CAM Software Market

CAM Software Market by Application (Machining & Production (CNC Machining, Sheet Metal Fabrication), Product Design & Prototyping (Additive/3D Printing, Tool & Die Manufacturing), Quality Control & Inspection), 2D, and 3D - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Computer-Aided Manufacturing (CAM) software market is poised for robust expansion, projected to grow from USD 3.40 billion in 2024 to USD 5.70 billion by 2030, registering a CAGR of 9.0%. This growth is fueled by the accelerating adoption of Industry 4.0 technologies, including industrial automation, IoT-enabled manufacturing, AI-driven production planning, and robotics integration. Manufacturers across sectors are undergoing digital transformation to remain competitive in a rapidly evolving industrial landscape. CAM software plays a pivotal role in this shift by enabling precision machining and automated toolpath generation, real-time production monitoring and predictive maintenance, reduced cycle times and minimized human error, customization at scale and agile manufacturing workflows. As factories become smarter and more connected, CAM solutions are no longer optional—they are mission-critical tools for achieving operational excellence, cost efficiency, and scalable production. Vendors are witnessing a surge in demand for CAM platforms that integrate seamlessly with PLM, CAD, and MES systems, offering end-to-end digital thread capabilities. The market is also seeing increased interest in cloud-based CAM, AI-enhanced simulation, and multi-axis CNC programming—all of which are reshaping product development cycles and shop floor operations. For buyers, investing in CAM software is a strategic move to align with smart manufacturing and digital twin initiatives, enhance machine utilization and asset performance, support mass customization and just-in-time production.

KEY TAKEAWAYS

-

BY OFFERINGThe services segment is growing fastest, driven by demand for implementation support, training, and technical consulting. As manufacturers adopt CAM, expert services are critical for system integration, workflow optimization, and continuous upgrades—maximizing ROI and minimizing downtime.

-

BY APPLICATIONMachining & fabrication holds the largest share, fueled by CAM’s role in CNC machining, milling, and turning. CAM enables error-free production, optimized toolpaths, and faster cycles, making it essential for high-volume, precision manufacturing.

-

BY CAPABILITYMulti-axis CAM is the fastest-growing segment, driven by demand for complex part machining in aerospace, automotive, and industrial sectors. It supports custom designs, advanced materials, and high-precision operations, boosting productivity and competitiveness.

-

BY VERTICALThe automotive sector leads in adoption, leveraging CAM for rapid prototyping, complex component production, and digital manufacturing. CAM helps automakers meet rising demand for customized, high-quality vehicles while improving efficiency and cost-effectiveness.

-

BY REGIONAsia Pacific is the fastest-growing region (CAGR: 11.9%), driven by industrial expansion, smart factory investments, and CNC automation. Government initiatives and rising demand for precision manufacturing position APAC as a key growth hub.

-

COMPETITIVE LANDSCAPELeading vendors like Autodesk, Siemens, Hexagon, Dassault Systèmes, and Mastercam are driving innovation in multi-axis machining, AI-powered simulation, and Industry 4.0 integration, shaping the future of digital manufacturing.

The CAM software market is expanding rapidly, driven by Industry 4.0, automation, and smart manufacturing. CAM enables precision machining, error reduction, and workflow optimization across CNC and complex production environments. Key growth drivers include: Rapid prototyping and customized production Real-time analytics for predictive maintenance Simulation tools for resource and cost optimization As industries prioritize digital transformation and agile manufacturing, CAM software becomes essential for scalable, high-quality, and efficient production.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The CAM software market is witnessing significant trends and disruptions driven by the adoption of Industry 4.0, automation, and AI-powered manufacturing technologies. The shift towards multi-axis machining, cloud-based CAM solutions, and real-time data analytics is transforming traditional production processes. Emerging trends such as additive manufacturing integration and predictive maintenance are enhancing efficiency, reducing errors, and enabling customized, high-precision production. These developments are reshaping manufacturing workflows and creating new opportunities for growth and innovation in the CAM software market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for cloud-based and SaaS solutions

-

Growing adoption of smart manufacturing and industry 4.0 initiatives

Level

-

Lack of awareness regarding integration of CAM software with legacy systems

Level

-

Adoption of precision manufacturing for specialized high-performance components

-

Increasing demand for shorter product development cycle

Level

-

Lack of skilled workforce

-

Limited customization options for complex manufacturing process

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for cloud-based and SaaS solutions

The shift toward cloud-native CAM platforms and SaaS delivery models is reshaping the market. These solutions offer scalable, cost-effective, and collaborative environments for manufacturers, enabling real-time data sharing and remote project management, lower upfront investment, ideal for SMEs and mid-market manufacturers, flexible deployment and on-demand scalability.

