High Power LED Market by Packaging Type (Flip Chip, Mesa, and Vertical), Application (General Lighting, Automotive, Flash Lighting, Backlighting,) and Geography (APAC, North America, Europe, Rest of the World) - Global Forecast 2025-2036

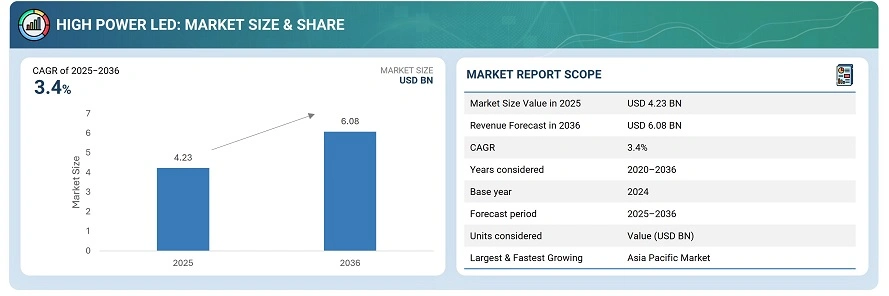

The global high power LED market was valued at USD 4.23 billion in 2025 and is estimated to reach USD 6.08 billion by 2036, at a CAGR of 3.4% between 2025 and 2036.

The global high power LED market is driven by the growing demand for energy-efficient lighting solutions across automotive, industrial, and outdoor applications. Increasing government initiatives promoting energy conservation and the phasing out of traditional lighting technologies are further accelerating market adoption. Advancements in chip design, thermal management, and phosphor materials are enhancing luminous efficacy, durability, and color quality of high-power LEDs. Additionally, the integration of smart lighting systems with IoT connectivity and sensors is enabling adaptive and remote-controlled illumination solutions.

High-power LEDs are semiconductor-based light sources designed to emit high-intensity illumination with superior energy efficiency and longer operational life compared to traditional lighting technologies. They operate by converting electrical energy into light through electroluminescence and are commonly used in applications requiring strong and focused lighting, such as automotive headlights, industrial equipment, streetlights, and stage lighting. High-power LEDs feature advantages such as compact size, high luminous efficacy, low heat generation with advanced thermal management, and excellent color rendering.

Market by Application

Automotive

The automotive segment is expected to witness the highest CAGR in the high-power LED market due to the growing adoption of LED lighting in vehicles for headlights, daytime running lights, and interior illumination. High-power LEDs offer superior brightness, energy efficiency, and longer lifespan compared to traditional halogen or HID lights. Additionally, increasing demand for electric and autonomous vehicles, along with advancements in adaptive lighting and design flexibility, is driving automakers to integrate high-power LEDs for enhanced safety, aesthetics, and energy efficiency.

General Lighting

General lighting holds the largest market size in the high-power LED market due to the widespread adoption of energy-efficient lighting solutions across residential, commercial, and industrial sectors. High-power LEDs are increasingly replacing traditional incandescent and fluorescent lights owing to their superior energy savings, long lifespan, and low maintenance costs. Additionally, government initiatives promoting sustainable lighting and rapid urbanization are driving large-scale installations of LED-based lighting systems in streets, offices, and public infrastructure, further supporting market growth in this segment.

Backlighting

Backlighting applications in the high-power LED market are gaining traction as they provide efficient and uniform illumination for displays, signage, and digital screens across consumer electronics, automotive dashboards, and advertising sectors. High-power LEDs deliver superior brightness, color accuracy, and energy efficiency, enhancing visual appeal and readability in various lighting conditions. Their compact size and long lifespan make them ideal for slim display designs and dynamic lighting effects. Overall, backlighting with high-power LEDs ensures high performance, durability, and improved visual experience.

Flash Lighting

Flash lighting applications in the high-power LED market are growing rapidly due to their ability to deliver intense, short-duration illumination for cameras, smartphones, and professional photography equipment. High-power LEDs provide excellent luminous efficiency, fast response time, and consistent color temperature, enabling high-quality image capture in low-light conditions. Their compact design, low power consumption, and long operational life make them ideal for integration into portable and compact devices. Overall, flash lighting with high-power LEDs enhances imaging performance, reliability, and energy efficiency.

