3D Printing Business Insights: Market Demand and Opportunities

The 3D printing business has undergone a remarkable transformation, revolutionizing manufacturing processes across various industries. From rapid prototyping to customized products, this technology has an impact on how companies design, produce, and deliver goods. The rise of industrial 3D printers, advanced materials, and innovative software solutions has opened up new possibilities for businesses to optimize their supply chains and embrace sustainable manufacturing practices.

As the global 3D printing market continues to expand, companies are exploring diverse applications in sectors such as aerospace, healthcare, and automotive. Metal 3D printing and polymer 3D printing technologies, including selective laser sintering (SLS), are pushing the boundaries of what's possible in industrial applications. This article delves into the current state of the 3D printing business, examining market trends, emerging opportunities, and the evolving ecosystem of services and software that are shaping the future of additive manufacturing.

Evolution of 3D Printing Technologies

The 3D printing industry has undergone significant transformations since its inception in the late 1980s. Initially used primarily for rapid prototyping, this technology has steadily moved towards production applications, including low-volume production, mass customization, and serial production.

From prototyping to production

While rapid prototyping remains a common application, there's a clear trend towards full-scale production using 3D printing technologies. In 2023, 21% of survey respondents used 3D printing for end-use parts, up from 20% in 2022, with an additional 4% using it for esthetic parts. This shift has an impact on traditional manufacturing methods, particularly for low-volume production where 3D printing often proves more cost-effective than injection molding.

The scalability of 3D printing for production has improved significantly. In 2023, 47% of respondents opted for different manufacturing technologies due to concerns about "production volume and scale." However, this number dropped to 45% in 2024, indicating increased confidence in scaling with 3D printing. This growth extends beyond the printing process itself, encompassing software, design, materials, and post-processing tasks.

As the 3D printing ecosystem matures, a support system of companies providing various services has sprung up, simplifying production processes. For instance, post-processing, which was once a bottleneck, has seen improvements with the prevalence of vapor smoothing and enhanced surface finishes. Automation in manufacturing processes, such as computer-vision-supported systems for sorting finished parts, has also contributed to cost efficiency and labor savings.

Advancements in metal 3D printing

Metal 3D printing has made significant strides, particularly in industries like aerospace and medical. These sectors are willing to invest in high-performance, high-quality, complex custom designs and components, areas where 3D printing in production has shown great potential. The ongoing space-race boom has provided a tailwind for 3D printing in these industries.

Emergence of multi-material printing

Multi-material 3D printing has emerged as a game-changing technology, allowing for the creation of objects with varied properties in a single printing process. This technique combines materials with different characteristics, such as conductivity, hardness, softness, transparency, or chemical resistance, to achieve specific applications.

The benefits of multi-material printing extend beyond just combining material properties. It also enables the printing of support structures using easily removable materials like PVA and HIPS. This advancement has greatly reduced post-processing requirements, as end parts made of several materials can be produced in one go, eliminating the need for assembly of separately printed parts.

Various 3D printing technologies have adapted to multi-material printing, including Stereolithography (SLA), material jetting, and Fused Deposition Modeling (FDM). FDM, in particular, has become one of the most productive and advanced solutions for multi-material 3D printing, especially for those new to additive manufacturing. It offers a cost-effective and simple approach to processing various thermoplastic polymers and composite materials.

Multi-material 3D printing has found applications across various sectors. In medicine, it's increasingly used for creating prostheses, combining materials like TPU (soft) and carbon fiber composites (hard). In robotics and soft robotics, it's used for creating grippers that require both flexible and durable parts. The technology has also shown promise in the production of microfluidic chips.

As 3D printing technologies continue to evolve, they're reshaping manufacturing processes across industries, offering new possibilities for design, production, and customization. The ongoing advancements in materials, processes, and applications are driving the 3D printing business towards a future of increased efficiency, sustainability, and innovation.

