Humanoid Robotics: The Fastest-Growing Billion-Dollar Frontier in Industrial Tech

“Humanoid robots are no longer just a laboratory curiosity; they are becoming the next frontier of industrial automation in factories, warehouses, and healthcare settings.”

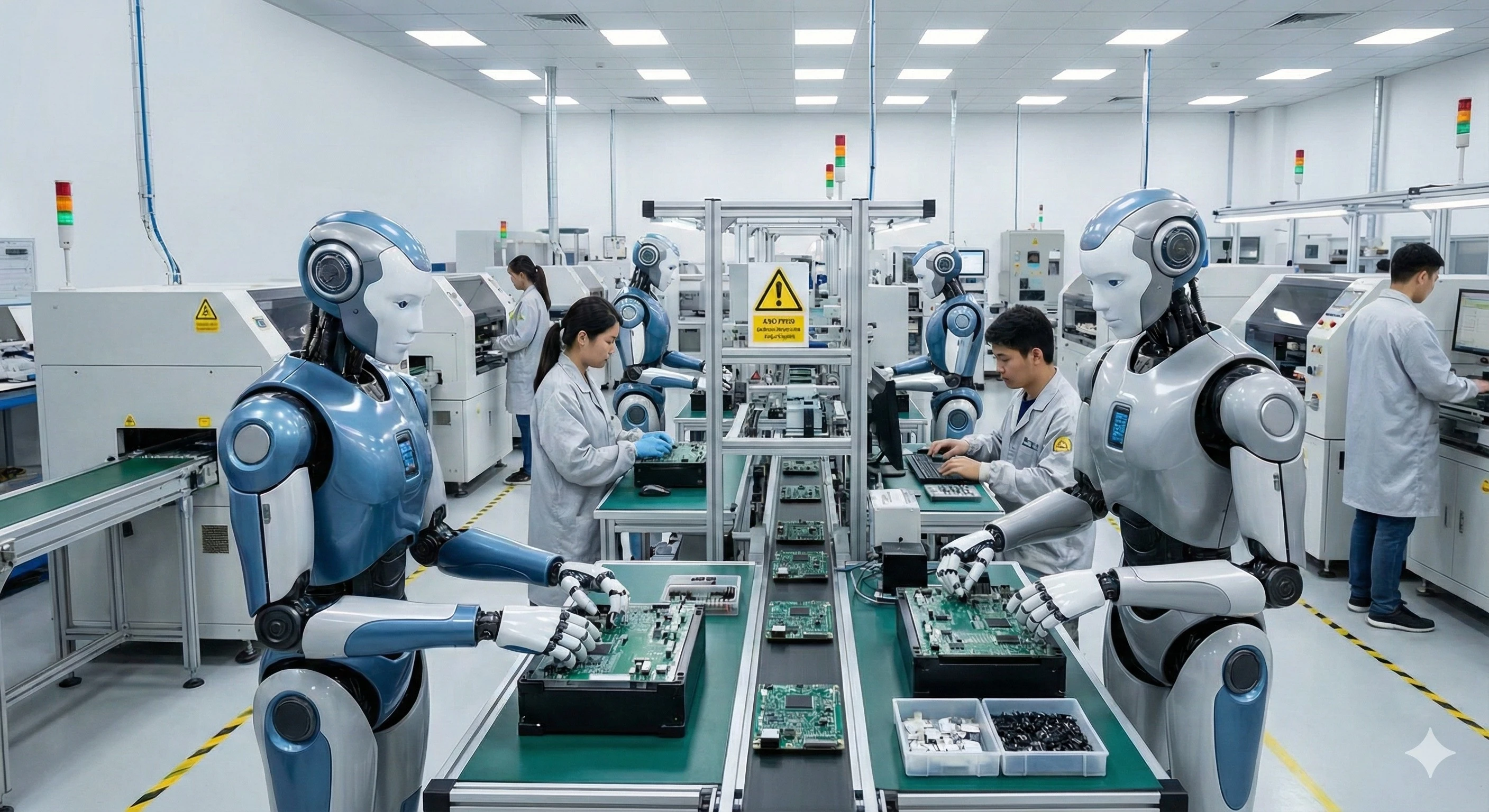

The convergence of AI breakthroughs, high-efficiency actuation, and energy-optimized power systems, coupled with the urgent need to offset labor shortages, has transformed humanoid robots from experimental prototypes into real workforce extensions. Humanoid robots are being designed to take over repetitive, physically demanding, or hazardous tasks so that people can focus on higher-value work such as decision-making, creativity, and supervision.

MarketsandMarkets’ latest analysis indicates that the global humanoid robot market is entering a phase of exponential expansion and is projected to reach USD 15 billion by 2030, growing at a CAGR of 39.2%. This momentum is fueled by rapid commercialization efforts and a surge of investor confidence signaling the humanoid sector’s shift from prototype to large-scale industrial deployment.

FROM DEMONSTRATION TO DEPLOYMENT: HUMANOIDS ENTER REAL INDUSTRIAL WORKFLOWS

The humanoid robotics sector is entering a decisive transition, where it is moving from demonstration and prototype testing to structured industrial deployment. The conversation has shifted from proving technical feasibility to validating measurable business outcomes.

Initial commercial pilots, such as Agility Robotics’ Digit robots being evaluated within Amazon’s logistics sites, represent the early stages of industrial integration. These pilots demonstrate how humanoids can seamlessly work alongside automated material-handling systems, performing repetitive pick-and-place tasks across predefined routes. Similarly, Apptronik’s Apollo is being tested by Mercedes-Benz in production environments to handle component delivery and assembly assistance. These pilots aim to quantify safety gains and throughput efficiency, laying the foundation for scaled adoption.

SHIFT FROM HARDWARE PERFORMANCE TO SOFTWARE INTELLIGENCE: THE NEW SOURCE OF VALUE

While hardware design continues to matter, long-term differentiation in humanoid robotics will come from the sophistication of software and AI learning systems. The future of humanoid competition will revolve around how seamlessly these integrate into enterprise automation ecosystems. Winning players will integrate robots seamlessly into data flows, ERP systems, and remote service models, enabling “humanoids-as-a-service” models that could drive recurring value. For instance,

- Figure AI is using advanced AI training models that allow robots to learn and adapt to new tasks with little or no reprogramming. Figure AI’s Figure robot, recently displayed in collaboration with BMW Manufacturing, uses a vision-language model that allows it to understand task instructions and object semantics.

- Tesla’s Optimus is being built on the company’s full-stack AI and manufacturing ecosystem, which shows how firms with cross-domain capabilities can compress cost curves and accelerate learning cycles.

- Boston Dynamics is advancing robotic mobility with the next-generation electric Atlas robot, designed for greater balance, agility, and durability in real-world industrial scenarios.

REGIONAL STRATEGIES AND BUSINESS MODELS: LOCALIZATION WILL DRIVE ADOPTION

Asia-Pacific is growing fast in humanoid manufacturing and adoption, due to abundant robotics expertise, aggressive national strategies, and cost advantages. For instance, the launch of South Korea’s K-Humanoid Alliance in 2025 underscores the nation’s commitment to building a comprehensive, locally integrated humanoid-robotics value chain by 2030. In China, companies like Fourier and Ubtech Robotics are expanding from rehabilitation and education robots to multi-purpose humanoids for logistics and smart manufacturing.

Meanwhile, North America and Europe are focusing on human-robot collaboration in regulated industries. Partnerships like Mercedes-Benz’s pilot with Apptronik in Germany and Hungary show how Western firms are integrating humanoids into structured assembly lines and quality inspection tasks. In Europe, startups such as PAL Robotics and Engineered Arts are focusing on collaborative service and interaction models suited for healthcare and customer service roles.

Ongoing innovation in business models is key to achieving sustainable growth in the humanoid robotics sector. Companies are now planning to use approaches like Robotics-as-a-Service (RaaS), leasing, or outcome-based contracts to help customers lower upfront costs, while ensuring vendors are rewarded for performance and system uptime.

SCALING FOR RELIABILITY AND COST: INDUSTRIAL SCALE WILL SHAPE FUTURE COMPETITIVE ADVANTAGE

Reliability and affordability are the two key barriers to mainstreaming humanoid robots. However, production philosophies from the electric vehicle sector are now reshaping robotics economics. For instance, Tesla and Figure AI are applying automotive-scale precision manufacturing by using shared component designs and integrated electronics to reduce the costs of humanoid robots.

Similarly, Boston Dynamics, with its newly unveiled all-electric Atlas robot, has demonstrated how design simplification can improve durability and reduce maintenance cycles. Initiatives like these will address the affordability and reliability issues that have long constrained humanoid adoption.

STRATEGIC MILESTONES THAT ARE DEFINING THE NEXT PHASE OF HUMANOID ROBOTICS

Recent developments from prominent humanoid robot makers mark the shift from concept to large-scale industrial deployment. These milestones have confirmed that the commercial era of humanoid robotics has truly begun.

- Tesla’s Optimus platform has highlighted advanced motion control and dexterity, including demonstrations of dynamic balance and coordinated grasping. Such advancements are signalling how humanoid locomotion and manipulation are evolving under AI-driven training systems.

- Apptronik recently secured USD 350 million in funding from companies like Google and Mercedes-Benz. This investment will accelerate the global rollout of its Apollo humanoid robots across organization and manufacturing applications.

- Agility Robotics’ RoboFab facility in Oregon marks one of the first large-scale production sites for humanoid robots, with a planned output of around 10,000 units annually. This is a major step toward true manufacturing industrialization of humanoids.

- Figure AI’s BotQ facility is expected to produce up to 12,000 humanoids per year, and this also marks the initiation of economies of scale in the humanoid industry.

-

Fourier’s GRx Humanoid Robot Series is a purpose-built bipedal robotic lineup designed with an “AI-first” philosophy, modular hardware, and advanced motion control. With models such as the GR-1, GR-2, and GR-3, the series has use-cases from industrial automation (GR-1), advanced development platforms (GR-2), to human-centric service and companion roles (GR-3).

WHAT THIS MEANS FOR BUSINESS LEADERS

Humanoid robots now stand at the intersection of AI, mechatronics, and human collaboration. As these robots become more capable, dependable, and affordable, they will redefine the boundaries between human labor and machine intelligence.

For CXOs and Strategy leaders, humanoid robots are no longer just a trend to watch, but instead a strategic capability that needs to be explored. Over the next decade, enterprises that proactively embed humanoid robots into their logistics, manufacturing, or service workflows will achieve levels of operational flexibility and resilience that conventional automation cannot match.

Author: Monika Nehra, Assistant Manager - Semiconductor and Electronics

LinkedIn ID: https://in.linkedin.com/in/monikanehra

Related Reports:

Artificial Intelligence (AI) Robots Market Size, Share & Trends

https://www.marketsandmarkets.com/Market-Reports/artificial-intelligence-robots-market-120550497.html

Embodied AI Market Size, Share & Trends

https://www.marketsandmarkets.com/Market-Reports/embodied-ai-market-83867232.html

Future of Robotics Market Size, Share & Trends, 2025 To 2030

https://www.marketsandmarkets.com/Market-Reports/future-robotics-56928872.html

Service Robotics Market Size, Share and Trends

https://www.marketsandmarkets.com/Market-Reports/service-robotics-market-681.html

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024