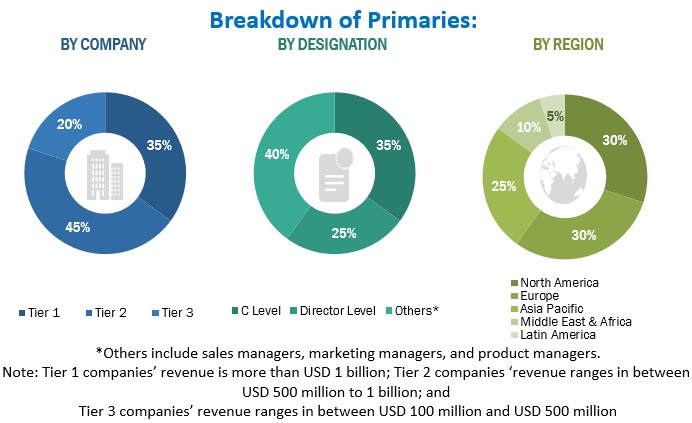

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the AI Toolkit market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering AI Toolkit solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the AI Toolkit market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as Journal of Artificial Intelligence Research, the Journal of Artificial Intelligence (AIJ), Association for the Advancement of Artificial Intelligence (AAAI) have been referred to for identifying and collecting information for this study on the AI Toolkit market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that primary sources have further validated.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from AI Toolkit solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AI Toolkit solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AI Toolkit solutions which would impact the overall AI Toolkit market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the AI Toolkit market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of AI Toolkit offerings.

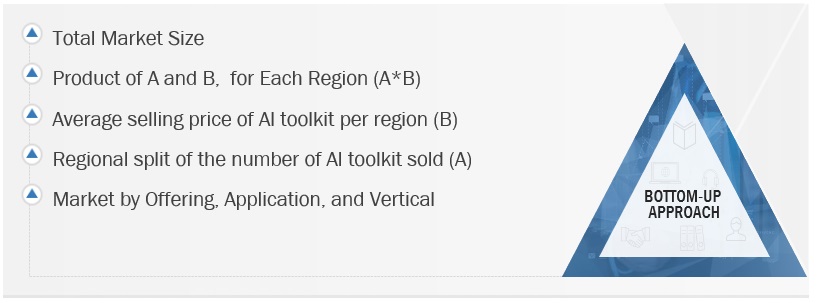

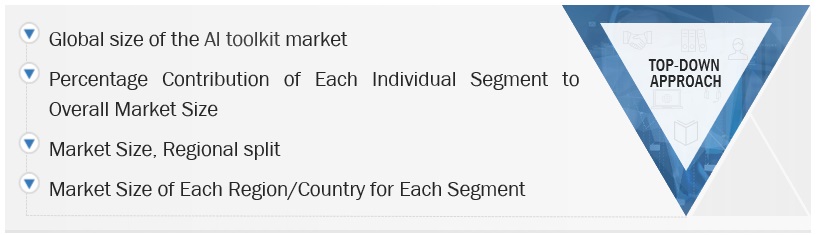

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI Toolkit market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

-

Key players in the market have been identified through extensive secondary research.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AI Toolkit Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

AI Toolkit Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the AI Toolkit market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An AI toolkit, often referred to as an AI framework or AI development platform is a set of software tools, libraries, and resources that are designed to facilitate the development, deployment, and management of AI and ML applications. These toolkits provide developers with a structured environment for building and training AI models, handling data processing, and deploying AI solutions. AI toolkits typically include pre-built algorithms and data manipulation functions and often support deep learning and neural networks. They are essential for streamlining the development of AI applications across various domains, from natural language processing and computer vision to recommendation systems and predictive analytics. AI toolkits make AI technology more accessible and practical for various industries and applications.

Key Stakeholders

-

AI Toolkit providers

-

Government organizations, forums, alliances, and associations

-

Consulting service providers

-

Value-added resellers (VARs)

-

End users

-

System integrators

-

Research organizations

-

Consulting companies

Report Objectives

-

To determine and forecast the global AI toolkit market by offering (hardware, software, services), application, vertical, and region from 2023 to 2038, and analyze the various macroeconomic and microeconomic factors affecting market growth.

-

To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

-

To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI toolkit market.

-

To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

-

Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise Information

-

Analysis for additional countries (up to five)

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Artificial Intelligence (AI) Toolkit Market