Restraint: Lack of awareness regarding integration of CAM software with legacy systems

Despite innovation, many manufacturers face hurdles integrating CAM with legacy infrastructure. These systems often lack compatibility with modern platforms, leading to high implementation costs, operational disruptions, delayed ROI realization. The shortage of professionals skilled in both legacy and modern systems compounds the issue, slowing digital transformation.

Opportunity: Transforming microlearning and modular learning with digital education

Industries like aerospace, automotive, and medical devices are driving demand for CAM in high-tolerance, complex part production. CAM software supports rapid prototyping and small-batch customization, material efficiency and design-to-manufacture workflows, integration with CAD, additive, and hybrid manufacturing. Companies like ITM use CAM to produce precision titanium components for aerospace, showcasing its strategic role in next-gen manufacturing.

Challenge: Lack of skilled workforce

The CAM market faces a persistent shortage of skilled professionals in areas like CNC programming, robotics, and automated machining. This talent gap is driven by retirement of experienced machinists, limited access to vocational training, slow adoption of modern learning models. To overcome this, manufacturers are investing in technical education, modular learning, and AI-assisted programming tools to enhance workforce capabilities and ensure sustainable growth.

Computer Aided Manufacturing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Western Saw developed the WSX-1 using SolidWorks and CAMWorks to enable precise, safe, and efficient corner cuts, while streamlining design and prototyping to cut development time. | Achieve high-precision cuts while preserving structural integrity Reduce manual handling, improving worker safety Cut development timelines significantly (e.g., prototype in 6 months) Deliver cost-effective alternatives to specialized tools Improve installation speed and operational throughput |

|

Edwards implemented the 3DEXPERIENCE platform to centralize data, streamline product development, and improve collaboration, enabling secure sharing and customized vacuum pump solutions for the life sciences industry. | Centralize engineering data and streamline cross-functional collaboration Accelerate design iterations and enable virtual testing Improve project visibility and resource planning Reduce delays and enhance team communication Support sustainable innovation in high-performance components |

|

Decathlon utilized Autodesk’s generative design technology to develop a lighter, more sustainable diving fin, reducing material usage and environmental impact while ensuring superior performance and durability. | Reduced material usage and carbon footprint by 50% Created lighter, recyclable products with high durability Maintained performance standards while enhancing user comfort Used single-material recycled plastic for easier end-of-life processing |

|

Brasseler, a leading German medical technology company, implemented PTC’s Creo NC to enhance the design and manufacturing of precision dental tools through advanced 3D modeling, automation, and integrated workflows. | Cut design time from hours to minutes Improved machine utilization and shop floor productivity Accelerated product launch cycles Increased design precision and manufacturing quality |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The CAM software market ecosystem comprises software providers, machinery manufacturers, system integrators, and end-user manufacturers working in tandem to enable digitalized production. Key software vendors offer AI-driven CAM solutions, simulation tools, and generative design platforms, while machinery providers supply CNC machines, robotics, and additive manufacturing systems.End-users, including OEMs and contract manufacturers, leverage these solutions to enhance efficiency, precision, and scalability. The ecosystem is further strengthened by training institutes and R&D centers that support workforce upskilling and innovation in advanced manufacturing technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Computer Aided Manufacturing Market, By Offering

The software segment dominates the CAM market, driven by the adoption of integrated platforms that support automation, simulation, and precision machining. Manufacturers are investing in CAM software to streamline design-to-production workflows, minimize manual errors and downtime, optimize resource utilization and production efficiency. Integration with CAD and PLM systems is becoming standard, enabling seamless operations and data continuity across engineering and manufacturing teams.

Computer Aided Manufacturing Market, By Application

The quality control & inspection segment is growing at the fastest pace, reflecting manufacturers’ focus on compliance, accuracy, and cost control. CAM-enabled inspection tools help reduce scrap and rework, ensure regulatory compliance, integrate with CNC and metrology systems for real-time validation. This segment is critical for industries with tight tolerances and high-quality standards, such as aerospace, automotive, and medical devices.

Computer Aided Manufacturing Market, By Capability

The 2D CAM segment continues to hold the largest share due to its widespread use in milling, drilling, and cutting applications. Key advantages include cost-effectiveness for small and mid-sized operations, ease of integration with legacy systems, operational simplicity for basic geometries and prototyping. While advanced 3D and multi-axis capabilities are growing, 2D CAM remains essential for high-throughput, low-complexity manufacturing environments.

Computer Aided Manufacturing Market, By Deployment Mode

The cloud deployment segment is projected to grow at the highest CAGR, driven by the shift toward remote operations, real-time collaboration, and scalable production environments. Cloud-based CAM platforms offer subscription-based access to advanced tools, AI-driven optimization and analytics, seamless data sharing across distributed teams. This model supports global manufacturing workflows, enabling faster decision-making and improved agility.

