Feed Additives Market on Track for 5.6% CAGR Through 2029

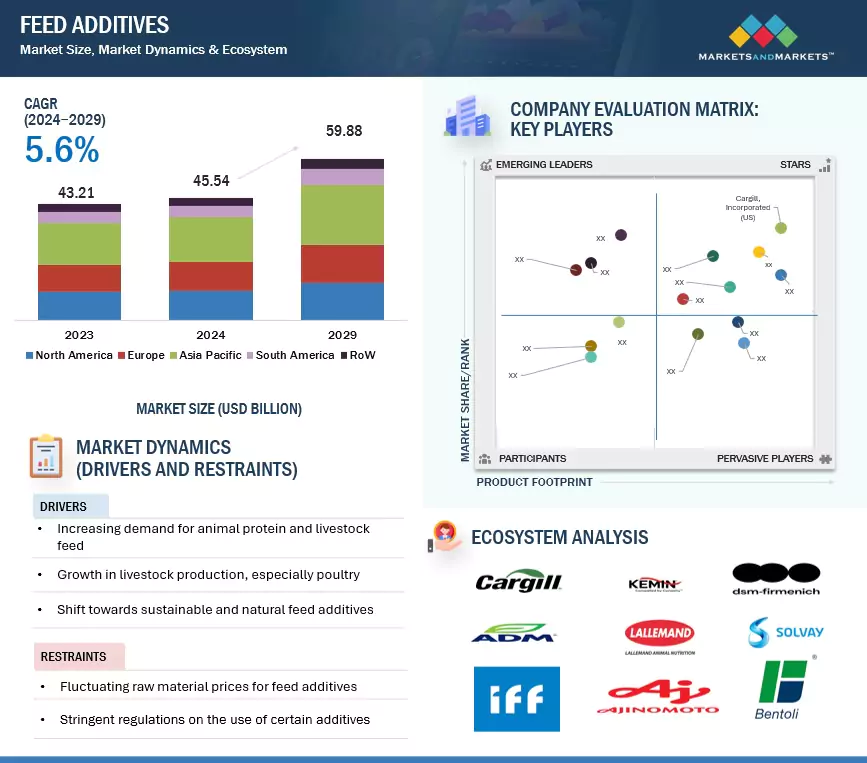

The global feed additives market is on a strong growth trajectory, estimated at USD 45.54 billion in 2024 and projected to reach USD 59.88 billion by 2029, registering a CAGR of 5.6% during the forecast period. This growth reflects the rising importance of feed additives in enhancing the quality, safety, and efficiency of animal farming worldwide.

Why Feed Additives Matter

Feed additives play a pivotal role in improving the nutritional profile of animal feed, boosting livestock health, and ensuring sustainable productivity. These include vitamins, minerals, amino acids, enzymes, probiotics, and acidifiers, which help in:

- Strengthening animal immunity

- Enhancing growth and feed efficiency

- Reducing environmental impact

- Meeting consumer demand for high-quality meat, dairy, and other animal products

With increasing global demand for protein and rising awareness of animal health, the animal feed additives market is emerging as a cornerstone of modern livestock and poultry farming.

Liquid Feed Additives on the Rise

One of the fastest-growing categories is liquid feed additives. Innovations are making liquid formulations more efficient and impactful. For example, in October 2022, Kemin Animal Nutrition and Health (US) launched MillSAVOR Liquid and Liquid Concentrate, which improve milling efficiency, reduce energy consumption, and enhance pellet durability. Such advancements highlight how liquid feed additives are reshaping production processes for better feed quality and performance.

Natural Sources Gaining Momentum

A major shift in the market is the growing preference for natural feed additives market solutions. Consumers are increasingly opting for animal products that are free from synthetic additives and antibiotics. This is driving demand for plant, herb, spice, enzyme, probiotic, and essential oil-based additives.

Recent innovations include:

- Kemin AquaScience’s Pathorol (2023): A phytogenic additive promoting shrimp digestive health and growth.

- Amlan International (2022): Natural mineral-based additives for gut health in poultry and livestock.

With stricter global regulations on antibiotics in animal farming, natural alternatives are expected to dominate, aligning with consumer trends toward organic, antibiotic-free, and sustainable products.

Request Custom Data to Address your Specific Business Needs

Regional Insights: Europe Leading the Market

Europe holds a significant share of the feed additives market, driven by sustainability regulations and strong innovation. While overall feed production in Europe has seen some decline, the pet feed and poultry feed sectors remain resilient.

Leading players in the European feed additives market include:

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- dsm-firmenich (Switzerland)

- Novonesis Group (Denmark)

- Adisseo (France)

- Nutreco (Netherlands)

Recent investments reinforce Europe’s commitment to innovation and supply security, such as Evonik’s USD 26.5 million investment in MMP production (2023) and Nutreco’s USD 26.8 million feed plant inauguration in Nigeria (2024).

Market Outlook

The global animal feed additives market size will continue to expand, powered by:

- Innovation in feed formulations

- Shift toward natural and sustainable products

- Growing consumer demand for safe and high-quality animal proteins

- Technological advancements improving feed efficiency

As animal farming evolves to meet sustainability goals, feed additives will remain central to improving productivity, health, and environmental outcomes.

Key Questions Addressed by the Report

Q1. What is the current size of the feed additives market?

The feed additives market is estimated at USD 45.54 billion in 2024 and is projected to reach USD 59.88 billion by 2029, at a CAGR of 5.6% during the same period.

Q2. Which are the key players in the market, and how intense is the competition?

Cargill, Incorporated (US), ADM (US), dsm-firmenich (Switzerland), International Flavors & Fragrances Inc (US), and BASF SE (Germany) are the key players in the feed additives market. The market is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Q3. Which region is projected to account for the largest share of the feed additives market?

The Asia Pacific market is expected to lead during the forecast period. The increasing consumer preference for healthier and safer animal products has driven the use of feed additives to enhance the nutritional quality of meat, eggs, and milk.

Q4. What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

Q5. What are the factors driving the feed additives market?

The growing poultry and swine industries in Asia Pacific require feed additives to enhance growth, immunity, and meat quality. Feed additives improve feed conversion ratios, resulting in better livestock growth and production, making them attractive for farmers.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024