-

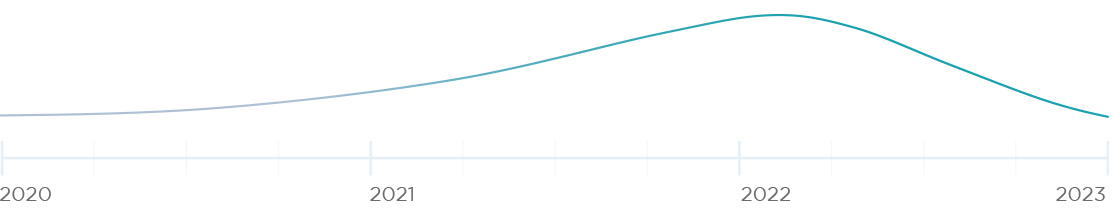

2020

● Global Pandemic

● Major Downfall in Oil Prices

● Crippled Global Supply Chains

-

2021

● 10X Increase in New Money Printed

● Global Semiconductor Chip Shortage

● Lowest Repo Rates to Combat Economic Downturn

-

2022

● Hyperinflation surge

● Russia's Invasion of Ukraine

-

2023

● Global Recession?

The world economy continues to be driven by such disruptive mega-events. There's a threat of recession looming this year because of the cumulative effects of the global pandemic followed by Russia's invasion of Ukraine. This is not the first global recession the world has seen, and it won't be the last. Companies have bounced back from economic recessions before and will continue to do so.

What differentiates such companies from those that don't survive in the face of unpredictable forces?

Secret Sauce to Navigating through Uncertainties

Should you switch to survival mode and double down on your Business-as-usual (BAU) or focus on your investments and prepare alternative growth scenarios by unlocking resources in existing markets?

The key here is to narrow down your focus to LESS markets/opportunities to get MORE growth and profitability out of them.

According to MarketsandMarkets research, the B2B economy will witness $25 trillion of disruptive revenue opportunities by the end of this decade and will comprise these LESS opportunities.

THE CONTRIBUTION OF THESE DISRUPTIVE OPPORTUNITIES IN GLOBAL B2B ECONOMY WILL INCREASE FROM 12% IN 2022 TO 40% IN 2030

Register for the "Less Is More" event to get a first-mover advantage with our exclusive and actionable insights, specially curated for your industry

Less is More Mega Trends Playlist

The Less is More Curve

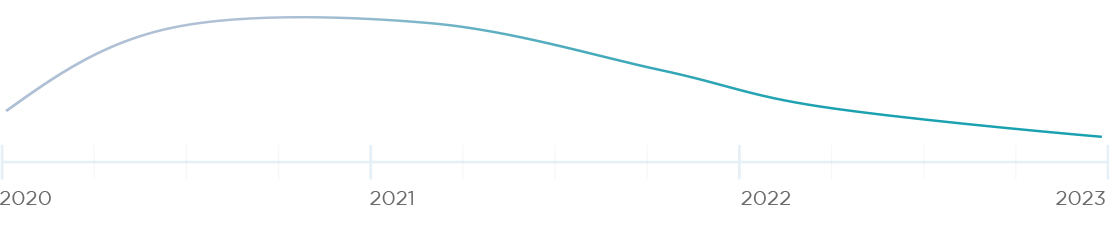

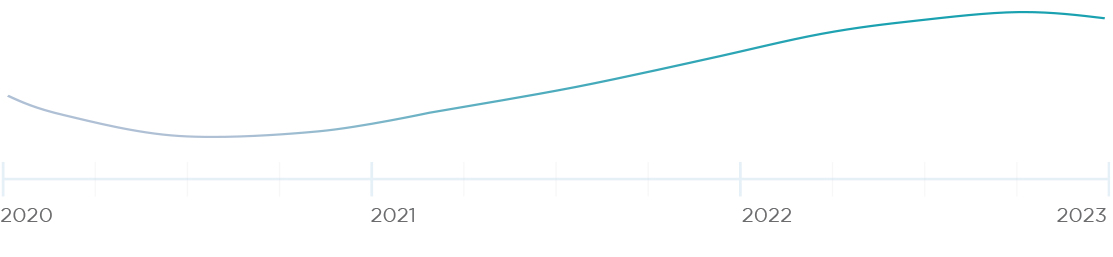

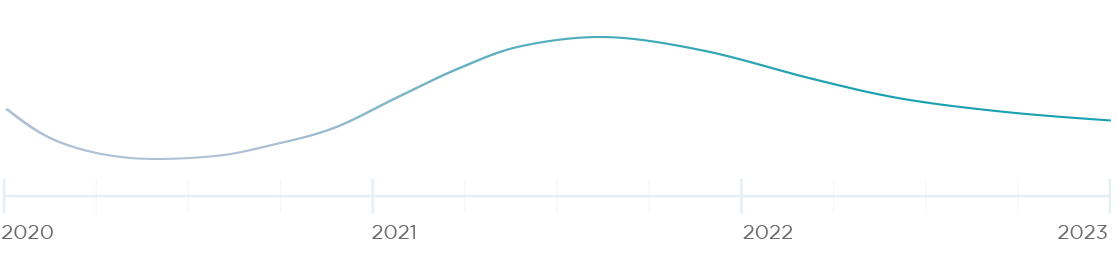

Every business goes through phases of growth, marked by ups and downs in their revenues, profitability, share price, etc. Companies often stagnate or de-grow on the growth-time continuum, owing to overfocusing on their BAU.

A critical source of competitive advantage in the 21st Century is playing the 'Less is More' sine curve with proactive market choices

Identify your LESS and generate your MORE!

Connect with us to explore the 5 pathways to revenue success for your business.

| Opportunity Prioritization (Attractiveness VS Right To Win) | New Market Entry (Geographies, Customers, Technology, End Use Case/Industry) | Competitive Analysis & Right to Win | Voice Of Customers (Unmet Needs) |

| Customer Identification & Prioritization | Voice Of Customer & Refine Value Proposition | Competitive Anlysis (Right to Win) | Partner Identification & Prioritization | Pricing Strategy/Commercial Model | M&A or Inorganic Growth |

| In-depth Competitive Insights & Quarterly Updates | Voice Of Customer: Perception Of Client Vs Competitors | Positioning And Differentiation Via 360 Quadrants |

| Account Iq - Executive Conversation And Demand Enablement | Account Nudges (Connect IQ) | Buying Centre Expansion : Unmet Needs and Share of Wallet | Value Prop and Right to Win V/S Competitior |

| Thought Leadership Content For Campaigns (Whitepapers, Films) | Events/Roadshows | Account Based Marketing | Sales Play/Sales Priority And Localisation | Positioning And Differentiation Via 360 Quadrants |

Meta

Meta

PELOTON

PELOTON