Computer Aided Manufacturing Market, By Organization Size

Large enterprises dominate the CAM software market due to their ability to invest in automation, smart manufacturing, and digital transformation at scale. These organizations are deploying advanced CAM systems to enhance operational efficiency across global facilities, standardize production quality and process control, integrate CNC machining, robotics, and multi-axis capabilities for precision manufacturing. Their focus on scalable, interoperable, and data-driven CAM platforms supports enterprise-wide optimization and ROI.

Computer Aided Manufacturing Market, By Vertical

The medical devices and pharmaceutical segment is projected to grow at the highest CAGR, driven by the need for precision machining, customized components, and regulatory compliance. CAM software enables rapid prototyping of complex, biocompatible parts, traceable manufacturing workflows for quality assurance, integration with digital validation tools to meet strict standards. This vertical demands high accuracy, material integrity, and design flexibility, making CAM essential for innovation and patient safety.

MARKET REGION

North America is expected to largest share in market during the forecast period

The North American CAM software market is witnessing significant growth, driven by increasing demand for advanced automation, precision machining, and agile manufacturing across industries such as aerospace, defense, automotive, and medical devices. Key initiatives, including Michigan’s Maritime Manufacturing (M3) project, are addressing workforce shortages by investing in CNC machining training, outreach programs, and support for veterans, strengthening the region’s manufacturing capabilities. Partnerships like TriMech and SolidCAM’s iMachining technology are enhancing CNC programming efficiency, reducing cycle times, and extending tool life, enabling manufacturers to optimize production and adopt scalable solutions.

Computer Aided Manufacturing Market: COMPANY EVALUATION MATRIX

Autodesk (Star) continues to lead the CAM software market with its advanced, integrated software solutions that streamline design-to-production workflows, enhance precision, and support complex manufacturing processes. Its robust portfolio, including Fusion 360, offers scalable, cloud-enabled, and AI-driven tools, enabling high efficiency, reduced cycle times, and improved productivity across industries. NTT Data Engineering Systems (Emerging Leader) is gaining recognition for its innovative approach to digital manufacturing and CAM integration, delivering tailored solutions for smart machining, automation, and process optimization. The company focuses on bridging gaps between design, simulation, and production, helping enterprises enhance operational efficiency and adopt flexible, technology-driven manufacturing practices. Both companies are shaping the CAM landscape, with Autodesk driving established market leadership and NTT Data Engineering Systems emerging as a key innovator for specialized, next-generation manufacturing solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 30.40 BN |

| Market Forecast in 2030 (value) | USD 5.70 BN |

| Growth Rate | 9.0% |

| Years Considered | 2020–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD MN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Computer Aided Manufacturing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Provider (US) | Comprehensive segmentation of the global CAM market, covering offerings (software, services), applications (machining, quality control), capabilities (2D, 3D), deployment modes (on-premise, cloud), organization size, and verticals. Extended regional analysis for North America, Europe, APAC, and Latin America. | Identified high-growth regional and segment opportunities across aerospace, automotive, defense, and medical devices & pharmaceutical industries. Enabled tailored market entry strategies based on regional manufacturing trends, adoption of advanced automation, and digital infrastructure readiness. Supports optimized resource allocation and investment prioritization aligned with emerging CAM technologies, AI integration, and smart manufacturing initiatives. |

| Leading Provider (EU) | Detailed profiling of additional market players (up to 5 vendors), including software solutions, CAM integration capabilities, deployment models, and competitive positioning. | Enhances competitive intelligence for strategic planning and go-to-market execution. Reveals market gaps and white spaces for differentiation and innovation. Supports targeted growth initiatives by aligning product development, CNC automation, and digital manufacturing strategies with evolving industry needs, emerging technologies, and precision-driven manufacturing demands. |

RECENT DEVELOPMENTS

- October 2024 : Siemens integrated CloudNC’s AI-powered CAM Assist into NX CAM, automating CNC programming for aerospace and automotive industries, reducing programming time significantly.

- September 2024 : PTC partnered with AWS to enhance Onshape CAD/PDM with AI-driven features, improving efficiency and migration tools for secure cloud solutions.

- August 2024 : Autodesk and Haas Automation launched a Fusion CAD/CAM curriculum with hands-on CNC training, bridging the skills gap in manufacturing.

- July 2024 : Dassault Systèmes collaborated with Mistral AI to integrate generative AI with virtual twins, driving sustainable industrial transformation.

- April 2024 : Hexagon and Microsoft integrated CAD/CAM workflows into Teams, enabling real-time collaboration and AI-driven automation for faster product development.

- May 2024 : Hypertherm Associates launched ProNest 2025 with Tekla PowerFab Connector, introducing advanced features for improved cut quality and operational efficiency.

Table of Contents

Methodology

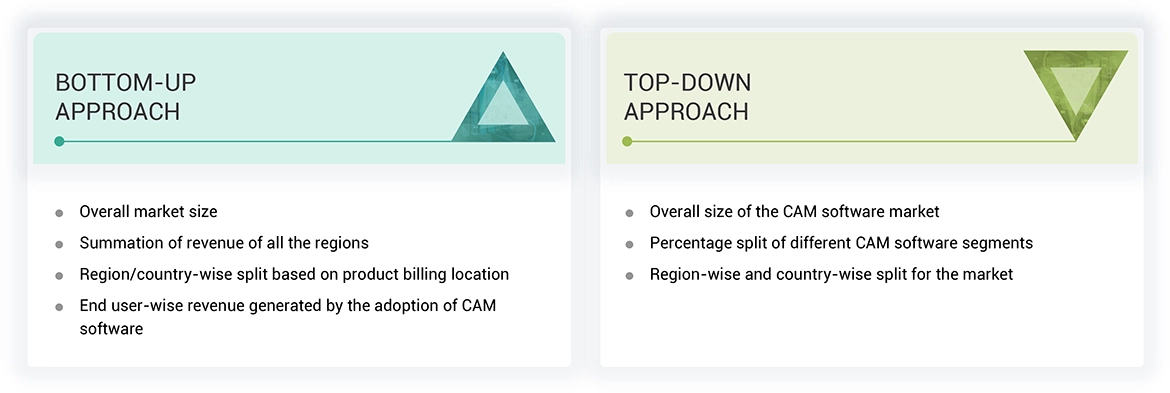

The study comprised four main activities to estimate the computer-aided manufacturing market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various computer-aided manufacturing market segments using the market breakup and data triangulation techniques.

Secondary Research

The market size of companies offering CAM tools was arrived at based on secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain essential information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

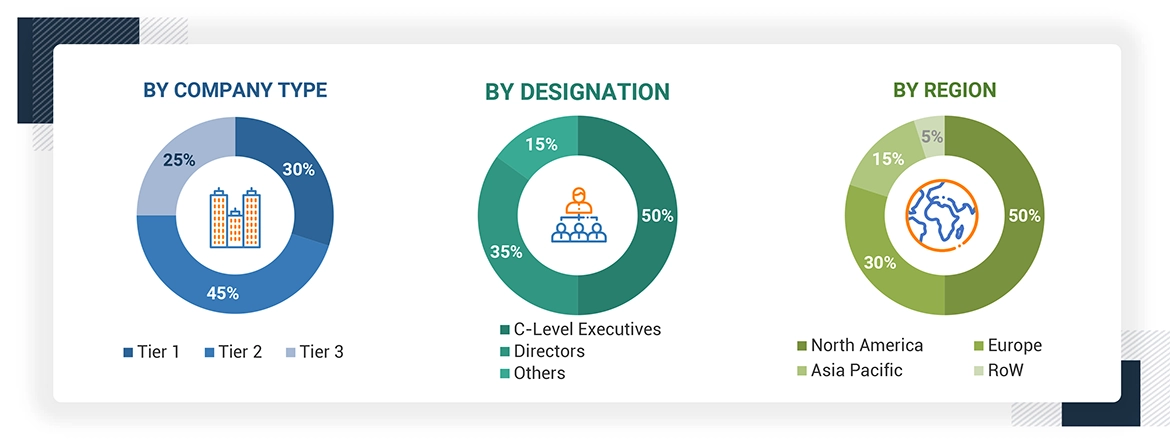

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the CAM market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various technologies-related trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using Modular Data Centers, and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall CAM market.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range

between USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The computer-aided manufacturing and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

The research methodology used to estimate the market size included the following:

- We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

CAM Software Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines Computer-aided manufacturing as "computer software used to automate the generation of machine tool instructions for manufacturing parts. CAM software typically produces precise, detailed instructions—commonly G-code—that direct computer numerical control (CNC) machines, such as lathes, mills, and routers, to produce highly accurate and efficient components. CAM supports end-to-end product designing & prototyping, machining & production, and quality control & inspection."

Stakeholders

- Cloud Service Providers (CSPs)

- CAM Software Vendors

- Machine Tool and CNC Equipment Manufacturers

- System Integrators and Resellers

- Technology Partners

- Government Agencies & Regulatory Bodies

- Manufacturing Companies

Report Objectives

- To define, describe, and forecast the Computer-aided manufacturing (CAM) market based on offering, application, organization size, capability, deployment mode, vertical, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets for growth trends, prospects, and their contribution to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the computer-aided manufacturing market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

- Manufacturing Enterprises

- CNC Machining Service Providers

- Tool and Die Makers

- Industrial Equipment Manufacturers

- Metal Fabricators

- Additive Manufacturing (3D Printing) Companies

- Robotics and Automation Specialists

- Product Design and Prototyping Firms

- Engineering and R&D Organizations

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the CAM Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in CAM Software Market