Industry-Specific 3D Printing Applications

3D printing technology has found widespread applications across various industries, revolutionizing manufacturing processes and opening up new possibilities for design and production. This section explores how 3D printing has an impact on three key sectors: automotive, aerospace, and medical.

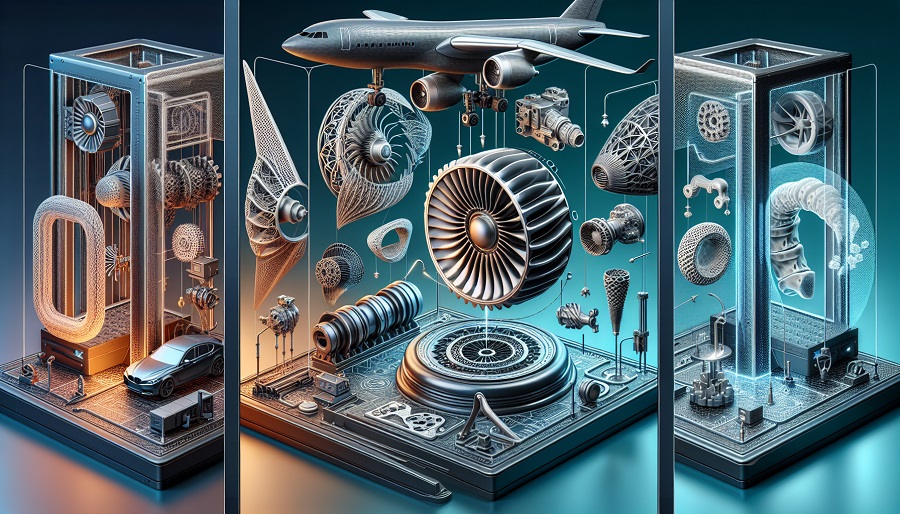

Automotive parts and tooling

The automotive industry has undergone a significant transformation due to 3D printing technology. Major automotive manufacturers have adopted 3D printers to reduce lead times, improve efficiency, and create complex designs that would have been impossible with traditional manufacturing methods.

One of the primary benefits of 3D printing in the automotive sector is the speed it brings to prototyping processes. Designers and engineers can quickly iterate and refine their designs, enabling the development of new products in less time than traditional methods. This rapid prototyping capability has an impact on how vehicles are designed and built, reshaping supply chains and production lines.

3D printing also offers cost-effectiveness in creating prototypes. Traditional prototyping methods, such as injection molding, can be expensive and time-consuming. 3D printing eliminates the need for expensive molds and tooling, thus reducing costs. This cost reduction extends to the production of bespoke tools and jigs used in the assembly process, which can be produced quickly and at a lower cost compared to traditional tooling methods.

The technology has an impact on the creation of complex geometries that would be difficult or impossible to produce with traditional methods. This enables designers to create highly detailed, intricate parts with ease, which can be tested and refined before committing to mass production. For example, companies like BMW and Ford have been using 3D printing to prototype complex parts such as intake manifolds, engine blocks, and large panel sections of vehicles.

3D printing has also found applications in the production of lightweight structural components for high-performance vehicles. Companies such as Audi and Porsche have explored this technology to create components optimized for strength while reducing weight, enhancing fuel efficiency and vehicle dynamics.

Aerospace components and spare parts

The aerospace industry was an early adopter of 3D printing technology, beginning its use in 1989. By 2015, aerospace accounted for 16% of additive manufacturing's global revenue. Today, 3D printing has an impact on various aspects of aerospace manufacturing, from prototyping to production of critical components.

One significant application is in the production of spare parts. Airbus Services, for instance, has supplied what it believes to be the first additively manufactured certified metal printed flying spare part to a U.S. airline operating a fleet of Airbus A320 aircraft. This advancement represents a growing trend where major OEMs like Airbus are able to 3D print older aircraft parts using new materials at lower costs and faster lead times.