Market by Packaging Type

Flip Chip

Flip Chip packaging is expected to witness significantly high growth in the high-power LED market due to its superior thermal management, high current handling capability, and enhanced light output. This packaging design eliminates wire bonds, reducing resistance and improving heat dissipation, which significantly boosts performance and reliability. Additionally, Flip Chip LEDs offer compact size, better lumen efficiency, and improved durability, making them ideal for demanding applications such as automotive lighting, industrial illumination, and outdoor displays that require high brightness and long lifespan.

Vertical

The vertical packaging type is expected to witness high growth during the forecast period due to its superior thermal management and higher light extraction efficiency. Vertical LEDs allow current to flow perpendicular to the substrate, reducing heat accumulation and enhancing performance in high-power applications. They are increasingly adopted in automotive lighting, general illumination, and backlighting, where compact size, high brightness, and reliability are critical. Growing demand for energy-efficient, high-intensity lighting solutions further drives their adoption.

Mesa

Mesa packaging accounts for a significant share due to its balanced performance in thermal management, reliability, and cost-effectiveness. It offers good heat dissipation, ensuring stable operation under high currents, making it suitable for applications like automotive lighting, streetlights, and general illumination. While not as compact or high-performing as Flip Chip LEDs, Mesa LEDs remain widely adopted because they are easier to manufacture, provide strong luminous efficiency, and support diverse application requirements, driving steady demand during the forecast period.

Market by Geography

Geographically, the high-power LED market is witnessing substantial adoption across North America, Europe, Asia Pacific, and the Middle East & Africa. Asia Pacific holds the largest market size, driven by rapid urbanization, growing automotive production, and extensive deployment in consumer electronics and industrial lighting. North America, however, is expected to witness significant growth during the forecast period due to increasing adoption of energy-efficient lighting solutions, smart city projects, and government incentives promoting sustainable and eco-friendly technologies. Europe shows steady growth, supported by strict energy regulations and smart infrastructure initiatives, while the Middle East & Africa are emerging markets, fueled by rising industrialization and infrastructure development.

Market Dynamics

Driver: Need for long life and continuous usage to drive demand for high power LEDs

High-power LEDs are increasingly favored for applications requiring long life and continuous usage due to their superior durability and energy efficiency. They offer consistent high-intensity illumination over extended periods without significant performance degradation, making them ideal for industrial lighting, streetlights, automotive headlights, and commercial displays. Their ability to operate continuously under high thermal and electrical stress reduces maintenance and replacement costs, while ensuring reliable performance. This longevity and sustained operation drive widespread adoption across commercial, industrial, and infrastructure lighting applications.

Restraint: High initial cost

The high-power LED market faces a significant restraint due to the high initial cost of these lighting solutions. Compared to conventional lighting technologies, high-power LEDs require greater upfront investment for components, advanced thermal management systems, and installation. This initial expenditure can deter adoption, particularly among small and medium-sized enterprises and cost-sensitive end users.

Opportunity: Increasing demand for smart lighting systems

The rising demand for smart lighting systems is creating significant growth opportunities in the high-power LED market. Connected LEDs integrated with IoT, sensors, and automated controls enable energy-efficient, customizable, and adaptive lighting solutions for homes, offices, streets, and commercial spaces. These systems allow real-time monitoring, remote management, and predictive maintenance, enhancing convenience and reducing operational costs. Government initiatives promoting energy efficiency, sustainable infrastructure, and smart city projects further accelerate adoption, driving strong demand for high-power LEDs in intelligent and connected lighting applications.

Challenge: Overcoming the thermal problems

As high-power LEDs deliver greater brightness and energy efficiency, they face significant challenges related to thermal management. Excess heat generation can reduce LED lifespan, lower luminous efficacy, and cause performance degradation over time. Overcoming these thermal issues requires advanced heat sinks, efficient cooling systems, and careful design of circuit and packaging, which increase manufacturing complexity and costs. Ensuring consistent performance under continuous and high-power operation remains a critical challenge for manufacturers, particularly in industrial, automotive, and outdoor lighting applications.

Future Outlook

Between 2025 and 2036, the high-power LED market is expected to witness substantial growth as energy-efficient and long-lasting lighting solutions become essential across industrial, commercial, automotive, and smart city applications. Advances in smart lighting systems, IoT integration, and adaptive controls will transform LEDs from simple illumination sources into intelligent, connected solutions capable of optimizing energy use and enhancing user experience. Increasing government initiatives for energy conservation, sustainable infrastructure, and urban modernization will further drive adoption, positioning high-power LEDs as a key technology in shaping efficient, eco-friendly, and technologically advanced lighting ecosystems.

