Cold Chain Market Analysis: Trends, Growth Drivers, and Opportunities

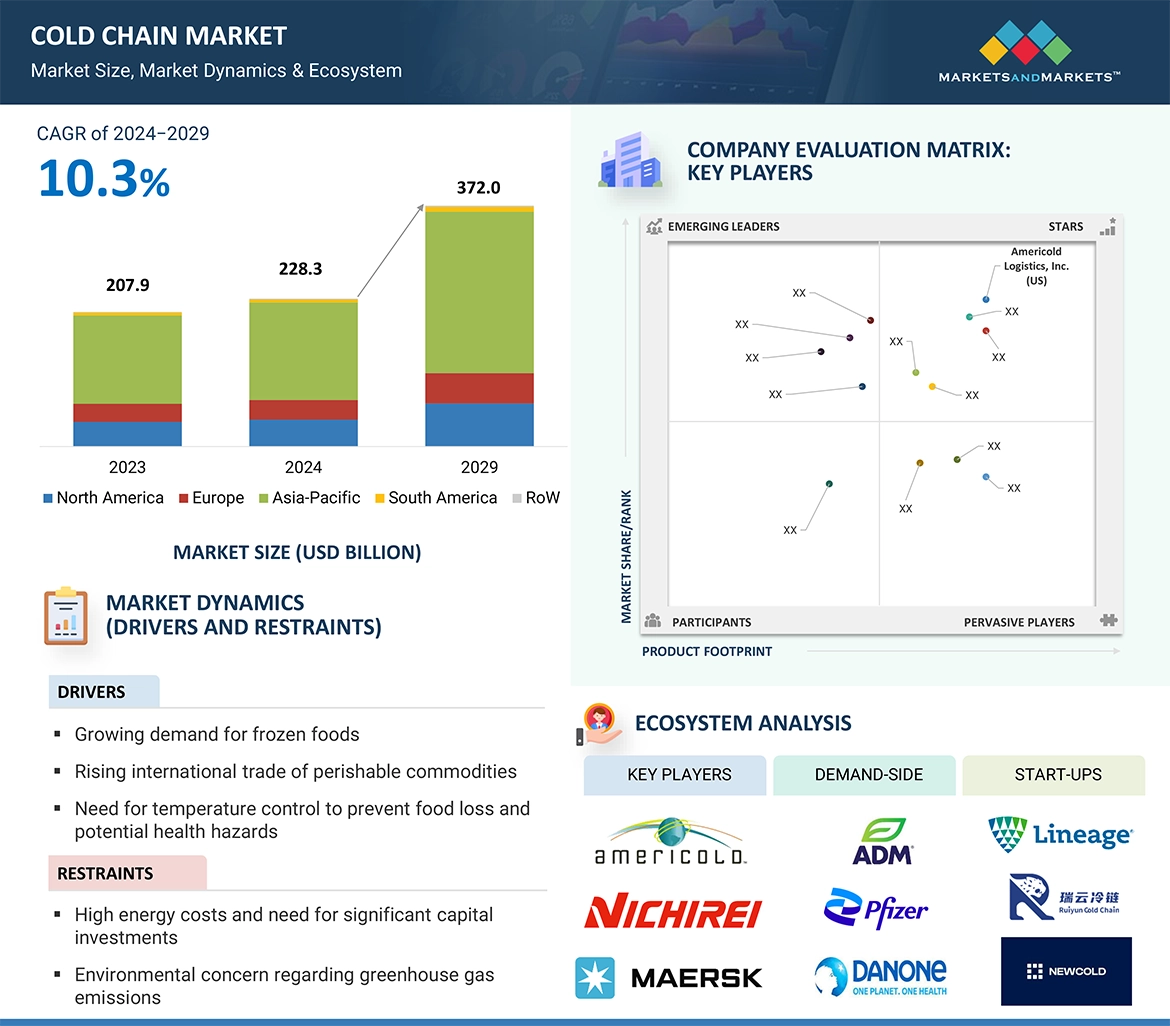

According to a research report “Cold Chain Market by Type, Temperature Type (Chilled, Frozen, and Deep-frozen), Application (Food & Beverages, Pharmaceuticals), Technology (Blast Freezing, Vapor Compression, Programmable Logic Controller) and Region - Global Forecast to 2029” published by MarketsandMarkets, the global cold chain market, valued at USD 228.3 billion in 2024, is projected to reach USD 372.0 billion by 2029. This represents a strong CAGR of 10.3% during the forecast period.

Organized Retail Driving Market Growth

The growth of organized retail has significantly fueled the demand for the cold chain market. According to the Retailers Association of India (RAI), sales in the organized retail sector grew by 34% in 2022–23 compared to pre-pandemic FY20 levels. Supermarkets, hypermarkets, and quick-service restaurants increasingly rely on cold chain logistics to preserve the quality of perishable goods such as fruits, vegetables, bakery items, dairy products, electronics, and meats.

Additionally, evolving consumer preferences toward frozen and chilled foods have amplified the need for reliable networks. Stringent food safety regulations further highlight the importance of effective cold chain market analysis across retail channels.

International Trade Fuels Expansion

Global trade liberalization has played a major role in boosting the food cold chain market. With reduced trade barriers, perishable goods including fruits, vegetables, baked goods, and pharmaceuticals are increasingly shipped across borders.

For instance, the USDA reported that U.S. baked goods exports in 2022 reached USD 4.21 billion, up from USD 3.73 billion in 2021. Canada remained the top importer, followed by Mexico, Japan, South Korea, and the Philippines. Similarly, the UK’s Dairy Export Programme, announced in 2023, allocated USD 1.2 million to enhance global exports of British dairy products, further underlining the sector’s international focus.

Request Custom Data to Address your Specific Business Needs

Social Media Influencing Demand

Digital platforms and influencers are reshaping consumer preferences. Culinary content promoting butter, cheese, and other dairy products has spurred rising demand in Asian markets where these were once niche. According to the FAO, China saw a 7% increase in butter imports in 2022, driven largely by growth in the bakery sector. This cultural exchange, amplified by social media, highlights the increasing need for temperature-controlled logistics to maintain product quality across borders.

Technology Enhancing Efficiency

Advancements such as IoT-enabled monitoring systems, real-time temperature tracking, and blockchain-based traceability are strengthening reliability in the food cold chain market size. These innovations help companies meet stringent food safety and pharmaceutical standards while minimizing spoilage during transportation.

Refrigerated LCVs Gaining Momentum

Among refrigerated road transport, light commercial vehicles (LCVs) are expected to post the highest growth rate. Their versatility in navigating urban areas and cost-effectiveness make them an attractive option for last-mile distribution. The trend toward sustainability also favors smaller, fuel-efficient LCVs, aligning with industry efforts to lower emissions.

India: The Fastest-Growing Market in APAC

India is poised for the fastest growth in the Asia Pacific cold chain market size. With high dairy consumption—nearly half the population regularly consuming milk or curd—and increasing urbanization, demand for efficient logistics is soaring.

Reports show India’s daily milk consumption stands at 427 g per person, well above the global average of 305 g. Moreover, the rapid expansion of quick-service restaurants (QSRs)—expected to grow by 20–25% in FY24—combined with growth in pharmaceuticals and processed foods, is creating immense opportunities for cold chain providers.

Key Market Players

Major companies shaping the cold chain industry include:

- Americold Logistics, Inc. (US)

- Lineage, Inc. (US)

- NICHIREI CORPORATION (Japan)

- Burris Logistics (US)

- A.P. Moller - Maersk (Denmark)

- Tippmann Group (US)

- Coldman Logistics Pvt. Ltd. (India)

- United States Cold Storage (US)

Frequently Asked Questions

- What is the cold chain market and why is it important?

- How big is the global cold chain market expected to be by 2029?

- Which factors are driving the growth of the cold chain market size worldwide?

- What are the key challenges faced in the food cold chain market?

- Which technologies are transforming the cold chain market analysis today?

- How is the food cold chain market size evolving in emerging economies like India?

- What role does organized retail play in the expansion of cold chain infrastructure?

- Which applications—food & beverages or pharmaceuticals—dominate the cold chain industry?

- How are refrigerated LCVs shaping last-mile distribution in the cold chain sector?

- Who are the leading players operating in the cold chain market globally?

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024