Europe’s Prominence in the Global Vector Control Market

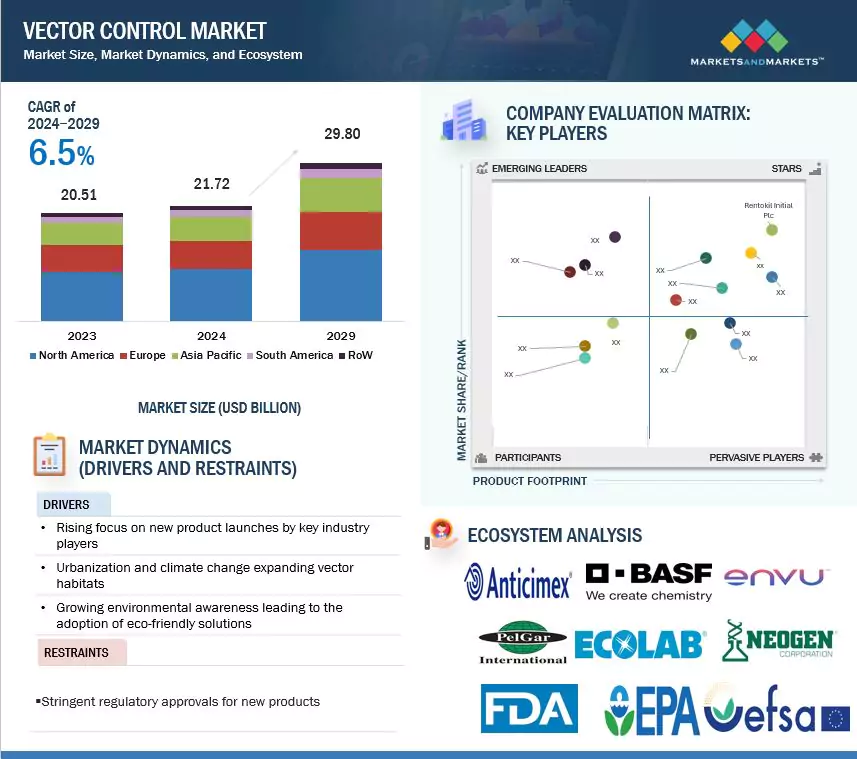

According to a research report "Vector Control Market by Technology (Chemical, Physical & Mechanical, Biological), Control Method (Comprehensive, Integrated Vector Management, Targeted), Vector Type, End-Use Sector, Mode of Application and Region - Global Forecast to 2029" published by MarketsandMarkets, the global vector control market is estimated at USD 21.72 billion in 2024 and is projected to reach USD 29.80 billion by 2029, growing at a CAGR of 6.5% during 2024–2029. This report provides a comprehensive vector control market analysis covering key technologies, control methods, and end-use sectors.

The market is fueled primarily by the prevalence of vector-borne diseases such as malaria, dengue, and Zika, alongside growing public health awareness. Governments and health agencies are increasingly investing in preventive measures to curb disease vectors, integrating traditional control methods with advanced technologies like AI-driven surveillance and biological solutions. Regulatory shifts toward eco-friendly practices are also driving demand for novel, sustainable vector control solutions. Urbanization and rising population densities further emphasize the need for effective vector management. These developments are expected to significantly influence the vector control market trends in the coming years.

Biological Vector Control Gaining Momentum

Among technologies, the biological segment is witnessing rapid growth due to increased demand for sustainable and environmentally safe pest management methods. With concerns over the environmental impact of chemical pesticides, biological approaches target pests while minimizing harm to non-target species and ecosystems. For instance, Anticimex (Sweden) offers Bti (Bacillus thuringiensis israelensis) treatment, a bacterium that selectively kills mosquito larvae without affecting humans, pets, or other wildlife.

Request Personalized Data Insights for Your Business Goals

Residential Sector Leads End-Use Market Share

The residential sector dominates the end-use segment, driven by the need to protect homes from disease-causing pests. As urban populations expand and awareness of health risks associated with mosquitoes, rodents, and other vectors increases, demand for effective control solutions grows. Additionally, the rising popularity of eco-friendly and non-chemical products has encouraged the adoption of biological vector control solutions in residential spaces, contributing to the overall vector control market size.

Europe Holds Significant Market Share

Europe represents a major share of the vector control market, thanks to strict public health regulations and high awareness of vector-borne diseases. The region invests heavily in effective control measures and fosters innovation in technologies like biological control and integrated pest management. Agencies such as the European Centre for Disease Control (ECDC) actively monitor diseases like West Nile fever and tick-borne encephalitis, providing risk assessments and outbreak information across the EU and its territories.

Key Players Shaping the Market

The report highlights prominent companies leading the global vector control market, including:

- BASF SE (Germany)

- Rentokil Initial Plc (UK)

- Sumitomo Chemical Co., Ltd. (Japan)

- Syngenta Group (Switzerland)

- FMC Corporation (US)

- Ecolab (US)

- Rollins Inc. (US)

- Anticimex (Sweden)

- UPL (India)

- Neogen Corporation (US)

- Senestech, Inc. (US)

- Environmental Science U.S. Inc. (US)

- Bell Laboratories Inc. (US)

- Pelgar International (UK)

- S. C. Johnson & Son, Inc. (US)

With growing investments in public health, regulatory support, and eco-conscious technologies, the vector control market is poised for steady growth through 2029.

Frequently Asked Questions

1. What is the current size of the vector control market?

The global vector control market is estimated at USD 21.72 billion in 2024 and is projected to reach USD 29.80 billion by 2029, growing at a CAGR of 6.5%.

2. What factors are driving the growth of the vector control market?

The market growth is driven by the prevalence of vector-borne diseases like malaria, dengue, and Zika, increasing urbanization, rising population density, and growing public health awareness. Regulatory support for eco-friendly solutions and advancements in technologies such as AI-based surveillance and biological control methods also contribute significantly.

3. Which end-use segment holds the largest share in the vector control market?

The residential sector holds the largest vector control market share, due to the increasing need to control pests in homes and prevent disease transmission. Eco-friendly and non-chemical solutions are seeing growing adoption in this sector.

4. Which technology segment is growing the fastest?

The biological vector control segment is growing rapidly, driven by demand for sustainable and environmentally safe pest management solutions. Products like Bti (Bacillus thuringiensis israelensis) target mosquito larvae without harming humans, pets, or other wildlife.

5. Which region has a significant share of the vector control market?

Europe holds a significant market share due to strict public health policies, high disease awareness, and investments in innovative pest control methods like integrated pest management and biological solutions.

6. Who are the key players in the vector control market?

Major players include BASF SE, Rentokil Initial Plc, Sumitomo Chemical, Syngenta Group, FMC Corporation, Ecolab, Rollins Inc., Anticimex, UPL, Neogen Corporation, Senestech, Environmental Science U.S. Inc., Bell Laboratories, Pelgar International, and S. C. Johnson & Son, Inc.

7. What are the current trends in the vector control market?

Key trends include the adoption of eco-friendly and biological solutions, integration of AI and digital surveillance for pest monitoring, increased awareness of public health, and regulatory shifts encouraging sustainable pest control practices.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024