Key Market Players

Top high power LED companies include NICHIA CORPORATION (Japan), ams–OSRAM AG (Austria), Samsung (South Korea), Lumileds Holding B.V. (Netherlands), Seoul Semiconductors Co., Ltd. (South Korea)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 High Power LED Market, 2019–2024 (USD Billion)

4.2 Market in APAC, By Application and Country

4.3 Market: Developed vs Developing Markets, 2019 and 2024 (USD Billion)

4.4 Geographic Analysis of Market, 2019–2024

4.5 Market, By Application (USD Billion)

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Long Life and Continuous Usage

5.2.1.2 Small Size, Less Power Consumption, and Low Voltage

5.2.1.3 Increasing High Brightness LED Applications

5.2.2 Restraints

5.2.2.1 High Initial Cost

5.2.3 Opportunities

5.2.3.1 Increased Demand for Smart Lighting Systems

5.2.3.2 Increased Awareness Regarding Implementation of Energy-Efficient Systems

5.2.4 Challenge

5.2.4.1 Overcoming the Thermal Problems

5.3 Value Chain Analysis

6 High Power LED Market, By Packaging Type (Page No. - 36)

6.1 Introduction

6.2 Mesa

6.2.1 Mesa Packaging Being Common LED Packaging Type is Key Factor Contributing to Its High Adoption

6.3 Flip Chip

6.3.1 Wireless Bonding Technology, Enhanced Durability, Heat Dissipation, and Superior Light Performance Fuel Growth of Market for Flip Chip LED Packaging

6.4 Vertical

6.4.1 Use of Vertical Packaging in High and Super High Power Applications is Major Driver for Growth of Market for Vertical Packaged High Power LEDs

7 High Power LED Market, By Application (Page No. - 39)

7.1 Introduction

7.2 Automotive

7.2.1 Use of High Power LEDs in Automotive Exterior Lighting is Major Driver for Growth of Market for Automotive

7.3 General Lighting

7.3.1 Increased Use of High Power LEDs in Street and Roadway Lighting to Drive Growth of Market for General Lighting

7.4 Backlighting

7.4.1 Increased Use High Power LEDs in Display Backlighting to Drive Market Growth for Backlighting

7.5 Flash Lighting

7.5.1 Increased Demand for High Power LEDs in Smartphones to Drive Growth of Market for Flash Lighting

7.6 Others

7.6.1 Use of High Power LEDs in Traffic Signals and Signs to Boost Growth of Market for Other Applications

8 Market, By Geography (Page No. - 53)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increased Focus on Energy-Efficient Systems in US to Drive Market

8.2.2 Canada & Mexico

8.2.2.1 Increasing Investment in Smart Lighting to Fuel Growth of Market in Canada and Mexico

8.3 Europe

8.3.1 UK

8.3.1.1 Continuous Focus of the Government on Improved Lighting Systems to Drive Growth of Market in UK

8.3.2 Germany

8.3.2.1 Continued Innovation and High Adoption of High Power LEDs in Automotive Expected to Drive Market in Germany

8.3.3 France

8.3.3.1 Increasing Demand for High Power LEDs in General Lighting and Automotive to Drive Growth of Market in France

8.3.4 Rest of Europe

8.3.4.1 Spain, Italy, Poland, Finland, Sweden, Belgium, the Netherlands, Switzerland, and Austria are Major Contributors to Market in Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 Presence of Several Manufacturers of High Power LEDs to Drive Growth of Market in China

8.4.2 Japan

8.4.2.1 Presence of Major Automotive Players in Japan to Fuel Growth of Market

8.4.3 South Korea

8.4.3.1 Presence of Major Smartphone, Automotive, and Display Manufacturers in South Korea Would Encourage Adoption of High Power LEDs

8.4.4 Rest of APAC

8.4.4.1 Countries Such as India, Singapore, Taiwan, and Australia to Drive Growth of Market in Rest of APAC

8.5 Rest of the World

8.5.1 Middle East and Africa

8.5.1.1 Smart Lighting to Fuel Growth of Market in Middle East and Africa

8.5.2 South America

8.5.2.1 Rising Need for Reducing Energy Costs to Boost Growth of Market in South America

9 Competitive Landscape (Page No. - 68)

9.1 Introduction

9.2 Ranking of Market Players

9.3 Competitive Scenario

9.3.1 Product Launches and Developments

9.3.2 Partnership, Agreement, Expansion, & Acquisition

9.4 Competitive Leadership Mapping

9.4.1 Visionary Leaders

9.4.2 Dynamic Differentiators

9.4.3 Innovators

9.4.4 Emerging Companies

10 Company Profiles (Page No. - 73)

10.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.2 Key Players

10.2.1 Cree

10.2.2 Nichia

10.2.3 OSRAM Opto Semiconductors

10.2.4 Samsung Electronics

10.2.5 Lumileds

10.2.6 Everlight Electronics

10.2.7 Epistar

10.2.8 Seoul Semiconductor

10.2.9 LG Innotek

10.2.10 Broadcom

10.2.11 MLS Co. Ltd.

10.3 Other Key Players

10.3.1 Luckylight Electronics

10.3.2 Plessey Semiconductors

10.3.3 Betlux Electronics

10.3.4 Effilux

10.4 Key Innovators

10.4.1 Lite-On Technology

10.4.2 Crescent LED

10.4.3 Vollong Electronics

10.4.4 Stanley Electric

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 104)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (39 Tables)

Table 1 High Power LED Market, By Packaging Type, 2016–2024 (USD Billion)

Table 2 Market, By Application, 2016–2024 (USD Billion)

Table 3 Market for Automotive, By Region, 2016–2024 (USD Million)

Table 4 Market for Automotive in APAC, By Country, 2016–2024 (USD Million)

Table 5 Market for Automotive in North America, By Country, 2016–2024 (USD Million)

Table 6 Market for Automotive in Europe, By Country, 2016–2024 (USD Million)

Table 7 Market for Automotive in RoW, By Region, 2016–2024 (USD Million)

Table 8 Market for General Lighting, By Region, 2016–2024 (USD Million)

Table 9 Market for General Lighting in APAC, By Country, 2016–2024 (USD Million)

Table 10 Market for General Lighting in North America, By Country, 2016–2024 (USD Million)

Table 11 Market for General Lighting in Europe, By Country, 2016–2024 (USD Million)

Table 12 Market for General Lighting in RoW, By Region, 2016–2024 (USD Million)

Table 13 Market for Backlighting, By Region,2016–2024 (USD Million)

Table 14 Market for Backlighting in APAC, By Country, 2016–2024 (USD Million)

Table 15 Market for Backlighting in North America, By Country, 2016–2024 (USD Million)

Table 16 Market for Backlighting in Europe, By Country, 2016–2024 (USD Million)

Table 17 Market for Backlighting in RoW, By Region, 2016–2024 (USD Million)

Table 18 Market for Flash Lighting, By Region,2016–2024 (USD Million)

Table 19 Market for Flash Lighting in APAC, By Country, 2016–2024 (USD Million)

Table 20 Market for Flash Lighting in North America, By Country, 2016–2024 (USD Million)

Table 21 Market for Flash Lighting in Europe, By Country, 2016–2024 (USD Million)

Table 22 Market for Flash Lighting in RoW, By Region, 2016–2024 (USD Million)

Table 23 Market for Others, By Region, 2016–2024 (USD Million)

Table 24 Market for Others in APAC, By Country,2016–2024 (USD Million)

Table 25 Market for Others in North America, By Country, 2016–2024 (USD Million)

Table 26 Market for Others in Europe, By Country, 2016–2024 (USD Million)

Table 27 Market for Others in RoW, By Region, 2016–2024 (USD Million)

Table 28 Market, By Region, 2016–2024 (USD Million)

Table 29 Market in North America, By Application, 2016–2024 (USD Million)

Table 30 Market in North America, By Country, 2016–2024 (USD Million)

Table 31 Market in Europe, By Application, 2016–2024 (USD Million)

Table 32 Market in Europe, By Country, 2016–2024 (USD Million)

Table 33 Market in APAC, By Application, 2016–2024 (USD Million)

Table 34 Market in APAC, By Country, 2016–2024 (USD Million)

Table 35 Market in RoW, By Application, 2016–2024 (USD Million)

Table 36 Market in RoW, By Region, 2016–2024 (USD Million)

Table 37 Ranking of Top 5 Players in Market

Table 38 Product Launches and Developments: Market, 2017–2019

Table 39 Partnership, Agreement, Expansion & Acquisition: Market, 2015–2018

List of Figures (33 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Bottom-Up Approach to Arrive at Market Size