3D printing has also made significant strides in the production of flight-critical engine parts. Honeywell Aerospace, for example, has created what it describes as the "first certified, flight-critical engine part using additive manufacturing." Similarly, Boeing's 777X features GE Aviation's GE9X engines, each with 300 3D printed parts.

The technology has proven particularly valuable in the production of complex, lightweight components for satellites. Airbus has used 3D printing to manufacture critical brackets for satellites using titanium, resulting in reduced material waste, consolidated parts, optimized geometries, and lighter-weight components. This has led to cost savings in production and fuel efficiency over the lifecycle of the satellites.

Medical implants and prosthetics

In the medical field, 3D printing has revolutionized the production of implants and prosthetics. The technology has allowed implant manufacturers to create complex geometries that mimic the shape and function of natural organs, and to produce these items on an accelerated timeline.

3D printing has reshaped what implants can do and how patients can be treated. For instance, 3D printed titanium cranial plates offer several advantages over conventional CNC machining methods. They can be manufactured within 1-2 days, significantly shortening lead times. The porous structure of these implants is similar to human bones, effectively addressing common issues such as stress shielding and low biological activity associated with traditional implants.

Another innovative application is in the creation of customized bone screws. Conventional bone screws have a solid construction, which can trigger rejection and prolong recovery. 3D-printed cannulated screws, on the other hand, can be customized to match the varied shapes, sizes, and densities of human bones, leading to quicker recovery and better health outcomes.

The ability to produce components with complex and precise structures has made 3D printing particularly valuable in orthopedic applications. By combining medical imaging technologies such as X-ray scanning, CT, MRI, or ultrasonic scanning, 3D printing can create patient-specific implants with almost the same anatomical structures as the injured tissues. This level of customization has led to numerous clinical trials with 3D printed implants, attracting surgeons and engineers who are making considerable efforts to improve clinical outcomes.

3D Printing Software Ecosystem

The 3D printing software ecosystem has evolved significantly, offering a wide range of tools to support the entire additive manufacturing process. This ecosystem encompasses various software categories, each playing a crucial role in bringing 3D printed objects to life.

CAD and Design Software

Computer-Aided Design (CAD) software forms the foundation of the 3D printing process. These tools allow users to create digital 3D models that can be translated into physical objects. The market offers a diverse range of CAD software options, catering to different skill levels and specific needs.

For beginners, browser-based applications like Tinkercad provide an intuitive block-building concept, making it easy to develop models from basic shapes. As users advance, they can explore more complex tools like Blender, an open-source software that covers various aspects of 3D creation, including modeling, animation, and simulation.

Professional-grade software like Fusion 360 and SolidWorks offer advanced features for industrial applications. These tools utilize parametric modeling, allowing for easy modifications and iterations of designs. They also provide cloud-based collaboration features, enabling design teams to work together on complex projects.

Simulation and Optimization Tools

As 3D printing technology advances, simulation and optimization tools have become increasingly important. These software solutions help predict and address potential issues before the actual printing process begins, saving time and resources.

Ansys, a leader in engineering simulation software, has partnered with Materialize Magics to integrate advanced simulation technology into the 3D printing workflow. This integration allows for the prediction and addressing of part deformation and thermal stress early in the design process, ensuring consistent quality and reducing costly rework.

These simulation tools can optimize part orientations and support structures, minimizing post-processing and material wastage. They also provide unprecedented accuracy and reliability, enabling confident design validation and faster product innovation. Some solutions offer up to 15% faster mechanical simulations and up to 95% faster thermal simulations, significantly improving efficiency in the design and production process.

Workflow Management Platforms

As 3D printing becomes more prevalent in industrial settings, the need for effective workflow management has grown. Several platforms have emerged to address this need, offering comprehensive solutions for managing the entire 3D printing process.

