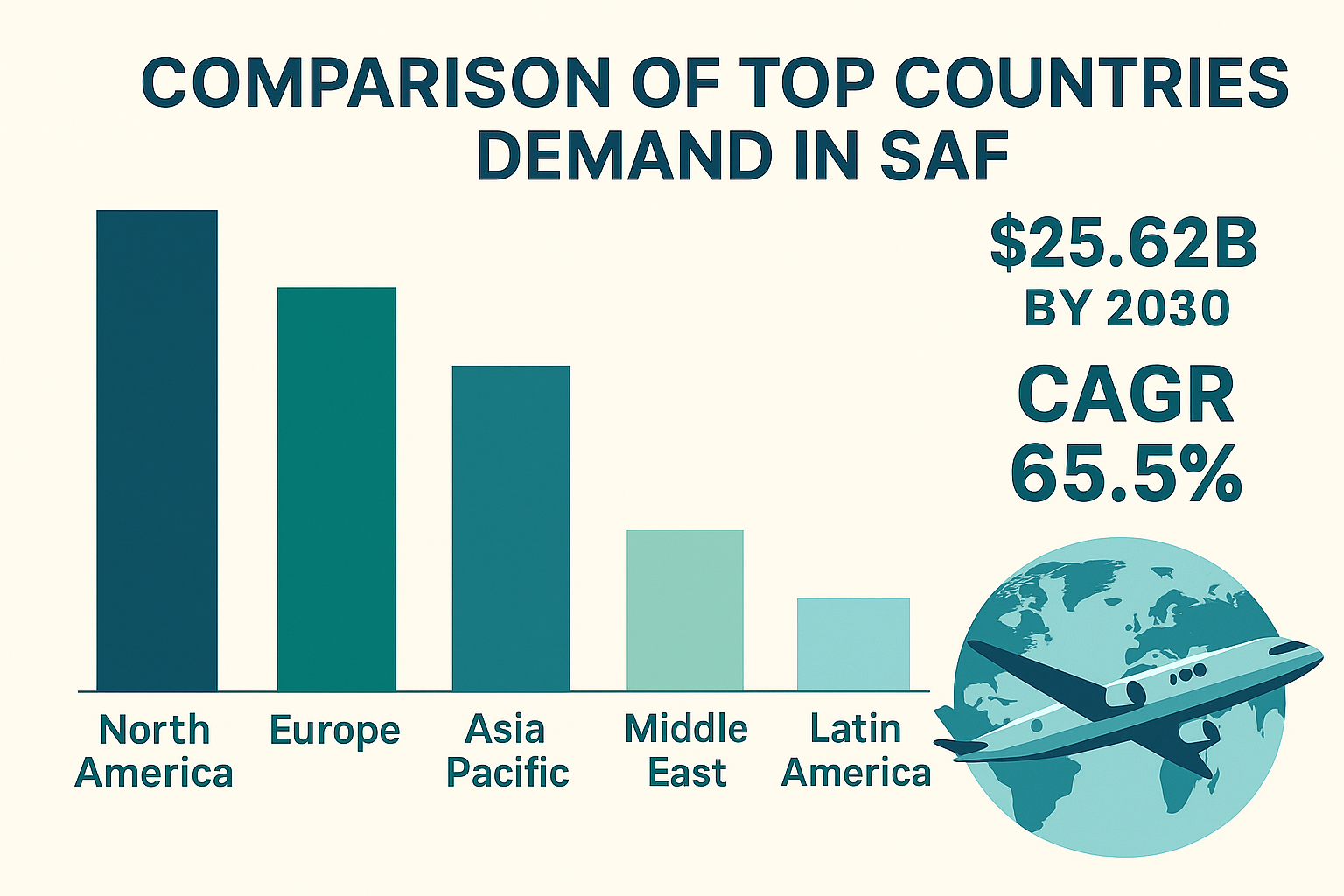

Comparison of Top Countries Demand in SAF

The Sustainable Aviation Fuel Market is experiencing an unprecedented transformation as countries across the globe intensify their efforts to decarbonize aviation. With growing environmental concerns, technological advancements in feedstock processing, and a surge in aircraft production and fleet expansion, the demand for sustainable aviation fuel (SAF) is accelerating at a remarkable pace. The market is projected to reach USD 25.62 billion by 2030, growing from USD 2.06 billion in 2025 at a staggering CAGR of 65.5%. In terms of volume, consumption is forecasted to increase from 0.30 billion gallons in 2025 to 3.68 billion gallons by 2030.

The rising focus on reducing lifecycle greenhouse gas emissions by up to 80% compared to conventional jet fuel, combined with regulatory frameworks and airline commitments toward net zero targets, positions SAF as a cornerstone of sustainable air transport. This blog provides an in depth comparative analysis of the demand for SAF across top regions North America, Europe, Asia Pacific, the Middle East, and Latin America while highlighting the strategies of key players shaping the market.

Market Overview

The Sustainable Aviation Fuel Market is primarily driven by a mix of environmental, economic, and regulatory factors. The aviation sector is responsible for approximately 2–3% of global carbon emissions, and with air travel expected to rise sharply in the coming decades, governments, airlines, and fuel producers are working to accelerate the adoption of SAF.

Recent technological innovations, including Hydroprocessed Esters and Fatty Acids (HEFA), Fischer Tropsch synthesis, and Alcohol-to-Jet (AtJ) pathways, are enabling the efficient transformation of feedstocks such as used cooking oil, agricultural waste, municipal solid waste, and algae into SAF. These technologies are not only improving fuel quality but also making SAF more cost competitive.

Despite these advances, the market continues to face challenges, including high production costs, infrastructure limitations, and the need for scalable solutions. However, the opportunity for SAF adoption is significant as regulatory pressures intensify and airlines seek sustainable options to meet corporate social responsibility goals and climate commitments.

Regional Demand Comparison

North America

North America leads the Sustainable Aviation Fuel Market, driven by strong policy support, significant feedstock availability, and the presence of leading SAF producers. The US market benefits from a robust biofuel industry and large scale investments by major airlines such as United, Delta, and American Airlines, who have signed long term contracts with SAF producers. The region is projected to reach USD 10.66 billion by 2030, with a CAGR of 50.1%.

Canada is also advancing its SAF adoption through supportive regulations such as the Clean Fuel Regulations, which aim to reduce lifecycle carbon emissions across transportation sectors. The infrastructure challenge remains, but continued government support and private sector collaboration position North America as the global leader in SAF production and consumption.

Europe

Europe is one of the most proactive regions in the Sustainable Aviation Fuel Market, thanks to ambitious climate policies, including the European Union’s ReFuelEU Aviation regulation, which mandates increasing SAF blending levels in jet fuel. Countries such as the UK, France, Germany, and the Netherlands are heavily investing in SAF production and refining capabilities.

Neste, headquartered in Finland, is one of the largest SAF producers globally and supplies major European carriers. Airlines such as British Airways, Lufthansa, and Air France are actively incorporating SAF into their fuel mix. Europe’s strong regulatory push, coupled with public demand for sustainable travel, ensures that the region remains at the forefront of SAF adoption.

Asia Pacific

The Asia Pacific region presents significant growth potential in the Sustainable Aviation Fuel Market, fueled by rapid economic development, expanding airline fleets, and government led sustainability initiatives. Countries such as China, Japan, India, and Australia are increasingly prioritizing SAF production to meet both domestic and international climate targets.

China is investing in large scale biomass utilization and SAF refining technologies, while Japan has set ambitious targets for SAF blending by 2030. India is gradually building momentum in renewable energy and low carbon fuel adoption, positioning itself as an emerging player in the SAF industry.

Middle East

The Middle East is a hub of global aviation, with airlines such as Emirates, Qatar Airways, and Etihad Airways leading international travel. The region’s demand for SAF is rising due to both international pressure and the airlines’ strategic sustainability goals. Governments and energy companies are partnering to establish SAF production facilities, leveraging abundant feedstock potential from waste and renewable resources.

The UAE and Saudi Arabia are spearheading SAF initiatives, with projects focusing on biofuel and synthetic fuel production. The region’s aviation centric economy ensures that SAF will become an integral part of long term growth strategies.

Latin America

Latin America represents an emerging market for SAF, with Brazil leading the charge due to its strong biofuel industry. The region benefits from abundant biomass feedstock availability, including sugarcane ethanol, which can be processed into SAF. Airlines in Brazil, Mexico, and Colombia are gradually incorporating SAF into their operations, supported by government programs and international collaborations.

While infrastructure and investment challenges remain, Latin America’s natural resources provide it with a strong foundation to expand SAF production and meet rising global demand.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70301163

Market Drivers

The Sustainable Aviation Fuel Market is driven by three primary factors:

- Advancements in feedstock processing and refining technologies, which make SAF production more scalable and efficient.

- Increasing global pressure to reduce greenhouse gas emissions and achieve net zero targets.

- Airline commitments and government regulations mandating SAF blending in jet fuel.

Market Restraints

Despite its promise, the market faces hurdles such as:

- High production costs compared to conventional jet fuel.

- Limited infrastructure for production, blending, and distribution.

- Economic uncertainty for airlines operating on thin margins.

Market Opportunities

The Sustainable Aviation Fuel Market is poised for growth through:

- Expanding technological innovations, including carbon capture integration in refining processes.

- Increased consumer and corporate demand for sustainable travel.

- Policy incentives, subsidies, and international agreements supporting SAF adoption.

Key Market Challenges

Challenges include inadequate infrastructure, the need for large scale production facilities, and hesitancy from airlines to adopt SAF without clear economic incentives. Overcoming these hurdles will require coordinated efforts between governments, fuel producers, airlines, and technology developers.

Key Players in the Sustainable Aviation Fuel Market

The competitive landscape of the Sustainable Aviation Fuel Market includes a mix of global energy companies, biofuel specialists, and innovative startups.

Neste (Finland)

Neste is a global leader in renewable fuels and the largest SAF producer in the world. Its flagship product, Neste MY Sustainable Aviation Fuel, is widely adopted by airlines across Europe, North America, and Asia. Neste’s focus on scaling production capacity and long term airline partnerships positions it as a dominant force in the SAF industry.

Shell (UK)

Shell has invested heavily in SAF production, leveraging its global refining and distribution network. The company is focusing on developing scalable SAF technologies and aims to become one of the leading suppliers of low carbon aviation fuels worldwide.

TotalEnergies (France)

TotalEnergies is advancing SAF projects across Europe, focusing on partnerships with airlines and governments to support large scale adoption. The company is also investing in new refining technologies to improve SAF cost competitiveness.

OMV Aktiengesellschaft (Austria)

OMV is expanding its SAF production capacity with a focus on HEFA based fuels. It is actively collaborating with airlines and airports in Europe to ensure sustainable fuel availability.

World Energy, LLC (US)

World Energy is one of the pioneers in SAF production in North America, operating commercial scale plants that supply SAF to airlines in the US and globally. Its role in advancing bio based fuels makes it a significant contributor to market growth.

Lanzatech (US)

Lanzatech specializes in gas fermentation technology, converting industrial emissions into SAF. Its innovative approach positions it as a disruptor in the market with strong sustainability credentials.

Velocys Plc (US)

Velocys is focused on Fischer Tropsch synthesis based SAF production, leveraging waste feedstocks and biomass. The company partners with airlines and governments to expand SAF capacity.

Skynrg (Netherlands)

Skynrg is a specialist in SAF supply and logistics, ensuring airlines can access SAF globally. It is actively working on new projects to expand the availability of sustainable fuels.

Topsoe (Denmark)

Topsoe provides advanced refining technology for SAF production, supporting global energy companies in scaling capacity. Its expertise in catalysts and process optimization strengthens SAF adoption.

BP Plc (UK)

BP is heavily investing in SAF as part of its long term decarbonization strategy. The company is leveraging its refining infrastructure and airline partnerships to become a key supplier in the global SAF market.

Future Outlook

The Sustainable Aviation Fuel Market will play a crucial role in aviation’s path toward decarbonization. With supportive policies, increasing airline adoption, and advancing technologies, SAF is positioned to become the dominant alternative to fossil based jet fuel by 2030. Regional leaders like North America and Europe will continue to drive global growth, while Asia Pacific, the Middle East, and Latin America emerge as critical contributors in the long term.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024