Figure 4 Top-Down Approach to Arrive at Market Size

Figure 5 Data Triangulation Methodology

Figure 6 Market, 2016–2024 (USD Billion)

Figure 7 Market, By Packaging Type, 2019 vs 2024

Figure 8 General Lighting Held Largest Size of Market in 2018

Figure 9 APAC Held Largest Share of Market in 2018

Figure 10 APAC Expected to Be Largest Shareholder in Market for General Lighting By 2019

Figure 11 Attractive Market Opportunities for Market

Figure 12 China and General Lighting to Be Largest Shareholders in Market in APAC By 2024

Figure 13 US to Register Highest CAGR in Market During 2019–2024

Figure 14 US and Canada to Witness High CAGR in Market From 2019 to 2024

Figure 15 General Lighting Application Expected to Dominate Market During Forecast Period

Figure 16 Increasing High Brightness Applications Drive Growth of Market

Figure 17 Value Chain Analysis (2018): Major Value Added During Research and Product Development, and Manufacturing Stages

Figure 18 Flip Chip Packaging to Lead Market During Forecast Period

Figure 19 General Lighting to Hold Largest Size of Market During Forecast Period

Figure 20 Geographic Snapshot: Market in North America to Witness Highest Growth During Forecast Period

Figure 21 China to Hold Largest Size of Market By 2024

Figure 22 North America: HMarket Snapshot

Figure 23 Europe: Snapshot of Market

Figure 24 APAC: Snapshot of Market

Figure 25 Companies Adopted Product Launches and Developments as Key Growth Strategies During 2015–2018

Figure 26 Cree: Company Snapshot

Figure 27 Nichia: Company Snapshot

Figure 28 OSRAM Licht: Company Snapshot

Figure 29 Samsung Electronics: Company Snapshot

Figure 30 Epistar: Company Snapshot

Figure 31 Seoul Semiconductor: Company Snapshot

Figure 32 LG Innotek: Company Snapshot 2017

Figure 33 Broadcom: Company Snapshot 2017

The study involved four major activities in estimating the current size of the high power LED market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the high power LED market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

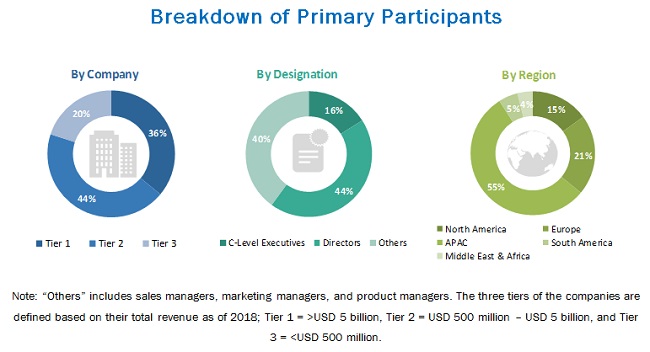

The high power LED market comprises several stakeholders, such as suppliers, system integrators, suppliers of standard components, and original equipment manufacturers (OEMs) in the supply chain. The demand side of this market is characterized by the development of general lighting, automotive, flash lighting, backlighting, and other applications such as traffic signals and signs. The supply side is characterized by advancements in packages of high power LED and its applications. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the high power LED market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply sides in the general lighting, automotive, flash lighting, backlighting, and other applications such as traffic signals and signs.

Report Objectives

- To define, describe, and forecast the high power LED market, in terms of value, based on packaging type, application, and geography

- To forecast the size of the market for various segments with regard to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro-markets with regard to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments in the high power LED market

- To analyze growth strategies such as acquisition, partnership, product launches & developments, expansion, and agreement of the key players in the high power LED market

- To strategically profile key players, comprehensively analyze their core competencies, and describe the competitive landscape of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in High Power LED Market

We are the manufacturer of LED lights, we are looking for the information on packaging type like Mesa and lip Chip. Do you have any specific study on this?

Would like to understand the market potential for high power LED in automotive application? Do you have such information qualitative or quantitative?

I am looking to do business as a High power LED distributor. This is a completely new venture for me and I will love to receive more insight on what I need to do to becoming a distributor/marketer of this product. I look forward to receiving your response. Thanks.

My specific interest in high power LED Lighting Market by Installation Type (New Installation and Retrofit Installation) in North America and Asia Pacific. Do you provide quantitative analysis for these 2 regions only?

What would the pricing for all quantitative tables related to Asia Pacific regions and top company profiles in this region?