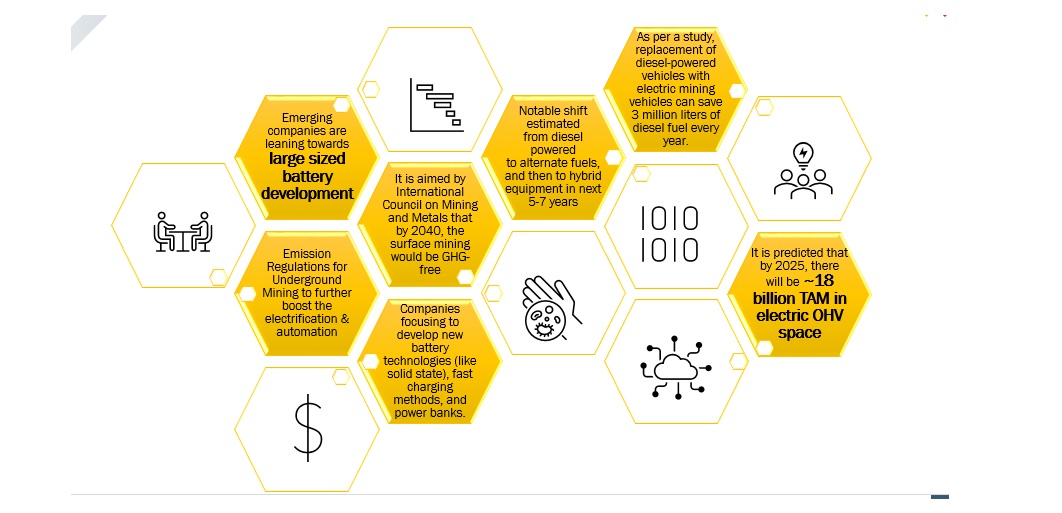

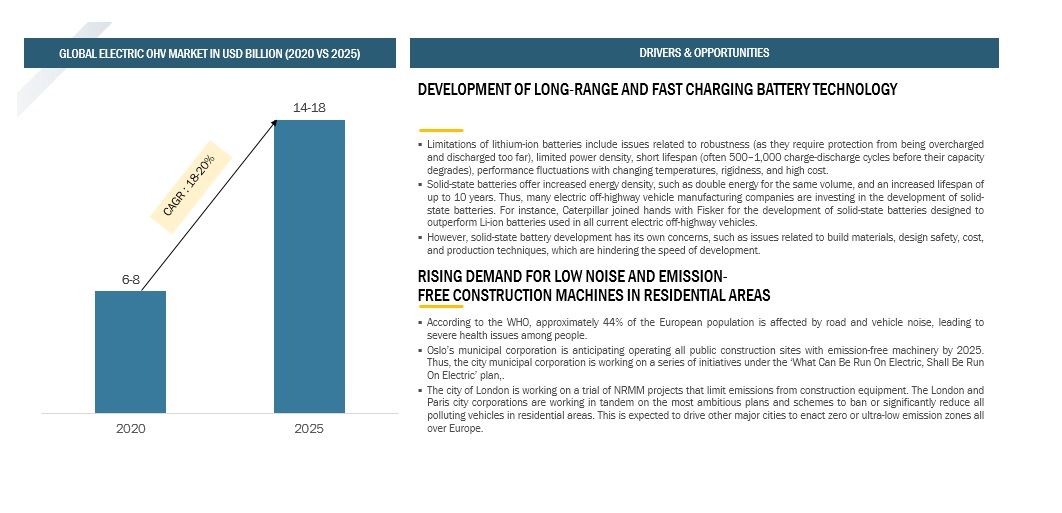

DISRUPTION – Though Li-Ion Batteries are dominating the e-OHV segment, the solid-state batteries is the next potential technology worth $300 Mn post 2023