3YOURMIND, for example, provides a software platform that serves as the foundation for responsive and automated manufacturing. It includes modules for evaluating and storing files, defining production requirements, and coordinating all aspects of additive manufacturing. The platform also offers Enterprise Resource Planning (ERP) capabilities to automate distributed production networks and improve business process management.

AMFG is another versatile service that provides a tailor-made production management platform. It allows users to manage orders, prioritize them, evaluate each model for printability, and automate print launches. The platform integrates with existing ERP, PLM, and CAD software, combining all necessary tools into one additive manufacturing solution.

These workflow management platforms aim to streamline the entire 3D printing process, from initial design to final production. They offer features such as real-time monitoring, predictive analytics, and AI-powered optimization to enhance productivity and reduce lead times. By providing a centralized system for managing all aspects of the 3D printing workflow, these platforms are playing a crucial role in scaling additive manufacturing for industrial applications.

Global 3D Printing Market Dynamics

The global 3D printing market has experienced significant growth and transformation in recent years, driven by technological advancements, increasing adoption across various industries, and supportive government initiatives. The market share was estimated at USD 17.5 billion in 2024 and is anticipated to reach around USD 37.4 billion by 2029, recording a CAGR of roughly 16.4% between 2024 and 2029.

Competitive landscape analysis

The 3D printing market has witnessed a constant influx of new players, driven by the Industry 4.0 movement, which combines advanced manufacturing techniques with intelligent digital technology. This has resulted in significant demand prospects for both global and regional market players, making 3D printing a crucial element in emerging industry trends.

Prominent key players in the market include Stratasys Ltd., Materialize, EnvisionTec Inc., 3D Systems Inc., GE Additive, Autodesk Inc., Made In Space, Canon Inc., and Voxeljet AG, among others. These companies are at the forefront of innovation, developing new technologies and applications for 3D printing across various industries.

Regulatory environment by region

The regulatory environment for 3D printing varies by region, with governments and regulatory bodies working to adapt existing frameworks to address the unique challenges posed by this technology. In the United States, the Food and Drug Administration (FDA) has begun developing a framework for regulating 3D printing at the point of care (3DPOC), which allows for the customization of medical products within healthcare facilities.

The FDA's Center for Devices and Radiological Health (CDRH) has proposed scenarios to clarify its approach to regulating 3DPOC devices. While there is not yet any draft or formal guidance, the agency has conducted webinars in collaboration with the American Society of Mechanical Engineers (ASME) to gather feedback on its framework.

In Europe, the 3D printing market has benefited from strong government support for innovation and collaboration between research institutions and companies. The United Kingdom has developed a 3D printing innovation policy, although Brexit-related uncertainties have caused some concern in the industrial sector.

Germany, with its strong Industry 4.0 focus, is likely to generate modern innovation strategies. The German government aims to capture 5% of the global market share in additive manufacturing by 2022, potentially adding 2-3 billion dollars to the GDP over three years.

As 3D printing technology continues to evolve and find new applications across industries, regulatory bodies worldwide will need to adapt their oversight approaches to ensure that the benefits of this technology outweigh potential risks while fostering innovation and growth in the global 3D printing market.

Emerging Business Models in 3D Printing

The advent of 3D printing technology has given rise to innovative business models that are reshaping various industries. These emerging models leverage the unique capabilities of additive manufacturing to offer new value propositions and revolutionize traditional supply chains.

3D Printing as a Service

One of the most prominent business models in the 3D printing industry is the "as a service" approach. Companies like Xometry have pioneered this model, offering an industry-leading online 3D printing service. This model allows customers to upload their 3D CAD files and receive instant quotes and lead times for their projects. Xometry provides a comprehensive range of 3D printing processes, including selective laser sintering, fused deposition modeling, and direct metal laser sintering, among others.

The "as a service" model has several advantages:

- Accessibility: It enables businesses and individuals to access high-quality 3D printing without the need for significant capital investment in equipment.

