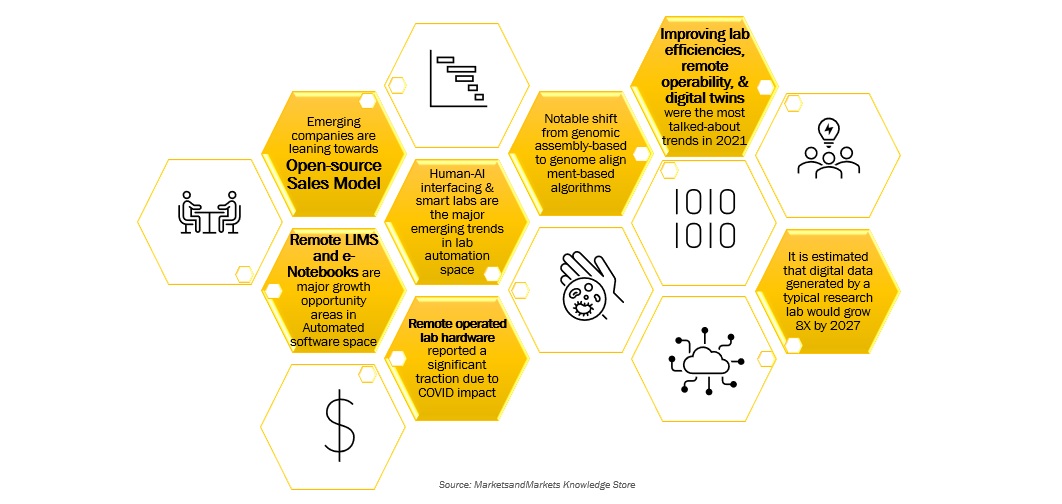

Disruption – OPEN SOURCE DEVICE PLACEMENTS AND vendor NEUTRAL SOFTWARE TOOLS ARE the next big trend IN LAB AUTOMATION INDUSTRY WITH $2.5 BN WORTH OF REVENUE opportunity BY 2027