TOP Off-highway Vehicle GROWTH STORIES

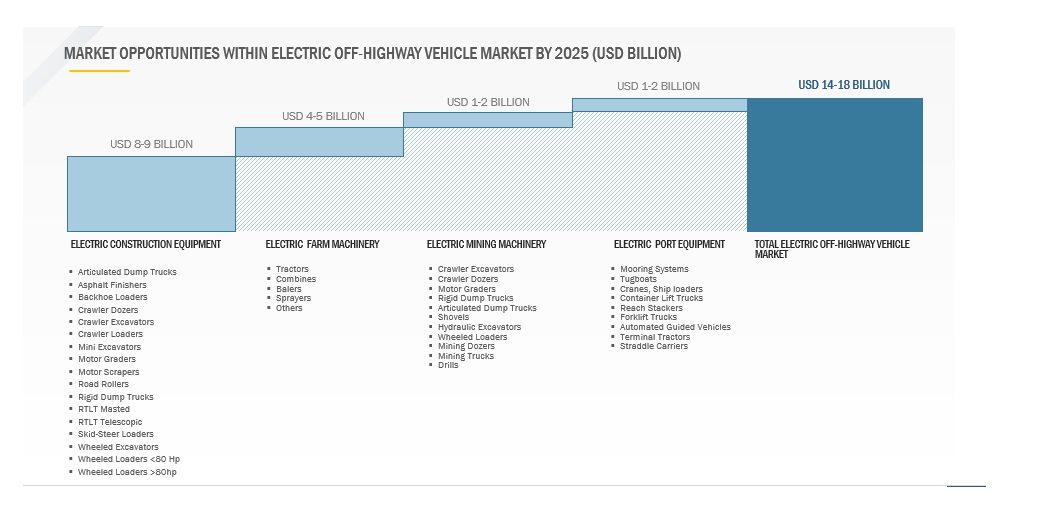

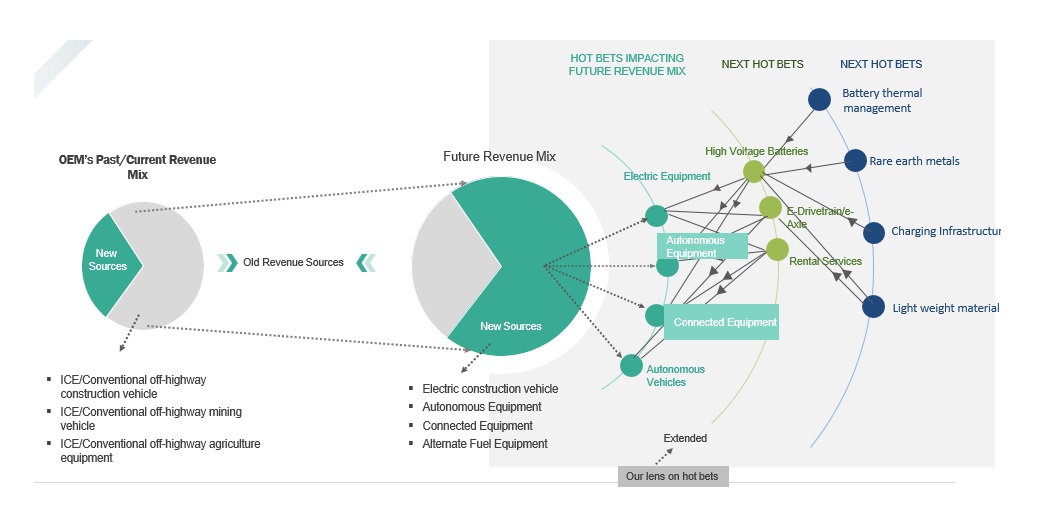

THERE IS USD 14-18 BN POTENTIAL WITHIN ELECTRIC off highway vehicles, more than HALF OF WHICH IS CONTRIBUTED BY ELECTRIC CONSTRUCTION EQUIPMENT