- Versatility: Customers can choose from a wide range of materials and processes to suit their specific needs.

- Speed: Parts can typically be shipped in as little as one day, facilitating faster design iterations and reduced time to market.

- Scalability: The model supports both single prototypes and production runs of thousands of parts.

Digital Inventory and Spare Parts

The concept of digital inventory has gained traction as a transformative approach to supply chain management. Instead of maintaining physical warehouses stocked with spare parts, companies are increasingly storing design files digitally and producing parts on demand using 3D printing technology.

This model offers several benefits:

- Reduced storage costs: Companies can eliminate the need for large warehouses and the associated maintenance expenses.

- Improved logistics: On-demand production near the point of need reduces shipping times and costs.

- Sustainability: Digital inventory helps reduce the carbon footprint associated with global shipping and warehousing.

- Obsolescence management: Parts for older products can be produced as needed, eliminating the risk of obsolete inventory.

While the adoption of digital inventory is still in its early stages, it has the potential to revolutionize aftermarket support and spare parts management across various industries, including automotive and manufacturing.

Customization and Mass Personalization

3D printing technology has enabled a shift towards mass customization and personalization, allowing companies to offer unique, tailored products at scale. This model leverages the design freedom and flexibility inherent in additive manufacturing to create products that cater to individual customer preferences.

Key aspects of this model include:

- Co-creation: Customers can actively participate in the design process, creating a deeper sense of engagement and ownership.

- Precision customization: Products can be tailored to meet specific functional requirements, such as ergonomic fit or performance optimization.

- Niche market targeting: Companies can cater to specialized needs and preferences that were previously uneconomical to address.

Examples of successful implementation include customized furniture by Poltrona Frau, personalized BMW MINI parts through the MINI Yours Customized service, and custom-fit earphones by Normal. These initiatives demonstrate the potential of 3D printing to create unique value propositions and enhance customer experiences across various industries.

As 3D printing technology continues to advance, these emerging business models are likely to evolve and expand, offering new opportunities for innovation and differentiation in the manufacturing sector.

Conclusion

The 3D printing industry has undergone a remarkable transformation, causing a revolution in manufacturing processes across various sectors. From rapid prototyping to full-scale production, this technology has an influence on how companies design, produce, and deliver goods. The rise of industrial 3D printers, advanced materials, and innovative software solutions has opened up new possibilities to optimize supply chains and embrace sustainable manufacturing practices. These advancements have led to a thriving ecosystem of services and software, shaping the future of additive manufacturing.

As the global 3D printing market continues to expand, businesses are exploring diverse applications in sectors such as aerospace, healthcare, and automotive. The emergence of new business models, including 3D printing as a service and digital inventory management, is reshaping traditional supply chains and offering new value propositions. With ongoing advancements in materials, processes, and applications, the 3D printing industry is poised for continued growth and innovation, driving efficiency, sustainability, and customization across various industries.

Frequently Asked Questions (FAQs):

What is the projected market size and growth rate for 3D printing?

The global 3D printing market was valued at approximately USD 17.5 billion in 2024 and is anticipated to reach to around USD 37.4 billion by 2029. it is expected to witness a compound annual growth rate of 16.4% from 2024 to 2029.

Is there a growing demand for 3D printing?

Yes, the demand for 3D printing has been increasing consistently among both consumers and professionals. The market for desktop 3D printers alone is projected to expand to USD 21.00 billion by 2030.

What does the future look like for the 3D printing industry?

The future outlook for the 3D printing industry is highly optimistic. A vast majority of manufacturing stakeholders, about 97%, anticipate a significant increase in the adoption and usage of 3D printing technologies over the next five years.

Who are the primary consumers of 3D printing technology?

The target market for 3D printing is diverse, encompassing professionals such as architects who require models, to gamers seeking custom figurines. Each market segment has distinct needs and preferences, and addressing these effectively can greatly boost engagement and interest in 3D printing services.

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE