The study involved four major activities in estimating the current market size for the Airport Automation Market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

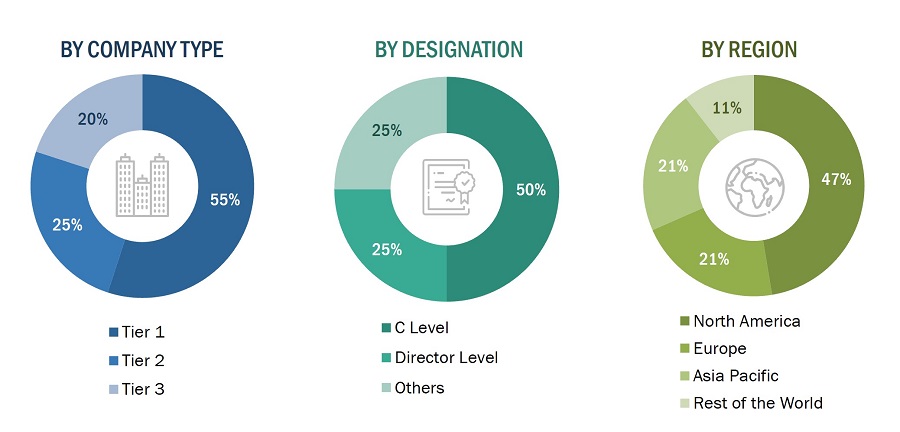

The Airport Automation Market comprises several stakeholders, such as raw material providers, Airport Automation equipment manufacturers and automation solution providers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in airport solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

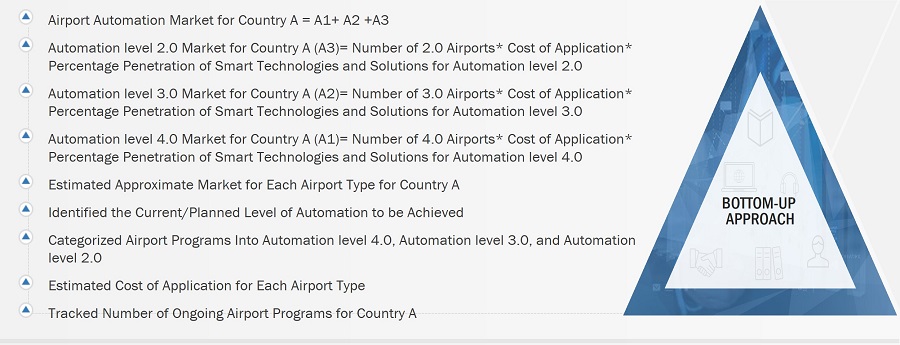

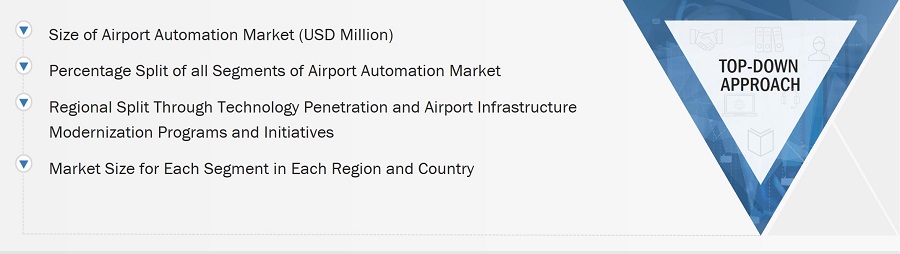

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Airport Automation Market . These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

-

Key players in the industry and markets were identified through extensive secondary research.

-

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up Approach

The market sizing was undertaken from the demand side. The market was sized based on the year-on-year growth of newly built boats and retrofitted electric boats.

Market size estimation methodology: Top-down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. For the calculation of specific market segments, the size of the most appropriate, immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenue obtained for various market segments.

-

Companies supplying airport automation solution, as well as components, were included in the report.

-

The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were not available, company earnings were estimated based on the number of employees, press releases, and any publicly available data.

-

Company revenue was calculated based on the various operating segments.

-

All publicly available company contracts related to Airport Automation were mapped and summed up.

-

Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of electric ships in each segment was estimated.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Airport Automation Market .

Report Objectives

-

To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Airport Automation Market

-

To analyze the impact of macro and micro indicators on the market

-

To forecast the market size of segments for four regions, namely, North America, Europe, Asia Pacific, Middle East and the Rest of the World, along with major countries in each of these regions

-

To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

-

To strategically profile key market players and comprehensively analyze their market ranking and core competencies

-

To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

-

To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Market Definition

A battery contains one or more cells that convert chemical energy directly into electrical energy. The primary electrical system in a vessel or boat incorporates one or more batteries. These batteries are used to power up the electrical system and to start the auxiliary power unit and the engines. A boat with a length under 70 feet and a lower range can be considered a vessel. An electric boat refers to a boat entirely driven by battery power.

Market Stakeholders

-

Smart Component/Solution/Service Providers

-

Airport System and Component Integrators/Manufacturers

-

Airlines

-

Airports

-

Research Bodies

-

Government Bodies, Agencies, and Regulators

-

Investors and Financial Community Professionals

-

System Integrators

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Airport Automation Market