The Med-Tech Crystal Ball

2023 ended balancing between market volatility and growth. Now, stakeholders are optimistic about an increase in demand of medical equipment and supplies in hospitals as the surgery backlogs are getting cleared, VCs are spending on new med-tech innovations, M&A enthusiasts are back in the market. As we progress, this crystal ball promises hope and optimism and that’s why it is important to that you take a closer look before your peers. Let us look at the top 5 to begin with.

For more details, get in touch with us here

1. MedTech Marketing and Sales increases budget for Tech adoption

Technological advancement in MedTech industry has assured that Gen AI may be the best solution for MedTech company. Besides helping physicians with better patient management, it is expected to help medical device company’s sales teams to find alternate paths to reach their end customers and can enable mass personalization and tailoring marketing messages to resonate more effectively with different customer segments. Many stakeholders have begun using the tool to enhance imaging quality (CT/MRI/ultrasound/others, e.g. Page, Pictor labs); guiding surgeons during procedures (Activ Surgical, Kaliber Labs); and brain health anomalies (DiagnaMed). 2024 will have many new players entering this space.

2. Generative AI and ML adds value in Connected MedTech or Integrated Diagnostics for better patient management and diagnosis

With the addition of Gen AI, AI and ML tools in medical devices, med tech especially in medical imaging and diagnosis is moving towards a connected ecosystem. AI-enabled devices are expected to be launched by Siemens Healthineers, GE Medical Systems, Fujifilm, and Hologic Inc. Companies are planning to add generative AI in 2024, e.g., Siemens (announced in November 2023) and Medtronic + NVIDIA (announced in March 2023). The focus on futuristic medical technology is back.

Earlier the focus on better patient management, now with usage of artificial intelligence, precision of diagnosis has reached a new level. In 2024, the industry is balancing between the demands from connected med-Tech and integrated diagnostic segments. While the former focuses on enhanced patient management example, Abbott is one of the early providers of connected MedTech devices for patients; it offers FreeStyle Libre (for diabetes) and CardioMEMS HF System (heart). These devices reduce the cost of care while providing an option to stay connected with patients. Integrated diagnostics on the other hand brings together sub-segments of med-tech together i.e. radio-diagnostics, laboratory diagnostics and treatment plan of a patient ensuring better compliance for providers, faster recovery and limiting the stay in IPD. Another major player, Medtronic announced its intentions to integrate NVIDIA Holoscan and initiated integration in 2023.

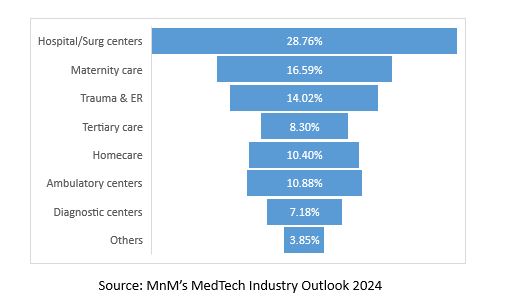

How will your business get impacted? Let’s segment the sectors where this integration will be in demand. If you are a distributor or supplier or manufacturer then you must look at the percentage split of segments that would need integration in coming days. If you are a service provider, then you must realize that there are peers who will invest in connected med-Tech this year. Markets and Market’s Med Tech Industry Outlook 2024 talks about the sub-segments where this opportunity will grow and how will be competing in this space.

3. Wearables or Remote Monitoring: The new revenue stream in a complex market

Well to an extent both segments are growing equally and globally. While wearable devices have moved beyond smart watches and monitoring calories burnt or steps taken in a day. Heart rate, oxygen saturation levels and pulse monitoring are new features that is attracting the GenZ and Gen Alpha generations. Earlier versions of wearable would limit the data (coming from an individual) to himself/herself. The new age versions allow users to upload the daily data to the company which in turn guides them on life-style correction and intervention. This is a major step towards preventive healthcare and in a way, it is part of remote monitoring in non-critical settings.

In critical care settings, remote monitoring is expected to play a major role in monitoring the well-being of patients discharged from the hospital or after a major medical intervention. E.g. Cardiac remote monitoring segment is expected to grow in double digits CAGR till 2028. Countries like USA, UK, and Australia are leading the segment closely followed by few European countries, China, and India. Abbott Laboratories, AliveCor, Boston Scientific, Dexcom, GE HealthCare, Medtronic, Omron, and Philips are ahead in the global remote patient monitoring segment.

For more details, get in touch with us here

4. Elective Surgeries are back and brings back demand for equipment and consumables.

The pandemic is over but the backlog of elective surgeries are far from over. Last year 2023, reported maximum number of surgeries across the globe, but the wait time for remaining patients is unlikely to be over in 2024. What does it mean for the industry?

>74,000 procedures are expected in US physician and ambulatory clinics. The backlog of orthopedic surgeries reached 114% of pre-COVID levels, general surgery searches were at 103%, and cardiovascular procedure searches were at 107% till Oct’23. In Australia, Victoria has the largest backlog (134,950 patients, or 44% of the backlog) together with NSW (77,845 patients, or 25% of the backlog). The UK is an attractive market, as the NHS fails to conduct surgeries.

This creates scope for robotic surgical equipment or assisted surgical equipment (to support the already overburdened surgeons and create a feasible plan for addressing eligible versus noncritical surgeries), Indirectly, this also creates demand for implementation of latest technology in healthcare. Hospitals are demanding more consumables, surgical accessories, and equipment, they are upgrading their IT systems for better patient management and measurable outcomes. The wait time for Med-Tech industry seems to be over and distributors and suppliers are back in action.

Based on the Med Tech Industry Outlook 2024 report, McKesson, GE Healthcare, Henry Schein, Cardinal Health, Intuitive Surgical, and Edwards Lifesciences in the US; EBOS Healthcare and LTR Medical (Australia); and MediMeds and AHP Medicals (UK) are some prominent players targeting medical equipment and accessories supplies outside hospital businesses in 2024.

5. Homecare and Ambulatory Care becomes the next best options to limit wait times in hospitals

Surgical backlog also created avenues for home-based treatment for post-operative procedures and limit the re-admission of patients in multiple settings. While countries such as the USA are enhancing their Ambulatory care set ups, UK and Australia are closely behind. Homecare is another segment where every medical device company wants to try their making in-roads.

In 2024, centralized virtual care departments may be clubbed with critical care department (in hospitals); efforts to integrate RPM into the core healthcare system and the acceptance of RPM by physician clinics and providers (who will reimburse and incentivize) will grow. According to Markets and Markets, Abbott Laboratories, AliveCor, Boston Scientific, Dexcom, GE HealthCare, Medtronic, Omron, and Philips are ahead in the global remote patient monitoring segment.

McKesson, GE Healthcare, Henry Schein, Cardinal Health, Intuitive Surgical, and Edwards Lifesciences in the US; EBOS Healthcare and LTR Medical (Australia); and MediMeds and AHP Medicals (UK) are some prominent players targeting medical equipment and accessories supplies outside hospital businesses in 2024.

To limit re-admission and deal with non-critical interventions, ambulatory care may be the best option in 2024 and a new revenue stream for many MedTech companies.

Ready to embrace the future of Med-Tech and unlock growth opportunities for your business? Reach out to lead.outlookstudies@marketsandmarkets.com to learn more and stay ahead of the competition!

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

Finally,

MarketsandMarkets’ MedTech Industry Outlook has identified more than 60 use cases for generative AI across the entire MedTech value chain. The Global MedTech Industry Outlook 2024 analyses the events of 2023 while exploring new opportunities in 2024. The report addresses several burning questions like which are the hot segments? where is the opportunity? How big is the competition in 2024?

Markets and Markets cover 100s of such high growth segments by country and by technology and cover comprehensive market pulse, and our experts can support you through the Go-No Go dilemma phase and provide actionable insights using data sciences, market research and access to key opinion leaders of the industry.