TOP Lab Automation GROWTH STORIES

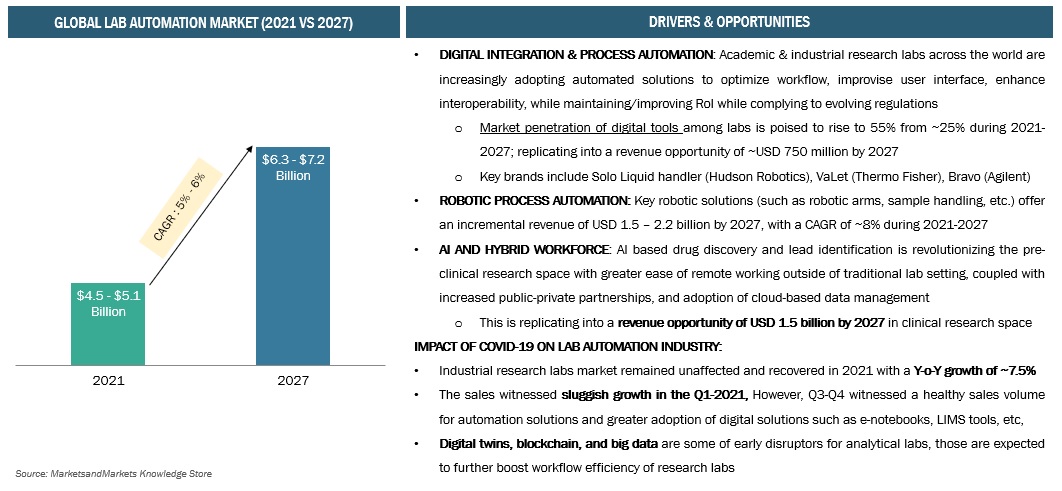

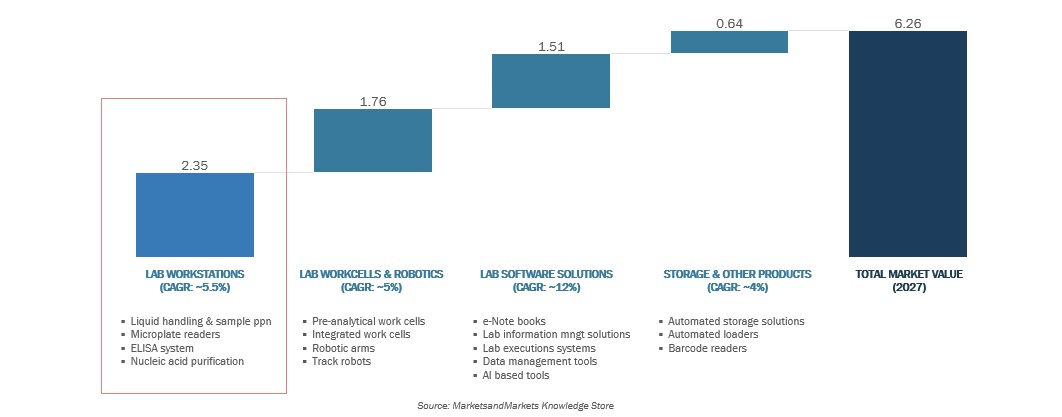

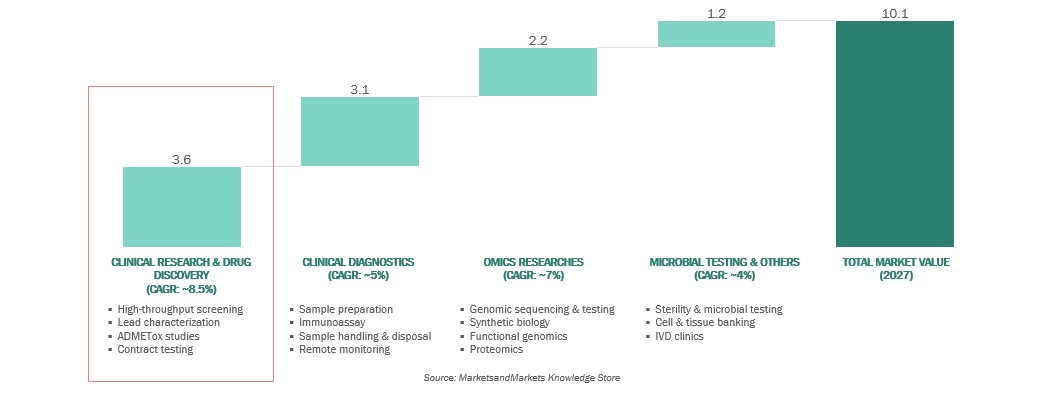

LAB AUTOMATION MARKET IS ESTIMATED TO GROW AT A HEALTHY CAGR OF 6% % IN THE COMING 5 YEARS, DRIVEN BY continued integration & digitalization of lab workflow, and stringent pharma quality regulations

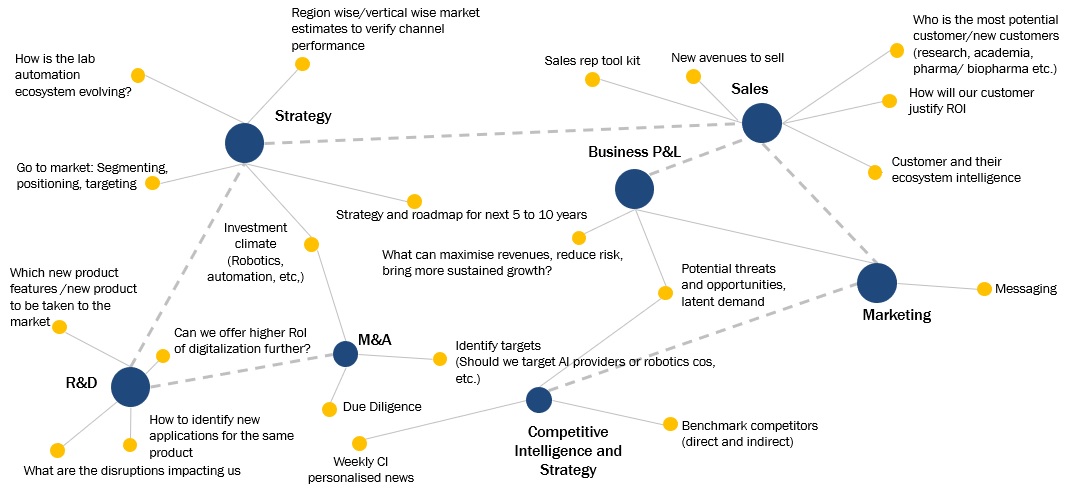

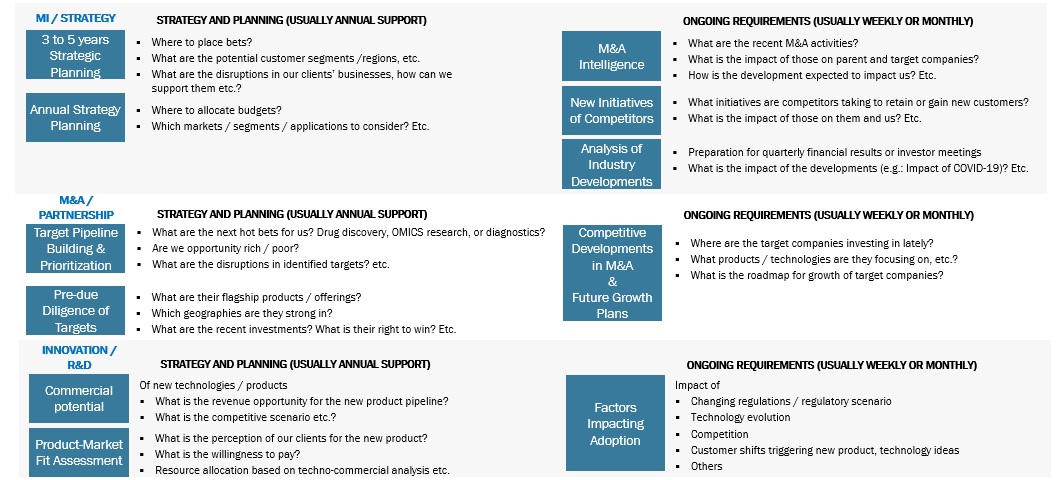

MNM ENGAGEMENT MODEL CAN HELP KEY STAKEHOLDERS WITHIN LAB AUTOMATION INDUSTRY ACROSS VARIOUS FUNCTIONS and PERSONA TO MEET THEIR STRATEGIC PRIORITIES.

WHY DO COMPANIES NEED HELP TO GROW?

ABSENCE OF ORIGINAL RESEARCH:

- Complex and fast evolving customer mandates for sample preparation, workflow integration, & regulatory compliance, hence difficult to ascertain product development roadmap or suitable portfolio differentiation for specific customer groups

- Insufficient secondary research for strategic decisions

INTELLIGENCE IS NOT DEMOCRATISED:

- Evolving regulations specific to product quality & novel therapeutics are replicating into technology gaps within analytical & manufacturing landscape, that need to be complied by technology providers

- Limited visibility on evolving business model those are contributing to early success or steep revenue growth of prominent startups

GROWTH PROGRAM DESIGN AND EXECUTION:

- Lack of GTM & pricing strategy, product features, and distribution model, especially in less penetrated geos such as ASEAN, META, LATAM

SOME UNKNOWNS & ADJACENCIES

- Adoption levels of automation in NGS & PCR workflow is low. Currently it ranges between 30-40% globally, however, in developed countries it is approaching 50%. As automation reduces TAT, helps in minimization of errors and provides reproducible results, it is largely used in clinical testing applications

- Bioinformatics, AI, & other digital tools are largely used in clinical settings vs research as former demands data analysis for clinical decision making

- Increasing focus on generic products, biosimilars & biologics to drive greater demand for clinical research & OMICS researchers

- Adjacent markets such as high throughput screening, AI based screening, and integrated robotic solutions to provide lucrative growth opportunities owing to current lag between technology evolution curve vs data analysis & storage demand among key customers

GROWTH PROBLEMS ENCOUNTERED BY Lab Automation COMPANIES

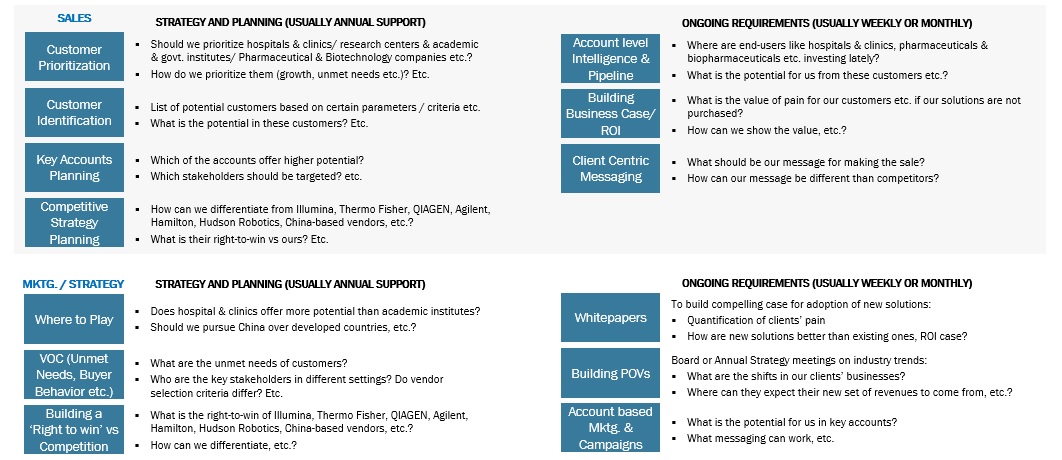

Customer prioritization and assessing unmet needs:

- What are the disruptions in our clients’ businesses? How can we support them for our own growth?

- Who are the most potential customers going forward? Should we prioritize industrial labs & CROs over diagnostic & research labs or contract testing labs?

- What are the key unmet needs of customers/non-customers? Who are the key stakeholders in different technology portfolio? Do vendor selection criteria differ by these? Which new product features should be added to the existing tools?

Where to Play:

- Which applications areas should we focus on? Should it be OMICS researches, drug discovery, clinical diagnostics, or others?

- Which regions should we place our bets on? Should we continue with developed markets or do developing geos offer more growth opportunities?

Building a compelling Right to Win (RTW):

- For M&A, which are the right targets for us? Should we target robotics companies or AI/digital solution providers? Should we enter new markets directly or through partners?

- How can we differentiate w.r.t.. competition? What is their right-to-win vs ours?

OBSTACLES TO GROWTH FOR CURRENT PLAYERS

- Not able to keep pace with fast evolving digital/robotics industry – New technologies are emerging leading to greater automation & digitalization

- Many start-ups and emerging companies are eating up market share of established companies through open-source business model

- Limited clarity on unmet needs among customers/non-customers, hence requirements for novel product features

- Limited clarity on relevant vs redundant digital aspects or evolving customer desires about service matrix for the future

- Unclear picture about the regulatory and technology evolution curve

KEY UNCERTAINTIES/ PERSPECTIVES WHICH INDUSTRY LEADERS SEEK ANSWERS TO:

KEY QUESTIONS OF Lab Automation COMPANIES

- What are the major technology/product segments driving adoption of automated solutions (Robotics, automation, etc.) in lab space?

- What are the prominent product segments (traditional or standalone) that is poised to become obsolete in the next 5 years?

- Can robotic workflow become affordable for routine manufacturing & diagnostics, or will it continue to be used in OMICS researches & epidemiology researches alone?

- What is the level of automation & workflow integration that would be desirable among industrial & academic researchers by end of decade?

- How can industrial customers optimize manufacturing processes to be more agile while achieving complete automation with minimum manual intervention?

- What regulatory policies can help strategize and achieve volumetric growth? How can institutionalized collaboration be leveraged in emerging markets to achieve the same?

- What can be more cost-effective strategies to support technology upgradation or infrastructure modernization among cost-sensitive customers?

KEY QUESTIONS OF COMPANIES IN ADJACENT MARKETS

- What are the regulations surrounding data privacy and security?

- What are current unmet data/digital needs w.r.t. automated or robotics or technology integration portfolio being used by key customers?

- Is brand exclusivity important for digital tools or are users open to adopt brand or technology neutral digital tools? What are the prominent customer groups those could be prioritized for short-term revenue growth?

- Which machine learning approaches can be used to address data limitations so that AI-based algorithms and AR/VR be used for drug discovery and clinical researches?

- How are companies handling unmet customer needs wrt rapid data management needs w.r.t. to current data analysis & archiving capabilities?

- When can a 100% AI integration into genomics or clinical researches be expected?

- What will be the impact of automation on genomics and drug discovery market?

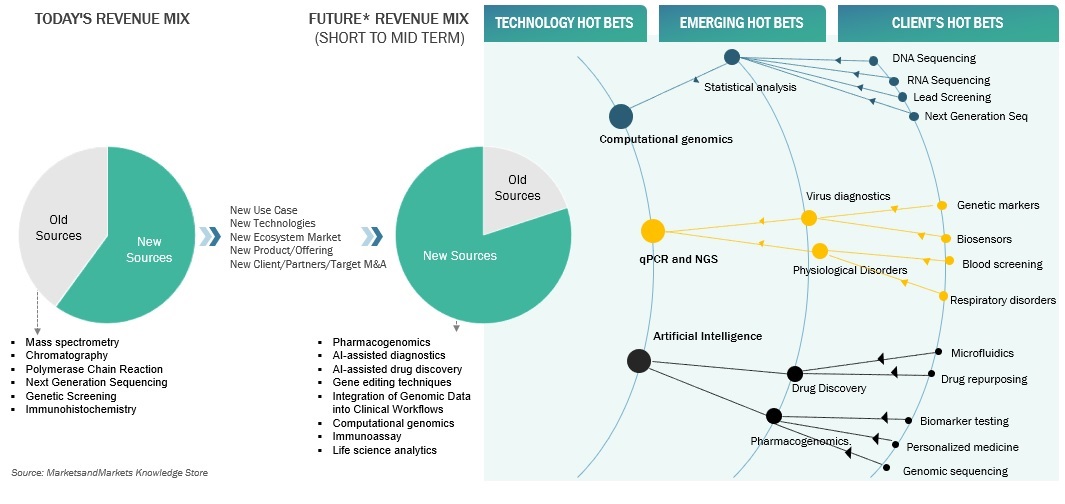

What is driving change

in your business

- Product life cycles getting shorter.

- Ecosystems getting converged.

- Newer technologies and new use-cases disrupting.

- New markets, new geographies, new clients, competition and partners.

Are changes only impacting you or your clients and their clients as well?

The trial will be a guided tour by our representative to help you discover the shift in revenue sources of your clients and clients' clients that will impact your revenue. This is your opportunity to unlock the research IP worth $100 million

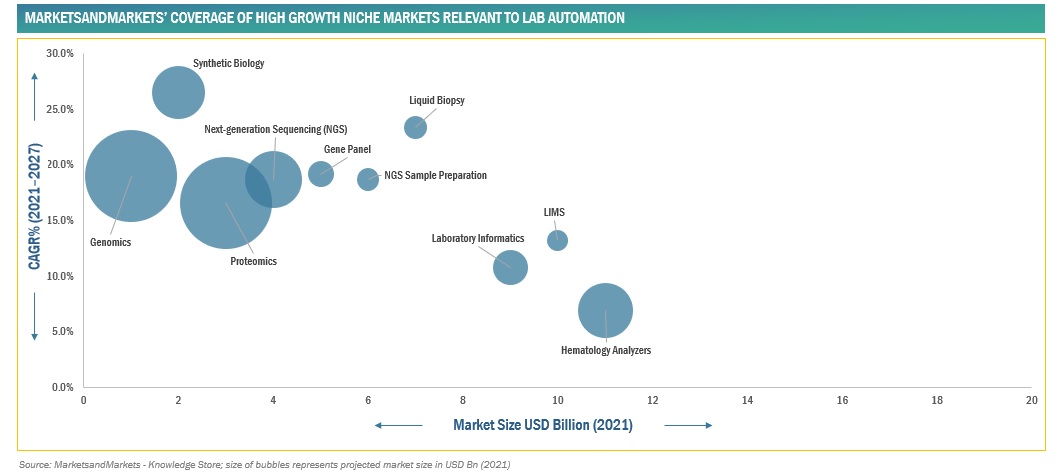

mnm RESEARCH FOCUSES ON HIGH GROWTH & NICHE MARKETS – such as robotics, automated workstations, software tools, AND RELATED MARKETS

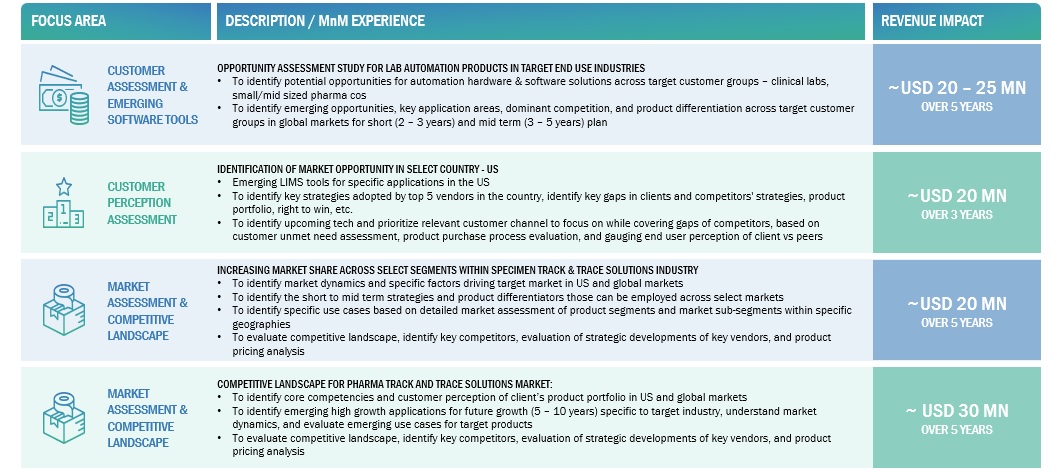

INDICATIVE LIST OF OTHER PROJECTS EXECUTED FOR Lab Automation COMPANIES:

- STUDY

- Lab Automation Hardware and Software Market Assessment Study For Small/Mid Sized Pharma Cos, & Clinical Diagnostic Labs

- LIMS Market Assessment and Competitive Landscape Study

- Competitive Intelligence Study for In Vitro Diagnostics Market

- Partnership Identification Study on Analytical Lab Software Solutions Market Study

- Lab Informatics Market Assessment Study

- Anatomic Pathology Track and Trace Solutions Market Assessment Study

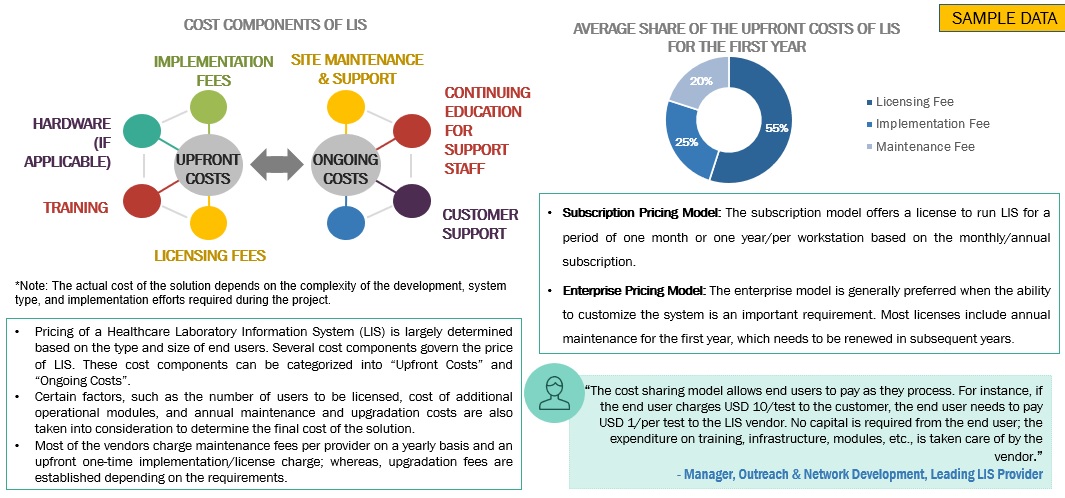

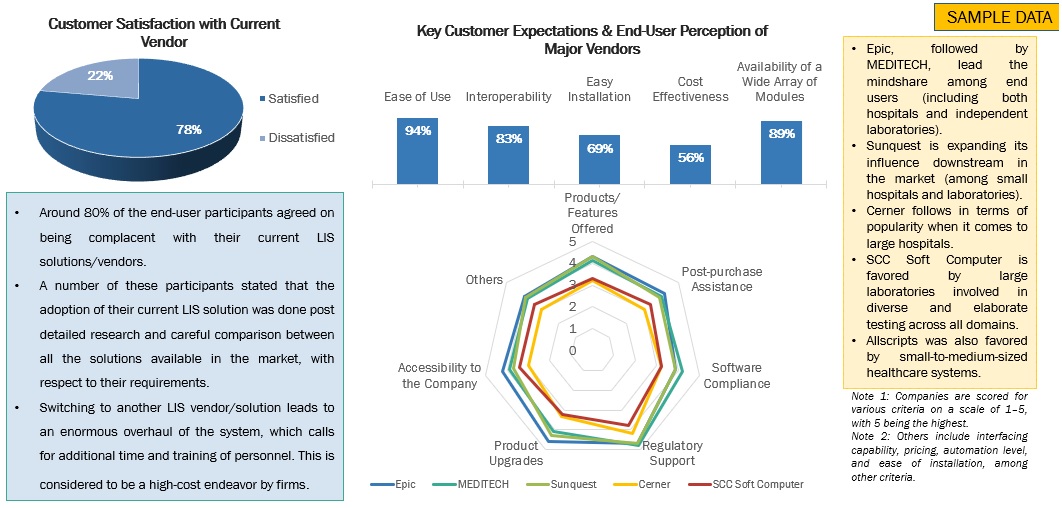

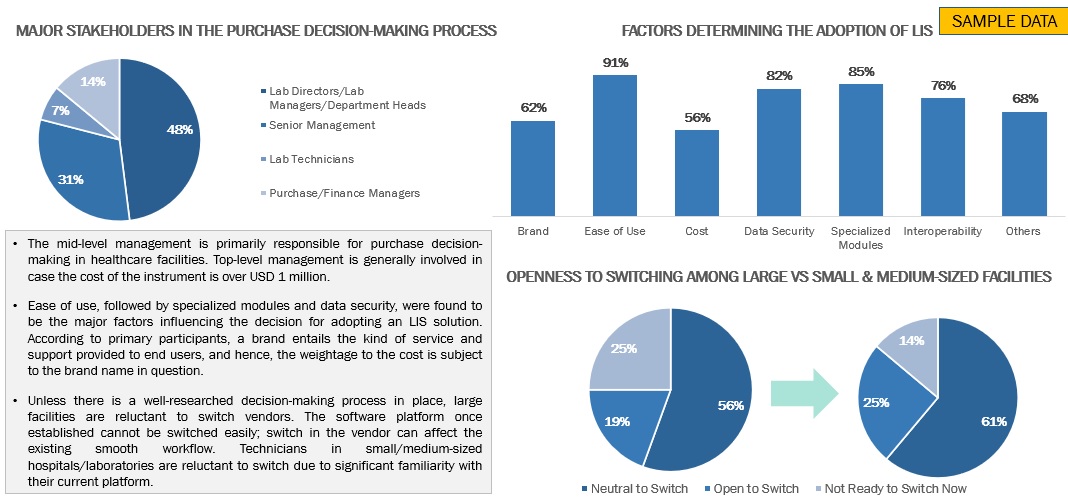

- Pricing Assessment & End-user Perception Assessment Study for Laboratory Information Systems (LIS) In US Market

- Market Assessment and Competitive Analysis Of North America Healthcare Laboratory Information Systems (LIS) Market

- Diagnostic Testing Track and Trace Solutions Market Assessment Study

- Pharmaceutical Track and Trace Solutions Market Assessment Study

OTHER KEY REVENUE IMPACT STORIES

impacting you and

your clients

Lab Automation COMPANIES

JENNIFER PRESTON,

GLOBAL MARKET INTELLIGENCE & STRATEGY DIRECTOR,

THERMO FISHER CMD

MarketsandMarkets offers a unique combination of expertise and dedicated engagement model. The Analysts and Client Services team at MarketsandMarkets is extremely supportive and flexible, the analytical capabilities are commendable. The business insights were very detailed and aligned well with our expectations which we have been using to make strategic decisions. We were thoroughly impressed with their approach and continue to partner on revenue impact.

Judy Nolan,

Strategic Market Research Consultant,

Roche Diagnostics

Markets and Markets has conducted two studies that were instrumental in developing our market book for segments of a market where depth of information is not readily available. The understanding they provided set the baseline for a market we expect to grow substantially above the overall market in the next five years. Without this common ground, our efforts could not be focused to maximize our future growth. The biggest asset was their willingness to seek alternative sources, work with our internal knowledge and synthesize a full analysis that all of the relevant players could support.

Second Panel

Third Panel