Exploring the Lithium-ion Battery Technology and Top Li-Ion Manufacturers 2024

How lithium-ion battery technology works?

Lithium-ion batteries (LIBs) are the primary power source for various devices, encompassing portable electronics, electric cars, and medical devices. The fundamental working principle involves a sequence of processes facilitating energy storage and release as lithium ions traverse between the anode and cathode of the battery.

The fundamental structure of a lithium-ion battery technology includes crucial elements: an anode, cathode, separator, electrolyte, and two current collectors (positive and negative). The anode and cathode function as storage reservoirs for lithium, while the electrolyte enables the migration of positively charged lithium ions between the anode and cathode. In the charging process, the cathode releases lithium ions, which are then absorbed by the anode. Conversely, the anode releases lithium ions to the cathode during discharge to generate an electric current.

Access our popular detailed report here: https://www.marketsandmarkets.com/Market-Reports/lithium-ion-battery-market-49714593.html

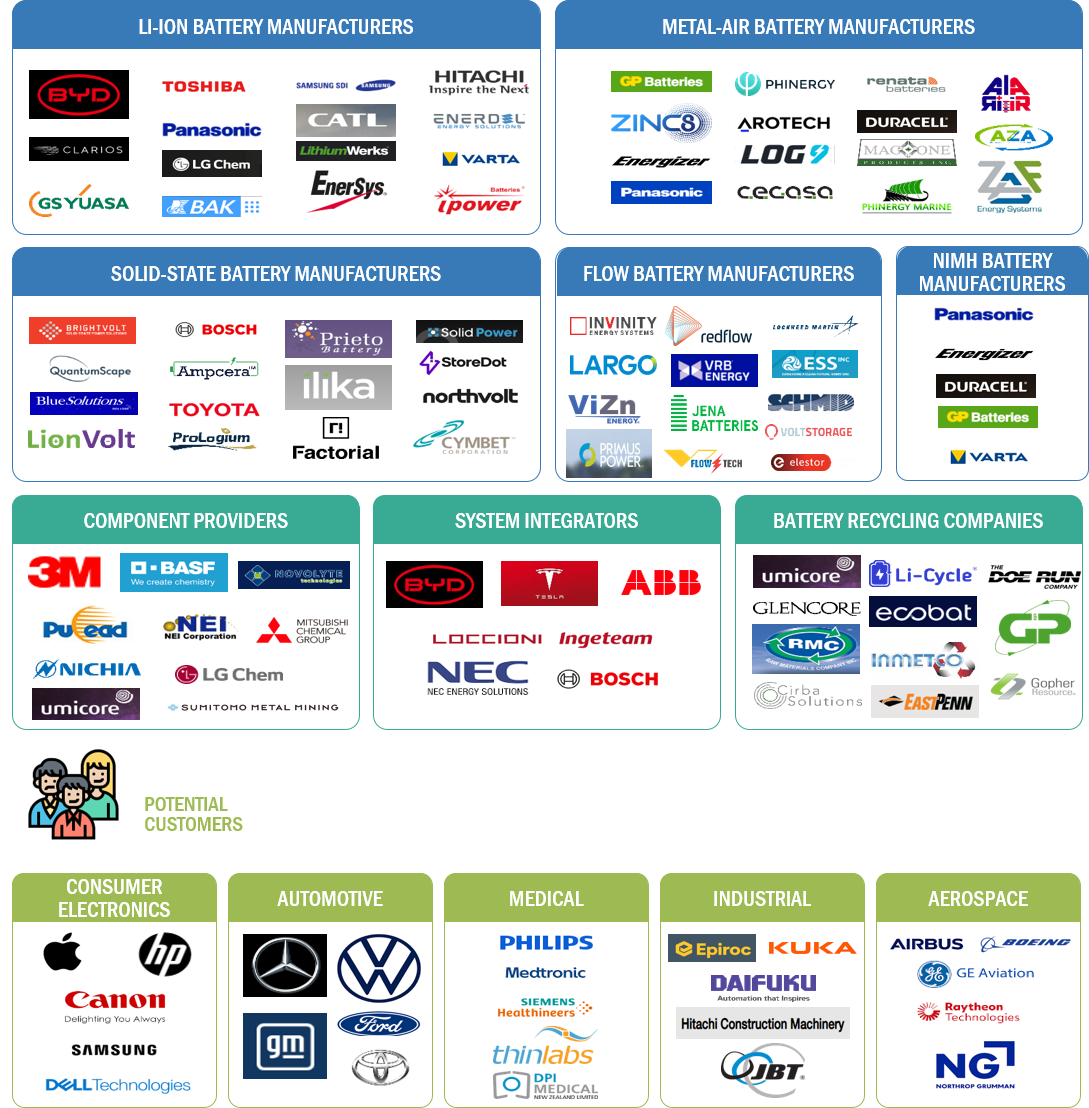

Battery Technology Ecosystem

How vital is lithium-ion battery

The lithium-ion battery, a compact and powerful rechargeable battery, has become essential in our everyday work, driving innovations from smartphones to electric cars and energy storage systems. Its role in the digital revolution, electro-mobility, and the transition to green energy is crucial. However, the technology faces challenges as it relies on rare earth metals and other depleting natural resources, raising sustainability concerns. Battery recycling remains a significant challenge.

Future of lithium-ion battery technology

The lithium-ion battery stands out as a pivotal player in the current economic landscape, holding a substantial share of the battery market, particularly in prominent applications like smartphones and electric vehicles. Its dominant market position is attributed to its remarkable energy density and exceptional specifications. Given these advantages, lithium-ion batteries are projected to maintain their significant market presence for the next 5 to 10 years. Despite ongoing efforts by various companies and start-ups to innovate in battery technology, many of these advancements are either partially commercialized or remain in the research and development stage. Technical challenges, such as unsuitable specifications, often hinder the market integration of these innovative batteries.

While some emerging battery technologies show theoretical promise, practical limitations necessitate extensive research and development before being widely adopted. Even if these new technology batteries are commercialized, they find limited applications and are not prevalent in major sectors like smartphones or electric vehicles. Despite lithium-based batteries having certain drawbacks, they are anticipated to remain at the forefront of technology or occupy a substantial market share for a significant period.

Beyond reliable technical specifications, the lithium-ion battery industry boasts a robust logistics infrastructure encompassing mining, transportation, production, battery manufacturing, and machine development. This comprehensive infrastructure underscores the challenge of any alternative battery technology seeking commercialization, particularly for significant applications like smartphones and electric vehicles. The demand for batteries in these applications is predominant, and the existing manufacturing capabilities are well-aligned with their production requirements. Therefore, for a new battery technology to establish dominance in the market, it must offer solutions specifically tailored to these high-demand applications, necessitating a logistics infrastructure akin to that of lithium-ion batteries.

Lithium Extraction and refining

The global economy has witnessed a growing significance of lithium, primarily driven by the demand for energy-efficient electric vehicles and the worldwide initiative towards decarbonization. Various companies are exploring and developing new reserves and refining processes to extract lithium with the highest purity. The extraction and processing of lithium-bearing minerals or brine demand specialized techniques, mainly due to the presence of other mineral salts. Lithium exists in different forms, including lithium minerals and brine. Traditional hard rock mining methods are employed to extract lithium minerals.

In contrast, lithium brine is obtained by pumping underground brine deposits to the surface, where lithium is extracted through a chemical process. Both methods necessitate specialized equipment for efficient extraction. The lithium ore undergoes a refining process upon extraction before being utilized in batteries or other applications. The refining process includes extracting lithium, eliminating impurities, and purifying the substance to create a pure, usable form of lithium. As the demand for lithium-based batteries increases, there is an escalating need for efficient and cost-effective extraction and refining processes. One successful method in producing highly pure lithium crystals is crystallization, which involves the meticulous control of crystal formation and growth. This technology proves essential in the lithium refining industry, ensuring the production of valuable, battery-grade lithium products. Lithium refining emerges as a pivotal process in the entire value chain of lithium, especially when refined for battery-grade applications. The refining business presents a profitable venture with limited players in the industry. Companies engaged in the entire process, from mining to lithium-ion shipping, stand to enhance profitability further.

Lithium availability

Derived from lithium minerals found in the original rock, lithium does not naturally occur in its metallic form due to its highly reactive nature, making it highly flammable and prone to spontaneous reactions with water. Lithium finds applications in various industries, including glass manufacturing, ceramics, pharmaceuticals, batteries, and the production of Aluminum and manganese alloys. Several countries have identified lithium deposits, with some of these identified deposits proving commercially viable.

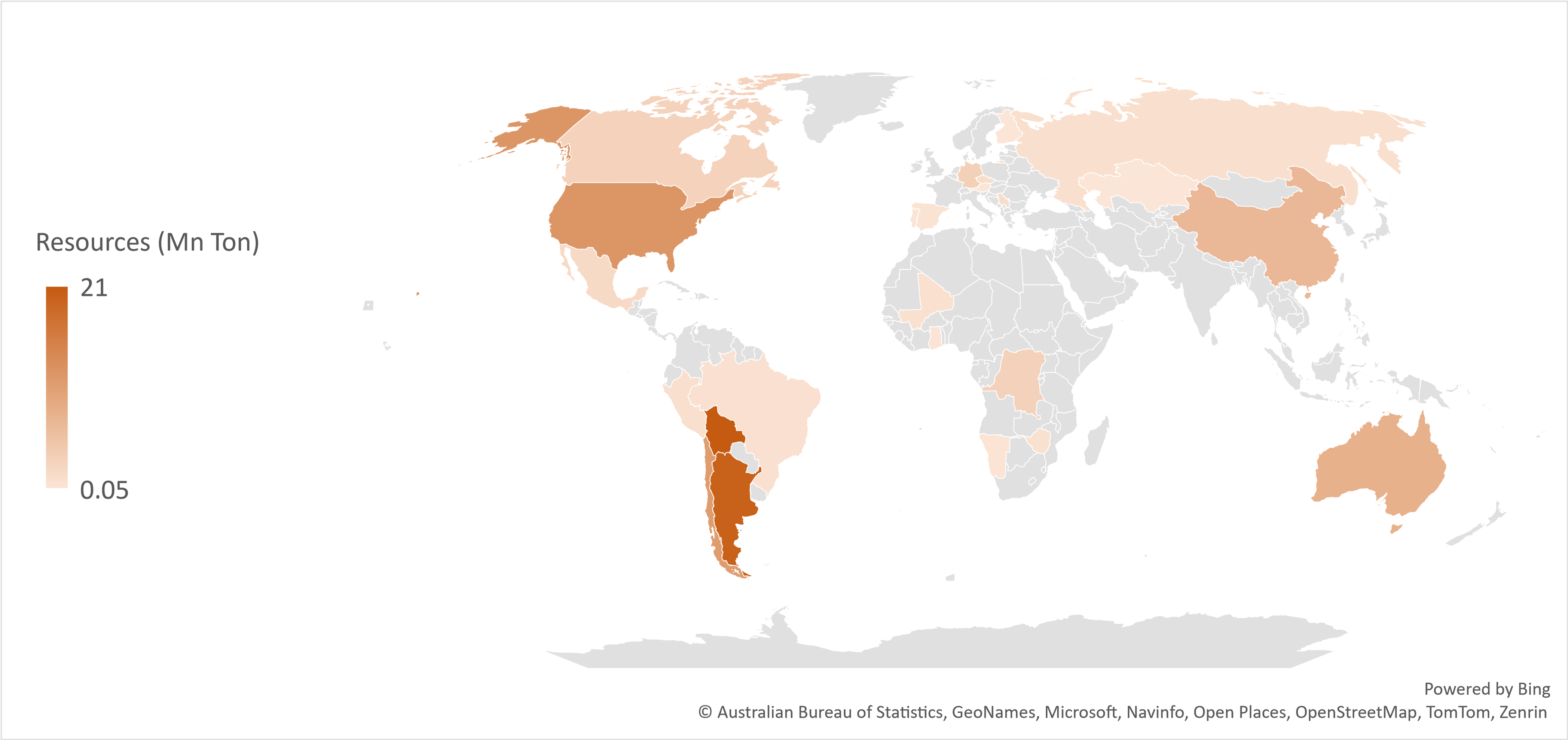

Lithium Resources 2022

Source: USGS

Recently, the United States Geological Survey (USGS) updated the lithium resources for the United States to 12 million tons and the resources for other countries to 86 million tons. As a result, the total available lithium resource currently stands at approximately 96 million tons.

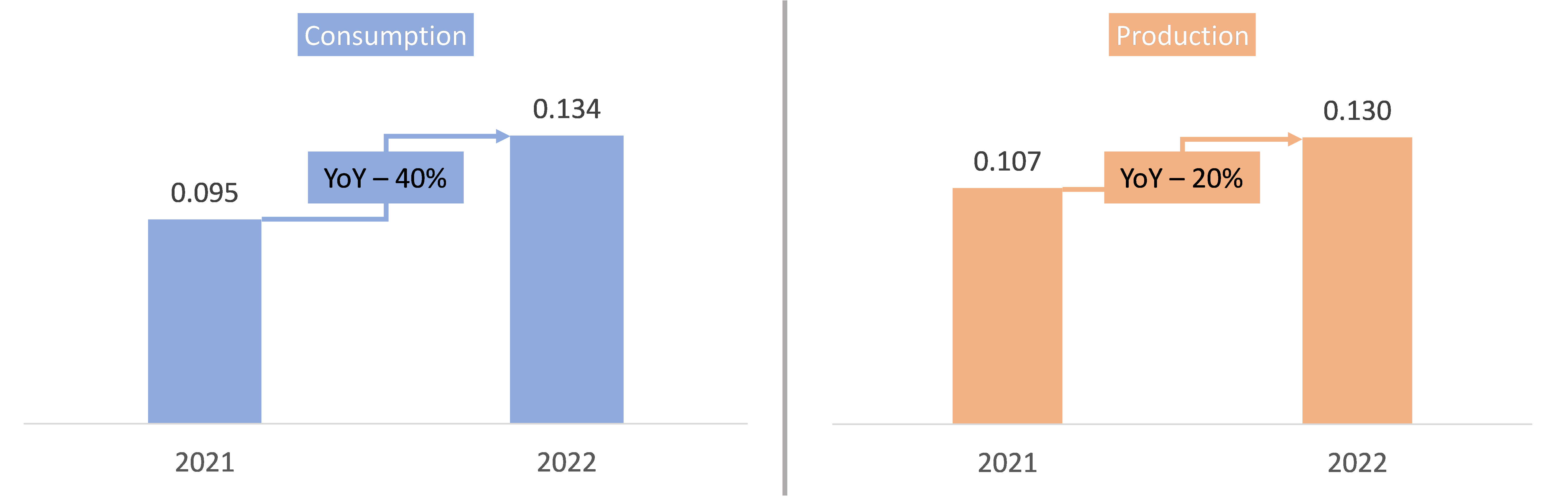

Lithium Consumption and Production (Million Tons)

Source: USGS

Note: Production doesn't include data from the US

In recent years, the surge in demand for lithium has been driven by global initiatives to transition from fossil fuels to cleaner energy sources. A key aspect of this transition involves reducing reliance on internal combustion engine vehicles, leading to a notable upswing in the demand for electric vehicles. Consequently, global lithium consumption witnessed a substantial year-on-year increase, surpassing 134,000 tons in 2022, marking a growth of over 40%.

The heightened demand exerted upward pressure on lithium production, which experienced a notable year-on-year boost, reaching 130,000 tons in 2022. However, this production figure still falls short of meeting the annual demand for the metal.

Recycling of lithium-ion battery- How technology helps?

Lithium-ion battery recycling involves the repurposing, reusing, and reprocessing of spent lithium-ion batteries to diminish their disposal as municipal or material waste. As lithium-ion batteries contain various toxic chemicals and heavy metals, disposing of them as regular trash has raised environmental and health concerns, contributing to water pollution and soil contamination. Lithium-ion battery recycling is crucial not only for recovering valuable metals but also for efficient waste management.

A typical battery comprises the cathode, anode, electrode, separator, binder, current collector, and packaging materials. These cell components consist of diverse combinations of materials, including copper, aluminum, nickel, polyethylene, cobalt, nickel, and other chemical compounds. Therefore, the feedstock for lithium-ion battery recycling includes all these components, constituting the spent or end-of-life lithium-ion batteries.

Commonly, used batteries are gathered from electric vehicles, smartphones, laptops, computers, energy storage systems, and other electronic devices. These collected batteries are then sent to battery recycling companies. The recycling process for lithium-air batteries employs various technologies depending on the battery chemistry involved. Critical metals like lithium, nickel, cobalt, magnesium, copper, aluminum, and graphite are extracted from lithium-ion batteries during recycling. The recovered materials are utilized to produce new batteries for various applications.

The construction of lithium battery recycling plants has experienced swift growth. Until November 2022, approximately 44 companies in Canada and the United States and 47 companies in Europe were actively recycling lithium batteries or planning to initiate such recycling operations. Partnerships between automobile companies and battery recyclers were formed to provide the automotive industry with a sustainable source of battery materials.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

Sodium-ion battery – a promising alternative to lithium-ion in the electric era.

The imminent challenge revolves around electrical technology spanning across industries such as automotive, consumer electronics, and renewable energy storage, heavily relying on advanced batteries. While lithium-ion batteries currently dominate these markets, there is a growing concern that the demand for essential materials required in their production will exceed the available supply.

Given the limited availability of lithium and related chemicals, major corporations in various countries are exploring alternative battery chemistry. Consequently, certain original equipment manufacturers have embraced sodium-ion batteries, which share similarities with lithium-ion batteries in design and manufacturing processes. Sodium, positioned below lithium on the periodic table, exhibits a strong chemical resemblance to lithium. However, sodium is more abundant and cost-effective. Sodium-based batteries do not rely on costly raw materials such as cobalt, copper, lithium, or graphite. This suggests sodium batteries can be low-cost, offering safety advantages as they are not prone to catching fire like lithium batteries.

Furthermore, sodium batteries are widely available and can be found in common table salt like NaCl. Sodium-ion batteries offer an extended life cycle, allowing them to be charged and discharged more times than lithium-ion batteries. In 2022, Reliance Industries acquired Faradion, a UK-based startup specializing in sodium-ion batteries, for $135 million. There are some companies that are involved in the development of sodium batteries, including CATL, Fradioan, and Neutron.

Top Startup – Lithium Ion Battery Manufacturers

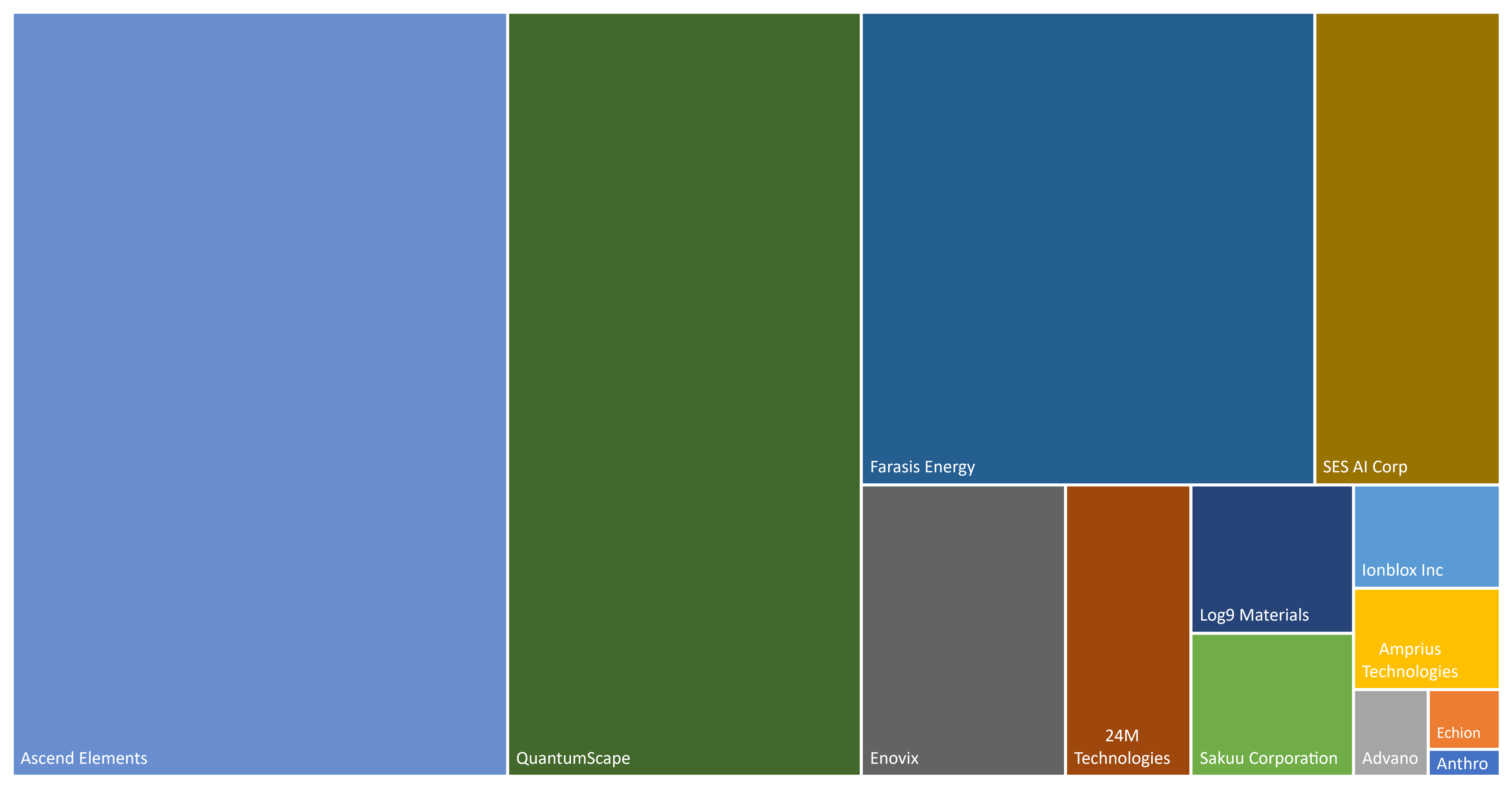

Many start-up companies have started developing and manufacturing lithium-ion batteries to fulfill the increased demand for batteries. These lithium-ion battery manufacturers are not only working on batteries as a final product but also working on innovative chemistry of various materials used in batteries, increasing the battery's efficiency in multiple ways. To support these lithium-ion battery manufacturer startups, venture capitalists have invested an enormous amount in developing lithium-based batteries. Since 2018, it is estimated that funding for battery-related startups has surpassed USD 25 billion, with expectations of further increases in the near future. Below are the brief details of some of the startups working towards the development of lithium-ion batteries, which include 24M Technologies, Advano, Amprius Technologies, Anthro, Ascend Elements, Echion Technologies, Enovix, Farasis Energy, Ionblox Inc, Log9 Materials, NorthVolt, QuantumScape, Sakuu Corporation, and SES AI Corp.

Extent of Funding to Battery-Related Startup

Note: The above data is just for reference and does not reflect the complete ecosystem of funding for battery startup.

Top 14 Lithium-Ion Batteries Manufactureres Worldwide-

24M Technologies:

MIT spinout 24M Technologies has revolutionized lithium-ion battery production with its "SemiSolid" design, employing gooey electrodes, which reduces production costs by up to 40%. This innovation enhances energy density, safety, and recyclability. Companies like Volkswagen, Fujifilm, and Axxiva have licenses from 24M's technology, with plans to establish gigafactories in India, China, Norway, and the United States. 24M's platform allows large-scale production of batteries with different lithium-ion chemistries, providing flexibility for future advancements without major changes to manufacturing processes and offering potential breakthroughs for electric vehicle adoption and renewable energy storage.

ADVANO:

Founded in 2016, ADVANO focuses on advancing energy storage through its proprietary technology, REALSi™, integrated into current Lithium-ion batteries. The REALSi™ technology enhances energy storage and accelerates charging by incorporating earth-abundant silicon. Based in New Orleans, Louisiana, and a Y-Combinator graduate, ADVANO has received support from notable investors like Build Collective, Mojo Partners, DCVC, PeopleFund, and Mitsui Kinzoku. The company aspires to become a global leader in battery-grade silicon technology, contributing to the transition to clean energy. In 2019, Advano acquired Nanostart, which provides semiconductor products with silicon solutions for Li-ion batteries.

Amprius Technologies:

Amprius Technologies, founded in 2008, is a leading manufacturer of high-energy and high-power lithium-ion batteries known for its breakthrough performance in silicon anode technology. The company's batteries have achieved record energy densities, with the latest cells reaching over 500 Wh/kg and 1321 Wh/l at 25°C, validated by industry leaders. Amprius' silicon batteries utilize more silicon, enabling higher energy density and excellent cycle life, with a 100% silicon anode providing up to 10 times the capacity of graphite anodes. The company's patented silicon anode technology has produced the world's highest energy density rechargeable lithium-ion batteries, ideal for applications such as electric mobility and portable electronic devices.

Anthro Energy:

Energy is a company focused on advancing battery technology, particularly in developing bendable lithium-ion batteries. These batteries are designed to withstand mechanical deformation, making them suitable for various applications, including wearables, military, and medical devices. The company's innovative approach aims to overcome the limitations of traditional rigid batteries, enabling their use in previously unsafe or space-limited applications, such as drones and electric vehicles. The company has received significant support, including a $7.2 million seed funding round led by Union Square Ventures and Energy Revolution Ventures, to accelerate the commercialization of its core battery technology.

Ascend Elements:

Ascend Elements, founded in 2015, is a U.S.-based company focused on sustainable engineered materials and lithium-ion battery recycling. The company has been actively involved in revolutionizing the production of sustainable lithium-ion battery materials, with a particular emphasis on closed-loop battery material solutions. Ascend Elements has secured a total funding of approximately USD 843 Million. This funding is intended to accelerate the commercialization of the company's innovative and proprietary Hydro-to-Cathode™ technology, establishing a closed-loop EV battery materials supply chain in North America. The company aims to address the urgent need for sustainable lithium-ion battery materials and contribute to developing the domestic EV supply chain for the global energy transition.

Echion Technologies:

Echion Technologies is a Cambridge University start-up that focuses on developing new technology for lithium-ion batteries. Founded in 2017, the company has received significant funding from various sources, including a "significant" investment from US investor Volta Energy Technologies and funding from the UK Government through the Faraday Battery Challenge. Echion's innovative XNO® battery material aims to improve lithium-ion batteries' performance, addressing current limitations such as anode material and charging time. The company is targeting industries like off-highway transportation and grid-scale energy storage, with the potential for self-charging e-ferries.

Enovix:

Enovix is a company that specializes in developing and producing 3D silicon lithium-ion batteries, aiming to improve mobile product performance and energy density. Founded in 2006 and headquartered in California, Enovix has raised approximately $220 million in total funding. Enovix's investors include strategic partners like Intel, Qualcomm, and Cypress and institutional investors like Sofinnova Investments, DCM Ventures, and York Capital Management. The company is building a $1.2 billion high-volume manufacturing facility and expects to supply the electric vehicle market within five years.

Farasis:

Farasis Energy is a leading supplier of lithium-ion battery technology and pouch cells for electric vehicles. The company has been at the forefront of research and development in battery recycling, having validated a sustainable Direct Recycling process for lithium-ion batteries, which enables the recovery and reuse of valuable materials, significantly enhancing environmental friendliness and sustainability. In 2023, the United States Advanced Battery Consortium (USABC) awarded Farasis Energy a $2.6 million contract for developing and manufacturing lithium electrode-based cells as part of a broader effort to advance battery technology.

Ionblox:

Ionblox Inc. is a next-generation lithium-ion battery company focusing on developing high-energy-density batteries for various applications, including electric aviation and electric vehicles. Founded in 2017, the company is based in Fremont, California. Ionblox's unique technology features pre-lithiated silicon anodes, enabling high power and fast charging. The company has attracted significant investment, with approximately USD 56 million in total funding. Strategic partners in this round include original investors Lilium and Applied Ventures and Temasek and Catalus Capital. The company will use this funding to develop advanced high-power cells for electric aviation and prototype fast-charging batteries for electric vehicles. Ionblox has also formed a joint development agreement with Gelion to develop lithium-silicon-sulfur batteries. With over 40 issued patents, Ionblox is poised to revolutionize the lithium-ion battery industry.

Log9 Materials:

Log9 Materials, founded in 2015, is a prominent player in the lithium-ion battery ecosystem. The company has been actively involved in manufacturing lithium-ion cells and has recently raised a Series-B funding round, bringing its total funding to approximately USD 89.2 million. Log9 has also made significant strides in battery recycling, forming strategic alliances and introducing innovative approaches such as chemistry-based financing and battery tokenization. The company's focus on the complete circular economy of lithium-ion batteries and its efforts in enhancing the sustainability of EV batteries reflect its commitment to driving innovation and addressing the growing demand for energy storage solutions in India and beyond.

Northvolt:

Northvolt is a Swedish lithium-ion battery manufacturer founded in 2016 by Paolo Cerruti and Peter Carlsson. The company focuses on providing eco-friendly batteries with a minimal carbon footprint and recycling capabilities. Northvolt has secured over $9 billion in debt and equity since 2017, including $1.2 billion raised in August 2023 and another $1.2 billion raised in December 2023. The company has built Europe's first homegrown gigafactory in Sweden and is developing other North American and German factories. Northvolt has secured orders worth over $55 billion from key customers, including BMW, Fluence, Scania, Volvo Cars, and Volkswagen Group.

QuantumScape:

QuantumScape, founded in 2010, is a company focused on revolutionizing energy storage with its solid-state lithium-metal battery technology. The company has developed an anode-less cell design to deliver high energy density while reducing material costs and simplifying manufacturing. QuantumScape has raised approximately $1.0 billion, with significant investments from Volkswagen Group of America Investments and other sources. The company has a partnership with Volkswagen, with the potential to integrate its batteries into cars by 2025, and has made significant claims about the performance of its solid-state batteries, including fast recharging and increased range compared to traditional lithium-ion batteries.

Sakuu Corporation:

Sakuu Corporation, founded in 2019, is a leading provider of solid-state battery solutions, specializing in 3D-printed batteries and dry electrode manufacturing for next-generation lithium-ion cells. The company has secured approximately $62 million in funding to advance its innovative battery technologies and bring them to market. Sakuu's focus on 3D printing and dry electrode processes aims to revolutionize battery production by eliminating solvents and strengthening domestic manufacturing. The company has also licensed its battery technology for producing lithium metal cells, positioning itself at the forefront of battery innovation and sustainable energy solutions.

SES AI:

SES AI is a Boston-based company founded in 2017 that pioneers the development of advanced Li-Metal batteries for electric vehicles (EVs) and electric vertical takeoff and landing (eVTOL) aircraft. The company's Li-Metal batteries offer higher energy density and are lighter, scalable, and smarter compared to conventional Li-ion batteries. The company has raised funding of approximately USD 324 million. SES AI takes a systems approach to developing and commercializing Li-Metal batteries, focusing on large-scale manufacturing and practical implementation. The company's global headquarters is in Woburn, Massachusetts, and it has a pilot-scale production facility in Shanghai. SES AI has received funding from a range of investors, including SK, Temasek, Geely, Shanghai Auto, Vertex, Koch, LG, Tianqi Lithium, and Applied Materials, among others, to support its innovative battery technology.

We at Marketsandmarkets have developed a detailed study on Lithium Ion batteries and their related ecosystem, which includes a study on Battery anode, electrolyte, binder, recycling, and lithium metal. We studied lithium-ion batteries in terms of types like NMC, LFP, LCO, LTO, LMO, NCA, capacity in terms of mAh, Voltage, application, and region. The lithium-ion battery market is expected to grow at a CAGR of more than 14% and is estimated to reach more than USD 180 billion in the next 10 years.

Authored by Farhan Hussain, Co-Authored by Kevin Kelly, Co-author Shweta Surender, MarketsandMarkets

- Lithium-ion Battery Market by Battery Type (NMC, LFP, LCO, LTO, LMO, NCA), Cell Type (Prismatic, Pouch, Cylindrical), Capacity (<50 kWh, 50-100 kWh, >100 kWh), Energy Storage (Residential, Utilities) Consumer Electronics, Medical - Global Forecast to 2033

- Battery Technology Market by Type (Lithium-ion Battery, Lead Acid, NiMh, NiCd, Sodium-ion, Solid-state Battery, Redox Flow Battery, Lithium Silicon, Lithium Sulfur Battery), Li-ion Battery Type (LFP, NMC, LCO, LTO, LMO, NCA) - Global Forecast to 2030