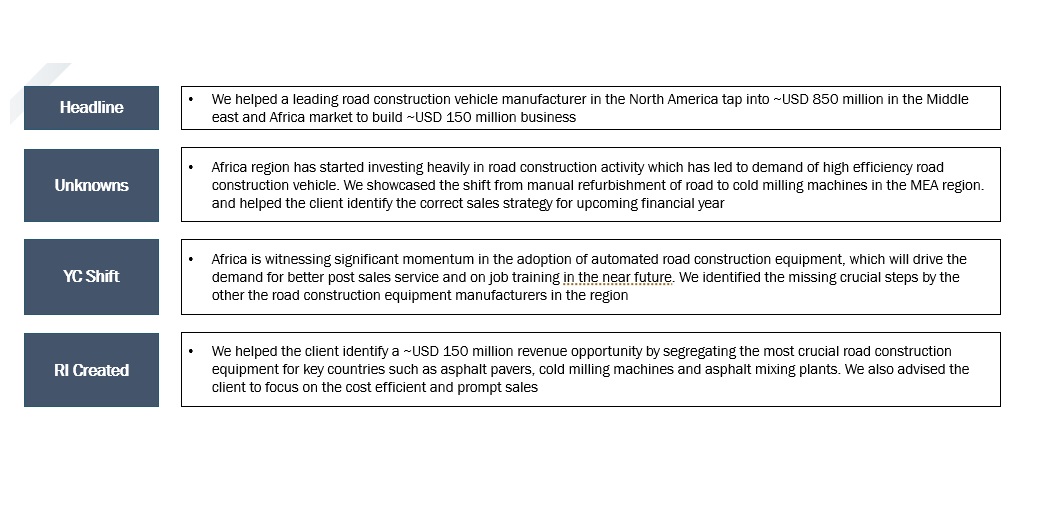

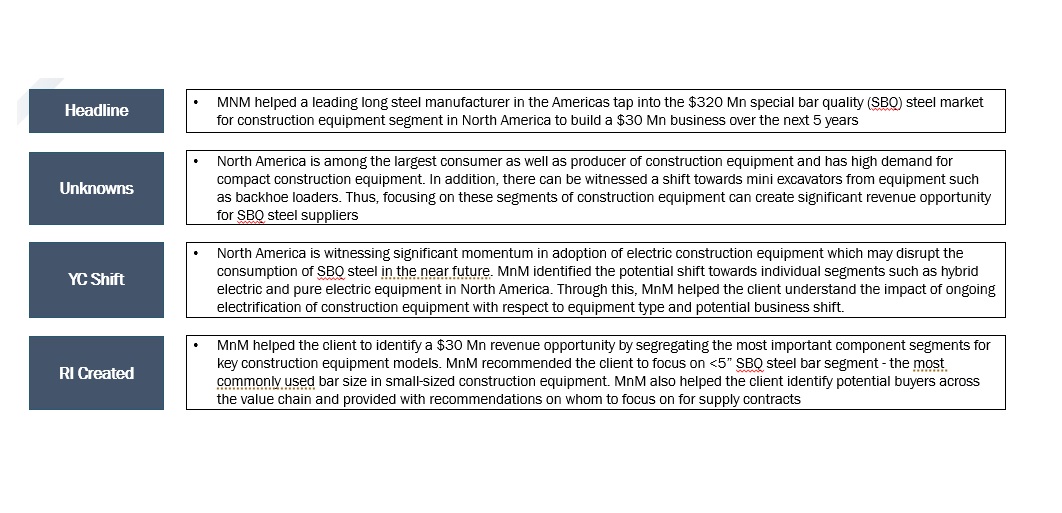

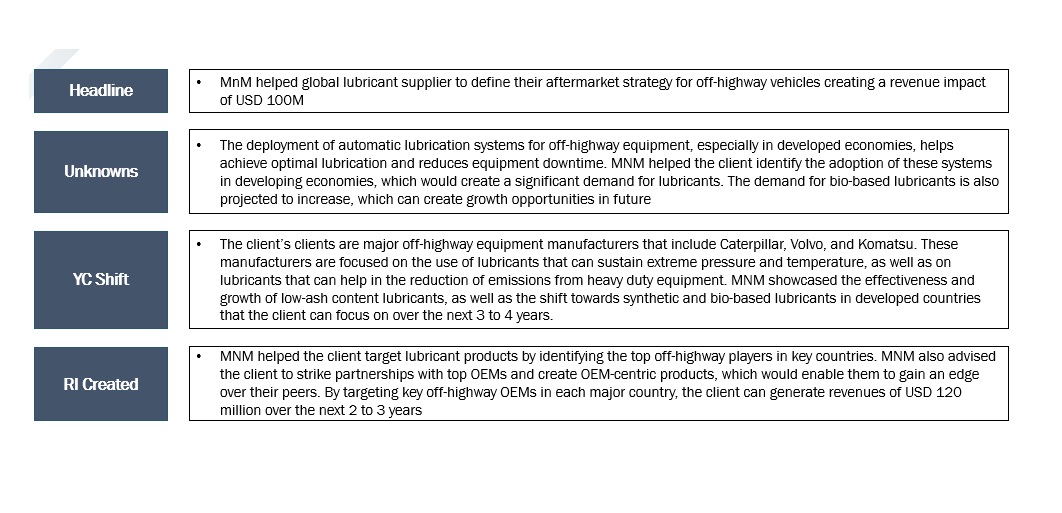

ADDITIONALLY, WE HAVE ASSISTED A HOST OF OHV PLAYERS to TAP HIGH GROWTH OPPORTUNITIES ACROSS EMERGING END-USERS segments and GEOGRAPHIES

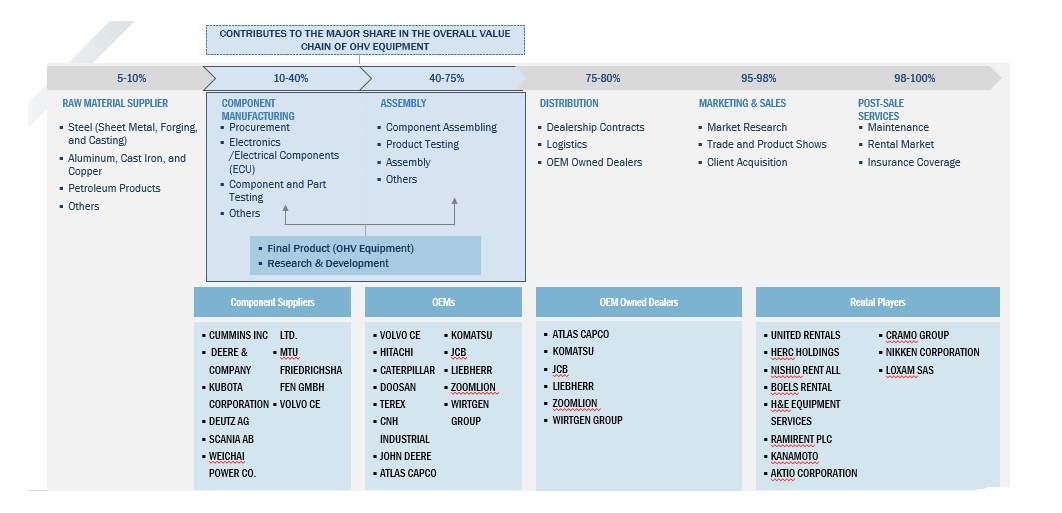

WHY DO COMPANIES NEED HELP TO GROW?

ABSENCE OF ORIGINAL RESEARCH:

- Complex and overlapping markets for library prep and target enrichment kits, hence difficult to calculate market potential and TAM

- Insufficient secondary research for strategic decisions

INTELLIGENCE IS NOT DEMOCRATISED:

- Client unmet needs need to be understood by all market facing employees for new product development and vendor selection.

- Bleak knowledge about upcoming technologies and growing applications such as hybridization and electrification in OHV equipments.

GROWTH PROGRAM DESIGN AND EXECUTION:

- Lack of knowledge and practice in competitive intel, pricing and product features, especially in Mining and construction sector

SOME UNKNOWNS & ADJACENCIES

- How are OEMs dealing with limited driving range and long charging time of eOHVs?

- Which would be the applications and regional/country level eOHV markets to target first?

- What will be the potential markets for hybrid and all electric battery and powertrain in next 5 years?

- What can EV component suppliers capitalize on in order to grow their eOHV production and sales?

- What would be the tipping point where electric off-highway vehicles would cross the sale of ICE vehicles?

- What should OEMs develop and build considering growing EOHV penetration? How are the competitors dealing with this trend?

- Which would be the applications and regional/country level EOHV markets to target first?

- What is the potential of EOHV with long cord in urban construction and underground mining?

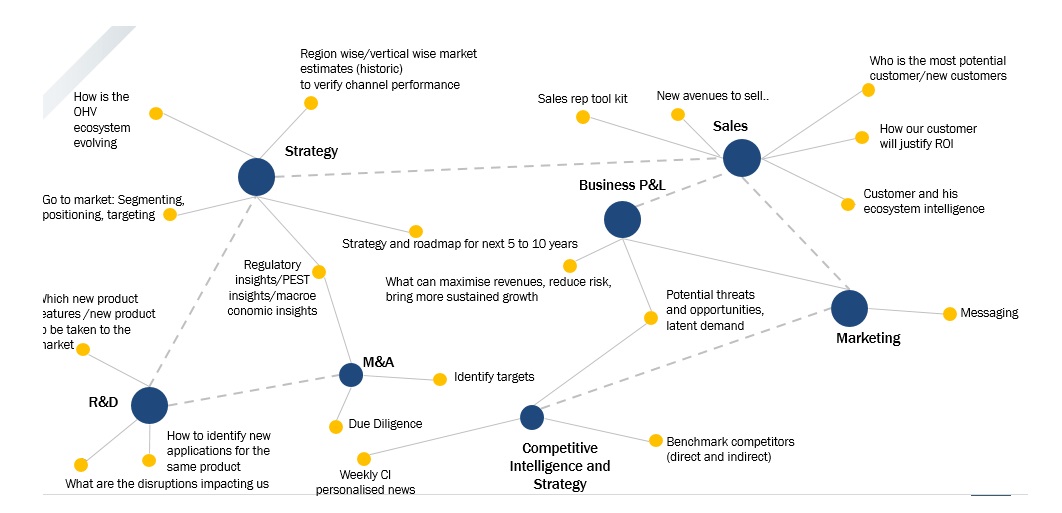

GROWTH PROBLEMS ENCOUNTERED BY Off-highway Vehicle COMPANIES

Customer prioritization and assessing unmet needs:

- What are the disruptions in our clients’ businesses? How can we support them for our own growth?

- What are the key unmet needs of customers? Who are the key stakeholders in different settings? Do vendor selection criteria differ by settings? Which new product features should be added to the existing products?

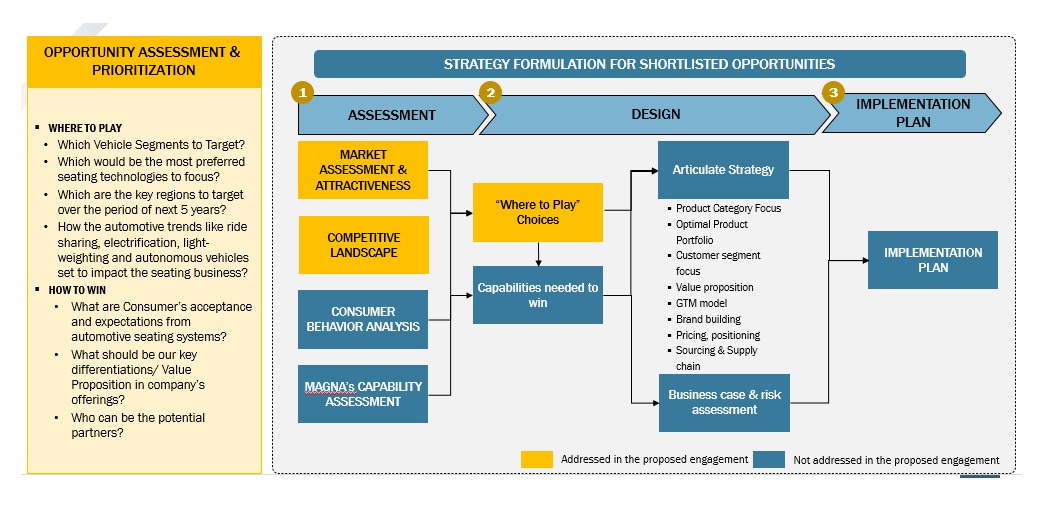

Where to Play:

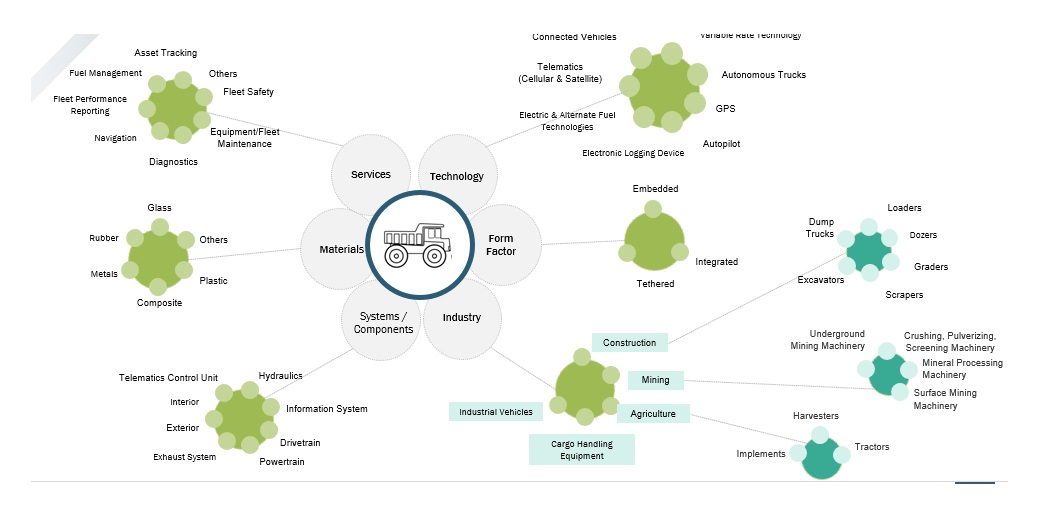

- Which applications areas should we focus on? Should it be mining, construction, agriculture or any other?

- Which regions should we place our bets on? Should we continue with developed countries or do developing countries offer more growth opportunities?

Building a compelling Right to Win (RTW):

- For M&A, which are the right targets for us? Should we target battery development companies or consumables companies? Should we enter new markets directly or through partners?

- How can we differentiate from top players? What is their right-to-win vs ours?

OBSTACLES TO GROWTH FOR CURRENT PLAYERS

- Not able to keep pace with fast evolving drone industry – New technologies are emerging with increasing level of autonomy

- Not able to keep pace with fast evolving electric off highway vehicles industry – New technologies like solid state batteries to outperform Li-Ion batteries in near future are emerging

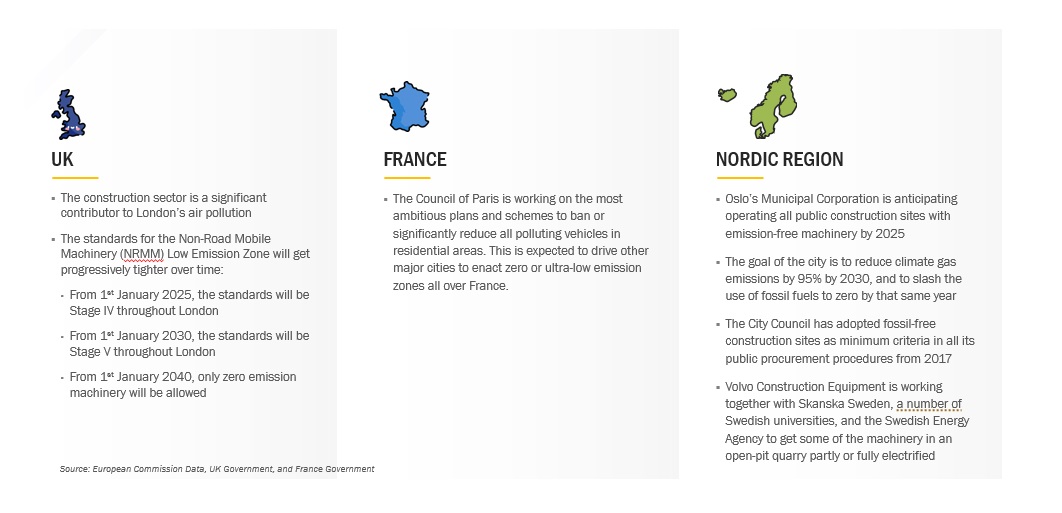

- Unclear picture about the emission regulatory and reimbursement policies for electric OHV from many countries

- Different electrification adoption rate at regional/country level

- Varying battery performance in harsh working environment

- Limitation of battery capacity and higher charging times

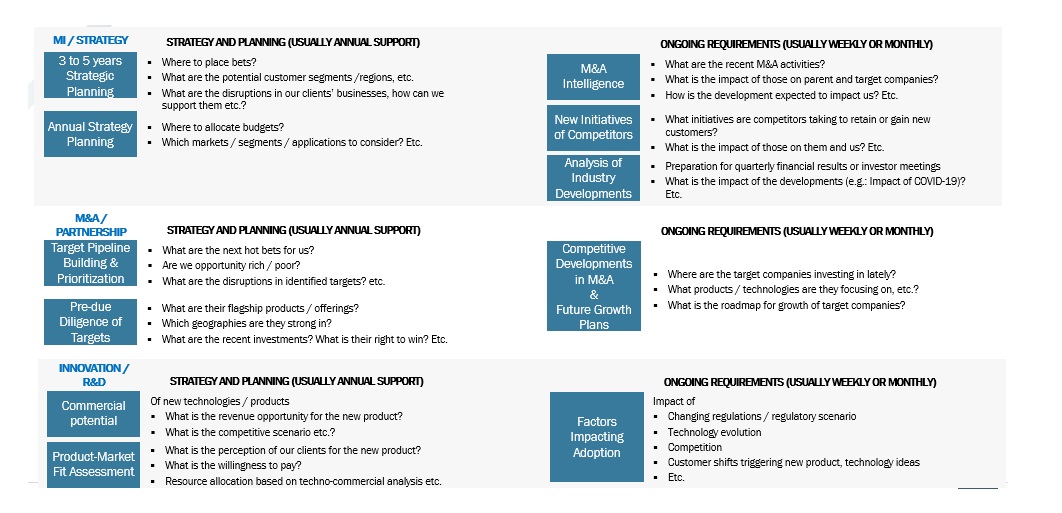

KEY UNCERTAINTIES/ PERSPECTIVES WHICH INDUSTRY LEADERS SEEK ANSWERS TO:

KEY QUESTIONS OF Off-highway Vehicle COMPANIES

- What would be the tipping point where electric off-highway vehicles would cross the sale of ICE vehicles?

- What should OEMs develop and build considering growing EOHV penetration? How are the competitors dealing with this trend?

- How are OEMs dealing with limited driving range and high charging time of EOHV?

- Which would be the applications and regional/country level EOHV markets to target first?

- What is the potential of EOHV with long cord in urban construction and underground mining?

- How should battery manufacturers deal with varying battery performance in harsh working environments?

- Which are the potential battery types to outperform Li-Ion batteries in near future?

KEY QUESTIONS OF COMPANIES IN ADJACENT MARKETS

- How recent and upcoming emission regulations in OHV sector will boost the market for emission aftertreatment devices?

- How would be the future of automation in underground mining?

- How would electric car battery development boost the electric OHV developments?

- What opportunities are there for hybrid and electric powertrain manufacturers in OHV industry in next five years?

What is driving change

in your business

- Product life cycles getting shorter.

- Ecosystems getting converged.

- Newer technologies and new use-cases disrupting.

- New markets, new geographies, new clients, competition and partners.

Are changes only impacting you or your clients and their clients as well?

The trial will be a guided tour by our representative to help you discover the shift in revenue sources of your clients and clients' clients that will impact your revenue. This is your opportunity to unlock the research IP worth $100 million

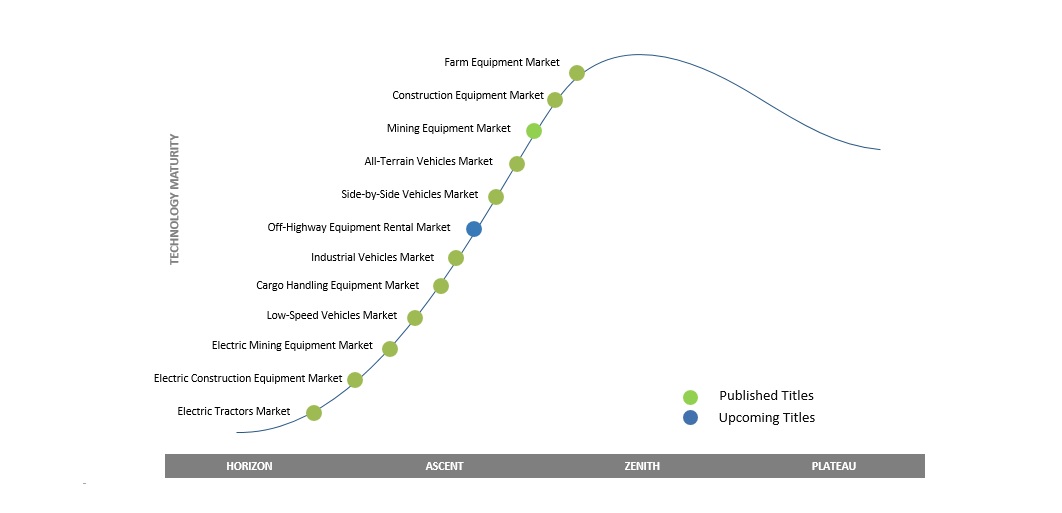

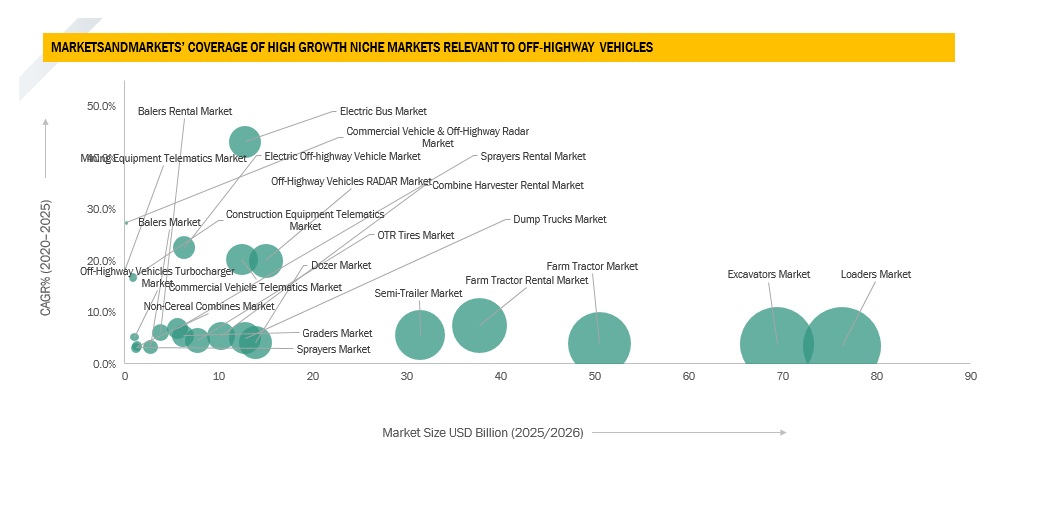

mnm RESEARCH FOCUSES ON HIGH GROWTH & NICHE MARKETS – such as Construction Equipment Telematics Mining Equipment Telematics, Electric Bus, Electric Off-highway Vehicle, AND RELATED MARKETS

INDICATIVE LIST OF OTHER PROJECTS EXECUTED FOR Off-highway Vehicle COMPANIES:

- STUDY

- Impact of Regulations on Exhaust System and After-treatment Devices used in NRMM

- Regulations for Off-highway vehicles and Sales projections of Tier IV-compliant equipment

- OEM Rankings and Market Share Analysis

- Retail Pricing for Construction Equip

- OHV SBQ Steel Market

- Global Construction Equipment Lubricants Market

INDICATIVE LIST OF OTHER PROJECTS EXECUTED FOR OFF-HIGHWAY VEHICLE COMPANIES:

impacting you and

your clients

Off-highway Vehicle COMPANIES

CALVIN FENNELL,

Regional Sales Director - Infrastructure Solutions

ASTEC INDUSTRIES

I am happy to confirm that the info is realistic for our markets and scope. Further, it is of sufficient validity so as to form the basis for us to set sales targets for the regions with the challenge to the Regional Sales Managers to prove the data wrong. I would like to thank and commend the Markets and Market team for a report well done and in particular for involving me in the processes over the duration.

KIMBERLY MURPHY,

Global Marketing Director

BENTLY NEVADA

A big shout out to the team who tirelessly and successfully helped the client reach their desired business/revenue goals.

Second Panel

Third Panel