMI) (Singapore), and Siemens (Germany).

To know about the assumptions considered for the study download the pdf brochure

Landis+Gyr delivers smart metering solutions to their clients they offer advanced metering infrastructure (AMI) systems with smart grid solutions for improved power grid reliability and efficiency. Smart meters from this company offer real-time measurement and transmission of consumption data and support both remote service operations and load management functionalities and advanced meter analytics capabilities. The solution from Landis+Gyr adds smart home services together with grid management programs to their offering.

Itron Inc. maintains its position as an international leader in critical infrastructure solutions because it operates 200 million devices which monitor utilities and cities across the globe while providing secure dependable systems. The company provides customers with software as well as smart meters and sensors alongside services which optimize the management of energy and water usage data. The company devotes its operations to Automatic Meter Reading (AMR) system design while simultaneously manufacturing both automatic reading and computer-based electronic reading solutions. Itron operates through three major business segments—Device Solutions and Network Solutions alongside the Outcomes segment—and the company provides smart meters in Device Solutions but its smart meter analytics and meter data management services exist within the Outcomes segment.

OSAKI ELECTRIC CO., LTD. (EDMI) is a provider of smart metering solutions, specializing in the development, manufacturing, and design of advanced energy meters and systems. The company also offers energy management systems, metering infrastructure, and related products. Acquired by Osaki Electric (Japan) in 2012, EDMI operates as a wholly owned subsidiary of OSAKI ELECTRIC CO., LTD.

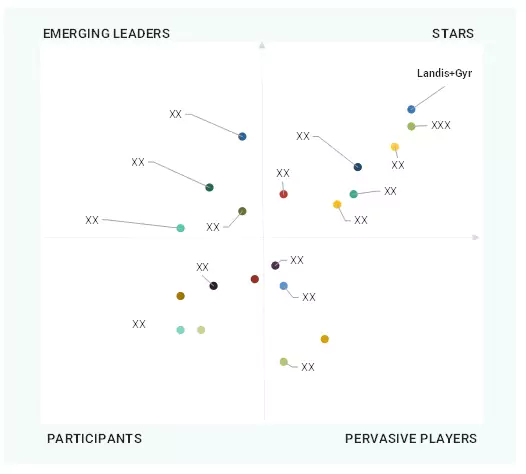

Company Evaluation Matrix Overview: Smart Meter Market

A complete market assessment of smart meter market exists through the company evaluation matrix which combines both qualitative and quantitative examinations of core determinants. The evaluation system divides vendors into separate groups according to their market standings and performance results throughout the market landscape.

Star category - The star classification in market assessment indicates firms with a commanding status within their given markets based on their large number of products and services, well-established market positions, and capacities to evolve along with the demands of the ever-changing market conditions. Such organizations have positioned themselves as industry powerhouses by their fiscal solidity, technical proficiency, and savvy business maneuvers. Their innovation and expansion into new markets help them remain ahead of the curve and enjoy a high degree of customer trust and brand awareness. Star category companies invest in research and development consistently to improve their product portfolio and launch sophisticated solutions that meet changing customer requirements. They also possess an established international presence, with a good network of distributors and strategic alliances that enable them to effectively penetrate different regional markets.

Emerging leaders - Emerging leaders are established firms that have made a significant presence in their respective domains by means of strategic business planning and innovation. Although they do not yet occupy the market dominance position of star category companies, they have proven to have enormous potential for expansion and growth. These organizations are defined by their capacity to harness particular technologies and sophisticated methodologies to advance their solutions and services, targeting niche market segments with customized offerings.

Pervasive players - Pervasive players are marked by their outstanding emphasis on product innovation and technological development, differentiating them from the competition in terms of specialism and innovation. As opposed to market leaders providing an extensive lineup of products and services, pervasive players direct their efforts into a limited range of offerings, further developing and improving them to attain higher quality and performance. Their power is in profound knowledge in their own area, enabling them to advance the frontiers of technology and design, making their offerings extremely competitive and frequently industry standards. They invest heavily in state-of-the-art developments and focus on research and development, constantly enhancing their solutions.

Participants - New businesses entering an incumbent market normally fit into the participant category with its early stage business development and dedicated focus towards segments of particular products. The business ventures normally approach the sector introducing new concepts, innovative strategies, and specialization based on a narrow niche so that they could etch a specific market image for themselves. Yet, their influence and extent are still small relative to the established players because they do not have extensive market coverage, solid brand awareness, and the scale of resources to compete on a larger level.

The evaluation framework draws its insights from market analyses together with technological assessments and stakeholder interviews to develop a comprehensive understanding of vendor position and market potential in the dynamic power quality equipment market.

Market Ranking

The global smart meter market is highly competitive, and various established companies command large market shares. Landis+Gyr is one of the leading companies owing to its comprehensive portfolio of power quality solutions, technological advancement, and extensive global presence. Other prominent market players compete on product innovation, geographic expansion, and strategic collaborations. Firms concentrate on enhancing efficiency, reliability, and regulatory standards compliance to build their market base. The market witnesses ongoing improvements in smart grid integration, and renewable energy support systems that fuel competition between vendors. Due to growing demand in residential, commercial, and industrial markets, the market positioning is determined by product offerings, geographic presence, R&D spend, and customer base.

Related Reports:

Smart Meter Market by Type (Electric, Gas, Water), Component (Hardware, Software), Technology (AMI, AMR), Communication Technology (RF, PLC, Cellular), End User (Residential, Commercial, Industrial), and Region - Global Forecast to 2030

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets Inc.

1615 South Congress Ave.

Suite 103,

Delray Beach, FL 33445

USA : 1-888-600-6441

sales@marketsandmarkets.com

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE